This is Naked Capitalism fundraising week. 864 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in financial realm. Please join us and participate via our Tip Jar, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our fourth target, 24/7 coverage, 365 days a year.

Yves here. I’m sure some readers will take issue with this post, since it asks a very big question, one that it would take a book or at least a very long study to begin to address many of the complexities, and seeks to answer it in a short space. But even by focusing on a few 50,000 foot issues, it nevertheless brings some important considerations to the table: that even with renewables being more cost-efficienet than many laypeople realize, it’s still a long way before we see oil displaced as a major energy source. By implication, one of the factors impeding change is the installed base effect of existing infrastructure (readers have pointed to supply chains as one of the elephants in the room). Mere behavioral inertia is a bigger impediment to the adoption of new technology than most people realize. And there is the related issue that cars and trucks are widely adopted, critically important means of transportation. The lower-carbon-footprint alternatives to gasoline as fuel have other high environmental costs, making it ambiguous as to whether they are all-in “greener” choices.

The bigger issue which is not addressed at all here, is the only way to reduce carbon output in the near term is conservation. Again, as of all parties, BP demonstrated in the late 1990s, it is possible to reduce carbon footprints at modest cost outlays and produce large net savings. As we wrote in 2007:

BP in 1997 decided to lower its carbon emissions below the 1990 level by 2010. It achieved the goal in 3 years rather than 13 at a cost of $20 million. Oh, and it happened to save $650 million. With that sort of calculus, you’d think that every big corporation would be on the emissions-reduction bandwagon.

In other words, entrenched habits and a “don’t tell me what to do” mentality are at least as large an obstacle to curbing greenhouse gas output as the state and cost of technology.

By Gaurav Agnihotri, a mechanical engineer and an MBA -Marketing from ICFAI (Institute of Chartered Financial Accountants), Mumbai. He is an Author of a book ‘Oil- Past, present, future- An Indian Perspective.’ Follow Gaurav at Twitter at @Gaurav81184. Originally published at OilPrice

History has been so fascinated with oil and its price movements that it is indeed hard to imagine our future without oil. Over the last few months, we have witnessed how oil prices have fluctuated from a 6 year low level of $42.98 per barrel in March 2015 to the current levels of $60 per barrel. It is interesting to note that, in spite of the biggest oil cartel in the world deciding to stick to its high production levels, the oil prices have increased mainly due to falling US crude inventories and strong demand. However, the current upward rally might be short lived and there may yet be another drop in the international oil price when Iran eventually starts pumping its oil into the market at full capacity, potentially creating another supply glut. In these endless price rallies, it is important to take a holistic view of the global energy industry and question which way it is heading. Are the dynamics of global energy changing with current improvements in renewable energy sources and affordable new storage technologies? Can the oil age end in the near future? Will we ever stop feverishly analyzing the rise and fall of oil prices? Or, will oil remain irreplaceable in our life time?

Are Renewables Ready to Take Over?

With little or no pollution, renewables like solar, wind and biofuels are viewed by many as a means to curtail the rising greenhouse emissions and replace oil as a sustainable alternative. There is little doubt as to why China, US, Japan, UK and Germany, some of the world’s biggest energy gluttons have invested heavily in renewables.

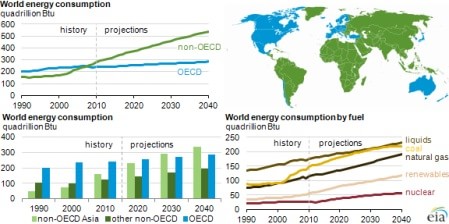

Image Source: EIA

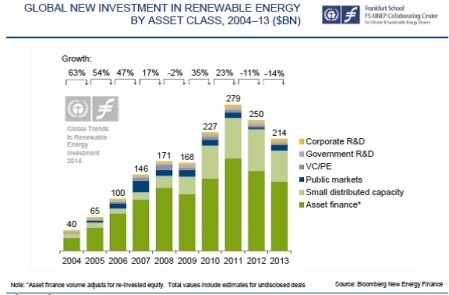

However, according to a study conducted by Frankfurt School-UNEP Collaborating Centre for Climate & Sustainable Energy Finance, the United Nations Environment Program (UNEP) and Bloomberg New Energy Finance, the total global investments in renewables fell by 14% to $214 billion in 2013. One of the major reasons of this fall was the backing out of some big oil firms such as BP, Chevron and Conoco Phillips. These companies significantly reduced their investments in renewables and decided to focus on their ‘core’ business; that is, oil and gas. As per Lysle Brinker, an oil and gas equity analyst at IHS “It’s not their (Big oil majors) strong suit to be spending a lot of money and time on renewables when they are definitely challenged in their core industry.”

However, if we take the example of the solar industry, where the cost of an average photo voltaic panel is declining at a rate of more than 10% per annum we see that, in spite of reduced global investments, renewables still hold a lot of promise. Some of the major integrated oil and gas companies such as Shell, Total and Statoil have actually been slowly and steadily increasing their renewable related investments. Shell is investing big time in biofuels, while Total, with its stake in Sunpower, is investing substantially in the solar sector while Statoil is placing its bets on wind energy. This shows that renewables are a phenomenon that many believe can give oil a run for its money.

Is Saudi Arabia Sensing an End of the Oil Age?

“No one can set the price of oil – It is up to Allah”, this is what Saudi Arabia’s oil minister Ali Al Naimi had to say while speaking to CNBC recently. OPEC, which holds around 40 % of the world’s crude output, is showing no signs of reducing its production levels, even if Iran starts pumping more oil after sanctions are lifted should the international nuclear deal with P 5+ 1 counties prove successful. Many see this move by OPEC as a means to protect its market share and drive US shale players out of business. But is the decision of OPEC (especially Saudi Arabia) part of a much bigger game? The Saudis, who lead OPEC, would obviously be very interested in delaying ‘Peak Oil Demand’ after which global demand for oil would start declining steadily, along with Saudi oil revenues.

