By Lambert Strether of Corrente.

I like to think that economics should be like plumbing, and if you had my house you’d see why I’d be happy if there were a Sveriges Riksbank Prize for the great plumbers of the world. Good plumbing is very important, as you know if you’ve ever had the pipes fail. There is also an ethic to plumbing; the plumber should exercise all this skills of their craft as a contractor, shouldn’t put in cheap stuff when good stuff was specified, should warn you if you are about to do something stupid, and needs to deliver toilets that actually flush and sinks that actually drain, and needs to ensure that sewer gas doesn’t blow up the whole house. (We could think of neo-liberals as rotten plumbers who did blow up the house.) And although every plumber has a slightly different toolbox, and a slightly different techniques and points of emphasis, nevertheless there is scientific reasoning behind plumbing — for example, “water runs downhill” — and you can go to plumbing school and learn about it. Of course, I could never be a plumber, though some days I wish I could have been, because I don’t see very well and I’m all thumbs. However, I know enough about plumbing, and enough about my house, to find a good plumber when I need one. A plumber that will free up the pipes and get the job done.

And I like to think of MMT as the kind of plumber I’d like to have work on the economy. I’m not an economist and didn’t go to that school. But I think I know enough about MMT, and enough about political economy, to pick my plumber.

My reasons are simple and pragmatic: I want people like me (working people) to have nice things — concrete material benefits. Lots of them. And I believe MMT — unlike other schools of thought, but especially neo-liberalism — can deliver on that promise, given the chance. But there are obstacles: MMT, like plumbing, isn’t all that simple, it’s not all that well-known, and it’s “heterodox,” where neo-liberalism is Orthodox with a capital O.

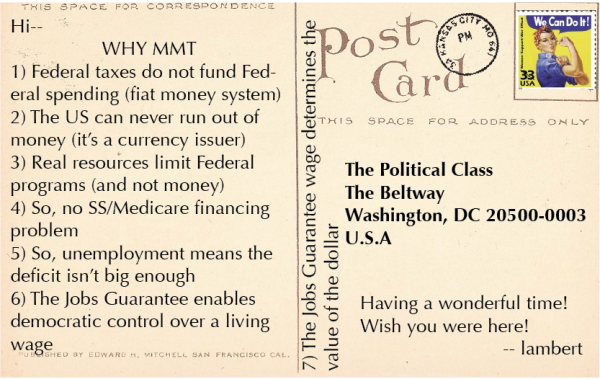

So I took on the project of putting “Why MMT” onto a postcard. That’s not the same as getting an entire textbook of MMT onto a postcard, but I hope to at least persuade you to put the postcard up on your fridge and keep it there. Here it is:

Let me just go point by point. (I’m going to be linking mostly to the MMT Primer[1] at New Economic Perspectives, but also to this trenchant article from Professor Paul Davidson, and transcripts from the 2010 Fiscal Sustainability Conference. Not being an expert or especially creative, I have to go to the sources and quote them. I apologize in advance for any severe pain caused to those quoted.[2])

1) Federal taxes do not fund Federal spending (fiat money system)

Stephanie Kelton said in her presentation at 2010’s Fiscal Sustainability Conference:

[T]he government is the issuer of its currency. It is not like a household. It doesn’t have to raise money by borrowing or collecting taxes in order to spend. Those of us in the private sector have to earn or borrow dollars before we can spend. The government must spend first. And we say this, and sometimes people have a hard time understanding that. How can the government spend first? How can it not spend first? How could the government collect taxes, in dollars, first? It first had to have spent those dollars into existence. The spending has to come before the payment or the collection of taxes. The government must spend first. Government spending is not (we use this term a lot) operationally constrained by revenues. It doesn’t need tax payments and bond sales in order to fund itself. It is not operationally constrained. The only relevant constraints are self-imposed constraints. We talked a little bit about this earlier, things like debt ceilings. That’s a self-imposed constraint. Rules that prevent the Treasury from running an overdraft in its account at the Fed. That’s a self-imposed constraint. It is a constraint that is imposed by Congress. Rules that prevent the Fed from buying Treasury bonds directly from the Treasury, so-called monetizing the debt, is a self-imposed constraint.

So why do we have taxes, then? To give money value! Rebecca Rojer in The New Enquiry:

Forcing people to pay their taxes in a money that is otherwise worthless creates demand for money and gives it its value. This idea, called chartalism, is one of the core building blocks of Modern Monetary Theory. “Modern money” is fiat money, state-issued currency not backed by precious metals or any other commodity. … You cannot trade in fiat money with the state for a fixed quantity of gold or barley, but you still need it to pay taxes.

Sovereigns [like the United States] create money as a tool to obtain the labor and other resources they need to fulfill their political goals. The sovereign steers the ship, at least initially, not some money god. If sovereignty lies with the people, money can be used to serve the common good. If people lack formal political power, more democratic layers of sovereignty may be possible in the shadow of the official sovereign, provided the means of production exists within a community. An understanding of modern money, and its relationship to sovereignty, would be necessary but far from sufficient to bring about such transformations.

Here I should address the pre-2008 pre-2016 hope and change “tax the rich” meme being pushed by the same crowd that brought us Obama. MMT, as such, isn’t against taxing the rich, and many MMTers are for it. For example, I think it’s good to tax the rich to prevent the formation of an aristocracy of inherited wealth, to prevent the rich from buying the government up with their loose cash, and for the sake of their children, to whom wealth often does not bring happiness. However, a program of taxing the rich is often coupled with the claim that such taxes are needed to fund services, a claim that puts us squarely into “it’s what they know that ain’t so” territory.

2) The US can never run out of money (it’s a currency issuer)

Stephanie Kelton had this to say in her presentation at 2010’s Fiscal Sustainability Conference:

Can the government run out of money? The U.S. government can’t run out of money any more than the Washington Nationals Baseball team stadium can run out of points. Every time a ball game is played at Washington National Stadium, some team scores some points and they appear on the screen and then the other team scores and some more points appear on the screen. And there’s nobody behind the screen going, ‘Hey Johnny, we’re running out of points here’, you know, right? Look in the trust fund. That’s not the way it happens. You just add the points.

Same exact thing with the way the government operates. And this is the quote that Marshall brought up earlier and the one that Warren likes to use a lot, and I like it too. So here it is in writing so that you know we didn’t make it up. This is Ben Bernanke in an interview on Sixty Minutes just last year when Pelley asked him, “Is that tax money the Fed is spending?” And Bernanke says, “It’s not tax money. The banks have accounts at the Fed much the way that you do, have an account at a commercial bank. So when we want to lend to a bank, we simply use the computer to mark up the size of the account they have with the Fed.

Note that this demolishes the constant refrain of Beltway institutions like the Peterson Institute, or Bowles-Simpson, or the Can Kicks Back, that “we’re running out of money.” Not only are we not, we can’t. The United States is sovereign in its own currency, creates it by fiat, and literally and truly cannot run out. Bill Mitchell writes:

[T]he government in a fiat monetary system is not “revenue-constrained”.

Intuitively this is hard to accept because we are so wedded to the idea that nothing is certain but death and taxes and that the latter is to raise money for governments to spend. The issue of taxation is also very emotional – as we see in some comments on my blog – taxation is linked by conservatives to concepts of slavery; loss of freedom; etc.

So the idea of a government that is not revenue-constrained is hard to grasp at the emotional level.

It is. It is indeed.

3) Real resources limit Federal programs (and not money).

Quoting (at Warren Mosler’s suggestion) Professor Paul Davidson:

The U.S. dollar is not legally convertible into anything by the government on demand [and hasn’t been since Nixon closed the gold window]. It is, however, designated by the government as the only means of discharging federal tax liabilities. Tax liabilities are an ongoing debt the private sector owes the government, and they create a continuous need for dollars. The private sector obtains the needed dollars primarily as payment for the transfer of real goods and services to the government, and it is government spending or lending that provides the dollars needed to pay taxes. For purposes of this analysis, government spending includes spending by the government or any of its agents. For example, when the central bank buys foreign currency, it is the same, for cash flow analysis, as the treasury buying military equipment. This is commonly referred to as viewing the treasury and central bank on a consolidated basis.

