John Dizard of the Financial Times sounded an alarm over the weekend. Central clearinghouses, also known as central counterparties (“CCP”), which were implemented on a large-scale basis to reduce the risk of clearing standard derivatives, may not be working as advertised.

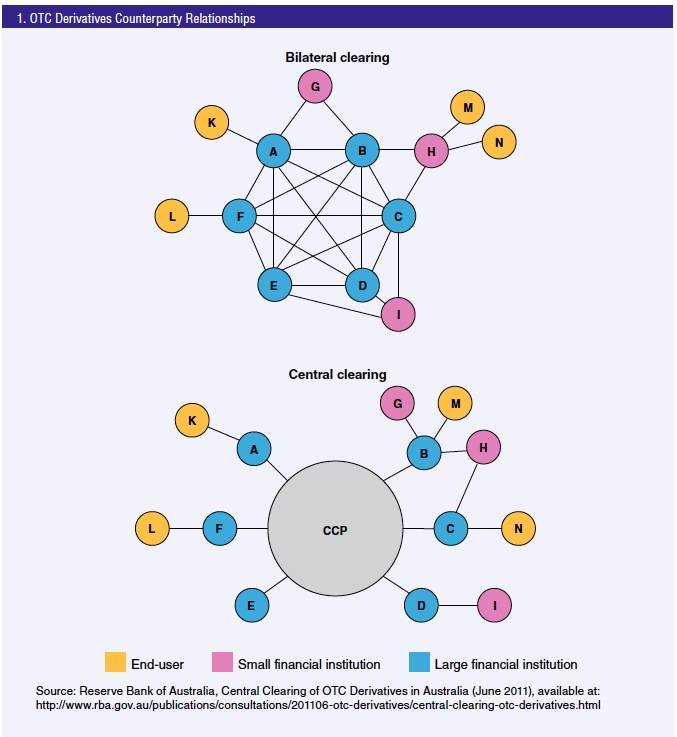

The high concept was that by having dealers all interact with a single counterparty, it would reduce the opacity and complexity of counterparty risk, thus making it easier to manage.* This chart which the Chicago Fed cribbed from the Reserve Bank of Australia illustrates how the world of central clearing is perceived to be an improvement over the old regime:

The theory of the advantage of central counterparties was that it reduces risk by reducing opacity. And a further assumption was that because the central counterparty would be owned by the entities for which it was providing clearing services, their incentives would be aligned.

However, those assumptions may not be as valid as the proponents of central clearing believed, or to put it another way, they appear to have overestimated the amount of risk reduction that would result. From the Chicago Fed primer (emphasis original):

As pointed out in CPSS-IOSCO (2012):

A CCP has the potential to reduce its participants’ risks significantly by multilaterally netting trades and imposing more-effective risk controls on all participants.

Furthermore,

A CCP’s risk reduction mechanisms can also reduce systemic risk in the markets it serves depending on the effectiveness of the CCP’s risk controls and the adequacy of its financial resources.

Nevertheless, the CPSS-IOSCO also recognizes that CCPs and other financial market infrastructures concentrate risk:

If not properly managed, [CCPs] can be sources of financial shocks, such as liquidity dislocations and credit losses, or a major channel through which these shocks are transmitted across domestic and international financial markets.

Reading between the lines, there are still credit and counterparty risks that remain with centralized clearing. If one side of a trade fails, the central counterparty has to have the wherewithal to step into the breach. In addition, while the central counterparty will make the exposures to it more transparent and hence amenable to better risk management, there are credit risks that are part of this type of arrangement that remain opaque. An illustration from the Chicago Fed:

For example, members A and B may be settlement banks for the CCP and its other members and, possibly in addition to that role, may act as backup liquidity providers to the CCP and other participants in the market. Members A and B may also have noncleared credit relationships with others, including but not limited to, members X and Z; and these credit relationships, like the “credit chains” I described earlier, are completely opaque.

Shorter: banks that provide critical support to the CCP have their own credit exposures; they can become impaired or liquidity constrained and hence fail as major counterparties or as critical backstops in times of stress.

So the high-level conclusion is that CCPs in theory are an improvement over the old status quo, but they need to be implemented well to achieve their promise. Most important, they need to have strong enough capital buffers. Even then, they are not a magic bullet.

