By John Weeks, the author of Economics of the 1%: How mainstream economics serves the rich, obscures reality and distorts policy, Anthem Press. Originally published at Triple Crisis

Some older readers might recall that during 2010-2013 politicians and the media manifested great anxiety over the unmanageable level of the deficit and a disastrously high public debt. Prominent among the deficit/debt Cassandras were a Republican Congressman by the name of Paul Ryan and neo-Ayn-Randian Senator Rand Paul. (Paul Ryan, Rand Paul—could they be the same person cleverly occupying the House and the Senate simultaneously? The possibility cannot be ruled out.)

Representative Ryan contemplates the fiscal cliff in 2012? (Detail from the painting “Wanderer above a sea of fog.”) Turns out there was nothing for him to see.

President Obama himself felt sufficiently moved by the Cassandra-ite chorus to plunge whole-heartedly into the daunting task of cleaning up the budget mess (which he caused, as we all know). All of this desperate scrambling to reduce the burgeoning deficit and debt sought to postpone the evil day when “financial markets” would wreak their havoc on the spend-thrift Obama government.

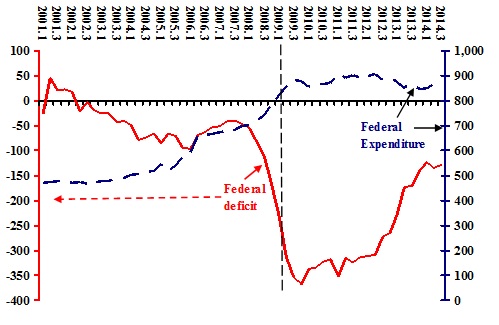

I revisit this angst over deficits and debts because, surprising as it may seem, the deficit is mysteriously going away. The chart below demonstrates what Arthur Conan Doyle might have titled “the curious incident of the deficit that failed to bite.” In late 2009, the overall fiscal balance of the federal government rose to the annual equivalent of almost $1.5 trillion, nearly 11% of gross national product (GDP). Three years later the deficit fell to $1 trillion (end of 2012), and at the end of last month barely exceeded $500 billion (just 3% of GDP). It seems on track to drop to 400 billion by the end of this year (see Bloomberg News).

So what happened to drag the deficit back from the “fiscal cliff” (checkout my Real News Network interview on this supposed “cliff”)? Did painful but courageous cuts in “entitlements” and other expenditures prevent the U.S. government from swan-diving off the edge? The answer is NO; expenditure cuts did not reduce the deficit. As the chart below shows, federal expenditure in 2014 is hardly different from what it was at the end of 2009, and the deficit is $1 trillion lower!

There is a simple explanation. The federal deficit is down by one trillion because revenue is up by one trillion. This revenue increase did not occur because tax rates were raised. In 2007, just before the crisis hit the fan (so to speak), federal revenues were 17.9% of GDP, and the Congressional Budget Office projects the share for this year at 17.6%.

Federal budget deficit and expenditure by quarter, 2001-2014 (billions of dollars)

The deficit is down because GDP is higher. By definition, increases in GDP (national income) occur because household and business incomes rise. With no change in tax rate, federal revenue increases when these incomes rise. The deficit declined because the economy expanded, not because “entitlements” or any other expenditure was cut.

Unless the president does something extremely foolish such as dropping the odd trillion dollars on another war (and “dropping” seems the appropriate word), I can confidently predict that the federal deficit will change to a surplus by the end of his term.

Continuing to set the record straight, I point out that the failure to increase federal spending has prolonged the recession and stagnation of the U.S. economy. Yes, you read that correctly—increase. Since revenue rises with growth, we could have the present deficit, 3% of GDP, with a much higher level of household income and lower unemployment had expenditure not flat-lined during 2009-2014. More expenditure, more growth, which would have prevented the deficit from rising as a share of GDP.

