This is Naked Capitalism fundraising week. 1224 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in financial realm. Please join us and participate via our Tip Jar, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our fifth goal, more original reporting.

Yves here. Many people have predicted a bust in China’s bubblicious housing market for quite some time. Regardless of whether you believe that the endgame is nigh or not, this analysis contains some interesting data. Wolf Richter posted yesterday that China House Price Bubble Soars Most Ever, Government Freaks out, Preannounces Plunge. Even though this is a deliberately attention-geting headline, Richter also stresses that the government has taken aggressive steps to try to keep its latest round of monetary stimulus from goosing housing prices further by imposing restriction, including requiring bigger down payments. This appears to have led to an influx of purchases ahead of the October 1 deadline, and in a never-before move, released preliminary data for October, which shows a meaningful decline in many big cities.

And one point I found telling in the article below was that it was retail investor money that has been pouring inin even as professionals are pulling out. That is often the sign of a market top.

By Dee Woo, chief economist of Beijing Zhonghua Yuan Financial Institute

Summary

What’s behind the property fever in China?

The financial truth of the destocking of China’s property market.

Using quantitative analysis to predict when the bubbles of China’s housing market will burst

1.What’s Behind the Property Fever in China?

Before Mount Vesuvius erupted in A.D. 79, the nobles in Pompeii carried on their extravagant lives without a care in the world. Humans have very narrow visions, oftentimes can only see people around them fiddling away the good times, and have no idea that their landmarks-such as Mount Vesuvius to Pompeian, can evolve into such a deadly force of mass-destruction.

Since April 2015, the property price in China has been growing fast, and the trading volume per month and price YoY growth rate have broken all previous records by significant margins. This market rally is the strongest in the 18-years long bull market of China’s housing market. Housing market speculation has become the talk of the town so much so that people would give up their own business or jobs for it.

However, the real picture of China’s economy couldn’t be more depressing apart from the red hot housing market: the GDP growth rate has been falling steadily towards the historical lows since “Reform & Opening up”; the export values (rolling 12 months) YoY growth rate has been declining for the past 6 years and arrive at the level last seen in the aftermath of the 2009 global financial tsunami. If above facts were ignored, the period since April 2015 would be seen as the most prosperous by many, when the housing market is the hottest on record. China’s housing market is truly reminiscent of Pompeii right before A.D. 79.

Humans have very narrow visions, oftentimes can only see people around them fiddling away the good times, and have no idea that their landmarks-such as Mount Vesuvius to Pompeian, can evolve into such a deadly force of mass-destruction. However, the evolvement of the force of mass-destruction can be spotted well in advance by analyzing the macro financial economic data.

In the 18 years long bull market of China’s housing market, there are two market makers: local governments, and the institutional money which are property developers and their financial backers(banks, insurance companies and shadow banks). the retail investors are the residents-ordinary people enthusiastic about investing, the vanguard of which were nicknamed Chinese Damas.

In the current housing market rally, how do the market makers and Chinese Damas (aka ordinary people) fare? Let’s look at the below chart:

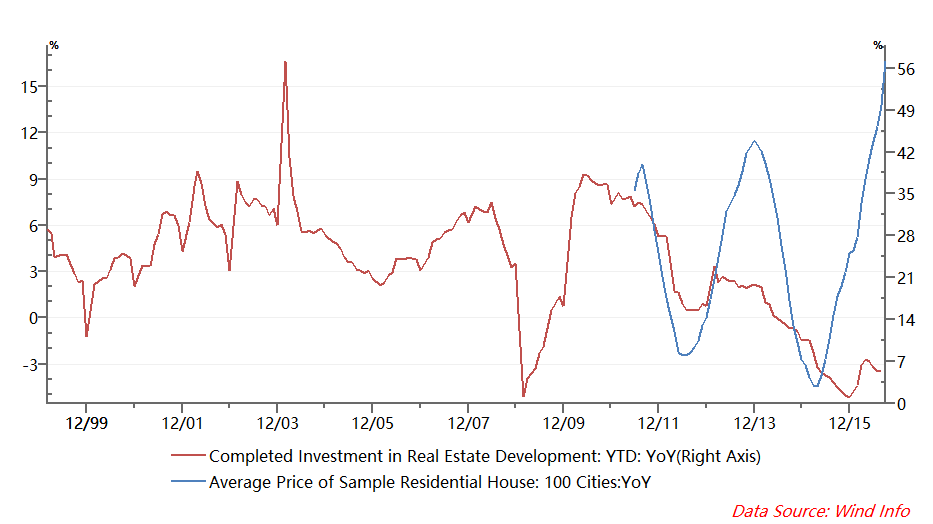

Chart 1

2.The Financial Truth of the Destocking of China’s Property Market

The destocking of property market is one of the 5 essential economic tasks in 2016 given by the central government, which are now one of the hottest trending economic topics in China.

