Ambrose Evans-Pritchard makes a compelling argument in his latest article: that the $5.4 trillion of investment poured into fossil fuel exploration and development projects over the last six years includes quite a lot of investments that will never show an adequate return. He argues that when that sorry fact starts to be recognized, the losses could be the wake-up call to investors who have shrugged off risk as financial assets climb to ever-more-implausible valuations.

To play devil’s advocate for a minute, what made subprime losses so deadly wasn’t their magnitude on paper but the colossal degree of leverage employed. Subprime was only a $1.3 trillion or so market, and the losses across subprime loan pools was only 40%, so on paper, only a bit over a half a trillion of value was torched. But that’s before you get to the fact that more than 5 times the value of subprime bonds was created synthetically, via credit default swaps packaged into heavily or entirely synthetic CDOs. And those CDS weren’t on the value of the entire pool; they were on the riskiest tranches. So all the “extra” bets were on the parts of the bonds that were most likely to, and did, blow up.

We worked through how spectacular the leverage was in some detail in ECONNED, but for a rough sense, we’ve often referred back to an article by Gillian Tett we quoted in the early days of this blog, in January 2007:

Last week I received an e-mail that made chilling reading. The author claimed to be a senior banker….

“Hi Gillian,” the message went. “I have been working in the leveraged credit and distressed debt sector for 20 years . . . and I have never seen anything quite like what is currently going on. Market participants have lost all memory of what risk is and are behaving as if the so-called wall of liquidity will last indefinitely and that volatility is a thing of the past.

“I don’t think there has ever been a time in history when such a large proportion of the riskiest credit assets have been owned by such financially weak institutions . . . with very limited capacity to withstand adverse credit events and market downturns.

“I am not sure what is worse, talking to market players who generally believe that ‘this time it’s different’, or to more seasoned players who . . . privately acknowledge that there is a bubble waiting to burst but . . . hope problems will not arise until after the next bonus round.”

He then relates the case of a typical hedge fund, two times levered. That looks modest until you realise it is partly backed by fund of funds’ money (which is three times levered) and investing in deeply subordinated tranches of collateralised debt obligations, which are nine times levered. “Thus every €1m of CDO bonds [acquired] is effectively supported by less than €20,000 of end investors’ capital – a 2% price decline in the CDO paper wipes out the capital supporting it.

“The degree of leverage at work . . . is quite frankly frightening,” he concludes. “Very few hedge funds I talk to have got a prayer in the next downturn. Even more worryingly, most of them don’t even expect one.”

The general point is that leverage makes all the difference in how big the knock-on effects are from investment losses. The dot-bomb era destroyed about $5 trillion in market value (and $5 trillion in 2000 is worth more in current dollars), but these were equity investments, with not much in the way of borrowing juicing them.

Now it’s almost a certainty that these fossil fuel plays aren’t geared anything remotely like subprime paper was. But there is likely to be some borrowing at work, certainly at oil majors themselves, and the companies they are investing in are likely using some debt financing as well (readers who know typical capital structures of the various major types of players in this space are very much encouraged to speak up). Moreover, wealthy individuals (and this includes the 0.1%) are much more leveraged that the rich of the past. They’ve bought into the logic of subprime borrowers (“put your assets to work”) and have been using the super cheap interest rates on offer to finance investments (including borrowing against notoriously illiquid-in-bad-times collateral like art). So there may be more leverage-on-leverage than there appears to be at first blush.

Here are the highlights of the Ambrose Evans-Pritchard article, which I encourage you to read in full:

Data from Bank of America show that oil and gas investment in the US has soared to $200bn a year. It has reached 20pc of total US private fixed investment, the same share as home building. This has never happened before in US history, even during the Second World War when oil production was a strategic imperative.

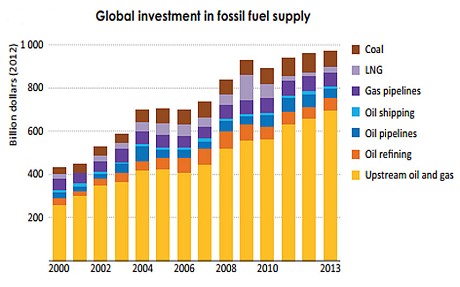

The International Energy Agency (IEA) says global investment in fossil fuel supply doubled in real terms to $900bn from 2000 to 2008 as the boom gathered pace. It has since stabilised at a very high plateau, near $950bn last year.