The imperative of taxation is to create sellers of real goods and services willing to exchange them for the unit of account selected by the government. Dollar denominated tax liabilities function to create sellers of real goods and services who must have dollars to extinguish their tax liabilities. Raising revenue, per se, is of no consequence to the government, as dollars are not a limited government resource, but a liability, or tax credit, that can be issued at will. The government’s ability to raise revenue does not limit what it is able to purchase. The purchasing power of the government is limited only by what is offered for sale in exchange for dollars.

“[W]hat is offered for sale in exchange for dollars”: That is the real resources. Look around you. Is there work that needs to be done? Are there the real resources to do it? Then we can afford to do it. Rebecca Rojer writes:

Those at the very tip of our economic pyramid understand that fiat money is unlimited, but most everyone below believes it to be scarce.

How those at the tippy top must be laughing!

4) So, no SS/Medicare financing problem

Stephanie Kelton on Social Security:

”Funding Social Security is always and everywhere a political choice. The strongest evidence of this comes directly from the 2009 Annual Report of the Trustees. In that report, they predict gloom and doom for Social Security because “there is no provision in current law that would enable full payment of benefits, once the Trust Funds are exhausted”.

In contrast, the Supplementary Medical Insurance (SMI) Trust Funds are “both projected to remain adequately financed into the indefinite future because current law automatically provides financing each year to meet next year’s expected costs.”

It is that simple. The former is in ‘trouble’ because the government isn’t committed to making the payments, and the latter gets a clean bill of health because the government will always make the payments.”

Exactly the same logic applies to Medicare.

5) So, unemployment means the deficit isn’t big enough

Bill Mitchell, on What Causes Mass Unemployment:

The purpose of State Money is to facilitate the movement of real goods and services from the non-government (largely private) sector to the government (public) domain.

Government achieves this transfer by first levying a tax, which creates a notional demand for its currency of issue.

To obtain funds needed to pay taxes and net save, non-government agents offer real goods and services for sale in exchange for the needed units of the currency. This includes, of-course, the offer of labour by the unemployed.

The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

This analysis also sets the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid. In addition, net government spending is required to meet the private desire to save (accumulate net financial assets).

It is also clear that if the Government doesn’t spend enough to cover taxes and the non-government sector’s desire to save the manifestation of this deficiency will be unemployment.

6) The Jobs Guarantee enables democratic control over a living wage

How would the JG work from the perspective of a working person (not an owner?) Or from the perspective of the millions of permanently disemployed? The MMT Primer:

If you are involuntarily unemployed today (or are stuck with a part-time job when you really want to work full time) you only have three choices:

- Employ yourself (create your own business—something that usually goes up in recessions although most of these businesses fail)

- Convince an employer to hire you, adding to the firm’s workforce

- Convince an employer to replace an existing worker, hiring you

The second option requires that the firm’s employment is below optimum—it must not currently have the number of workers desired to produce the amount of output the firm thinks it can sell. …

If the firm is in equilibrium, then, producing what it believes it can sell, it will hire you only on the conditions stated in the third case—to replace an existing worker. Perhaps you promise to work harder, or better, or at a lower wage. But, obviously, that just shifts the unemployment to someone else.

It is the “dogs and bones” problem: if you bury 9 bones and send 10 dogs out to go bone-hunting you know at least one dog will come back “empty mouthed”. You can take that dog and teach her lots of new tricks in bone-finding, but if you bury only 9 bones, again, some unlucky dog comes back without a bone.

The only solution is to provide a 10th bone. That is what the JG does: it ensures a bone for every dog that wants to hunt.

It expands the options to include:

- There is a “residual” employer who will always provide a job to anyone who shows up ready and willing to work.

It expands choice. If you want to work and exhaust the first 3 alternatives listed above, there is a 4th: the JG.

It expands choice without reducing other choices. You can still try the first 3 alternatives. You can take advantage of all the safety net alternatives provided. Or you can choose to do nothing. It is up to you.

If I were one of the millions of people permanently disemployed, I would welcome that additional choice. It’s certainly far more humane than any policy on offer by either party. And the JG is in the great tradition of programs the New Deal sponsored, like the CCC, the WPA, Federal Writers’ Project, and the Federal Art Project. So what’s not to like? (Here’s a list of other JGs). Like the New Deal, but not temporary!

OK, what do you mean by “democratic control over the living wage,” then? The MMT Primer describes JG program design:

The national government provides funding for a universal program that would offer a uniform hourly wage with a package of benefits. The program could provide for part-time and seasonal work, as well as for other flexible working conditions as desired.

The package of benefits would be subject to congressional approval, but could include health care, child care, old age retirement or social security, and usual vacations and sick leave. The wage would be set by government and fixed until government approved a rate increase—much as the minimum wage is usually legislated. …

And this program wage cannot be “market determined”. It must be socially determined: government offers an infinitely elastic demand for labor at the wage (plus benefits) it chooses to pay. It sets the wage as public policy, then hires all those who accept the offer of a job. To get workers, the private sector will have to offer something better than the JG compensation package. It could be a higher wage, better benefits, better working conditions, or better opportunities for career enhancement.

Intuitively: What the JG does is set a baseline[3] for the entire package offered to workers, and employers have to offer a better package, or not get the workers they need. When I came up here to Maine I’d quit my job voluntarily and so wasn’t eligible for unemployment. Then the economy crashed, and I had no work (except for blogging) for two years. There were no jobs to be had. I would have screamed with joy for a program even remotely like this, and I don’t even have dependents to take care of. It may be objected that the political process won’t deliver an offer as good as the Primer suggests. Well, don’t mourn. Organize. It may be objected that a reform like the JG merely reinforces the power of the 0.01%. If so, I’m not sure I’m willing to throw the currently disemployed under the bus because “worse is better,” regardless. Anyhow, does “democratic control over the living wage” really sound all that squillionaire-friendly to you? Aren’t they doing everything in their power to fight anything that sounds like that? The JG sounds like the slogan Lincoln ran on, to me: “Vote yourself a farm!” [3]

So, what does the JG for the economy? MMT was put together by economists; from an economists perspective, what is it good for? Why did they do that? The Primer once more:

some supporters emphasize that a program with a uniform basic wage[4] also helps to promote economic and price stability.

The JG/ELR program will act as an automatic stabilizer as employment in the program grows in recession and shrinks in economic expansion, counteracting private sector employment fluctuations. The federal government budget will become more counter-cyclical because its spending on the ELR program will likewise grow in recession and fall in expansion.

Furthermore, the uniform basic wage will reduce both inflationary pressure in a boom and deflationary pressure in a bust. In a boom, private employers can recruit from the program’s pool of workers, paying a mark-up over the program wage. The pool acts like a “reserve army” of the employed, dampening wage pressures as private employment grows. In recession, workers down-sized by private employers can work at the JG/ELR wage, which puts a floor to how low wages and income can fall.

Finally, research indicates that those without work would prefer to have it:

Research by Pavlina Tcherneva and Rania Antonopoulos indicates that when asked, most people want to work. Studying how job guarantees affect women in poor countries, they find the programs are popular largely because they recognize—and more fairly distribute and compensate—all the child- and elder care that is now often performed by women for free (out of love or duty), off the books, or not at all.

Enough of this crap jobs at crap wages malarky!

7) The Jobs Guarantee wage determines the value of the dollar

Quoting Professor Paul Davidson once again:

The proposed [JG] program recognizes that the government is a monopoly supplier of its currency. Price is set through the [JG] wage, which defines the purchasing power of the currency.

