It’s a mystery why CalPERS keeps putting its hand in the buzzsaw by continuing to present misleading or outright false information, now that the trade and even the mainstream press is becoming more savvy about private equity.

The latest example is the content of and the messaging surrounding the publication of CalPERS’ most recent Comprehensive Annual Financial Report, or CAFR, as they are called in the public pension fund world, for the year ended June 30, 2015. CalPERS doubled down on its incomplete and therefore inaccurate reporting of private equity fees and costs.

CalPERS is Still Misleading Its Beneficiaries and California Taxpayers About the Total Cost of Investing in Private Equity

We’ll start with the big items and then dip into some details. Let’s start with the headline from Private Equity International, CalPERS paid $414m in fees to PE funds in 2014. As we will discuss post haste, this headline is utterly false. CalPERS’ fees to PE were more on the order of $2 billion, making this a massive understatement, approximately $1.6 billion, or 80%. And that headline was not the result of helpful cherry-picking by a private-equity-friendly trade publication; it faithfully picked up CalPERS’ messaging. From the article:

“The California Public Employees’ Retirement System released its annual comprehensive investment report, which indicated that of the total $414.1m paid to fund managers in 2014, the largest portion of it went to a managed account with Apollo.

The California Public Employees’ Retirement System (CalPERS) paid $414.1 million in fees and costs to private equity funds in 2014, according to CalPERS annual investment report released on 7 January.

This is down 6 percent from $439.7 million it paid the previous year.

CalPERS spokesman Joe DeAnda told Private Equity International that the fees include “everything besides carried interest” and consist of “mostly management fees.” The fees and costs were paid in relation to CalPERS’s Public Employees’ Retirement Fund (PERF).

In November CalPERS released carried interest data for the first time, showing a total $3.4 billion shared in profits with managers advising funds for the pension system, as PEI reported.

First, it is absolutely false to say that fees include “everything besides carried interest”. This total does NOT include all the management fees, which is the 2% annual charge in the protoyptical “2 and 20” private equity fee schedule (the “20” is the 20% carry fee, which is 20% of the profits after a hurdle rate, usually 8%, has been met).* It includes only management fees paid in cash, and excludes the large portion of management fees shifted onto portfolio companies via management fee offsets.

Private equity general partners charge numerous fees to the companies they have purchased with a fund’s money. As limited partners started objecting to how large these fees were getting, rather than simply saying, “Cut it out,” they agreed to the peculiar and non-transparent ruse of having the general partner rebate (“offset”) a percentage of these fees, which in recent years has averaged 85% across outstanding private equity investments, against the management fees, which are paid quarterly.

Whether a dollar is paid directly by the investors via funds they wire to the general partners, or indirectly by being shifted onto the companies they have purchased, the money still comes from the limited partners. Industry standard-setter and CalPERS’ own consulting firm, CEM Benchmarking, underscores this reality. From a seminal 2015 report, The Time Has Come for Standardized Total Cost Disclosure for Private Equity:

We believe that the LP share of portfolio company fees is misrepresented by the industry as a management fee rebate or offset. The net management fee amount does not reflect total management fees paid to the GP because the “rebated” amount is still an expense to the portfolio company and therefore an indirect cost to the LP.

CalPERS’ continuing to report only the net management fee is the sort of intellectual dishonesty we’ve called out in other aspects of how investors like to look at private equity: too many prefer accounting fictions to economic realities even though they know better.

As Georgetown Law Professor Adam Levitin said earlier, “It’s total cost that matters.”

Second, excluding the carry fees, which CalPERS did not include in the CAFR even though it had the data as of July last year, is like an obese man saying, “I only weigh 195 if you exclude both of my legs.” The cost of the “carry fee” most assuredly is part of the total costs. Levitin again: “Smaller management fees could be offset by larger carry costs.”

Oxford professor Ludovic Phalippou’s reaction to the CalPERS’ private equity fee claims:

I am surprised that CalPERS is continuing to provide a false number for the fees they pay. By now GPs are saying that they give the detailed portfolio company fees to their LPs and CalPERS said they now had the system in place to track carried interest – hopefully both realized and unrealized one.

But they keep on pretending nothing had changed. Yes, $400 million is a high number in absolute term but it is pointless because we do not know how much rebate there has been etc. It is almost laughable that they are comfortable writing $400 million in their (ironically?) titled comprehensive annual report. It would mean that private equity managers make just as much as mutual fund managers (relative to NAVs). It does not add up. If I had to make a guess as to the true fee paid to PE by Calpers, it would be about $2 billion a year. And if I am right (my previous back of the envelop calculations on fees at CalPERS turned out to be), then I hope that CalPERS received a big thank you card for Xmas.