….. Output from conventional fields peaked in 2005. Not a single large project has come on stream at a break-even cost below $80 a barrel for almost three years….

There are, of course, other candidates for the bubble prize of the current economic cycle, now into its 22nd quarter and facing the headwinds of US monetary tightening. China’s housing boom has echoes of the Tokyo blow-off in 1989, and is four times more stretched than US subprime in 2006, based on price-to-income…

Yet the sheer scale of “stranded assets” and potential write-offs in the fossil industry raises eyebrows. IHS Global Insight said the average return on oil and gas exploration in North America has fallen to 8.6pc, lower than in 2001 when oil was trading at $27 a barrel. What happens if oil falls back towards $80 as Libya ends force majeure at its oil hubs and Iran rejoins the world economy?…

The Oxford Institute for Energy Studies says the Eagle Ford Dry Gas field, the Marcellus WC T2 and “C” Counties, Powder River, Cotton Valley, among others, are all losing money at the current Henry Hub spot price of $4.50. “The benevolence of the US capital markets cannot last forever,” it said.

And that’s before we get to another threat to fossil fuel investments that Evans-Pritchard mentions: that governments might get serious about climate change and impose meaningful restrictions, like hefty carbon taxes. Right now, that seems like a tail risk, but the crisis just past was a tail event as well. And much higher energy prices resulting from restriction on fossil fuel production would slow down economic activity markedly, which again could blow back to leveraged investors in unexpected ways.

Evans-Pritchard was freakishly accurate in calling the oil/commodities bubble in 2008, and in predicting, contrary to conventional wisdom in the financial press at the time about inflation risk, that the deflationary forces were very much intact and would dominate. So while this article falls short of being a market call, Evans-Pritchard is flagging a risk that bears watching.

Evans-Pritchard’s scenario has oil prices coming down. But is that really in the cards?

The situation in Lybia seems to be getting worse, not better.

And it’s virtually certain that the U.S. will take care to prevent Iran from “rejoining the world economy” (unless the Iranians cry uncle, of course – but how likely does that seem?).

Plus, there is the chaotic situation in Iraq, with potentially adverse consequences for supply.

As for hefty carbon taxes, they remain a tail risk. And tail events usually don’t happen every other year.

So – on balance – the safer bet still seems to be against equating fossil fuels with the next subprime.

Crude oil is a little above half way within the huge price range it traced in 2H 2008, from a high of $147 to a low of around $50/bbl. Long-term chart:

http://www.mrci.com/pdf/cl.pdf

Asset bubbles usually are associated with record high prices, not with halfway recoveries from recent price smashes.

Like cicadas, the LP cold callers are at work, chirping the riches of drilling partnerships to the upper middle class who aspire to become Clintonaires (it means making your first $100 million). Eventually many of these partnerships end in tears. But their buyers usually aren’t leveraged and don’t pose any systemic risk.

In 1982 the oil patch bank Penn Square failed, after the second oil shock started to fade (and interest rates went into the teens). Today, Federal Reserve central planners are keeping the entire banking system on a rejuvenating ZIRP venous drip. No worries, comrades: our wise authorities are in complete control.

Oil was at $147 for all of two nanoseconds and over $140 for maybe a week. And the amount of funds going into dubious shale gas plays is most assuredly a bubble.

Maybe the fossil fuel deal in TTIP is another potential “subprime lending” scam.. (not crisis- scam) in the making, with TTIP’s ISDS being the vehicle this time, again, for large scale theft (theft.. as in whenever the government is exposed to these huge potential laibilities, watch out, the insiders will always figure out how to abuse it to line their pockets.) i smell a great potential article in that theory.. it all fits together – maybe you or Lambert might want to explore it? It could be as large or larger than the subprime lending scam. look at the bottom of this page for a bunch of good reasons why we might want to get out of the TTIP fracking export deal, quickly.. if it goes horribly wrong, as I suspect it will. There are at least a dozen other big good reasons not to do it not mentioned there.

It’s not just fossil fuels… it’s alternatives also. Like wind farms that somehow don’t produce as much wind as was expected when they got the subsidies….

We already have a good idea of the malinvestment that led up to the crisis which was 40nyears in the making. Now imagine all the pocket lining that has occurred thanks to bailouts and quick easy money… the same amount in 5 years!!!

If the policies of the last few decades managed to destroy the finances of 70% of US household finances, the last 5 years will surely move up the wealth curve and make a few more casualties… how could it not? It has been status quo, kick the can down the road.