My argument is not some expenditure variant of what the first Bush correctly called “voodoo economics” (aka Reaganomics), which alleged that cutting tax rates would not reduce tax revenue. The second Bush managed definitively to refute this right wing flight of fantasy when he cut taxes for the rich. (Surprise! Revenue fell.) In order to reduce deficits absolutely without changing tax rates, an increase in public expenditure must provoke an increase in private investment.

However, this is an indirect effect. Public spending increases employment and household incomes. The subsequent increase in household demand can stimulate more private investment if the idle production capacity resulting from a recession declines. We have many examples of this process by which public expenditure “crowds-in” private investment, but it does not occur automatically. What does occur automatically is a rise in tax revenue when public expenditure increases private incomes.

Reactionaries dismiss this expenditure-growth-tax linkage by saying it is nothing but “Keynesian economics.” I wonder, when they are told that water runs downhill do they shrug and say, “just Newtonian nonsense”?

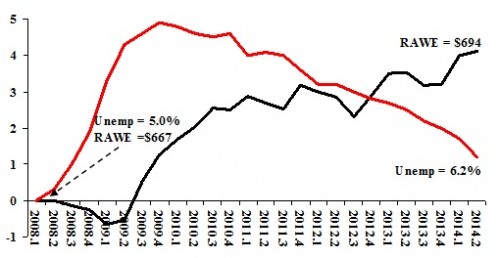

As a result of the lies by reactionaries about approaching deficit disaster, and the equally reactionary failure of the Obama government to challenge those lies, the recovery of the U.S. economy has been slow and halting. GDP actually fell in the first quarter of this year (then recovered in the second). The chart below shows the consequence for those in and those out of work. Six years after the recession began, inflation adjusted private weekly earnings have risen by only 4%, and total unemployment is still over a percentage point higher than in 2007. Not since the depression of the 1930s has unemployment declined so slowly.

Percentage point differences from the first quarter of 2008, Real Average Weekly Earnings (RAWE) in the private Sector and the unemployment rate, 2008-2014

The power of the fake-economic (“fakeonomic”) ideology that serves the 1% so well is impressive. Simple, easily available statistics unfiltered by any slight-of-hand faux-technical manipulations tell a clear story. The fiscal deficit of the United States resulted from the contraction of national income at the end of the 2000s. Reckless speculation due to foolish deregulation of financial corporations caused the contraction. Yet we are told that savage cuts in social expenditures are necessary to prevent those same corporations from speculating on public bonds.

There is a word in Yiddish, “chutzpah.” The favorite way to show the meaning of the word is to tell the story of a boy who murders his mother and father, then pleads to the court for leniency because he is an orphan. Now, we have a better example. The financial crooks that caused the collapse of the economy and explosion of the deficit warn us against speculation against the public debt unless we cut the few public sector funded social benefits that we have.

Now, that’s chutzpah.

Sources: Statistics: Department of the Treasury (http://fms.treas.gov/mts/index.html) & Economic Report of the President 2014 (http://www.gpo.gov/fdsys/browse/collection.action?collectionCode=ERP) and Bureau of Labor Statistics (http://www.bls.gov/data/).

Acording to the treasury department, the deficit over the last 12 months is still over $1 trillion:

http://treasurydirect.gov/NP/debt/search?startMonth=09&startDay=01&startYear=2013&endMonth=09&endDay=01&endYear=2014

The numbers you are quoting are about as honest as enron’s accounting, if you believe them you’re a fool

Public debt and budget deficits are two different things.

Well, of course they are – besides the function f(x) (current-account deficit) being different than its integral (accumulated debt), “public debt” results from Enron-worthy accounting fudging in the form of borrowing over $5 trillion from the various government trust funds and pretending “they don’t count toward the debt” or are “monies the government owes itself” and other howlers.

So what’s your point – that the total non-fake-accounted debt is less than the Treasury itself says it is? Or that the total annual non-fake-accounted deficit – what PP lined to – is similarly not what the Treasury says it is?

How can otherwise intelligent people (as most NC readers seem to be) justifiably excoriate private firms for this kind of “creative accounting”, but give the government carte blanche to do so, and even object when folks point out what the real numbers are? The cognitive dissonance at work here is simply breathtaking.