Now aside from Dizard’s warning, there was reason to be concerned about the motivation for creating central counterparties, in that it was to reduce the “too big to fail” problem. In other words, given the limited, conditional risk reduction that would result, the idea of moving more credit risk to central counterparties was more than anything else to solve a political problem: to get the government out of the liquidity provider of last resort game. If you look at the chart above, those little blue circle in the first chart would be banks that would almost certainly get government support, particularly given that the authorities have allowed banks to use taxpayer deposits to fund derivatives exposures. By contrast, the central counterparty is in theory a more robust entity and does not have direct access to the government drip feed.

But an inadequately capitalized CCP is just another “too big to fail” entity. And since the CCPs are private, there would be motivation for the participants to have the CCP be underresourced, since higher margins mean higher transaction costs and therefore lower trading volumes. And although no one would admit to this, bankers know full well that no financial regulator is willing to let markets seize up in our brave new world of market-based credit, as opposed to bank-loan-based credit.

Dizard is particularly worried that China is increasing its capital control and other countries are informally following suit. The reduction in international liquidity could blow back to the central counterparties in a nasty way.

Dizard may be right about capital controls serving as the trigger for a crisis, but it could be any event that leads to market discontinuity…say strong evidence that a Brexit is in or an assassination of a political leader.

A key section of Dizard’s article:

US officialdom is admitting that it needs to give some thought to what could possibly go wrong with the clockwork of the securities and derivatives clearing houses, or CCPs, that process trades on behalf of financial institutions.

The reformers among them had been convinced that forcing banks to move uncollateralised, trust-me, bilateral swaps transactions into collateralised, marketable instruments traded on CCP platforms would do much to end systemic risk.

Now they are beginning to see that there are some unforeseen consequences to their attempt to shift risks from taxpayer-underwritten banks to “the market”.

There is already too little speculative capital available to moderate the volatility in fixed income, currency, and commodities prices. It is dawning on the regulators that in any serious financial crisis, the shortage of dealer capital would make it very difficult for the securities and derivatives clearing systems to work effectively..

The problem, as this column and others have pointed out, is that in volatile or discontinuous markets, clearing houses do not eliminate risks, but rather concentrate them on the clearinghouses’ own balance sheets.

In orderly markets with prices that trend in a relatively smooth way from day to day or hour to hour, the margin postings that are the real basis for CCP stability can be met with calls on clients for cash or liquid securities. In disorderly markets, though, there can be a problem getting money-losing customers to provide margin quickly enough.

.

This takes a little unpacking. It isn’t just the availability of collateral for margin loans that is an issue. Margin requirements are a function of counterparty risk and market volatility. So when markets are heaving, a counterparty will want more collateral both due to greater market risk and to cover for the risk of worsening conditions at specific firms.

And Dizard’s passing swipe at the idea that the risk of trading markets now deemed to be essential for commerce could be shifted from the government to “the market” is correct. Economist Paul Davidson explained the issue long form in a 2008 article. He was discussing securitizations, but the same logic applies here:

In the EMT [Efficient Market Theory], any observed market price variation around the actuarial value (price) of the traded liquid assets representing these debt instruments in the aforementioned markets is presumed to be statistical “white noise”….If, therefore, you believe in the EMT, then permitting computers to organize the market will decease significantly the variance and therefore increase the probability of a more well organized and orderly market than existed in the pre-computer era….

For believers in EMT, the presumption that there is a plethora of market participants buyers and sellers that can be collected by a computer assures that the assets being traded are very liquid. In a world of efficient financial markets, holders of market traded assets can readily liquidate their position at a price close to the previously announced market price whenever any holder wishes to reduce his/her position in that asset…

Keynes’s LPT [liquidity preference theory] can provide the explanation. LPT presumes that the economic future is uncertain. Consequently, the classical ergodic axiom2 that is fundamental to any efficient market theory is not applicable3 to real world financial markets. Keynes’s analysis presumes that, in the real world of experience, the macroeconomic and financial systems are determined by a nonergodic stochastic system. In a nonergodic world, current or past probability distribution functions are not reliable guides to the probability of future outcomes [Davidson, 1982-3, 2007]. If future outcomes can not be reliably predicted on the basis of existing past and present data, then there is no actuarial basis for insurance companies to provide holders of these assets protection against unfavorable outcomes.

