Mossack Fonseca are in it up to their thighs, and Stuart Gulliver has “no idea”.

…That idealessness matters a lot already, and will soon matter more.

Naked Capitalism, 6th March 2015

Let’s explain a few terms:

- “Stuart Gulliver” is the CEO of the world’s second-biggest bank, HSBC, which is usually embroiled in some giant tax dodging or money laundering scandal or other; Swiss, on this occasion. He’d been summoned before the UK’s Treasury Select Committee to explain himself. He was shortly to endure another torrid session at the Public Accounts Committee in which he didn’t really explain how HSBC selected “Mossack Fonseca” to supply a shell company through which Gulliver received his bonuses.

- “soon” turns out to mean “starting in about 10 days’ time and continuing for the foreseeable future”.

- As for “Mossack Fonseca” itself, a picture is worth a thousand words; accordingly, several pictures follow, and several words, too.

First up, here’s March 16 2015, (“soon”), in Brazil:

Close to a million demonstrators marched in cities and towns across Brazil on Sunday…

Here’s a little bit of what that looked like:

Photo: Agência Brasil.

The WSJ adds:

Many taking part in Sunday’s march called for President Rousseff’s impeachment, amid revelations of alleged graft at oil giant Petróleo Brasileiro SA that largely occurred while she chaired the company’s board of directors from 2003 to 2010.”

Petróleo Brasileiro SA is better known as Petrobras. By December 2015, the impeachment proceedings against the Brazilian President had indeed been started:

Brazil’s president Dilma Rousseff has begun the fight for her political life after the first impeachment proceedings for more than 20 years were launched against her in Congress.

After months of jockeying, the removal proceedings were pushed forward by her political nemesis – the lower house speaker Eduardo Cunha – as Brazil slipped deeper into a crisis that has hamstrung decision-making even while the economy suffers its worst downturn since the Great Depression.

Mind you, our axe-grinding Eduardo might be dodgy too:

Julius Camargo, one of the whistleblowers in the Lava Jato investigation into corruption at Petrobras, has testified that the Cunha asked him for a $5m bribe – a claim that the speaker denies.

Oh, and here’s Mossack Fonseca:

Brazilian police and prosecutors said Wednesday that as part of their investigation into a massive corruption scheme centered on Petrobras they were looking into whether some of the money diverted from the state-controlled oil company was laundered through real-estate transactions coordinated by a Panamanian-based law firm.

Investigators said they were probing the alleged role of Panama City-based Mossack Fonseca, which also operates in 40 other countries and is suspected of assisting several of those implicated in the Petrobras scandal with opening “offshore” companies in that Central American nation.

“The investigation points to money laundering and asset-concealment transactions via real-estate businesses,” prosecutor Carlos Fernando Dos Santos Lima said at a press conference.

Evidence obtained thus far indicates that “Mossack Fonseca is a big money launderer,” Dos Santos said, adding that Brazil’s federal Attorney General’s Office has asked police in other countries for their cooperation, without mentioning which ones.

It looks as if Mossack Fonseca’s Brazilian employees may have taken their client service commitment a bit too far:

One of the Mossack employees who was arrested, María Mercedes Riaño, is accused of destroying and hiding documents. An e-mail obtained by prosecutors indicates that she removed due diligence documents and client records from the office.

Mossack Fonseca issued a statement claiming that the employees are being wrongly charged and that the firm has no connection to the suspects in the Lava Jato investigation.

Even while that was brewing, HSBC was already heavily entangled with the Petrobras scandal:

HSBC this week admitted failings in compliance and controls in its Swiss private bank after media reports alleged it helped wealthy customers conceal millions of dollars of assets in a period up to 2007. However HSBC noted that there are numerous legitimate reasons for having a Swiss bank account.

Being Swiss, or a Swiss resident, are the main ones, I’d have thought; definitely not this, anyway:

In what is being called Brazil’s worst corruption scandal in history, prosecutors allege that politicians from President Dilma Rousseff’s ruling coalition used Petrobras to skim billions of reais through overpriced contracts for over a decade. So far more than 40 people have been detained over their involvement in the scandal, which is known in the country as “Operation Car Wash.”