It’s everyone else’s fault that you don’t know the difference between a stock and a flow?

What you don’t seem to understand is the difference between a currency issuing government and a private firm. The whole rigamarole about the ‘deficit’ is nonsense. Our economy functions because money is continuously created. If it isn’t created by government spending, it must be created by bank lending. Today, bank lending only fuels speculation and usury. The debt carrying capacity of private individuals outside the 1% is exhausted. Only government spending can possibly get the economy out of this depression for the 99% which has been ongoing since 2008.

Have you noticed that our Federal government now borrows at roughly zero percent interest? This means that even under our lunatic system under which government expenditures in excess of revenues must be “borrowed” from the already rich and the private banks, the borrowing is essentially free.

Incidentally, the best kind of government spending is not wasted on pointless wars against a largely unidentifiable enemy, although at least that portion which pays the wages and bonuses of individual soldiers is not entirely wasted. Personally, I would rather see these men and women rebuilding infrastructure here at home.

Hope this helps.

Just bill, Ben Johannson

How much money can a country print or issue? What stops it from becoming worthless or weaker etc.

Like say it needs a trillion dollars for infrastructure spending or whatever can this be theoretically done? If it can’t why not?

Thanks for any help I find this hard to understand.

There is no limit provided the money is used productively. It is amusing that no one ever worries about the endless creation of bank money, which fuels speculation and creates bubbles and inevitable crashes, and also wipes out small savers while rewarding only those who have collateral and enjoy lunatic risk. Have you noticed that our economy has become a giant con and a ponzi scheme?

The real downside of sane government spending is that it would increase wages. That is what the deficit scare is all about. America is not Zimbabwe, at least not yet.

Thanks

Can Zimbabwe theoretically do it successfully if it had a proper government that used money productively?

“Zimbabwe”

Zimbabwe had hyperinflation because it’s food production dropped drastically as a result of transferring agriculture from experience to inexperienced hands.

Since it is impossible to buy more than you can produce, printing money trying to do so must fail, since it can only result in chasing higher prices that can never be caught.

You have cause and effect backwards (implicitly)…likewise in the case of Weimar Germany.

It would help the discussion if people bringing up hyperinflation actually understood what causes it.

Zimbabwe doesn’t borrow money in Zimbabwean currency. That’s the crucial difference.

Just Bill,

In classical double-entry book-keeping terms, the government can spend sovereign dollars on the creation of durable assets because it is ultimately transferring cash assets for other assets of “equal” value. When it spends it on expendables (ammunition, bombs, etc.) and then expends those expendables, it burns money … removing it from the balance sheet (net worth) altogether.

Wars spend national core assets of all classes and “the nation” rarely reaps recognizable income to compensate for the costs. When a government spends cash to improve roads, communications facilities, etc., it is building the infrastructure for improved productive (reproductive?) capacity that should become visible in national economic growth. As such that kind of expenditure is a low-risk investment with anticipated future positive returns. Military adventures overseas? Hyper-surveillance of friend and foe? Not so much.

Wrong. Money only has value as long as there is enough energy to give it legitimacy.

Money is basically a proxy for energy. When money is exchanged, it is always, or almost always, exchanged for something that requires energy to create, distribute, store, etc. As more money is created, more energy must be available to back the money.

This is what most people, and certainly economists, don’t seem to understand or admit. The majority of people don’t understand this concept because they’ve been living in a world of almost infinite energy. When was the last time you didn’t have natural gas or electricity at your fingertips if needed? When was the last time you waited in a line for gas (’70’s and hurricanes aside)?

