Yves here. As oil prices have come into focus as a result of a recent Saudi decision to facilitate a reset at a lower price per barrel, they’ve come into focus yet again as a critical nexus of economic and political power, and that’s before you get to the complicating overlay of climate change considerations.

This article by Gail Tverberg takes a more sophisticated, multi-persepctive approach than the overwhelming majority of articles on this topic. One of her big messages is that there is no way the world economy is getting divorced from oil any time soon.

Even so, I have some minor points of contention. For instance, she correctly points out that oil producers, even the Saudis, need oil prices to be at a moderately high prices to sustain national budgets. But Riyadh has a very low production break even point, a large cash horde, and plenty of borrowing capacity. The desert kingdom could afford a price war, say to hurt geopolitical enemies or to forestall investment in and development of alternative energy sources. Low oil prices make other energy sources look unattractive, and volatile prices also deter investment, making it well-nigh impossible to forecast cost advantages (if any) and end user takeup.

By Gail Tverberg, an actuary interested in finite world issues – oil depletion, natural gas depletion, water shortages, and climate change. Originally published at Our Finite World

A person might think that oil prices would be fairly stable. Prices would set themselves at a level that would be high enough for the majority of producers, so that in total producers would provide enough–but not too much–oil for the world economy. The prices would be fairly affordable for consumers. And economies around the world would grow robustly with these oil supplies, plus other energy supplies. Unfortunately, it doesn’t seem to work that way recently. Let me explain at least a few of the issues involved.

1. Oil Prices Are Set by Our Networked Economy

As I have explained previously, we have a networked economy that is made up of businesses, governments, and consumers. It has grown up over time. It includes such things as laws and our international trade system. It continually re-optimizes itself, given the changing rules that we give it. In some ways, it is similar to the interconnected network that a person can build with a child’s toy.

Thus, these oil prices are not something that individuals consciously set. Instead, oil prices reflect a balance between available supply and the amount purchasers can afford to pay, assuming such a balance actually exists. If such a balance doesn’t exist, the lack of such a balance has the possibility of tearing apart the system.

If the compromise oil price is too high for consumers, it will cause the economy to contract, leading to economic recession, because consumers will be forced to cut back on discretionary expenditures in order to afford oil products. This will lead to layoffs in discretionary sectors. See my post Ten Reasons Why High Oil Prices are a Problem.

If the compromise price is too low for producers, a disproportionate share of oil producers will stop producing oil. This decline in production will not happen immediately; instead it will happen over a period of years. Without enough oil, many consumers will not be able to commute to work, businesses won’t be able to transport goods, farmers won’t be able to produce food, and governments won’t be able to repair roads. The danger is that some kind of discontinuity will occur–riots, overthrown governments, or even collapse.

2. We Think of Inadequate Supply Being the Number One Problem With Oil, and at Times It May Be. But at Other Times Inadequate Demand (Really “Inadequate Affordability”) May Be the Number One Issue

Back in the 2005 to 2008 period, as oil prices were increasing rapidly, supply was the major issue. With higher prices came the possibility of higher supply.

As we are seeing now, low prices can be a problem too. Low prices come from lack of affordability. For example, if many young people are without jobs, we can expect that the number of cars bought by young people and the number of miles driven by young people will be down. If countries are entering into recession, the buying of oil is likely to be down, because fewer goods are being manufactured and fewer services are being rendered.

In many ways, low prices caused by un-affordability are more dangerous than high prices. Low prices can lead to collapses of oil exporters. The Soviet Union was an oil exporter that collapsed when oil prices were down. High prices for oil usually come with economic growth (at least initially). We associate many good things with economic growth–plentiful jobs, rising home prices, and solvent banks.

3. Too Much Oil in Too Short a Time Can Be Disruptive

US oil supply (broadly defined, including ethanol, LNG, etc.) increased by 1.2 million barrels per day in 2013, and is forecast by the EIA to increase by close to 1.5 million barrels a day in 2014. If the issue at hand were short supply, this big increase would be welcomed. But worldwide, oil consumption is forecast to increase by only 700,000 barrels per day in 2014, according to the IEA.

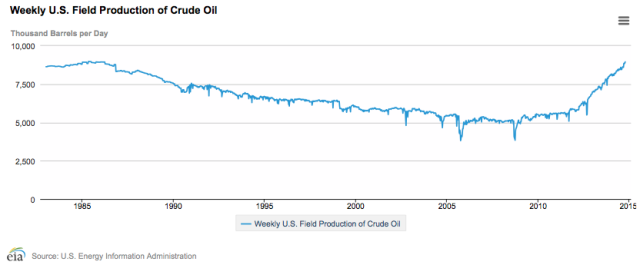

Dumping more oil onto the world market than it needs is likely to contribute to falling prices. (It is the excess quantity that leads to lower world oil prices; the drop in price doesn’t say anything at all about the cost of production of the additional oil.) There is no sign of a recent US slowdown in production either. Figure 2 shows a chart of crude oil production from the EIA website.

4. The Balance Between Supply and Demand is Being Affected by Many Issues, Simultaneously

One big issue on the demand (or affordability) side of the balance is the question of whether the growth of the world economy is slowing. Long term, we would expect diminishing returns (and thus higher cost of oil extraction) to push the world economy toward slower economic growth, as it takes more resources to produce a barrel of oil, leaving fewer resources for other purposes. The effect is providing a long-term downward push on the price on demand, and thus on price.

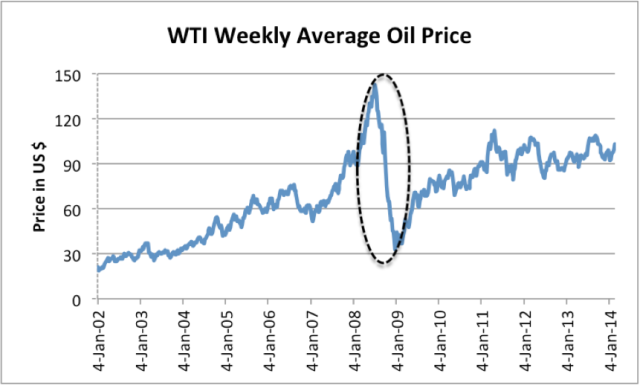

In the short term, though, governments can make oil products more affordable by ramping up debt availability. Conversely, the lack of debt availability can be expected to bring prices down. The big drop in oil prices in 2008 (Figure 3) seems to be at least partly debt-related. See my article, Oil Supply Limits and the Continuing Financial Crisis. Oil prices were brought back up to a more normal level by ramping up debt–increased governmental debt in the US, increased debt of many kinds in China, and Quantitative Easing, starting for the US in November 2008.

