Yves here. This post from VoxEU gives a partial answer to a question many US readers have been asking: what are the prospects for the Transatlantic Trade and Investment Partnership? As we’ve written, the Transatlantic Trade and Investment Partnership’s evil twin, the TransPacific Partnership, looks to be in trouble. Both the Senate and the House are opposed, and Obama wants them to give him “fast track” approval to facilitate completing the accord. Our resident Japan commentator Clive says the Japanese press is treating the deal as dead, absent major changes in US posture that no one expects to happen. The Wikileaks publication of two draft chapters showed that all of the proposed parties to the agreement have significant objections to many of the provisions.

But much less is known about the state of play of the Transatlantic Trade and Investment Partnership. Many commentators have assumed it is moving forward simply due to positive messaging by the US Trade Representative’s office, the assumption that Europe and the US have generally common interests, and the lack of negative press. But as we wrote recently, sentiment in Germany is strongly against the Transatlantic Trade and Investment Partnership. With Germany already reconsidering its relationship with the US as a result of US spying, pushing back against the investors panels, which is the part that Germans and people not in the pocket of multinationals find most offensive, is far more likely than if US/German relations were on a better footing.

The VoxEU post recaps commentary among economists on the Transatlantic Trade and Investment Partnership. What is striking is the level of objections, and that if you look carefully, most of the economists who are supportive of the TTIP and TPP are American, while most of the Europeans (and Dean Baker) are opposed or (like Pascal Lamy) approve of the liberalization of trade but object to the investor panels. The European economists’ reactions likely represent a considerable swathe of official views.

By David Saha, Affiliate Fellow, Bruegel; Consultant, Berlin Economics. Cross posted from VoxEU

An early draft of the Transatlantic Trade and Investment Partnership (TTIP) sparked an intensive public debate over possible advantages and disadvantages. This column reviews some arguments in favour of the Partnership and against it. While there is some debate over how large the economic benefit could be in the face of already relatively low trade barriers, critics claim that the deal will lower standards of consumer protection, provision of public services, and environmental protection in the EU.

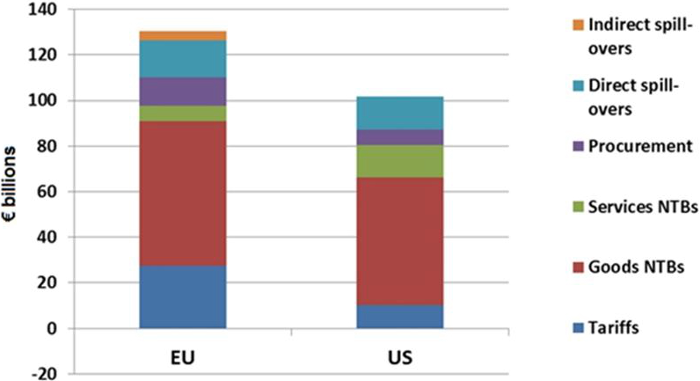

A study by the Centre for Economic Policy Research (CEPR 2013) for the European Commission models the effects of the Transatlantic Trade and Investment Partnership (TTIP) in a computable general equilibrium model. An ambitious deal, consisting of tariff barriers being lowered to zero, non-tariff barriers lowered by 25%, and public procurement barriers reduced by 50%, would lead to an increase in EU GDP by 0.5% by 2027. Growth effects for the rest of the world will be positive, on average, 0.14% of GDP due to increased demand from the EU and US. Because of different compositions of trade, particularly low income countries will not be negatively affected by the TTIP.

Another, less frequently cited study by the Bertelsmann Foundation (2013) finds larger long-term GDP per capita effects of 5% for the EU and 13.4% for the US as a result of dismantling all tariff and non-tariff barriers. Here, gains would largely come at the expense of third countries. For Canada and Mexico, whose free trade agreements with the US would lose value, TTIP would in the long run imply a 9.5% and 7.2% decrease in GDP per capita over the baseline scenario.