But many are still waiting for a return to normal.

At least in Europe, wind power is paying off really well.

He is of course talking about US markets. I have observed the same thing. All though this has mostly to do with how the energy market is set up which gives priority to more traditional plants.

Europe has a centrally managed system that starts energy production based on weather reports for wind conditions. With high winds on forecast, the lager power generations are turned off and a few “fast-spin” systems are placed on stand-by. Fast spin would be generators that have a short power up and power down time. They can spin up quickly to take up any slack from the wind farms. On slow wind days, it’s the main plants that power up and the fast-spins that are shut down.

In the US, there are not that many fast-spin plants. Mostly because they would have to compete on an open market and they are simply not productive in that way. Thus to maintain “base power”, it’s always the larger coal and oil plants that are permitted to run first. Wind farms get to pick up the slack, which is not much.

I have seen the local wind farms in Kansas feathered on windy days. Most likely because current market conditions doesn’t give them the space needed to sell power.

I’m pleased to announce that down here in Naples, FL, we just beat back an attempt to expand oil production in the western Everglades. On Friday Collier Resources, which controls some 800,000 acres of mineral rights across Southwest Florida, canceled its exploration leases with the Dan A. Hughes oil company on 115,000 acres under heavy pressure from the community. A month ago the (all-Republican) Collier County Board voted 5-0 to take Collier and the Florida DEP to court over one of the exploratory wells, while Preserve Our Paradise filed a strong appeal against a second well. Apparently at the direction of tea party favorite Gov. Rick Scott, the FDEP then reversed course and publicly and aggressively attacked both the Colliers and Hughes. Fracking is not polling well in Florida. In the face of this opposition, the Colliers threw in the towel.

We expect they will be back, but markedly less emboldened. Nobody foresaw public opinion changing so fast in this very red corner of Florida. Beneath this change is the dawning awareness that with global warming, Florida is screwed. The legislature won’t change much in this November’s elections, but don’t be surprised to see a Florida carbon tax in 2016.

Now is the time and now is the hour for all Florida coastal landowners to sell their land to global warming deniers from further inland. And then move further in and up their own selves.

Maximum predicted sea level rise: 200 ft. +. My place, a hundred miles up three rivers, would be oceanfront (220′). In FLA, “up” means “out”.

Here in Oregon, we’re already seeing climate refugees from the SW – the smart ones arrived years ago.

Oregon,

If by “climate refuges” you mean people looking for a better climate to grow pot you might be correct. At least when I lived in Oregon that industry had surpassed logging as the state’s key economic industry.

And by the time ocean levels reach your doorstep ocean acidification will have long since turned the ocean into a virtual desert. You won’t be catching any salmon from your ocean beachfront. At best you might be able to harvest a newly evolved species of algae and turn it into a soup if you can find a way to de-toxify it.

Let the global warming deniers find that out for themselves. Sell them present and near-future seafront property.

Lambert, did you know that under the conditions of 50 or 6 meter ocean rise Maine turns into an island, with the Hudson becoming a channel connecting the St Lawrence and New York “Bays”. I end up on a peninsula overlooking a sort of bay, I think.

Delaware completely vanishes. Almost all of Florida does too.

People will also be able to buy coastal property in Arkansas. Crazy Horse is probably right about the biotoxins – the toxins are already a problem as they can destroy people’s livers and they go right through the skin. In cases of chronic exposure, Cholestyramine will help pull them out of the enterohepatic recirculation. They should make it OTC.

The risks in investing in fossil fuels are rapidly diminishing due to free trade agreements and mandatory “regulatory convergence” and are already much smaller than most Americans think, given their risks. The cost of those risks is being shifted to the least able to bear them in society.

The proposed TTIP fracking expansions supersede any national, state or local laws that impact investors, protecting their rights even above national interests.

The Obama Administration is working closely with the US and EU chemical industries to deregulate chemicals. Sorely needed new laws, which reflect information discovered in the last 20-30 years, on many chemicals, including ones on those that are endocrine disruptors, would be frozen and forced to go through a single process for more than 3 dozen countries, making new regulations very difficult.

Concerns that the water used in the fracking process releases heavy metals are being brushed aside as detrimental to business interests. The recent Lone Pine case under NAFTA shows that energy companies consider themselves as possessing special rights above national laws. TTIP will make it worse. Because it is an FTA, and it gives corporations these free entilements to massive compensation from countries , it intentionally becomes impossible to ever reverse, except at monumental cost to the nations taxpayers, who have to pay corporations for the estimated future value of “their investment” to buy their freedom.

