By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Now that 495 of the S&P 500 companies have reported second quarter earnings, something has become abundantly clear: 2015 is going to be a nasty year for corporate revenues.

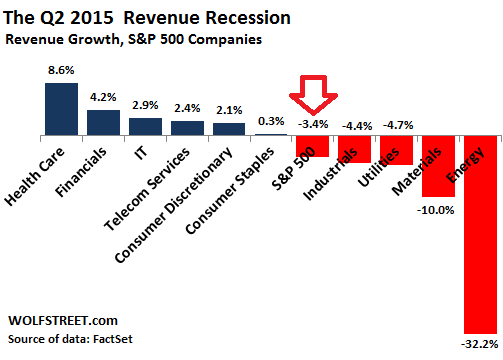

Blended revenue for the S&P 500 companies dropped 3.4% in Q2, according to FactSet. “Blended” because it includes estimates for the five companies that have not yet reported. This follows the first quarter, during which reported revenues also declined. The last time year-over-year revenues declined two quarters in a row was in Q2 and Q3 2009 during the Financial Crisis.

Analysts liberally blame the strong dollar. It’s convenient. But numerous companies that mostly benefit from the strong dollar, such as GM (more on that in a second), still reported shrinking revenues in the quarter.

And analysts blamed energy companies whose revenues have totally collapsed. But company by company outside the energy sector reported declining, and in some cases plunging revenues, including in Big Tech and financial services.

Here is a sample of revenue losers:

Caterpillar (-13%), Dow Chemical (-13%), MetLife (-12%), Microsoft (-4%), Intel (-5%), International Paper (-21%), JPMorgan Chase (-3%), Johnson Controls (-11%), Oracle (-5%), PepsiCo (-6%), Pfizer (-7%), Procter & Gamble (-12%), Union Pacific (-10%)….

Wait… Union Pacific? Would it blame the strong dollar or the price of oil? Hardly. It doesn’t operate trains in Europe. It doesn’t sell oil. It buys and burns it; so cheap oil is a godsend. It’s blaming the economy, particularly the reduced number of carloads of coal and other commodities. And it’s blaming that obnoxious add-on, the fuel surcharge that has been declining with the plunging price of oil. Surcharges go straight to revenues. Competitive pressures forced it to back off. Easy come, easy go.

Then there’s former tech darling QUALCOMM (-14%), insurer ALFAC (-9%), and of course IBM, always, at least for longer than anyone can remember, well, for the thirteenth quarter in a row, strong dollar, weak dollar, hot China, cold China, nothing matters…. Its revenues decline through thick and thin, this time -15%.

Then there’s GM (-3.5%). It gets the vast majority of its revenues from its number one market, China, and its number two market, the US. Over that 12-month period through the end of June, the yuan lost less than 1% against the dollar. And GM sells practically nothing in Japan whose currency lost out against the dollar.

Sure, it’s exposed to the euro and other struggling currencies. But in Europe and Latin America, its unit sales (not just dollar sales) have been declining, and that’s what kicked GM in the shin. A function of the global economy, not the dollar.

But GM imports components and vehicles into the US from countries around the world, particularly from Mexico and Canada, and their currencies have gotten slammed in unison over the period, thus lowering the costs of these imports. In reality, GM has been sitting at the sweet spot of the strong dollar.

But healthcare had majestic revenue gains of 8.6%, with three of its six industries reporting double-digit revenue growth: Health Care Technology (32%), Biotechnology (17%), and Health Care Equipment & Supplies (13%). Earnings soared 15.5%.

Powered by rampant price increases, near endless patent protections, and lack of competition, this already vast sector is hogging an ever larger slice of the limited national pie. Americans are not particularly healthy and don’t live very long either, but they sure pay a lot for it.

So this is what the corporate revenue picture looks like, with company details mercifully hidden from view, and with four of ten sectors reporting revenue shrinkage.

