Someone went to the ECB to the tune of $1.2 billion to get dollar funding, which meant the ECB has to access its currency swap line with the Fed. There was no use of the dollar swap line in the prior report.

The ECB makes it not exactly easy to find this report. They include the summary on the “Open market operations” page. This is the top:

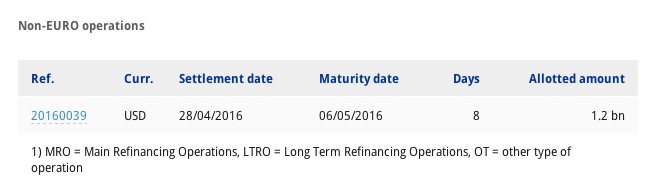

If you scroll down the page, you find the dollar swap facility as a single line entry…

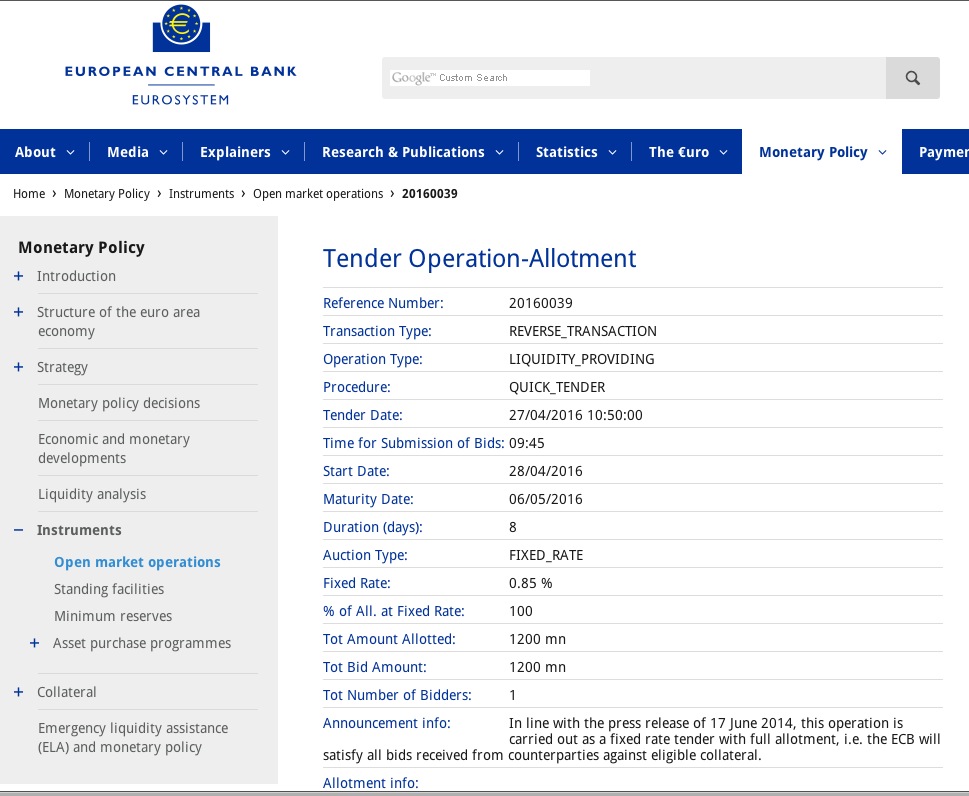

…and if you click on the reference number, you get the details. Note this page does not clearly indicate that the transaction is in US Dollars, which the ECB gets via swapping with the Fed:

Note that this is only one bank (see “Total Number of Bidders” line).

Who could this be? The banking systems under most stress right now are Greece and Italy. But the amount of this transaction is much too large for the institution to be a Greek bank. It would have to be a pretty to very hefty Italian bank, say UniCredit, or else a sizable bank somewhere else that was having short term dollar funding issues. Any ideas?

Our old friend Deutsche Bank?