Yves here. The focus on insurers made sense in 2008 given that collateralized debt obligations had become essential to the subprime market, and collateralized debt obligations in turn depended on guarantees from insurers like AIG and the monolines. But the same logic applies to a central counterparty. It is effectively guaranteeing against the failure of a counterparty. Ergo, it must be have enough in the way of reserves (actual resources on hand plus the ability if needed to call capital from third parties) to withstand defaults. That means it needs to be able to measure its exposure to know how much it needs in the way of reserves. But Davidson says that that can’t be done reliably.

In addition, Davidson argues there needs to be a market maker somewhere in the mix, and that market marker ultimately has to have government support:

In other words, in our world of nonergodic uncertainty, for an orderly liquid resale market to exist, there must be a “market maker” who assures the public that he/she will swim against any rip-tide of sell orders. The market maker must therefore be very wealthy, or at least have access to significant quantities of cash if needed. Nevertheless, any private market maker could exhaust his/her cash reserve in fighting against a cascade of sell orders from holders. Liquidity can be guaranteed under the most harshest of market conditions only if the market maker has easy direct or indirect access to the Central Bank to obtain all the funds necessary to maintain financial market orderliness. Only market makers having such preferred access to the Central Bank can be reasonably certain they always can obtain enough cash to stem any potential disastrous financial market collapse.

Recall what Dizard said earlier: he warned, as others have, that dealers are committing less capital to market making and hence trading is less liquid. It’s reasonable to take this crying about liquidity with a fistful of salt, since investors have become habituated to having a level of liquidity that is well in excess of what they need in order to perform well (for instance, bond markets were vastly less liquid in the 1980s, yet investors didn’t complain about it, they managed their buying and selling accordingly). However, we now have lots of institutions that run big complex dealing books with lots of hedges that are dynamic, meaning they need to keep adjusting the hedges as the prices of the underlying move. Markets with unpredictable liquidity greatly increase the odds of a big risk management mess.

And even putting aside Davidson’s worries as overwrought, Dizard points out that there are reasons to worry about how resilient the central counterparties are:

Over the past couple of years, large banks have been arguing that for-profit CCPs are not as well capitalised as they should be to deal with the potential failure of large participants. The CCPs pushed back, replying that their risk management is perfectly adequate, and that the banks just want to hold on to their profitable intermediation of custom swaps trades.

Careful readers may recall that one of the assumptions was that the central counterparties would have the same incentives as their sponsors. But someone had the bright idea to set them up to make profits, say as opposed to operating as utilities. Dizard also flags other problems the central counterparties are having, such as difficulty in getting enough safe collateral like Treasuries from clients since central banks have hoovered so many up. And the scarcity is being made worse by new rules imposed on the dealers that require them to hold more capital and obtain collateral from their clients faster than in the past.

Dizard finally warns that executives of banks and money managers were pressing for action by bank regulators last fall. All they got was lip service. There is no willingness to take action prior to the 2016 Presidential elections. The Bush Administration also thought it could keep the subprime crisis at bay and dump the mess on the next Administration. We know how that movie ended.

____

* Lisa Pollack gave a great example, admittedly using a case that is analogous, that of ongoing counterparty risk exposures in the credit default swaps market. She showed how a default by one counterparty can lead to cascading failures. Bear in mind that the default risk of clearing is much lower, since the exposure is over the settlement time period of a mere few days. However, the general mechanics of how the domino effect works is applicable. And notice that one of her examples is the failure of a central counterparty.

That big circle labelled CCP looks a lot like a single point of failure to me. And it’s coupled to political risk? What could go wrong? Help me out here…

A single point of failure? Are there several of those CCP or just one giant CCP? True, even multiple CCP are indirectly interconnected via the participating financial institutions, but containing a crash should still remain easier.

Any particular CCP could be considered a single point of failure for those CCP members that choose to clear their trades there,

It’s really no different than any Clearing House structure where the membership is responsible for capitalizing the clearing/settlement process.

What could go wrong? Lots.

If member A can’t come up with the cash to settle a trade with member B and the CCP is under capitalized (i.e. it can’t settle for the member either) we can easily have a cascade of non-settled trades leading to a very large ripple effect of liquidity problems for all the members – which in turn would have a systemic knock-on effect throughout the whole financial system.

