We’ve been telling readers, to sometime hostile responses, that Syriza has in fact already agreed to a continuation of austerity. What the party was hoping to get appears to be a mere weakening of the intensity of austerity and shifting the impact to fall more on more affluent citizens.

The evidence we cited earlier was Varoufakis committing to continued austerity even as he tried to present it as the reverse. His May statement about Greece always maintaining a primary surplus is consistent with earlier statements. From Reuters:

Varoufakis said Athens was prepared to implement a series of reforms.

“What are we talking about? Of an independent tax agency, of keeping forever a reasonable primary surplus, of a sensible and ambitious privatization program… of a true reform of the pension system …of liberalizations of markets for goods and services etc,” he wrote.

But it would not be able to attain those goals if it tried to reach the “unbearably high” primary surplus targets demanded by the country’s creditors.

Now as we’ve stressed, any primary surplus is contractionary, and will be particularly damaging in an economy already in depression like Greece’s. Varoufakis had finessed the problem in his Modest Proposal by having what amounts to fiscal transfers provided to Greece by European Investment Bank for a large-scale infrastructure spending program. But that was nixed by the creditors early on. And Varoufakis pointed out how the idea that Greece had returned to a pale version of economic growth was a chimera. Greece’s supposed real economic growth occurred by virtue of Greece still having falling nominal GDP but a deflation rate even higher than that of the rate of fall in nominal GDP. Declining nominal GDP, needless to say, is a bad place to be for an economy carrying a millstone of debt already (and it raises the question of whether the GDP deflator was tweaked to produce an illusion of expansion).

Greece was originally expected to achieve a primary surplus of 3% for this year and 4.5% for 2016. Everyone except the most rabid austerians argeed those targets were insane. And this discussion started when Greece had a modest primary budget surplus. The IMF forecasts that it will be a fiscal deficit for 2015 of as much as 1.5% (given the desire of official forecasters not to scare off the confidence fairy, one should regard supposed “worst case” scenarios as likely). So while the current creditor “ask” of 1% for 2015 looks accommodating by virtue of comparison to the old 3% level, in light of the deterioration of the economy, the amount of budgetary tightening required (negative 1.5% to positive 1% or a 2.5% change) is pretty much on par with going from a modest primary surplus to 3%.

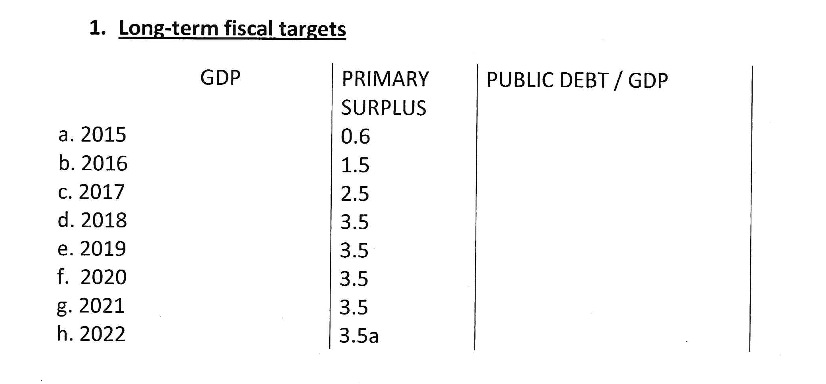

But what Greece is proposing in terms of overall budget targets is not all that different from what the creditors are demanding. This is from the 47 page Greek proposal published by Tagesspiegel last week (we’ve also embedded it at the end of the post:

3.5% from 2018 onward is precisely what the creditors have asked for. And it’s crushing level. For Syriza to present their plan as anti-austerity is flat out untrue.

Bruegel provides an overview of the main differences between the two different plans.

By Silvia Merler, an Affiliate Fellow at Bruegel and previously an Economic Analyst in the DG Economic and Financial Affairs of the European Commission (ECFIN). Originally published at Bruegel

It has been an intense couple of days on the front of Greek negotiations, with leaks from both sides. Beyond the noise, here are some key points to watch over the next week.

Redemptions Postponed

Greece needs to repay about 1.5bn to the IMF in June, distributed as follows: 5 June: about EUR 300 mn on the 5th, EUR 335 mn on the 12th, EUR 558 mn on the 16th and EUR 335 mn on the 19th. Greece announced yesterday that it decided to bundle all this payments into a single tranche to be redeemed at the end of the month. As some commentators promptly pointed out, this turns Greece in “the new Zambia” – Zambia being the last country to ask for this procedure to be activated, in 1980s – but it also buys some time for the negotiations to stretch over another week. Negotiation will most likely be centred around the points of contention included in the two different proposals (one from the creditors and one from Greece) that have been leaked in the past days to the press and that are reviewed below.

Different Proposals

The latest creditors’ proposal was leaked and published by a Greek paper (here), while the Greek counter-proposal was published by a German paper (here). There are some important elements on which numbers have been put on paper, and these are likely to be the catalyst for the negotiations during next week.

-

Primary surplus targets: this has been the bone of contention since the beginning of the negotiations. The second programme targeted a primary surplus of 3% of GDP in 2015 and 4.5% in 2016. The economic situation has deteriorated to the point that creditors now expect Greece to run a deficit of about -⅔% of GDP at unchanged policies. The leaked creditor proposal offers a target of 1% in 2015, 2% in 2016, 3% in 2017 and 3.5% in 2018 and beyond and ask that Greece introduces a supplementary budget for 2015 to meet the new target. The Greek counter-proposal asks for 0.6% in 2015, 1.5% in 2016, 2.5% in 2017 and 3.5% in 2018 onwards. Based on these documents, there appears to have been a significant convergence from the creditors towards the Greek position. In fact, the 1% offered by the creditors now would be below the 1.5% that Varoufakis unsuccessfully bargained for during the first Eurogroup meeting he attended. Both sides see 3.5% from 2018 on, so the matter is more about how the adjustment will be distributed over this and the next two years.

-

VAT reform: this is another contentious issue that is closely linked to the estimates of the fiscal gap, and therefore to the primary surplus negotiations. The current Greek VAT system includes 3 rates (6.5%, 13%, 23%). Creditors ask to move to a 2-rates system, with the two rates being 23% and 11%. The expected revenue increase from this change would amount to 1 percentage point of GDP, i.e. 1.8 bn euro. The Greek proposal keeps the three rates and envisage a reduction of the lowest and mid rates, to 6% and 11% respectively. On this issue the difference of views seems therefore quite significant, as the Greek proposal goes in the opposite direction of the creditors’ one. However, at the end of May the Greek newspaper To Vima had reported a significantly different idea from the Greek side. At that time, the Greek government was reportedly envisaging three rates at 7%, 14% and 22% and it was estimating this reform to generate about 800 million euros. This suggests that the Greek government had in fact previously considered the hypothesis of increasing rates. The significant U-turn may signal the fact that the government realised the internal political constraints on this issue are harder than initially thought (which would not give many reasons for optimism).