They will be back and they wont need to be emboldened because TTIP will give them a right to frack that supersedes local/national laws.. so watch out if the TTIP secret fracking deal goes through.. there is a reason its secret. It might also hurt the economy quite a bit by doubling or tripling US energy prices.

Doubling or tripling energy prices would be a negative feedback suppressor on rising rates of fracking.

Raising energy price that much would force many people back into a pre-gas/pre-petro subsistence lifestyle or into early death itself, reducing the amount of gas and oil bought and sold and hence reducing

the amount of fracking needing to be done.

If the price could rise 10 times it might have even more negative feedback suppression, so 10 times the price is what we should hope for if the Catfood Democrat Senators pass their TTP/TTIP.

The more accurate comparison is as I did a couple weeks ago in equating the shale boom to “subprime” here http://www.nakedcapitalism.com/2014/06/joe-costello-oil-industry-running-major-trouble.html .

Simply you’r making loans that are not going to get paid backed. In doing so finance is basically subsidizing an industry sector, which at some point, supposedly, will have to be accounted for. For example the massive debt taken on by the shale sectors both gas and oil have led to lower prices for both, distorting their use. The so called benefits of cheap natural gas for industrial sector or the continued subsidization of a gallon of gasoline for US consumers, distorting the fact that the price for gaining these fuels is not falling or static but rising, and this is not being passed across the economy, but in fact subsidized by the markets, which of course makes sense when everyone is dependent on cheap fossil fuels for their business models.

The accounting for shale is a big question and who, if anyone, is making money is important. Yesterday for example a Sunday merger was announced based completely on stock for two companies in the Bakken, which will create the largest enterprise there http://www.bloomberg.com/news/2014-07-13/whiting-petroleum-to-acquire-kodiak-oil-for-3-8-billion.html

Yet notice the acquirer “Whiting is buying a company that more than doubled production last year while Whiting’s own output growth slowed as costs to bring new wells online surged.” And of course Kodiak the acquired doubled production by bringing on a couple billion dollars in debt, again who is making money? Why did Whiting’s production slow while costs rose?

The breaking of the shale debt bubbles, oil and gas, will not so much cause massive hemorrhage to the financial sector, though it wont be pleasant, as a massive whack to the real economy with significant price rises in oil and gas once the market subsidies stop. The simple fact is finding and producing oil and gas is becoming an ever more capital intensive process, at some point prices will have to reflect that.

Hey Joe,

The shale gas and oil “industry” more closely resembles the real estate industry in the USA than it does the subprime ponzi. The real money is made by the developers (Can you say Chesapeake?) who buy drilling rights, create a flurry of buzz by drilling a few wells and buying stock analyst whores, and then sell the “dirt” to greater fools who are worried that they are too late to the party. Whether there is an actual product is of little importance—- the smart money has already shuffled the winnings into accounts in Panama, Grand Cayman, and Jersey and villas in St. Barts.

Praise God that rising sea levels drown and destroy all that beautiful money.

“Only one nonconservationist society in an entire region can begin a process of conflict and expansion by the “grasshoppers” at the expense of the Eden-dwelling “ants”.”

imo Russia is that nonconservationist society, going all-in on global warming, which can open arctic sea-passages and potentially turn the tundra into productive agricultural land. They seem to be in a position to undercut price-based conservation efforts to keep the CO2 flowing.

Maybe global warming will turn Russia’s traditional heartland breadbasket into a burn barrel in the years to come. Who is laughing last then?

Them and Canada, very similar situation.

It’s worse than $5.4T being spent on exploration and development. That was just the entry fee, they still have to extract and convert those fossil fuels into a usable energy form, and then transport and burn it. And then pay for the impact on health (well, actually, they let others pay for it).

That capital could have created more than 3 million MWatts of solar and wind capacity, which would not have needed a lot more money to distribute the energy to users. But then the fossil fuel industry’s managers would not be making as much money. Lucky for them they are better at lobbying.

perhaps some of the leverage is in the MLP structure that makes up the majority of investment in the post exploration companies? They pay out the majoirty of their cash flow as “dividends” (though you get a K-1 as in a partnership), but they use 5-8x leverage to fund growth expenditures on the hope that they pay out. Right now they all continue to generate income.

