This is Naked Capitalism fundraising week. 1055 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our fifth target, more original reporting.

Yves here. I’m glad to see a post by Stormy again. I’ve probably managed to miss some in the meantime, but there were ones by Stormy back in 2007 that we cross posted on ocean acidification and the impact of Chinese plans to increase electrical production via building more coal-fired plants that were way ahead of their time, and we referred back to them quite a few times.

By Stormy. Originally published at Angry Bear

“Free Trade,” the banner of Globalization, has not only wrecked the world’s economy, it has left Western Democracy in shambles. Europe edges ever closer to deflation. The Fed dare not increase interest rates, now poised at barely above zero. As China’s stock market threatened collapse, China poured billions to prop it up. It’s export machine is collapsing. Not once, but twice, it recently manipulated its currency to makes its goods cheaper on the world market. What is happening?

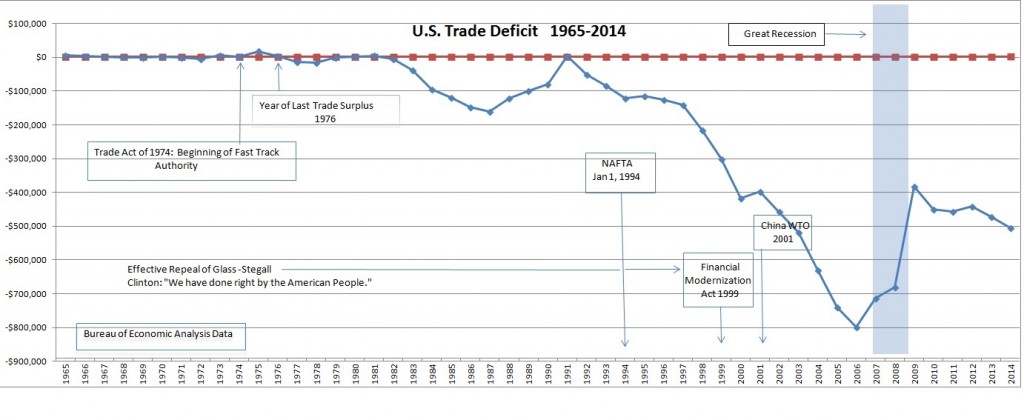

The following two graphs tell most of the story. First, an overview of Free Trade.

Capital fled from developed countries to undeveloped countries with slave-cheap labor, countries with no environmental standards, countries with no support for collective bargaining. Corporations, like Apple, set up shop in China and other undeveloped countries. Some, like China, manipulated its currency to make exported goods to the West even cheaper. Some, like China, gave preferential tax treatment to Western firm over indigenous firms. Economists cheered as corporate efficiency unsurprisingly rose. U.S. citizens became mere consumers.

Thanks to Bill Clinton and the Financial Modernization Act, banks, now unconstrained, could peddle rigged financial services, offer insurance on its own investment products–in short, banks were free to play with everyone’s money–and simply too big to fail. Credit was easy and breezy. If nasty Arabs bombed the Trade Center, why the solution was simple: Go to the shopping mall–and buy. That remarkable piece of advice is just what freedom has been all about.

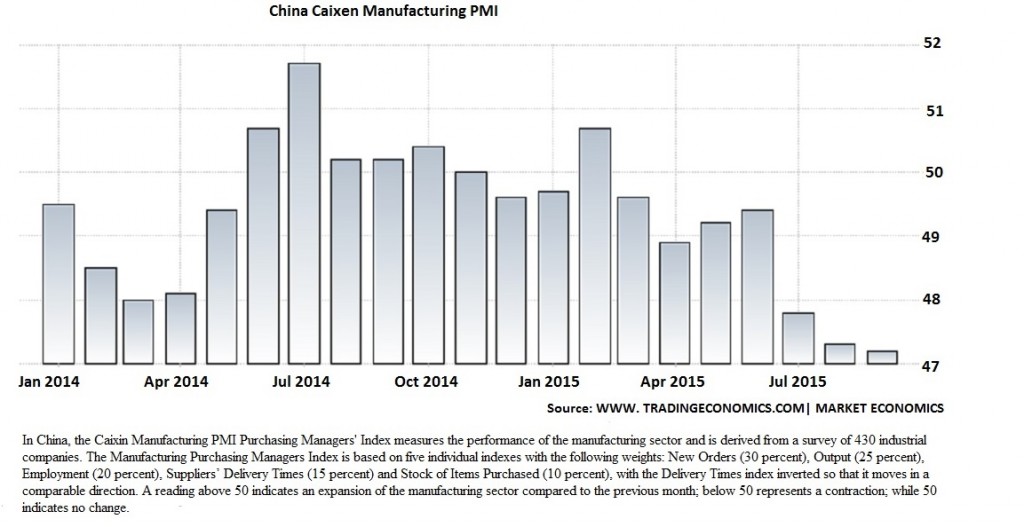

Next: China’s export machine sputters.