According to Bank of America and Merrill Lynch commodity researchers, if crude prices stay in the range of $50 – $70, peak oil demand would be pushed beyond 2030. This delay in peak oil demand would definitely hurt renewables and anyone who is investing in them. As per Alex Thursby, Chief Executive at the National Bank of Abu Dhabi, “Renewable energy technologies are far further advanced than many may believe: solar photovoltaic (PV) and on-shore wind have a track record of successful deployment, and costs have fallen dramatically in the past few years. In many parts of the world, indeed, they are now competitive with hydrocarbon energy sources. Already, more than half of the investment in new electricity generation worldwide is in renewables. Potentially, the gains to be made from focusing on energy efficiency are as great as the benefits of increasing generation. Together, these help us to reframe how we think about the prospects for energy in the region.”

Yes, OPEC has sensed the end of its glory days. And it is obvious that Saudi Arabia, with 85% of its export revenues coming from petroleum exports does not want the oil age to end anytime soon.

What Can We Expect?

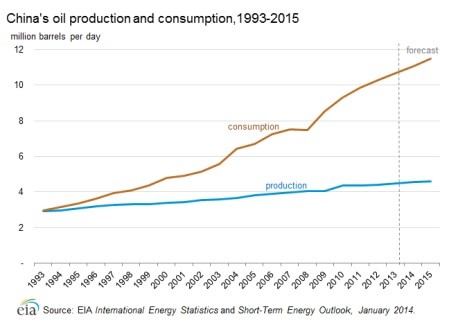

If we look at China, the second biggest global consumer of oil, we find that its oil consumption rate constitutes about one third the world’s total consumption rates and shows no signs of slowing. In fact, EIA even predicts steady growth of China’s oil production reaching 4.6 million barrels per day in 2020 and 5.6 million barrels per day in 2040.

China has also invested heavily in building its strategic petroleum reserves and plans to expand them to 500 million barrels by 2020.

Now take India, a country that is considered by many as the next solar investment hotspot. India has been investing heavily in building its own strategic petroleum reserves and its public sector undertaking, Oil and Natural Gas Corporation Limited (ONGC) is planning to invest about $62 billion on its discoveries in Krishna Godavari Basin block KG-D5.

These are two of the world’s fastest growing economies that are investing heavily in renewables but also safeguarding their oil and gas aspirations. Moreover, when we analyze past oil price trends, we find that volatility related to geopolitical equations, speculations, wars, economic sanctions and climate change have always kept the global energy markets guessing about the future. The world is still myopic when it comes to energy. Yes, it wants to embrace renewables but not at the cost of oil. Whatever happens to oil prices in the coming years, one thing is certain: that the age of oil isn’t ending anytime soon, at least not in the next 30 years.

I wish the author had discussed his current estimates of recoverable oil in the $50-70 range rather than just implying it’s there for the taking. A lot of countries have had their own individual peaks in production (i.e. Egypt, Syria) and only much higher oil prices may reverse that (like how high prices lead the US to increase energy extraction w/fracking).

One question I’d really love to see tackled: if you could calculate the true, total cost of production and use of a barrel of oil, including all the costs currently externalized (such as the cost of repairing damage from earthquakes from fracking, or full ecosystem restoration and financial restitution to affected people from pipeline breaks, etc) and compare that to the market price, are a greater percentage of costs externalized than in the past? And where does that trend go in the future?

including all the costs currently externalized

With all the mountains of BS on the internetz, this fundamental mat’l you will not find

BTW add the cost of attributable MIC and Failed States to the list.

Rather than rehash things I’ve said before many times, I’ll just provide a link to this classic post from Nicole Foss at the Automatic Earth website. I think it offers context and interpretation that’s quite a contrast from the rosy and perhaps ill informed post above:

http://www.theautomaticearth.com/2012/10/renewable-energy-the-vision-and-a-dose-of-reality/

I agree with you, but this is a hard sell at this site due to deeply entrenched mythological beliefs about 1. what money is and can do and 2. about infinite growth on a finite planet (collectively, we’re at the bargaining stage on this latter one as the signs of the end of growth and ecological overshoot abound but are blocked from recognition by a paradigm that explains them as aberrations or human failures). I’d add to the Nichole Foss post the book “Green Illusions: The Dirty Secrets of Clean Energy and the Future of Environmentalism (Our Sustainable Future),” the webiste of Gail Tveberg, Our Finite World,” and the site “Economic Undertow”.

It’s not such a hard sell, I read plenty of comments here that understand what is in your references. The issue is how you get where we need to go from where we are. Calling everyone who disagrees ignorant doesn’t help much: we all know what we know and don’t know exponentially more. But it is very hard to propose actionable ideas beyond “personal virtues” which on their own have no chance. This is possibly the ultimate coordination problem: agreement on goals is much further along than agreement on means.

+1

very perceptive comment

JSN’s comment is indeed perceptive, but it is also too reasonable a response to DanB, who has clearly not bothered to read NC before dumping his/her easy assumptions in comments.

deeply entrenched mythological beliefs [at NC] about 1. what money is and can do and 2. about infinite growth on a finite planet[…]

Huh??? Seriously?; DanB can’t have read much here, or else he should consider opening his eyes while in the process of what he imagines reading to be.

Please note I use “collectively” to refer to our culture, not to NC readers. Perhaps that was not clear. And i’ve been reading and commenting here since 2009.

This is a great exchange. Perhaps what I might add is I’m not so sure we do have agreement on goals. I think that does a disservice to those voices that quite passionately advocate moar.

They genuinely believe that more work, more output, more deficit spending, more higher education, more home equity, more development and infrastructure, more aggregate activity, will improve society. It is a moral calling they see, and it is quite distinct from the perspective that we should live differently. We can’t paper over how deep that chasm is between those that want full employment and those that want a world where less is more. One irony of the post-Keynesian (and post-Bretton Woods) MMT world is that Keynes himself thought we’d only need to be working a few hours a week by now. Capital accumulation was the great liberator of our time, to allow us human beings to do more important and exciting (and less polluting) things than go to work. But the secularization of the puritan work ethic – the notion that human life is directionless without an authoritative (and fatherly) figure to give direction – dies hard.