-

Solidarity contribution and corporate tax: absent any increase in the VAT rates and therefore any additional revenues from that source, the Greek proposal envisages an extraordinary levy on large corporate profits (which would yield 1bn in 2015), a solidarity contribution (yielding about 220/250 mn in 2015 and 2016), a television advertising tax (100 mn in 2015 and 2016), other measures on television licences and station (340 mn in 2015), luxury tax (30 mn in 2015 and 2016) and other tax revenues (expected 120 mn in 2015 and 90 mn in 2016).

-

Privatisation: creditors’ offer include a target of 22bn by 2022. The original target in the second programme was of 22 bn but by 2020, so the new proposal would stretch it over two more years. Yearly targets are still not set in the document. Greece has a very detailed table that totals at about 16bn from now to 2020, with the bulk of revenues coming in from 2020 onwards. The Greek proposal envisages privatisation revenues of 3.2 bn for 2015-2016 and 2.1 bn for 2017-2019. As a comparison, the original second programme had a more ambitious schedule expecting 5.6 bn in 2015-2016 and 5.9 bn in 2017-2019.

-

Pension reform: remains a red line for both sides. The creditors ask for “further immediate steps to improve the pension system, that are expected to yield around 1 percent of GDP in savings annually in 2016-17, including significantly tightening early retirements rule, increasing health contribution for pensioners, and phasing out the non-pension solidarity grant”. By September 2015, Greece should also “legislate further to establish a closer link between contributions and benefits and integrate funds”. The Greek proposal includes a gradual phase out of early retirements over 2016/2025 and consolidation of social security funds into three, but still keeps in the suspension of the “zero-deficit clause”.

-

Labour market reforms: are probably the most red among the red lines, at the moment. The Creditor ask for a Greek commitment that “important reforms under the programme […] will not be reversed”, and in particular that “no changes to the current collective bargaining framework will be made prior to end-2015 and any changes to the legislative framework will only be adopted in agreement with the EC/ECB/IMF”. the Greek document state that “the Greek government will reinstate collective bargaining procedures, similar to existing arrangements in other EU countries […]” and gradually increase the minimum wage level and salaries for workers in the private sector until the end of 2016 back to the 2010 level (later they should be “freely negotiated within the context of collective bargaining”).

Restructuring Plans

So, to sum up. Greek negotiations will continue next week, after Greece asked to bundle all June IMF payments at the end of the month. In the meantime, the finding of a common ground between Greece and its creditors is not yet in sight. The primary surplus issue is where positions seem to have converged the most, with the creditors moving significantly closer to the Greek position. On the VAT, the Greek government appears to have taken a U-turn compared to the proposals rumoured last month and positions on pensions and labour market remain still very far apart, with no immediate solution evident from the documents.

The negotiations over next week will be further complicated by the fact that the Greek proposal includes a section on the restructuring of its debt vis-à-vis the creditors. The details of the plan have been clarified in another leaked paper, which was published by the FT this morning. Many of the restructuring elements had been hinted at or heard before, during these months of negotiations: the plan would include (i) a buyback of the debt owed to the ECB with a ESM loan; (ii) IMF partial buyback with SMP profits; (iii) additional re profiling of the Greek Loan Facility; (iv) splitting EFSF loans in two and substitute half with a perpetuity.

None of these seems to be politically acceptable at the moment: IMF has previously appeared in favor of debt relief, provided it is done on the EU side of Greek debt; the GLF and EFSF terms have already been eased substantially and the perpetuity idea looks hardly digestible in Berlin; the ECB president Mario Draghi said yesterday that the ECB expects timely and full repayment of the SMP; and political support for the ECB/ESM swap idea looks elusive. Given the postponement of IMF payments, the hard deadline becomes the redemption of debt due to the ECB in July. But for the agreement to be signed off nationally and money to be disbursed on time, a deal should be reached sooner. Time is running out, and options would start to look scarce, even to the most resourceful Ulysses.

We’ve been telling readers, to sometime hostile responses, that Syriza has in fact already agreed to a continuation of austerity. What was hoping to get appears to be a mere weakening of the intensity of austerity

With all due respect: I think your should be give the commentariat more credit. You have said repeatedly that it was all about the structural reform. Today, FINALLY you write about debt restructuring.

Many Troika-friendly outlets have focused solely on structural reform. In fact, Greece originally wanted a different process for addressing the crisis – but the Troika pushed for a two-step process that puts Greece at a great disadvantage: by presenting a plan for servicing the debt, they undermine their argument for debt restructuring.

The only logical reason for this is that the Troika want to keep Greece in a stranglehold.and do not want to accept any losses from write-downs.

Syriza’s program calls for REAL debt restructuring (not creditor-friendly measures like interest caps and extended maturities) plus new money for investment. When these are considered, I imagine that the primary surplus is much less of a drag.

=

PS Cugel had a comment in yesterday’s links post talking about how the debt restructuring was being ignoring, saying:

This ft article comparing the Greek and Troika proposals doesn’t mention debt restructuring at all (http://www.ft.com/intl/cms/s/0/24f91856-0b81-11e5-994d-00144feabdc0.html).

=

=

H O P

Huh? You seem to be arguing to make a point of arguing.

If you look at the Bruegel summary, it confirms exactly what I have said for months, that the bone of contention is structural reforms. The two most contentious issues, again as I have said repeatedly, are pensions and labor market “reforms.” And the primary surplus targets part of the bailout (the old “memorandum” and hence are not part of debt restructuring (although they clearly have implications for the sustainability of Greece’d debt burden).

The debt issue is not the sticking point. It is not on the table because Greece signed a memorandum with the Eurogroup in February in which it agreed that to get the bailout, it would have to submit a detailed list of structural reforms that had to be reviewed and approved by the Troika first, then the Eurogroup. Greece has for months refusing to comply with the process it agreed to by circumventing it, by running to various European leaders, most important, Merkel. They’ve all told Tsipras and other Greek representatives that they have to deal with the Troika, and that the political leaders are neither willing nor prepared to negotiate the detailed agreements that Greece needs to enter into.