According to Chart 1, in this rally, the YoY growth rate of “Average House Price in China” now reached its highest level since the data was collected and also surpassed its previous record by significant margins, meanwhile the YoY growth rate of” Completed Investment in Real Estate Development” drops to the historical lows and stay there since April 2015 when the housing market started to take off. This means that institutional money has flown out of the property sector during this rally.

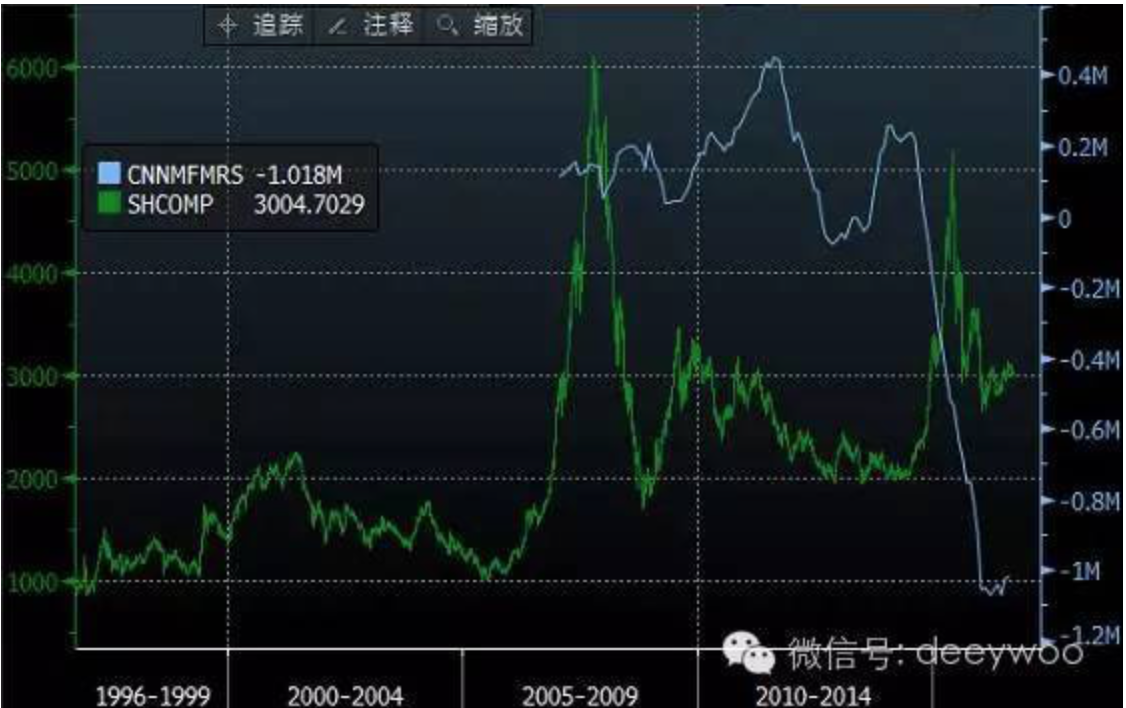

If institutional money doesn’t buy into this rally, who do? The situation is much like what transpired in the 2015-16 Chinese stock market turbulence. According to Chart 2, during the crazy rally of A shares from June 2014 to June 2015, the net capital flow (rolling 12 months) of China started to drop very quickly and turn negative in the late 2014 for the 1 st time since the data was collected. The hot money was flowing out of China at its highest speed, which is the total opposite of what happened in the previous rallies of A shares. According to Bloomberg, China suffered capital outflow of one trillion dollar in 2015. Hot money didn’t buy into the crazy Rally, and it was Chinese Damas that were left holding the bags and suffered the heaviest loss in the end.