The…source said that “there is a clear link between ‘Operation Car-Wash’ and the HSBC Swiss bank accounts.”

Presumably laundering the proceeds of grand corruption is not one of the reasons for holding a Swiss bank account that HSBC would consider legitimate, but for the moment, it’s not easy to be sure.

These are certainly strange days for HSBC. Its apparent link to rampant Brazilian corruption now seems to be trampling all over other apparently respectable lines of HSBC business:

HSBC Holdings Plc is suing Schahin Engenharia SA, a Brazilian oil-industry supplier accused of paying kickbacks to win public contracts, for 173.6 million reais ($55 million) related to unpaid promissory notes.

The claim, which was filed in Sao Paulo on March 30, doesn’t say when the notes were supposed to have been paid to London-based HSBC, a court filing shows. HSBC joins Deutsche Bank AG and Banco IBM SA, the local financial division of International Business Machines Corp., in making claims against Schahin this year.

Schahin is among more than 20 companies that have been temporarily banned from bidding on new projects with state-run Petroleo Brasileiro SA, known as Petrobras, amid allegations that suppliers and builders paid bribes to inflate the value of contracts.

Synergies can go wrong in the world of banking, in surprising ways.

That’s it from Brazil for the moment, where the situation, as they say, continues to develop.

Our next photo is of a street protest in Moldova in April 2015, concerning a billion-dollar bank fraud:

(User tolea93, Wikipedia)

(User tolea93, Wikipedia)

To the relief of Stuart Gulliver, no doubt, HSBC hasn’t shown up in connection with this particular imbroglio. Money laundering in the former Soviet Union isn’t one of HSBC’s big franchises, as far as anyone knows.

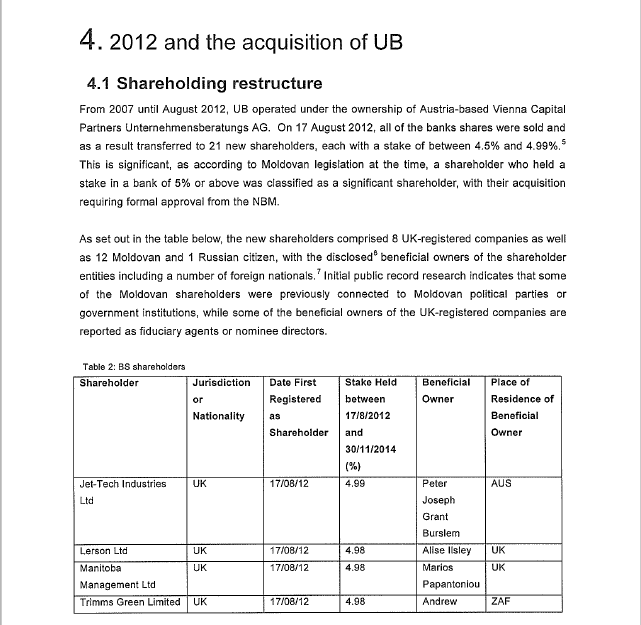

However, there’s certainly a cameo by Mossack Fonseca, under a light disguise. According to Kroll Investigations, whose initial fraud report was leaked by Moldovan politician Andrian Candu, one of the British companies that facilitated the Moldova fraud was Trimms Green Limited. Trimms Green has a registered office at Invision House, Hitchin, the address of Mossack Fonseca’s UK subsidiary, RM Company Services. Kroll explains the role of Trimms Green Limited in the covert seizure of control of one of the Moldovan banks involved in the fraud, Unibank SA (“UB”):

The truncated “Andrew” is in fact Andrew Moray Stuart, who has since resigned his directorship, and is heir presumptive to the Viscountcy of Findhorn. He is a descendant of one of many by-blows of the magnificently fertile, but reliably erratic Stuart dynasty.

