In January 2008, CalPERS made what would seem to be a no-lose investment: the purchase of a 9.9% equity interest in Silver Lake Technology Management, which serves as the fund manager, or colloquially, the general partner, for various Silver Lake private equity funds. In her early years as a star analyst, Sallie Krawchek observed, “It’s better to work for a Wall Street firm than invest in one.” That same logic would seem to apply for CalPERS’ participating side-by-side with the firm’s founders in the management company: they would reap rewards akin to those of owner/operators rather than those of ordinary investors.

Yet from the end of its fiscal year 2011 to 2012, CalPERS showed a nearly 50% drop in the market value of its stake in Silver Lake in its Annual Investment Reports in the absence of any big decline in assets under management or other bad news. By contrast, publicly traded private equity firms KKR and Blackstone showed declines only half as large in their unit prices over the same period. In early 2013, as reported by Fortune’s Dan Primack, CalPERS sold approximately 30% its Silver Lake holdings back. In March 2015, Silver Lake stated in an SEC filing that CalPERS owned only 0.5% and intended to exit in the next few years, which in 2016, Silver Lake stated could be in the next few months.

What happened? Industry rumors, including from insiders, suggest that CalPERS took a loss well over $100 million on a $275 million commitment. Data first supplied by CalPERS to us showed an $80 million loss even with what looks like an implausibly rich valuation of its remaining interest. After we told CalPERS that it was required to show more of the history of its investment, CalPERS provided a second set of records that was radically at odds with the first disclosure. These records showed the giant pension fund, remarkably, just breaking even, which is still poor result.

As we’ll explain in detail later, this second, less damaging data story is inconsistent with other disclosures CaLPERS had made about Silver Lake, its established practice for how it reports investments, and documents about the transaction obtained from independent parties. In other words, other information as well as CalPERS’ own records and established practices strongly suggest that CalPERS suffered a significant loss on this investment.

CalPERS’ poor performance results directly from its failure to insist on protections widely recognized as necessary for minority investors. An individual knowledgable about the initial Silver Lake investment stated that it did not include a customary anti-dilution provision.1Silver Lake did indeed dilute CalPERS as it restructured the ownership of the management company.

CalPERS’ embarrassing result is due to the fact it listened to the two most dangerous words in investing: “Trust us.”

Just as troubling: CalPERS appears to be trying to cover up its loss. One might normally wonder whether the inconsistencies in documents that CalPERS provided in response to our Public Records Act requests were the result of incompetence in record-keeping, since the differences between the spreadsheet that depicts CalPERS breaking even and other reports made by CalPERS show numerous eight figure discrepancies. But CalPERS’ short explanation of its “tah dah” spreadsheet is that it found and attributed “contingent” investments to the Silver Lake parent investment…and that’s contrary to how it reports its cash flows and returns from other private equity investments. Further, CalPERS also scrubbed the metadata on its records to obscure when they were created, a step which requires third-party software.

Put it another way: CalPERS could have been so eager to muddy the waters regarding Silver Lake that it was willing to create the impression that its private equity information systems are so deficient that they routinely have $10 to $90 million errors on single investments. If CalPERS maintain that this is the case, which is what the public would have to believe in accepting the story in its second spreadsheet, that should send alarms ringing among beneficiaries, legislators, trustees, and California taxpayers and lead to demands for an investigation of CalPERS’ reporting and controls. We asked CalPERS staff about large inconsistencies in the information provided and they declined to comment.

The fact that CalPERS decided to attribute cash flows in with this investment that it in other cases it has reported separately highlights another troubling issue: CalPERS increasingly has been making co-investments in private equity in addition to investing in private equity funds. Co-investments are the right to invest side by side with the general partner of the fund in a fund investment, in addition to investing through the fund. These opportunities are offered only at the discretion of the fund manager. While they allow investors like CalPERS to save management and carry fees (with the tradeoff of bearing the full brunt of portfolio company fees), these investments take place completely outside the public’s view. Thus private equity investments are becoming even more opaque as the SEC has raised red flags about private equity practices and returns to public pensions funds have overwhelmingly fallen short of their own benchmarks.