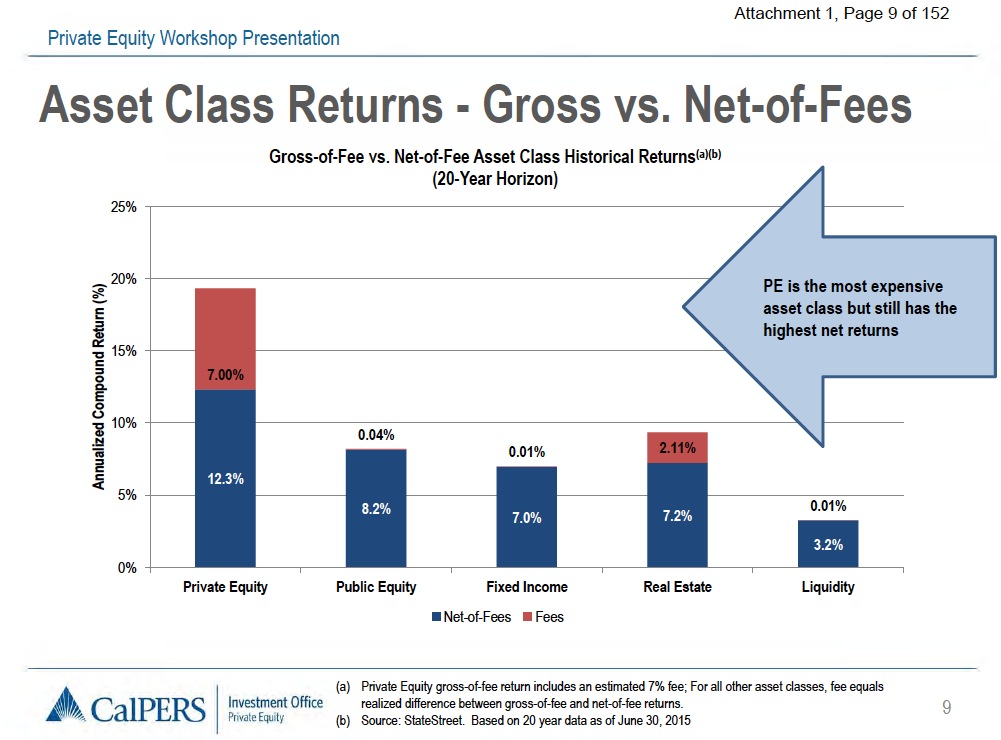

Phalippou has regularly used 7% as his estimate of the total annual cost of investing in private equity. CalPERS concurred with that in its private equity workshop in November of last year:

Mind you, at this point, CalPERS had the carry fee data for the entire history of its investment in private equity, so if that data suggested that Phalippou’s rough and ready number was too high, you can be sure staff would have used a lower figure.

CalPERS’ CAFR for 2014 shows the total value of its private equity investments as $31.5 billion as of June 30, 2014. The latest CAFR puts the total value at June 30, 2015 at $28.8 billion. So to get an approximate average assets under management, let’s average the year end figures, which gives us $30.2 billion. Multiply that by 7% and you get $2.1 billion, or a nearly $1.7 billion understatement of the likely level.

Key Details of the CAFR Are Also Misleading

Eileen Appelbaum, the co-author of Private Equity at Work, is disturbed by CalPERS’ continuing sleight of hand:

Two astounding things jump out from the CalPERS investment report. After all the brouhaha over CalPERS’ 25-year failure to report performance fees paid to private equity, the $414.1 million in fees and costs just reported by the pension fund does not include these fees. And CalPERS continues to pat itself on the back because its PE investments beat its own stock portfolio. What taxpayers and retirees want to know is, did these risky investments beat CalPERS chosen stock market index and did they do so by the 3% necessary to compensate for the risk?

CalPERS’ staff lost its attempt to have the board replace the long-standing strategic objective of “maximizing risk-adjusted returns” with “enhancing the pension fund’s performance.” The change was voted down at the last board meeting in December, but the staff seems not to have noticed.

Mind you, not only did CalPERS not include the carry fee information in its cheery report to the press about private equity’s costs, it did not include it in the CAFR, even though it obviously had it at the time and could easily have incorporated it.**

And as far as Appelbuam’s consternation that CalPERS’ staff is still trying to snooker the public about the attractiveness of private equity returns by omitting its failure to meet the required risk premium, it was not just the board that nixed staff’s effort to pretend that the extra risks of private equity should be airbrushed away. So did CalPERS’ own consultant, Andrew Junkin of Wilshire Consulting.

