This is Naked Capitalism fundraising week. 864 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in financial realm. Please join us and participate via our Tip Jar, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our fourth target, 24/7 coverage, 365 days a year.

UK-based independent private equity researcher has prepared a short but very instructive analysis which we’ve embedded at the end of this post. One of the ongoing struggles in the effort to penetrate the private equity regime of unwarranted secrecy is that, as we’ve discussed, investors have for decades entered into contracts that unlike virtually ever other legal agreement that state agencies have entered into, have been kept shrouded in secrecy. Worse, as the SEC’s former examination chief Andrew Bowden described in May 2014, these contracts are surprisingly one sided by virtue of begin vague on key terms and allowing for weak ongoing oversight. And the SEC also described how the private equity firms are not merely exploiting the ambiguity they created, but went further by taking fees to which they were not entitled, which in any other line of work would be considered stealing and result in a customer never using that vendor again, as well as other serious compliance abuses. Yet the private equity limited partners continue to remain in deep denial about what the depth and extent of this misconduct says about what their supposed partners, as if that meant for more than the mere type of legal vehicle used.

Reflecting the depth of intellectual capture among the limited partners is the continued foot-dragging in their efforts to get to the bottom of the matter of fees and costs. As anyone with a modicum of financial training will tell you, it’s critical to understand the total charges involved in order to assess a manager and strategy. As Georgetown law professor Adam Levitin stressed when California public pension fund CalSTRS attempted to defend the fact that it did not track one of the biggest charges that private equity general partners extract from the funds they manage, that of the profits interest widely called a “carry fee”:

CalSTRS argument is like saying that the only cost of a credit card that matters is the annual fee, not the interest rate or other fees. Smaller management fees could be offset by larger carry costs. It’s total cost that matters.

And that concern is confirmed by the fact that Maryland Policy Institute found that high fee strategies like private equity cost public pension funds billions compared to lower-fee alternatives.

One reason that public pension fund employees are resisting the effort to get at total fees is that they have a dim idea how big the total is, and they know it will correctly call into question why private equity firms are taking so much, particularly since, as Eileen Appelbaum and Rosemary Batt discussed in Private Equity at Work, over 60% of their revenues come from fees that have nothing to do with performance. This puts paid to one of the widely-repeatedy myths of limited partners: that the general partners’ interests are aligned with theirs. In fact, the general partners get rich no matter whether their funds do well or not, although it is true they get richer when they deliver on their performance promises.

Ludovic Phalippou of Oxford has estimated that the total cost is likely in the range of 7% per annum. That is so high as to call into question why the limited partners have tolerated this for so long, particularly in light of what is now a decade of serious underperformance relative to benchmarks at CalPERS, CalSTRS, as well as savvy endowments like Harvard. But rather than demand a fee regime change in light of the new normal of lower PE performance, the limited partners appear to prefer the expedients of defining investment deviance down and lowering their benchmarks. That’s like telling a sprinter that can’t finish the 100 meter dash quickly enough to be competitive is to time him on an 80 meter run.

The efforts of the limited partners that are circling the wagons to defend the private equity secrecy regime looks particularly dubious in light of the data that Peter Morris has complied from the financial reports of the four private equity firms that have publicly traded stocks: Apollo, Blackstone, Carlyle, and KKR. Most of them disclose for the bulk of the funds that they manage, both gross and net IRR (internal rate of return). While we have stressed that IRR is a deeply flawed metric for measuring fund performance, the difference between gross and net IRR does give a rough idea of what investors are paying to private equity general partners. Keep in mind the result is still an underestimate, and certainly a meaningful one, since it does not include the compensation that the private equity firms take directly from the portfolio companies themselves.*

Based on a very small sample, Morris finds that Phallipou’s 7% estimate is in the ballpark:

Both CalPERS and CalSTRS list on their websites the private equity funds they have invested in over time. CalPERS discloses both a net IRR and a net cash multiple for each fund; CalSTRS, only a net IRR. Neither discloses a gross return of any kind. That makes it impossible to see how much the pension funds are paying in order to receive such net returns as they do disclose.