Finally, this incident reaffirms a pattern we’ve documented again and again with public pension funds. While they can be and typically are very competent investors in traded securities, they are no match for private equity firms. And rather than steer clear of private equity, they instead compound the error by putting their trust in general partners who view them as just another meal ticket. As UK-based private equity researcher Peter Morris said by e-mail,

The significance of this story goes way beyond Silver Lake, private equity and CalPERS. Finance academics and regulators alike make it a core article of faith that big investors like CalPERS are “sophisticated”. The sorry saga of CalPERS and private equity helps to show that both academics and regulators need to change the way they think about these big investors.

.

Background: CalPERS’ Naive Approach to Taking Stakes in General Partners

In publicly traded stocks, CalPERS’ ambitions served it well. In the 1990s, it acted as a leader in corporate governance reforms and backed its commitment up by operating as an activist investor. That strategy proved effective, not only burnishing CalPERS’ reputation but also improving its returns.

CalPERS, as the largest single investor in private equity as of the early 2000s, again wanted to establish itself as a leader; indeed, until recently, this was an explicit policy goal. The giant pension fund saw acquiring stakes in fund management companies as a way to further that aim.

But individuals familiar with how CalPERS approached these deals described a process that lacked an investment thesis, which in turn resulted in questionable investment discipline. For instance, one rationale for CalPERS to participate at the management company level could have been to earn a much higher return, or alternatively, to have a less risky investment, since most of the income at large private equity firms comes mainly from fees which are not at risk of market performance. However, CalPERS sought only modestly better results than from investing in private equity funds themselves.2 It also had no exit strategy other than assuming that its chosen firms would do a public offering or be acquired by a larger financial institution. By contrast, private equity funds have typically cashed out their investors out by year ten, and the general partners have incentives to realize profits and return at least some proceeds relatively early in the fund’s life. 3

Another potential benefit of CalPERS’ investing in general partners would have been to increase their expertise, so that they could move in the direction that Ontario Teachers has, of doing more private equity investing in-house. However, McKinsey ruled that out in a study for CalPERS in the early 2000s. In addition, CalPERS didn’t ask for the sort of measure that Japanese investors who want skill transfer routinely get, such as having a set number of “trainees” work side by side with firm professionals.

Finally, CalPERS did not obtain any voting rights. It was prohibited by law.

Andrew Silton, North Carolina’s former Chief Investment Officer, in a 2012 post, A bad idea: when pension plans own a piece of a money manager, set forth why he opposed this type of investment, using the State of Florida’s pension fund investment in Providence Equity Partners as his example:

These are the kinds of investments that create conflicts of interest and undermine confidence in pension plans. The last we thing we need is a bone-headed investment that gives critics another excuse to attack public employee pensions…. Even if the investment turns out okay, this is still a bad idea.

The real reason for this type of investment is that the boards and staff of pension plans like to be viewed as “sophisticated” players…. However, the playing field is hardly level. The private equity firm is, after all, in the business of buying and selling companies. The folks on the other side of the table, even if they’re advised by an investment bankers, are completely outmatched….

How can Florida objectively review the investment performance of Provident [sic] and decide whether to continue to participate in their investment products when they also own a piece of the manager? Normally, if investment performance deteriorates, a private equity investor can simply decide not to participate in any new funds. However, Florida will now face a dilemma; if they choose not to invest, they will be hurting their economic interest in the manager. If they decide to participate, they will be not be acting as good stewards of the plan.

Obviously, CalPERS did not consider those to be serious concerns.

The Silver Lake Investment

In 2006, CalPERS had approached a short list of private equity firms that it viewed as attractive and said it would be interested in acquiring a stake in the fund management entity. CalPERS had bought a 5% stake in Carlyle in early 2001 and had considered that investment to be successful.