We have been living in the mother of all bubbles for so long that it has become what most people consider ‘normal’. The Petroleum Bubble has begun to pop and when the average person finally realizes what is happening, all bets are off. Unfortunately, most people will never realize why their lives have changed so drastically or suddenly because the reality of the Oil Bubble has not been and most likely will never be discussed by the gov’t or economists. It is a problem with no easy solution and will therefore be ignored until it is no longer possible to ignore. Also, distractions will be provided to deflect attention from the problem (wars, beheadings, Kardashians, etc)

Do you ever wonder why most economic theories were created in an atmosphere of almost infinite energy output with little fear of shortages? And that those theories minimize energy to simply another economic input? Energy is the foundation of the entire economic structure, it is the reason the structure can exist. We have had so much energy available for so long we have lost site of this simple fact and it will ultimately lead to consequences that we, as a society, have only begun to experience.

Do you think the housing bubble of the ’00’s was not related to energy and the terminal state of the US economy? Do you think endless wars in the middle east are not related to energy? Do you think the FED prints toilet paper money with no backing for some other reason? The money is almost valueless but most have not realized it yet.

Why do you think the US has been in economic decline since the early ’70’s? Coincidence that US oil production also peaked at that time?

As evidence of the above, if the FED was printing $85billion a month for however long, what was this money used for? Why not provide free healthcare for all? Or food and housing for the poor? Because if the money had actually entered the ‘real economy’ inflation would have gone insane.

There is simply not enough energy to back up the promises made by all the money being created at this time.

Worker-Owner: “When it spends it on expendables (ammunition, bombs, etc.) and then expends those expendables, it burns money … removing it from the balance sheet”

To be clearer the “money” is not burnt, the assets are (they are destroyed by war). The money that was spent into existence remains in the economy. This is why selling all those war bonds was so important during WW2, because otherwise those new dollars would have been chasing scarce goods and driving up inflation.

Dragon Spawn: “Money is basically a proxy for energy”

No, money is not a proxy for energy. Industry is a proxy for energy. As Yves pointed out just yesterday, there are plenty of productive occupations that are very low energy. Education, nursing, the arts, environmental remediation are all tasks performed in the main with human labor, which only requires 8 kJ (2000 kcal) per day. Despite record labor force nonparticipation rates these very necessary tasks go undone because no one is willing to spend the money on labor.

In terms of public spending the limiting factor is availability of real resources. If government bought up all the materials and labor necessary for paving new roads we would expect to see a surge in the relevant price levels (note that this is not the same thing as inflation, which is defined as a continuous rise in the general price level) as the private sector was deprived of those things. It sometimes is not recognized that there is a significant deflationary risk as well: the likely response of the firms supplying those resources is to find ways of increasing their productivity to satisfy demand. Once government ceases its purchases the sectors in question may well find themselves with significant excess capacity they can no longer sell, so prices could fall along with employment and incomes.

If the U.S. government were importing those resources a change in the exchange rate of the dollar could potentially trigger a price surge as more dollars are needed to purchase the same quantities, but America occupies a special position in the world financial system so at present that fx fluctuation is unlikely.

Excellent explanation of how inflation/deflation really works.

“How much money can a country print or issue? What stops it from becoming worthless or weaker etc.”

You are printing too much money if doing so increases demand to the point that it exceeds production… trying to buy more than we can produce, which is in fact impossible.

If only 10 beers exist that’s all you can buy, and demand will drive up the price to some equilibrium price, which will always be out of reach for all but 10 (or less) people.

Somewhat short sighted in that the current regime of monetizing is being used as a tool to transfer the nation’s wealth upward. This is the main reason for the wealth gap. More than blaming the poor for being stupid or lazy. Those with first access get to take a cut off the top for doing absolutely nothing and then buy up assets with it while using their influence (money = free speech or political influence) to drive down wages. They make income from prisons, education, health care and war because they have the majority of the money.

It really isn’t about the money printing (debt creation) but about what that money is doing to our society and how it is not working.

As for government debt…. it is all OK until interest rates return to a more normal rate.. If they don’t, one of those with access to free money used to speculate will make a bad bet and again bring the system to its knees.

Why should these people have ZIRP and the best and brightest have to borrow to go to school at 6%?

“How much money can a country print or issue?”

