While there has been ample discussion the impact of falling oil prices on the national budgets of major oil producing nations, there’s been less media focus on how some of the countries that face budget squeezes are likely to react.

Consider what a difference nine days makes. Moody’s gave six Middle Eastern countries a thumbs up on December 8, based on the assumption that oil prices will average $80 to $85 a barrel in 2015. With WTI now at $55.33, it appears reasonable to assume a price of $60 or below for the first half of 2015. The consensus is that production cuts will lead to much firmer prices in the final two quarters,* but $70 a barrel would now seem a more reasonable forecast for the year.

Here is the money part of the Moody’s assessment (emphasis ours):

Moody’s Investors Service says that while the six sovereign states in the Gulf Cooperation Council (GCC) can withstand the pressure of oil prices averaging around Moody’s estimate of $80 to $85 a barrel in 2015, Bahrain and Oman’s credit profiles will be the most adversely affected, because the two sovereigns exhibit a combination of high fiscal breakeven oil prices and low reserve buffers…

Kuwait and Qatar are the most resilient, given their very low fiscal and external breakeven oil prices, and large reserve buffers. Saudi Arabia and the UAE exhibit slightly weaker fiscal fundamentals and higher external breakeven oil prices than Kuwait and Qatar. However, all four sovereigns have similar shock absorption capacities, given Saudi Arabia’s and the UAE’s large non-oil sectors and sizeable reserves.

Bahrain and Oman will be more adversely affected by the lower oil prices becasue they have the highest fiscal break-even prices and the lowest reserve buffers in the GCC. While the sovereign wealth funds of Kuwait, the UAE, Qatar and Saudi Arabia can cover multiple years’ worth of government expenditures, Bahrain’s and Oman’s do not provide that level of cover..

According to Moody’s report, Bahrain and Oman are likely to finance any increase in fiscal deficits in 2015 through sovereign debt issuance in 2015. Saudi Arabia has indicated that it will use its reserve buffer to finance its deficit. Moody’s does not expect Kuwait and Qatar to raise their debt levels.

Translation: While Gulf states can make some spending cuts, they’ll need to do more to cover likely shortfalls. The states with bigger sovereign wealth funds will tap them as needed. The ones with weaker positions will borrow.

Let’s look and see how big these funds are. From Wikipedia:

Look at how oil producing states dominate by ranking and by heft. Norway in particular is a very active stock market participant.

First order oil dislocation effects, such as general market volatility, currency repricing, continuing declines in energy-related debt prices, and cautiousness about risky investments, will dominate the investment picture. But the shift in posture of these big oil-funded sovereign wealth funds will play into this pictures as an undertow. They are pretty certain not to be making new investments and are likely to be making some sales. Not only will their sales have some impact at the margin, but their absence as deep pocket opportunists could be more important than one might imagine. Recall that in the early stages of the financial crisis, sovereign wealth funds stepped up to provide capital to quite a few wobbly banks. There will be fewer to act as rescuers this time around. And sovereign wealth funds are also big investors in private equity. The sorry side effect of that is likely to be that the private equity firms will become even more aggressive in their plans to hawk their funds to retail investors.

Again, we must stress that these expected moves by sovereign wealth funds aren’t earth-shaking in and of themselves, but they illustrate how these second-order effects are still meaningful and not favorable to the outlook for financial assets.