And for whatever reason, the less-is-more crowd isn’t so much in the habit of proposing actionable ideas. We might consider that dismissal and scorn are nothing more than rhetorical tools in a conversation about power. (See Ghandi or Nicholas Klein: “first they ignore you…”)

– We can tax excessive consumption at the rate of its externalities, even (and especially) for necessities like food, water and housing

– We can publicly fund taking people and institutions off of the grid.

– We can publicly fund light industry and massive agricultural infill in our cities.

– We can lift property taxes and subsidize rents for anyone who walks or bicycles to work.

– We can tax energy in direct proportion to the loss rate of whatever grid carries it.

– We can enable the State to enter the Market wherever a discernible demand is not being met, as consumer or provider (see giving medicine to sick children or eating unadulterated food)

– We can scrunch city streets to the size of cart paths, confiscate any vehicle that exceeds 25 mph, shade everyone’s windows, turn off our a/c, criminalize the use of drinking water for anything but drinking, locally compost all our bio-waste, end the industry of converting sunlight to meat, criminalize bulk possession of any bio-toxin, enforce a 25 hr / 3 day work week with no overtime, revoke the commerce clause (or not), buy back guns at triple the sticker price and melt them into strollers and windmills…

It’s simply a matter of keeping the conversation on point (what works within the limits of our solar income?) and being willing to discuss policies that might or might not reduce our level of comfort and privilege.

Naomi Klein reads like USA Today, but The Shock Doctrine is right. The inevitability of scarcity means that crises will escalate. And with each escalating crisis, the most unthinkable ideas will become potentially acceptable (including comic-book nastiness like a nuclear first strike; ethnic cleansing in Kansas; a 0% capital gains tax; or declaring global, never-ending war against

non-christiansterror).If enough of us agree that shit is really going South in a bucket, and that the Fiat dollar allows us to spend relatively freely on things like war in Iraq; QE; or mitigating the disruption of mass industrial shrinkage, then we should also agree that the “actionable” in actionable ideas is all encompassing. Because the next time someone flies a false flag or blows up a critical asset class, the table will be in dire need of transformative food for thought.

Yep. I think that’s one of the characteristics that makes proposals to do less (for example, tax the rich or end the drug war or scale back IP law) the most realistic in a system as corrupt intellectually and financially as ours is today.

It’s the first rule of holes: stop digging. Almost all of the big ideas to do more require an infrastructure of good faith management that simply doesn’t exist.

I did not call anyone ignorant, nor did I imply it.

my bad!

The issue is how you get where we need to go

the issue before that is knowing/agreeing where we need to go.

a quickie on the topic of the “costs” where the cost of an average photo voltaic panel is declining at a rate of more than 10% per annum

IIRC China has the true costs gamed at the moment. Beyond that are the associated energy and pollution externalities that are never factored in.

I liken celebrating declining solar voltaic panel prices to celebrating the fact that windshield wipers on a Lamborghini are getting cheaper. This is completely nuts.

Thanks for the link. That is a very interesting and well written article, worth reading and re-reading since it gives a good perspective on many issues. But you should also take into account that it (and all the links inside it) was written in 2012 and the costs of producing renewable energy are dropping to such an extent (like compound interest) that they are changing the nature of the issue.

Moreover, the argument the article makes doesn’t negate the need to transition to renewables; rather it acknowledges that need but emphasizes the gains of doing so locally in support of (as alleviation to) the current centralized power model rather than immediately replacing it. My argument about corruption below, I think, is one of the reasons that this effort has not gone further. Example, Hawaii, where electric utilities have had considerable success in halting renewables at the local level by individuals due to fear of reduction in profits.

Note, the fear of reduction in profits isn’t entirely without merit. But what is without merit is the capitalist system that makes it possible for the utilities to win a battle for profits in a war for existence.

The article is even more relevant than it was in 2012; the issue is not the cost of a solar panel, which is perhaps the least important cost in the process. Rather, it’s the way our infrastructure is set up. The centralized utility/grid model is still just as incompatible with renewable energy today as it was in 2012.

It’s possible that we could all have a solar panel array and a windmill directly adjacent to the demand–but we’ll still have to cut our energy consumption by 95%. In that kind of a world, things like personal passenger vehicles and the internet will not exist. I’m looking forward to it.

The primary issue is one polite society refuses to address: population.

That is the issue that makes it “possibly the ultimate coordination problem”. The moral reality of billions of lives lie in the balance of the actions one takes or doesn’t take. That weight may be among the biggest barriers to responsible action: those who aspire to be responsibleare the most unnerved by this issue.

I’m much more optimistic on that front. Population is not a large coordination problem because there is no scaling needed to have fewer kids later in life (at least until the authoritarians perfect their Huxley Bokanovsky groups, I guess). Those are individual choices that can be made at the ultimate local level.

It’s already happening all around the globe, and outside of China, it’s mostly happening as a genuinely free choice made available by the intersection of reproductive healthcare and a basic standard of living. It’s almost like our species subconsciously recognizes the value of reducing the total population. Even against the stern worrying of the Serious People that declining birth rates threaten The Economy(TM).

+1, an other perceptive comment.

Also the ‘population problem’ is a relative problem to consumption, resources and distribution. Population will plateau at some point during this century.

There is no such thing as ‘population problem’ with the appropriate policies if the population does not go beyond 10 bill. (and old people consumes much less, by then humanity will be aging, damn, it already is in developed nations).

The problem is to get smart non-psychopaths in power, that’s the #1 problem we have right now.

Right now the real resources ratchet is producing civil wars and mass migrations, for instance, among other problems that are just beginning to blossom.

It isn’t population per se that is the coordination problem, it is equitable distribution of diminishing real resources in real time to support it without mass die offs that is.

So far industrial overshoot is playing out with all the harbingers of collapse which will solve the distribution problem by natural selection. The coordination problem is to solve the distribution problem ethically to prevent nature taking its course.