Moreover, the creditors accept (and again this has been discussed widely in the press, from the very time Syriza came into office) that they expect to give Greece debt relief, in the form of extending maturities and lowering interest rates further.

You’ve been arguing for the sake of arguing consistently, at length, and have continued to try undermine the site’s posts even after I’ve pointed out often considerable errors in what you have written. This has now gone well beyond a reasonable difference in points of view into trolldon. I suggest you get your own blog.

Yves, I don’t see how you can argue that a difference between a proposed surplus of 0.6% and 1,5% GDP out of €283 bn isn’t a sticking point, especially since the amount in € is actually larger than the effective savings of the “structural reforms” and especially since this is a moving target as the Greek economy is tending towards free fall again.

Failure to agree on the size of the surplus is enough in and of itself to force a default. Disagreement of a few tenths of a percent is still a large difference. And as for the Government’s proposed surplus for 2016, that is already irrelevant since the Greek economy is certain to contract further, lowering tax revenues further and rendering such targets just as impossible to meet as the 2015 target continues to be.

That’s not even mentioning that the Greek government is counting on various tax reform strategies that seem to be highly unlikely to produce the revenues they are projecting, not least because of tax avoidance and flat refusal to pay.

I’d say that the structural reforms are actually small potatoes, and that the real money is in the surplus and that a failure to come together on surplus targets alone would prevent a deal even if Greece were to accept every “reform” demanded, which doesn’t seem to be the case.

The reason the Troika has been so bent out of shape about tax and labor reforms is for symbolic reasons. They want to impose “fiscal discipline” and make everybody wear a hair shirt regardless of how much money is actually involved.

And I remain convinced that the EU is not serious about wanting a deal.

They are not even pretending to negotiate at this point and want Greece to either accept every demand 100% or else default. Gabriel’s refusal to even take a phone call from Tsipras in response to Tsipras’ “provocative” speech to Parliament rejecting lender demands over the weekend is very telling: ”We know that in part [that] is theater, but [we] do not need to have a role in every scene of the drama.”

There is no more negotiation and Greece must either capitulate 100% or default. And is there any doubt that the Greek political system simply cannot capitulate without the government collapsing?

All the scenarios point directly to default. At best the parties will cobble together an agreement that will extend and pretend for another month, but what happens when it becomes obvious once again that none of the proposed targets are in fact going to be met?

The poll you yourself cite points out the current state of the Greek electorate:

In short, some Greeks who were formerly supporters of ND have come to see that ND has been vindicated in their main election arguments that Syriza’s promises of change through negotiations were unrealistic, but ND has failed to advance a creditable alternative program to simply surrendering to the EU and extending Austerity forever. There is simply no support for extending Austerity and the opposition parties are not considered viable governing parties because they have no alternatives to Austerity.

Basically, this leaves only the Syriza left-wing and the extreme rightist parties as alternatives, which really means that Greece is becoming ungovernable. Another reason why the EU wants to wash their hands of things and force a default.

Syriza can propose whatever it wants, but nothing is going to make a real agreement possible.

“And I remain convinced that the EU is not serious about wanting a deal.”

This seems to be the case. But what country is really showing itself to be anti-austerity or anti TPP/TTIP? It’s hard to find a country solidly behind a living wage program or meaningful social programs.

——–

Although:

“And so, two Levy scholars have moved into government this month—Rania in Greece and Stephanie Kelton in Washington. What will the world come to?”

http://neweconomicperspectives.org/2015/01/jobs-greeks.html

Tiaras, as many have noticed, has been stalling; stalling his own party and electorate while coming up with a plan for total capitulation to the Eurogang. Syria and the “revolution” against austerity are over.

This “heroic fighter” versus “betrayal” dialog is just all nonsense. What is really happening is that nothing has changed since the Greek people rejected PASOK. If it were going to be possible to implement the Memorandum, PASOK and New Democracy would be in power right now. Instead they basically have no support.

Syriza tried and failed to get the creditors to face reality. They now face the choice of either caving in to creditor demands and having the government collapse, or else rejecting those demands and forcing a default, and THEN having the government collapse.

They cannot implement an agreement even if they capitulate. Their party will splinter amid mutual recrimination, and the economy will continue to collapse. If Austerity was going to work, it would have worked for PASOK, so any government that tries to implement the Memorandum will simply fall from power.

Syriza cannot accept the agreement and make it stick because there is no Parliamentary support or popular support for that.

Take a look at Varoufakis’ article: “Austerity Is the Only Deal-Breaker”. He parses his words carefully, to make it appear that Syriza opposes austerity (emphasis added):

However, Varoufakis is not actually opposing austerity; he is criticizing the Troika for requiring more austerity than Syriza’s current proposals. Varoufakis also boasts that Syriza embraces the entire neoliberal agenda:

“Our government is keen to implement an agenda that includes all of the economic reforms emphasized by European economic think tanks.”

Jackrabbit: You have said repeatedly that it was all about the structural reform. Today, FINALLY you write about debt restructuring.

——————-

But two days ago:

Tsipras: “Time is not only running out for us, it is running out for everyone,” […] “Greek people should be proud because the government is not going to give into absurd proposals.”

He also insisted that a debt restructuring – writing off some of the €320bn that Greece owes – must remain on the table. (emphasis added)

(The Guardian http://www.theguardian.com/world/2015/jun/05/tsipras-warns-g7-leaders-time-running-out-to-rescue-greece-from-bankruptcy)

—————–

Evidently, just because Tspiras says something is on the table doesn’t mean it’s actually on the table.

And just because Syriza doesn’t capitulate entirely in negotiations doesn’t mean they’ve haven’t already capitulated (accepting budget surplus targets etc.). A significant lessening of austerity is still austerity.

The casual mention of Ulysses at the end is intriguing. After all, Ulysses got rid of the Plague of Suitors by killing them off. This after Penelope patiently deflected the importunings of the Suitors through what has become the classical definition of “extend and pretend.” What I like about this story is the detail about the dog “that didn’t bark in the night.” The lowliest of Ulysses subjects was the only one to recognize him when he returned. So, what is Syrizas popular support level among the lowest socio-economic classes in Greece? The Demos could still hold the key to how this Greek Tragedy ends.

Agreed, and a very lucid comparison.

At least Mr Juckers did not seem to be able to recognize a serious offer…

more like a greek comedy

but who will be molovros and who will be palamedes after tuesday ?