Some folks like to insist that yeah, but without energy, revenues wouldn’t have been that bad, they would have edged up 1.5%. OK, but without the vast health care sector, revenues would have been puke-in-the-corner terrible. Once you start selectively removing sectors to make the picture look rosier, you end up with weird results.

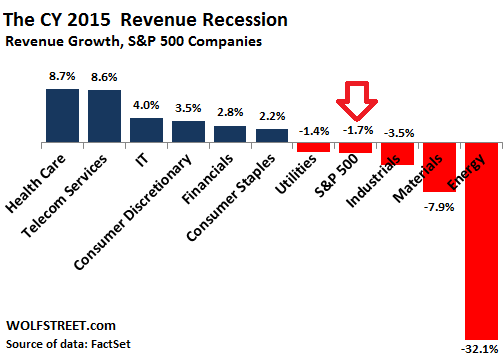

For the remainder of the year, analysts expect revenue shrinkage to continue: -2.6% in Q3 and -0.6% in Q4, according to FactSet. So revenue shrinkage as reported in the first half and as estimated for the second half produces a revenue decline for the calendar year of -1.7%:

Four quarters in a row of declining year-over-year revenues! That sort of long-lasting revenue recession would take us back to the bowels of the Financial Crisis.

Next year is going to be great, however, according to these analysts. Revenues will soar 5.7%, as they always do far enough into the future because analysts need to justify the still sky-high stock prices with their forward-looking miracle metrics.

Or do these analysts and the companies they promote expect the dollar to crash next year and oil to fly off the chart in order to get to this revenue growth? That would be ironic. Because when revenues and earnings turn sour, the dollar and China get blamed. But when revenues and earnings look good, executives take full credit, based on their brilliant strategies and excellent execution.

The pressure will be on the politicos to ramp up the falling rate of profit and the floundering asset prices. How they and the Central Banks are going to manage it this time is anyone’s guess. Wage suppression at this stage of the game is going to give you a massive recession. The world is already awash in liquidity, and we aren’t going back to Volker-era returns on T-Bills (and even CDs) any time soon. The dollar is tough to kill because it is the least bad of a very bad bunch of international currencies. Where can the moneyed class go next for a “proper” return on capital? I have no idea. Perhaps it will be back to Social Security for one last great uptick in stock prices. Then they can cash out and hunker down for the collapse.

Finance shows revenue increases. Ex Nihil Nihilo Fit! So where do the profits come from and how is our social/economic structure sustainable in the best case? Moses knew.

“Moses knew?”

The last time I looked, Moses had his people pack up their tents and steal off into the night. Then it was forty years in the Desert. (The number forty pops up a lot in Biblical writings, doesn’t it.) Then the “Chosen Ones” overrun some agricultural communities and do ‘bad things’ to all and sundry. (Never say that they didn’t learn anything from Pharoah.)

So, I would characterize ‘Moses’ Knew’ as yet another version of “I’m Alright Jack!”

Just as the Biblical Patriarchs had “The Cities of the Plain,” Sodom and Gomorrah, we have “The City of the Tidewater,” Washington D.C.

I think the truth is that they stole all the Pharoah’s gold and then stole off into the night. More like high-tailed into the night. But whatever; it really doesn’t matter how disgraceful the whole thing was. From then to now we have all practiced tribal warfare, and pretended to become civilized.

Which is why it’s so imperative that we continue to pay those executives more than most people make in a lifetime every year. Else they might get grumpy and decide to go do something that doesn’t create nearly as many benefits for society at large and we’d all be the worse off for it. hahahahahaha! I crack me up…

I’ve found myself wondering for several years now, who shined John Galt’s shoes? Surely somebody must have. Surely the great genius wouldn’t have spent precious time shining his own shoes. I don’t wonder about it enough to go re-read the book to see if it says and I just don’t remember. Or, who washed the dishes? Who did the laundry? Who mowed the lawns? Who cleaned the toilets?