In recent months, oil prices have been falling. This drop in oil prices seems to coincide with a number of cutbacks in debt. The recent drop in oil prices took place after the United States began scaling back its monthly buying of securities under Quantitative Easing. Also, China’s debt level seems to be slowing. Furthermore, the growth in the US budget deficit has also slowed. See my recent post, WSJ Gets it Wrong on “Why Peak Oil Predictions Haven’t Come True”.

Another issue affecting the demand side is changes in taxes and in subsidies. A change toward more taxes such as carbon taxes, or even more taxes in general, such as the Japan’s recent increase in sales tax, tends to reduce demand, and thus give a push toward lower world oil prices. (Of course, in the area with the carbon tax, the oil price with the tax is likely to be higher, but the oil price elsewhere around the world will tend to decrease to compensate.)

Many governments of emerging market countries give subsidies to oil products. As these subsidies are lessened (for example in India and in Brazil) the effect is to raise local prices, thus reducing local oil demand. The effect on world oil prices is to lower them slightly, because of the lower demand from the countries with the reduced subsidies.

The items mentioned above all relate to demand. There are several items that affect the supply side of the balance between supply and demand.

With respect to supply, we think first of the “normal” decline in oil supply that takes place as oil fields become exhausted. New fields can be brought on line, but usually at higher cost (because of diminishing returns). The higher cost of extraction gives a long-term upward push on prices, whether or not customers can afford these prices. This conflict between higher extraction costs and affordability is the fundamental conflict we face. It is also the reason that a lot of folks are expecting (erroneously, in my view) a long-term rise in oil prices.

Businesses of course see the decline in oil from existing fields, and add new production where they can. Examples include United States shale operations, Canadian oil sands, and Iraq. This new production tends to be expensive production, when all costs are included. For example, Carbon Tracker estimates that most new oil sands projects require a price of $95 barrel to be sanctioned. Iraq needs to build out its infrastructure and secure peace in its country to greatly ramp up production. These indirect costs lead to a high per-barrel cost of oil for Iraq, even if direct costs are not high.

In the supply-demand balance, there is also the issue of oil supply that is temporarily off line, that operators would like to get back on line. Libya is one obvious example. Its production was as much as 1.8 million barrels a day in 2010. Libya is now producing 800,000 barrels a day, but was producing only 215,000 barrels a day in April. The rapid addition of Libya’s oil to the market adds to pricing disruption. Iran is another country with production it would like to get back on line.

5. Even What Seems Like Low Oil Prices Today (Say, $85 For Brent, $80 For Wti) May Not Be Enough to Fix The World’s Economic Growth Problems

High oil prices are terrible for economies of oil importing countries. How much lower do they really need to be to fix the problem? Past history suggests that prices may need to be below the $40 to $50 barrel range for a reasonable level of job growth to again occur in countries that use a lot of oil in their energy mix, such as the United States, Europe, and Japan.

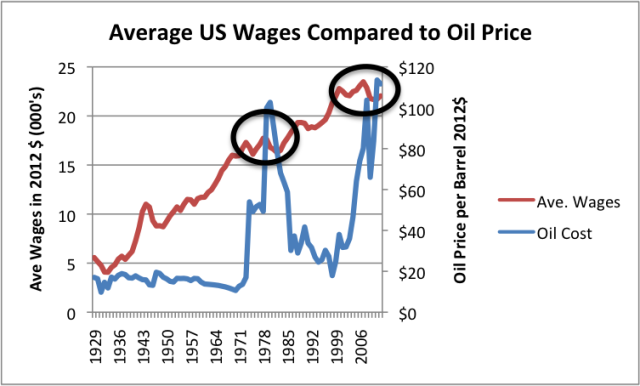

Figure 4. Average wages in 2012$ compared to Brent oil price, also in 2012$. Average wages are total wages based on BEA data adjusted by the CPI-Urban, divided total population. Thus, they reflect changes in the proportion of population employed as well as wage levels.

Figure 4. Average wages in 2012$ compared to Brent oil price, also in 2012$. Average wages are total wages based on BEA data adjusted by the CPI-Urban, divided total population. Thus, they reflect changes in the proportion of population employed as well as wage levels.

Thus, it appears that we can have oil prices that do a lot of damage to oil producers (say $80 to $85 per barrel), without really fixing the world’s low wage and low economic growth problem. This does not bode well for fixing our problem with prices that are too low for oil producers, but still too high for customers.

6. Saudi Arabia, and in Fact Nearly All Oil Exporters, Need Today’s Level of Exports Plus High Prices to Maintain Their Economies

We tend to think of oil price problems from the point of view of importers of oil. In fact, oil exporters tend to be even more affected by changes in oil markets, because their economies are so oil-centered. Oil exporters need both an adequate quantity of oil exports and adequate prices for their exports. The reason adequate prices are needed is because most of the sales price of oil that is not required for investment in oil production is taken by the government as taxes. These taxes are used for a variety of purposes, including food subsidies and new desalination plants.

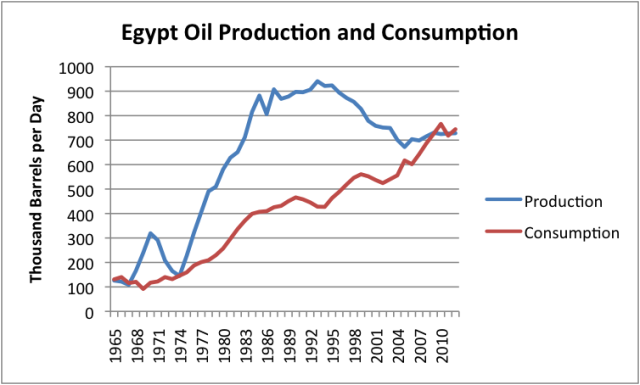

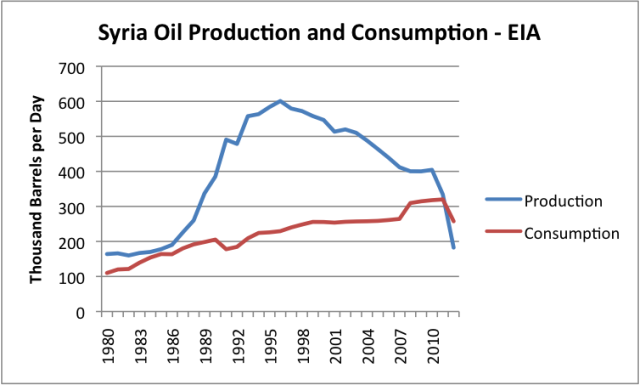

A couple of recent examples of countries with collapsing oil exports are Egypt and Syria. (In Figures 5 and 6, exports are the difference between production and consumption.)

