Yves here. Reader ifthethunderdontgetya™³²®© cited @ryanlcooper on a reason, in addition to the ones cited by Richter, why banks are champing at the bit for higher interest rates:

Say the Fed wanted to raise short-term interest rates to 1 percent, meaning that it did not want banks to lend at lower rates. Because the glut of reserves is so great, the Fed could not easily raise rates by reducing the availability of money. Instead, the Fed plans to pre-empt the market, paying banks 1 percent interest on reserves in their Fed accounts, so banks have little reason to lend at lower rates. “Why would you lend to anyone else when you can lend to the Fed?” Kevin Logan, chief United States economist at HSBC, asked rhetorically.

This is not a cheap trick. Since the crisis, the Fed has paid banks a token annual rate of 0.25 percent on reserves. Last year alone, that cost $6.7 billion that the Fed would have otherwise handed over to the Treasury. Paying 1 percent interest would cost four times as much. The Fed has sent roughly $500 billion to the Treasury since 2008. As the Fed raises rates, some projections show that it may not transfer a single dollar in some years. Instead, the Fed will pay banks tens of billions of dollars not to use the trillions it paid them previously.

It’s also worth pointing out that financial firms historically have been losers in tightening cycles because they hold inventories of securities which fall in value as interest rates rise. In the past, they were inevitably net long. There simply was not enough hedging capacity for big dealers to go net short or simply flatten their positions. But Dodd Frank has forced dealers to cut their positions considerably, so the banks may feel they can make enough profit on having customers rearrange their lives (as in taking advantage of volatility) to offset losses on their OTC trading positions. i’d be curious to get informed reader views.

Now the Fed could use its reverse repo facility too, as reader craazyboy pointed out. But the Fed is already accounting for a significant portion of that market and may not want to become the repo market. Hence interest payments on reserves could be the Fed’s first line of intervention.

Separately, I find the idea that the banks are having a hissy fit over the need to preserve their profits to be all too typical. The fact is we need a smaller financial system (and that means shrinkage in more than just the banks). More and more economic research has shown that larger financial services sectors are a drag on growth. So the outcome that financiers are trying to depict as a negative is actually one sorely to be wished.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

“Let me assure you, if the revenue environment weakens or interest-rate structures don’t move up and the economy slows down, we’ll have to take out more costs,” Bank of America CEO Brian Moynihan said on Thursday at the Barclays Global Financial Services Conference. And that would mean more job cuts.

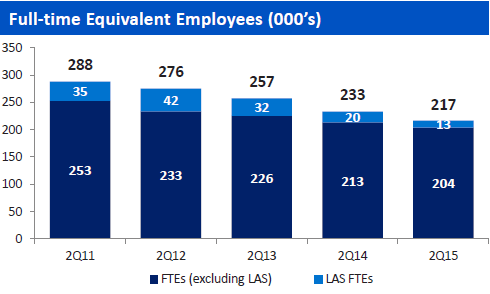

BofA is famous for whittling down its headcount in recent years. In Moynihan’s 25-slide presentation, there was this chart that shows just how skillfully he has trimmed down his workforce, chopping it by 25% overall since the second quarter of 2011:

So if, as he said, “interest-rate structures don’t move up,” there would be more of the same. These interest-rate structures are the result of the Fed’s zero-interest-rate policy. The purpose of this policy suddenly isn’t the wealth effect any longer – Bernanke’s stated purpose – but ironically, as Chair Yellen claimed today somewhat defensively, to “put people back to work.”

Not get them axed from banking jobs.

Banks try to make money in a myriad newfangled ways. But the classic way is on the spread between the interest they pay on deposits and the interest they charge on loans. A wide spread fattens their profits. But these spreads have become paper-thin.

Banks can get all the money they need from the Fed at near-zero cost. They don’t need depositors, and there is no competition for depositors. So, in one of the biggest scams in history, depositors get next to nothing from banks around the country. And the banks’ cost of money is near zero.

But there is desperate competition for making loans in an environment when bankers and their customers, especially big corporate customers, wade up to their nostrils in Fed-engineered liquidity. This mad frenzy pushes down lending rates (along with bond yields). And the banks’ spreads and profit margins have been squeezed.

