By Nick Cunningham, a Vermont-based writer on energy and environmental issues. You can follow him on twitter at @nickcunningham1. Originally published at OilPrice

Oil prices have shown signs of life over the past few weeks, as production declines in the U.S. raise expectations that the market is starting to adjust. As a result, Brent crude recently surpassed $40 per barrel for the first time in months.

A growling list of companies are capitulating, announcing production cuts for 2016. Continental Resources, for example, could see output fall by 10 percent. A range of other companies have made similar announcements in recent weeks. The energy world has been speculating about declines from U.S. shale, and the declines are finally starting to show up in the data.

Despite the newfound optimism that oil markets are balancing out, crude oil sitting in storage is at a record high in the United States. Energy investors may have preferred to focus U.S. production declines, or the fall in gasoline inventories in early March, but meanwhile crude oil stocks continue to signal that oversupply persists.

Crude stocks rose once again last week, hitting yet another record of 521 million barrels. Storage levels at Cushing, Oklahoma, an all-important hub where the WTI benchmark price is determined, have surpassed 90 percent of capacity. U.S. output may be starting to decline, but it is doing so at a painfully slow rate.

(Click to enlarge)

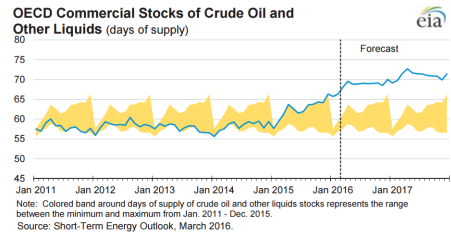

It isn’t just a U.S. problem. Crude oil storage levels continue to climb around the world. Commercial stocks in the OECD surpassed 3 billion barrels in 2015. The EIA sees oil storage in the OECD rising to 3.24 billion barrels by the end of this year. It doesn’t stop there. Storage levels rise a bit more next year, hitting 3.30 billion barrels by the end of 2017.

That is a staggering forecast that should scare any oil investor. It also suggests that the price rally over the past few weeks, which has pushed oil prices up around 40 percent since early February, could be fleeting. There is evidence that suggests the rally was driven by speculators closing out short bets on oil, after accruing net-short positions at multiyear highs in recent months. In early March, hedge funds and other major investors shed short positions at the fastest rate in almost a year. The rally, then, hinged on the sudden shift in sentiment from oil speculators.

The underlying fundamentals, however, have not appreciably changed in recent weeks. U.S. oil production is declining, but more or less at the same pace that it has for months.

On the other hand, rising inventories undercut the notion that the market is adjusting. As a result, as the short-covering rally reaches its limits, and the markets digest the fact that the world is still oversupplied with oil, prices could fall once again.

The problem, as mentioned above, is that inventories could continue to rise around the world through the rest of this year, if EIA data is anything to go by. Oil prices may have rallied in recent weeks, but the EIA was more pessimistic in March than it was in February. The EIA says that global storage levels could rise by 1.6 million barrels per day (million b/d) in 2016 and by another 0.6 million b/d in 2017. Those predictions are higher than the EIA’s February estimate.

“With large global oil inventory builds expected to continue in 2016, oil prices are expected to remain near current levels,” the EIA concluded in early March. The EIA lowered its price forecast for Brent by $3 per barrel, expecting it to average $34 for the year.

2017 does not look much better: the EIA sees Brent prices averaging just $40 per barrel next year, a whopping $10 lower than what the EIA predicted last month. That could mean prices stay below $50 per barrel through 2017.

Price forecasts are always wrong, and often wildly off the mark. While it is difficult, if not impossible, to accurately predict price movements, especially a year or two out, it is impossible to argue with the sky-high levels of oil sitting in storage. Even if U.S. oil production continues to decline, the greater than 500 million barrels of oil inventories – a record high – need to start declining in a substantial way before the oil markets will see a sustained rally.

Part of the psychological reason for the recent rebound in crude price has to do with some members of OPEC wanting to freeze production at current levels.

The problem is that current production is about 1.5 million barrels per day above the world-wide usage rate.

The math just doesn’t add up.

I don’t think the production freeze is a unified front. It may indeed just be wishful thinking… I think it’s true no one wants to stop pumping, they’re sticking with high production because like everybody else they need the money. I heard somewhere that US storage is at 85%, this could impact imports? I, too, see math and it’s inherent hardness.

