This is Naked Capitalism fundraising week. 101 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, PayPal. Clover, or Wise. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year,, and our current goal, strengthening our IT infrastructure.

Yves here. We haven’t done a “How’s your economy?” reader query in quite a while. The latest GDP revision suggests it might be useful to get some sightings. Even if the plural of anecdata is not data, it can make sense of things that don’t seem to add up.

The big anomaly here is the now-very-peppy 3.8% second quarter GDP, now revised two times upward from its original 3% level. That stands in stark contrast with anemic jobs growth. It also seems inconsistent with many reports, both in the press and from readers, of many small businesses suffering bigly from tariffs, making them unable to sell their wares at anything like their former price points, having great difficulty finding US sources, and seeing their revenues shrink to the point of vanishing.

Similarly, growth in the US has increasingly been help up by spending at the very top of the income chain. Yet there are signs of less than robust health there, from luxury vendors faring badly to a collapse in art sales.

Perhaps what is going on in the economy parallels the stock market, with averages propped by ginormous AI valuations at a very few companies, along with ginormous AI “capital investment” which as Ed Zitron has chronicled in detail, has produced almost bupkis in the way of revenues. AI is one sector with superheated activity. Are there other very strong pockets that could more than compensate for what seems like way too much lackluster activity?

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Government consumption and inventories were a bigger drag though. All adjusted for inflation.

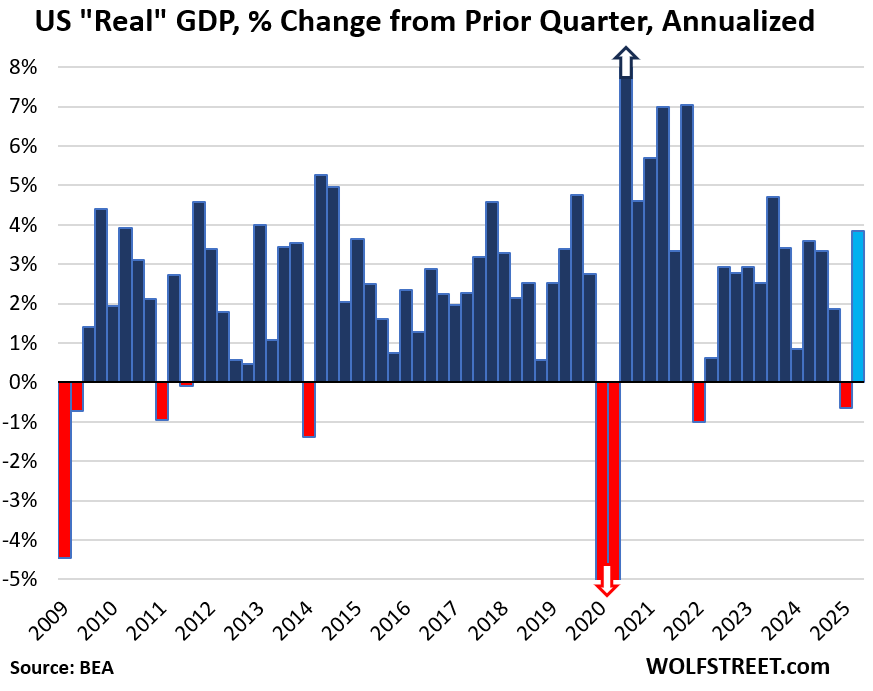

Back on July 30, the “advance estimate” of GDP for the second quarter showed 3.0% growth, held down by anemic consumer spending growth and plunging inventories. The “second estimate,” released on August 28, revised GDP growth for Q2 higher to 3.3%.

Today, the “third estimate” of Q2 GDP revised Q2 GDP growth to 3.8%, the fastest growth since Q3 2023, driven largely by a big up-revision of consumer spending. This 3.8% rate of growth is in the hot zone for the US, whose average GDP growth over the past 10 years is just over 2%. All growth figures are adjusted for inflation.

The “first estimate” of GDP growth is the one that gets all the attention in the media. The revisions are normally not the focus of any attention. For that reason, I will compare today’s “third estimate” to the “first estimate,” in part because the up-revisions were so big and cumulative.