The entire world has its eyes riveted on the Fed. There are days, like today, when nothing seems to matter other than what the Fed is going to do.

But the Fed once again couldn’t figure out what to do. It certainly didn’t want to ruffle the markets by doing anything in particular, such as raising rates from nearly nothing to almost nothing because it might somehow derail this economy of ours, or worse, that of the entire world.

So it did nothing. Now, no one can figure out under what conditions the emergency that led to this extreme monetary policy in 2008 might be deemed over, or whether it will be reclassified as a permanent condition, rather than an emergency, and remain in place until something Really Big breaks that will make the prior emergency seem banal.

Uncertainty – and frustrated bankers – is the result.

Instead of soaring, stocks languished. But the banking sector got hit hard. The KBW Bank Index dropped 3.0% from today’s high just before the announcement. Shares of Moynihan’s BofA dropped 3.9% from today’s high just before the announcement; Zions 4.2% from; Fifth Third Bancorp 3.8%; Citizens Financial 3.7%. Banks got crushed by the Fed’s inaction.

Now bankers are losing patience with the Fed. And they were firing back today while at the Barclays Conference.

US Bancorp CEO Richard Davis already lost patience; his bank would cut expenses – at a bank, that means jobs. Focusing on costs would allow him to “care less” about interest rates rise and whether they’d finally rise or not, he said according to the Wall Street Journal. And the shares of his bank dropped 2.4% following the Fed’s announcement.

“It would be a good thing to raise rates,” explained JP Morgan CEO James Dimon, as JPM dropped 3% from the hopeful moments just before the announcement. “It would be a good sign,” he said but didn’t expect his wishes to come true.

“I dream about it every night,” is what BB&T Corp. CEO Kelly King said about rate increases. His bank’s shares dropped 3.1% from the moments when hope still reigned.

A wider interest rate spread would come in handy because not all is well in banking land. Yesterday, Citigroup CFO John Gerspach, warned that trading revenue could fall 5% in the current quarter.

Moynihan’s slide deck shows that investment banking fees at BofA in Q2 2015 were lower than in both Q2 2014 and 2013. Sales and trading revenues were also lower in Q2 this year than in both prior years. Moynihan said that revenue from trading bonds, currencies, and commodities would be down this quarter as well.

Meanwhile, according to the presentation, BofA’s global average loan losses are rising. That’s not a good combination.

The financial sector plays an outsized role in the US economy, and if it sneezes, the Fed gets even colder feet. But the medication for banks – higher rates – may not be available, or not in sufficient measure, in this perverted economy that the Fed has so skillfully engineered over the past seven years.

But Wall Street engineering does perform miracles, even though investors in such miracles are now getting their hands burned off. Read… A Spinoff Goes to Heck, after Just 10 Months

Wow…a wholesale changing of the guard at every major bank in the next 18 months…could not happen fast enough…time for the provost to yank the privileges of this frat house…dear friends at Morgan Lewis…play nice with Madame chairwoman…or all bets(and understandings) are off… tell your clients there are at least 9 aces in my deck of cards…peeling back a few more layers of this vDalai is not a problem…perhaps we can open a new line on the “tying” problems your frat boys have…it ain’t over

I would argue that the problem is not the 0% rate per se but the fact that most economic projects have been based on much higher rates. There’s the .1% and then the next 10%, mostly those with a pension…

The funding of most of pension plans is based on 5-7% return on plan assets and the discount rate of the liabilities which is really low and jacking up the value of liabilities. It used to be that the mix was 60-40 but with zirp and the end of gains in the traditional bond funds, many have been shrinking their 40% and putting the difference in alternatives and immunizing the leftover bonds (basically going very long when rates are at their lowest)

But as we have seen here on NC, many of those alternatives will not deliver! This zirp environment is making pension plans take on all kinds of unmeasurable risks. If rates don’t go up soon, the next 10% will get shafted.

But even then, the damage might already have been done. It is quite possible that the next 10% gets shafted no matter what.

Banks don’t need depositors is a falsehood. They definitely a source of core, stable funding from your local yokels so to speak.

Moms and Pops don’t shop around nearly as much with those core deposits like they could with Certificates. There are core deposit studies available by reputable service providers (its been a focus in the last decade).