Does this reflect the new normal of suppliers’ scrum — more diffusion of production/ownership? And, just wondering, how much of the forecast is Iran’s ramp up?

I’m going to guess that irans production level is pretty well forecasted, but wonder if the saudi’s and russia made a deal would they fill the gap? and I also think (humbly or otherwise) that we don’t know if we’ve got a new normal right now, or we just have a right now. Isn’t storage the issue currently, because oil will always be worth something, and proven reserves, oil tankers, and tanks on land make the sum of it. The big major dividend paying oil co’s should be licking their lips, no? The frackers are pumping whatever they can sell and the tanks are full so low imports. Shutting down the pumps with low prices…raise your hand if you think oil will never reach $100 again? If you put 10 hippies on one side of the waterbed, what happens?…and when they switch to the other side? and if the hippies get off the waterbed? crisis

Iran’s oil production has suffered greatly due to US sanctions. It has no where to go but up.

Iran’s ramp up is and will be less than you think, because Iran’s production didn’t go down during the sanctions regime as much as advertised. There were a lot of barrels being labelled Iraqi and Russian that will now be accounted for as Iranian – but it’s a wash in terms of world supply.

Everything on the horizon seems aimed at pushing the price down. In the event of any substantial rise there is a huge amount of oil being held back which will rush into the market as the investors desperately try to get some money back. Its not just oil in storage – there are a lot of capped fracking wells which will be released as soon as the operators think they can get money for it.

A bit of a wild card in here though is the Russian pull back from Syria. Its no secret that the Saudi’s and Russians have been talking behind the scenes about strategic issues (oil and otherwise). Might they have come to some sort of an agreement? It might take the form of a joint easing in supply, while both focus on flooding specific markets – SA forcing their light crude into the US market to undercut tight oil directly, while the Russians lower the price of pipeline gas to Europe and Asia to undermine the LNG market. An important point which many economic commentators often miss is that oil is not as fungible a product as is assumed – its quite possible for one regional market to have collapsing prices while it rises in others if both use different oil grades – its impossible to change refining/storage facilities in the short to medium term. So it could be possible for SA to just focus on flooding light oil markets – which is primarily the US.

Another factor is that I suspect that fracking/tight oil is already dead, its just like Wile E Cayote with its legs spinning as he goes over the cliff. Fracked wells can produce for around 2 years – with ‘choking’ technology this can be increased. There are also many fracked and capped wells. So high production could be maintained for maybe up to 5 years with existing sunk investments. But without constant infusions of capital, it will rapidly decline after that. And once the workforce disperses and plant is sold off it can be very time consuming and expensive to ramp up again. The Saudi Arabian target was never the oil producers, it was oil investors – their intention was to warn them off lending/investing in unconventional oil, whether that be in the US or Argentina or wherever else it is found. They may well judge that this has already happened, although I suspect that in order to ‘maintain face’, they will want public evidence of a crash in investment.

“So it could be possible for SA to just focus on flooding light oil markets – which is primarily the US.” from above posting

——————————————————————————————-

Philadelphia refineries, once doomed since the dismantling of Suonoco as an oil refiner, found new life in cheap tight oil imported by US railroads. The port of Philadelphia which invested a fortune in the past decades to be a major multi-modal port facility, easily switching from trucks to railroads from the seaport, capitalized on the rail by crude and gained a new lease on life. Now, it would seem with the collapse of crude oil prices outside of the US, the local refineries can shop for even cheaper sources of crude than the domestic.

——————————————————————————————-

http://articles.philly.com/2016-02-25/business/70908117_1_heavy-canadian-crude-bakken-shale-oil

Ships importing crude oil to Philadelphia area up 19 percent in 2015

“Philadelphia Energy Solutions, the joint venture between the Carlyle Group and Sunoco that operates the South Philadelphia refinery complex, has not disclosed how much more oil it now buys from overseas. But Phil Rinaldi, the refinery’s chief executive, said the facility is configured to receive supplies from multiple sources.

“We designed PES to have a high degree of flexibility in the crudes we buy and the channels we use,” Rinaldi said Tuesday through a spokeswoman. “There is plenty of oil in the Bakken, but some foreign barrels have price-discounted themselves to be irresistible.”