This is very helpful. Will investigate if I can find time.

This is the boom to bust to boom cycle that the energy industry has been in since the 19th century. Since renewables can supply only a small fraction of current requirements, expect the cycle to continue.

Most interesting is the growth since the 1960’s of a mindset that looks forward to the end of the industrial order. Many of the comments seem to reflect this belief. It is the exact opposite of progressive thinking, the belief that material progress can and will be achieved .

Germany has shown that it can move towards renewables why not the rest of the world?

Germany has shown that it can move towards renewables but it won’t get there – ever.

Technology can be put into place if anyone chooses to use it to come very close to 100%. If you rely on mainstream media folklore the ok, I see why you would think that.

Podargus wrote: ‘Germany has shown that it can move towards renewables but it won’t get there – ever.’

One needs to think more analytically, less dogmatically.

[1] Sure, Germany’s renewables program AS CURRENTLY CONSTITUTED will not ‘get there’ and the idolatry from ‘progressive’ writers largely is technically ignorant, faith-driven cherry-picking of facts about peak energy generated on sunny days, etc. Nevertheless ….

[2] Here in 2014, the problem with renewables has become energy storage/battery technologies. Solar technologies for energy collection have reached the point of being efficient and cheap enough to be viable if the battery technologies emerge.

Well, those technologies may now be emerging. Obviously, the real point of Elon Musk’s Tesla cars will be the battery factory that will be built and the fact that one of Musk’s $10,000 batteries could equally be put in a house —

http://www.economist.com/news/business/21604174-better-power-packs-will-open-road-electric-vehicles-assault-batteries

Likewise, if you believe that battery technologies will never scale up to support much of the total urban/suburban grid, then you may be wrong. Because there are candidates there, too. For instance, the molten-salt batteries of MIT’s Donald Sadoway —

http://www.ted.com/talks/donald_sadoway_the_missing_link_to_renewable_energy

I can think of another approach to store surplus solar-electric energy in desert situations where vast amounts can be produced from vast facilities. Sell somewhat less than half of it into the grid during the desert daytime and use the other more-than-half to electrolyse water. Save the hydrogen gas in high pressure storage tanks and at night burn the hydrogen gas to produce steam from the heat of the burning hydrogen to drive turbines. The hydrogen will re-oxidise back to water and go back into the Water Cycle from where it came.

Where to get the water? Locate the water-electrolyzer near a desert seacoast and use seawater. No need to distill it.

You might want to compute the EROI of that system as well as the loss factor from converting from one energy state to another before you invest all your retirement funds in it——.

The question deserves careful study, to be sure.

Geology and physics say that we will all get there whether we try to or not. Someday the world will run on essentially 100% renewable energy because, well, it’s a tautology. There is less non-renewable energy every day. It’s being turned into atmospheric CO2 and spent fuel rods. The overall energy return on investment of non-renewables goes down every year. The real price of non-renewables will go up over time. At some point that price will exceed the elasticity of demand.

It was Randy Udall who said “Eventually the politics of energy gives way to the physics of energy.”

You have put your finger on a fatal flaw in “progressive” thinking.

The flaw lies in the inarticulate, position of the anti-industrial position of the left not in the basic idea. There is a good case to be made for moving beyond a brute-force political economy with dramatically increasing externalized costs. We are, a species, far more creative than we are displaying at present due to totalitarian political realities that deliberately suppresses ideas, processes, and technology so that those who are in power stay in power.

Mother Earth News Magazine and the Whole Earth Catalog/Co-Evolution Quarterly people featured small-scale versions of such creative approaches down the years. Would it be possible for civil-society persons and civil-society groups of people to learn and use such things in the face of North Koreanesque opposition and suppression by the Big GoverBizniss FIREchiseler complex?

On a full cycle basis, Art Berman has persuasively argued nat gas prices need to be close to $8 for gas plays to be profitable. So, the major oil companies have begun to delay defer or abandon nat gas projects.

Steve Kopits has persuasively argued that The vast majority of the Oil Industry Needs $100+ oil prices to achieve positive free cash flows. More than half the industry needs $120+ oil prices to achieve positive free cash flows, and more than 25% need oil prices $130+ to be cash flow positive. And because crude oil prices are not there, many crude oil projects are being abandoned, cancelled or postponed.