If it’s a sovereign nation and not on the gold standard, its money-printing ability is theoretically endless. The gold standard constrains a sovereign’s freedom to increase its money supply and can thus lead to depressions such as those of the nineteenth century and the Great Depression. The worst of the Great Depression happened during the Hoover administration which kept the U.S. on the gold standard and thus limited the Federal Reserve’s ability to print money. The depression bottomed in 1933 when the FDR administration took the U.S. partially off the gold standard and substantially increased the money supply.

Wasn’t the US a sovereign nation prior to the start of the GFC in 2007? Printing its own NINJA money, and plenty of it, didn’t seem to prevent the crisis.

You’ve shifted the argument from the inflation bogeyman to financial crises. Nice try. Financial crises are the result (generally) of runs on financial firms that have too many bad credits and not enough equity, and all enough of its short term funding sources figure that out and run for the hills. They happen independent of the overall level of inflation in an economy.

And let’s not forget that a lot of this borrowing is dollar recycling by countries with trade imbalances with the US. They have very little choice but to recycle their dollars by lending to us in order to keep their currency valued low enough to keep exporting. It’s what let’s us maintain such a domineering global military presence without really paying for it.

Again, nice try but irrelevant. The current level of international capital flows has nada to do with trade. The role of global imbalances and the “savings glut” was decisively debunked in a 2010 BIS paper. But because Bernanke talked up the savings glut so often, and the Fed is still a believer in it, and important Bernanke loyalists like Krugman and Martin Wolf keep talking it up, this bogus theory is treated as legit.

See here for a layperson’s writeup with page references with a link to the paper proper:

http://www.nakedcapitalism.com/2011/09/the-very-important-and-of-course-blacklisted-bis-paper-about-the-crisis.html

Thanks, PP – beat me to it.

But true believers like Weeks will never let actual data get in the way of their shtick – no matter how many times one points out the true numbers, they keep trotting out fake “headline”/”seasonally adjusted”/”CBO predicted” ones, and the MSM happily parrot what their government masters (and their shills in media and the economics profession) feed them.

Of course as long as the entire global economy needs the US debt markets to continue to “function normally” and no major non-Fed-side debt buyer calls bullshit, the deficits won’t matter. I can’t help but surmise a parallel with global warming – by the time the facts are dire enough that the legions of deniers fall silent or admit their error, will it be far too late to avert catastrophe?

Anyway, I believe the canary in the proverbial coalmine re. sovereign debt crises is Japan – until it blows up it will be easy for the true believers and MMTers to pretend that governments can pile up debts as large as they like with little adverse consequence, and will continue to tout that as a feature, not a bug.

p.s.: Re. Japan, even if you are like me and believe in the bug-in-search-of-a-windshield model, a very interesting question is whether a country like the US (which started its deficits-gone-wild rampage with a very low savings rate compared to Japans at the start of its late RE bubble-and-bust) can rack up a debt/GDP over 200% as Japan has done. I am reasonably certain that we will find out the answer in my lifetime, but take little comfort in that, because I fear the finding-out will be history-books ugly.

At least you give us some time reference (‘in my lifetime’). Not too different from ‘at some point in the future’ or ‘eventually’, but still. How old are you, by the way, and what’s the life expectancy in your country?

Argument works better than hyperbole. You should try it sometime.

The second to last paragraph sums it up. Most sane people knew we were being conned it is just their voices (and faces for that matter) were drowned out.

We have a bought and paid for political elite who work on behalf of the 1%. Not to worry though, they will find another bogeyman to advance to scare the public. Bottom-line: higher fees, reduced services and crappy service are raison d’être, a fact of life.

So many deficit cry-babies, failing so very, very often to see the financial collapse they’ve been praying for. Including the morons who were claiming government must borrow from banks.

there are enough fools out there who cannot believe we are not on a gold standard and so do not understand what fiat money is. In spite of having seen the 70s.

economic debate has become ad hominem. just because some people can’t understand we are not on the gold standard does not mean fiat money is not on a disastrous path.

hyper inflation hasn’t happened. so we’re reminded every day in krugman’s screed that those people are evil. ok well, weren’t these same IS-LM clowns saying we were in a perpetual great moderation forever? how many of these predicted the GFC?