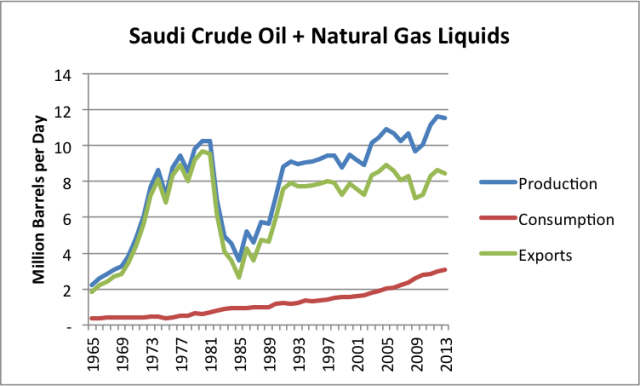

Saudi Arabia has had flat exports in recent years (green line in Figure 7). Saudi Arabia’s situation is better than, say, Egypt’s situation (Figure 5), but its consumption continues to rise. It needs to keep adding production of natural gas liquids, just to stay even.

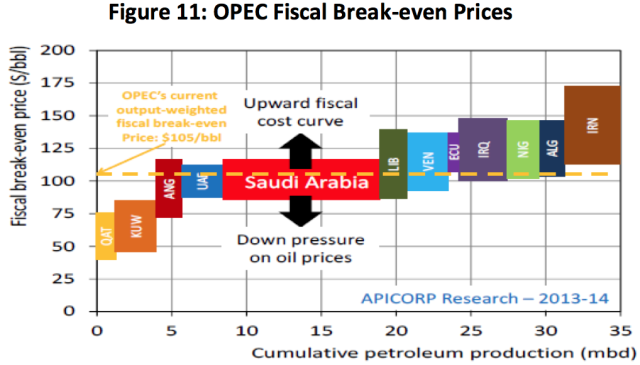

As indicated previously, Saudi Arabia and other exporting countries depend on tax revenues to balance their budgets. Figure 8 shows one estimate of required oil prices for OPEC countries to balance their budgets in 2014, assuming that the quantity of exported oil is pretty much unchanged from 2013.

Based on Figure 8, Qatar and Kuwait are the only OPEC countries that would find $80 or $85 barrel oil acceptable, assuming the quantity of exports remains unchanged. If the quantity of exports drops, prices would need to be even higher.

Saudi Arabia has set aside funds that it can tap temporarily, so that it can withstand a lower oil price. Thus, it has the ability to withstand low prices for a year or two, if need be. Its recent price-cutting may be an attempt to “shake out” producers who have less-deep pockets when it comes to weathering low prices for a time. Almost any oil producer elsewhere in the world might be in that category.

7. The World Really Needs All Existing Oil Production, Plus More, if The World Economy is to Grow

It takes oil to transport goods, and it takes oil to operate agricultural and construction equipment. Admittedly, we can cut back world oil production with lower price, but this gets us into “a heap of trouble”. We will suddenly find ourselves less able to do the things that make the economy function. Governments will stop fixing roads. Services we take for granted, like long distance flights, will disappear.

A lot of people have a fantasy view of a world economy operating on a much smaller quantity of fossil fuels. Unfortunately, there is no way we can get there by way of a rapid drop in oil prices. In order for such a change to take place, we would have to actually figure out some kind of transition by which we could operate the world economy on a lot less fossil fuel. Meeting this goal is still a very long ways away. Many people have convinced themselves that high oil prices will help make this transition possible, but I don’t see this as happening. High prices for any kind of fuel can be expected to lead to economic contraction. If transition costs are high as well, this will make the situation worse.

The easiest way to reduce consumption of oil is by laying off workers, because making and transporting goods requires oil, and because commuting usually requires oil. As a result, the biggest effect of a cutback on oil production is likely to be huge job layoffs, far worse than in the Great Recession.

8. The Cutback in Oil Supply Due to Low Prices is Likely to Occur in Unexpected Ways.

When oil prices drop, most production will continue as usual for a time because wells that have already been put in place tend to produce oil for a time, with little added investment.

When oil production does stop, it won’t necessarily be from high-cost production, because relative to current market prices, a very large share of production is high-cost. What will tend to happen is that production that has already been “started” will continue, but production that is still “in the pipeline” will wither away. This means that the drop in production may be delayed for as much as a year or even two. When it does happen, it may be severe.

It is not clear exactly how oil from shale formations will fare. Producers have leased quite a bit of land, and in some cases have done imaging studies on the land. Thus, these producers have quite a bit of land available on which a share of the costs has been prepaid. Because of this prepaid nature of costs, some shale production may be able to continue, even if prices are too low to justify new investments in shale development. The question then will be whether on a going-forward basis, the operations are profitable enough to continue.

Prices for new oil development have been too low for many oil producers for many months. The cutback in investment for new production has already started taking place, as described in my post, Beginning of the End? Oil Companies Cut Back on Spending. It is quite possible that we are now reaching “peak oil,” but from a different direction than most had expected–from a situation where oil prices are too low for producers, rather than being (vastly) too high for consumers.

The lack of investment that is already occurring is buried deeply within the financial statements of individual companies, so most people are not aware of it. Dividends remain high to confuse the situation. By the time oil supply starts dropping, the situation may be badly out of hand and largely unfixable because of damage to the economy.

One big problem is that our networked economy (Figure 1) is quite inflexible. It doesn’t shrink well. Even a small amount of shrinkage looks like a major recession. If there is significant shrinkage, there is danger of collapse. We haven’t set up a new type of economy that uses less oil. We also don’t have an easy way of going backward to a prior economy, such as one that uses horses for transport. It looks like we are headed for “interesting times”.