The current monetary system is a classic monopoly with the traditional analysis of monopoly sufficient to describe all aspects. The government is the monopoly issuer of the dollars needed by the private sector to pay taxes. … With a gold standard, gold can always be considered fully employed as gold can always be sold to the government at the fixed price. Likewise, with an [JG] policy, labor can always find a buyer. … The government sets the [JG] wage and lets the market allocate all other resources accordingly. This is the same process that determines relative value under a gold standard. Under the ELR proposal, the government adjusts fiscal and monetary policy to maintain the ELR pool much the same way that a government adjusts fiscal and monetary policy to maintain a buffer stock of gold with a gold standard.

All this said, the house design as a whole is not up to the plumber, but the architect. In a democracy, we the people are the architect! And it is up to us to design an ethical house, and also to determine the plumber to hire — I hope MMT — and to design the plumbing. Democratically.

ACKNOWLEDGEMENT: I would like to thank letsgetitdone (Joe Firestone), Scott Fullwiler, and Warren Mosler for their help with the points on the card. Any errors on the card or in the post are, of course, my own.

NOTE [1] Granted, it’s 52 chapters of Primer goodness. Professors! But many of those chapters are responsive to questions or critiques, and others address issues brought up by particular schools, like the Austrians. So just like Wagner’s music is better than it sounds, the MMT Primer is shorter than it looks. So it’s a textbook that needs to be popularized and simplified like the work of every other economic school. Of course, MMT doesn’t have think tank and entire economics departments funded by well-endowed squillionaires to get that work done. Go figure.

NOTE [2] The metaphor that MMT is a toolkit or smorgasbord is appealing but limited. I can’t do justice to Joe Firestone’s work on “knowledge claim networks,” but here’s a discussion.

NOTE [3] At this point, the real economists blanche, and point out that JG jobs are conceived of as “transitional,” and aren’t supposed to replace private jobs, merely to supplement them. And that is probably where the temper of the country is, right now. But I think democratic control over the living wage is a good thing to have until the glorious day when the soviets really do take power, or, more prosaically, until a lot more co-operatives start shaping the political economy to the liking of their members.

NOTE [4] Why doesn’t the minimum wage do this? You must be employed :-):

But the more important point is this: with the JG in place, the program wage and benefits set an effective floor, an effective minimum wage. As Hyman Minsky used to always argue, without the JG the legislated minimum wage is a lie. The true minimum wage is zero—if you cannot find a minimum wage job, you get a zero wage. With the JG in place, the true minimum is the program wage (plus benefits).

NOTE OK, there should be no plumbing! We should all use composting toilets in our back yard! I’m down with that, I’m a permaculturalist! It’s just a metaphor!

Two additional benefits of the Jobs Guarantee:

1) Elimination of the long-term unemployed effect. Workers will be able to maintain their skills, productivity and avoid the stigma of not having worked in six months.

2) Reduction of inflationary pressures due to capacity constraints. In a typical recovery the unemployed will require and adjustment period as they return to work and as a result their productivity may suffer. If a boom is of sufficient strength then the possibility of inflation exists as demand outstrips available supply; with a JG, however the worker maintains their skills, assuming of course they wish to return to the same sort of position they lost.

If we choose to add a strong retraining component we also have the most flexible, dynamic and empowered working class in the world with positions waiting once the retraining is complete.

Ben, the ‘lack of skills’ meme is a common blame-the-victim whine from the authoritarians. Do you really buy into that?

Where exactly do you see a dearth of worker capabilities? Are you thinking of a particular industry? Geographic location? Job function?

There is lots of evidence that employers won’t consider anyone who has been unemployed for more than six months. And the usual logic is they have “lost skills” or more generally, if they’ve been unemployed that long, they must be no good.

I completely agree employers ignore resumes from people with extended unemployment. Employers generally ignore resumes from people who are unemployed for any period of time. Most hiring is of people who are employed. Just like employers look for other factors they can use to screen people by class, such as education or criminal background, that has nothing to do with the performance of the job. There’s a whole cottage industry in the HR world of crafting job descriptions and BFOQs, for example, in such a way as to screen applicants without exposing organizations to legal liability.

What does any of this have to do with a lack of skill? The fact that employers can be so choosy about hiring labor demonstrates an excess of skills, not an absence.

I don’t accept the complaint that worker skills have deteriorated, I just see the JG as doing away with that particular excuse. If an employer doesn’t want someone who wants to work then screw ’em. There is no law requiring work done to generate profits for someone; if people would rather do socially beneficial work then they should be free to stay in the JG.

Indeed

But of course the rataionalization is ridiculous on it’s face. You don’t forget job skills in 6 months or even a year. 6 years, well yes, but not 6 months. So why should anyone accept arguments like “they have lost their skills in 6 months” that make absolutely no sense to begin with?

Most honest answer: they have too many applicants and need some kind of filter.

Skills atrophy is an excuse cooked up by the orthodoxy to say that unemployment is the job seeker’s fault, and not the fault of their faked up economics. Economists of the orthodox persuasion are probably the least qualified people in history to talk about employment and unemployment, and what causes each, and until we start firing them when they fuck up, just like we fire other workers when they fuck up, they will learn nothing.

That was really good Lambert. I would single out ‘Enough of this crap jobs at crap wages malarky!’ I’m fairly confident we only need this economics (MMT, positive money) because the insanestream is insane. Some way down the line one can imagine problems with job guarantee. Imagine being able to take jobs at reasonable pay without the dire constraints of current job seeking. I might say, ‘stuff lecturing tenure’ on the grounds I think it’s immoral to take sinecure from indebting students, and work in a community project instead. I think this is a good thing. Mr Sweat Shop will not. The motivational aspects of a world with full employment are not well understood. Ben mentions training above, but we’ve had a long period of stressing its importance while providing less and less relevant to work (our youth are allegedly more qualified and trained than ever, but can’t even get on the day shift with their degrees). And stuck somewhere in this thinking is “groaf”. None of this is to disagree in principle.

Whenever I think of groaf I think of all the niches we have not explored, all the details; I think how efficient and sophisticated we could become without pillaging the planet. Just a big fat jobs program to learn and apply good practices; to clean up our monster mess and then keep it clean.

To be honest, addressing the work we should be doing seems to be the missing component. I’m after a couple of years’ EU funded work here not unlike the permagarden thing (orchards), but it is a drop in the ocean. Joe says something apt on job guarantee and basic income below. My queries boil down to the extent of ideological baggage from current ‘terrornomics’ and motivation in the more egalitarian. To break from groaf we may have to redefine job.

We need more sappers digging at the foundation level, instead of penthouse corner office dwellers, and ask questions like

What is work

What is a job

What is the purpose of government or economics?

etc/

You don’t feel putting “public” purpose at the heart of economics is sapping at the foundations of, say, neo-liberalism?

I hope that public purpose includes more happiness, even with a smaller GDP.

If that public purpose assumes we always need more a bigger GDP to be happy, then we might want to inquire about what public purpose is or which public purpose.

Hmm. The JG would be an ideal place to experiment with redefining jobs, if only because the experimenter wouldn’t lose their shirt going out of business when it failed.

Thank you, Lambert. Excellent clarification of our arguments. I’m bookmarking it!

JuneTown May 29, 2014 at 2:40 pm

“”Stephanie Kelton said in her presentation at 2010′s Fiscal Sustainability Conference:

[T]he government is the issuer of its currency. It is not like a household. It doesn’t have to raise money by borrowing or collecting taxes in order to spend.””

Since the government ‘delegated’ its ‘public’ money creation and issuance powers to the private Federal Reserve Banking System, the government DOES have to raise money by borrowing or collecting taxes in order to spend.

If the Guv could create and issue money by spending, it WOULD be creating and issuing money by spending, but it does not, because it can not.

Just ask anyone who works at Treasury, paying the government’s Bills.

Does the government need the income in its account before it can spend?

The Guv has a string-pushing role in the issuance of the currency; it is only the banks that can advance purchasing power into the economy without having a balance available for transfer.

Funny how that One-Percent thing works.