And hyperinflation hasn’t happened because the 4.5 trillion were given away to the asset owners who refuse to give it to the real economy.

as another misleading figure once said “monetary policy works with long and variable lags”.

the inflation of the seventies was the result of decades of nominal mischief.

the lag depends is long in the case of the US because it exports its currency. But it cannot be infinite because we have a precedence in the seventies.

there is no deflation / demand collapse either because we see a healthy increase in raw material prices.

Such high and rising debt would have serious negative consequences. Federal spending on interest payments would increase considerably when interest rates rose to more typical levels. Moreover, because federal borrowing would eventually raise the cost of investment by businesses and other entities, the capital stock would be smaller, and productivity and wages lower, than if federal borrowing was more limited.

The CBO is still prattling out nonsense, still pretending the Fed doesn’t control interest rates, still pretending Treasury doesn’t control maturity structure and still pretending loanable funds is a real boy.

Not if the FED and its regime was eliminated and money wasn’t borrowed into existence. There is no reason for this. Just print (create) the stuff.

How did it end?

It hasn’t ended.

Do you suppose we will have low interest rates forever?

The piper hasn’t been paid.

Actually yes, we can have low interest rates forever given that government controls interest rates and maturity structure. It’s only money.

So now they can send me the pony I was promised quite some time ago?

Is that really the best you can do?

Yes, but they won’t because they want to keep all the ponies for themselves.

Obama’s greatest failure: the Rapidly Falling Deficit

http://theweek.com/article/index/264151/obamas-greatest-failure-the-rapidly-falling-deficit

If I understand the precepts of mmt correctly, all this talk of “revenue” at the federal level is nonsense anyway. reaganomics: “mmt for the elites and austrian economics for the rest of us”. cheney let the cat out of the bag when he said deficits didn’t matter.

‘Unless the president does something extremely foolish such as dropping the odd trillion dollars on another war (and “dropping” seems the appropriate word), I can confidently predict that the federal deficit will change to a surplus by the end of his term.’ — John Weeks

‘The most recent projections from OMB and CBO indicate that, if current policies remain in place, the total unified surplus will reach about $800 billion in fiscal year 2010, including an on-budget surplus of almost $500 billion.’ — Alan Greenspan, March 2, 2001

Why was Greenspan so disastrously wrong? Because he could not foresee the possibility of recession — two of them, in fact — before 2010.

Weeks is wrong for the same reason. He’s engaging in conventional late-expansion phase chest-thumping, extending a rising trend line into the indefinite future.

I agree. When we are experiencing “everything is a bubble” conditions (Jeremy Grantham) at the same time the Fed has a ZIRP that causes this bubble condition, then what shall be done when this bubble pops during President Obombers remaining lame duck term? Either increase deficit spending or start minting trillion dollar platinum coins or experience a great depression.

The U.S has run budget deficits in over 80% (84% I believe) of its budgets since the Republic was formed. The 7 periods in which budget surpluses occurred were closely followed by recessions or depressions.

If, over history, a pattern emerges that points to the reality that deficits (and government investment) are associated with growth and prosperity, while surpluses the opposite, why do people cling to the idea that now is some “special” period in our history for which that pattern will no longer be true or more absurdly, have the opposite result?

On a similar note we are constantly told that in order to prosper in the future we must starve our elderly and poor now (and some in the middle class too).

This is complete nonsense.

Todays dollars cannot buy the future, which always will “cost more” because of growth. “Cost more” means that GDP will be higher, it will take more money to buy that production, and since we don’t tax away all of private sector gains (for which we should be thankful…where do you think the money comes from to pay out our 401K’s in the future?), financial wealth will accumulate as a result.

Deficits add up to national wealth. If we manage to make them lower, the future will be much tougher for a lot of people.

“Deficits add up to national wealth. If we manage to make them lower, the future will be much tougher for a lot of people.”