Number 7 is kind of hand-wavy and it’s really a critical point, as far as the long term effect of oil prices. There are a lot of political and economic forces that come into play in the oil economy and it can be really difficult to take into account how they all combine to produce results.

High oil prices provide a powerful incentive for people and economies to try to figure out how to make do with less oil. Without that incentive, it seems much less likely that the transition begins to occur. I agree that a continuing economic contraction would be the most likely outcome of sustained high oil prices. An economic contraction is bad in terms of our short-term economic outcomes, but it might be good from a global climate change perspective.

I am also of the opinion that an economy that is based on any kind of fossil fuels is an economic dead end. The further we continue down that road, the more problems exist with scarcity and volatility of resources and environmental degradation. Any transition is likely to take time and have a large number of things that need to come together. The nice thing about higher prices is they push a lot of little levers at the same time, as individuals and companies make small decisions that add up to change, as opposed the trying to get the government to pull one big lever that would somehow get us out of this mess.

It is interesting to consider this article with the article in Newsweek by Assange in today’s Links section. You would think that coherent, top-down societies like Japan or China would be doing their damnedest to get away from oil and coal dependency and institute sweeping changes towards a post-carbon economy. Yet they don’t. My guess is they feel the transition will leave them too vulnerable to outside subversion feeding on the dislocation and hardships engendered by such a transition.

Chin actually is instituting sweeping changes towards a post-carbon economy. Industrial retooling is slow, however. But if you’ve really been following China, they are doing it.

Who would have thought 10 years ago that coal power plants would be firmly on their way out now? But they are. They are here in the US. But they are in *China* too. This has disrupted Australia’s right-wingers’ plan to sell coal to China; China has told Australia that from now on, China will be burning less coal each year than the previous year, and they’re making it true.

China is also leading the world in thorium nuclear power. Thorium nuclear energy was developed at Oak Ridge and was the nuclear power we were all promised and never got. It is cheap, abundant (enough thorium to power the world at present energy levels for 5000 years), can not be weaponized in any realistic manner, and most importantly, can not melt down (already in a melted state and when there is an accident it freezes up). It also only produces about 1% of the nuclear waste of uranium reactors, and that waste is nowhere near as hazardous. China hopes to have their first thorium plant by 2020.

And then why does our economy still rely on fossil fuels, despite the massive rise in prices over the past 15 years? A: because even at $100+ per barrel of oil, it’s still much cheaper than the alternatives.

Our current iteration of industrial civilization itself is at a dead end because we’ve been living high on the hog off of a seemingly limitless source of high-quality, concentrated energy (probably this is where most economists indulge in magical thinking and attribute our great economic success to “innovation” and “technology”. Nope. Just lots of near-free energy)–and there is no replacements possible that would allow us to profligately waste energy as we do today.

For those interested in survival, weening off this tapering source of (no-longer infinite or viably cheap) energy early is probably the best bet. If the community/state/federal government doesn’t direct this process for you, then you owe it to your family and neighbors to get started on it yourself.

Very good comment jgordon…up until the last sentence at least.

I have been hearing people advocating “weening” off of FFs for years now. I was even one of them for a while back when. Through observation of others and by my own experiences I came to understand that advocating weening or what is also called power down is simply telling people to embrace poverty before you are actually poor and this leads to some very tragic outcomes. That is probably why the advocates are usually very well off and comfortable.

The other interpretation of power down is to buy a farm, build out all the groovy green infrastructure and get down to work being “sustainable” which in reality is not powering down at all.

The only real solution is to pay people to do nothing, or more accurately pay them to not do the wrong things,(using lots of resources and big carbon footprint, etc.) and pay them to do the right things, (no car, grow food, produce art and literature, etc.) and tax the hell out of doing the wrong things to pay for it all.

Just to be clear here, “powering down” means a lower material standing of living. I’m not suggesting this because people will be able to live sedentary, comfortable lives after they go about it, but because it is necessary.

This is silly, pointlessly masochistic advice. Rather than a “lower standard of living”, get LED light bulbs and have the same amount of lighting for 1/10 the cost. Insulate your house and have the same amount of heating for 1/10 the cost. On a bigger scale, move to somewhere where you can walk to work (which is nice and gives you exercise) rather than driving (which is generally unpleasant) Etc.

Other people will be doing all the same things. Get there first, you’ll have a financial advantage over the latecomers.

I guess what I’m advising in terms of local “weaning off” could be described as *feather your nest*. There’s so much energy wasted on unpleasant things that we can save a lot of energy while increasing our standard of living.

There’s gonna be some pain. No two ways around it. Living standards–especially in the subjective sense–for many people in the world will undergo a noticeable decline post-FF dominance.

But just as with growth and improvement, it’s the distribution that matters most. It’s not a question of austerity. We’re gonna get some austerity whether we like it or not. The question is how do we distribute the austerity? How much austerity and for whom, and in which things?

Austerity does not necessarily create a political crisis. People accept scarcity more readily than you might think–as long as they know the logic of it, as long as they see some fairness in the way it’s done, and as long as they see their leaders suffering, too.

The advice is neither silly, pointless, nor masochistic. What we all need to “wean off” from is wishful thinking. Everyone needs to reconcile themselves with the reality of resource depletion. Our choices have largely been taken away, and preparing for such a future is just prudent and responsible.

Our current iteration of industrial civilization itself is at a dead end because we’ve been living high on the hog off of a seemingly limitless source of high-quality, concentrated energy (probably this is where most economists indulge in magical thinking and attribute our great economic success to “innovation” and “technology”. Nope. Just lots of near-free energy)–and there is no replacements possible that would allow us to profligately waste energy as we do today.

That’s it in a nutshell. We’re really enamored with our technological prowess, when in fact most of it has simply been due to ridiculous amounts of easily accessible cheap concentrated energy, along with the imperial military force which that enabled to make sure our access to it continues until the bitter end. But try as we might to deny it, that bitter end is rapidly arriving. Whether or not alternatives ever begin to fill even a small part of that void remains to be seen, but there remains little reason for optimism that they will at this point.

Oil is trivial to replace. Much bigger problem is peak metal ores; the only way to get the metals back is intensive recycling, and even when we do that, we’re going to be working with an essentially fixed stock of each metal.

“Oil is trivial to replace.” This statement shows how monumentally ignorant of the facts you are. Your ignorance along with some of your outright lies means your comments will be ignored.