The EU Trade Commissioner Karel de Gucht (2014a), citing the CEPR numbers, writes that TTIP offers significant benefits to the EU and the US over ten years during times of hesitant economic recovery. As shared values will facilitate negotiations, results should be reached in three dimensions: Market access, regulatory cooperation, and trade rules. Improved market access will benefit European companies and consumers alike. Standardisation in regulation would avoid unnecessary costs for global producers.

Dean Baker (2014a) argues that calls to support TTIP for its beneficial impact on jobs and growth are lies: The CEPR model assumes full employment anyway, and a GDP raise of only 0.5% over 13 years will not have a discernible impact on employment. Growth effects may in fact even go in the opposite direction — stronger patent and copyright protections may result in higher prices for goods.

Figure 1. Annual output gains from TTIP by type of liberalisation

Gabriel Siles-Brügge and Ferdi De Ville (2013) challenge the proclaimed benefits of this much-vaunted deal. Most of the economic benefit outlined in the CEPR study is due to the dismantlement of non-tariff barriers. Yet, the Commission has itself pointed out that only 50% of non-tariff barriers are at all ‘actionable’, i.e. within the reach of policy. Eliminating half of these, as assumed by the CEPR, seems already highly ambitious. Furthermore, due to strong inter-sector linkages, these benefits will only materialise if liberalisation is successful in all sectors.

The Global Significance of Bilateral Agreements

Pascal Lamy (2014) writes that preferential trade agreements (PTAs), such as TTIP, could be very beneficial if they helped to bring down remaining tariff barriers. However, most PTAs focus more on regulatory issues than tariffs. Some non-tariff barriers, such as consumer protection, serve legitimate objectives. And there exists a risk that PTAs may lock various groups into different regulatory approaches, increasing transaction costs. In the end, a functional multilateral trade system through the WTO remains vital to avoid economic fragmentation and set globally sensible rules.

Michael Boskin (2013) points out that the TTIP may have consequences that extend beyond the US and the EU. After NAFTA was signed, the Uruguay round of trade talks was revived. Similarly, a successful TTIP may be a major impetus for rekindling the moribund Doha Round. It will be of great importance whether compromises can be found in the truly contentious issues between the EU and the US. One of the most difficult is the EU’s limitation of imports of genetically modified foods, which presents a major problem for US agriculture. Another is financial regulation, with US banks preferring EU rules to the more stringent framework emerging at home. This is of interest to countries outside the deal, too; if the EU relaxed its rules on genetically modified food imports and translated this with careful monitoring to imports from Africa, this could be a tremendous boon to African agriculture.

Hans-Werner Sinn (2014) is not surprised that bilateral trade agreements have been lately gaining traction globally, as there is no real progress on multilateral trade negotiations. The Doha round of WTO talks basically was a flop. Currently, fear of negative effects on consumer protection in the EU is distorting the debate. In reality, consumer protection standards in the US are often much higher than in the EU where, following the Cassis de Dijon ruling of the European Court of Justice, the minimum standard applicable to all countries is set by the country with the lowest standards. TTIP could bring significant economic benefits while scrapping some misguided EU regulations, such as the capping of CO2 emissions on cars, which is a covert industrial policy aimed at protecting Italian and French manufacturers of smaller cars.

Non-Tariff Barriers to Trade and the Protection of Intellectual Property in TTIP

Paul Krugman (2014) writes that if the Trans-Pacific Partnership (TPP) agreement of the US with 11 countries throughout the Asia-Pacific region were to fail, it wouldn’t be a major disaster. Real trade barriers – tariffs – already are pretty low. The International Trade Commission in their latest report put the cost of American import restraints at 0.01% of GDP. What these agreements tend to be really about are issues such as intellectual property rights – with far less certain advantages. Intellectual property rights create temporary monopolies. These may be necessary to spur innovation but are not connected to classical arguments in favour of free trade.