___

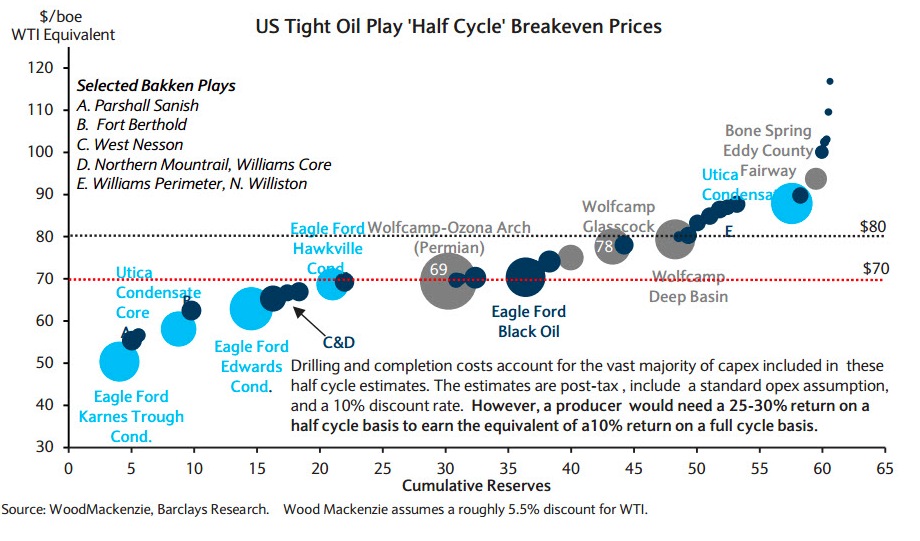

* Your humble blogger suspects it will take longer for production to be choked off. Too many shale gas producers need to keep pumping to service debt. That does not mean low prices go on forever, but it might take a quarter or two longer that expected for production to adjust. A corroborating detail is that various analysts keep lowering their claims as to the break-even cost of US shale producers. A mere couple of weeks ago, the claim was that 80% of the shale gas producers had breakevens in the $60 to $80 range (with virtually all the rest at higher levels). That summary was generally consistent with charts like this. From a December 12 post:

And this chart (hat tip Ed Harrison) gives an idea how much a difference the drop from $70 a barrel to yesterday’s below $60 price means (click to enlarge):

And notice that the “half cycle return” is a dubious metric and greatly understates the requirements for meeting long-term profit targets.

I have not been able to get independent confirmation, but an investor told me a new Goldman report issued yesterday stated that most shale producers could make money at $25 a barrel. The investor noted that it is quite remarkable how shale driller break evens keep falling as the price of oil keeps decaying, particularly since many were cash flow negative at $100 a barrel. If producers are giving this sort of blather patter to Goldman, you can be sure they are giving it to their friendly lenders, which means you can expect them to keep producing as long as oil prices are high than their claimed, as opposed to real, break-evens.

“Goldman report issued yesterday stated that most shale producers could make money at $25 a barrel.” – there’s no propaganda like financial propaganda, especially from the ones who keep selling shit in a different sector to the next mark. “Hey Rube” the Good Doctor called his last column and not without reason – http://proxy.espn.go.com/espn/page2/story?id=1996511

Royalties + Ad Valorem & State Taxes + Transportation + Electric cost on pump + Pumper Labor + Misc. = marginal breakeven cost

while this may be a “Full” Cost Loss (not drilling, completion, equipment , depletion costs) at these prices – which means no more drilling except to save key expiry leases – if you need to continue to pay banks and bonds – it is breakeven!

The problem is, we really don’t know at what minimum price the producers are still able to make money. Maybe Goldman did a bit of research? We need facts, otherwise it’s all just guessing.

I remember the oil glut of 1998. It reached a low of about $11 a barrel then. It cost the Saudis $2-$3 a barrel to pump it at that time leaving room for profit even at that low price point. I have no idea what their cost structure is today, but at $50 a barrel they’re still making a killing.

I recall the Economist chart that showed the Saudi $2-3 price. I am pretty sure it was cost and did NOT include profit. And all the other countries’ cost was considerably higher than the Saudis.

I gather you didn’t read the post carefully. The claims re the frackers’ break even levels have been dropping like a stone as oil has fallen. This simply is not credible. There would be no reason for them to understate materially what their breakeven was when profit was higher. It would lead to higher stock prices. And as our investors pointed out, many shale players were cash flow negative when oil was at $100 a barrel, which is not consistent with their breakeven claims. Did you not even read the chart? It used a “half cycle” breakeven, which is like using a 6 inch ruler and calling the results a foot. They were already clearly cooking the analysis to get to their “most are at a $50 to $70 breakeven” play.

And Wall Street does not have information sources to provide cost information independent of the companies. All they can do is compare reasonableness across companies. They don’t have petroleum engineers that they send to crawl over installations and look out output rates and make their own estimates. In fact, analysts’ financial models are effectively provided by the companies. It wasn’t that way when I was a kid (the 1980s) but now it is widespread for analysts to get tons of direct input on their financial models from the companies they cover. I was shocked in the 1990s when I realized the extent of communication and direct influence over model details.

If you plan on cooking the books anyway, its more efficient to get the “analysts” in on the game early

I used to think “hey rube” was carny-speak for targeting rubes, as in easy marks. But I learned recently that it was used as code for a fight with the locals. The Doc of course was of course quite adept at spotting the Lies We Tell Ourselves.