Oil is everything everywhere. Every energy transition humanity has made has been to a higher quality, less expensive energy source, not one that is less than half as useful and 5 times more expensive. Oh that and humanity has always continued using and in fact increased the use of the energy source that they have supposedly transitioned from.

Solar and wind have a place in the future but only a future that consumes about 10% of the energy we now do.

The only reason solar is even considered is because FF based generation costs are skyrocketing not because solar is getting less expensive. Virtually every so called “alternative energy” project is 100% dependant on hooking up to the existing FF based infrastructure

No Country is reducing their coal use and certainly not CHina.

“Indonesia developing mega coal mine five times larger than Singapore”

http://news.mongabay.com/2014/1020-gfrn-fogarty-indonesia-plans-mega-mine.html#jM0ZGq2iyrFxq81Z.99“

Blah blah blah. Stop showing off your ignorance. Oil is trivial to replace, technically speaking.

We used oil solely because it was cheap. It’s not cheap any more. Therefore we’ll replace it, because it is *really damn easy to replace*, technically speaking. Heck, I’ve replaced nearly all of my oil usage already — I’m down to plastics and cooking methane. We already know how to replace plastics, but they use so little oil (3% of global production) that it barely matters.

Replacing gas for cooking is a harder problem. The “tough replacements” for fossil fuels right now are natural gas for cooking, coal for steel production, and the CO2 emissions of concrete production. Everything else is *easy*, technically, and the prices are such that people are switching already.

There’s a delay in the switch to electric autos due largely to battery tech, but we’ll pass the hump there in a few years. This isn’t futuristic stuff, this is available-now stuff.

You haven’t researched China. They are, actually, cutting their coal usage. Really. It’s causing total consternation in Australia, which was doing most of the exports. Coal is going to shut down from the demand end, not the supply end; a bunch of the speculative mines are just not going to be profitable.

Will we use far less energy in the future? Certainly we will! That’s not going to lower our standard of living, though!

It turns out that there was a lot of low-hanging fruit in the energy-efficiency arena, such as LED lighting and insulation. And even electric motors for cars.

Learn to not be a fool. Do your research.

You never drive, or take a plane, or a bus, or a subway (where do you think the electricity comes from?), or buy food shipped in by truck or train? You don’t use electric lights? No fossil fuels are consumed in the fertilizer that grows the food you eat, or the tractor that tills the soil and harvests it?

After you answer those questions, you can tell me how you intend to harvest the crops we all depend on and then ship them to all the places they need to go without gasoline or diesel fuel.

spot on Eeyores…

everything humans touch is reducible to a energy content equivalent. Most people don’t grasp the giganormous amount of energy consumed annually.

What come to my mind is physicist Michio Kaku’s assessment that what sets humans apart from all other species is our unique level of consciousness. We humans build a virtual model of reality in our minds and then constantly feedback scenarios of the future w/ some objective in mind. IMO This ability to plan is our unique strength as well as our weakness when trying to predict the future w/ specificity because we all have subconscious biases.

Some related reading yuo might enjoy

http://physics.ucsd.edu/do-the-math/2011/10/the-energy-trap/

http://physics.ucsd.edu/do-the-math/2012/04/economist-meets-physicist/

“And then why does our economy still rely on fossil fuels, despite the massive rise in prices over the past 15 years? A: because even at $100+ per barrel of oil, it’s still much cheaper than the alternatives.”

No, actually solar is cheaper than oil already. Solar will be cheaper than coal in about 5 years.

People make these pseudo-wise statements, and they just don’t know the facts. It’s true that companies have stuck with fossil fuels because they *were* cheaper. That is over, ended, finito, thank you Swenson’s law. Solar is still slightly more expensive in some markets, but it’ll be cheaper everywhere very soon.

Renewables are cheap built with the support of oil economy thought. While it’s improving, if you removed oil now from the economy there is no way renewable could sustain our current civilization.

The solution has to come from a mutiple approaches, from stagnating population growth (and eventually degrowth), increasing technological progress, building up infrastructure preventively, reducing consumption and debt-based economy and proper policies to diminish inequality and resource exhaustion by certain segments of the population.

If that isn’t hard enough, it will take decades, and a lot of balance to do this properly without triggering a civilization collapse because of conflict and wars.

Do your research.

Renewables are cheap because they’re cheap. Solar power factories can be powered by solar power (pretty easily). Etc.

Yes, there’s a bootstrapping problem; it takes time to convert our technologies. You would still see horses on the highways regularly well into the 1940s, even though the auto revolution started in the 1910s. There’s going to be some disruption over the next couple of decades as the conversion takes place.

But my point is that it is *technically* easy and it is happening right now.

” if you removed oil now from the economy there is no way renewable could sustain our current civilization.”

Well, and if you removed whale oil from the economy ‘like magic’ it would have caused a mess in the 1800s too. But that doesn’t happen. You can remove oil in the next couple of decades quite easily though.

Our current civilization is unsustainable period because of overpopulation, but we know how to solve that *too* — it’s called the “demographic transition”, and we do it by educating and empowering women and making birth control easy to get.

The problems are essentially political problems: there are entrenched interests who want to prevent us from making the transitions we need to make, and they are fighting to keep us hooked on oil (and another entrenched faction is fighting to keep women oppressed and pumping out babies, for that matter). You can watch them doing it, with the Spanish government’s “tax on the sun”.

They know they’ve lost in the open market, and lost in the public mind; they are fighting to use raw power to retain their position. THIS is the danger.

I have, you can’t outsource most of the costs off balance sheet and just pretend. The real EROEI for most renewables is not high enough to sustain a developed industrial civilization (this is subject to debate but most people won’t argue that you need a 3 or higher coefficient), transitioning requires a high energy investment too to make things worse. That technology has to be efficient enough to keep building more technology for substitution, expansion and create a surplus: right now it isn’t, the whole industrial process and logistical chain is built on the backbone of oil supply. So no, with the current technology it can’t happen, not even in the next 20 years, without other substantial changes to our way of life. It may happen in the next 20 to 40 years if technology keeps getting better? Yeah, sure, why not. But right now is not technically possible (that’s what you are implying).