Anticlimactically, Andrew Moray Stuart earns his keep as an international stooge director, if you call that “earning”. His name therefore crops up in all sort of interesting places, such as the Magnitsky murder relentlessly investigated by Bill Browder, or as a director of Pennard Chemicals, which according to The Guardian earned EUR100Mn of “commission” on unexplained Russian deals in three years, or as a director of improbable British debt collectors such as Civil Enforcement Ltd.

By September 2015, the fraud crisis had claimed one Moldovan Prime Minister and the street protests had got even bigger:

Photo: Accent TV.

Then in October, with another former Prime Minister detained, the Moldovan government fell. The situation continues to develop…

Let’s remind ourselves of the timescales: the Petrobras scandal, with the current president, Rousseff, (update 3-Apr-16) ever closer to impeachment and her predecessor, Lula, now also facing the prospect of charges, (update 3-Apr-16 – or not: friendlier judges all of a sudden), was a decade or more in the making. The Moldova bank fraud, which has so far put paid to the tenures of two Prime Ministers and one government, and led to the detention of another Prime Minister, took about three years.

Lately, the delay between Mossack Fonseca rocking up, and the onset of street protests and government corruption scandals, seems to be shrinking still more. Here’s a 2013 press release:

PANAMA CITY–(Marketwired – Aug 9, 2013) – The Group Mossack Fonseca & Co. has reached a total of 47 offices around the world with the recent opening of its office in the Republic of Malta. It meets the objective of offering its customers a jurisdiction that has several attributes, including:

a) Be a member of the European Union.

b) To be included in the white list of the OECD since 2005.

Malta currently enjoys international recognition as an excellent jurisdiction for international trade. Multiple multinational companies have established their headquarters in this country, which is testimony to the confidence that large employers have placed upon strategically diversify their investments. And no wonder, because the reason is that this jurisdiction available to employers, users and customers, an address that complies with European Union directives, while being flexible, strong incentives and a international business vision aimed at satisfying the needs of customers from all over the world.

After that ominous 2013 press release, readers can probably guess what happened next in Malta. This time it only took a couple of years. Here’s a picture from a few days ago:

Photography by Alan Carville for wwww.daphnecaruanagalizia.com

This, and much more, comes from the ferocious and cunning Maltese blogger Daphne Caruana Galizia, who tells us what she was getting up to in late February:

In the afternoon of 22nd February, I uploaded two posts in quick succession…They would have seemed mysterious to everyone but four people: Joseph Muscat, Keith Schembri, Konrad Mizzi and Brian Tonna of Nexia BT. It’s unlikely that Sai Mizzi Liang, in Shanghai and clearly having already left Malta behind, would have bothered reading them.

Joseph Muscat is the Prime Minister of Malta. Keith Schembri is his “Chief of Staff”. Konrad Mizzi is Malta’s Minister for Energy and Conservation of Water. Sai Mizzi Liang is Konrad Mizzi’s wife. Brian Tonna of Nexia BT is also Brian Tonna of Mossack Fonseca, (Malta), and Galizia’s post is in fact a booby trap…

Some of my readers might even have thought that I was having a bad hair day, so to speak, as the posts seemed inexplicable. But they were not aimed at my readers. They were aimed at that audience of just four people. I wanted to see what they would do next.

…which is immediately sprung:

The following day, Konrad Mizzi approached Malta Today and gave the news portal a story in which he said he will “reveal” his ownership of a trust in New Zealand. He did not tell them that the only reason the trust exists is to further conceal the existence and ownership of a company in EU-blacklisted and top-secret Panama. Nor did he tell them that he set up this structure concurrently with the Prime Minister’s chief of staff, Keith Schembri, who has exactly the same set-up besides companies (plural) in another secretive offshore haven, the British Virgin Islands.

Malta Today then published its story early the day after, on the 24th. On reading it, I immediately reported that Konrad Mizzi owns a company in Panama, and that he lied to Malta Today by concealing key information from them.