Frank N Newman, in his April 2013 book Freedom From National Debt, says you’re wrong. He was Deputy Secretary of the US Treasury. 87 pages. Read it.

The Government, under the present arrangement, spend money into existence when the Fed buys its debt.

Whether the government is free from National Debt is a different question, which is related to can the Government spend and borrow (only to be monetized) as much as it wants.

What are you talking about? The Federal Reserve is not allowed to buy treasury securities from the government. The Fed can only buy treasury securities (“debt,” which it’s not) on the Open Market.

The Guv “spends”……..money into existence

when the Fed “buys”……. the debt the Guv issues.

hhmmmmmm…..

hmmmm…

The Fed actually never spends money to buy public bonds, it merely keyboards new reserve balances into the account of the bank selling them the bonds.

Totally unnecessary on both ends….. IF the Guv has the ‘money-creation-when-it-spends power, which it does not, but which it should have.

You’re mixing apples and oranges.

The govt spends first. It issues treasury securities in the same amount to the non-government sector for purchase: businesses, banks, foreign govts and banks, private individuals, trust funds, university endowments, whatever.

Subsequently, if members of this group wants to sell their treasury securities, they sell on the open market. The Fed can buy from this group on the open market. It cannot buy treasury securities from the US Treasury, the federal govt.

The Federal Reserve returns all profits from the purchase of these treasury securities (purchased not eh open market) to the US Treasury annually, per the 1947 or 1948 law that requires them to do so.

Let’s get just a few facts straight,

FIRST, there is no law that requires the Fed to remit its net income to the Treasury, merely a FRBoard Policy adopted in the era you suggest, and adopted only after Congr. Wright Patman, as Chair of the House Banking and Currency Committee, threatened to introduce legislation to require it.

Before that discourse, the Fed was unapologeticaly pocketing the change, thank you all very much.

No, the government does not spend first.

Stop repeating erroneous and un-provable statements like these.

The Guv must collect taxes first and issues deficit-spanning debt second, and pays the Bills only when it has the money, virtually none of which is US currency, all being bank credit balances..

We already discussed this….you said the requirement for first funding and then paying was a gold era throwback law. wrong.

For general edification, please take the quoted statement of mine, and explain which are the apples and which are the oranges…….and why.

Thanks.

I think it’s absolutely critical to include net 90 day payment terms to government contractors, dipping into Federal pensions to pay bills, and probably the three day clearing period for bond transactions before we can thoroughly understand this model.

But my brain cells quiver in anticipation!

I thought you said you read Newman’s book. Incidentally, you should have noticed that Newman said to read Mosler, Wray, and Fullwiler to know how the system works.

From Newman’s book, to cite one quote:

Gee, capital letters. FIRST.

Newman’s probably a good banker. but his recount of what would essentially be a Treasury monetary and finance operation is a complete fantasy. Please tell him I said so.

Your quote from his book really says nothing about money law, or science, or history, nor provides any operational context from a public financial administration perspective…… it is rather a tale, an anecdote of his random imagining on how, perhaps, typically, something like this may happen.

Or, maybe not.

Typically?,……, Randomly? ……Usually?

Perhaps.

So, what office or branch of the Treasury operation carries out that ‘distributing” of the $20 Billion, FIRST ? As in, without taxes or debt proceeds as income.

Because, if they existed, and they do not exist, then they would be creating money.

Changes to the money supply are effected, definitionally, by private banking operations.

I thought that you concurred that there IS a requirement that the Guv must have money in its account in order to spend.

This is not a mere ‘overdraft’ issue, as often portrayed.

If the Gov needs to acquire revenues in order to have money to spend, then obviously, the Guv is not creating money.

That’s the bottom line.

I don’t even understand the connection between the $20 Billion ‘distribution’ and the issuing of the $20 Billion in Treasury securities…..because I think ‘typically, perhaps’, as these things sometimes go, he came in about $10 Billion short.

It’s all just ridiculous.

Still accept that archaic ‘gold standard’ law??

Then, if they did distribute’ $20 Billion from the TGA account, then there was FIRST $20 Billion in the TGA account. Or they couldn’t spend (distribute) it.

And THAT $20 Billion in Treasury’s TGA account was bank-credit money.

All the money that circulates, being that which both we and the government use for finance and sustenance, is created by the private bankers, coins excepted,

The government could, and certainly should, create all the money, but the government has abdicated this sacred public trust to the private bankers, who pay the political parties to run the right candidates, and academia to advance the correct economists.

“”The bankers run this town””: Senator Durbin.

I can never figure out why otherwise righteous and progressive students of one theory that engages the politics of money would stand one more day of this unnecessary and malevolent private money system.

But I hear it ain’t so bad.

If net financial assets is your thing.

Like banker NEWMAN !!!

The other day, I went to Subway. I ordered my sandwich and when I got to the cash, I realized I forgot my wallet. They actually let me eat my sandwich and leave without payingand they did not even know me!!! Imagine that… And I went back to pay later in the day.

This is what drives me nuts about MMT…. who cares if the government spends before or after?!? At the end of the day, there are checks and balances and if these are not respected, there will be a comeuppance.

Arrêtez de vous enfarger dans les fleurs du tapis!

Eh bien, parce que c’est comment le High-Powered Money (HPM)–le monnaie du governement–fonctionne dans l’Etats-Unis. Après? Non. C’est le point.

Moneta, that is exactly what MMT opponents do – complicate things. The MMT picture is simple, intuitive, natural – the one that everybody uses without thinking. But a crazy, useless picture using crazy useless accounting is what everyone is schooled to believe, although it makes no sense at all.

And this has a tremendous problem – people “respect the checks and balances” too much because they imagine checks and balances that do not and can not exist. Precisely what check and balance do you think MMT advocates disrespecting?

All that MMT says is that if we stop actively preventing people from working – human work being the essential source of all human wealth – we will be much wealthier. One has to be insane to deny this – but that is how monetary societies have been run, more and more since the half dawn of the postwar era ended. Just run whole societies the way everything else is run.

What matters is not how much you spend, but what you spend it on. There is never any problem caused by governments employing every last unemployed person, and it causes tremendous benefits.

So Patman ascared ’em, and that stopped their unapologetic pocketing of change?

The Board of Governors of the Federal Reserve System, a separate government body that answers to the president, sets the policy for the Federal Reserve. It has the force of law under 12 U.S. Code Chapter 3, Subchapter II.

correction: appointed by the president, not answers to the president.

correction: appointed by the president for 14-year terms, not answers to the president.

You should read a little monetary history.

Yes, the righteous gentleman from Patman’s Patch in East Texas had a Bill drafted, and THEN the FR Board adopted a policy.

Patman, the noted populist, educated more people in Congress about money than any other Banking Chair, including the great Henry Gonzalez.

His “Money Facts” pamphlet from 50 years ago was far more telling about exactly how money works than the recent Bank of England missive on money.

To imply that such a Board policy has the force of law is outstandingly in error.

The BoG’s could adopt a new policy tomorrow.

And they have been talking about suspending those remittances when they start selling off CB assets.

Yes, they make their rules and we pay for their losses.

If you think the BoGs is separate government body, then tell me who pays their Bills.

Shoehorning is a terrible monetary education tool.

Since this thread is dead (June 3), I am placing this correction for the record here for future researchers who happen upon this discussion and might be tempted to think that the JuneTown statements (above) about Patman and his bill threatening the Fed to pay the US Treasury, and that the Fed was “pocketing the change” are correct. Neither is true.

I will deal first with the Fed was unapologeticaly pocketing the change, thank you all very much. If, as JuneTown claims, he or she read the Marriner Eccles 1936 document I linked to above, JuneTown would know the Federal Reserve paid 25% of its net income as a franchise tax to the US Treasury from 1913 (inception) to 1933, when it was appealed during the depths of the Depression.

Further in a 1947 Federal Reserve document entitled “The FEDERAL RESERVE SYSTEM Its Purposes and Functions” available at the St. Louis Fed, on pg 55

Now, Patman.