And ultimately, the problem are not politicians, is the people, because they haven’t “transitioned” their “mind” to a new paradigm, whoever argues that the majority has even considered starting to change the consumption western style way of life has to be blind. In reality what we have in the majority of the population which is poor wanting to transition to that western style. Politicians are doing what they usually do: telling the people what they want to hear, they want to hear that the current model is a model based on growth and consumption, period. They just don’t know how to fix the current financial mess because of their own limited view on monetary operations, if they did and growth was kicked nothing would change and we would return to the same old unsustainable path of not doing real changes.

Right now the probability of increasing chaos in the next 50 years is higher than the probability of some sort of soft ‘transition’. There is zero evidence to the contrary, in fact when nationalism and hatred starts to take over (already happening) it will only get worse. And the current ‘financial’ constraints are a joke compared to what we will see compared to resource constraints even if we try a controlled ‘contraction and transition’, for first hand experience go to countries that are experiencing or have experienced high inflation rates while stagnating or decreasing wages.

I think you are failing to appreciate the invisible rabbit hole of infinite regression which holds everything together. The employees, suppliers, and service providers of the solar panel factory all rely on FF. Each of those entities in turn has employees, suppliers, and service providers relying on FF. And on and on and on until you have included everyone who is alive. Each and every one of them uses FF for every chore they wish to accomplish. That network represents a hidden web of support and subsidy, on which the solar panel factory sits, thinking it is self-sufficient.

It is all made possible by the energy surplus which comes with conventional FF. When you start scraping the bottom of the barrel with polar, deep water, shale and tar sands, the oil is there but the energy surplus is much reduced. The network slowly degrades until it is no longer viable.

@jgordon;

“If the community/state/federal government doesn’t direct this process for you, then you owe it to your family and neighbors to get started on it yourself.”

A lot of you analysis is on the lines I think and even your conclusion I don’t dispute; however the reality of the human mind and the world around us is on the lines of the following parable.

“Every morning in Africa, a gazelle wakes up, it knows it must outrun the fastest lion or it will be killed. Every morning in Africa, a lion wakes up. It knows it must run faster than the slowest gazelle, or it will starve. It doesn’t matter whether you’re the lion or a gazelle-when the sun comes up, you’d better be running.”

So as long as the crisis is over the horizon it is out of site and people choose to either the gazelle or the lion.

I don’t mean to offend anyone’s sensibility nor recommending this course of thought just stating what I observe as the aggregate mass thought. – Incidentally this also goes towards partly answering the question another commentator asked as to why certain countries don’t try to cut out carbon. They don’t quite see the need to do the heavy lifting – just need to be faster then other EM’s.

At any rate, so long as this is a few decades way the above parable in conjunction with that wonderfully insightful comment ” Apre moi le deluge” likely sums up the extent of our species’ response. – pity!!

Peak oil consumption has arrived. Forces have arrayed to make something that seemed so impossible a reality. When the dust settles and the smoke clears, today’s stalled consumption figures around the globe will be seen as the beginning of a new slow trend down in oil use.

kinda what I think too

Watched the documentary on Michael Ruppert’s take on all this last night. Depressing but recommended:

Collapse

I missed that one. I know he was concerned about it all, but he didn’t seem as concerned in this early one about CO2 and global warming as he was about the collapse of our industrial way of life. We could always do some very sensible things (but we won’t) like migrate. Live south in the winter and north in the summer. Equatorial people don’t suffer life threatening weather temperatures so they can stay put. So build some north-south trains, since we won’t be driving cars to travel. Well, what’s not to like about that? It would be perfect for China and Russia too.

I wish Ms. Tverberg would itemize the optima that the oil standard has recently conferred upon the world economy.

I would also take hopeful exception to the assertion that

This unfortunate canard–that people and money are mutually fungible–is fortunately wrong here. Tens of thousands of young, smart scientists (ï.e., “human resources”) have already allocated themselves to wind, solar, and battery storage. Saudi Arabia’s desperate price cut may slow things down, but it’s too late for the Wahabis to put the genius back in the bottle.

Get back with me after those excellent ideas about alternative energies have been demonstrated to be economically viable, at large scale, without direct or indirect fossil fuel subsidies. Because otherwise you are engaging in the same sort of hopium and promising vaporware that’ll probably never arrive.

To be clear, your statement there is exactly equivalent to the statement that God/Allah/Satan, whoever, will come down and save us in our hour of need. And historically speaking, faith-based initiatives rarely work out well. There are certainly things that can be done to ameliorate our current crisis. However, believing in fairy tales detracts from those efforts.

jgordon, I’m with you. If you want to think big, we’ve had only two real human transitions: from hunter/gatherer to agriculture (human and animal power), and then from agriculture to industrialization via fossil fuels. Braudel argued that even in the Middle Ages Europe had an edge because it had more wind and water power, and animal power, per capita than any other region. When it got steam power all bets were off and the rest of the world was gobbled up in a century. The transition happened because of the obvious and unquestionable advantages coal and oil brought to the table. Any new transition away from fossil fuels will not go as smoothly (and for ye olde industrial proletariat, the last transition wasn’t a barrel of laughs itself). The advantages of wind, solar, geothermal, and tidal power are not nearly as obvious in any short term calculation, and the only calculations we make are short term. Our economic and political systems are designed that way. We would need a whole new economy and a whole new political setup in order to exploit the benefits of moving away from coal and oil. Most people want to put the cart before the horse. They want to “go green”, but we are not arranged as a human community to do that. What will happen is that a crisis will arise, and power be made so concentrated and centralized that it can push through the changes needed without worrying about quarterly profits or election cycles. The implications of what kind of order that will be need no elaboration.

Xcel Energy in Denver was planning to build a new power plant. They chose to build a solar plant because it was cheaper in total cost of ownership than building a coal plant.

Solar is substantially cheaper than grid power in Hawaii. The Hawaiian utility company is panicking and trying to prevent people from adding grid-tied solar. The reaction is (a) political, to force the utillity company to allow it, and (b) battery-backed solar, which is competitive with grid power in Hawaii for an efficient house (remember, not much in the way of heating costs).

This is happening NOW.

The Chinese government has stopped expansion of coal power plants and is now dismantling them as they install solar panels.

There are various problems with your assertions there, the biggest being that all those efforts rely on heavy subsidies from fossil fuels and fossil fuel infrastructure to be viable. We can start by asking ourselves how much fossil fuel energy does it take to create, transport, and deploy a solar panel? And were fossil fuel energy absent from the economy, would we be able to do any of those things at all?