Chart 2

CNNMFMRS: China Net Capital Flow(rolling 12 months), SHCOMP: Shanghai Stock Exchange Composite Index, Source: Bloomberg

The examples among the institutional money, which do not buy into this housing market rally are plenty. Let me count two of the biggest: Wanda and Anbang. Before 2015, Wanda Group invested totally 15 billion dollars overseas, and in 2016, it invested 10 billion dollars outside China so far. Since 2014, Anbang Insurance group has invested a hefty sum of 13.5 billion dollars overseas. Wanda Group is one of the biggest real estate developers in China. The insurance industry which Anbang Insurance group belongs to is one of the most important funding sources for the housing sector. Now the biggest names among the institutional money who once were the biggest patrons of the property market, are moving their assets overseas on an unprecedented scale. This is one of the most fundamental reason why the YoY growth rate of “Completed Investment in Real Estate Developmen” stays at its historical lows during this housing market rally.

The trend couldn’t be clearer: The current market rally is the strongest one in the 18 years of China real property bull market. However, to the opposite of what happened in previous rallies, this time the institutional money is flowing out of the sector, and when netting out, the capital is flowing out of China as a whole at a speed unprecedented since “Reform & Opening up”. While the institutional money is abandoning the sector, who is fueling the rally? Let’s look at the below Chart:

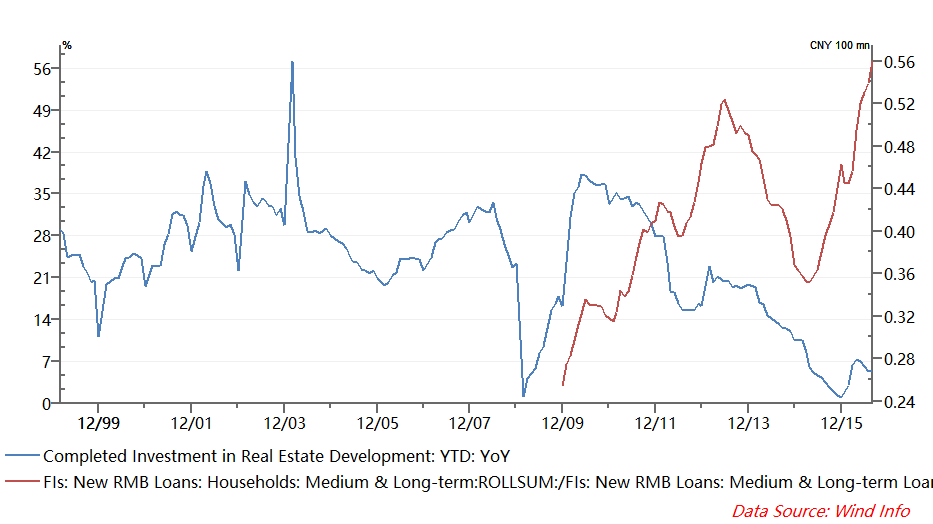

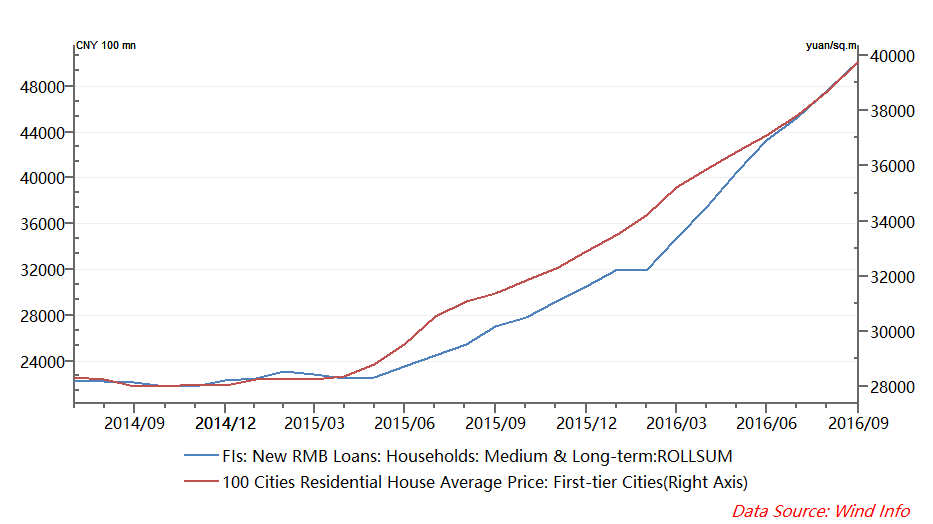

Chart 3

Completed Investment in Real Estate Development: YTD: YoY<Blue Line, Left Axis>, FIs: New RMB Loans: Households: Medium & Long-term (ROLLing 12 months)/FIs: New RMB Loans: Medium & Long-term Loans (ROLLing 12 months)< RedLine, Right Axis> Data Source: Wind Info

Be aware that the majority of “New RMB Loans: Households: Medium & Long-term” is home mortgage.