This column speaks solely on the TBTF institutions. I am speaking about those smaller institutions that are neither publicly traded nor TBTF (if they can fail the FDIC permitted or will permit them to fail).

*Sigh*

First. something like 70% of all deposits are at the ten biggest banks.. The top four account for close to 50%.

Second, local depositors are increasingly not the source of deposits of smaller banks. They are “brokered deposits”, from people who have more than $250,000 in deposits, who deposit them with services that spread them around smaller banks.

“They are “brokered deposits”, from people who have more than $250,000 in deposits, who deposit them with services that spread them around smaller banks.” Yves Smith

Hopefully, that stinks to high Heaven in your nostrils and might lead to you to rethink government deposit insurance in favor of ethical banking, ie. 100% private banks with 100% voluntary* depositors.

*Because of a Postal Savings Service for risk-free fiat storage and transactions.

I don’t know what you mean by “ethical banking”. I agree that the brokered deposit gimmick is regulatory arbitrage (brought to you above all by Gene Ludwig of Promontory Group). But the idea of deposit insurance has always been to benefit small depositors. There is a problem for small businesses, which often have to have large deposits at a single bank, particularly when they have to pay payrolls. Administratively, there’s no even remotely practical way to limit deposit risk for them in the current regime.

But I’m not sympathetic about the deposit issue for the wealthy. They can buy and hold Treasury bills or certificates of deposit and sell them when they need to get their hands on their dough. The brokered deposit racket is about convenience, as opposed to safety.

Ethical as in private businesses should sink or swim on their own without government subsidies. So why the huge exception for banks (and credit unions too)?

Why, for example, can’t we all have accounts at the Federal Reserve*? What need then for government deposit insurance since the Fed can’t go broke?

Of course unethical banking has caused enormous damage to both debtors and non-debtors so restitution is called for too, such as a Steve Keen like “Modern Jubilee” new fiat distribution to the population and to provide needed liquidity as banks are de-privileged.

*Better, the Fed and other explicit and implicit subsidies for the banks should never have existed and the US Treasury should have provided, from the beginning, a risk-free fiat storage and transaction service for all US Dollar users, including 100% private banks. And that service should not pay interest nor make loans for private purposes** to avoid violating equal protection under the law in favor of the rich.

**Exceptions which also benefit the general welfare can be imagined such as once in a lifetime education*** and home loans. But these might be better handled with outright grants from the monetary sovereign.

*** Why should we have to import MD’s for example?

Blame a former Treasury Secretary who basically allowed it all to liquidate, and hence the Great Depression which wiped out savers of all stripes. It decimated banks but it also decimated the ability to service debt on a home, and essentially it was a problem in farming communities.

That man basically implied we can let it all go. So, there is that. I read a story about a young man and his wife who lost what little savings they had in 1933. John Wooden eventually went to all some pretty successful years as college men’s coach.

If “ethical banking” poses a concern, then choose to place your deposits into a credit union (essentially it’s a co-op). For depositors, the offering rates are typically much better.

“Blame a former Treasury Secretary who basically allowed it all to liquidate, …” griffen

The solution then, as it is now, was to distribute new fiat* to the entire population along with new credit restrictions* on the banks to keep them from inflating the benefit away. Later, after banks were 100% private and a Postal Savings Service or equivalent was well established the restrictions could be lifted as all depositors would then be 100% voluntary.

As for credit unions, they too are subsidized by government. Sharing loot with SOME of the victims does not solve the ethics problems.

*Steve Keen proposes both in his “A Modern Jubilee.”

“But I’m not sympathetic about the deposit issue for the wealthy. They can buy and hold Treasury bills …” Yves Smith

Paying interest on the national debt of a monetary sovereign is welfare as Professor Bill Mitchell (billy blog) has noted and not welfare according to need but according to how much cash one has to “lend” to the monetary sovereign (which has no need to ever borrow it’s own fiat.)

“or certificates of deposit” Yves Smith

These are also backed by the FDIC (or the equivalent for credit unions) so the ethical* problem remains.

*Risk-free deposits should return 0% at most else the depositor is receiving welfare and not according to need but according to how large his deposit is.

So does that make core deposit studies worthless ?

I would persist about my point on TBTF institutions, which you saliently highlight have a majority of the nation’s deposits.