Isn’t the standard reply, “I have people for that!”?

What he thinks he is saying is, “I have allowed no-talent hirelings to do menial jobs while I run the world.”

But what this really means is “I have bent to my will a large number of people to supplement my energies so I can appear to be far more powerful and important than I would be if dropped on a desert island, the way I ought to be if there was justice in the world.”

Got that?

According to this paper:

The Financial Instability Hypothesis

Prepared for Handbook of Radical Political Economy, edited by Philip Arestis and Malcolm Sawyer, Edward Elgar: Aldershot, 1993.

by

Hyman P. Minsky* Working Paper No. 74

May 1992

“…aggregate profits equal aggregate investment plus the government deficit”. (page 5-6)

IBM is an interesting case. While I haven’t looked in detail at Union Pacific or others IBM appointed Palmisano as CEO who in 2010 set a goal of doubling earnings per share to $20. In service of that goal he has continued a long practice of slashing investments in workers and chasing the cheapest spot. He has also continued to shift their focus from hardware (the actual machines in IBM) and focused on cheap services.

The result has been economic decay in towns that where IBM was the chief employer and, I would argue, a loss of domestic economic growth which would actually support the services they want to sell.

In that context I not surprised that Palmisano wants to blame the dollar, the oil, sun spots, or anything else but a bad focus on short-term cost-cutting over real investment.

This makes even more sense given that the companies that have mostly weathered the downturn such as Apple are the ones that didn’t obsess about shareholder buybacks and immediate stock percentiles*

http://www.washingtonpost.com/business/economy/maximizing-shareholder-value-the-goal-that-changed-corporate-america/2013/08/26/26e9ca8e-ed74-11e2-9008-61e94a7ea20d_story.html

[*] Yes I know that Apple has only avoided massive stock buybacks because their chief shareholders are so greedy that they want to wait until they get another tax holiday but in this case their greed was good.

Edit: I should have noted that the current CEO is Ginni Rometty who has continued Palmisano’s strategy and thus its costs.

To increase earnings per share, you can increase earnings, or decrease share count. IBM has chosen the latter (through buybacks). And to increase earnings, you can increase revenue faster than costs, or decrease costs faster than revenue. IBM has chosen the latter.

IOW, IBM has chosen the purely financial ways to increase eps, while damning the long-term prospects of their company. As long as you can buy stock faster than your earnings are declining, and cut costs faster than your revenue is declining, you can keep the charade going. But there’s no such thing as a perpetual motion machine. In IBM’s case, this game stops when they can’t borrow cheaply any more to keep buying back their stock.

(I’ve long thought of buying bankruptcy puts on IBM, because the minute borrowing costs increase, IBM will be dead. Not just slowing growth, yada yada yada, but dead. They have turned themselves into the Japan of corporations. And I think their executives know it too…)

Nice presentation of revenue trends by sector; thanks.

On the Sector SPDRs site, when a 1-year lookback is chosen on the sector tracker tool, the energy sector fund (XLE) shows a -32.21% price decline, exactly matching its -32.2% sales decline in the first chart above.

http://www.sectorspdr.com/sectorspdr/tools/sector-tracker

Sometimes maff actually works!

When you come down to it, a lot of these industries are driven by consumer spending. And, if those storied consumers don’t have money to spend, there goes our economy.

I think this reflects the fact that our population has outgrown its ability for positive economic growth. We need our leaders to step up. The Pope is courageous; but where the hell is political world leadership? I’m disgusted with Obama – he’s Mr. Duck-it.

“..as the economy gets more specialized, the people at the top – not because they’re evil, or conniving, or anything of the sort – as a natural consequence .. uh..a lot of the wealth .. uh .. flows to the top, and you expect unequal results in a market economy..”

Always watch out for that word “natural.” Well over half the time, “cultural” and even “ideological” can be substitute with no loss of meaning and an increase in generality.

Point taken.