According to Chart 3, ever since ” New RMB Loans” data was collected from Dec 2009, ” New RMB Loans: Households: Medium & Long-term (ROLLing 12 months)/FIs: New RMB Loans: Medium & Long-term Loans (ROLLing 12 months)” almost moved in tandem with” Completed Investment in Real Estate Development: YTD: YoY“, which indicates that the institutional money and Chinese Damas almost leveraged up in line with each other in all the previous housing market rally.The current rally is an exception: “New RMB Loans: Households: Medium & Long-term (ROLLing 12 months)/FIs: New RMB Loans: Medium & Long-term Loans (ROLLing 12 months)” rises up with unprecedented speed while ” Completed Investment in Real Estate Development: YTD: YoY” languishes at the historical lows.

The institutional money is abandoning the housing sector and reducing its respective leverages, and meanwhile Chinese Damas are leveraging up at the unprecedented speed. So it is the financial truth of the destocking of China’s property market.

Chinese Damas nearly Run Out of the room to grow their leverage

This April, about 77% of “FIs: New RMB Loans: Medium & Long-term Loans” are home mortgages—close to the previous record number: 81%; this May, the YoY growth rate of the home price in the First-tier Cities arrived at 26.36%–a new record. Even more shockingly, in July, nearly all of “FIs: New RMB Loans: Medium & Long-term Loans” are home mortgages. The current housing market rally is entirely fueled by the Chinese Dama’s unprecedented leverages. How much further can Chinese Dama’s leverages go?

We should also be aware that on the one hand, Chinese Damas are heavily restricted to exchange their RMB for dollars and shift their dollars aboard, and they end up buying up houses feverishly; on the other hand, the institutional money moguls are a privileged bunch who can easily exchange their rmb for billions of dollars and shift their assets aboard on a massive scale, and they end up reducing their exposures to China’s housing market substantially. Similar situations happened in the previous crazy rally of A shares as well. According to Bloomberg, during the super strong rally and subsequent crash of A shares in 2015, the annual tally of China’s capital outflows reached 1 trillion dollars. In this regard, China’s housing market is not much different from A shares. There are all asset bubbles insanely leveraged up by Chinese Damas, which allow institution money to cash out.

In the casino that is China’s housing market, the institutional money has drastically cut down its exposures, and move its assets aboard on a massive scale; the local governments use the Local Debt Swap Program and the record number of “land kings” transactions to cash out and reduce their respective leverages; and there are only highly leveraged up Chinese Damas left holding the bag. So the question is how much further can Chinese Damas’ leverages go? Let’s see the below data from Economist Jiang Chao of Haitong Securities:

When looking at the balance of total home mortgage and taking into account Housing Provident Fund, the average debt-to-income ratio of Chinese mortgage takers is close to 50% which is close to the level of the US before the subprime mortgage crisis. The new home mortgage/GDP ratio is also close to the historical high of the US.

There’s really no much room for Chinese Damas’ leverages to grow substantially further. Right when Chinese Damas’ leverages nearly get out of hand, Local governments in China announced a flurry of property market cooling measures, many of which are the strictest in the history. The situation is reminiscent of last April when China’s financial authorities started to crack down shadow lending in the stock market.

According to my prediction, if the government stands aside, China’s housing market will reach its secular peak around the first half of the year 2017 and very likely enter a violent downward correction.

The property market cooling measures will drastically reduce the number of potential house buyers who meet governments’ criterions and slow down the growth of home mortgages. The government want the house prices of the First-tier and second–tier Cities to move sideways on the current high levels, and therefore force the money towards the housing market of the third-tier and fourth–tier Cities. That way, the destocking of property market could be carried out across the whole country. The local governments and institutional money across the country thus can decrease their exposures and leverages related to the property market, while the Chinese Damas are left holding the bag with really high leverages. If the housing market collapses, local governments and institutional money (central enterprises, state enterprises, privileged enterprises, and banks etc.) will be able to avoid as much damages as possible while the fortune of Chinese Damas will be dealt the deadly blow. So it is the ugly truth of the destocking of property market to help local governments and institutional money deleverage with Chinese Damas’ leverages greatly increasing.