In 1947, Patman was not “Chair of the House Banking and Currency Committee.” Jesse P. Wolcott was.

Congressman Wright Patman did not object to the Federal Reserve paying net profits to the US Treasury. He objected to banks getting interest on treasury securities. On page 45 of this 1947 Congressional record, Direct Purchases of Government Securities by Federal Reserve Banks

Patman said this:

Incidentally, what follows immediately is Wright Patman’s statement that it was Senator Robert L Owen, chairman of the Senate Banking and Currency Committee, and Senator Carter Glass, as then chairman of the House Committee on Banking and Currency, who wrote the Federal Reserve Act of 1913. Glass subsequently became secretary of the US Treasury in 1918.

Wow !

First, I never saw this comment til now, and second, I hope those researchers will do a little searching.

I begin by denying that I EVER said that Wright Patman did anything in 1947…..that was the year (1947 or 1948) that MRW originally claimed a law was passed that required the Fed to pay its net income to the Treasury.

I pointed out that no LAW exists, only Fed Board policy adopted after Wright Patman threatened to abolish the Fed, basically.

But I said ‘in the “ERA” you suggest.

Era’s are long spans of time.

I never mentioned 1947.

Patman was a member of the Banking Committee in 1947 and he introduced legislation to nationalize the Fed, originally in 1938, as a Member of that Committee (The Lost Science of Money. Stephen Zarlenga. Page 532.)

From Ellen Brown’s piece on the 100th anniversary of the Fed.

“”For its first half century, the Federal Reserve continued to pocket the interest on the money it issued and lent to the government. But in the 1960s, Wright Patman, Chairman of the House Banking and Currency Committee, pushed to have the Fed nationalized. To avoid that result, the Fed quietly agreed to rebate its profits to the U.S. Treasury.””

There is no historic question about the actions of the Fed being EXACTLY as I described earlier.

I have no idea why you might think the Eccles record in any way contradicts anything I said. Yes, we all know about the franchise tax…. It was a strong ‘public money’ booster…. We grant them a license and they pay us a tax….we’re in charge !

REPEALED !

We put the SecTreas and Currency Comptroller as head of the Fed Board of Guvs.

REPEALED !

And BEWARE anything coming from the Fed that purports to have said anything in their “Purposes and Functions” (P&F) publications. I have read the changes and the varied statements contained in the numerous printings over almost three-quarter of a century.

THIS…..

“”The Federal Reserve has, therefore, adopted a procedure by which it turns over to the Treasury nine-tenths of its earnings above expenses and dividends. The Federal Reserve makes these payments on the basis of authority contained in a section of the law dealing with Federal Reserve notes. This is another illustration of the public character of the Federal Reserve.”” (That last sentence would NOT have been in any 1947 publication as the Fed touted itself as ‘private’ in the old days.)

Supposedly, according to MRW, this was contained in a 1947 printing of P&F of the Fed. But that never happened til ’63, so how prescient was the observation??

Or, how impossible?

Also, the Fed’s currency statutes contain ZERO such authority, that is just plain Fed BS.

Now, on Patman.

Again, I NEVER said anything about 1947. Just what he did as Chair, as confirmed by Ellen Brown’s historic recollection, and again in Zarlenga’s book.

You imply that I said Patman objected to the Fed paying net-profits to Treasury. How wrong.

I said Patman DEMANDED that they do so. Of course, he was against the private Fed money and banking system, so he was equally opposed to both the people and their sovereign government paying interest to the banks on the money they create. Why isn’t MMT?

Sorry, MRW.

Lots of irrelevant quotes about stuff that does not inform either reader or researcher on why MMT needs to pretend these two things.

1. the Fed is a public body, and

2. the government issues the money.

Neither is true, and MMT will not advance behind such positions.

Ellen Brown, Dr. Joseph Mercola, Stephen Barrett, M.D. and posse do have a tendency for quackery June Town.

Skippy… you should check your sources validity and bias.

http://ftalphaville.ft.com/2011/01/20/464471/the-fed-cant-go-bankrupt-anymore/

JuneTown,

I don’t care what Stephen Zarlenga and Ellen Brown have written. There is no guarantee they saw the relevant documents. There is no proof they understood what they were reading.

The Congressional record stands: “AN ACT TO AMEND THE FEDERAL RESERVE ACT.” That’s called law.

1947. You should read it.

NEWMAN !!!

Have you read his book?

It’s about Freedom From WORRYING about the National Debt.

He worked for 35 years as a major banker, including mega-CEO, and about 2 years in the political position of DepSec at Treasury.

What did he do there?

He doesn’t know where the money comes from that goes into the TGA account.

He said so to Dr. Kelton.

Maybe Biblical?

Some Treasury official.

I read the book.

It says nothing about my statements being wrong about anything.

His book is about maintaining the bankers’school preference to indebt the government by issuing public securities that trade as financial assets in capital markets, continuing to drive the compounding-interest wedge between the NoFearing One Percent and the payers of interest.

NEWMAN !!!

That’s a law left over from the gold standard days.

Read Newman.. He’ll tell you how that’s achieved.

BTW. Only the Federal government can spend. Banks can only lend. Banks do not create money. They create bank credit. Big diff.

The government spends first, then issues treasury securities to supply the positive balance in its general account, which is required by law. “Income” has nothing to do with it.

Yeah, this is one of those Emperer has no clothes moments.

So, is it like a train ticket…..gotta sell them to take them back in for a ride?

So, you ‘bold’ the “first”… why?

I think everything you said was wrong.

We don’t pay taxes with Guv money(currency) ; we pay with bank credit.

Which bank credit, the Guv does not issue.

Neither FIRST, Second, or ever.

There is no need for the Guv to issue the currency that it spends, because it spends bank-credit money that the bankers’ create.

So, we agree here that the Guv “”issues treasury securities to supply the positive balance in its general account, which is required by law…”” in order to obtain bank-credit proceeds that provides the positive balance that is required in its account, BUT, we think that the reason it is required in its account is not for spending, BECAUSE the Guv already spent BEFORE it issued the Treasuries……

Do I have that right?

Did the Guv not need to have the positive balance BEFORE it spent, under the law?

Read Frank N Newman.

I’ve read, and own, both his books.

Any relevant quotes?

Banks don’t actually loan you anything; when you borrow your bank is simply clearing a payment for you in exchange for for a series of smaller payments over a defined period in the future. Once these transactions are completed there is no net quantity of dollars left over over to pay taxes with. If government wants the private sector to hand over a certain number of dollars on April 15th then it must spend that number out into into the economy beforehand.

Thank you.

Shoe-horner !! Shoe-horner !!!

Present.

Banks don’t lend you anything, but when you borrow,……

that is ‘not anything’?

Banks lend us $US-denominated bank credit that serves as the universal means of exchange in our national economy.

Banks lend ‘money’ into existence.

That may, for the sake of money non-science, sometimes, be “not anything’ to some financial-economic seers, but to the rest of us , it’s what we call ‘money’. We spend it. We pay taxes with it.

Your description defies logical gravity.

The Guv has NEVER asked me to provide ‘dollars’ on April 15th, plain old vanilla bank credit has done fine throughout my lifetime.

Where would I get ‘dollars’?

And I never got any of that money from the government until I went on Social Security and got back some of the bank-credit dollars that I paid to the government’s trust in the preceding years.

ALL of the money in circulation is dollar-denominated ($US) bank credit.

The fantasy of printing the ticket so you can get it back is a non-starter if you empower somebody else to do the ticket-printing.

Like, the banks do.

Your starting to foam a bit, really puts a dint in the old cognitive apparatus imo.

Energy can be a fantasy too, does the sun make loans or create currency or monies and who will be the master of it… Ra?

No, actually, I can spend.

And you can spend.

and all God’s children can spend.

and the government can spend.

And we all can spend the Bankers’ money.

The banks don’t lend.

They create and issue bank credit on the basis of debt contracts.