Odysseus had no “subjects”

that comes from the romanization of the name…Ulysses

besides….the dogs name was argo…meaning late…or I take my time…

or..in all due time…depending on its usage and context

he probably wound up barking a week later…

(molovros is what one of the soon to die suitors of Penny called Odysseus

as he went with eumus/eumaeus to the party/funeral)

“Odysseus had no “subjects”‘ leads us to believe that the Odyssey is one big picaresque epic poem?

No matter how much YV states that he is Gnoman, the Euro Cyclops looks more and more likely to catch him and put him in the cauldron. (A little Keil und Kessel anyone?)

I hadn’t thought of what the dogs name meant. Hence, Odysseus could have been trying to follow in Jasons path and become another Argonaut. The faithful old hound knew and so purged Odysseus of compassion before the hard work of clearing the suitors out of the house began. (A lesson Syriza could benefit from, even at this late hour.)

Isn’t is true, that default to IMF, aside from other creditors … will be mostly paid for by us Americans, since we are the primary financiers of the IMF?

At some point, if the financial deficit is great enough, no rearrangement of terms will do. Cuts to interest and even principle will have to be made … or Grexit.

If the intent of the EU is to use Greece not so much as an example, but as a neoliberal experiment … they may be willing to push Greece off the cliff … Dr Mengele was not noted for his compassion.

Real structural reforms would require a Marxist coup comparable to Venezuela … to end oligarchy, tax evasion, property ownership etc. Nothing proposed yet … is genuinely structural outside of finance.

Below, I replied to your contention that there was a “Marxist coup” in Venezuela (posted in the wrong place, by mistake).

I also wanted to add to your point about left-wing structural reforms; here even Syriza’s Left Platform is lacking. Their “alternate plan” calls for “The immediate nationalization of the banks” and “the suspension of servicing the debt”. Other than those two items, it contains a lot of polemics mixed with some vaguely-worded proposals.

In its alternate plan, the Left Platform does not even call for an exit from the euro. It only calls for the government “to counter decisively the propaganda” that “an eventual exit from the Eurozone will allegedly bring [a full disaster] upon the country.”

At Syriza’s central committee session, the Left Platform’s alternate plan got 75 votes, with 95 opposed and one abstention.

The roots of Syriza appear to have a long history of Marxism and communism but the current ideology seems to be less revolutionary. But things have gone so far in the other direction that small changes can now be considered revolutionary. Simply putting people to work and establishing basic social nets seem out of reach by a disenfranchised literally global populace being submitted to corporate supremacy.

Syriza seems to be trying to implement some heterodox reforms against great odds.

Varoufakis disagrees (emphasis added):

Syriza’s leaders support austerity and the neoliberal agenda. The dispute is over how fast and how severe. Varoufakis fears that the Troika’s timeline will stir up opposition to Syriza’s embrace of neoliberalism (emphasis added):

I see that somewhat as negotiation speak. I think Varoufakis and others in Syriza also don’t want to outpace their society.

“”http://www.theguardian.com/news/2015/feb/18/yanis-varoufakis-how-i-became-an-erratic-marxist

“The lesson Thatcher taught me about the capacity of a long‑lasting recession to undermine progressive politics, is one that I carry with me into today’s European crisis. It is, indeed, the most important determinant of my stance in relation to the crisis. It is the reason I am happy to confess to the sin I am accused of by some of my critics on the left: the sin of choosing not to propose radical political programs that seek to exploit the crisis as an opportunity to overthrow European capitalism, to dismantle the awful eurozone, and to undermine the European Union of the cartels and the bankrupt bankers.

Yes, I would love to put forward such a radical agenda. But, no, I am not prepared to commit the same error twice. What good did we achieve in Britain in the early 1980s by promoting an agenda of socialist change that British society scorned while falling headlong into Thatcher’s neoliberal trap? Precisely none. What good will it do today to call for a dismantling of the eurozone, of the European Union itself, when European capitalism is doing its utmost to undermine the eurozone, the European Union, indeed itself?”

Thanks for your insightful comment, financial matters. Given Syriza’s lack of options, I agree with Varoufakis’ statement and what I perceive to be the strategy he stated here: Give them precisely what they are demanding. Their policies are bankrupt on all levels and in all ways. That will continue to be revealed in due course, and ultimately they will be repudiated, one way or another.

The risk I see in such a deferral strategy is that the instruments of the state, particularly police powers, media and monetary control, will continue to be used to solidify and entrench the power of the narrow segment of society who benefit from these neoliberal policies. That entrenchment is likely to result in continued broad economic suffering and a longer and more difficult process of repudiation than if policy action were to be taken earlier. Further, how long will the process take to play out? The Pro-Austerity party was just re-elected in the UK. It has been a while since Thatcher was calling the shots.

But what political options does Syriza have, really? Although one can question the validity of polls, I have read Greek polls are showing that 74 percent of Greeks want to remain in the euro; and sovereign monetary (and hence, political) control continues to reside in Brussels and Frankfurt.

I actually look for the necessary political change to come from German and French voters. The large public demonstrations in Germany against the ECB and the TTIP and TISA agreements are telling IMO.

Yanis Varoufakis calls neoliberal structural reforms – which he helpfully details – “a sound economic program“. Varoufakis embraces Thatcher economics.

Regarding Thatcher’s 1983 victory, her popularity waned until the 1982 war with Argentina caused a surge of support, leading to her re-election.

I think of WWII.

You had the resistance partisans.

Then the hard core collaborators, more zealous than the conquerors.

And then you had those ‘we try to soften the blow’ less-ardent collaborators. Did they aim to bring the Taoist ‘Wu Wei’ – time will defeat our enemy – (regime) change?

But what good would have resulted from them NOT doing so. None at all is the likely answer. It was the same argument Blair used in turning Labour “towards the centre” and all that got Britain was a watered down version of Thatcherism. Is Yanis to be the Greek version of Gordon Brown?

I have to agree with you, and disagree with Mr Ludd … who seems more motivated by political ideology than economics. I must also state for the record that I am not anti-Marxist or pro-Capitalist. Venezuela has had both coup and counter-coup several times. And I have no dog in the fight between their oligarchs or proletariat.

Varoufakis clearly states that:

Silvia Merler substantiates this, above, with numbers:

So I am unclear what role my political ideology plays in the merits of my argument, except as an argumentum ad hominem.

Well, we can rhetorically separate politics from economics … yet it is also true that in reality politics and economics can’t be separated. Please don’t take any of this personally.