Kopits has also shown that CAPEX on E&P have increased at a rate of 11% annually from 1999-2013 whereas CAPEX had been 0.9% a year from 1985-1999. My takeaway from Kopits presentation and from Berman’s research is that the CAPEX Inflation for Oil Majors is structurally embedded, and will eventuate to Commodity Price Inflation Which Will Not Be Transitory

‘CAPEX Inflation for Oil Majors is structurally embedded, and will eventuate to Commodity Price Inflation Which Will Not Be Transitory’

Maybe I am misunderstanding your comment. But lack of capex creates shortages, while overshooting of capex in response to shortage-induced high prices brings prices back down … after awhile.

Meanwhile, the biggest oil services ETF (symbol OIH) is having a great year. So there’s no sign of capex cutback there.

Your argument depends upon ; More CAPEX = More oil , ie. no geological supply restraints. The counter argument is that , in a period of declining conventional oil and short lived tight oil plays, More CAPEX = (at best) Current oil with the need to amortize the increased CAPEX thus leading to higher prices.

Higher commodity prices automatically leading to greater supply via standard supply/demand graphs may be an artifact of the past. I think there is a good chance that fracking and artic drilling will ,in future, be seen not as a solution to the oil/gas supply problem but a last grasp “scraping the bottom of the barrel” (no pun intended).

Jim

Wat,

Nowhere did I imply more capex = more oil. Precisely because the quality of the fields are of much lesser quality. Most of the easy fields and projects have already been largely drained. And no, fracking oil and nat gas will not be a long term solution. Nat gas wells production curves plummet after the first few months. Art Berman’s research indicates the shale gas boom in the US will be played out by 2025-2030. All that will be left in its wake is an environmental/ecological disaster

Jim, the 11% rising CAPEX is not a transitory phenomena. Extraction of the same amount of energy simply costs about 11% more each year with no gains in production since 2005. The incessantly higher operating costs mean that oil and gas have to be above certain thresholds to be profitable e.g. Nat gas >$8 and crude oil > $120. This is leading to abandoned projects in 2014 which in turn will lead to shortages in the years to follow, and eventually much higher energy prices. We may start seeing higher energy prices as early as 2015-2016.

I am less concerned about this as a bubble than about the political impact. This means that the most powerful businesses in the world have a huge, existential motive to fight sane energy policy – which would mean leaving their assets in the ground.

That means “there will be blood” – probably meaning an outright coup, at least in this country – if, say, 350.org starts getting its way, unlikely as that seems right now. This might well be the real, underlying drive behind the steady accumulation of dictatorial powers in the presidency and police. More broadly, I think the .01% are deadly afraid that the rest of us will catch on to their scam (I’m addressing this to people who already have – didn’t know you were so dangerous, did you?) and shut it down – or simply lynch them, if it takes a little longer. I know I’m an alarmist, but I’m honestly alarmed.

The oil industry is the .01% of the .01%, the big dog on the block, the 500-lb. gorilla. Does anyone think they’ll go peacefully?

–

`—————————

I think you are right. In the US big Carbon dominates the world of K Street and literally writes US energy policy. Renewables have little chance of making any inroads. Few people who have not experienced, close up, the lobbying power of big Carbon can grasp the full situation in DC. Sensible energy policy is impossible with the current power structure in place.

The local news rag, Dallas Morning News, ran front page cover story in Sunday’s paper that attempted to cover the development of Mexico’s natural resources and the opening of that country’s once-closed access to foreign investment. It is notable how much their major oil field, Cantarell, has tapered over the past decade. Questionable though is the cartel and gang influence on any developing of the shale resources that extend down into the borders of northerly Mexico.

I’d link it, maybe will do so later tonight. In the short-run – it will not be easy, and maybe not economical if accounting for safety of a workforce.

Here is that link referenced above.

http://res.dallasnews.com/interactives/border_energy/

Re: different clue at 12:08 am

“Let the global warming deniers find that out for themselves. Sell them present and near-future seafront property.”

And then let taxpayers bail them out with federal disaster aid when they are wiped out by storms?

In a perfect world, they would take the loss all by themselves.

Excellent article on why ISDS must be dropped from current and future trade deals..

10 reasons why Europe and America DO NOT need business v state dispute rules (ISDS)

Also, people should know about the series of events that begun the US’s current addition to oil (and oil wars) (and the American underclass) It was created by the “National City Lines” scheme by GM, Firestone and Standard Oil to privatize and then intentionally destroy the nations public transit system, forcing people to buy cars.

Thank you!