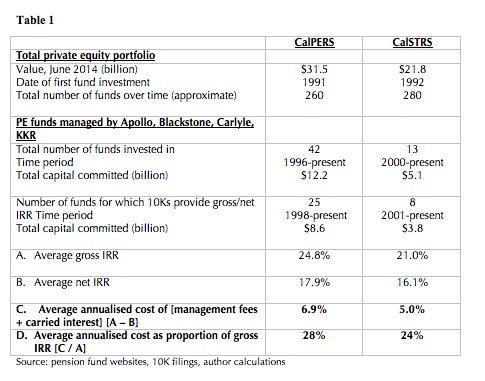

Given their size, CalPERS and CalSTRS have inevitably invested over the years in numerous funds managed by Apollo, Blackstone, Carlyle and KKR. The table below summarises what those four firms’ SEC filings reveal about the funds in which CalPERS and CalSTRS have invested:

C gives a broad sense of how much it has cost CalPERS and CalSTRS to invest in private equity over the last 15-20 years. Based on a range of funds managed by four of the largest buyout firms, the annual cost to these pension funds has averaged between 5% and 7%. (Remember, this figure excludes the impact of portfolio company fees that are paid directly to the private equity managers.)

5%-7% per annum is several orders of magnitude higher than what pension funds like CalPERS and CalSTRS pay to invest in more conventional strategies. It is similar, however, to what some analysts have estimated in the past for private equity.

Aa Morris continues:

Here are some of the questions that this analysis suggests:

• Over the last fifteen or so years, Apollo, Blackstone, Carlyle and KKR have on average received about one-quarter of the total gross return on funds in which CalPERS and CalSTRS invested (not including portfolio company fees). What proportion did that represent of the gross extra return that the managers generated in the first place (over an appropriate stock market benchmark, adjusted for risk)?

• How much of the extra return (over an appropriate stock market benchmark, adjusted for risk) was left for CalPERS and CalSTRS?

• If not much of the extra return was left after management fees and carried interest, then why have CalPERS and CalSTRS agreed to go on paying such high fees?

• How much further did portfolio company fees (after adjusting for rebates, when applicable) reduce the net return for CalPERS and CalSTRS?

• Why do CalPERS and CalSTRS not disclose both gross and net IRRs for all their private equity funds?

• The answer may be that confidentiality agreements prevent the pension funds disclosing both gross and net IRRs. If so, then what is the reason for this information being confidential in the first place? Apollo, Blackstone, Carlyle and KKR apparently do not believe that revealing both gross and net IRR in their 10K filings will hurt their business. Why should other private equity firms fear disclosing what their gross investment returns have been, and how much their fees have reduced the net return?

The last point is more important than it appears. These four fund managers are public. These disclosure are there for anyone to see. The sky has not fallen in on any of these four giants by virtue of them making this information available. Yet if you were to listen to industry stalwarts, or even the limited partners, you’d think presenting this data was a fundamental threat to these powerful firms’ businesses.

Earlier in his paper, Morris describes how ludicrous it is for funds like CalPERS and CalSTRS who have not been diligent about collecting fee data to defend their lapses:

CalPERS and CalSTRS might say private equity is complicated. True. But that has not got in the way of the South Carolina Public Employee Benefit Authority and the Texas County and District Retirement System. Although these pension funds are both much smaller than their California peers, they still manage to do better in this respect. Their annual filings disclose both management fees and performance fees (so-called “carried interest”) for their private equity portfolios.

CalPERS and CalSTRS might also say that confidentiality prevents them from disclosing much detail of their private equity investments. This does not seem to have stopped the South Carolina and Texas schemes. It also conveniently ignores the fact that the public domain already contains more information than CalPERS and CalSTRS choose to disclose. This readily available information sheds some interesting light on how much private equity managers cost. It also raises questions about why the public disclosure by funds like CalPERS and CalSTRS is so thin.

As a reminder, look at the responses that CalSTRS board members made to a call by a powerful union for more disclosure:

Dennak Murphy, American Federation of Teachers: We understand that you have been working hard on this issue. It is astonishing and troubling that hedge funds, private equity funds, and many real estate managers do not fully disclose the complete cost of investing. We know all of you, especially Controller Yee and and Treasurer Chiang, have been working hard on this and urge your persistent attention until full transparency of all investment fees and costs becomes the standard for all pension investors, their managers, and their consultants. We understand this will take some time, we understand there are concerns about being an investor of choice, we understand that some alternative assets deliver superior returns over time and that’s important to remember, and we know that costs matter. What is not measured is not managed. While net returns is clearly what matters most, hidden, secret, and need I say embarrassingly high fees should be disclosed. We believe that undisclosed fees and unreported fees are significant and are a fiduciary challenge. We again urge you to lead in this effort through your workplans or a fee workshop or a consortium with like-minded investors to investigate and address this embarrassing risk that we believe is as yet unmanaged.