You can only lend something you have.

Read The Credit River Decision.

Please explain your idea of how the legal fact that the Treasury has always, since our existence ( as are all National Treasuries) been obliged to only make payments from existing account balances, is, in any way, a throwback to the gold standard?

What you’re attempting to imply is that non-convertability somehow transformed us into a sovereign fiat government-creating-and-issuing money system.

Sorry, we missed that step,

The day before, the bankers were issuing the money.

The day after, the same.

Or, believe me, you would have heard about it before MMT..

We did hear about it before MMT. You haven’t, and it appears you made no effort to.

Marriner Eccles’ writings. Look them up. These are hardly representative. Just a couple at hand.

• Testimony of Marriner Eccles to the Committee on the Investigation of Economic Problems in 1933

• The Currency Function of the Federal Reserve Banks, 1936. You’ll have to search the St. Louis Fed for it.

• How to End The Crisis, 1933

• Marriner S. Eccles (a Republican banker from Utah): memo to FDR, December 1935

TAXES FOR REVENUE ARE OBSOLETE by Beardsley Ruml, Chairman of the Federal Reserve Bank of New York. 1946

Richard L Owen, Former Chairman, Committee on Banking and Currency, United States Senate: National Economy and the Banking System of the United States — An Exposition of the Principles of Modern Monetary Science in Their Relation to the National Economy and the Banking System of the United States

76th Congress, 1st Session, Senate Document 23, Sent to Government Printing Office, January 24, 1939. Google it. It’s in the Internet Archives. But he absolutely calls what going off the gold standard is: Modern Monetary Science. In 1939.

Owen sought in his own way to explain what the effect of going off the gold standard meant for the American people. But his 100+-page document didn’t reach the public until a few months before WWII started in September 1939.

“[I]t appears you made no effort to” Hey, people have lives. IMNSHO, that kind of riposte is suitable for a serial offender, but not for a first-timer or a novice. I know this will sound weird coming from me, but “Moderate your tone, sir or madam!”

Point taken, Lambert, and I would ordinarily have been of that position; however, JuneTown is not a newbie on this board and cannot be allowed to throw brickbats without responses in kind.

People’s lives are being destroyed–45 million lost their homes, and many of those are on food stamps and can’t afford access to the web to state their positions–while cruel economic falsities continue to ruin their chances of a decent recovery. Writing on this blog isn’t just a place to vent. It’s an opportunity to change things, however slim that might seem. I don’t come here because I have nothing better to do. I consider Yves Smith 5000% more educated about financial matters with a heart to boot–she and I disagree on climate stuff, but that’s another matter. Important people read this blog. And people who vent like JuneTown haven’t done their homework, so they are not going to backhand people like me who have invested a lot of time reading economic papers I can barely understand off the tabletop.

And, frankly, I think what you wrote is important. And If I want to defend it, tough.

MRW, I’ve read all of those.

Without going into detail, you are confusing their identification of ‘potential’ policy implications that comes from abandoning ‘convertibility’ with the actual existence of a policy that can only be accompanied by legislation that changes things. I wrote earlier…….we bypassed the steps necessary to establish a sovereign fiat money-issuance system after we got off the gold standard. Such a proposal was widely debated in the Congress under The Monetary Control Act of 1934. Had that passed, we would have the system you seem to think we have now, which we do not have.

Just such a proposal was made by Fisher, Graham, Douglas et al in this historic document……

http://faculty.chicagobooth.edu/amir.sufi/research/MonetaryReform_1939.pdf

What I can promise you is true is this.

HAD the world changed as you imagine, there would be no need for these proposed reforms, which were publicly supported by over 400 economists at the time, a feat never repeated in economics history that I am aware of.

Both Eccles ( a great CB leader) and Ruml were merely describing the ‘potential’ that exists when we resorted to non-convertability. If our money system we’re not tied to the amount of gold in the vault, then the government COULD create all the money needed to carry out. It still COULD do that today, with a modern version of that Monetary Control Act of 1934. Absent that, guess what?

The day before non-convertability, the banks created all the money as a debt.

The day after, the banks still created all the money as a debt, and we all continue to pay compound interest on all the money they ever created.

The purpose of Ruml’s speech was to call for an end to corporate taxation. He did not make any claim about actual changes in operations, merely stated what could be possible. Neither did he make any recommendation for that change to happen, ever. And, it never did happen.

I agree with him. There is the potential. But I am recommending that we make the change that non-convertibility allows, have the government take over the money-creation powers.

Unless MMT has some problem with that.

First, being precise, the SYSTEM isn’t private; it’s public. At the top of it sits the Board of Governors of the Federal Reserve, which is a Federal Agency. The member banks are privately owned, of course, and the 12 District Fed banks are privately owned, but they must turn their net profits back to the Treasury Department at the end of each year and are allowed only 6% for operating expenses. They are non-profit organizations, and are absolutely subordinate in policy making to the Board of Governors, which, in turn, is subject to the will of Congress.

Second, Stephanie said that the Government is the issuer of the currency, not the money. “Money” is an ambiguous term, with multiple definitions. Private banks generate deposits when they make loans. But those deposits are not net financial assets, because they are matched by the loans, which are liabilities of the borrowers. The Fed District banks do have the authority, delegated by the Congress, to create reserves which they can either trade or lend to the private banks. They can’t generate reserves to simply give to the banks, and what they do with the member banks is strictly determined by policy specified by the Board of Governors.

The regional banks order currency creation by the US Mint as Federal Reserve notes and then once the notes are delivered to them by the Mint, they pay it for its expenses in creating the currency and they issue the currency to the public through members of the banking system. But they do not create currency.

Coinage is still the province of the Treasury. The Treasury takes orders for coins from the 12 District Banks. The Mint then issues the coins to the Fed District banks, which buy them from the Mint. When the mint ships the coins to the District banks it then books the sales, including the seigniorage profits (the face value of the shipped coins less the Mint’s costs in producing them). The Treasury this earns seigniorage from coins, but not from currency. nevertheless it creates both the currency of the United States and its coins and is only Department authorized to do so.

The claim that “the Government” must raise money by either taxing or borrowing is also false. The Government, including the Congress and the Fed, as well as the Treasury creates high powered “money” (reserves and coins) by fiat, as is indicated above, always using Congressional authority, and, at times through a circuitous procedure where Congress first appropriates, Treasury borrows, and spends, and later the Fed creates new reserves to buy back Treasury debt from the private sector, completing the circuit from appropriations to creating new money.

In addition, however, the Treasury issues coins (money) which are bought by the Fed which then credits the Mint’s Public Enterprise Fund (PEF) at the New York Fed with reserves in the amount of the face values of the coins. So this is new money created by Treasury alone.

Also, while the following practice has never been used, the law allows the Treasury to issue 1 oz. platinum coins with face values determined by the Treasury. These can also be shipped to the Fed and deposited in the PEF. Once deposited, the Fed gets the coin as an asset in return for issuing serves into the PEF account, which can then be swept for seigniorage into the Treasury General Account (TGA). Since the face value of such a coin can be arbitrary, Treasury can, even though it has never done so, working through the Mint) mint a $60 Trillion platinum coin and deposit it at the Fed, whereupon the Fed would be forced to produce $60 T in reserves, which would then obviate the need to “borrow money” ant longer for at least 15 – 25 years.

Well, as I said above, it does create and issue money which is eventually spent. But, even to limit this to Treasury. That Department could create large quantities of money prior to spending using coinage, which after deposit would get converted into reserve credits in the TGA. After which Treasury can spend money into the non-Government sector by ordering the Fed to keystroke it into non-Government sector accounts into the banking system.

They will say that. The problem with their view is that the Government is not the Treasury alone, and, in addition, people who work at the Treasury haven’t used their platinum coin seigniorage authority before, so they are unfamiliar with this unused capacity.