China’s problem is that there are not enough orders to keep the export machine going. There comes a time when industrialized nations simply run out of cash–I mean the little people run out of cash. CEOs and those just below them–along with slick Wall Street gauchos–made bundles on Free Trade, corporate capital that could set up shop in any impoverished nation in the world.. No worries about labor–dirt cheap–or environmental regulations–just bring your gas masks. At some point the Western consumer well was bound to run dry. Credit was exhausted; the little guy could not buy anymore. Free trade was on its last legs.

So what did China do then? As its markets crashed, it tried to revive its export model, a model based on foreign firms exporting cheap goods to the West. China lowered its exchange rates, not once but twice. Then China tried to rescue the markets with cash infusion of billions. Still its market continued to crash. Manufacturing plants had closed–thousands of them. Free Trade and Globalization had run its course.

And what has the Fed been doing? Why quantitative easy–increase the money supply and lower short term interest rates. Like China’s latest currency manipulation, both were merely stop-gap measures. No one, least of all Obama and his corporate advisors, was ready to address corporate outsourcing that has cost millions of jobs. Prime the pump a little, but never address the real problem.

The WTO sets the groundwork for trade among its member states. That groundwork is deeply flawed. Trade between impoverished third world countries and sophisticated first world economies is not merely a matter of regulating “dumping”—not allowing one country to flood the market with cheap goods—nor is it a matter of insuring that the each country does not favor its indigenous firms over foreign firms. Comparable labor and environmental standards are necessary. Does anyone think that a first world worker can compete with virtual slave labor? Does anyone think that a first world nation with excellent environmental regulations can compete with a third world nation that refuses to protect its environment?

Only lately has Apple even mentioned that it might clean up its mess in China. The Apple miracle has been on the backs of the Chinese poor and abysmal environmental wreckage that is China.

The WTO allows three forms of inequities—all of which encourage outsourcing: labor arbitrage, tax arbitrage, and environmental arbitrage. For a fuller explanation of these inequities and the “race to the bottom,” see here.

Of course now we have the mother of all Free Trade deals –the Trans-Pacific Partnership (TPP)– carefully wrapped in a black box so that none of us can see what finally is in store for us. Nothing is ever “Free”–even trade. I suspect that China is becoming a bit too noxious and poisonous. It simply has to deal with its massive environmental problems. Time to move the game to less despoiled and maybe more impoverished countries. Meanwhile, newscasters are always careful to tout TPP.

Fast Tracking is a con man’s game. Do it so fast that the marks never have a chance to watch their wallets. In hiding negotiations from prying, public eyes, Obama, has given the con men a bigger edge: A screen to hide the corporations making deals. Their interest is in profits, not in public good.

Consider the media. Our only defense is a strong independent media. At one time, newsrooms were not required to be profitable. Reporting the news was considered a community service. Corporate ownership provided the necessary funding for its newsrooms–and did not interfere.

But the 70′s and 80′s corporate ownership required its newsrooms to be profitable. Slowly but surely, newsrooms focused on personality, entertainment, and wedge issues–always careful not to rock the corporate boat, always careful not to tread on governmental policy. Whoever thought that one major news service–Fox–would become a breeding ground for one particular party.

But consider CNN: It organizes endless GOP debates; then spends hours dissecting them. Create the news; then sell it–and be sure to spin it in the direction you want.

Are matters of substance ever discussed? When has a serious foreign policy debate ever been allowed occurred–without editorial interference from the media itself. When has trade and outsourcing been seriously discussed–other than by peripheral news media?

Meanwhile, news media becomes more and more centralized. Murdoch now owns National Geographic!

Now, thanks to Bush and Obama, we have the chilling effect of the NSA. Just whom does the NSA serve when it collects all of our digital information? Is it being used to ferret out the plans of those exercising their right of dissent? Is it being used to increase the profits of favored corporations? Why does it need all of your and my personal information–from bank accounts, to credit cards, to travel plans, to friends with whom we chat….Why is it afraid of us?

As Mr. Buffet so keenly said it, There is a war going on, and we are winning.

If ‘they’ are failing, I’d hate to see success!

Isn’t it the un-collective WE who are failing?

failing to organize,

failing to come up with plausible, 90 degrees off present Lemming-to-Brink path alternative plans and policies,

failing to agree on any of many plausible alternatives that might work

Divided- for now— hopefully not conquered…..

I gotta scoot and get back to Dancing with the Master Chefs

Just type `TPP editorial’ into news.google.com and watch a toxic sludge of straw men, misdirection, and historical revisionism flow across your screen. And the `objective’ straight news reporting is no better.

Don’t just watch the toxic sludge; respond to it with a letter to the editor (LTE) of the offending publication! For some of those toxic editorials, and contact information for LTEs, see:

http://www.nakedcapitalism.com/2015/10/200pm-water-cooler-10162015.html#comment-2503316

http://www.nakedcapitalism.com/2015/10/trading-away-land-rights-tpp-investment-agreements-and-the-governance-of-land.html#comment-2502833

A few of the editorials may now be obscured by paywalls or registration requirements, but most should still be visible. Let them know that we see through their nonsense!

“Why is it afraid of us?” Because we the people are perceived to be the enemy of America the Corporation. Whistleblowers have already stated that the NSA info is used to blackmail politicians and military leaders, provide corporate espionage to the highest payers and more devious machinations than the mind can grasp from behind a single computer. 9/11 was a coup – I say that because looking around the results tell me that.