As to the legitimacy of certain regimes, nations, political theories .. I will opt to remain silent.

And if you want to trust the statements by finance ministers in a political cage fight, that is your choice. Ultimately their bosses will decide, with or without popular concurrence.

Disturbed Voter, you are disturbed because you think that taxes underwrite government spending. Since this is not so, you can stop worrying. Taxes do not pay for anything. They are exacted for other reasons. It is true that governments pay for things, and the money they issue is in a sense public money, but it is public money in a collective sense, not in any sense where individual contributions are involved. Because a democracy is a government of its citizens and residents (us, as a collective), what such governments do, including paying for things, they do in our name; hence, any money they spend is in that sense, and only in that sense, OUR money. But this money is not taxpayer money. If you have a look at Abba Lerner’s Money as a Creature of the State, you will find a detailed argument setting out this point of view. The article appeared in 1947 and only a year before that, Beardsley Ruml, Chairman of the NY Fed from 1941 to 1946, wrote an article entitled “Taxes for Revenue are Obsolete” in American Affairs.

Upshot: The character of the economic system we have was largely better understood, however imperfectly, in and around the mid-twentieth century than it is now. Neoliberal politics and its cousin, the neoclassical economic paradigm, currently hold sway and have for around 30 years. These two inextricably intertwined conceptual structures appear to have captured, in virtually the entire world, the minds of elites, their lackeys, and many of those reporting about these issues in the mainstream press. No doubt you can think of a number of reasons why this capture has taken place and why it seems so difficult to break. NC, Bill Mitchell, and New Economic Perspectives do their best to undermine the hold these perspectives appear to have on those outside this conclave, but the “job” seems to be intractable.

Perhaps I should mention, though NC, Bill Mitchell, Bill Black, Randy Wray, and others have done so many times, is the fact that countries whose currency is the Euro are in a different position than sovereign countries like the US, the UK, and Japan, to mention only three, who are monopoly issuers of their own currency. The EU and its associated EMU (Eurozone) is an incompletely constructed federal system – the individual countries are, in this respect, not unlike individual states of the federal US. One of the Eurozone’s architects, Alexandre Lamfalussy, who died recently, thought that constructing a currency union in the absence of a political union was a nonsensical enterprise, and said so at the time. The elite took no notice and went ahead regardless. The consequences of this folly/hubris, call it what you will, are affecting most, though not all, of the world’s inhabitants at this very moment.

When the country was young, in the late 18th century, did taxes pay for anything?

The ability of the Federal Government to do anything was very restricted by the ability to only draw upon excise taxes … which only applied to overseas trade. There was no income tax. And there was no MIC to pay for … the creation of a standing Navy was very controversial … the USS Constitution was barely authorized along with her sister ships. Late 18th century America wanted to rely on privateers and state militias entirely. And the money supply … have you read of the battle with Alexander Hamilton over the disposition of the defunct Continental currency, over the establishment of the first United States Bank (grandfather of the FR) … and what the original Constitution allows for legal tender?

Just to highlight one point … gold and silver miners or reclaimers were to bring their production or scrap to the Mint … where for a small fee (seigniorage) the Mint would convert this metal into legal tender. This was first accomplished in 1792 by George Washington, who brought the silverware from Mt Vernon to the Mint, to be made into the first half-dimes (ancestor of our nickel). All other coins made in gold or silver that year were only patterns, but his silver was used to produce the first 10,000 regular coins … though that design was only used that one first year, and specimens are priceless today. The Mint entered into full production the following year.

Needless to say, this method restricted the supply of money and resulting credit (generated from cash deposits) too much … foreign silver coins were allowed to circulate, as a result, up until just before the US Civil War. There was no official paper money issued after the failed Continental Currency (which was only intended as an emergency issue) until the next emergency arose … Confederate and Union issues during the Civil War. Due to lax regulation in the individual states … particularly in the 1850s, there was an abundance of bank notes issued by private banks … which were of … questionable liquidity and value.

From the Constitution:

Interesting it doesn’t say (it is) ‘to lay and collect Taxes, Duties, Imposts and Excises, in order to pay the Debts and provide for the common defence and general Welfare.’

It just say to 1) lay and collect Taxes,… and 2) to pay the Debts and provide for the common defence and general Welfare…

One can argue that 2 doesn’t depend on 1.

But to me, it seems to read we should ‘collect taxes so we can have money to do this and that.’

It does read that, but that was written long before Nixon and Wall St. I seriously doubt the government as currently constitued could pay for its current activities solely through taxes without being able to just print up more dollars as needed.

Interesting, as well, the referenced title was ‘Taxes for Revenues are Obsolete,’ and not ‘Taxes for Revenues Were Never Needed in the First Place.’

It seems to imply that this is not the way it was before. But the old way of thinking was already obsolete by the time the article was written

And it also seems to imply that most people were not aware of this change. Thus he published a paper in American Affairs.

That’s a huge change, probably un-Constitutional (at least not most people’s reading of Article 1), without much public debate (or being made aware of it).

Or the public failed to read American Affairs.

The push and pull with the BoE went on all thru the following 100+ years .. particularly in 1861, 1871, 1892 and 1913. Except during the period of the first and second United States Banks … the US treasury was independent of the BoE. Accommodation had to be made with the BoE to keep the British Empire out of the Civil War, and then to accommodate the British Imperial system (gold and silver) prior to WW I.

This accommodation was necessary to open markets for US goods after industrialization was jump started during the Civil War. The British Pound zone acted much like the EU today, with equal predation on colonials. It was a 100 years peace (1815 – 1914) to match the earlier 100 Years War with medieval France.

In effect, because of international trade and finance in the presence of a declining British Empire … the US became an undeclared Commonwealth member … hence the Five Eyes.

In the early Republic, the US treasury was run as a household … except for those early capitalist hijinks by Alexander Hamilton and Aaron Burr. The plan to deal with the Continental currency, and the first United States Bank was pure politics, and deadly. Our present situation derives from what happened in the first three US administrations … where the speculators and Wall Street were the gradual winners.

It also says that the government will honor/pay all its debts. I take this to include the salary of civil servants working for the federal government. So, is a debt ceiling imposed by Congress unconstitutional?

We did not alway have the global reserve currency.

In a Greek like situation, we want the option to restructure.

Should not be unconstitutional to not honor all debts.

Article 1 only says taxes collected are for paying..if the reading is correct.

We didn’t always have the global reserve currency.

In a Greek-like situation, we want to have the option to not honor 100% of the debt. We might need to restructure, when we are just one of many nations in the world.