For any old bank to advance purchasing power into the economy, they must have a loan contract. In addition, they don’t create “currency” in this transaction, they create deposits, bank reserves in a depositors account. As for the District Fed banks, they can order currency, receive it from the Mint, and issue it into the banking system (selling it to the banks in return for reserves). But they cannot just create US currency without the using the Mint.

The Fed reserves issued by the District banks are traded to them in return for assets, frequently Treasury debt. But this doesn’t add purchasing power into the economy, because Fed reserves must stay “locked up” in the bank reserve accounts at the Fed. They can only be used to lend to other banks, to meet reserve requirements for lending, or to buy Federal debt instruments.

Sorry, Joe, too many words about unimportant stuff.

Too much fog around the money.

The Act creates a Federal Reserve Banking SYSTEM, whose private Bankcorporate Members control the money making powers of the country. The SYSTEM is privately owned, and operated for the profit of these owners.

Let’s not waste time on trivialities here. Who pays the bills?

More fog around he money and the currency.

They’re the same thing to most people ….money (currency)..

When we talk our political economics and we talk about using the money system to change our socio-economic outcomes, we can easily avoid the fog of the reserve-based banking system, because reserves are not money and make no contribution to any measure of what is important today, the gdP, P being he product measured in money quantities….that never include reserves. Nobody knows or cares about reserves. Except bankers.

Too much license is taken with functional finance.

It is not a fact of political-monetary-economic reality.

It is one method developed for analysis of national accounts.

We have a private central bank and a private banking system known as the Federal Reserve Banking SYSTEM. Functional Finance does not change that reality and its confluence within MMT is damaging to our political dialogue at this time of greatest opportunity.

Joe, while acknowledging that anyone at Treasury would dent it, you keep repeating, as above and always, that the Guv creates money when it spends, but you ignore my straight-forward questions in that regard….. Since when? and, How did it happen?

Don’t think I ignored your questions. Just think I pointed out why you’re dead wrong. To do that the detail was necessary. Sometimes it is necessary to tell the truth instead of just giving a BS story.

Anyway, the record of both sides is there for people to see. I’ll let them make up their own minds about who’s got the narrative right and who’s just slinging the BS to defend a pre-conceived opinion.

Funny that I saw nothing that you wrote that contradicts anything I had said, just some errant observations about how functional finance “joins’ the private CB with the Guv, which allows us to gladly pretend that the private CB IS the Guv, just so that we can say that the Guv creates the currency because they create coins and ‘reserves’…….., which reserves used to actually BE gold, but which today amount to nothing more than keystroked and journal-entried, inter-bank settlement media that NEVER contribute one cent to our GDP, and which remain quasi-necessary only as long as we have a debt-based system of money.

Please, Joe, tell me one fact that I wrote that qualifies for the BS pre-conceived opinion that you speak of.

Who pays the Bills of the FR system, Joe, including that sacred B of G’s?

Is it the Guv, or the banks?

It is past time to stop perpetuating the myth that we have either a public central bank (FRBNY is a stock-issuing PRIVATE Bankcorporation, with all advantages appurtenanced thereto) or a publicly-issued money system.

We have neither.

That the banks exercise what Lincoln called “the supreme prerogative of government” by creating and issuing the money does not make them part of the government.

Sorry ’bout that ‘too many irrelevant words’ carp, but we’ve all already had that discussion.

The BS is where?

Whenyou pay taxes using your bank deposit the Fed debits your bank’s reserve account to effect payment. Reserves come only from the Fed, and in the case of an overdraft in a reserve account, an overdraft *is* a loan from the Fed and booked as such on statement day. Bottom line- the $ that pay taxes come only from the govt/one of its designated agents.

And, as Joe wrote, functionally the Fed is entirely an agent of Congress. What are called shareholders are nothing more than depositors.

If we don’t tax people at all but the government proclaims the people must use its currency to conduct business, the same way that the government says we drive on the right side of the road, does that currency still have ‘value?’

Without tax collection it would be far more problematic to determine whether people are in fact using the currency.

Like we need to know how many drivers are driving on the right side of the road (which should equal to the total number of drivers, hopefully)?

I’m pretty sure drivers aren’t required to drive on one side of the road to maintain the value of cars.

Thus, I am hoping we can do the same with the currency.

Warren,

Nice try.

Nobody cares about what happens to their check when they pay their taxes. It has no relevance to what we are trying to accomplish with public purposed money.

The real people see their bank-credit balance reduced by the check amount….that is all that is relevant to their ‘real economy’.

Inter-bank settlement operations have NOTHING to do with our real economy.

CB-interbank reserve diddling is typical introduction of irrelevant ‘fog around the money.’ We’re long past being impressed by reserve-adds and reserve-drains.

‘functionally’ the Fed system produces Billion and Trillions of profits for the banker-owners of shares in the Fed SYSTEM (and others).

Those banker-owners making those profits are legally bodies bankcorporate, and no amount of Mosler shoe-horning can ever, in reality, make them agents of the Congress or of Guv monetary policy.

Fed Reg.Bank Pres’s serve as agents to the FR Board in their handling of printed currency until it enters circulation. That is the real extent of ‘agency’ within the system.

What are called ‘shareholders’ are the bankcorporate bodies holding shares in the Regional FR Banks, including our central bank.

Functionlly, the Fed SYSTEM perpetuates a system of money based on debt contracts, that draw perennially-compounding interest from the Ninety-Nine Percent to the One Percent.

Nobody cares whether a bank overdraft is a loan from the Fed, or not.

What I know is that if I overdraft my account for 10 bucks for one night, I get a $35 fee, but the banks pay only a quarter-to-half of one percent on their overdrafts.

I pay thousands of percent.

Funny how banking benefits the One Percent that way, eh?

Incredibly arcane subject but I think I’d declare June the winner.

We only get the “M” in MMT when it’s post 1971 and money is completely fiat. But it’s not as though the other 99.9% of mankind’s experience with money suddenly became irrelevant.

That prior history tells the same tale over and over. Money is not wealth, goods and services are wealth and money simply represents them. No matter what the mechanism, if too much money is issued representing a slowly-growing quantity of goods and services we get price inflation. This saps purchasing power and reduces a standard of living, unless of course the wage side keeps up.

Apologist theories that enable the endless expansion of the state are to me quite toxic. Eventually they end up in the same destination: a bloated parasitic state adding nothing to the productive capacity or wealth of a society.

[lambert blushes modestly] Giants, shoulders.

what if you don’t want a job, but still need a paycheck? It sounds like it would be a lot harder to skate by on the margins of society in an MMT regime. How could somebody not have a job if there’s a job guarantee? It would appall people. You’d have a hard time explaining yourself to society at large. To not have a job would be a form of sin and an odious dereliction. The police would come and arrest you for laziness and lock you up and then make you go to work, doing something that would require you to abandon both your mind and your soul. Not much would change! But the streets would be cleaner, that’s for sure.

That’s not the JG proposal. In the MMT proposal, the JG is non-coercive. People don’t have to take a JG job. They can rely on the same safety net they do now. There can even be a Basic Income Guarantee (BIG), for those who can’t work or who don’t want to, as long as there’s a substantial gap between the living wage of the JG and the BIG.

I agree with you that the existence of the JG would probably result in a greater stigma being attached to able-bodied people who didn’t want to work. But, if that results it will be because most people believe not working is reprehensible. Those of us who believe that working at a job ought not to be compelled, will then have to persuade others that ours is the right way to look at it.

That may be a burden on us, and having the additional stigma on those who make this choice may be a heavier burden on them. But, today there are roughly 26 million people out there who want a full-time job at a living wage with good fringe benefits who can’t find one. When I compare the burdens they are bearing with the burden of the additional stigma people who choose to remain free of employment at a job, I think the right choice for Government between these two burdens is very, very, clear. The obligation we owe to the unemployed who want to work, but can’t find work in our present failed economy is far greater than our obligation to those who want to avoid the additional stigma of choosing not to work in a JG world.