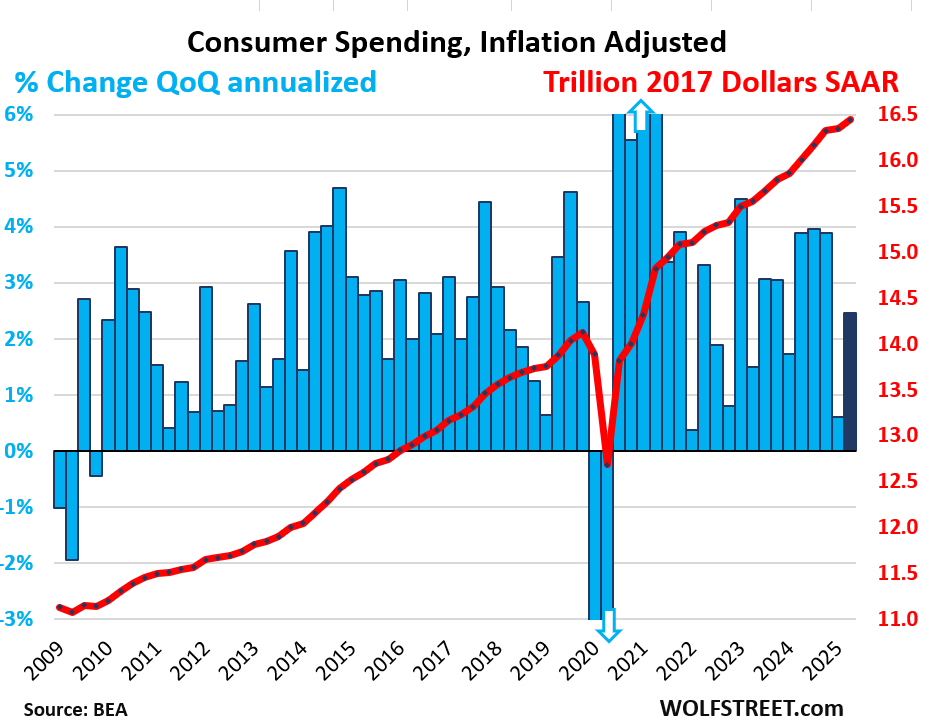

Consumer spending growth was revised up to +2.5% in Q2. The first estimate had pegged consumer spending growth at a worrisomely anemic 1.4%, the second estimate at 1.6%. Today’s massive up-revision to +2.5%, nearly doubling the growth rate of the first estimate, was the biggest contributor to the up-revision of overall GDP growth (all adjusted for inflation).

This 2.5% is healthy growth in consumer spending. The red line shows the annualized consumer spending in 2017 dollars (right scale). The blue columns show the growth rate in percent (left scale).

Private fixed investment was revised to a growth rate of 4.4%, from the dreadfully anemic 0.4% in the first estimate. Today’s up-revision substantially contributed to the up-revision of overall GDP growth:

- Investment in equipment was revised up to +8.5%

- Investment in intellectual property was revised up to +15.0%.

- Investment in structures had plunged by 10.3% in the first estimate. This plunge was reduced to -7.5% today.

But residential fixed investment (such as construction of single-family and multifamily homes) was pegged in the first estimate at a drop of -4.6%; this drop increased to -5.1% in today’s third estimate, and lowered the up-revision of private fixed investment.

Revisions That Pushed the Other Way v. First Estimate:

Net exports (exports minus imports) were revised lower, they worsened:

- Imports plunged a little less (-29.3%) than the first estimate (-30.3%); imports subtract from GDP.

- Exports fell by 1.8%, same rate as the first estimate. Exports add to GDP.

Government consumption shrank by 0.1% (federal, state, and local governments combined), compared to growth of 0.4% in the first estimate.

The plunge in private inventories worsened, and deducted 3.44 percentage points from GDP growth, versus 3.17 percentage points in the first estimate. Inventories had soared in Q1 on tariff-frontrunning, and in Q2 they undid some of that increase.

What Slowdown?

The strong Q2 growth came after the explosion of imports on tariff-frontrunning had knocked Q1 GDP growth into the negative (-0.6%). Consumer spending growth in Q1 was also weak. So there were a lot of concerns about growth. And the first estimate of Q2 consumer spending growth (+1.4%) did nothing to alleviate those concerns.

But the revised Q2 growth figures, especially the up-revisions of consumer spending back into the healthy range, should relieve those anxieties.

And Q3 consumer spending so far looks pretty good, as indicated by strong retail sales in July and August. So maybe the wait for the downward spiral of the economy – despite reduced government spending – may have to be extended a little further?