As for Article 1, it just says to collect taxes (in order) to pay debts. I can’t find anything about whether to have or not to have a debt ceiling. Under a Greek like situation, I believe it’s constitutional to not honor all debts, and the government should try to restructure.

(Please disregard anything posted under MLTPB. I had some problems with my phone).

To clarify a bit more.

When we are again E. Pluribus Unum, when we do not have the global reserve currency, it’s possible we face something many countries, Russia, Zambia and Greece have faced before – to restructure foreign currency loans.

We want to have the flexibility to not honor all the debts, just like all other governments.

Thanks for your extended response. It is hard given our personal distance, to avoid projecting or over generalizing. I did want to say that you made good points regarding the history of the EU etc. Taxes were, even under the gold standard, a matter of both policy and economics. But I am well aware that taxes and spending have become … disconnected ever since the dollar went off of gold and onto oil in 1971, the net money supply then becoming dependent on oil production, which is more exponential than that of gold production … and of course the general increase in leverage … and added instability/fragility … as leverage increased form 10×1 to 100×1.

The current economic turmoil is not only due to the struggle from control of the oil supply, but also the transfer of monetization beyond oil, and onto real estate. The QE ponzi balloon has to go somewhere. QE didn’t start with 2008 either, but in 1971. The monetization of real estate only reminds me of the Assignat of the 1790s. The further extension of monetization to derivatives .. reminds me of the PapierMark and Notgeld of the 1920s. But not all monetizations carry the same velocity or liquidity as the digital gold wielded by the FR and BoE. And novel monetizations can become suddenly demonetized … causing rapid deflation … as happened in 2008-2009.

The US quota to the IMF, which is how much we are obligated to pay them, is 17.68% of the total quotas for all countries. It is a bit more than our percent of votes, 16.74. See here for details on the quota system and here for the list of shares.

That is the first level effect … then if you count that the EU portion is backed by the US as well (see QE to Duetche Bank) … the net percentage just grows from that nominal value. If China is allowed to join the IMF as well, then thru Walmart consumers … we will be backing their portion also ;-)

Greece has small enough remaining payments to the IMF during the rest of the year. As the face of Mr Varoufakis in this interview tells, the troika mafia does not want an agreement. My working hypothesis is that Greece will pay the IMF, default on the ECB bonds, and keep trying to survive after this. Don’t forget that the conditionalities coming with the MoU disappear June the 30th.

The deputy chief spokeswoman of “Mr Clown” Junckers just said that they had not received the offer. I guess they are stupid enough to kill Europe. sigh

“Syriza Commits to Deep Austerity in Its Proposal to Creditors” obviously not deep enough

Yes, but if you look at the Bruegel summary, they are not at all far apart on the primary surplus. The big arguments are over pensions and labor market reforms. I honestly don’t see the pension issue as solvable unless the leaders of a lot of countries are willing to spend a lot of their political capital to keep Greece in the Eurozone. The press all over Europe has publicized the fact that Greek pensions are the highest % of GDP in Europe, and some of the features (retirement age of 65) are more generous than in other countries (in Germany, the retirement age is 67). The conservatives have managed to create, successfully, politics of envy. Rather than having the left ANYWHERE support Greece and say “Greece has an old population, and its old due to austerity, since young people have had to leave to find work. And what’s wrong with retiring at 65? We’re going the wrong way with weakening social safety nets” the “we aren’t about to pay to have Greece get better pensions than we get” has dominated the conversation.

The Greek ruling coalition has done a terrible job as far as making a case for not cutting pensions. It has not said anything along the lines of what was said above (or stressed how extended Greek families often mean the pensioner is supporting more people than in other countries). Instead, its defense has been,”We are a democracy and you can’t tell us what to do.” Well, you are asking for more money and that comes at a price. And it also happens that 18 other democracies are the ones that are giving you the money and many don ‘t agree.

As for labor reforms, that is neoliberalism/mercantilism v. Keynesianism. The neoliberals think everything can be solved by price, thus by making labor cheaper to compete in export markets (when previous cuts of wage rates in Greece have not had anywhere near the textbook impact). The Keynesians would recommend stronger internal demand, which is at a minimum more jobs (part of the new government program is to fund more hiring) and better wage conditions. Again, the ruling coalition has not pointed out that the wage crushing to date hasn’t worked.

Yes, Syriza often makes declarative statements, but without compelling logic, conviction, or passion, then always conceding or surrendering after token resistence. Their arguments seem weakly articulated by design, reminiscent of Obama, especially WRT single-player health care, minimum wage, social security, progressive taxation, and regulating or prosecuting Wall Street. In that respect Syriza looks like a Potemkin-left party intent on forestalling real reform by facadism and misdirection.

I totally agree that the ruling coalition did a terrible job in projecting and getting across their rationale. On the other side they are against a well oiled media machine that projects mainly [and often only] the other side of the argument. The truth about pensions is that in a population where the 60% of the young are unemployed and the official unemployment ratio is 26% they are the last safety net for hundreds of thousand of families and this is one of the main reasons that the coalition is insisting that this issue is a “red line”. As for the left ANYWHERE it amazes me how absent it is from the general picture.

Is it just me, or do others find plans setting out fiscal outcomes years ahead completely unrealistic? Surely, after 2008, we know that events can occur which very few have forecast that can blow forecasts/prior commitments clean out of the water.

I am doubtful I would rely now on commitments for the 2015 outcome, let alone one for 2016. And 2022?!!!

I wonder to what extent what is going on now is just theatre? Not that I am unsympathetic to the circumstances of poorer Greeks. But we know the Greek government will never pay back all of their debts. The other European governments must know that, but feel they have to pretend otherwise. So what is likely to happen – the Greeks will pretend that they will comply with the demands to repay their creditors while nobody seriously expects that they will? And the game goes on?

Nope it isn’t just you … :-D. As to whether “what is going on now is just theatre”, the principal actors are not reading the same script, and they are playing in different theatres, to different audiences, without a director. If the title of the play is “Lets Fix Greece” … the underlying plot is actually structured around the different interpretations of the word “Fix”.

I totally agree. I would say that Greece can agree to this in an extend and pretend model and then revisit the issue when the time arrives and a 3.5% account surplus is unrealistic in 2018. Who knows what happens in two or three years from now?