Ryan Avent (2014) thinks that Krugman hasn’t done his homework on this issue. Firstly, tariffs are not universally low. Even if the macroeconomic impact may be limited, reducing high tariffs on some goods would be microeconomically desirable. Secondly, one of the ambitions of both TPP and TTIP is the reduction in non-tariff barriers. In most cases, such as agricultural imports, these barriers are much costlier than tariff barriers.

Dean Baker (2014b) is highly sceptical of the usefulness of increased protection of intellectual property: The possibility of silly patents such as one on a peanut butter sandwich in the US only raises prices and impedes competition. The big winner may be the pharmaceutical industry, which may extend the unchecked patent monopolies it enjoys in the US to the EU, resulting in higher drug prices and lower quality healthcare. Other companies see TTIP as a way of promoting their particular interests, for example, by being able to use free trade arguments to circumvent the democratic process on issues such as fracking.

Investment protection – a threat to national sovereignty?

TTIP is not about the interests of the US dominating those of the EU, but of the interests of capital owners prevailing over those of ordinary citizens, writes Jens Jessen (2014). Investor protection clauses in TTIP would be a vast threat to national policies on culture and education — public universities could no longer be supported to be more affordable than private ones. Support to a local film industry would be impossible as big companies would have the same rights to subsidies. Production companies for popular entertainment could sue states to extend to them their support for local operas and symphony orchestras, and public radio stations would be under threat as well.

Karel de Gucht (2014b) sharply retorts that these allegations are unfounded — the EU treaties and the UNESCO convention on cultural diversity require member states to protect cultural diversity and explicitly permit schemes such as support to local film industries, whereas audio-visual services are not at all in the scope of TTIP anyway. Investment protection treaties, of which Germany alone has signed 130, have never included compensation rights for firms in case of profit reductions. And after Poland signed an investment protection treaty with the US in the early 1990s, its right to offer subsidies in the sector of culture or education was never called into question.

The investment chapter in TTIP is less of a threat to EU and US democracy than often alleged, writes Robert Basedow (2014). Critics claim that investor-state dispute settlement clauses will allow investors to sue states before supranational arbitrational tribunals for the annulment of social, health or environmental protection laws. However, due to the existence of a multiplicity of bilateral treaties with financial hubs like Hong Kong or Singapore, investors with holdings in these jurisdictions already have this right today. Indeed, TTIP offers the chance to make such arbitration proceedings more transparent and legitimate.

References

Avent, R, (2014), “More homework, please“, The Economist Free Exchange blog, 28 February.

Baker, D (2014a), “Why Is It So Acceptable to Lie to Promote Trade Deals?“, Beat the Press Blog, Centre for Economic and Policy Research (Washington, DC) 30 May.

Baker, D (2014b), ”TTIP: It’s Not About Trade!“, Atlantic-Community.org, 12 February.

Basedow, R (2014), “Far from being a threat to European democracy, the EU-US free trade deal is an ideal opportunity to reform controversial investment rules and procedures”, LSE EUROPP Blog, 2 July.

Bertelsmann Foundation (2013), “Who benefits from a transatlantic free trade agreement?“, Bertelsmann Stiftung Policy Brief 2013/04.

Boskin, M (2013), “Transatlantic Trade Goes Global”, Project Syndicate, 16 July.

Centre for Economic Policy Research (2013),”Reducing Trans-Atlantic Barriers to Trade and Investment“ , final project report for the European Commission.

De Gucht, K (2014a), “Aiming high: the values-driven economic potential of a successful TTIP deal” , Oecdinsights blog, 16 June.

De Gucht, K (2014b), “Zum Glück kein Wahnsinn“, Die Zeit, 13 June.

Jessen, J (2014), “Eine Wahnsinnstat“, Die Zeit, 12 June.

Krugman, P (2014), “No Big Deal“, The New York Times, 28 February.

Lamy, P (2014), “The Perilous Retreat from Global Trade Rules“, Project Syndicate, 9 January.