3.Predicting When the Bubbles of China’s Housing Market Will Bburst

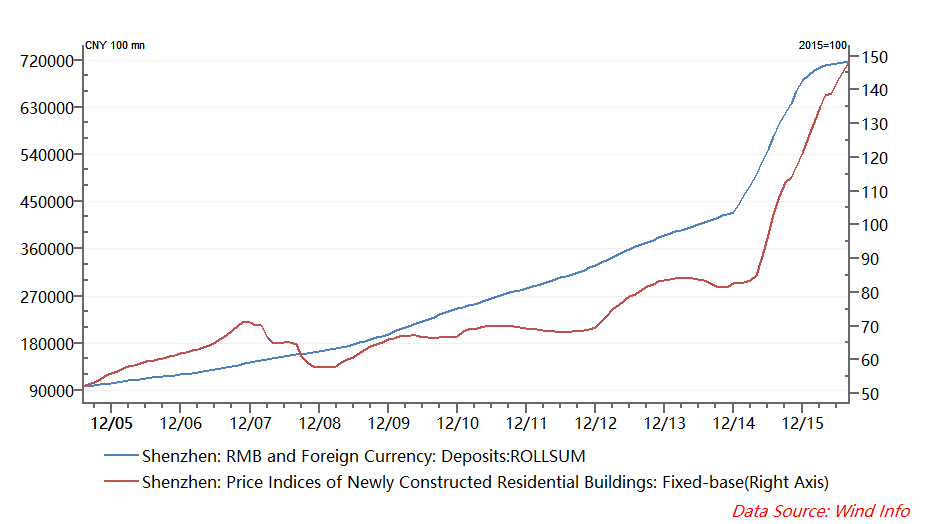

Chart 4

According to chart 4, since July 2005 when the data “Shenzhen: Price Indices of Newly Constructed Residential Buildings: Fixed-base” was first available, the variable of “Shenzhen: RMB and Foreign Currency: Deposits (rolling 12 months)” has been highly correlated to the variable of Shenzhen: Price Indices of Newly Constructed Residential Buildings: Fixed-base, the correlation coefficient of which is 0.94.

Since Dec 2014, the variable of “Shenzhen: RMB and Foreign Currency: Deposits (rolling 12 months)” has gone up super exponentially obeying a power law increase. Running its data series through the Log-Periodic Power Law (LPPL) model, we can predict the YoY growth rate of “Shenzhen: RMB and Foreign Currency: Deposits (rolling 12 months)” will collapse around this December, and six month later around June 2017, “Shenzhen: Price Indices of Newly Constructed Residential Buildings: Fixed-base” will reach its secular peak and afterwards very likely enter a violent downward correction. Taking into account the government’s manipulation and intervention, I made some adjustment to my prediction. My final prediction is the house price of Shenzhen will reach its secular peak in around August 2017 (the difference between the actual time and my predicted time is less than 10 months) and afterwards very likely enter a violent downward correction. Since the house price of Shanghai is highly correlated to that of Shenzhen, the house price of Shanghai will reach its secular peak in around August 2017 (the difference between the actual time and my predicted time is less than 10 months) and afterwards very likely enter a violent downward correction as well. The home price of China’s housing market will reach its secular peak in around the second half of 2017 (the difference between the actual time and my predicted time is less than 10 months) and afterwards very likely enter a violent downward correction.

When it comes to the leverages, China’s housing market is just like A shares

Let’s look at the below 2 charts:

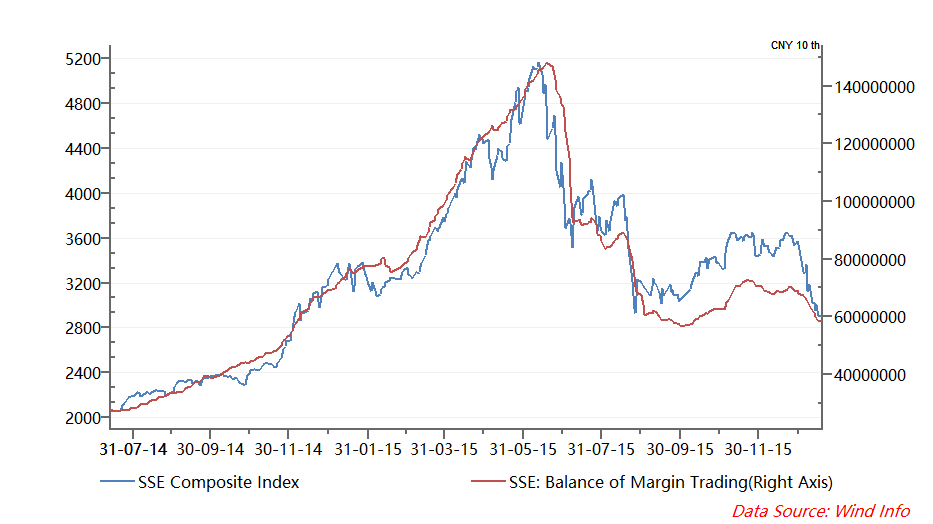

Chart 5

Chart 6

According to Chart 5, fromJuly 2014 when A shares started its previous rally to January 2016 when A shares found its bottom, “SSE Composite Index” had been highly correlated to “SSE: Balance of Margin Trading”, the correlation coefficient of which is about 0.95.

According to chart 6, from July 2014 when the home price in the First-tier Cities started to move sideways to consolidate its previous bottom to present days, “FIs: New RMB Loans: Households: Medium & Long-term (ROLLing 12 months)” has been highly correlated to “100 Cities Residential House Average Price: First-tier Cities”, the correlation coefficient of which is about 0.98.

When it comes to the leverages-especially Chinese damas’ leverage, China’s housing market is just like A shares. It is also highly alarming that shadow landing plays a critical role in both market rallies in A shares and China’s housing market. Chinese home buyers are borrowing massive amounts of money to pay for down payments through the country’s hard-to-track shadow banking system. It is possible for someone with no savings at all to take out a mortgage in China. Property developers, real estate agencies, and internet peer-to-peer lenders are active in this highly leveraged market, and they sell the loans as wealth-management products, to millions of individual investors in China. This is the Subprime mortgage of Chinese characteristics. The previous crazy rally of A shares had its notorious umbrella trust from shadow banks, and now the current insane rally of China’s housing market has its subprime mortgage offerings from shadow banks. It looks highly likely the history will repeat itself again.

In around the second half of 2017 (the difference between the actual time and my predicted time is less than 10 months), China’s housing market will enter its secular bear market. Considering the very high leverage, the process could be very forceful. It will be reminiscent of the massive market crash of A shares in 2015. China’s foreign reserve will face massive drawdowns. Its capital outflow will be really huge. In 2015 when China’s stock market crash, the tally of capital outflow that year is 1 trillion dollars. When China’s housing market forcefully unwinds its leverages in around the second half of 2017(the difference between the actual time and my predicted time is less than 10 months), the situation will be much worse. RMB will probably be devalued by around 10% next year.

China’s Mount Vesuvius – its insanely leveraged housing market – will be erupting.

I don’t claim to understand the broad property market in China, but I have been in Shanghai for 3 years.

People like to apply Western sensibilities to things that operate in completely different ways in China.

Let me give you a basic rundown of the life of a 20 something young professional in Shanghai:

Born maybe on a farm in Sichuan. Oldest child, so your parents spent the money they had to educate you. If you are successful, you will be obliged to help your uneducated siblings later (one child did not apply to everybody).

Your only job is to be educated and to do well on the national entrance exam, the gaokao. You don’t clean your room, you don’t go to playdates. You don’t play sports. None of this is tested on the gaokao, so you don’t waste energy. You certainly aren’t “in a relationship.”

Somehow you manage to do well on the gaokao and gain admission to an OK university. You leave your family and travel to a faraway city to study at university. You aren’t in a relationship there either, although I don’t understand the logic of that as yet.

You graduate and get a job in a tier 1 city. Now you are expected to find a mate and marry by 27, because you will be leftovers past 27. To get married, you generally need an apartment. Really. And their is immense pressure to get married and produce an child, that is the social safety net for the entire family. And if you somehow manage to get married without the apartment, you will have a child to provide a safety net, and for that to be meaningful the child will need to be educated. But since your hukou is in Sichuan, you have no rights for your child to go to a school in Shanghai. Unless you own property. So you must have an apartment.

I think this is what traders call technical factors, and they are very important in China.

Probably the most talented software engineer I know borrowed the down payment for an apartment in Shanghai from his employer. When I expressed reservations about doing (there were a lot of reasons to not be locked into that employer, including the possibility that the startup would fail and the investors would seek to recover the debt from this engineer) he simply responded that he had no other choice.

One thing about the leverage in China is who is using it. Most of the leverage is in the hands of the developers, and not the endusers, particularly for middle and lower class income housing. Nearly every person I know in those income brackets either paid cash or got a loan from their employer, ie non-banking industry finance.