Regulation brings

A strong econ’my

If it has strong teeth.

http://imgur.com/fVElhIq

Banks calling for higher rates. It’s kinda like Chinese industrial companies calling for pollution legislation in Bejing to level the playing field before they all choke to death.

We do have 6000 some banks still, and the vast majority are trying to be engaged in traditional banking things, which does include making loans to biz and consumer markets.

It’s a handful of Wall Street TBTFs that are into everything and anything. So they are quite conflicted over whether they are in traditional banking, investment banking, or are outright hedge funds. but they would lose investment clients if they become “less profitable” than competitors. Hence the only leveler of the playing field is the Fed.

Maybe some of the TBTFs really are becoming worried that their VAR models for the very profitable ZIRP and QE enabled activities to date have glowing red risk indicators.

Then the age old problem of stimulating consumption, or loan demand, is you are pulling demand from the future. Soon everyone that can has refinanced at low rates, bought the house, or car, or accessed the corporate bond market, or started up that small biz, as we are wont to do. Then you are looking at a down cycle in new lending anyway.

Hmmm, I seem to remember an old law that kept the professional gambling operations separate from the genuine banks. Named after Mr. Glass and Mr. Steagall, as I recall… Maybe we could use something like that today.

I think soon we will find out that is very much the case.

What Sanford Weill wants he gets.

And we got…Citigroup. big whoop

Not sure where you get your “smaller banks are making business loans” from. There’s pretty much no small business lending done in the US. It’s morphed into collateralized lending, as in against real estate owned by the business or the owner, or against equipment purchases (financing for computers, car purchases, etc).

The big source of lending for small business has been and continues to be lending to the principal, via credit cards or “business lines of credit” which are guaranteed personally by the owner. They are effectively personal loans and are priced at personal loan rates, as in 12% and higher.

Small banks can’t begin to compete in these businesses. Their credit card products are effectively co-branded; they are the marketer and get a cut for acquiring the customer, but the transaction processing is handled by one of the big card players. It’s a hugely concentrated business.

And what do you mean by “consumer loans” besides credit cards? Mortgage lending is very much driven by the ability to securitize or sell the loan….

I just assumed a loan snuck out of our 6000 banks now and then. I should have stuck with “doing banking things”. Also, I think the bank gets the credit card interest and the MasterCard or Visa get the transaction fees.

Well, it is much simpler to not pay any attention to what banks do that are under $1.0 billion (by total assets).

You know, community banks. There to make a profit, but also can serve just their local communities or industries.

All about the Wall Street institutions.

The guys who run the TBTFs are adept at playing Liar’s Poker and media management. Watching the long end of the yield curve moving up while the short end continues to be held at nearly zero, I see plenty of Net Interest Margin, albeit with the risk of future interest rate compression from maturity mismatches if they don’t “securitize” paper or position their banks with a reasonably prudent mix of adjustable rate assets, as always. It’s the quality of their underwriting and the anticipated impact of loss provisions on their net interest margins that I believe has them concerned. Perhaps they have forgotten that the Fed also has regulatory responsibilities.

Side Issue: Are the Fed Grownups – and will they make good choices or bad choices

Choice #1 – Do QE and increase Fed balance from $1 trillion to $4.5 trillion. This combined with ZIRP will energize the economy one way or another – we are economists and we know these things. This includes ignoring anyone with contrary views.

Consequence – we can’t shrink the balance sheet by selling long term bonds, because long term rates may increase more than we like, and we just want to do short term rates (just because – tradition maybe – all they used to have in inventory pre QE was short term T-bills)

But tradition dies hard.

Choices #2 and #3

Pay interest on bank reserves as an attempt to hoover up money that way. How can they afford this? Because $4.5 trillion in long term treasuries pay interest! They used to just turn that back over to the treasury, but now they will pay it to banks.

Set up a huge reverse repo facility to offer the Fed Rate to 160 some large players – money market funds and others – to broaden access beyond just the 19 primary dealers. They of course are still funding the interest rate payment from long term bond interest cash flow on their balance sheet. Besides, in the short to medium term, if someone hands you a $100, you can always give them $1 back and say it’s an interest payment. Especially if you don’t get audited.