The issue is ergodicty and uncertainty. Assuming that the future is simply some sort of linear transform of current ergodic distributions is, in Wolfgang Pauli’s immortal phrase, “Not even Wrong”

I am tempted to read CCP as OCP, the big, amoral, corporation in the Robocop movies.

Or maybe we should find some way to tag another C on there and make it the CCCP?

CCPs concentrate risk. That means that smaller risk events are suppressed, at a price of increasing the impact of tail events (i.e. if CCP fails, the failure WILL be systemic and require gov’t bailout, there’s no way around it).

Moreover, the likelyhood of failure will be increased by CCPs competing with each other, for example by including more instruments to clear. And it doesn’t take a complex instrument to increase risks massively – say a non-principal resetting XCY swaps will do nicely, thank you very much (the principal is a direct credit risk, compared to which IR risk pale in insignificance. Add to that the FX risk, and you can have massive MtM swings and exposures)

The only credible CCP around is the central bank. In fact, they already do that for a payment system, are non-profit, and have a mandate to monitor the parties – and can order them to “cease and desist” on a fairly granular basis. In other words, using CBs for CCPs would in effect require the regulator to approve pretty much all the derivative transactions. Of course, it assumes that the CB is a reasonable competent and not captured regulator, which makes the whole idea moot.

I neglected your point re competing CCPs. And that’s problematic for another reason: network theory basically says highly distributed systems are robust, and one that are centralized are too. The worst structure is one with a bunch of big nodes, which is what we have here.

So the proposed solution is the government becomes the buyer of last resort when all the bad bets go bad and assumes all the counter party risk when buyers disappear from the market.

” Only market makers having such preferred access to the Central Bank can be reasonably certain they always can obtain enough cash to stem any potential disastrous financial market collapse.”

To me this is TARP on auto pilot, designed to save the speculators who should die on their cross of greed. Once again, Big Banks get saved and the taxpayer pays. I know, I know, a systemic market collapse is the boogie man that sleeps under everyone’s bed and ends the world as we know it, but this proposal sucks. No wonder it is politically DOA before the elections.

In the run up to the 2008 GFC, I truly expected one of the CCP’s to fail, especially the options clearing house. Needless to say that did not come to pass.

Having a CCP for OTC derivatives (as with any CCP) does create a central point of failure. When it does fail then the taxpayer will have to bail it out, which will be just another back door bailout of large financial institutions that are too-big-to-fail.

This discussion brings to mind the New York Clearing House of the late nineteenth/early twentieth century and the Panic of 1907.

That clearing house dealt with the payments system prior to the birth of the Federal Reserve. When the panic of 1907 hit, it wound up issuing its own certificates as a money substitute until the panic passed. Those certificates were of dubious legality, but were ratified after the fact.

The way in which the private sector handled the panic of 1907 was a contributing factor to the creation of the Federal Reserve.

“History doesn’t repeat itself, but it rhymes.”

Derivatives are a form of insurance already – so now we are going to insure the insurance in an effort to eliminate risk – so then why do we need insurance any more? This would be a good way to eliminate the risk up front; eliminate the need for derivatives in the first place, no? Just cut to the chase, have all CBs “expand their balance sheets” to cover 1.5 quadrillion dollars in liquidity demand – because that is the mean value of the world as we know it – and make playing derivatives pointless. Just guarantee all assets and prices and forget the casino. Otherwise somebody is going to figure out how to short the world. I mean if the PBoC can laugh at George Soros and all the other currency vigilantes, why not? Nevermind.

Classic example of not solving a problem, the risk has to reside somewhere, and moving the problem (among much arm waving, noise and distraction) under another rock.

The CCP is a financial single point of failure. How the computers are organized is irrelevant. All the fault tolerant systems design in the world is no substitute for Capital.

If derivatives are settled through this system, there probably is insufficient capital in the whole private sector to manage the risk.