Siles-Brügge, G and de Ville, F (2013), “The potential benefits of a US-EU free trade deal for both sides may be much smaller than we have been led to believe”, LSE USAPP blog, 17 December.

Sinn, H-W (2014), “Free-Trade Pitfalls“, Project Syndicate, 24 June.

Thanks a lot for this balanced review of the issues involved in TTIP! Apart from the issues, TTIP is currently as good as dead from the political point of view. Maybe the unfolding Ukraine crises, the deteriorating European relationship with Russia and progress in US negotiations with China (also involving ISDS) will change that, but it’s too early to tell.

Its outside my usual brief (I have too much fun with Japan-related TPP shenanigans), but the European Court, in a ruling about a narcolepsy inducing case concerning organic ingredients in foodstuffs — you can read it here http://www.bailii.org/cgi-bin/markup.cgi?doc=/eu/cases/EUECJ/2014/C13713_O.html but that’s not recommended unless you like this sort of thing, I rather strangely do enjoy such things but then my mother always warned me I’d turn out bad if I kept on reading the Socialist Worker — is gearing up for what looks to me like a fight.

To quote from the judgement handed down (emphasis mine):

“59. The issue is, potentially, of immense importance. It prefigures, in a rather more limited context, one of the types of issue likely to come to the fore in relation to the Transatlantic Trade and Investment Partnership (‘TTIP’) currently being negotiated between the Commission on behalf of the EU and the US Trade Representative on behalf of the US. (21) It is an issue of ‘mutual recognition’ which raises questions of equality of treatment and, possibly, of reverse discrimination. If the EU must admit the import and subsequent sale, as organic, of foodstuffs which are not compliant with EU rules but merely provide equivalent guarantees, one may query whether it should not also be possible to market, as organic, foodstuffs produced in the EU which would meet the requirements of the rules which provide those equivalent guarantees. With regard to the TTIP, concerns have been voiced that, inter alia, there would be a de facto assimilation of vast swathes of regulatory measures and a consequent loss of regulatory autonomy.

…

Footnote 21: – See http://trade.ec.europa.eu/doclib/docs/2013/july/tradoc_151605.pdf for a brief summary. It may also be noted that Article 2.7 of the TBT Agreement (cited in footnote 18) requires Members to ‘give positive consideration to accepting as equivalent technical regulations of other Members, even if these regulations differ from their own, provided they are satisfied that these regulations adequately fulfil the objectives of their own regulations’.

Here’s something that the USTR should realise, but I’m sure it doesn’t. It’s true in Japan vis-à-vis the TPP and, from the above, I’d say it’s also true of the EU where the TTIP is concerned. Courts are prissy, vain and territorial creatures. They absolute hate — and often with good reason because their history is strewn with having to fight such things — interference in their jurisdictions. They have to pick up the pieces of bad law, bad politics and bad actions for when states try to undermine hard-won segregation between the law and the state.

The battles to keep the state, the justice systems (and religion too, but we won’t go there now) fully separate have left deep scars and those working in the justice systems don’t forget them. It is a brave, probably foolish, politician who threatens to unpick the uneasy truce between the state and justice.

Yeah, the courts won’t allow it. They didn’t spend the last 30 years slowly arrogating power for themselves which had previously belonged to sovereign governments just to give it away to a bunch of City and Wall Street lawyers.

I do quite a bit of buying and selling across international borders here in the EU and can add the tariff issue is always a pain. It does raise the cost of goods sometimes higher than your competitor. We don’t even have uniform duties processes. Import something in France will be a different cost than importing them in Belgium.

Standardization is another huge problem for international shipping. I knew a case where a $84,000 Ferrari was shipped to the US from Germany. The German dealer told him the specs would be OK to import into the US. However, that was not the case. Once the Ferrari landed in the US, customs told him the car did not meet US specs and the only to fix it would be to have the car factory alter them. He was forced to re-export the car back to Europe to try and get some money back at a huge loss. If there was a standardized agreement between US & Europe, this incident would not have happened.