This comes down to an accounting gimmick, hiding energy costs off balance sheet and then claiming that the result is sustainable and good for the environment. When as of today, it’s nowhere near that. How I wish it weren’t so.

“There are various problems with your assertions there, the biggest being that all those efforts rely on heavy subsidies from fossil fuels and fossil fuel infrastructure to be viable. ”

[citation needed]

“We can start by asking ourselves how much fossil fuel energy does it take to create, transport, and deploy a solar panel?”

None. You power the factory with solar power, you power the transportation equipment with solar power, you power the mining equipment with solar power. Next question?

Your frankly idiotic question is like asking “How much horse power does it take to manufacture all these automobiles? Look at all the horses you’re using to build them. You’re dependent on horse infrastructure and horse subsidies!”

Think about it for a minute and you’ll realize why this is arrant nonsense. The entire production / distribution line can be run by solar power. Easily. It’s just a matter of doing it.

Here are some things which are actually dependent on fossil fuels / carbon emissions with no clear replacement:

(1) methane (& propane etc.) for cooking. It’s considered technically superior to electricity by chefs, and there are no alternatives which are considered better.

(2) coal for steel production. Nobody knows another way to get the carbon levels right.

(3) ammonia for artificial fertilizer (this is a *huge* problem, of course)

(4) CO2 emissions from concrete production

These are all cases where the fossil fuels are used for purposes other than pure energy generation. These are hard. Things where it’s just energy are *easy*.

*easy* is more like hard than easy. Fossil fuel declines will wreak havok with our technological pyramid.

@”The Chinese government has stopped expansion of coal power plants and is now dismantling them as they install solar panels.”

Perhaps. But perhaps the reasoning is differently based and not necessarily a resounding vote for the efficacy of the solar platform. One can present the following hypotheses;

1. Given the extra ordinary steep build out of the coal and nat gas plants they were staring to chock on the pollutants.

2, In addition the flack they were receiving as a polluter, manufacturer of shoddy goods et al required a strong PR repositioning. (optics ?? ).

3. They are hoping and needing to move up the value chain as their USP of cheap costs is getting under cut by others – furthermore it makes economic sense to try and sell higher value and margin items and let someone else make a zillion undies for walmart at a penny a piece margin. For this it is imperative that they change the perception of a smoke belching sweat shop location.

4. They have been aggressively investing in what was seen as a sun rise industry – solar panel fabrication, turbines etc. A lot of these capacity creation was not necessarily based of economic calculus a prudent man would comprehend but more on the early US railroad/ build and they will come mentality.

5. By now easing off the throttle on the coal build out they will gain all the optics needed to help transition image, win brownie points in future markets, help keep the solar fabricators etc in business even as they can dump and decimate the competitors abroad. And the huge fleet of coal plants they got are online and will remain for decades. They just are signaling they are reaching a lower trajectory of incremental power needs and will now experiment with the alternate energy arena for a while. This way it dove tails with all other requirements – PR, indirect support to what could be a big dominance in alt energy manufacture etc. Furthermore remember they are also reasonably big producers of coal both at home and through their investments overseas – hence this lower demand can be used as a stick to leverage Australia (they continue importing Indonesian coals without the extra tariff ). This is all part of the nonsense of Australia not playing ball easily – witness Aus boycott of the Asian Infra Bank.

Overall a brilliant strategy for China using the natural decline in power gen growth trajectory to try and parley it from PR and get dominance in a new Industry to boot.

BUT it may not necessarily imply that the fundamentals of Alternate energy can come close to fossil as it stands.

“Get back with me after those excellent ideas about alternative energies have been demonstrated to be economically viable, at large scale, without direct or indirect fossil fuel subsidies.

Done. This was demonstrated several years ago. So you’re wrong and he’s right. Next question?

We do indeed know how to do without oil – don’t use it. Oil is basically used for transportation, and for the most part we can either not travel, or use other methods (electric trains). We could live in a very nice world where most people live in compact communities, long-distance transportation happens on trains, and flying is minimized. Some self-propelled vehicles would be needed for farming and such but they could be powered by biodiesel, alcohol or electricity. We’d still need some oil for flying and transoceanic shipping but with some reductions in usage we could make the necessary quantities from biodiesel.

The problem we have is that we have built many things that we need a lot of oil to use. Houses in the exurbs, factories in China producing for the US, highways, buildings with massive parking lots, hotels and offices clustered near airports, etc. – we don’t need any of it and we could do well if we’d never built them. But now that they exist they create powerful economic and political interests to keep using them.

Very high oil prices are a good thing, and the sooner the better, because every day with oil prices far below their long-term state of “very expensive because it has to be made from limited biodiesel” is another day of building things that will last decades and need oil. At present most economic “growth” is not really increasing wealth, but increasing “illth”, incentives for people to continue wasting and living unsustainably.

This is why Saudi Arabia — whose wealth depends on oil — is trying to force oil prices down in order to keep people dependent on Saudi oil.

They have forced oil prices down, but they’re still high enough that most of the more high-cost producers of oil don’t make a profit, and are eventually going to have to throw in the towel and quit. The “oilmen” are in denial and are throwing money down ratholes of “exploration”.

Even the UAE sees the future: they’re investing in solar (and everything else they can buy up). The merchant princes of Dubai and Abu Dhabi are not “oilmen”, and they have no emotional investment in oil, so they are cold and calculated enough to see that oil profits are going away and it’s time to switch to a new racket. (They’ve done so many times in their history, having started out trading spices, and later slaves…)

Matt Taibbi in his book Griftopia offered a convincing explanation for the plunge in oil price, $147 —> $30/barrel in 2008. Bigger than oil is the sum of everyone’s retirement funds. Wall Street had weakened the “prudent man” rule to allow Wall Street to sell commodities to retirement fund managers. Traders made huge profits both on the way up, and on the way down.