Nature bats last, so the trick is to keep the inning going.

I think this is true, and there are two big reasons for it:

1. It flies in the face of capitalist orthodoxy and its requirement of ever-expanding markets

2. If flies in the face of certain religious teachings on sexuality

Both of these need to be rethought.

It also flies in the face of a conception of personal liberty that is deeply ingrained and that we have been taught is worth dying for. If we really have entered the “lifeboat Earth” stage then some of those freedoms are going to have to go out the window. This is awful and I hate it, but if you want to survive on a lifeboat everyone can’t just do whatever the hell they feel like doing. They have to accept discipline and rationing. This can either be done by all the participants pulling together and acting responsibly or at the point of a gun. I fear this will end with all of us at the point of a gun.

Very succinct framing!

The ratchet of real resource constraint will only tighten.

We can let it squeeze out our excesses, or if those who benefit from the excesses maintain their grip, we can continue to maintain them by squeezing out lives, human, animal and plant.

Just to play a little devil’s advocate here, isn’t that what we have now? The groaf economy is life stuck on the lifeboat with work and compliance meted out at the point of a gun.

A different way of living is more like reaching shore and returning to land. That’s where the opportunity to live is.

Indeed.

I wonder what portion of human waste been directly predicated by theft – Colonial theft, Imperial theft, Super-Capitalism, Predatory lending (the IMF kind as well as the Countrywide kind), State Confiscation from the left, Austerity inflicted Privatization from the right, the fraud of the tithe . . .

Is it simple-minded to imagine that we might be more frugal with resources that we have a more legitimate claim to, as in “hey I made this . . . “

Its noteworthy that the curve is flattening – by that I mean the growth is looking linear rather than exponential.

I’m interested in why. Some combination of enlightened middleclass-ness here, and global poverty pushing up against the real limits of local resources there? I’m certainly curious where its going. Those “exponential-curve-limit meets real-world-constraint” moments aren’t so easy to see beyond.

I also wonder if there’s a more humane or workable way to manage it beyond simply providing peoples’ basic needs with decency. I haven’t seen any convincing arguments for one, although I’m always on the lookout.

First World populations are ALL trending over and down.

America

Europe

China

Russia

Japan

The sole and only reason that America and Europe are not showing amazing population drops is that politicians have dropped immigration controls.

The reason for the low birth rate — self opinion — the opinion that life is too crowded.

Japanese culture would not be destroyed if its population were to drift down to 30,000,000.

Likewise, Europe’s current population is a mighty modern thing.

The problem is not with advanced societies — they are all NATURALLY shrinking.

The insane population growth is where food can’t be grown (MENA) and where the termites eat every structure — just about. (Africa, South America)

It’s ironic, but the First World MUST stop feeding the Third World… especially for free.

We’ve managed to double the size of the population bomb… with the BEST of intentions.

“It’s ironic, but the First World MUST stop feeding the Third World… especially for free.”

Thank you Green revolution and Norman Borlaug for its contribution to industrialized food…. don’t know about the free bit tho… they made a squillion off it…

There are two game changers technologically that the article ignored.

First, cost advantages of renewables powering large scale electric grids that may become continental in nature and taking advantage of much great second law efficiency. Electric cars, electric heat pumps etc. increase efficiency several fold compared to combustion.

Second, the rapidly dropping cost of battery storage for renwables, Tesla style giga factories with haopen door to renewably powered electric world.

Trillions of investments and trillions of profits and a planet that might dodge climate change bullet. The issue isn’t willingness of exxon to invest, but political support to help catalyze a global ecological economic growth strategy. The support for this must come in part from below, from millions in the streets.

See my next book Sustainability Sutra, forthcoming in 2016.

If you look further down the supply chain, the issues get more complicated. The jgordon link to Nicole Foss is a good summary. Conditions are changing, maybe faster than she assumed in 2012, but this: http://www.lowtechmagazine.com/2015/05/sustainability-off-grid-solar-power.html indicates, if you read all the way through, we are much further from sustainable battery production than capitalist spin suggests.

The article does not mention the word “capitalism” even once.

Private enterprise market economies — capitalism — are literally incompatible with reduced emissions. As long as we have a private enterprise economy with market-based allocation, we will simply continue to destroy the planet.

Private enterprise centrally planned economies, public enterprise centrally planned economies, and public enterprise market economies have all existed in real life: Nazi Germany, the former Soviet Union, and the former Yugoslavia. None of these are viable alternatives to capitalism, if the goal is reduced carbon emissions.

People are not yet ready to discuss the alternative though. This is not good.

…it’s not “market based allocation,” unless one does a little trick with definitions and categories– I’d call it “corruption based allocation,” with a secondary diagnosis of terminal metastatic idiotic greed…

Thank you for this comment. If you really meant “the” alternative (as opposed to “an” alternative), could you please enlighten us as to what “the” alternative is in your opinion?

I’m a pareconist.

Sure. However, you did not mention that the different political-economical systems (including collectivism/individualism) you described competed with each other. And this competition (and especially war) drives technological progress, that is, “as negative result of negative actions”, basically equal to the amount of waste: The guy with the largest Nuke factually “wins” , creating literal wastelands. For capitalistic individualism and fascistic collectivism competition is practically the “name of the game” , while capitalist globalization brings it to the last places of the planet. The opposite economic paradigm has been proclaimed ever since (be it Lao Tse, monotheism, or Marx) under the name “Solidarism”, without ever being largely successful in a barbaric (“pre-historical”, Marx; – “from sticks to nukes” , Adorno) environment. It would require “Internationalism” (as opposite to competiitive globalization) and this seems largely impossible today.

Add the US during World War II to the list of command economies. Shifting to a centrally planned eocnomy can be done and done fast.

yes, like hoextra’s proposal for a 5 trillion/year mobilization to change the way we live from the ground up. which is sensible considering the inertia involved in this change and the seriousness of the danger if we fail to achieve our goals.