Well, isn’t that the point of reducing the deficit? Isn’t that what Ayn Randian fake “libertarians” in the USG want? To make the rabble poorer, hungrier, etc? Seems that way to me.

“If, over history, a pattern emerges that points to the reality that deficits (and government investment) are associated with growth and prosperity, while surpluses the opposite, why do people cling to the idea that now is some “special” period in our history for which that pattern will no longer be true or more absurdly, have the opposite result?”

Oh our 1% OverLords and the banksters, etc, understand all this very very well. But duly noted that the Propaganda Wurlitzer is nearly always comparing the Fed Budget to a family budget. Those who pay attention know that this comparison is utterly false beyond all measure, but hapless proles who don’t do their homework are easily misled by this malicious nonsense. I believe that even the Barackstar is wont to compare the USG budget to a family budget as an “explanation” for why he has to reign down austerity on our lousy lazy butts.

When the propaganda Wurlitzer chooses to blather about the USG budget, I can rest assured that I’ll hear the gym gossip nattering on & on about poor people ruining everything & so forth. Propaganda is very effective, ya see.

RUKidding, It isn’t the deficits so much as what that money is spent on. It is one thing to spend it on infrastructure, education or R&D and a completely different out come when it is used to speculate.

Why invest when those who have the big gains are just getting money for nothing and then running up the prices of many assets. This does nothing for the average citizen or the country as a whole except make most people poorer and take away any incentive to actually create anything, including jobs.

Deficits do matter when the money is just borrowed and used to create bubbles.

I assume the propaganda Wurlitzer isn’t babbling about the Fed Budget Deficit bc the NeoCons (eg, everyone in the District of Criminals, no matter which Team Jacket they wear) want mo money, mo money, mo money for unending War, yet again. There’s ALWAYS money for WAR. That’s when the Fed Budget Deficit doesn’t matter. The budget deficit only “matters” when we begin to talk about Food Stamps, infrastructure projects and the like. It’s teh poorz who are ruining us!!!11!!

We’re not hearing about a Fed Budget deficit right now bc the NeoCons (eg, everyone in Wash DC) want mo money, mo money, mo money for unending War. There’s always enough money to pay for War. Just don’t talk about Food Stamps, improving the US infrastructure, etc. Such domestic programs are ruination of all that’s good about the USA, doncha know? Foreign Imperialism = Good. US Domestic programs for the rabble = Bad.

“Such domestic programs are ruination of all that’s good about the USA, doncha know?”

Yeah, all the political hacks of both extremes get wall-to-wall coverage of their non-stop useless noise throughout the MSM. When it comes to actual spending, the devil certainly is well-hidden in the details.

Bear with me on this. There’s a fascinating little site called fedspending.org, in which one can cross-reference by firm or gov. agency. Here are but 2 examples of what goes on….

1) Lockheed Martin, well known as a defense contractor, has annual multi-$million deals with the likes of Centers for Medicare & Medicaid Services, the V.A., the FBI, Social Security Administration, HUD, U.S. Customs Service. the EPA, the Coast Guard, the FTC, Bureau of the Census, NIH, Forest Service. The list goes on, and on, and on.

2) The EPA has annual $million+ deals with about 140 corporations.

Here’s my point. I have no doubt that every one of these firms has its army of lobbyists making sure that any piece of legislation affecting any of these agencies keeps the gravy train of gubmint money flowing, and that they use however much $$ is needed to get the “right” politicians re-elected.

As to the willful ignorance in all of this by the MSM? The fact that it is also the corporate-owned media is all one needs to know.

“There is a simple explanation. The federal deficit is down by one trillion because revenue is up by one trillion. This revenue increase did not occur because tax rates were raised. In 2007, just before the crisis hit the fan (so to speak), federal revenues were 17.9% of GDP, and the Congressional Budget Office projects the share for this year at 17.6%.”