Late in the evening on the 29th (Saturday) I watched Konrad Mizzi lying even further in the TVM news bulletin that had omitted to cover, in any way, the story everyone was talking about. I also heard that he had given “exclusive” interviews to all three English-language Sunday newspapers, The Sunday Times, The Malta Independent on Sunday and Malta Today, not letting them know that the others had the “exclusive” too. I discovered that he had still failed to mention that he did this together with the Prime Minister’s chief of staff, so at 9.30pm I uploaded the news on this website: Keith Schembri, too, has a Panama in company sheltered by a trust in New Zealand whose sole purpose is to contain the Panama company, and they set them up in concert, using Brian Tonna of Nexia BT for all the arrangements.

Now that they’ve been screwed over by Mizzi’s incomplete and non-exclusive exclusive, the Maltese pressmen are taking no prisoners. Here’s The Independent plying its cattle prod on the Prime Minister…

Prime Minister Joseph Muscat this afternoon could not say exactly what role Brian Tonna of Nexia BT has within the government. Mr Tonna advised Energy and Health Minister Konrad Mizzi and Dr Muscat’s Chief of Staff Keith Schembri to acquire a company in Panama.

He said that this question was already answered in response to a Parliamentary Question, and that he could not say off the top of his head.

…and chasing him round and round and round…

Dr Muscat was asked to clarify comments he made on Thursday. At one point Dr Muscat said that Dr Mizzi “has paid” the fine for breaking the tax law and then said that he “will be” paying the fine. Dr Mizzi had admitted he had broken the law by not informing the Commissioner for Inland Revenue about the financial structures he had set up – the law stipulates that he had 30 days to do so.

Asked about whether Dr Mizzi has in actual fact paid this fine, in light of the procedures involved such as the Commissioner filing a police report and an investigation taking place, Dr Muscat replied:

“I checked the transcript of what I said yesterday and I checked the procedure in full. Dr Mizzi has now filed (a submission) in order to conform to the situation – the fine is still to be determined.”

…and round and round…

The Malta Independent this morning broke the story that Economist and Director of E-Cubed consultants, Gordon Cordina and his staff have left the offices of Nexia BT in order to distance themselves from the current scandal.

Questions were raised as to why Dr Cordina chose to do this if it was true that no wrongdoing had occurred, with Dr Muscat responding that “it’s his business.”

Due to Mr Tonna’s position within Nexia BT, and the fact that he provides services for the government, Dr Muscat was asked whether the government would still be using their services.

He deviated from giving a point blank response, and said that “we use the services of any company that is registered in Malta…including the big four and all companies.

This government suddenly looks just as precarious as the Moldovan Powers That Were, and the almost-impeached Brazilian president, doesn’t it?

The Maltese back story is just as bad, too. Courtesy of the Times of Malta, who prudently don’t call Azeri supremo Ilham Aliyev a dictator:

An Azeri billionaire described by the US State Department as a very close “collaborator” of Azeri President Ilham Aliyev set up various companies in Malta soon after Joseph Muscat visited the country, The Sunday Times of Malta has learnt.

On December 23, 2014, Manuchehr Ahadpir Khangah registered Mulsanne Investments Ltd together with BTI Management Limited, a company owned by Nexia BT. The new company shared the same registered office as Nexia BT in San Gwann.

The Azeri businessman set up the company just a week after Dr Muscat’s unannounced visit to Azerbaijan, during which the government signed an oil and gas cooperation agreement.

Dr Muscat travelled with his chief of staff, Keith Schembri, and Energy Minister Konrad Mizzi. However, no government officials or members of the media accompanied the delegation.

The following month, Mr Khangah set up six more holding companies in Malta, all named after famous composers – Mozart to Vivaldi to Puccini. Mr Khan-gah’s company, Mulsanne Investments, held all the shares in the new companies except for one share which was held by a subsidiary of Nexia BT.

Though the companies are relatively new in Malta, some of them just over one year old, all Mr Khangah’s companies have been put into liquidation. It is not known why they were set up and what trading, if any, was done.