That’s what’s funny about this debate, as though we have market-driven prices for oil (or stocks or money or anything in this Casino Age). Look up ICE: Intercontinental Exchange. Wall St and the oil majors couldn’t manipulate prices effectively enough so they set up this exchange. Prices are formed at the margins, so a very tiny investment (estimated at $500M annually) let’s them bid prices up at key moments, and they easily reap billions. Works both ways on prices…when they want to position the New Vlad The Impaler (Putin) as this week’s World’s Worst Guy (after Noriega, Chavez, Saddam, Morsi, Ahmadinejad, Gaddafi, Assad etc etc) they can put the squeeze on him by lowering prices at will (LOL didn’t work because the ruble also dropped and Vlad gets paid for oil in dollars, but they can try…)

During the $147/barrel oil price runup, oil company presidents said the price should be about $80. They were mostly disregarded (including by Gail, I suspect) by those fearing the resource was about to run out. Eventually it will run out, but for the foreseeable decade, these guys knew where the resources were and the costs of the technologies needed (fracking, etc) to bring it to market.

http://www.advisorperspectives.com/dshort/updates/Gasoline-Sales.php

Short puts into perspective gasoline consumption taking into account population growth. Undoubtedly, aging of the population and fuel efficiently are factors in less gasoline and oil use.

But I think it is obvious that the big factor is price. Sure, the people with money can buy SUV’s and pay the cost of the gasoline. But more and more cannot, and use their car only to get to their minimum wage part time job, hit the grocery store on the way home, and don’t use the car other than that.

Kind of tough for retail to sell tchotchkes when the 90% can’t afford periodic drives to the mall, or any business for that matter.

I don’t know why, I’ve got nothing to quote on the subject, but I do not think price has anything to do with anything like supply and demand, except maybe in some minor way. After all, this crazy volatility in oil started after 2007 and at one point nobody was buying any of it so they stored it in tankers off the coast of England among other places – until the price went back up. They kept pumping. Most likely because the Saudis needed the cash. Everything can be controlled through a global market of cooperation. Everything probably is planned. The Saudis do have a finite resource which they need to conserve but it will still run out, and fairly soon. My guess would be that it will be price-controlled to the last drop.

I don’t think there’s a single persons in the state of Maine who doesn’t think the heating oil market is manipulated….

I thought the predicament was that oil was going to $500/barrel?

http://archive.fortune.com/2008/09/15/news/economy/500dollaroil_okeefe.fortune/index.htm

Always interesting to see predictions from the past! Those guys might be feeling a bit sheepish (been there done that). It seems what they failed to consider is that our exponential economic growth is predicated on cheap oil…and every time oil gets expensive the global economy rolls over and dies. In 2008 oil hit $147 which seemed to be the trigger for the crash (lots of things ready to fall apart once overal demand fell away), this time $110 and the global economy rolled over and looks like its dying again. As Gail Tveberg has explained in other posts on her website, when oil gets too expensive, it kills the economy/jobs etc, people can no longer afford it and demand falls.

Getting to $500 a barrel may be difficult as the economy and people simply can’t afford to buy as much oil (and things that oil is an input to) a long way before price gets to that level and then global demand drops away and the economy shrinks, a Catch-22. In my view the fundamental importance of cheap (liquid) energy to economic growth is completely underestimated, especially by economists, and unfortunately there are no perfect substitutes and I think we are now starting to see the real impact of more expensive, unsubstitutable liquid energy on economies. Economic growth dies at the shock of higher energy inputs.

It’s also interesting that shale oil is very light and not suitable for refining into diesel, which is what much of big industry uses day to days. It’s easier to refine a heavy oil into diesel than the other way around. I’m not sure how solar/renewables can replace oil in big agriculture and international shipping and global trade for example, and those renewables also have their own non renewable, high energy inputs. Roads/asphalt are made from heavy oil for example, solar energy can’t be be magically turned into asphalt.

And our debt systems are predicated on exponential growth…oops.

With our globalised, fully interconnected, super efficient but not so resilient, just in time, exponential growth demanding but finite world, a perfect storm is brewing methinks…The follies of seeking exponential growth in a finite world…

Is it possible that Saudi Arabia has lowered the price for the express purpose of reducing (denying) profits by ISIS from the oil fields they have seized and now control? Could that perhaps also be helping to supply the Iraqi army for an anticipated ground assault against ISIS? It’s hard to imagine that the Saudis would be doing this without complicity from the U.S. Govt.

Wait until after the mid-terms

Prices will be up…up…and away

And yes, it really is “that” simple

I just love Gail for continually inserting the Figure 4. graph in her posts. lol.

I hope she continues to do so until everyone GETS IT.

Look at it, take a sip of coffee, tea, beer or wine and ponder for a minute or two that what this chart shows is an absolute debate ender.

This is by itself the anvil that crushes any remaining doubts about what our civilization is built on.

(if the science of energy, entropy & thermodynamics didn’t get through to you that is…)

If I had to pick one resource to recommend to a layman interested in all the implications of the oil story, it would be Gail Tverberg’s blogs and presentations.

Short form: Tverberg:oil :: Yves:financial “services”.

The late Matt Simmons had figured out a big chunk of the story by 2004 or so, but his reputation is temporarily in eclipse. It turns out the “technology fairy” (which he used as a dismissive metaphor for unrealistic hopes that engineers would find a fix for the oil supply problem) actually showed up, in the form of hydraulic fracturing in the shale plays. That put off for a few years the crunch that Simmons was projecting. Of course, the time is being wasted.

Simmons made his career as an investment banker to the American E & P’s, and so the oil story was integral to his work experience. What’s especially impressive about Tverberg is that she didn’t have that background, and so far as I know is entirely self-taught. She belongs on anybody’s short list of valuable public intellectuals.

Simmons had an interesting method: He did content analysis of technical papers in the petroleum industry, where Aramco engineers regularly published, and found that the engineers were writing on technical topics appropriate to declining fields. It would be interesting to see if the same method could be applied with fracking, today.

That was a funny story about Simmons. You had a bunch of wonky petroleum guys (Arabs and Anglos both) who were totally fascinated by the geological puzzle at Ghawar, and writing up papers for each other at industry conferences. In the process they left a bunch of Saudi Aramco state secrets lying around in plain sight. All anybody had to do was to hunker down and plow through the papers. Which Simmons – to his great credit – did.

The closest analogue wrt the shale plays is the case Art Berman has made, which has been covered on NC. Is he right? As of now I don’t think anybody knows. The answer is in the geology. The rocks wil tell you, but only in their own good time.

I used to get depressed thinking there really was going to be no solution to the world’s energy problem until I heard about thorium nuclear power. Nuclear energy from the element thorium is radically different from that of uranium. We developed it at Oak Ridge but never got it commercially. But it’s day seems to be coming. Learn about it by its leading proponent in this TED talk.

http://www.ted.com/talks/kirk_sorensen_thorium_an_alternative_nuclear_fuel