Is this the first cooking the books we are getting since trump fired everyone reporting data he didn’t like?!

Because on the ground I have friends losing jobs due to budget cuts, unable to find jobs, and moving into long term unemployment….

Relax, if you don’t have cooked-to-order official numbers, you can’t make bitchin’ graphs with squiggly lines which run akimbo, that somehow mean everything is a-ok.

I doubt this numbers have been toyed with (yet). So many crazy things have happened in the last 9 months you can’t expect the headline number to tell you much of anything. Imports are a negative in the GDP calculation and they dropped massively; that’s a significant reason why even in the first estimate we had GDP of 3.0%. I’m not surprised CPE was revised up… 2.5% is healthy and it follows a .6% Q1 when people were delaying decisions as chaos reined in DC. The other important numbers were all likely related to the AI bubble investment spending and that wont last. Considering all this doesn’t mean you don’t have a sick patient, you just happened to catch them on a good day. My guess is we could have an October surprise in the markets… there are increasing more articles about an AI bubble and even people saying it’s not sustainable. At some point those conversations are going to turn into cancelled purchase orders.

That was my second thought about this; if AI spending is really fueling a notable amount of economic “growth”, that must be reflected in one or more components of this print. Bubbles can persist for a really long time, though, so I guess we’ll see what happens. Sooner or later, though, these investments must be shown to generate a profit worthy of the funds invested.

What’s more: Core inflation rate held at 2.9% in August, as expected, Fed’s gauge shows

I thought I’d seen the end of “revenge spending”, a stupid trope, revenge for what?

this cracks me up in that Wolf didn’t toucj on the blatantly bad news of the week for the bottom 85%—-Carmax’s dreadful earnings. (maybe he did at his website) …which wasn’t a surprise if you follow the used car market

we are in a bifurcated economy…too much liquidity for the top 0.5%, too little liquidity (and big tax increase—the tariffs and non-tariff commodity shocks) for the bottom 85%

I work in local government and what we’re experiencing is 180 degrees away from this report. When I saw the articles yesterday trumpeting this growth I was like “this must be happening in the universe where Spock has a beard” …. I’m retiring in a few months but they say they can’t hire a replacement, and I’m not a top tier employee. Other positions are also going unfilled and still they are having to lay people off.

And it’s not just work, my friends are mostly looking to cut back on pretty much anything that isn’t a necessity, and changing grocery types and going to outlets and following sales.

Whose consumer spending went up during April to July? Because it wasn’t the folks I know in my county, or family.

We just bought new car and laptop (a year earlier than planned/necessary) to get ahead of the obviosly incoming inflation. I wonder how much of the econ boost is due to people trying to get ahead of inflation?

High inflation rates tend to increase the velocity of money as no one wants to be sitting on cash as it slowly devalues over time

Building on Laughinsongs’s anecdotes which raise some doubts about the value of the GDP numbers, there’s a man named Craig Fuller who posts on X under @FreightAlley. This is what he had to say a couple of days ago:

For me – I’ve been dealing with a 100 yr old house and have had to replace the main sewer line to the street, then the central heat stopped working after 40 years and I had to replace that. This is the most money I’ve spent in decades all in one year. Fortunately I have no debt and have been saving for my grandson’s education. The silver lining is that with my 10 yr old solar panels, I’ve finally become gas free and my PG&E bill was less than $30 last month. I’m just glad that I’ve done this as the coming decline means less expert work.

$ 2 trillion dollar deficits leave a mark. They are trying to say that goods inflation is 2% while services inflation is 3.5%. There is an increase in sales of goods but little information about volumes. A realistic measure of the GDP deflator like Tim Morgan’s RCCI would be a big help but it hasn’t been updated for a while for the US ,understandable since there is huge churn going on in the US. BEA says the US is still borrowing $ 400 billion a quarter from overseas to keep the plates spinning.

Stagflation-lite while the deficits continue is the best guess. When the bailouts are needed for the stablecoin bros and the AI complex it will no longer be lite.

Source = law360.com

Its a Friday and its pick your parking spot at unbelievably empty Newark International. Perhaps 50% of parking capacity taken at terminal c and we got $110 shuttle flights to Reagan. I booked a debate team in a DC hotel at the tournament rate – usually very reasonable – then I had a last minute addition and needed another room and it was actually cheaper at the desk for two nights than what was reserved at the high school rate a month ago. I think the 1% is spending for everyone else (like, for example, on tuition here at the Georgetown Day school).