Yes, Bill Mitchell has said that Greece needs to run budget deficits on the order of 10% of GDP for a while to get its economy out of the ditch. That’s how deep its depression is and how much in the way of underutilized resources it has. Stiglitz has stressed that achieving a primary surplus caused the Greek economic contraction:

http://www.theguardian.com/business/2015/feb/04/a-greek-morality-tale-global-debt-restructuring-framework

We’ve said that any surplus for Greece is nuts and surpluses that high are nuttier. 3.5% is punitively high.

But sadly a lot of widely read economists differ. A weird sort of anchoring has taken place. For instance, both Wofgang Munchau (who is normally sensible) Martin Wolf of the Financial Times recommended a 2% fiscal surplus target for this year (MUCH earlier in the year, before Greece’s tax receipts fell) as a reasonable compromise. I nearly gasped when I read it. And it wasn’t with caveats, “Look, these levels will worsen the damage to the Greek economy, but that’s the best deal they can probably get.”

Your use of the word “coup” is hopefully unintentional.

In 2012, former President Jimmy Carter told The Carter Center:

Mark Weisbrot, co-director of CEPR, wrote:

This was meant as a reply to Disturbed Voter

I was speaking in general terms. I consider the replacement of FDR by Truman in 1945 as a coup … as I do the replacement of Kennedy by Johnson, or the election of George W over Al Gore. Coups are not limited to Latin America … with or without military involvement, and go on all the time, most often without generals covered in medals for wars that were lost or never happened. From the POV of the oligarchy, oil interests … and US interests … any election that went against those interests … would be considered “illegitimate” … particularly if it were both democratic and popular. I am well aware of President Chavez personal view, that he was following in the footsteps of Simon Bolivar … and indeed he may have been ;-)

In general, democratic elections should be seen as the facilitation of bloodless coup.

I appreciate your clarification.

And I don’t want to leave you with the impression that I have a callous middle class disregard for the proletariat or the peasants (hence your objection to my support for small business) … I am uneasy regarding distributive or retributive justice (these being political). I have compassion for all parts of the social hierarchy, but usually the proletariat and the peasants are the numerical majority and suffer the most. I find Marxist analysis to be … a corrective to Capitalist analysis and vice versa … though I find prognosis by either as tainted by personal and class interests. There is a lot of wrong done in the world … and I find that one-on-one amelioration to be the only pragmatic option.

Still not enough for the Troika.

Reuters: EU’s Juncker rebukes Greece’s Tsipras, urges swift proposals

There are two bones of contention.

1. Tsipras had said he’d present the creditors with a new plan on Thursday and would meet Juncker on Friday. He instead did not present a plan, cancelled the meeting, went to Greece, and gave his now famed speech in Parliament. So Juncker said we have nothing to discuss until you give us a new plan.

2. It did not help that Tsipras savaged Juncker in his speech. Merkel and Juncker (and to a lesser degree Moscovici, also in the EC) are his only sorta friends on the creditor side. He poked Merkel in the eye with a stick in his Le Monde op ed and was harshly critical of Juncker when Juncker has actually been working hard to get the creditors to moderate their stand (remember, the EC is not a lender).

“Syriza has in fact already agreed to a continuation of austerity. What the party was hoping to get appears to be a mere weakening of the intensity of austerity and shifting the impact to fall more on more affluent citizens.” I don’t find such a goal distasteful. I would want Syriza to be working to alleviate “austere policies” along a continuum that inches closer to a balance in a sustainable way.

Unless there is an economic definition that defines the opposite of austerity, then I’ll choose the antonyms of “austerity” provided by my trusted dictionary that best define the other end of the economic policy continuum: extravagance, indulgence, spending. I’m sure nobody wouldn’t advocate a return to that … so aside from arguments regarding whether applied negotiating strategies are effective (perhaps best left to historians) what’s wrong with striking for a reachable goal?

I am reminded of my annual budget exercises when I was a senior exec in a public company. I always presented financial goals that could be justified by “bottom-up” strategies and tactics I could actually implement within the calendar year, leaving myself some room for unforeseen snafoos, and ever-present negotiation with bottom-down accounting largely based on manipulation of stock-price perception. That’s how I earned my bonuses, and kept my staff creatively engaged. The day the latter concerns would trump what I genuinely believed I could achieve … I’d leave my personal version of the Eurozone, and start building my own version of my own currency, in a manner that suited my very reduced needs. Perhaps naively, I see Syriza currently involved in a similar albeit massively-more-complex exercise.

Syriza did not promise voters austerity lite. It promised voters an end to austerity. And it is telling them, dishonestly, that it is fiercely opposing austerity when it in fact has offered in its own proposals to implement what is still quite severe austerity. Wolfgang Munchau in the FT today discusses at length what a both more honest and productive type of proposal would have been preferable.

Tsipras continues to promise the impossible: an end of austerity and staying in the Eurozone. Greek citizens astonishingly seem to believe him. They are about to have a rude and painful awakening. His months of defiance have come at high cost to the economy, and Syriza’s inept messaging and negotiations have not won them any concessions they would not have gotten otherwise.

Are there ways in which SYRIZA isn’t wasting everyone’s time? I’m beginning to feel that my time is being wasted typing this comment.

Lousy either-or. Pick your antonyms how you care to, I say “austerity” is grasping cruelty by cowards with current power over the rest of us. A better choice of antonym might be “governance based on comity.” Your selection of synonyms for profligacy might reflect your own position in the hierarchy of ridiculous wealth, rather than some kind of prudence. And gee, how nice to have it on one’s resume that one did well in managing a corporate budgeting process. That kind of “prudence” sure seems to be a dodo these days. But how many times does the BS about corporations and households being the correct model for large governments to aspire to have to be repeated before it finally results in a projectile-vomiting rejection as self-serving tripe?

And yes, nominally Greek kleptocrats and oligarchs and corrupt government types need ” regulation,” and it’s hard to get ordinary people to feel the love if those are the “successful models.” But you can only get just so much blood from a spanakopita… And somebody has to grow the spinach and milk the goat and and roll out the phyllo…

It ain’t over ’til it’s over. Many have been predicting that this or that will happen ever since Syriza came to power. But nothing ever happens, deadlines come and go, and everyone says, well, at the next meeting, things will finally be resolved. At some point of course there will be a final decision. It does at times look like Syriza is just looking for a way to save face with its voters. But I don’t think we can compare them with, say, liberal Democrats, who, with heavy heart supposedly vote in favor of some neoliberal bit of legislation. The unemployment rate in Greece is over 25%. It is harder to pull the wool over the people’s eyes now. At the same time, there is no way they will go back to the old parties (or to the Potami or River party that the media tries to sell). There are still a lot of unknowns.