Note again, this is all so the Fed doesn’t have to sell their long term bonds, and just make short term rates go up like they want – just because. (in the pre QE world they never tried it backwards) This may sound like a plan – but it really isn’t… if it worked, the Fed would create a flat yield curve, and the banks couldn’t make money on any level of loans, unless the banks do it all with the spread over long treasuries. Come to think of it – they would try that. But competition. So that’s good. But it will also make the carry trade be unprofitable, so the long end of the bond market will undergo what they call a “re-pricing”. (fast move upward of some amount) But plans are boring and uncertain outcomes keep people focused and awake.

Consequence: They can “normalize” everything. Including bubbles, derivatives, whatever.

This scenario is the “all fixed economy” scenario. If, for whatever the reason, the Fed finds out it really isn’t fixed (by whatever metric they use now????), then go back to Choice #1 and repeat the process.

‘Now the Fed could use its reverse repo facility too, as reader craazyboy pointed out. But the Fed is already accounting for a significant portion of that market and may not want to become the repo market. Hence interest payments on reserves could be the Fed’s first line of intervention.’

To my understanding, if the Fed actually does a quarter-point hike, IOER (currently 0.25%) will rise to 0.50% to set the upper bound, while O/N RRP (overnight reverse repos) will be offered at 0.25% to set a lower bound on the policy rate.

Of course, since the price (interest rate) is being controlled, the quantity is not. For the floor rate of 0.25% to be effective, the Fed has to take on all comers. Papers by Fed staffers express uncertainty over what quantity of O/N RRPs will be demanded.

Craazyboy pegs the fly in the ointment with his remark about a flat yield curve. Banksters presume that long term rates will tend to rise along with short ones. But if the Fed is making a deflationary error, long rates won’t rise, and may even fall. There goes the yield spread!

What to do, what to do? As the bailouts of 2008 demonstrated, the only certain way to obtain money for nothin’ is a direct raid on the U.S. Treasury. Why do banksters rob the Treasury? Cuz that’s where the money is!

For one thing, I have a hard time believing they need to worry about setting an upper bound, after 4 trillion of QE, massive excess reserves, and the idea is to tighten quantity. They have 160 some entities lined up with the reverse repo facility. Just let it rip at .5%. If banks don’t move up savings and checking account rates accordingly, they will lose much of it to money market funds. Maybe they accidently suck up all the money in the world because .5% in US Dollars is the best deal going in the whole world right now? Maybe, but let’s try it anyway.

The flat yield curve is more silliness, really. The banks (in competition with each other) will arrive at market rates for loans that they can make some money at. It will have a spread above the treasury longish rate as usual. The only ones directly concerned about flat yield curves are treasury carry trader types. So there will be a sharp selloff, because if your late you’re stuck with a short term loss, until the market settles and they can do carry trades with .5% borrowed money. Or if treasuries ever pay real return again people might just buy them with their cash. Never know. It’s happened before.

Bankster Jamie Dimon speaks:

Implicitly, he’s raising the specter of the yield curve steepening. But if lack of Groaf is the problem, long rates may come down as they did today.

TBTF banks such as Jamie’s are inherently the ‘Treasury carry trader types’ you speak of. If they get their forecasts and their hedges wrong, they’ll soon be back, whimpering for another bailout … or threatening to “pull it” [the market, that is] if they don’t get their way.

It’s how Larry Fink sunk First Boston in the ’80 (except using MBS), LTCM (except I think it was Russian bonds in their case) and a whole long list of others.

The flipside is longer term buyers buy longish treasuries if they sense a recession coming. So ideally, the Fed needs to raise short rates just as a recession is approaching so the carry traders get cancelled out by the recession buyers. They will then have achieved perfection and long treasury rates stay the same. Who knows what happens with the rest of commercial and residential rates and their spreads vs. treasuries. But ya gotta start somewhere as an economy manager.

I prefer the 10yr yield pushing towards 3.0%. How can that be a bad thing?

2.0% growth with little to no inflation is just not ideal.

The picture here is of a financial sector divorced from the community it formerly served. How nice it would be to have ‘decree absolute’ and bring an end to the constant devaluation of wages and society these people cause.

Let the banks play their games. Let someone called ‘Fed’ throw darts at a board to establish rates. Do as JV with Vegas. The sky’s the limit. Just don’t use our money. OK?