In 2007, in three transactions, CalPERS, the Abu Dhabi Investment Authority, and other investors had together purchased a 28.9% interest in Apollo.4

According to a source familiar with the Silver Lake transaction, in late 2007, Silver Lake contacted CalPERS to take them up on their offer. The CalPERS staff apparently did not consider the issue of adverse selection; for example, that Silver Lake approached CalPERS at that time because it foresaw that it might face liquidity issues. CalPERS did examine the proposed valuation in light of the developing financial crisis but in the end accepted Silver Lake’s assessment. CalPERS also objected to the lack of an anti-dilution provision in the proposed agreement. But Silver Lake partners Jim Davidson and Glenn Hutchins pressed CalPERS hard to agree to omit that provision, arguing that their interests were aligned.

In December 2007, CalPERS’ board authorized an investment of up to 10% in Silver Lake. On January 3, 2008, CalPERS purchased 9.9% of Silver Lake Technology Management for $275 million, valuing the firm at $2.8 billion.

As of June 30, 2011, CalPERS reported that the market value of its stake in Silver Lake was just shy of $330 million. A year later, even though the price of KKR’s and Blackstone’s units declined by 22.2% and 24.6% respectively, CalPERS reported a market price for its Silver Lake position of $166.9 million, nearly a 50% decline.5

Later in 2012, CalPERS decided to restructure its interest in Silver Lake. CalPERS was to be diluted pari passu with the founders, so as they withdrew, CalPERS’ interest would be diluted massively. Silver Lake had proposed a full repurchase at a large haircut to the original $275 million price; the eventual deal was a partial buyout. Dan Primack of Fortune, using data from CalPERS’ Annual Investment Report, noticed that CalPERS ownership had fallen by approximately 30% and that the cause was the sale of units back to Silver Lake.6

In its March 31, 2015 Form ADV filing,Silver Lake Technology Management, LLC wrote:

CalPERS previously owned 9.9% and currently owns 0.5% of Silver Lake Technology Management and is also an investor in certain Funds. The Adviser and CalPERS have an agreement pursuant to which, by a future date, the Adviser has the right to purchase CalPERS’s remaining stake at a fixed price and pursuant to which CalPERS can force the Adviser to repurchase the remaining stake upon similar terms. As a result, the Adviser expects to acquire CalPERS’s remaining stake within the next few years.

Bear in mind there was no similar statement in Silver Lake’s March 31, 2014 ADV filing, which means the buy/sell agreement was struck in the previous 12 months.

CalPERS’ First Story: They Lost Money

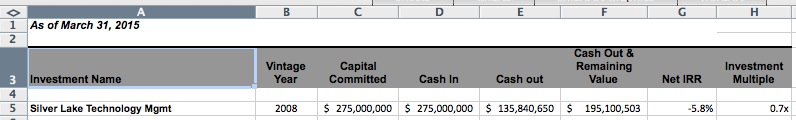

In early 2015, having heard reports of CalPERS’ loss in its Silver Lake investment, we submitted a detailed Public Records Act request for financial information about the Silver Lake investment. This is what we got back. Recall that this is an investment in a private equity fund manager, an operating business, and not in a private equity fund. Private equity funds, indeed all “alternative investments,” which are defined as funds, are subject only to limited disclosure under the Public Records Act. Moreover, CalPERS clearly does not regard this investment as a private equity fund, since it has never listed it in its quarterly disclosure of Private Equity Program Fund Performance Review. However, without ever giving a basis for refusing to provide anything but a portion of the information sought, CalPERS provided one quarter-end of data in the same data format they would use if the Silver Lake stake were a private equity fund:

This does show an $80 million loss. But on further inspection, this looks to be understated.

If you subtract “cash out” from “cash out and remaining value” you get $59.26 million. As of this date, per Silver Lake’s SEC filing, CalPERS owned 0.5%.

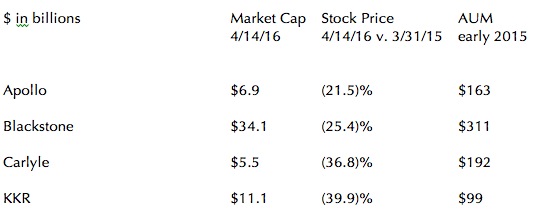

That remaining value values Silver Lake at $11.85 billion when it had assets under management of $26 billion in early 2015. How credible is that? Look at the Silver Lake figures versus the market capitalization of the publicly-traded private equity firms:

This is admittedly a very crude comparison given the difference in the stock market’s view of private equity firms in March 2015 versus now.7 But you don’t need the refinement to get the general picture. The changes in units outstanding over the intervening period were not large for any of these firms. So if you gross up the current market caps to a March 31, 2015 price level by using the change in stock prices as an approximation, you can see that the Silver Lake $11.85 billion valuation is awfully rich given its much smaller size.