Another standardization issue is medical device approvals. Here in Europe we certify devices much quicker than the US FDA. What medical device companies have done since the approval is slow in the US, they export them as ‘parts’ to Europe (selectively duty free) to be re-assembled for re-export. They get a quick approval in the Europe and they are able to export them to countries like China. This has been a dangerous game Europe has played. I will leave this story alone.

GMOs is another hot button issue. The EU has a long-time ban on imported GMO products. GMOs are modified food stuff like corn to resist pests. Most of the world use GMO foods, including the USA. At some point, because of climate change, Europe will have to come around to GMOs because it will be the only way to sustain crops. From the USA point of view, there is no science evidence to back Europe’s position. Trust me, the arguments against imported GMOs is pretty fierce so it may have to wait.

As for the investment protection, I am in favor of having a separate court system to resolve conflicts outside of the domestic courts. Sure, there are egregious, high-profile, cases but the court system here in Europe is horrible and not uniform across the Continent. Believe me, you don’t get justice in a dispute. They take too long and cost too much to resolve. When you are in business you need quick resolutions to disputes. (Lawyers are a well protected industry here in Europe. They talk up a good game on free movement of goods and people… except for lawyers. Lawyers are so well protected if you have a dispute in a neighboring province, you cannot file it locally and you cannot use your local lawyer. You must hire a lawyer in the province where the dispute is. As a result, dispute cases costs are sky high and will cost you royally. You can count on the legal industry not being a topic in TTIP.)

Obviously, trade agreements have a lot do with politics these days. Neither de Gucht (outgoing) nor Obama have this long running trade talks wrapped up, although they act as if it is in the bag. Both will have to confront their skeptical constituents, which seem like it will fail. Folks on both sides of the Atlantic realize trade globalization has been a disaster for jobs and the environment and are reacting negatively to the hype.

You couldn’t be more wrong about GMOs. The Europeans–and now the Central Americans–are absolutely correct to fight against introducing these seeds. As a plant pathologist, I can state that using GMO seeds flies in the face of every best practice for pest management that I learned in graduate school. The two most effective methods for increasing yields relative to pests are: 1) Rotate products in order to avoid insect adaptability to any one control, and 2) Monitor crops regularly to apply only the amount of control needed as needed. BT corn, in particular, is a serious threat to the efficacy of one of our best natural defenses against assorted insect larvae, Bacillus thuringiensis. The push for GMOs is a desperate attempt by a two-trick pony, Monsanto, to buy off U.S. government officials in order to keep their company alive. It’s sad, really, because Monsanto could have focused its efforts on developing more drought-resistant crops through breeding, or crops better adapted to local land and climate.

Hey, Grayslady, I was going to respond to what John said about GMO, but after reading what you said, I don’t need to! Well done.

Is it fair to suspect that the Bt-trait was engineered into corn preCISEly and exACTly to select FOR Bt resistance and immunity among target pests to precisely and exactly and DELIBERATELY ON PURPOSE deSTROY the efficacy of Bt-spores in organic agriculture? So as to destroy the Bt-spores tool in order to make organic agriculture more difficult? On purpose? On purpose?

Not only is the GMO example a bad one, but the Ferrari anecdote is near worthless. An $84,000.00 Ferrari is obviously a well-used one considering a new one runs anywhere from about $190,000.00 to around $400,000.00.

I’ve often wanted to import a foreign made car into the U.S., but unlike the Ferrari buyer, I usually check with US Federal laws first, myself, and then check with one or two buyers of the same model, easy to do in today’s connected world. You know, Caveat Emptor?

When it comes to import/export rules of foreign used cars from anywhere into the U.S., who in their right mind would ever believe anything a used car salesman tells them?

I don’t think you’re entirely wrong in everything you say there John, but I don’t think you’re entirely right either. Let’s take your imported (to the US) / exported (from the EU) Ferrari example. Taking your argument (which, I’ll paraphrase, let me know if I’ve got the wrong end of your stick here) to its logical conclusion, what you’re suggesting is that “barriers to trade” such as auto emissions, safety and even such fundamentals as weight (i.e. what is a passenger car, when does it become a light truck and so on) should be harmonised.