We thank you again for your extraordinary work on behalf of California teachers and taxpayers. Thank you.

Sharon Hendricks, Chairman, Investment Committee : Mr. Murphy, we appreciate that. As you know, I’m going to read a statement from I guess myself as the chair of the investment board. Just to respond, that our board is reviewing private equity reporting and accounting practices. I think the challenge for us is balancing our responsibility to achieve the highest return while being as transparent as possible. So as part of this process, we’ve asked our staff current industry standards on profit-sharing arrangements or what we’ve talked about today is called today “carried interest”. Currently staff can estimate with a reasonable level of accuracy the amount of carried interest its investment partners receive, but as a board, we want more information regarding this issue to follow up on the recent public debate. So we have asked staff to identify strategies to address these concerns and report back to us. So, thank you. Miss Yee?

Betty Yee, Controller, State of California: Thank you, Madame Chair. I just want to thank Mr. Murphy for coming forward. I just want to assure him that we are definitely giving this issue serious consideration and I appreciated your statement while identifying the complexities of really getting our arms around this. This is a complex asset class but I just want to assure you that this board is being very diligent about some of the concerns being raised.

Yee’s response as an elected official is particularly disappointing. Perhaps we missed it, but we have yet to see her support California Treasurer and fellow CalPERS and CalSTRS board member John Chiang’s call for legislation to require full disclosure of private equity fees and of related party transactions. Does this silence speak to her desire to curry favor with the private equity robber barons? Or is it her merely being new in her role as board member and taking an unduly deferential posture towards staff, which themselves are captured?

CalPERS at least has seen how the winds are blowing and its staff has indicated that it supports Chiang’s proposal. By contrast, CalSTRS, as you can see from the video above, has refused to relent on the matter of gathering carry fee information, despite other funds demonstrating that it’s a mere matter of doing the work. CalSTRS has no legitimate excuse, but is trying to mislead beneficiaries that are unlikely to be following developments at other public pension funds that this is oh-so-hard and therefore demands further study.

If you are a California citizen, it’s time to tell Yee that her job is to oversee staff at the public pension funds, and not run interference for their retrograde behavior. If you have friends or family in California, please send this post to them and encourage them to write or call her. Her contact details:

Ms. Betty Yee

California State Controller

P.O. Box 942850

Sacramento, California 94250-5872

(916) 445-2636

Thanks again for all your efforts to bring more transparency to this secretive industry.

___

* Yes, these charges are typically offset against management fees, but the fee offsets are estimated by CEM Benchmarking to average 85%, so a portion is still kept by the general partners. Moreover, the offsets are limited to the amount of management fees. Not only have reporters and the SEC identified cases where charges were not offset as investors assumed they were, but we have been told about additional ways that the general partners may be gaming the fee offsets.

Another great post on this topic. The ending teaser is a real cliff-hanger–

.

We really need a sea change in the extent of transparency that pension funds must require in order to invest in PE, and in the extent of transparency that PE funds must provide on a statutory basis.

Individual states should take action on this in tandem with pressure at the federal level. It’s up to us to put the pressure on all sides. As you and commenters have previously pointed out, when a pension fund is underfunded it is always the general taxpayer who loses out when governments have to pay the cost of public service pension fund shortfalls.

By contrast, CalSTRS, as you can see from the video above, has refused to relent on the matter of gathering carry fee information, despite other funds demonstrating that it’s a mere matter of doing the work. CalSTRS has no legitimate excuse, but is trying to mislead beneficiaries….

So, unlike CalPERS which is making an effort to correct an error, CalSTRS is digging in to continue the error.

Fortunately, Yves’ continuous reporting on PE fees is laying siege to CalSTRS unsupportable position.

Thanks again for these great reports.

Why are the large public pension funds so keen to invest in Private Equity? One of the reasons may be that they receive all sorts of ‘inducements’, free tickets to sports events to name the most innocent one. Given the huge amounts of money involved it would take a saint to resist temptation.

Many thanks for keeping up the effort into this topic. I presume that the fee structures can be complex (but not so much that the pension managers can actually do their job).