While the upper class housing purchasers would have far less difficulty getting a loan, most just pay cash anyway, as disclosure of the real financial power necessary to get the loan would be embarrassing. Hence I’m not so sure how much leverage there is on consumers in real estate (vs the developers). What is probably just as bad a news is that much of these purchases represent attempts to hedge against inflation and provide security against medical crisis beyond what the state subsidy medical savings account provides), as well as retirement. If people see their savings depreciating rapidly, they are likely to pull in their consumer spending even if they don’t have loan officers kicking in the doors.

Another issue is fraud, where cadre’s use state money to buy real estate, planning to replace the funds later when they sell the real estate (if anyone starts poking around). If the prices go down, how many more corrupt cadres will be exposed?

So, I don’t think it’s going to be anything like the mortgage crisis in the USA, at least not directly. Rather it’s the big boys who might get hurt, and it will be interesting to see how the CCP deals with these oligarchs under the Maoist revival of Xi.

I hope that, with the new friendship between the Chinese and the Filipinos, the Chinese will start to invest more in the Philippines condo market, so maybe the cash value of my modest condo will rise.

Trillions of dollars get printed every year. Where do you think the newly minted money will need to go to?

Don’t disagree, Softie. But unlike the BOJ, ECB, the BOE and the Fed, the balance sheet of China’s central bank (the People’s Bank of China) has actually contracted by over $0.5 trillion (in $USD terms) since early 2015 after a huge expansion. That was undertaken in part to shield China’s domestic economy from inflationary pressures due to exports-driven foreign capital inflows. Would be interesting to see the total footings of the largest state-owned and privately owned Chinese banks, though, as from what I can tell they are either directly or indirectly the key source of funds for China’s domestic shadow banking sector, which in turn has funded China’s property market.

Fascinating article both in the sense of who is being targeted for asset stripping and penury, and capital flight. Seems consistent with unstated policies elsewhere in the world in that regard. Wonder how China’s policy makers will deal with the aftermath, both in economic and social terms; and whether it could lead to regime change and/or geopolitical diversions.

This is one thing that makes me a little sceptical of some of the conclusions in the article (although I would share the basic analysis). The obsession of the CCP is internal stability – this means keeping the ‘Chinese Damas’ happy. I cannot see the CCP dumping on ordinary domestic investors in an overt manner – it is simply too dangerous for them. Its not like most Western countries where people glumly accept their financial fate, China is, and always has been, a powder keg. The widespread assumption of every Chinese person I know is that if and when things get bad, it is the wealthier who will be made scapegoats – this is precisely why almost to a man and woman they have their exit strategies planned and set up.

Its possible of course that the CCP does not yet understand fully the dynamics at work – or they possibly believe that if the property market fails, they can find a new bubble (as happened when many lost their shirts on the stock market just last year), but I would be very sceptical that it is deliberate. In a major property collapse tens of millions of mid income Chinese will lose everything. And if that happens they will take to the street – all of them. Thats Chinese history and nobody knows it better than the CCP.

If the Chinese keep generating inflation, it makes their goods more expensive in local $ terms, which means for export as well unless they depreciate their currency. The rest of the world won’t tolerate that. China has been losing export share to the rest of the world v. Germany as a result.

That is also why China’s growth has become more dependent on investment than exports post crisis. But its investment is debt driven and the GDP gains from increases in debt have fallen, big time.

All bubbles end. The only question is when and how badly, and whether it is an implosion or a long fizzle like Japan’s close to three lost decades.

This will be very bad news for the medium-upper tiers of American higher-ed (everything except the very richest schools), which have become dependent on full-paying international students, Chinese in particular. If even half of them disappear, or fail to show up in the freshman class in the first place, there will be budgetary carnage at many places. A bold claim, I know.

In theory, and not just the USA, but Australia and the UK, and even harder hit will be the private prep schools. However, all of these overseas students represent a very small % of China’s upper class party members, whom I suspect have already smuggled quite a lot of dirty money outside of China which in part is to set these children up for business when they graduate.

Watch the first episode of the recent docu ‘ America-Divided’.

On Manhattan housing and on ‘gentrification’ narrator ( Norman Lear!) learns from RE agent ‘ Condos have been bid up and bought between 50M and 100M by overseas buyers, with no one living in them. For them it is SAFETY deposit boxes to park their cash’

so if renminbi is tied into $USD will the first US rate hike push things over?