Indulging in a bit of magical thinking for a moment, let’s imagine a world where — after no doubt tortuous wrangling — the Cadillac Escalade sold in mainland USA can be shipped out straight from the factory and given type approval for (say) use here in the UK. And a Range Rover can similarly be sent across the Atlantic and offloaded showroom-ready in the same version as sold in the UK. But, oopsie, I’m on the wrong side of the road here in “old world” Hampshire. As is the US Range Rover customer in, say, New Hampshire.

This is, of course, because the USA is Left Hand Drive, the UK is Right Hand Drive. This fundamental — but merely national — differential standard means auto makers having to produce two different versions of the same product to comply with national legislation. And this isn’t trivial — providing for both left and right hand drive involves substantial re-engineering. At the moment, auto makers make a cost/benefit choice about whether or not they undertake this re-engineering to provide right hand drive vehicles for those markets. If volumes justify it, they do. Otherwise, they don’t.

But wait ! Now there’s TTIP ! So what is to stop GM (and Tata industries, who own Land Rover, for that matter) taking the UK state to the TTIP “trade court” because it has a restrictive, trade inhibiting, national standard ? The case would be pretty overwhelming — there is absolutely zero safety grounds to justify driving on the right as opposed to driving on the left. There is also, as previously noted, a self-evident cost associated with auto makers producing two different types of the same vehicle model design. If this hypothetical “case” was decided on the facts alone and those facts were limited to how much a national standard restricts trade, it would be, to use a non-legal expression, a slam-dunk.

Of course, the UK state government could claim that there would be an economic cost in switching from right to left hand drive and that would in the short term greatly exceed the benefits to auto makers. But the auto makers could then claim okay, there is a cost, but it is only short term, there is a precedent as countries have switched from right hand to left hand drive and that the long term benefits outweigh the short term costs. Even if the TTIP “trade court” wasn’t stacked in favour of the corporations (and I’d be taking bets on that not being a complete certainty), the UK state would have a pretty weak economic argument taken over a long timeframe.

Completely unrealistic ? Hmm… I’m not so sure. The earlier NC feature today about how a US court has made a completely outlandish ruling on Argentina’s sovereign debt which is totally crazy even if technically correct within the letter of the (US) law suggests to me that such capricious outcomes are entirely possible — once you introduce a disconnect between a state’s ability to represent the wishes of its population and its ability to enforce those wishes through a supra-national judicial system, all bets are off.

You could have saved a lot of time if you simply states that you are against state sovereignty and the associated protections of the citizens and the environment. It stands in the way of the free reign of global corporations so its destruction is what these trade agreements are all about.

i am just a garden-hobbyist layman, so all I can say right now regarding GMOs is that Acres USA has run/runs many articles about successful ecology-based agriculture/agronomy with zero use for any GMO input. Will GMOs remain irrelevant to future issues of global warming adaptation etc? I suspect they will.

Since President Obama can not accomplish any thing of any value other than photo-opps on non-controversial subject, how can he possibly do anything substantial like this?

Interesting sentence about hoped-for GMO import regulation relaxation in the EU and the “benefit” this would bring to Africa. Where GMO is now grown by (I’m assuming) Monsanto plantations which have been promoted by Bill Gates who also bought big into Monsanto. I agree with the common sense of Grayslady above. The whole GMO thing is a disaster perpetrated by a two-trick pony for the monopoly of agricultural profits. So taking Monsanto as just one example, one very egregious example, of global trade agreements, then if we are to have a balanced discussion of what possible benefits global trade offers we most certainly need a show-stopping story about some corporation that is actually doing some good somewhere. I don’t thing those stories exist.