Efforts to reach Nexia BT about the sudden liquidation of Mr Khan-gah’s companies proved futile.

Daphne Caruana Galizia spells out what the “sudden” liquidations look like to her:

What Ivan Camilleri describes in this article is – perhaps unbeknown to him or he’s just not permitted to say it – typical money-laundering strategy. You open up several companies concurrently or at brief intervals, then close them down a year later or less. Then you open up several more either in the same jurisdiction or another one and repeat the process. Not to draw attention to what you’re doing, you move between jurisdictions, so that no red flag goes up on all the opening and closing of companies which are just a few months old.

The situation continues to develop. You can keep up with the knockabout in Malta via the Twitter hashtag #Panamagate.

So that was Mossack Fonseca’s year in words and pictures, except: the anniversary of this announcement in the Süddeutsche Zeitung, of a huge Mossack Fonseca document leak that sparked a tax raid on Commerzbank, has just passed (my English):

According to the documents, at least three more large German financial companies are entangled in alleged criminal activity in Luxembourg and Panama, including state-owned banks. For years, just like Commerzbank, these companies obtained shell companies for rich clients from Mossack. The financial industry expects further raids on more banks in the coming weeks.

After that it went a bit quiet, but in October, the other culprits emerged, rather reluctantly (my English):

To our tax investigators, the Luxemburg subsidiaries of several German banks have started looking a bit…Spanish, lately. That includes private firms such as Commerzbank and HypoVereinsbank as well as state-owned banks: Landesbank Baden-Württemberg (Stuttgart) und HSH Nordbank…

In each case, the banks paid tens of millions of Euros in fines. The bills their clients paid, if any, are not disclosed; such is tax confidentiality the world over.

We go back to the Süddeutsche Zeitung to discover that’s still not the end of it. Mossack Fonseca has another interesting year or two ahead:

Other European countries and the USA have also acquired Mossack data.

HSBC are still living in interesting times, too. A couple of years ago they were subpoena’d to provide to the IRS a huge swathe of historic account transactions relating to their subsidiaries in Panama, Hong Kong and the USA. Given HSBC’s known fondness for Mossack Fonseca’s shell companies, that swathe may well make even more interesting reading, in conjunction with the Mossack leaks…

One last thing: the Maltese press reports imply that Mossack Fonseca is well-versed in setting up anonymous trusts in New Zealand. That’s a story all by itself. So, perhaps in the company of US IRS agents, we shall soon be bothering the poor old Kiwis, some more.

(Updates 3-Apr-16: correction: Roussef still not quite impeached; fresher links on Brazil; and I simply must add a link to Ken Silverstein’s 2014 deep dive into Mossack Fonseca).

a key phrase which prompted me to do the obvious search. It turns out that Mossack Fonseca is not just setting up anonymous trusts in NZ but proudly exist under their own name:

MOSSACK FONSECA & CO. (NEW ZEALAND) LIMITED (4852039) (NZBN: 9429041033395) Registered NZ Limited Company

Bentleys Chartered Accountants, Level 13, Dla Piper Tower, 205 Queen Street, Auckland, 1010, New Zealand

The latest Auckland median home price/income ratios are 8+ and have been high for years. The (relatively) high base rate does not explain this sustained defiance of market gravity. Perhaps the price-insensitivity of money launderers does.

The Auckland property market needs bothering. Bother away.

Check out Orion Trust at that address too!

NZ Companies Office is a bewildering haystack. Good luck finding the needles. Panasuisse might be another.

I wrote up a bit about Panasuisse a year or two back. They look cheesy to me… http://www.nakedcapitalism.com/2014/06/new-zealand-shell-company-incorporation-franchises-v-panama-switzerland.html

Thanks – that piece is appalling but fascinating. Some revision to do here! Of course your “cheesy” is an in-joke: Panasuisse local director F. Gillain (several name variants) also directs Cheese & Llama Associates Limited (and many more).