This post is OK as far as it goes, but it misses a couple of realities in the current situation that are relevant to finance and politics when viewed – as Yves does – from 50,000 feet.

First, a big piece of what’s going on stems from happy memories among Western policy makers of how a similar Saudi-initiated oil price war played a big role in breaking the USSR back in the 1980’s. It’s true that the price cut attends to some necessary cartel-management housekeeping, but this is a side benefit – the motives are mainly geopolitical rather than commercial. War by other means, as somebody said. For Putin, of course, the 1980’s memories are not so happy. His objectives include showing that Russian policy can’t be jerked around via the oil price, and ideally setting up consequences so painful to the Saudis that they’ll never want to try this again. So events won’t follow the path you’d expect in a normal OPEC cartel management exercise – either in time or in plot line.

Second, there’s a wicked price spike coming. It could be the day after tomorrow, if the Russians and Iranians engineer something kinetic around the export facilities and trade routes on the western shore of the Gulf. Or it could be a year or two from now, as the two sides – exhausted and poorer – settle for some kind of mutually livable compromise. In either case the capex cuts now in train will flip the oil supply from its present “glut” (very small in percentage terms as compared to the 1980’s experience) to a shortage at least as severe as the one in the middle years of the last decade..

Why should progressives care? Many good reasons, but the big one I haven’t seen mentioned is this: There’s a good chance the spike lands smack in the middle of the 2016 election. That being the case, this is probably not a great time to be parading around bragging about successes in blocking pipelines and keeping the oil on trains.

I would say that the price of oil (and supply shortage or glut) is irrelevant over the span of 30+years. Climate change will FORCE a catastrophic end to the “oil age” by simple side effect. Loss of all major coastal cities to sea level rise, loss of food production as much current farmland is lost to productivity due to climate change. Loss of fisheries and the foodstuff from that sector as a result of climate change and ocean acidification. Already ocean scientists are seeing a major collapse of the ocean food chain and with that collapse necessarily comes major human loss of life to starvation, societies collapsing as food riots start and expand.

Nope, the price or availability of oil is largely immaterial to the end of the oil age. It will end itself along with the loss of much economic activity and loss of human populations as side-effect of the oil age.

I agree and I’m convinced that every government on Earth agrees. What I see playing out between the Saudis-Qataris and the Russians is a struggle to control natural gas. The Gulf wants to pipe gas thru Syria and turkey to the EU. Russia wants to pipe gas from the Caspian to southern Europe. France wants to gain a share of the gas fields belonging to Egypt and get in on the action. It looks like Iran intends to supply China with natural gas via a pipeline thru Pakistan. What this looks like is a pact among the producers to leave oil in the ground after a certain window of time needed to switch to natural gas and then the reduction of the use of natural gas as it is replaced by renewables. The Saudis are using their natural advantage to sell as much of their oil as they can before the window closes. Maybe.

Or the brave leadership has accepted that a die-off is likely; their imaginations include a world where a gazillion guns and warheads laying around somehow washes with their institutions riding things out; and they are more concerned with how they might be insulated from the coming shit-storm than in avoiding or forestalling it.

I believe this post is closer to the truth. There ARE those (most?) among the rich and powerful that sees most of humanity as “useless eaters” that need to be culled (one way or another) and WILL be culled in the near-ish future. The rich and powerful, being rich and powerful, will have secured for themselves all the access to food and water necessary to let their privileged families ride out the storm while being “helpless” (Ooooh, how tragic. Tut tut. Nothing can be done. So sad.) to help the “useless eaters” make it. Afterwards, with much less human crowding, things will improve AND the survivors will be happy to do any needed work for a pittance.

The title is rhetorical nonsense. It’s a question that cannot be answered.

The real question is, how long will we remain in denial of the necessity to divest our investment in oil.

The quick answer is; as long as war is our main thrust; a hell of a lot of years; decades or more…

Inertia is a force of physics and not to be denied…

What this thoughtful article doesn’t cover except obliquely as yves summarizes with “behavioral inertia”, is the cost and influence of global corruption, the spring from which crapification flows, not to mention the inability to address over population.

One way to look at this is to ask why it was so easy 100 years ago to transition from steam (coal, wood, etc.) and whale oil to petroleum and automobiles and so difficult now to transition to renewables? There was a similar amount of infrastructure and “behavioral inertia” back then if one takes population and other factors into consideration. What’s different is that back then there was more room (and time) for corruption and greed to flower (as it indeed did) than now. It was a cleaner slate by virtue of historical fact, not by any fault of ours or lack of effort on our part to foul our own beds. At this point, as far as corruption goes, even on a global scale, the world is, well, saturated, or near it. It’s not so much inertia that pushes out max oil demand, but rather max corruption in so many forms big and small, of which inertia is but one symptom, urgency and lack of time another, that makes the transition to renewables so difficult. It’s not simply the vested interests of giga oil corporations, though that is a major obstacle. Instead, it’s everywhere, increasingly visible in every thing, like a pond that’s been invaded in every nook and cranny by non indigenous weeds, the ones that have no natural predator for control.

Austerity is the enemy of innovation; austerity is the child of corruption. Just one example. And so it goes.

There are a number of issues not mentioned that factor into any prediction:

1) Oil isn’t electricity. It’s not used the same way and currently can’t be used the same way. There are no electric airplanes, freight trains or cargo ships. Despite innumerate claims to the contrary, no current battery technology is capable of replacing hydrocarbon fuels. The volumetric energy density is not there and won’t be for the foreseeable future.

2) Price is a proxy for energy return. Prior to the current overproduction glut (the equivalent of squeezing a sponge harder for a few seconds), oil became expensive because acquiring it from fracking or drilling in deep water is more expensive, both energetically and economically. Despite the current overproduction blip, the upward pricing trend will inevitably continue.