Which leads to one of three solutions:

a) Automatic bail in of deposits from the CCP members, but there are two multiplier on risk, and thus liquidity capital, one from the fractional reserve system and one from the leverage of derivatives. That is: The CCP can call in capital from its member at any time (as a Lloyd’s syndicate was able to call inn money without limit to cover a claim), and its members can seize deposits, demand deposits for small institutions, to ensure the “systemically” important institution do not fail. The FDIC has a small role here.

b) Move the CCP function to the various Federal Reserve banks, who cna call on the Central Bank to eliminate systemic failures.

c) Remove the risk (which I believe was the intent of (Glass-Stegal).

When Brooksley Born’s plan to regulate the derivatives market was stopped by Summers and Rubin in 1999, the derivatives market continues as an opaque and unregulated area. Seems like any attempt to reduce derivatives risk without including real regulation is so much hand-waving. Appreciate your reference to subprime loans and AIG.

This graph made me chuckle:

“For believers in EMT, the presumption that there is a plethora of market participants buyers and sellers that can be collected by a computer assures that the assets being traded are very liquid. In a world of efficient financial markets, holders of market traded assets can readily liquidate their position at a price close to the previously announced market price whenever any holder wishes to reduce his/her position in that asset…” -Davidson

That’s an old, old hope or fantasy: The idea that the latest technology is not just an improvement in technology but is in fact a reflection of the entire cosmos, and so global outcomes can be understood and controlled by means of new technology. Think of the mid-17th century thinkers who talked about the ‘clockwork of the universe’. And this is where, in my opinion, much goes wrong in an argument like “presumption that…can be collected by a computer assures..” The mental shift from technology as analogy (ok) to a reified entity that does not in fact exit. (fantasy) It’s the equivalent of: “Step 3 – Then a miracle occurs.”

Wouldn’t it be simpler and more effective to just ban most derivatives – those that don’t have a clear social purpose?

I realize this isn’t quite as simple as it looks to me; but by the same token, one lesson of the Great Financial Collapse was that complexity is a disguise for fraud.

+100k

As a programmer I’ve learned deep in my bones that complexity is the enemy of stability. I’m not looking forward to another round of bailing out billionaires when their Rube Goldberg gizmo breaks down again (to massive profits for themselves).

No, no, no! Credit derivatives are an extension of the banksters ultimate entitlement of money creation, they aren’t about to give up either without a bloody battle of some sort.

Thank you for this very insightful and timely article. Particularly appreciated the observations about the difficulty of getting margin in highly volatile, disorderly markets; and “our brave new world of market-based credit, as opposed to bank-loan-based credit”.

Seems nobody wants to be held responsible for or incur losses from their poor underwriting and risk management decisions by holding their derivatives Old Maid cards; and this “Game of Speculations” continues to really be “Privatize the gains, and socialize the losses!” Golly, what a surprise.

As noted elsewhere, we need these thirty-one words in Wall Street reform legislation:

“No bank holding insured deposits can own or be affiliated with an investment bank, broker-dealer, futures commission merchant, insurance company or engage in the underwriting of stocks, bonds or derivatives.”

http://wallstreetonparade.com/2016/01/bernie-sanders-meets-with-obama-today-what-they-might-talk-about/

Thanks for this post. I keep wondering how the Commodity Futures Modernization Act of 2000 plays into the essential risks of derivative trading, and how any ‘risk mitigation’ structure can eliminate those risks. Doesn’t seem possible to me, but I’m not a financial engineer.

Tuning in War: The Police / Welfare State

False assumptions, all data-driven theories, act as a filter, tuning out what you don’t want to see, and tuning in what you do want to see, to meet expectations. The psychologists do understand dc autonomic expectation, which is why the majority is so easily funneled into the obsessive-compulsive loop, with nothing more than a selfie-phone and a bitcoin app. The war on poverty doesn’t grow poverty and social engineering by accident.

Children are a resistive load tuning itself in, first through the parents and then society. The psychologists, who have never worked a day in their lives, simply removed parents with social engineering, destroying small business, and left nothing but implosion into TBTF RE. Without coping mechanisms, reality is brutal and escapism is quite profitable, in the short-term locally and the medium term globally.

The TBTF empire has always employed the Family Law Pavlov Swap, granting corporate rights to the rest, always a false promise of equal rights and affirmative action, in a rigged lottery fueling an actuarial ponzi. With these rights, the majority has commandeered the future of children with public education, and cps if necessary, and is liquidating retirees with inflation, and aps if necessary. Obamacare simply makes the IS system a one-stop shop, populated by social workers pretending to be educators and healers.