Two years ago I was attending the annual Acres USA conference (as a mere layman) and remember hearing presenter and ag-expert Gary Zimmer present an offhand anecdote about the effects of a certain kind of GMO corn on people in Africa. (I can’t remember all the details and perhaps an enterprising agricultural journalist might want to find them out to do an interesting story on them). Anyway . . Mr. Zimmer was consulting for a big plantation-style corn operation somewhere in Africa and one of the problems this operation had was poor African peasants sneaking onto the operation now and again to steal some corn to eat. The operations-management noted that when they adopted some kind of new GMO corn, that the steady attritional theft shrinkage-leakage stopped somewhat soon after. It seems that the locals reported the new kind of corn making them sick when they ate it so they stopped stealing it.

why is the tpp in so much trouble in the US? are there powerful economic interests opposed to it?

good question.

Perhaps the Republicans hate Obama so totally that they would deny him a Fast Track victory in the House and Senate rather than let HIM take any credit for getting such a Republican trade bill passed and signed. If so, we should consider electing more Republicans in 2014 so as to make it harder for the trojan horse vichy democrats to pass Obama’s fast track for TTP.

I don’t think it’s in all that much trouble. More likely, they’re just waiting until the lame duck session to ram it through. The Nikkei link on Links 7/22 suggests that they’re wasting no time in readying a hard sell for some big Pacific economic forum to be held the week after US elections.

160 Representatives, mainly Democrats, have signed letters against it, and there are more that won’t sign that will either vote against it or will abstain, and Harry Reid has said he won’t table it in the Senate. So I wonder why you are so confident.

but why? the democrats are usually such loyal lapdogs. I wouldn’t think they are actually motivated by principle, which makes me think some very influential (rich) people oppose it.

The thought of increasing the number of Republicans in Congress makes me very uneasy. If they would have strong enough control of the Senate, they might be able to pass Republican style trade agreements as treaties rather than as fast track agreements. And Obama might move even farther to the right, as he maintains his relative position vis-a-vis the Republican Congress.

How about if we try to weaken both the Republicans and the Democrats? That seems like a win/win! Vote third party.

My comment was meant as a reply to Different Clue.

Well I wonder . . . are there still some legacy anti-NAFTA Democrats in office? Do they say they are anti TPP/TPIP for similar reasons to having been against NAFTA? Can they be trusted? If so, it might be well to return those particular Democrats to office.

Have any Republican officeholders just lately opposed Fast Track? (I think a few did). If so, what kinds? If it is a certain kind of R that opposed Fast Track . . . say the Teaparty kind . . . would it make sense to elect genuine Teaparty Rs to office if they are running against DLC Turd Way Trojan Horse Vichy Clintobamacrats?

I’m going to stick my neck out and predict this thing is going nowhere. It steps on too may toes.

For example, the UK labour party has demanded an opt-out for the NHS. There will be a host of similar issues for every european country-German industiralists, French and Italian food producers and their semi-nationalised firms, big solar and wind power companies, the list is near endless.

And even if politicians are craven enough to go for it, the legal industry wont. They will not except there are areas which they have no control over, as would be the case.

It’s just not going to fly. The Doha round failed, and so will this. Sure, they may come up with a kabuki version to placate Obama so he can make his bucks when out of office and not get blackballed for membership of the classiest golf clubs, but nothing serious will come of it.

This is the most naked merchant grab for power in history. Since when does “actionable” relate to “policy” rather than to the Law? Ready for all Law to bite the dust except for The Law Merchant, crooked as a corkscrew?

This is a truly wicked, a reaming “finesse” of the (Tarot) cards of the MasterRaceGame. All Masochists now?

There is no good whatsoever in any of these deals. Every single piece is not what its represented as. Every assertion made about it has been false, in one way or another. Such is what we get today from politicians. The gutting of US and EU chemical regulations and the expension of fracking despite major health problems caused by fracking liquids, methane, radioactivity, endocrine disruption, and heavy metals are both odious. So is the so called standstill and ratchet, which prevent affordable healthcare in the US in the future for any reason. What is there in it thats good? I have yet to see a single plus that was what it was represented to be.