3) Production breakdown will be nonlinear. The world’s current interdependent, global, just-in-time supply chains depend on *cheap* oil to be economical. When oil prices jump again, as they inevitably will, these will start breaking down in unpredictable ways as production and transportation costs increase. This affects everything, including the price of oil

4) Oil price feedback will eventually kick in, though this is far in the future. High oil prices increase the prices of all things dependent on oil for production or transport. Eventually, the high price of oil starts to affect the price of oil itself. Those spikes will be numerous and rapid, for a while.

re: your point 1.

Modern militaries run on oil.

This article, as do most reasonable discussions on the topic, focuses on the transition to renewables (BTW, trains CAN and DO run on electricity). Shipping and aviation could easily be continued using oil during that process without preventing dramatic reductions in carbon emissions. Ultimately, shipping and aviation will need to change, just as will society. But your predictions do not come about by any rational limitations of electricity vs. oil; instead, the culprit is far more likely to be mankind’s inability to let go of the damned banana so as to free up it’s hand..

I recognize that trains can and do run on electricity.I would even argue that in the long run, it’s cheaper to do so since electricity can be generated without coal or natural gas. Building infrastructure to support this, however, is neither free nor fast and I see nobody even attempting this for freight. It’s just not cost effective.

As for the statement, “shipping and aviation will need to change,” I quite agree. Shipping will eventually raise in price, and reduce in volume, while aviation is going to rediscover the blimp. As I stated before, the battery technology simply isn’t there, nor is it likely to be in the foreseeable future.

Energy intensity is in transportation is driven by time expectations which are culturally determined. Moving goods by sail would still be the cheapest but for the cost of time.

The market relation of time to money is a crushing force wherever one looks for it, relief at all those points both makes life more livable and less energy intensive.

The social change that presents the best opportunities is to simply slow down, but this idea is fundamentally anti capitalist.

Good clarifications, but the implication that trains, ships, and even planes would prevent us from reaching acceptable levels of carbon emissions if a serious effort was made to use renewables where ever possible, remains questionable.

Of all the uses of oil, trains and large ships are perhaps the MOST efficient and could easily be among the last things needed to address in a transition. Even the use of oil as a night time shock absorber where needed would remain viable for a long time while still permitting economies of oil consumption overall sufficient to tip the scales in our favor. Planes, on the other hand, will probably have to be replaced and the replacement may not be an easy sell.

Of course we both agree that society will change if it is to continue and that certainly means shipping, in it’s current state, becomes uneconomical. Personally, I suspect there will have to be a big increase in cottage industry. How to preserve the benefits of technology with the beneficial restraints of small (less globally corruptible) local enterprise is admittedly an issue.

Oil isnt’ electricity, but, I drive a Chevy Volt, and with zero change to my lifestyle, i’m running 190 MPG.

If there were more Level-2 chargers, particularly at the movie theater we go to and where the GF works,

we’d be at 250 MPG.

I have friends with Tesla Model S, and they drive around just fine.

The Nissan Leaf isnt’ a bad car, especially with the new 16 model, and Chevy will be turning out

the Bolt next year.

While Electric Aircraft aren’t in the product mix, I did a proposal 4 years ago for an electric military airplane.

It met all the requirements.

Your experience with electric vehicles misses the energy accounting fraud involved. Almost all of that electricity that goes into your Volt comes from fossil fuels, and the fact is that without the electric grid receiving at least 80-85% of its energy from steady source fossil fuels (or nuclear, which also relies on heavy fossil fuel subsidies to function itself), the grid would simply not function anymore. In other words, without heavy use of fossil fuel Volts and Teslas aren’t going anywhere.

Not true. The Union of Concerned Scientists did a thorough study on this and found, logically, that it depends on where you live. In many locations in the US, electricity is produced by NOT coal and NOT nat gas (hydro, nuke, wind all mixed). In those locations the electric car (or nearly 100% electric) is MUCH cleaner than gas vehicles, all things accounted for. In many central or south eastern areas, a lot of power comes from coal. In those locations an electric car isn’t much cleaner, all told, than excellent gas mileage gas vehicles.

The capper: most enthusiasts anticipate that electric vehicles will be recharged at NIGHT — when the grid is not so heavily taxed.

Wait … ?

How’s that again?

The REAL long term solution is synthetic liquid motor fuels. While not economically viable at this time — and for a long time to come — they will ultimately make sense — in the 22nd Century.

Electric cars ONLY work in benign environments.

Hawaii, the Virgin Islands — these are market niches that mate well with electric car metrics.

Alaska, Yukon, … the wild, generally, just can’t benefit from electric vehicles.

What ought to be the national priority ?

A super scale PV array in New Mexico. All conditions are ideal.

PV array COST is the real problem. New Mexico figures to be the lowest cost location for solar-electric conversion.

An array one-hundred miles on a side would be enough to power most of the nation. Of course, a project of such a scale will never be built — but it does give an idea of how even a fraction of one western state dedicated to PV collection would have a colossal impact.

I was involved in a book entitled the Carbon Conundrum, by Bob Kelly. Bob has a PDH in economics from Harvard. He mapped out the anticipated volume of fossil fuels remaining and it’s impact on the world climate. His take was that we’d run out of oil in the not too distant future and that it would take the world about 500 years to get back to pre-industrial carbon levels.

My take in Oil Dusk was to leave global warming out of the book and focus on the importance of oil to the current infrastructure in the developed world and what a disruptive transition might look like. Also, oil is truly scarce and took many millions of years to produce a quantity that will mostly be gone within the next hundred years. Oil scarcity concerns me a lot more than climate change.

While a book about oil scarcity might seem unrealistic at this juncture with world prices hovering in the $45 – $50 range, I remember twelve years ago when I couldn’t persuade the bank to provide me with a price deck above $30 a barrel so that I could make some energy investments. Within the next five years, we will almost certainly see oil prices return to at least $90 a barrel – and perhaps considerably more.

The real alternative right now to oil is natural gas and it’s likely that we transition from a oil to a natural gas energy infrastructure before we get to a solar and wind driven world structure.

Energy transitions are difficult and the actual path will make a huge difference in where we are as a species in the next 100 years.