Net, the domestic economy is discharging at excess rent/income to maintain the status quo, Putin is watching similar developments in the Ukraine, and the Europeans are already demanding another Marshall Plan, before WWIII has even officially begun, all with contingency plans to nowhere, currency and trade wars, the grand spectacle – tune into empire and tune out of life.

Iowa, the current drama, exchanges an inferior product for subsidies, like every other political organization. The bankers offer the unmotivated a loan they cannot repay, merge the land into a TBTF black hole, and raise everyone’s rent, to continue indefinitely, and then prints money for temporary make-work like APHIS, so the participants can poison themselves. Not being quite so stupid, the IOWA militia is heavily armed, expecting TBTF to employ the paper-pushers as locusts.

The response to denial is anger to threshold, when you will be convicted of anger, but if you allow depression, the only alternative, you lose a generation into the gap, leaving war as the outcome. It’s all very cute, until the populations wake up with the drugs removed, and America is knee-deep in the sh-, right along with the rest of the nation/states. The Nazi and Jewish German leaders didn’t divorce; they just moved over here, like all the others, to plunder some more, nature and their own.

In the final leg of this saga, legacy demands the latest and greatest technology for FANG, threatening middle class MAD. Because dc autonomous expectation is true and phrenology is false, a false duality, does not mean that you have to choose between the two. Labor works on event horizons in other event horizons, completing the ac signal recursively, at the point of implicit and explicit expectation, which the critters can’t see, until it’s far too late.

Anonymous cash is sooo analog … like yesterday … and tomorrow.

Money is a welfare program for legacy capital, and training wheels for the middle class. Legacy employs the middle class to replace labor and make current sunk-cost operations more efficient until they collapse, with a welfare, surveillance and police state, courtesy of Silicon Valley in this iteration. Labor is the capital legacy can’t see. And the middle class is a cultural connection maintained as a buffered counterweight, until its cost is prohibitive.

You and your spouse have six boys. Four want nothing to do with work, one is highly self-motivated and one is marginally self-motivated. You are going to give the inheritance to the marginal boy, knowing that the self-motivated boy doesn’t need it and the four will gang up to liquidate. The marginal boy will have choices, with the demographic boom and bust expected.

You and your spouse have six girls. Four want nothing to do with raising their own children…

Equality isn’t about who raises the children and who occupies the corner office; it’s about where you choose to go, together, which is rarely where you end up. The kids come and go, largely beyond your control; if they come back for a visit, that’s icing on the cake. Life isn’t about the destination.

The next time you read Les Mis, or the first, note the geometry of the author’s mind, and you may learn to appreciate that young lady in the front of the class, always with her hand raised, which is the only reason that young man in back by the door, ready to exit, bothers to show up at all, or to read Les Mis. When that young lady is truly motivated to explore space, that is when humanity will go, and not before. NASA is just another weaponization sh-show, for those who want to talk about it, and do nothing.

“To tell you the truth, sir, we don’t do it because it’s useful; we do it because it’s amusing.” People who do nothing spend much of their time analyzing those who do, just to get in the way, as an excuse to do nothing, missing the entire point. That’s life, most of which is about people using people for survival and sex, surprise.

A lot of people went to war over a long period of time, conveniently assuming the earth was flat, and from the perspective of empire, it still is. Anxiety doesn’t come from noise in the clutch by accident. Willful ignorance is the tarmac.

When you net it all out, History is nothing but gossip, and with all the moaning and groaning, no one is willing to let the RE bubble burst, so WWIII it is.

I had been under the impression it was going to be the HTF’s directly that would be immediately fingered as most convenient scape-goat when a very expensive market ‘accident’ revealed there was far, far less liquidity than assumed.

The fused leadership of Wall Street and Washington have been allowed to make such a tremendously stupid series of decisions the ensuing mess is going to blow right on through any blockages in the financial plumbing and put a good part of the globe chin deep in misery. Honestly, when I ponder the mere fact that people who’ve driven and/or enabled criminality at this level and scale are not only not identified as dangerous sociopaths, and kept from power like a tot from the fire, but instead deemed the world’s most resilient leadership, I think we are entirely unfit for this planet.