He also had a lot to say about police/prosecutor misconduct that is looking particularly prescient at the moment. In particular, later in life when he was easier to dismiss via caricature, he took a stand for a woman who was heinously railroaded by Denver cops for her poor choice of boyfriend (Lisl Auman). The Denver cops have since emerged as every bit as out of control as some of their more visible peers. Personally, I fear the odds of getting a beatdown by the DPD as higher than Chicago or NY. Since the DPD carries a bit of the small time, small town chip on their shoulder of a southern sheriff who answers to no one.

Meanwhile, the Goldman report is a great example that everything coming out of Wall Street and Financial Press is likely complete BS, fabricated on the spot to serve an immediate need to hoodwink an amnesiac culture.

Oftentimes the Squid does the opposite of what they recommend. This is a large part of their business plan: profit by deceiving and lying to others. This is what Obama does as well. Lying and deception is the cornerstone of his foreign and domestic policies. Which is why I have little doubt that Obama was put in power by the Squid, including Morgue and Shitigroup.

Why the American people can’t see this is totally beyond me. They know that if they lie and deceive at home, they’ll lose their friends and family; if they do this at work, they’ll lose their job; or if they do this before a judge, they’ll be thrown in jail. Why do they continue to put Obama and the banksters not only above the law, but above obvious standards of right and wrong, common ethics if you will? It is something that I will never, ever understand.

Nigeria also has a small SWF as well – its “Oil Stabilization Fund”l:

http://en.wikipedia.org/wiki/Nigeria_Sovereign_Investment_Authority

In the case of Bahrain, does it matter? In the NDAA, which no CONgress Member read in it’s entirety, our main airbase there is being expanded, plenty of money coming in. Not sure if this means further involvement for our military (I think it does), or whether we’re just taking advantage of a country in a bad economic position. Strategically, Bahrain is in a great spot, middle of everything. For Oman, to a lesser extent, we would still use their air space for flights from Diego Garcia should things escalate.

I’m going with the lower for longer thesis. Spoke with my brother (working in the Permian Basin) yesterday. Seems as though many are still overly optimistic about a quick rebound, not really cutting output. Cutting back expansion yes, but output is likely to rise for at least another quarter. OPEC still seems to be the target for blame, because no one stateside wants to point fingers at the reflection in the mirror.

Interesting times!

Since oil production is a capital intensive business, depreciation is a big part of their expenses. Cash operating expenses must be well below their fully amortized expenses. Considering the past investments are sunk, it would be economical to continue pumping oil even at current prices of $55, as long as cash expenses are below that. They probably won’t make new investments pay, so production won’t increase at current price levels.

What you wrote about drillers being cash flow negative at $100 per barrel must be “free” cash flow negative, ie, operating cash flows minus capital expenditures. Most drillers we’re expanding operation, hence their large capex. They surely would have been cash flow positive at $100 /per barrel if they can be cash flow positive now.

The 4Q financial statements are not yet out for the world to see whether they are cash flow positive as the oil price shock has started to hit and some have cut back production. We probably won’t have a good picture until we see the 2Q 2015 reports. This is just analyst puffery at this point.

This WSJ story from April gives a broad brush picture:

The companies at the forefront of hydraulic fracturing consistently have spent more cash leasing land and drilling than they made selling oil and gas.

Now, with the U.S. shale boom in its ninth year, they are trying to end that streak. Value over volume—the idea that spending wisely is more important than pumping lots of fuel—has become the refrain on Wall Street and in board rooms across the oil patch.

The era when energy executives cared more about rapid growth than cash flow is over, says Arun Jayaram, a Credit Suisse energy analyst. The companies were run in the early days “by a group of teenagers,” he says, “and now they’ve grown up to be real adults.”

The 20 largest U.S. exploration companies—those that drilled wells, but didn’t operate refineries—outspent their cash flow by a combined $11.5 billion last year, according to an analysis of CapitalIQ financial data. A year earlier the companies had $29.9 billion in negative cash flow.

Many of these companies, promise they soon will become cash-flow positive. Reining in spending has been tough, however…

The economics of fracking are starting to improve, making positive cash flow attainable for some companies. The competitive—and expensive—sprint to lease land in promising shale formations has ended as the best prospects have been scooped up. A cold winter pushed natural-gas prices higher, helping producers generate more cash after several years of overproduction depressed prices. And the costs of fracking wells—injecting sand, water and chemicals to crack open shale and free oil and gas—is falling as companies have gotten better at it.

http://www.wsj.com/articles/SB10001424052702304688104579467810326527526

So their main hope for improved results was higher prices. That is clearly not in the cards any time soon.

SWFs have never been home to the sharpest minds in the financial sector. Their heavy bets on private equity and hedge funds will be the hardest to unwind.