And to drive her point home, page 101 shows PE underperforming its benchmark by exactly 300 basis points over the longest time frame shown, ten years. That means CalPERS earned the same amount from private equity that it would have had it invested in the relevant stock indexes instead, and would have come out ahead by reducing risk, since public stocks are more liquid and less leveraged than private equity. Failing to beat stocks means CalPERS would have been undeniably ahead over the last decade on a risk/return basis had it merely sought to replicate its private equity benchmark.***

What is particularly distressing about CalPERS efforts to stick its head, and that of the public, in the sand about the total costs of investing in private equity is that this is a clear breach of fiduciary duty. There is plenty of case law that says that a fiduciary must assess the reasonableness of costs in making investments. Because CalPERS staff refuses to provide the total management fees to its board, along with the carry fee and other expenses,**** the board remains in the dark about the cost of private equity even though they have an obligation to CalPERS’ beneficiaries and ultimately California taxpayers to know and evaluate this figure. This is yet another example of how the passivity of CalPERS’ board is tantamount to a dereliction of duty.

___

* As regular readers know by now, it’s more complicated than that. The fee is lower for big funds, and also steps down after the investment period, typically five years in. However, the flip side is the management fee is calculated on the committed amount, not the amount of money actually put to work. That means in the early years, the effective fee level, as Oxford professor Ludovic Phalippou has pointed out, is an average of 4% of the funds deployed.

** There appears to be only very marginal improvements in reporting of private equity fees and costs. The 2014 CAFR included a schedule that described as showing performance fees on “all funds”. That was misleading because it did not include private equity. In the 2015 CAFR, “all funds” disappeared from that title. The description is now less misleading, although the performance fee data is still just as incomplete.

*** CalPERS keeps trying to divert public attention from this sorry fact by harping that private equity outperformed CaLPERS’ other investments, including “global equity.” CalPERS’ “global equity” results have been poor, due to the fact that (among other reasons) CalPERS made a huge bet on foreign stocks, which are roughly 50% of that portfolio, which has not worked out well in this strong dollar environment. CalPERS’ bad luck or incompetence in public equity (take your pick) is no justification for pretending that private equity performance is better than it was.

**** Let us also not forget that expenses are also charged to portfolio companies, including ones that may not add up to a big percentage in the total scheme of things but are hard to justify, like the lavish use of private jets, including, sometimes explicitly, for family members of top partners as well as fund professionals.

You talk about CalPERS “putting its hand in the buzzsaw,” but come on – getting some bad press on a complex issue is not actual accountability. They have been breaching their fiduciary duties with impunity for years and getting away with it. The CEO still has her job and the trustees seem content to preserve the status quo. Until their privileges are seriously threatened — either by the state or a beneficiary who (a) understands the issue and (b) is willing to stand up and do something about it — nothing will change at CalPERS.

CalPERS has been losing on the PE front, in case you missed it. And the underlying fact set is so bad in PE that they will lose more, and more serious battles, if they don’t up their game pronto and take a tougher posture towards general partners. You fail to recognize that this is not a position CalPERS has often, maybe ever, been in.

since public stocks are less liquid and less leveraged than private equity—more liquid/liquider, no?

Thanks, will fix pronto!

Was “… since public stocks are less liquid … than private equity.” a typo? Maybe I’m misunderstanding, but I thought that private equity is riskier *because* it’s less liquid. Public stocks are quite liquid. I suppose it’s not important, since most readers are going to understand the intent, but it’s disconcerting.

“That means CalPERS earned the same amount from private equity that it would have had it invested in the relevant stock indexes instead, and would have come out ahead by reducing risk,”

That about sums it up, and of course they would have saved themselves billions of dollars in management fees and whatnot.

I’m kinda stunned that their Board doesn’t get it. They have flushed billions down the toilet over the last 10 years.

I have no idea; no links; and know nothing.

That said, it does cause me to wonder if, in fact, members of the Board get a nifty kick-back for PE investments. It would be irresponsible not to speculate on this, and hey, this time I’m not being snarky.

Whyever would they DO that for so many years? I fail to believe that all of the Board members were ignorant about the fees, etc. Not all of them certainly. And if they were that ignorant… well it begs the question: whyever were they on the Board bc they certainly were not carrying out their fiduciary duty.

Your guess would be right, as least the current staff would want as good treatment from the PE guys as Former CalPERS CEO Fred Buenrostro got.

Any news of his sentencing? This was the most recent thing I could find.

$414m in fees vs $2b in fees. The board/staff didn’t notice a $1.6b accounting discrepancy? $1.6b is a bit more than a simple rounding error or misplaced decimal point. It is interesting that the report states:

“[Fee] is down 6 percent from $439.7 million it paid the previous year.” That seems to indicate the board knows how much it pays in fees is becoming a real issue. If only they would report real numbers instead of PE created fictions.

Thanks so much for your PE reporting.

Who signed off on Calper’s CAFR? Macias Gini & O’Connell LLP of Sacramento. Their opinion concludes,

Apparently Calpers can “write its own ticket” in presenting investment fees. Ignoring carried interest pertaining to general partners’ 20% profit share above the hurdle rate certainly seems questionable.