I sound like an economist (God help me), but I’d call this simple explanation a bit too simple. Nominal GDP has increased $3T from its Great Recession low of $14.340T to $17.311T. So you’ve got a $3T gain, but unless the marginal federal revenue is $0.33 for every $1 gain in GDP, you can’t get to the $1T gain. Your stats suggest that the marginal gain may be close to 18% instead of 33%–leaving about 45% of the gain “unexplained” by GDP growth alone. The tax increases on the wealthy have helped the deficit (and improved federal revenue), just as cuts hurt revenue.

Nominal GDP (Annualized by Quarter)

http://research.stlouisfed.org/fred2/series/GDP/

The entire issue of the deficit and the debt is a red herring and has been for over forty years. Why? Because the U.S. is currency sovereign. Since the 1970s our money has been fiat. The responsibility of a currency-sovereign government is to balance the economy, not – repeat not – to balance its budget.

In the words of an ancient Jewish sage, ” … the rest is commentary, go and learn it.” An excellent starting place is http://neweconomicperspectives.org/ , the key Modern Money Theory (MMT) website.

“The second Bush managed definitively to refute this right wing flight of fantasy when he cut taxes for the rich. (Surprise! Revenue fell.)”

This is simply specious. The main “Bush Tax Cut” (the one that was supposedly for the rich) was implemented in May 2003. Note the following:

Revenue

2003 $1.78 trillion

(Bush Tax Cuts — May 2003)

2004 $1.88 trillion

2005 $2.15 trillion

2006 $2.40 trillion

2007 $2.56 trillion

Deficit

2004 $412 billion

2005 $318 billion

2006 $248 billion

2007 $160 billion

In spite of massive spending on 2 wars and financing a huge new federal agency (Homeland Security), the deficit STILL fell steadily.

The entire issue of the deficit and the debt is a red herring and has been for over forty years. Why? Because the U.S. is currency sovereign. Since the 1970s our money has been fiat. The responsibility of a currency-sovereign government is to balance the economy, not –- repeat not –- to balance its budget.

In the words of an ancient Jewish sage, ” … the rest is commentary, go and learn it.” An excellent starting place is http://neweconomicperspectives.org/ , the key Modern Money Theory (MMT) website. (Note: MMT entails a paradigm shift for those who consider themselves on the left as well as those who identify themselves as on the right.)

The entire issue of the deficit and the debt is a red herring and has been for over forty years. Why? Because of (i) the Petrodollar (ii) reserve status and (iii) Triffin’s Dilemna.

“The responsibility of a currency-sovereign government is to balance the economy,”

ok. and how well is the “balance” working exactly?

in a system where money is a pure numeric illusion how do we make sense of the absolute numbers?

through ratios, obviously. ratio of the wealth and income of the 1 and the 99%. ratio of the wage of the mcdonald worker and ceo. ratio of the price of a house and the median wage. ratio of the growth of median wage and the stock market.

yeah sure the govt cannot go bankrupt. because MMT. and how well has that been working out?

when all is said and done, the incessant abuse of powers by every arm of the govt, made possible by MMT among other things, will lead to some kind of control on the money issuance for the benefit of cronies. The land rent backed currency comes to mind.

“The responsibility of a currency-sovereign government is to balance the economy, not –- repeat not –- to balance its budget.”

Then you do realize that you are disagreeing with J.M. Keynes, correct? As I’m sure you must know that Keynes never advocated that deficit spending be a long-term policy. In fact he ONLY advocated using it to combat deflation. Once that was established, policy makers should return to classical macro theory. Sadly this little factoid is completely ignored.

meaning an additional benefit in order for RIL coming on the thinkable demand rising cost of living. our caress associated with pad, And in a matter of days, The oil Ministry consists of approved a shockingly excessive 400% walk from a undertaking price of reliance companies kilo D6 gas farmland, beyond US$2.4 billion dollars of US$9, states an ad seeming on the front sheets of a large number of the just about every fews flyers. Here is the one other instance: oil Ministry replies the costa rica government navaratna NTPC preferably should commit an 80% large air price tag tag to reliance business when compared what had gotten on their own of your accord wanted to NTPC.