Switching all the infrastructure from gas pumps to natural gas stations is no less difficult than installing charging stations all over the place – and ALL stations or workplaces or garages already have electrical power. Only need to expand the wiring to include chargers. Tesla is already starting to show storage is very soon going to be a non-problem, from that end.

You write, “While a book about oil scarcity might seem unrealistic at this juncture with world prices hovering in the $45 – $50 range…” Actually, the reason the price is low is due to the scarcity of cheap light sweet crude oil. We’re seeing more and more people unable to afford more and more of life’s necessities while simultaneously the cost of extracting oil is increasing (along with bankruptcies and mergers among energy companies to fend off the inevitable consequences of peak oil on debt, finance and the economy.) Low prices do not mean a glut of oil; they signal just the opposite. And then we have a neoliberal political/economy that worsens the matter.

Actually, it’s even CHEAPER to convert methane to liquid fuels in a refinery — right now.

Then there’s no need to change our retail infrastructure, our vehicles.

The sole and ONLY reason that natural gas powered vehicles look practical ?

They are paying ZERO road taxes !

Heh.

Such a scheme can’t possibly scale up big.

There are different ways of looking at the energy issue depending on where do you live and I appreciate very much the insigths from Mumbay, India. I live is Spain and I have a different view. India is growing briskly while spain is stagnated and will be so for years to come it seems. Instead of growing fossil fuel consumption we have seen a quite noticeably decline, particularly for petrol products. Since the beggining of the crisis, petrol products consumption has declined by 28% (From 75 million tons annually in 2015-2017 to 54 million tons in 2014). Domestic oil production covers less than 1% of total consumption. We depend almost totally on oil imports.

The observed decline has been caused of course by the financial crisis and high oil prices. Nevertheless, I bet that in Spain we have already seen an all-time peak oil consumption. Of course, lower oil prices are now playing in reverse and 2015 will see a modest rise in petrol products consumption for the first time since 2007. Nevertheless the observed decline shows clearly that an economy can function with much lower oil energy input. And there is still a lot of room to reduce consumption.

A country like Spain, totally dependent on oil imports and crushed by bad debt is very sensitive to oil price volatility and there are many economic incentives to reduce oil consumption and replacement with renewables. In a depressed economy like ours, every euro/dollar saved on imported petrol products has a multiplier effect on growth. Besides, pressure is mounting from the side of public health (toxic emissions from gasoil, fueloil and kerosene) and climate protection. Spain has not the size nor the population of India and its international impact is small. But it migth become an advanced laboratory trial to test the end of the Oil Age.

Funny you should mention Spain.

The politicians blew up the Spanish economy with a crazy scheme to go ‘all green’ with PV power.

Incredibly, rates as high as $0.56 per kWHr were contracted for. (!!!)

Source: the NY Times.

It bankrupted the nation. When such high-priced power was blended into normal sources — but in scale — the general public became obligated to pay $ 0.23 per kWHr — twice the French power rate.

Spanish manufacturers simply folded up… bankrupt. The ensuing mass unemployment cratered government tax collections. Then the government fell. (Socialists)

Such high power rates ruined the tourist business, too. For the peak season means air conditioning — and plenty of it. Tourists only want to sweat at the beach — not in their hotel.

Now Spain is in a great depression.

It’s not enough to be ‘Green’ — one has to do so at a reasonable cost — or it’s “game over.”

@DahrJamail | Are Humans Going Extinct?

If we dig up all the oil and gas, and if we convert all the oil shale, and if we consume these fossil fuels at the current rate, we will have enough to last us 150 years.

But we wouldn’t be here to see the end of those 150 years. Certainly no civilization would. Climate change overrules economic fantasy.

Oops, clicked too soon. I meant to add that if we don’t get completely off fossil fuels by 2050, the supply will not matter.

The Saudis have the largest reserves of high quality cheaply extractable oil. They are the highest rent producer. (There are likely further reserves of such cheap, high quality oil to be found in a couple of places, Libya and Iraq, but you can see the problem there, and after that there’s nothing left to be found of conventional reserves). But they must also realize that the age of oil is coming to a close over the next few decades. Hence it is in their interest to make sure that they sell off their reserves to the last drop, before the end, and thus to squeeze out higher cost unconventional producers. In the meantime, they also have an interest in keeping the global economy from recession, since the value of their immense financial reserves depend on the health of the global economy, which can readily be sent into recession by high oil prices. SO likely they will try to keep the oil price from rising above , say, $70 for quite some time. so as to balance out their various objectives.

The article is looking from 5,000 feet and not even getting anywhere near the clarity of the recent photos from the space shuttle. As peak oil hits in the nex 20 to 30 years (if not sooner), the transition to renewables will be well on its way to completion.

California may be leading the way, but even Texas is making a transition to renewables because they are cheaper. Austin has a natural gas plant but is adding solar at fixed 20 year prices that are on a par using current gas prices, let alone when they go back to $5-8/mmBTU. Coal has been essentially priced out of the current market.

San Diego Gas & Electric is predicting that cost and capabilities of batteries are at a point that there will be no more peaker plants built in CA. Our peakers, and even one that was not built as a peaker, run less than 1% already.

EV’s that only get 85 miles per charge will soon be replaced by those getting 200 miles per charge. With electric utilities having plenty of excess energy at night, recharging those at a reasonable rate will not be a problem. It will be the beginning of I.C.E. vehicles.

In many cases the costs of renewables for electricity are not hugely more expensive than brown power. A prospective $35M purchase of renewable power for 10 years is penciling out to average 5% more per year than an all brown power portfolio and 3% more per year than our existing portfolio.

California electric utilities are mandated to have 50% of their power coming from renewable sources by 2030 and Hawaii has a similar mandate to go renewable power. I can be done because our small municipal utility has been higher than 50% renewable for the last 10 years.