Meanwhile, this statement from CIO Ted Eliopoulos (page 100) is quite striking:

In other words, “past performance predicts future results” — the exact opposite of the disclaimer that every SEC-registered investment is obliged to include in its disclosures.

Twenty years ago, in June 1995, the 10-year Treasury note yielded 6.21%. By June 2015, it yielded 2.08%. In other words, there was a monster bond rally from 1995 to 2015. It cannot be repeated from here unless yields go deeply negative (which would imply a collapse of equities in a deflationary depression). Barring a depression, the prospective return on fixed income is about 2%, if yields stay low.

Likewise, Schiller’s CAPE (ratio of S&P 500 index price to its past 10 years earnings) was 22.72 in June 1995 (in the 82nd percentile of the past hundred years) and rose to 26.49 by June 2015 (in the 92nd percentile). That is, stock valuations went from high in 1995 to stratospheric by 2015. If stock valuations mean revert to the 50th percentile by 2035, equities also will deliver a return of around 2%.

For a balanced stock/bond portfolio, two plus two equals two (percent return). Unattainable assumed rates of return are the “extinction event” risk for pension funds — all of them. Ted E. says it’s no sweat; the last twenty years predict the next twenty.

Ted E. is either lying or delusional.

Thank you for the above comment!

It is unconscionable that a Board with fiduciary obligations under California Constitution Article 16 section 17 would accept a document purporting to be a CAFR that is explicitly not certified as having been subjected to auditing procedures by the outside accounting firm purportedly hired for that purpose.

It is equally outrageous that a 20-year snapshot is being used by Eliopolous, when it is clear that the investment landscape has changed so substantially in the past decade that it would be unrecognizable from the perspective of 1995. Maybe he is both lying and delusional!

All this “no bad news” pretend for the benefit of the politicians who don’t want to increase contributions in the age of ZIRP is going to send the plan into an under-funding death spiral. They’ll simply renege on their promises, and I’ll be eating dog food in my old age…

Spam file just sucked up a post pertaining to Calpers’ CAFR that might be interesting.

Thanks again, Yves!! Keep the heat on. We are seeing more attention paid to the PE investment “strategy” of CALPers out here in California. This must stop.

It’s absolutely infuriating that, after so much investigation (mostly by you but now by others), that the CalPERS Board continues to LIE BIG about PE investments.

I did get some happy-happy routine newsletter from CalPers recently giving a bs “glowing” report on their PE investments.

It’s like, if they keep lying about it continuously, maybe everyone else – for ex, NC – will pack up their tea cups and go home (with tails between legs or something).

So again, I speculate: cui bono??

The title of this post is missing an important word: “Equity” needs to go after “Private”, although given PE’s secretive nature, I suppose “investing in private” makes sense too.

Oh, I could spit. The whole point of the post was that headline.

I’ve been up past 9 AM 2 days running, and it shows.

Of course the board is going to hide the management fees.The money managers are the boards own family and personal friends.They have to work too!

Quite cozy really

Hi Yves,

I recently learned that Nevada’s PERS reports their annual investments gross of fees, which seems unusual.

As a layperson, it seems like the only useful number would be the return net of fees. Is there a reason that returns gross of fees would be a preferable metric?

I noticed in their 2015 CAFR they report an investment return of 4.2% gross of fees for the 2015 year, then mention their investments only grew 2.9%, which I assume is the net of fees result.

Their 9.6% annualized return since inception is explicitly labeled gross of fees. Given that is frequently used to defend their 8% discount rate, I am trying to uncover what their return net of fees would be.

Thank you.

Your instincts are correct. Returns before fees are not a useful performance metric. It is useful in comparison with net results, to see how much the management costs are. But if the public is to get only one number, it should be net, not gross.

I’ve pinged some of my contacts to see if they have any insight into Nevada PERS.

It’s so funny to read all the pundits spewing financial advice all over the place for CalPers, and the unscrupulous California republicans (Pete Wilson and Co.) can’t decide whether to steal from it, or call it unsustainable. Meanwhile, it just keeps growing and growing (now over 300 billion) and continues to grow. Employees and employers have been asked to double their contribution into Calpers (which they have over the past 4 years). By the time a career employee retires after 40 years of service, 2 million dollars +/- will have been invested in the fund on their behalf, and they will never get the money out. They will receive a modest prescribed amount, and the fund will swallow up the remainder of their money and earn interest on those funds long after the retirees are dead and buried. The fund will grow over a trillion dollars in the next 7 to 10 years, so I don’t want to read any BS about sustainability. Calpers doesn’t need the same types of people who caused the housing bubble collapse giving advice about pension fund investing.