That actually was my first thought…

I’m sure it’s Deutsche Bank. If not, it soon will be. Actually the first sign of a disaster will be when DB stock sinks into the single digits…

Me three. We call them “douche bank” in my shop, but I’m certain we’re not the first to do so.

Isn’t Deutsche Bank the German translation of CitiBank ? or We’llPretendIt’sNotCompletelyF*ckedBank ?

This represents what – an ECB member bank short on USD borrowing from the lender of last resort to cover its shortfall? WHy is it short USD – client requirements (weapons buy?); or perhaps covering short positions in fx markets? Or is it a sign of weakness?

The fx markets are moving fast – much of the change in oil and other global commodity prices, for example, are really currency-related. It would not surprise me if several banks are short the USD as it is moving downwards – and about time too – it’s been overvalued for some time.

Okay, this comes with a *huge* health warning as my friend is, ah-hem, somewhat prone to getting his facts completely wrong, but I was told last week by a fellow IT shyster who is on a contract at DB that their treasury ops is a total basket case. Mid-month (this month), their reconciliation job (calling it a “job” is apparently being way too nice about it, it is collating a load of disparate outputs from half a dozen systems, importing them into a custom central ledger, doing data transformation then having a whole floor of people using Excel — yes, *Excel* — generate the final reporting of DBs various positions in various currencies, instruments and operating units) fell over. It isn’t just London, this mess is DB-wide (i.e. endemic across all their operations inc. mainland Europe)

DB is dragging in anyone in the Greater London area https://www.db.com/careers/en/prof/role-search/job_search_results.html#job_category=10&country=71&cityname=109 to try to sort out their various problems but no-one with a functioning brain cell will go near the place so they are stuck with relatively inexperienced people who don’t know any better, hopeless alcoholics who just go from place to place figuring it’ll take a few months until they’re found out as being unemployable, blaggers with CVs more padded than Ru Paul’s bra and so on.

DB top management though can’t quite bring themselves to realise that they don’t need another round of hotskilling short-term labour, what they need is to recruit and retain a dedicated set of technicians willing to invest 5+ years of their careers to really get under the hood of the mess that is DB’s spaghetti systems and sort out the plumbing good and proper. They treat their contractors like dirt so no-one with any talent sticks around for longer than they have to, so adding to the problem of churn and leaking knowledge.

But like I say, my friend does nothing but moan and I frequently think he’s not happy unless he’s got something to complain about, so I do think he may be making it out to become worse than it is. Even allowing for DB’s self-admitted rubbishness in terms of their systems, it’s not that unusual for a daily reconciliation to fall over and I don’t get how it could spill over into the kind of liquidity crunch which would lead them going cap-in-hand to the ECB.

That is some juicy stuff, right there.

You would be surprised how common the situation you describe is in institutions large and small. The financial statements look professional and tidy but the underlying processes are all-too-frequently chaotic.

Indeed. They have Kondor+, Opics, Summit, plus several internally built treasury systems depending on location, often more than one. Dozens of home grown satillite systems encircling those. In addition to the Excel monkeys in London, they have a few thousand in Bangalore doing exactly the same activities non stop for other parts of the business. So I can generally confirm your friend’s comments, but as divadab intimates, DB is merely below average for a bank of this size and scope.TBTF? “Too complex to live” is more like it.

Engineer’s are priviledged, they get to see how the sausages are made ;).

I am related to someone who worked on selling investment projects in green energy. They would build sophisticated options models in excel, sometimes the model would “slip some digits” and give NaN’s.

When that happened, they would just re-run the model until the NaN’s were gone and trade that. That shop is not bankrupt yet. Maybe a few of their clients did.

Maybe Danske Bank? They are well known here for blowing themselves up and getting bailed out to have another crack at it. Denmark had the second largest bailout package in the eu in 2008. Most of that was Danske.

CS?

May we all live in interesting times indeed…

BNP Paribas? Ooo, we should have a contest! Winner gets a $20 savings bond that matures in 2036. :D

http://www.evergreengavekal.com/wp-content/uploads/2016/04/CS-DB-and-STAN.png