For another superb analysis, here’s a post on how seniors are preyed upon in Vancouver, BC as a means to obtain property that functions as a money laundering vehicle out of ‘Asia’.

http://davidstockmanscontracorner.com/vancouver-lockbox-for-chinese-flights-capital/

This post would do credit to Steig Larsson

My dear Richard, always happy to see you name on the NC morning listing. It is hard to say which is more delightful, the scandals themselves or your writing.

Thanks! They move slowly, my stories, but every now and then there’s a bit of drama.

At the risk of exposing myself to ridicule, can all of this enhanced “financial laundering” be tied in to QEs of various sorts? Absent ‘legitimate’ avenues of investment, what’s a poor crook to do but find ‘illegal’ conduits for loot? Thus, ‘out of touch’ property valuations everywhere one looks. To be granular about it, the long anticipated Housing Value Reset has yet to occur here in the American South. Other places see their ‘bent’ politicians set out to dry. Here, from the worms’ eye perspective, it is the lowly potential home owners who languish. If your theme plays out properly here, we expect a “transformative” election in November.

I wonder if Mossack Fonseca in concert with HSBC is a CIA / MI-6 setup for payoffs & bribery to enable illicit operations around the world. This is beginning to look like a supersized octopus with tentacles attached to everything. With an emphasis on New Zealand and Panama.

Perhaps I should take off my tinfoil hat before I get carried away into the Neverland of conspiracy theories.

Where is James Bond when you need him?

Richard… you always have the best corruption pron…

A reply to your post…

“Some changes that came in last October.

Vendors and purchasers will be required to provide their IRD (NZ Tax Office number) and if they are also resident in another jurisdiction for tax purposes their foreign Tax Number at the time of transfer. This information will be provided to Land Information NZ as part of the transfer documentation and then forwarded to Inland Revenue. All parties to a land transaction will be expected to have an IRD number, even if they are non-resident. Thus, non-residents intending to buy or sell New Zealand property will need to obtain an IRD number before they can finalise their property transaction….. a non-resident will be required to provide evidence of a New Zealand bank account as a prerequisite to obtaining an IRD number.

These proposals will apply from 1 October 2015 to align with the introduction of the ‘brightline test’ that will, in general terms, make the disposal of residential property taxable* if the property is bought and sold within a two-year window

(* Taxable at the full marginal Income Tax Rate of the vendor)

Sure, it’s just another rule to be broken. But it shows intent, and will make a few people nervous about ‘the list’ ending up back in their home country.” – H/T Janet

Might I appeal to you for a short reply, your times worth noted.

Skippy…. Its a small pleasure sticking it under some people noses… TA

A part-answer: people may not care about paying tax so long as they can do it anonymously via nominee company and its NZ bank account & IRD number. NZ govt may not care so long as they get their share.

Hi Skippy, thanks, catching up with that right now offline, also have to bone up on its interaction with NZ Trust law…post coming…

Bated breath and indebted as always… Cheers…

No matter how cynical I become, I just can’t keep up.

La solution est la guillotine.

Many thanks for this latest in your long-running series of exposés, Richard.

Let us not forget that the same venerable HongKong and Shanghai Bancorp – or to be clear, certain persons working for same, since although corporations can own and promote politicians (according to the business-friendly US legal definition of ‘personhood’) and influence elections they cannot commit fraud, only their employees and owners can – was cought a few years back laundering $billions for Mexican drug cartels. From the Wikipage linked below, check out the obligatory “mistakes were made” exculpatory verbiage from the USDO(in)J:

“Regrettable lacunae in oversight rooted in dysfunctional corporate-family dynamics occurred”, dotnchaknow. But thankfully no crimes were committed!

So the global business model here seems clear, and will remain as it is until someone actually goes to jail. (Speaking purely fictional-hypothetically, of course.) In a historical sense HSBC is simply being consistent with its roots — it got its start based on the money flows associated with the UK-sponsored opium trade in China, after all.

Lastly, thanks to RS for this delicious turn of phrase:

Singalong: “If you see a big eel and its teeth are like steel, it’s a moray…”