The fourth estate (the media) has been purchased outright by the second estate (the nobility).

I guess you could call this an ‘estate sale’. All power to the markets!

it does stand to reason that when nobody’s buying, nobody’s trading… that’s the nice thing

Even when newsrooms were more independent they probably would not, in general, have reported on free trade with any degree of skepticism.

The recent disappearance of the old firewall between the news and corporate sides has made things worse, but at least since the “professionalization” of newsrooms that began to really take hold in the ’60s, journalists have tended to identify far more with their sources in power than with their readers.

There have, of course, been notable exceptions. But even these sometimes serve more to obscure the real day-to-day nature of journalism’s fealty to the corporate world than to bring about any significant change.

As for the ’60s—merely recall that the New York Times and Washington Post fully justified their membership in The Establishment with their coverage of the war in Vietnam. . .

I’m confused. First it was bad that China exported cheap stuff, now its bad that they don’t? Also, deflation, bad, explain? Real or nominal, meaning wouldn’t you rather pay less for a tee shirt than more? If your same dollar buys more stuff (food lets say) thats deflation. Is that bad?

I guess I could be wrong about this but I’ve read in a few places that China’s standard of living has improved quite a bit in the last twenty years. Are China’s poor less worthy than U.S. poor? Or another way, should everyone else pay more for a tee shirt “made in the USA” so that some people can keep there crappy factory job in the U.S.? (don’t say Micky-d’s, not everyone works there instead of in the garment factory)

If China wants to make their exports cheaper so we pay less, how is that bad for us, if its all about us? It seems free trade has made goods here cheaper, especially basic goods, like food and clothing and improved living standards in China. This is good, I think.

Now, has China overbuilt recently and is this causing a slowdown in growth. Yes. Is this normal stuff and will they grow again, yes there as well.

Press: ok agree on MSM but there’s plenty of information, research, blogs (I heard naked capitalism has some revealing articles). The internet has improved the information flow although its tough to cut through the bull sometimes.

You are missing a key ingredient which is employment – the demand side of the equation.

A job is subtracted from the United States and added to China when manufacturing moves. As local manufacturing is lost, tightens and contracts, falling employment forces loss of bargaining power for higher wages, wages stagnate and shrink, eventually resulting in less and less to no income with which to use to buy the products that are made cheaply overseas. For a short while, as wages stagnated and fell, Americans filled this gap by borrowing against the rising equity in their homes to keep buying those cheap goods made overseas.

So in the short term, yes, you can buy cheap goods made overseas. In the long term, It’s a recipe for social and economic disaster.

When you support strong wages for local labor, you support a strong local economy.

@rfam – Re: deflation. Once prices start falling and people expect them to continue to fall, they will postpone purchases so they can get better prices. This reduces the already deficient demand so prices have to continue to fall in order to sell the product. With falling prices the producer is squeezed and will eventually start to layoff her employees, meaning they have no income to spend, and thus demand continues to fall. I’m sure you can see this this does not end well for the vast majority of the people.

@sd – You are right. It’s always about demand.

Once you offshore the factory floor, how do you stop the engineering, product and process development, R&D, even precious intellectual property from going along with it just because of the physics of how stuff works: distance and proximity really does matter to the total process of producing a product. Pretty soon you will loose the capacity to produce anything of value to pay for even the “cheap” imports. There is nothing to ensure that the “free trade” global system is not dynamically unstable and capable of catastrophic imbalance and crashing and burning. The is plenty of evidence that financial meltdown is the new norm.

[meaning wouldn’t you rather pay less for a tee shirt than more?] They sell the tee shirt at the highest price the market will bare. Ship jobs over seas they said, it will be good for the consumer they said, ya? Jordans still cost $150 a pair. They slashed overhead and kept the difference.

Wow this guy is all over the place.. financial deregulation to china mercantilist policy to apple sweatshots, and then he winds up talking about the NSA! Gawd I wanna be a financial writer so I can have my own creative license to _________ my readers.

Why do a single coin worth $1T why not multiple coins each valued at say $20B? The treasury could deposit coins at the fed as needed to pay bills. This would continue until congress passes a new bill. A 1 oz platinum coin costs ~ $1200. That leaves plenty for seignorage.

I can feel the globalization and exponential growth. The place where I have grown up used to be quiet and clean(er). Things they do not quantify in income. Now the traffic is dense and almost perpetual. If it`s not cars it`s jumbo jets above. Fertile land has been carved up and developed into prototypical suburbs. Amount of people, cars and pollution of all sorts has increased to the point where it`s becoming annoying. Getting to work is a greater nuisance. Space is becoming a luxury and privacy has eroded.

I can feel the globalization and exponential growth. The place where I have grown up used to be quiet and clean(er). Now the traffic is dense and almost perpetual (cars, airplanes). Land has been carved up and developed into a congested suburb. It is a nuisance to get to work. Space and privacy is becoming a luxury for which more and more people bid with debt.

It is all about keeping the debt emission accelerating – is it not.