——————————————————————————————-

Thanks Paul, I’ve no doubt that whoever is selling that super cheap oil has a very good reason for it.

You can take the oil out of the Carlyle Group, but you can’t take the Carlyle Group out of oil.

Who’s to say the Fed isn’t controlling oil prices through the future’s market? Who would oppose that outcome, except maybe speculators and they would have their head handed to them.

I think financial pricing in todays new reality is more than a bit bizarre. Which points to heavy manipulation.

Old solutions for old problems.

Rinse and repeat …….

1920s/2000s – high inequality, high banker pay, low regulation, low taxes for the wealthy, robber barons (CEOs), globalisation phase

1929/2008 – Wall Street crash

1930s/2010s – Global recession, currency wars, rising nationalism and extremism

It’s Keynes time.

.

The Neo-Liberal rinse didn’t make a blind bit of difference.

Neo-Liberal = Emporer’s New Clothes

In the long term, the oil storage capacity figure that is critical is that of the Earth.

In the short term, the Saudis can still flood the market at will, until their own reserves deplete sufficiently. Forecasting the market is a matter of determining what the Saudi royals are up to and how long they will be able to keep doing whatever it is they are doing. But these are closely guarded secrets, and the people who really have access to this sort of information are not making their living writing for investment newsletters.

I don’t think the Saudis could decide this on their own – had to be a joint-deal with the US. But agree a substantial Saudis cut in production would be good for an immediate boost in price, storage or no storage.

Let’s see, the U.S. is now producing about 9.2 million barrels per day of crude oil and is consuming 19 million bopd. U.S. production is not sufficient to cause an increase in storage.

The increase in storage is coming from refineries buying oil cheaply and storing it until prices rise in the near future. That’s not a bad business decision for these refineries. Thank God U.S. producers now have the option to sell oil outside the United States. It’s the only thing that will allow U.S. producers to get a fair price for their output.

Is there any truth to the reason SA isn’t cutting production is because the market share they lost from the 1973 oil embargo never returned and they don’t want to make the same mistake again?

Yves, there is one “when, not if” event that would take up to 4 million barrels of oil per day off the market.

That will be the collapse of the Mosul Dam on the Tigris River, 45 kilometers north of Mosul. Built in 1980-84 on a foundation of water-soluble anhydrite, gypsum, and limestone, it has required a 300-man crew working three 8-hour shifts a day to keep it from collapsing. The soft minerals under the dam dissolve away because they are as water soluble as sheetrock, and this rinsing away constantly creates gaping channels through the limestone for water to gush through. It’s like sticking a pressure washer wand into a big block of Swiss cheese. The water will come right on through.

The 300 men spent 28 years pumping grout into these gaping holes deep under the dam just as fast as they occurred. Then in the spring of 2014 ISIL captured the dam for about a month, and the 300 men fled. ISIL saw fit to destroy the grouting equipment, and the huge stockpile of cement, and they captured the city of Mosul, the source of their cement (it’s usual population of 2.5 million is down to 1 million now).

The dam has gone right on springing leaks underneath for 18 months, and it is unlikely that 1,000 men grouting around the clock can catch up. The US Army Corps of Engineers is warning that this enormous rock-filled dam is going to collapse in on itself due to its limestone foundations having melted away, and it is not and ‘if’ but a ‘when’ question. The collapse would only take about five minutes, and it would release a 65-foot tsunami down the Tigris flood plain, erasing Mosul, and within two days covering most of Baghdad in 13 feet of water. It would also destroy the pipeline that brings most of Iraq’s northern oil down to the Gulf.

Iraq would lose most of its oil production, most of its heavy industry, and all of its fragile government and infrastructure because this is all to be found right along the Tigris and Euphrates flood plain.

Take four million barrels per day off the world market, and prices are going to go up for a while.

Yeah but…. how the the market front runners time it is critical….

Skippy…. duty to the future….

Wouldn’t a paced regime of higher oil prices now be the very dream of the Fed?

Maybe completely irrelevant but when looking back at the housing crisis, the time from when prices peaked in July 2006 to the peak in inventories matches to the time to today from the oil price peak in June 2014. From that point housing inventory was stuck at that level and if history repeats then in twelve months time from now the crisis will nearly be over and the stock market bottom will have been reached.