Given the way gov’t numbers have looked suspicious lately (whether they were “corrected” later or not), I’m not so sure if I could put much trust in these figures any more.

Its just the number for a single quarter. Q1 was a contraction of 0.5% and Q2 is growth of 3.8%, put them both together and you have 1.7% annualized for the year. Pretty close to the average of 2.2% since 2000.

I still don’t get how growth of 2.2% with a balanced budget can be considered the same as 2.2% growth with a deficit of close to $2 trillion – which is the average deficit for the past 9 years. That deficit is pumping $6,000 per year, per capita; close to 8% of GDP into the economy but only generating $600 billion in growth.

On the ground here in Northern California, we are definitely in a recession and have been all year. Everyone is struggling to varying degrees. Restaurants are relatively empty. Tourism is down. Wine sales are way down. Entrepreneurs and small businesses are getting slammed by tariffs. Sports events and concerts are empty. People I know who are looking to be rehired in tech industry have been unsuccessful.

The 8.5% increase in equipment purchases in the report could be spend on data centers and Nvidia chips. So sure that might be “legitimate,” even if absurd and short-lived.

Other than that, the massive upward revision in consumer spending is highly suspect.

Finally the 15% increase in investment in investment in “intellectual property” is perplexing. That sounds like it might be an attempt to recategorize expenses (ie, salaries, office rent) as investments. If there was a rule change in this area, that could explain a lot.

As for the idea that these numbers were not manipulated, please give me a break. These are revisions after all. Revisions that were made last week… revisions that were made by an administration that just fired the bureau of labor statistics Commissioner because Trump didn’t like bad labor numbers.

So of course the numbers were manipulated. That is absolutely certain. The only question is how.

I work for a company that manufactures high-end scientific devices along with the corresponding chemicals and other assorted consumables, repair parts, etc. We also do service & repair agreements and software subscriptions. We manufacture about 2/3 of our products in the US and export all over the world.

Earlier this year we had a “temporary” price increase which was explicitly due to the tariffs; about a month ago it became permanent and then we had our normal annual price increase. For reference the largest part of our customer base are municipalities, utilities, food manufacturers, and energy producers. Our stuff isn’t cheap in the first place and it’s getting more expensive. We’ve also had some trouble sourcing things like certain chemical feedstock.

We’ve been doing a lot of hiring (especially entry level) due to internal promotions because the business is doing well, however we’re definitely an outlier. It helps that the people who buy our products have to do so as a matter of regulation & law. Home prices locally are starting to get hit hard and there’s a lot of local construction, but easily close to the majority of the local population is Boomer.

only 2 trucks worth of hunters coming down my road so far this year…normally its at least 6 trucks worth…sometimes even 10(whole cluster of RV’s and other assorted “hunters cabins” in a big circle back behind my neighbor at the end of the road)

similar to post 9-11 and 08.

also seen fewer than normal picking up deer corn and such at the feedstore.

hunting is expensive, and the not-so-rich save up all year for opening day.

it is also a huge boost to the local economy..with follow on(multiplier) effects that spead all around, top to bottom….but that multiplier can go both ways.

You guys can do what you want, but over here we will not believe any economic statistics issued by this administration, insofar as it has already made it very aggressively clear that it will lie about anything, including economics statistics, regardless of the consquences.

Well, here in northern Appalachia, I can tell you that I know of 2 hardwood sawmills and one softwood mill that have closed permanently. The one that I know the most about, which was in my town, produced 2 million board feet of high value hardwood per year, owned 20,000 acres of timberland (consider that they did not have to buy a significant fraction of their logs on the open market), had been in business for over 120 years, and had done a fairly serious modernization about 20 years ago, and carried no debt. The tariffs destroyed the market by shutting off exports (due to retaliatory measures). I also know of a couple of dairy farms that have recently closed, so that trend which has been occurring for the last 5 years or so is continuing. My own household has found it financially increasingly tighter and tighter as each month passes, and I am lucky enough to have a job that provides annual COLAs (which obviously do not even come close to offsetting inflation). I do not believe these numbers either, and on top of the things we see, you also know that tourism is way down, and any economic activity driven by immigration, whether legal or not, also has to have fallen off a cliff.