And that’s before you get to the fact that private, non-tradeable equity is valued at a discount to public stocks, with the rule of thumb a 20% to 40% discount. So the Silver Lake valuation should be markedly lower than public market comps.

Now perhaps CalPERS “remaining value” is the “fixed price” mentioned in the Silver Lake Form ADV. But recall that the ADV specifically mentioned that the put-call arrangement was operative only at a “future date.” But why would Silver Lake give CalPERS such a rosy valuation? This seems even more unlikely given that:

1. If Silver Lake did nothing, CalPERS would continue to take losses and would have no recourse

2. Silver Lake’s offer to buy out CalPERS in 2012 was at a large discount to both its purchase price and its recent market value estimates. Silver Lake thus previously took advantage of its bargaining leverage. Why should it change its behavior?

Consider how “remaining value” is often treated for the few assets remaining in a private equity funds at the end of its life, the ones that have proven hard to sell. They are effectively always on sale, and it’s not infrequent that a general partner will maintain roughly the same valuation for several years, then take an offer at lower than the target price, explaining why it was better to get out then.

The bigger point is that “remaining value” in CalPERS’ private equity reports is not market value; it’s a very loose concept. So it is not at all implausible that that $59.26 million is the strike price for three years or more out. Equity risk premia are generally set off the 10-year Treasury bond, but we’ll be charitable and use the 5 year to match the time frame of the exposure better. The five year Treasury was trading at 1.40% at the end of March 2015. The equity risk premium, per a regularly performed survey of CFOs, was 4.5%. CalPERS sets a 300 basis point premium for private equity to that (which we’ve argued is too low). That gives you an 8.9% discount rate. That gives you a present value of $ 45.9 million. This would bring the total loss close to $100 million.

Nevertheless, several experts we asked to look at the Silver Lake valuation (even allowing for the possibility of needing to discount it) found it hard to square with the 0.5% stake with the “remaining value” shown. As one expert said, “In my experience staff spreadsheets tended to drift pretty far from accounting statements.”

CalPERS’ Second Story: They Barely Broke Even

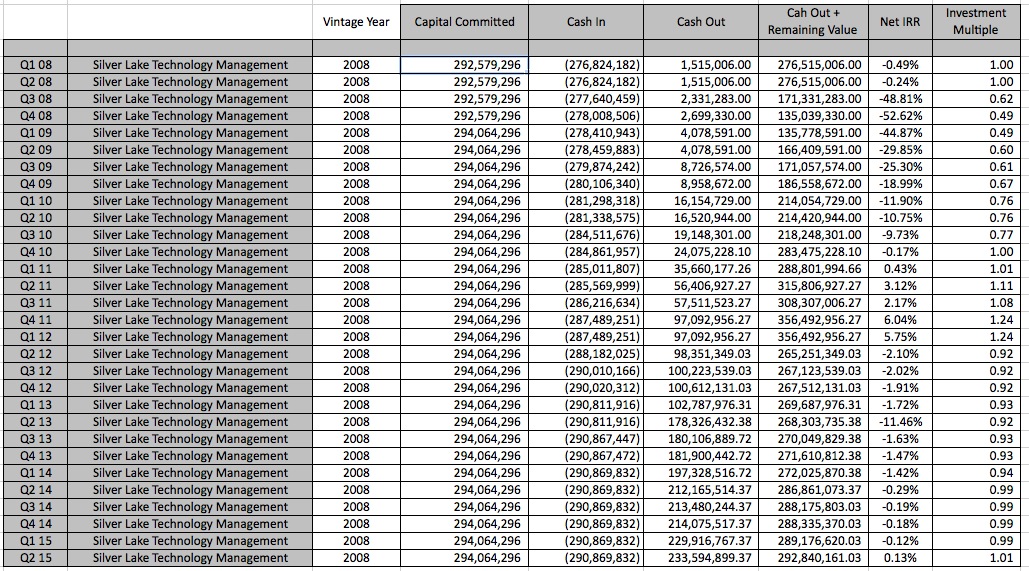

We objected to the skimpy PRA response, and argued that we disagreed strongly with CalPERS trying to claim that its investment in Silver Lake was in an “alternative investment fund.”8 They also sent the data below:

Here are the major differences from the first spreadsheet:

1. The first one lists a “commitment amount” of $275 million and shows “cash in” of that amount as of March 31, 2015. “Commitment amounts” are authorized maximums in the contract signed at closing. The first spreadsheet is consistent with an equity purchase at a set date. By contrast, the second spreadsheet shows an authorized amount at the end of the first quarter of 2008 of $292.6 million, nearly $18 million more than the “commitment” amount. At March 31, 2015, the second spreadsheet shows an authorized amount of $294.1 million. The increases in the authorized amount are not readily explained.

2. The second spreadsheet shows “cash in” as of the closing date of $276.8 million which increases over time to $290.9 million as of the end of 2Q 2015. But the increases from quarter to quarter look too small to be capital calls for deals, and look too large to be the sort of other charges you might expect to see for an investment like this, say having to reimburse the cost of a special annual audit.

2. “Cash out” as of March 31, 2015 is $229.9 million, $94.1 million more than in the first spreadsheet.

Where did all the extra money come from? From the transmittal e-mail:

The spreadsheet differs from the Q1 2015 information that was sent to you on September 25, 2015 (PRA #2141). This is a result of the original report inadvertently excluding the investment structures related to Silver Lake Technology Management to which CalPERS optional commitments to various Silver Lake investments and CalPERS share of the carried interest flowed.

Translation: CalPERS had some special side deals with Silver Lake that were part of the original investment and those results should be included.

How credible is that position, that CalPERS has almost $100 million more of “cash out” of the Silver Lake investment by March 31, 2015 that it somehow forgot about? Remember, under the Public Records Act (PRA), CalPERS is supposed to send records, not special-purpose documents it made up.

The wee problem is that this second spreadsheet differs from other documents that were almost certainly prepared with more care. For instance:

1. We have multiple documents from one of the parties to this transaction. They repeatedly and consistently describes the 2008 investment as a $275 million purchase

2. The second spreadsheet is not consistent with CalPERS’ Annual Investment Report. The unaudited Annual Investment Report (AIR) is published every year as of CalPERS’ fiscal year end, June 30, separate from the Comprehensive Annual Investment Report (CAFR).

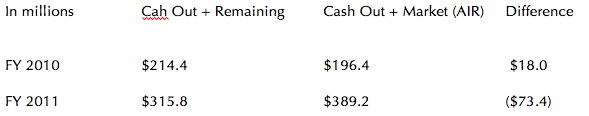

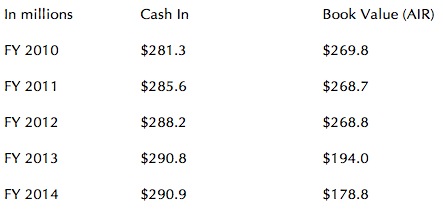

For year end 2012 through 2014, the “Cash Out” and “Cah [sic] Out + Remaining Value” columns in second spreadsheet tie with the AIR; the difference between “Cah [sic] Out + Remaining Value” minus “Cash Out” as of the end of the second quarter equals the market value shown for Silver Lake Technologies Management in the AIR. But not in 2010 and 2011:9

Similarly, “Cash In” is not consistent with Book Value in the AIR, when it should be up through the share buyback, meaning fiscal years 2010 through 2012:

3. CalPERS CAFR for fiscal year 2014 in its Schedule of Fees & Costs for Private Equity Partners (which is footnoted as being on a calendar year basis, so this schedule is confusingly for calendar year 2013), shows expenses for Silver Lake Technology Management of $3.25 million. This is presumably for the 2013 restructuring. There is only a $1,000 (yes, one thousand dollar) fee listed for the previous year and none for any earlier years. It is not clear how this charge is included in the second spreadsheet