While the disgusting Saudi barbarians still control energy prices the end of their stranglehold is within sight. Changes in solar, wind, energy efficiency, storage, and electric vehicles are beginning to reinforce each other and will begin to transcend coal and natural gas, at least in the electric world.

if we changed our world, to cooperation instead of competition I’m sure we could create discoveries in energy that would dramatically reduce our consumption of oil. Only a global revolution can achieve this. Check out this teenagers revolutionary idea http://www.FB.com/Earthvote

One hesitates to add to an overly long thread.

Conversion to renewables is just happytalk. Conversion to anything is just happytalk. A quick look at physical fundamentals would reveal that there is simply not the means to continue industrial civilization in anything vaguely like its current configuration.

Civilization will be seriously disrupted–more likely, ended. Any technology or process that would mitigate the resulting suffering would need to be robust against disruption. High technologies and complex systems will not be robust, and will be of no use.

Photovoltaic technology is a mid-term, niche, small-scale amelioration. It cannot power the grid, and it cannot replace the grid. Until panels can be made without rare-earth elements, the supply is seriously constrained by geology. Even if they are freed from rare-earths, the high technology and long suppy chains mean they will not go more than a few decades into the future.

The grid itself will go down, region by region, never to return.

Those of us who use photovoltaics know they are wonderful for the small-scale low-power applications to which we put them. And of no use for the high-energy large-scale schemes we keep hearing about.

Capitalism has been mentioned. The key point is that return on investment (on loans) is in fact usury, and fundamentally criminal on a finite planet. The Industrial West “got away with” usury for five centuries firstly because of imperialism (colonialism–the immiseration of the periphery to prop up the center) and secondly because of cheap fossil fuels. Now that both of those are at an end usury just means destroying the economy that already exists in the name of trying to pay back the unpayable. Usury drove expansion, when expansion was physically possible; now it accelerates decline. If we eliminated return on investment tomorrow, we would open a window for addressing our problems. But usury will not be eliminated, and thus the chance of addressing our problems is nonexistent. Won’t happen–end of story.

There is much to be done nonetheless. Learning to live will less, and on things which can obtained locally, is both possible and necessary. Managing local, available sunlight for heating and cooling was well researched (and ignored) back in the 1970s. Much can be done on a small, local scale.

Meanwhile greenscams are everywhere, and will increase. Greenscams–proposals for endless energy and stuff (delivered in an environmentally friendly way, of course)–are about to become their own proper industry. As everyone wants the impossible, greenscammers promise just that–money up front (from you, the sucker) for unicorns delivered in the future. After all, who can prove the unicorns won’t appear? This industry will be very profitable until we run out of suckers. I give it a decade.

–Gaianne

Great post, spot on.

Just about the best take I’ve found on this subject – and on money and economics – is Frederick Soddy’s “Wealth, Virtual Wealth and Debt” (2nd edition). Here are some samples:

• …though as yet the applications of the knowledge to the economics of life are not generally realised, life in its physical aspect is fundamentally a struggle for energy,… p. 49

• As Ruskin said, a logical definition of wealth is absolutely needed for the basis of economics if it is to be a science. p. 102

• The vast potential productivity of the industrialised world, particularly in the engineering and chemical industries, must find an outlet. If that outlet is by financial folly denied it in the building up and reconstruction of the home-life of nations, it remains as a direct and powerful incentive to the fomenting of war. p. 303

The first bullet obviously goes far beyond mere oil wars. Ecology 101 says we can’t turn the earth into one wriggling mass of humanity, that other forms of life are necessary to sustain our existence. You’ve heard variations of the second bullet before, e.g. Oscar Wilde describing the Anglo Saxon version of economics: “they know the price of everything and the value of nothing.”

If the third bullet doesn’t ring a bell, you have been listening to too much Fox news. The military industrial complex gained its death grip on the American economy in the aftermath of a Great Depression that left America’s financial and political leadership with a profound fear of the return of peace. At stake was not just unparalleled political and military hegemony but the power to create money ex nihilo and exchange it for the world’s wealth.

As others have pointed out we are stuck in a situation where there is no overlap between the range of oil prices which allow extraction companies to cover production costs and the range of prices which customers can afford to pay, while keeping the economy alive. There used to be a big sweet spot where both producers and customers were happy, and the economy could expand. We are now reduced to scraping the bottom of the barrel with tar sands, shale oil, arctic, and deepwater sources. The cheap oil that we all think of as normal does not exist any more. Thus arises the dilemma stated above. The usually stated alternatives only function because they are immersed in a soothing bath of (hidden) fossil fuel subsidies. There really is no “solution”, the best we can hope for is to mitigate the unpleasantness as we migrate to a lower energy consumption future.

Digital electronics is making oil cheaper than ever.

1) It’s extending retail efficiencies at the point of use. The results have been astonishing.

2) It’s extending the resource base — exponentially.

It’s this latter economic threat that has the Saudis flipping out.

We’ve been ‘here’ before. A century ago was the beginning of flotation cell mineral concentration technology. Circa 1915 it looked like the planet would run out of minerals.

It appeared that a HUGE price increase would be suffered as inferior grades became all that was left.

Then, out of left field, flotation cells — and the chemistry driving them — changed everything — forever.

Other than placer deposits, today all significant mines use ‘benefaction’ technology. All ores are pulverized and separated. ( iron, by magnetism; most others by flotation cells )

The hard rock resource base for humanity exploded by 1,000 times over.

America’s largest gold mine works an ore body that was not even recognized as even having gold — in the 19th Century.

Now this same leap in resource extraction is underway with smart drilling tips.

The Russians claim that they have a thin strata of crude oil that largely covers European Russia — everything west of the Urals. !!! They claim this strate has 1,000 times as much crude oil as all of Saudi Arabia… by itself. They just have not been able to extract it economically — though it was discovered in 1953 and kept a state secret all these years.

Which brings us to politics: ALL of the oil drillers and oil nations have every incentive to LIE about their situation.

When was the last time you heard a gold miner say: “I’ve hit a major strike at location X ?”

No-one ever admits prospecting success. This means that we are, all of us, fed a steady diet of lies — from everyone in the know.

Which rather kills any predictive insight.