Not having a job is already viewed as stigma. It has been this way for centuries. Choosing not to work because one has the financial means to do so is of course the exception. But, not working and being poor is a moral crime. The problem we have is lack of a mechanism in place that will ever guarantee that folks in poverty that would like to work can find work. That’s what the Job Guarantee proposes to fix.

Of course, we can challenge the linkage between income and work. Personally, I think it’s a detestable arrangement. But, that’s a criticism of capitalism, not MMT’s Job Guarantee.

I hope one day we move beyond making sure people ‘who like to work can find work’ to helping people who ‘like to work meaningfully can find meaningful work.’

Right now, people already working, at jobs they detest, are completely left out of the discussion.

It’s a ‘quality’ issue, similarly to asking Krushchev that ‘we don’t care about your record wheat harvest, but only this, are they organic and healthy or laced with pesticide?’

Please pay closer attention to the Job Guarantee literature then. The jobs created in the MMT Job Guarantee will be defined with the bottom-up participation of enrollees in the program. So they will have their input on shaping jobs so they will be meaningful to them.

Since that’s the case, people working in the private sector at non-meaningful jobs will be able to quit those and move to the meaningful jobs in the JG. Soon that will pressure the private sector to either structure meaningful jobs or pay more per hour for people to trade-off meaningfulness against increased compensation.

I wonder if it will work as described in the literature you mentioned.

It sounds like we all should be in JG then, from the president on down.

Mitch, if you detest that work-income linking arrangement, I believe JG perpetuates it.

This is a good opportunity to philosophically reflect on the human condition and to post rock & roll lyrics that sum things up:

Cleaned a lot of plates in Memphis

Pumped a lot of pain down in New Orleans

But I never saw the good side of the city

‘Til I hitched a ride on a river boat queen

Big wheel keep on turnin’

Proud Mary keep on burnin’

Rollin’, rollin’, rollin’ on the river

Rollin’, rollin’, rollin’ on the river

If you come down to the river

Bet you gonna find some people who live

You don’t have to worry ’cause you have no money

People on the river are happy to give

Big wheel keep on turnin’

Proud Mary keep on burnin’

Rollin’, rollin’, rollin’ on the river

-Credence Clearwater Revival, Rollin on the River

I don’t know where that river would be. It may just be a river in the mind and you only get there if you make lots of money as a rock & roll artist and you can lay around and not work. At any rate, it’s hard to manage a society with 300 million people without Jawbs. God know what kind they’ll be or what it’ll do to politics, but if you don’t have one it doesn’t really matter does it? It wouldn’t to me. Let them test the JG on a place like Memphis and if it works, roll it out on the river!

Ya CCR! Been listening to them lately on the Walkman at the gym when I need a sonic barrier to protect me from whatever the hell that crap is they are playing.

Not that the lyrics make any sense…they got riverboat gambling on ‘Ol Miss…but I think the cash flow is the wrong direction.

Humans in general are weaker today than 100 years ago.

Today, people fear silence.

Everywhere they go, they must have ‘music.’

Silence? That’s scary.

I don’t know if there can be a “Saskatchewan of the JG” (single payer reference). Is there a real guru out there who does?

If you haven’t noticed, there’s a stigma working at shit jobs too, and the majority of jobs are shit jobs. It’s also extremely depressing that one has to spend all the best years of one’s life toiling for eight to ten hours a day, 5-6 days a week, for fifty odd years at said shit jobs, or any job for that matter. That’s pathological.

I might buy into a JG if we witness a radical shift in the nature of work (far better flexibility, work conditions enjoyed by the average tenured professor, and mandatory vacation time counted in months not weeks, shorted work weeks–25hrs sounds good–along with a humane and living wage). Absent those types of systemic changes, and all the JG boils down to is a pontificating Puritanical noose around one’s neck: It’ll be same old same old for workers laboring in shit jobs

To reiterate. A JG would only be a just arrangement if the work to be done was meaningful and fulfilling, with humane perks, say, like a tenured college economics professor enjoys.

*** On a related note, any one with an income over $1 million a year will be taxed at 90%. Redistribution should be a staple of MMT. It’s a perk from privileged workers to unprivileged workers in shit jobs—MMT JG shit jobs too.

100%, otherwise they would start making 10 million a year to come out ahead, after taxes.

“It’s also extremely depressing that one has to spend all the best years of one’s life toiling for eight to ten hours a day, 5-6 days a week, for fifty odd years at said shit jobs, or any job for that matter. That’s pathological.”

It is extremely depressing. People say it’s depressing to be unemployed. Indeed it is. It’s also depressing to spend one’s life working most jobs. Some people claim to collect disability because they are too depressed to work, I say work itself is a major cause of depression, work such as it is makes people depressed. Do you not work because you are depressed or are you depressed when you work?.

“I might buy into a JG if we witness a radical shift in the nature of work (far better flexibility, work conditions enjoyed by the average tenured professor, and mandatory vacation time counted in months not weeks, shorted work weeks–25hrs sounds good–along with a humane and living wage).”

I’m with you. I think most proponents of JG like to work within the system, and that’s why they don’t go there – to reduced work weeks, etc. and not because of any inherent conflict of that with the JG. They’re basically “work wihtin the system” types not radicals.

“Absent those types of systemic changes, and all the JG boils down to is a pontificating Puritanical noose around one’s neck: It’ll be same old same old for workers laboring in shit jobs”

Although in theory a JG allows a lot of flexibility to say take 6 months off and get hired again etc. (although that should be explicit – any government program can decide the criteria of eligibility – very little of the current meager safety net comes without constraints for instance – and in a work ethic culture, it would be easy to say “take 6 months off, no job guarantee for you!”). I have this lingering fear that what will really happen is something like Vonnegut’s novel “Player Piano”. Almost everyone employed with the reeks and wrecks doing BS jobs. We may have a minimal choice of masters with a JG (not really if you can’t get another job), but where is the system in which working people DON’T HAVE masters?

Malmo, craazyboy, Jrs, excellent points.

One word: quality.

Sounds like an impossible demand. Check the post again on better options, and realize the JG sets the baseline for the private sector wage and benefits package. JG may not provide “justice.” But it makes matters more just.

Here’s a good conversation starter on the subject of work:

http://news.yahoo.com/swedes-test-future-less-more-play-150640783.html

Malmo: The JG can have those kind of conditions if the society is productive enough to make every job have a working conditions / pay mix at least as good as that of tenured professors. If the working conditions are worse, the pay should and would be higher. But many societies in the past were not so productive. Saying that a JG has to wait until the society is wealthier, that unemployment and dire poverty, perhaps starvation is and was OK as long as it is in a poor society is not very sensible.,

As for the JG being the same old, same old, “working within the system” – Though this guy should have thought more carefully about “the right to work” which he clumsily called ” the first clumsy formula wherein the revolutionary demands of the proletariat are summarized” in the preceding sentence, he next said:

Contemporaries like Nassau Senior & De Tocqueville on the other side understood perfectly well that the JG was dynamite to the established order. The bad guys, the elites have always understood this. Not having a JG is the only thing that keeps their boots on everyone else’s neck. But so many think that the .01%ers are stupid. (As a class) they’re evil, not stupid.

They may have learnt nothing since back then – 1848. But equally they have forgotten nothing, while they have worked hard to ensure everyone else has. Hell, people hardly remember 1948 or 1978!

Have you considered how many of the 92,594,000 Americans who have been defined out of the workforce might be interested in applying for the JG, as a way to participate in the economy instead of struggling to subsist? Benefits? That would be a HUGE savings for many of them. Especially if the BIG doesn’t include health care and they don’t want or can’t get Medicaid. The pool of ready and able workers may well be structurally huge in comparison to capitalist needs. Sparkle pony jobs?

http://www.washingtonsblog.com/2014/05/almost-3-times-many-people-dropped-labor-force-joined.html

“Rules that prevent the Fed…from monetizing the debt, is a self-imposed constraint”.

This is how it is in the U.S.