Keep in mind that the reduction in book value from fiscal year end 2012 to 2013 of $76.9 million is generally consistent with the second spreadsheet, which shows an increase in “Cah [sic] In” of $75.5 in the second quarter of 2013 versus first quarter, consistent with the buyback closing then. The decline in book value in the next year, of an additional $15.2 million, is presumably due to dilution. But the book value then, of $178.8 million, is roughly 2/3 of the highest book value we see, as of end of fiscal year 2010 (earlier years are not available online). It’s puzzling to see the small reductions in book value after that but before the buyback. But it’s pretty safe to treat the fiscal year 2010 as pretty close to the book value as of the time of the investment.

So if we believe the book value is accurate, that would mean CalPERS held a roughly 6.6% stake in Silver Lake as of June 30, 2014. How did it decline to 0.5% as of March 15, 2015, a mere 9 months later? The change in “Cah Out” for the end of fiscal year 2013 to 2014 is greater than for 2014 to 2015, so there’s no fingerprints of another buyback to explain the plunge.

Mind you, Silver Lake’s current Form ADV does say that CalPERS’ did obtain additional investment rights in connection with its investment in the management firm. But the picture that this section presents is inconsistent with the tale of the second spreadsheet:

CalPERS, by virtue of its stake in the General Partner of Silver Lake, has in the past received and will in the future receive the opportunity to co-invest fee-free on a “blind pool” basis in transactions made by the Funds over a preset time period. Such investments are added to Silver Lake’s affiliates’ investments for purposes of calculating limits under the LPA on the General Partner’s ability to make co-investments. For the most recent Silver Lake Partners fund, CalPERS has exercised this right to invest a significant amount of capital on this basis. These pportunities are distinct from the individual company co-investment opportunities offered to all limited partners including CalPERS which are subject to the Adviser’s sole discretion, as described above.

The part that is completely inconsistent with the second spreadsheet is “a significant amount of capital”. For CalPERS, that translates into amounts much larger than the $20 million or so shown as the “cash out” over and above the $275 million commitment amount for the investment in Silver Lake Technologies Management. And that’s before you get to the issue we pointed out earlier, that it has not been CalPERS’ practice, either with its other reports on Silver Lake or its general practice for reporting on private equity funds, to lump returns on co-investments in with the returns from the fund proper.10

In other words, if the mystery additional cash flows in the second spreadsheet did indeed come from the Silver Lake Management co-investment blind pool, the amounts are so small relative to the capital that Silver Lake states was provided that they must have been cherry-picked.

Andrew Silton, North Carolina’s CIO, was one of several experts who spent a considerable amount of time trying to make sense of these figures. His take:

My guess is that they’ve taken different accounting approaches to this investment. Silver Lake has taken the view that they’ve diluted CalPERS and CalPERS has not accepted that view. Meanwhile, I’m guessing that the investment staff and accountants aren’t synced up on the investment either. The staff is estimating market values, which accounts some of the diminution in the value of the asset (we see that in the spreadsheets), and the accountants for financial reporting purposes are even further behind with respect to book value. I’m betting, both staff and the accountants would like to slowly let the air out of the investment over multiple reporting periods.

The figures are so far apart, I don’t think they can be reconciled except by assuming each of the relevant parties is on a different page.

Ouch.

Also noteworthy: CalPERS scrubbed the metadata on both spreadsheets. This is not normal practice in FOIA responses generally and CalPERS’ PRA responses in particular.

What Do We Have to Believe to Believe CalPERS’ New and Improved Story?

CalPERS, no doubt, will attempt to dismiss the analysis above, claim that the second spreadsheet is accurate, and maintain that it got out of its Silver Lake investment whole.

But to believe that, you have to believe that CalPERS is utterly incapable of keeping accurate, consistent records on one of its most important single investments in strategic terms, one that has also repeatedly commanded a considerable amount of senior staff time. As we’ve shown, CalPERS has numerous eight-figure inconsistencies, the largest over $94 million, on an investment of either $275 or $290.9 million. That level of disparities should sound alarm bells not just among CalPERS beneficiaries and California taxpayers, but also the legislature and Governor’s office.