Greece can become a failed state. The US has created a lot of them. Europe might be about to emulate this bad practice of ours.

You forget the old riposte by Hemingway:

The bank run was 700 million euros on Friday. I am pretty sure that is the highest level of daily outflows since Syriza was voted in. It is certainly the highest on a percentage basis. Greece does not have the money to pay all its wages and pensions this month in cash. Between dire state of the banks, which will put pressure on the creditors to take action soon (and “soon” does not favor Greece, since it will take time and a lot of political capital to sell the hard core austerity governments on a program of being less hard on Greece) and the Greek citizens finally facing much higher costs of defying the creditors, things will start changing shortly. The bailout really does expire at the end of the month and the Le Monde op ed and the speech Friday were not plusses in the already uphill proposition of getting it extended.

Limited by geographic distance and minimal understanding of institutions, processes, the wide array of accepted and less mainstream theories of economics, currency and finance, I have been watching this unfold since the early 2000’s.

What occurs to me as the most disturbing feature in all of it is the ability for one class to create debt and obligation that it falls to another class to repay. Whether or not sanctioned by law or custom – there were financial, moral and ethical ‘crimes’ committed against the Greek people that involved the short term (borrowers) and long term (lenders) extraction of their wealth through collusion and the betrayal of trust.

Even more unfair (and I realize how naive that word sounds) is the ability of one generation to yoke up the working class of future generations to the debt load that their parents, grandparents (and on and on) were deceived or defrauded into accepting. What is being leveraged is future generations access to healthcare, the ability to build and maintain infrastrucure, the affordability of housing – all so the initiating immoral (if not criminal) transactions can serve as shackles to keep those future generations indebted and working on behalf of the heirs of the original transactions.

Being in my 60’s I doubt I will be around to witness the awakening at some distant point in time when someone says ‘No. We have had enough’, and refuses to live their own life indebted to the crimes, kleptocracy and comedic cronyism of OUR generation. I wonder can it be done without violence – and if so will it be intellectual or moral reasoning that enables them to unstrap themselves from the burdens we have cinched around their lives generations before they even began?

I do wish them well.

We wish ourselves well too…those of us who have been deceived or defrauded into accepting that debt load.

Hopefully that awakening happens not when we are in our 80’s and 90’s, or those of us lucky enough to live that long…not when we are dependent on the kindness of strangers.

What???

As an aside, does anyone else see the correlation between the dysfunctional paralysis of the supranational Eurozone and Globalization? If a common currency without a fiscal union and federal powers is absurd, then why isn’t liberalized trade and capital flows without an international regulator with enforceable fiscal powers? I don’t want to cede power to such a regulator and am not advocating for that, but it seems to me that awful agreements like the TPP/TTIP will yield the same disastrous results as the Eurozone. You’ll achieve the same sclerosis that the Eurozone has, i.e., national governments cannot pursue policies that help their nations because they are lashed to an austerity inducing international trade regime. It just seems to me that the Greek drama is our future if we allow the TPP or TTIP.

Yes. TPP or no, it is easy to see Greece, and Cyprus, as trial runs for what the U.S. middle class and working poor (which are becoming more and more the same group of citizens) are about to experience.

It is too bad there is no way for Greece and Spain (Podemas) to coordinate their opportunities. Will be watching the Spanish elections closely and thinking if Greece can just hold out a bit longer there may be some additional leverage they gain as Spain’s larger economy and population starts making their own demands on their IMF/ECB creditors.

Thanks to Yves for the great coverage.

Greece was taken for a ride, was itself a willing partner. Then it became, inevitably, the victim of economic warfare, which btw. includes deals and selling to the country (arms, etc.), and when things went south, the EU had to see to it that the Big Banks, French and German in the main, would not be drastically affected. So there was shuffle, wait time to limit ‘exposure.’…take measures…

Greece, a member of the EU, and loving the Euro (low interest rates), collaborated in its downfall or present predicament. Apportioning blame is not relevant, an empty, vicious exercise. Everything only points to the EU as an arrangement that is faulty for various reasons — set up with dirty dealing or negotiations, between France and Germany — no fiscal union albeit a currency union, madness — power given to supra-nationals, Brussels, to please the US, etc. It was designed for purposes not exactly beneficial to the people of Europe to put it extremely gently.

Greece was taken on board the way a rapacious Sports Org (see FIFA for ex) gets extra members, to be exploited, and then possibly discarded.

Greece had, has, an economy that is for some % informal – I reckon a third but from limited reading / observation only, Idk, perhaps a bit less.

It depends also on how you count, or could possibly count, the army, arms /defense expenditure (incredibly high in Greece), the Church (largest land owner filled with fat cats), and the the ins an outs *very complex* of the Merchant Marine, all of which are in some sense part of the ‘State’…or at least in what is falsely or circumspectly called ‘private-public’ partnerships, or ‘laws under the present constitution / legal framework’ that aren’t actually, imho, clear or detailed.

In such a landscape, pensions are a social safety valve, as they shunt social aid into that ‘elder’ channel and because also of the housing situation etc. it thus permits many families to stay alive, keep a home, a bed, and some food. So that is sticking point for Syriza.

Different countries do different things.

The US has ‘food stamps’, which many ppl in Europe consider a sign of alienation and barbarism : .. what? ppl can’t buy food? we had rationing in 1945 and they still have it in the US? Ppl can only buy in some shops or some goods, not ice cream? US citizens can’t get aid for the very basics of life without jumping through hoops and a lot of BS and often be denied and children starve? Europeans would ban food stamps as medieval or not competitive or dishonorable or whatever if they could! The Troika applies exactly the same type of weird reasoining.

Deeper issues are left aside with calcls. of that or that debt.

The EU is by nature expansionist and its problems now acute and cristallized (by design, as concerns Greece, so as to be able to assume plausible deniability, a one off, bad apples, radical left regime, cheaters, lazy ppl, small country, move along nothing to see here, we will be stronger..) but it will be a failure all the same, no matter exactly how it all turns out.

Not just because of a domino effect, others might demand/act the same way, but becaue the EU project is shown up to be inefficient, contrroversial, no Nirvana, harmful, etc. So, an existential crisis for the EU.

For Greece, beyond whatever payments to the IMF/others are due, etc., a cross-roads. It must decide to go it alone (and perhaps find other allies, contacts, Russia for ex.) or submit to the present oppressive masters. That is a big decision.

Geography is destiny, the saying goes.