This shifting “what happened with Silver Lake” story raises another set of troubling questions. The fact that CalPERS found some “tah dah” funds that it previously missed, at the very best, says that CalPERS has large pockets of money that it accounts for nowhere until pressed. And as CalPERS makes more and more co-investments, the new vogue in private equity, the less and less the public will know about how these risky investments are doing.

No matter how you look at this, CalPERS lost a significant amount of beneficiary money relative to its targets and as we have argued, probably in absolute terms, by placing unwarranted trust in a private equity “partner,” a failing the SEC has effectively called out across all private equity limited partners by describing how vague the limited partnership agreements are on critical points and how lax ongoing oversight is. CalPERS has compounded the damage by engaging in what looks like a coverup on top of the “crime” of incompetent negotiating.

____

1. There are ways to reduce this risk, such as having a put option. But CalPERS did not seek any compensating terms.

2. CalPERS expected its improved return to come from saving paying management and carried interest fees. Oddly, it did not expect to do better by having access to all the portfolio fees that most fund managers charge. Needless to say, this view would work in favor of the private equity fund manager in valuing the stake sold to CalPERS.

3. The incentive to realize some profits relatively early comes from the fact that the use of IRR for computing fund returns has an overly-positve impact on total reported returns. This can distort behavior, since a general partner may sell a business earlier than would have been optimal if the returns were reported on a more accurate basis, such as public market equivalent. However, general partners have additional incentives to sell some business before year 4, when most firms start raising their next fund, since investors will be skeptical of reported returns for the most recent fund if no actual cash profits have been realized.

4. The Abu Dhabi Investment Authority did not get anti-dilution protection on its investment in Apollo, and knowledgeable individuals said that means that it is virtually certain that CalPERS didn’t either. That precedent no doubt played into CalPERS not standing up more firmly with Silver Lake.

5. Note that the valuation of this position was prepared from time to time by outside accounting firms, and otherwise by Silver Lake. As we’ve noted repeatedly in our private equity reporting, the well-established practice is to understate losses in down equity markets, on the cheery view that the investors will get out only when pricing is favorable. So the plunge in market value is even more striking.

6. More precisely, the year-to-year change in reported book value was 27.8%.

7. And that’s before you get to complicating factors like the fact that most of these firms have announced share repurchases: KKR of $500 million, Apollo, $250 million, and Carlyle, $200 million. And their businesses are not exactly comparable. Blackstone is a diversified alternative asset manager. KKR puts much more firm money in deals than the other players do. Apollo manages real estate and credit funds in addition to private equity funds, and both feature lower fee levels than private equity firms.

8. As one expert on FOIA said of CalPERS’ response, “It merely lists sections of the Public Records Act. This is particularly disingenuous given that the request letter contained a lengthy discussion as to why the legal form of the investment, as well as CalPERS’ consistent failure to include it in any of its legally mandated disclosures of private equity investments and other alternative investments in its periodic filings meant that under the language of the statute, as confirmed by CalPERS’ treatment of this shareholding, it was not an “alternative investment vehicle”. It’s also procedurally pathetic–not surprisingly–in that they failed in their legal obligation to state the “express provisions” of the PRA that they are relying on. To claim ‘It’s exempt pursuant to 6254″is to basically say that ‘It’s exempt pursuant to the PRA.’ 6254 is pages long and contains dozens of different exemptions, and you are left not knowing which they are claiming.”

9. No, CalPERS was not using book value for “remaining value” as opposed to market value in 2010 and 2011. Book value is also listed in the Annual Investment Report. If you take the book value as of the Annual Investment Report for the end of FY 2011 and add it to the “cash out” for 2Q 2011, you get $325,168,492, nearly $10 million greater than in the second spreadsheet. This seems even harder to fathom given CalPERS claim that the Silver Lake Technologies Management had additional cashflows associated with it. You’d expect that to result in higher, not lower, market values in the event of discrepancies.

10. Although it would not apply in this case of a blind pool co-investment, which is an unusual arrangement, a big reason for reporting co-investments separately is that staff chooses which deals to invest in, so measuring staff’s performance is important from a managerial perspective.

Thanks yves for more on this public/private skimming operation. I no longer wish to be sophisticated, which I had thought meant “smart” but now I realize means something else. If someone could clear this point up for me, when calpers wanted to get out of the investment, silver lake was able to make their (CalPERS) investment value smaller because there was no anti dilution clause? Or could and did SL dilute the shares in the natural course of the “partnership” and that’s what made CalPRS want out? More precisely, did SL just wind up with the 100 mil or was it lost to other parties? Sorry for my confusion, and also if it’s a dumb question, I really don’t understand this stuff, but I’m trying to figure who wound up with the money.

On this…

“Put it another way: CalPERS could have been so eager to muddy the waters regarding Silver Lake that it was willing to create the impression that its private equity information systems are so deficient that they routinely have $10 to $90 million errors on single investments”

If you can’t dazzle them with brilliance, baffle them with B.S.

Bernie Sanders says that the business model of Wall Street is fraud. Your investigation of CALPERS is a demonstration of that business model in action. And, FWIW, I agree with Stilton. It sounds to me like the parties do not agree on the nature of the current relationship between the CALPERS and Silver Lake Management, possibly because CALPERS realizes they have been cheated.

As do other pieces in your investigations of CALPERS, it shows that there is no such thing as a sophisticated investor when it comes to specialized investments. Years ago, I learned the hard way that a guy sitting in his office and talking to his broker once a month isn’t going to beat the guys who stare at the screens all day and into the night. This is exactly the same thing. If there is one thing this investigation proves, it is that the rules should be changed to eliminate the concept of sophisticated investor. When you deal with professional thieves, the amateur thieves you hire to advise you are not competitive.

The entire private equity investment side of CALPERS is in dire need of a house-cleaning. Is anyone in charge there?

I keep wondering why CalPERS goes out of it’s way to give itself a public relations black eye. It seems that the head doesn’t know what the left hand is doing and the right hand doesn’t know what the left hand is doing.

Then there’s the disgustingly obvious obfuscation: To claim ‘It’s exempt pursuant to 6254″is to basically say that ‘It’s exempt pursuant to the PRA.’ 6254 is pages long and contains dozens of different exemptions, and you are left not knowing which they are claiming.”

Perhaps the discrepancies can be explained by a multi-million dollar “penny jar” at CalPERS that can be used to adjust accounts.

This willingness to take on risk without anti-dilution or put clauses had to be in response to someone on CalPERS staff being in Silver Lake’s pocket. As a CalPERS member, I would like to know who that person or persons are and what they received, or have been promised when they leave CalPERS.

There is no other rational explanation. The obfuscation being thrown up around the apparent loss of $80 or $100 million of my and my employer’s money suggests that they are still on staff. This suggests why staff have been actively attempting to intimidate the Board out of fiduciary oversight.

Yves, once again thank you for terrific PE reporting.

It should be obvious by now that laws need to be pass not only to protect pension funds from PE managers, PE consultants, PE accountants, and PE lawyers, but also to protect pension funds from themselves.

If this is happening at CalPERS, one can only wonder what is happening at other “less sophisticated” pension funds.

+1

Does ‘sophisticated’ mean ‘rich enough to stand the loss’? In the case of pensions the loss accrues to retirees who generally aren’t rich. So many lessons in this post for all investors, pubic and private.

Great post.

The Losses accrue to the current contributors/future annuitants, current annuitants/retirees, as well as current and future tax payers.

This is all about privatize the rewards, socialize the losses.

All CA taxpayers get ripped off by scams like Silverlake.

Thanks, Yves. Busy day here, so I don’t the time to read fully and get right into the weeds on this. But I appreciate it that you do.

Once again you highlight one among many deficiencies of CalPers investment “strategies.” It’s great to highlight this, as I hope it leads to better decisions and performance on the part of CalPers BigWigs for us small people who hope some day to enjoy the pensions that we contribute to.