A few links from 2014:

http://www.forbes.com/sites/gordonchang/2014/04/13/china-property-collapse-has-begun/#372f094448e8

https://www.theguardian.com/business/grogonomics/2014/sep/08/why-a-collapse-in-chinas-housing-market-will-hurt-australia

http://www.cnbc.com/2014/08/31/china-real-estate-a-bubble-bursting.html

The lesson in this? Don’t believe what the Press writes about China. For some reason everyone wants China to fail so they write stories that it is about to fail.

Go figure…

The IMF and the World Bank have no reason to want China to fail, since they are preoccupied with world groaf and love to cheerlead, yet they have been pretty alarmed re China of late.

seems like such a precise prediction for collapse of chinese housing that anybody could see it coming… just like our housing market in 2007… where is all the preventive medicine? If it isn’t there there must be a reason.

B/c they all believe in the CONFIDENCE fairy of CBers! Aren’t they keeping the house of cards – asset bubble of all kind’ floating up and up, with easy money since 2009?

Hm, once this bubble pops, another one will show up immediately to replace it. The difference between the US and China so far is that in the former if a bubble pops, it takes a while for another to show up. Whereas, in China the housing market takes over from the stock market without too many people seemingly getting hurt. Maybe the Chinese people have a ton of cash hidden under their mattresses?

Here is a photo by Henri Cartier-Bresson, taken in Shanghai around 1948:

http://www.metmuseum.org/toah/works-of-art/2002.419/

From the link, this description:

This photograph captures the pandemonium incited by the currency crash of that month, when the value of paper money plummeted and the Kuomintang decided to distribute forty grams of gold per person. Thousands waited in line for hours as the police made only a token gesture toward maintaining order, resulting in ten deaths by suffocation.

Too much cash under the mattresses???

What does something that happened years ago have anything to do with today? I mean should I be dragging up Germany’s hyperinflation everytime a German story comes along? Or how about Confederate paper at the end of the Civil War?

The fact of the matter is we haven’t seen anything close to pandemonium after the stock market “crash” of 2015 in China. Where did all the money go?

If Germany is facing inflation in any sector, yes, we can talk about it.

In China, there is raging housing inflation. I am trying to remind the Chinese communists how they came to power, how the KMT lost the mandate of Heaven.

If Germany is facing inflation in any sector, yes, we can talk about it.

In China, there is raging housing inflation. I am trying to remind the Chinese communists how they came to power, how the KMT lost the mandate of Heaven.

With printing money out of thin air with no accountability and with creative accounting, no one knows the real GDP or GDI data of China! To a certain this is also true of other western Nations including US!

One look at the chart of Deutsche Bank (global systemic bank) tells the charade of viability of Global Banking system. But every one is in denial of that reality!

Just like Japan they can keep this ‘house of cards’ more than any one dare to predict!

AS long as the confidence fairy is sprinkling the dust and the populace believe in it, NOTHING will change!

The Chinese communists came to power amidst KMT wheel-barrow money.

They know, or should know, the risks of printing money out of thin air.

Just like Japan they can keep this ‘house of cards’ more than any one dare to predict!

AS long as the confidence fairly is sprinkling the dust and the populace believe in it, NOTHING will change!

Fully agree with your post. I also agree that there’s a limit to the current situation in China. But there are lots of differences. China is much more of a closed system – closed in many ways, financially, monetarily and culturally – than the US of 2007 ever was. And it’s way bigger in terms of sheer size. IMHO the crash will happen when absolutely no one will bet on it, including Chanos himself. 2017 looks quite early from this perspective.

When Chinese authorities decided their 2009 policies I expected the Chinese market to crash within a reasonable timeframe. Within a couple of years I expected the country would be swamped under a deluge of over-capacities of all kinds. It it. But I was definitely wrong on the timing.

We are in 2016… And we still have some sort of momentum, at last on real estate. 2017 seems an early bet for a crash.

Reading through the adamant Roubini of 2006 and a few other blogs – just do not remember their names – at that time, I could see it coming and I was not alone. Yves was certainly on the right track as well (was not reading her at that time). As long as you wanted to, the situation could be read “crystal clear” as far as the US, Spain and a few other markets, were concerned… It happened 18 months to two years after my (our) “predictions”….

I appreciate the effort the author of this post is putting into the argumentation. Sure this nice piece of blogging looks like a decent intellectual construction. It certainly it. But we may need an even more “obvious” situation in order to get the long overdue crash to happen. China is way too big. Way too much inertia. So 2017, 2018, 2019?

What I am sure about: the whole worldwide real estate market will crash for a multi-generational time period. At least in OECD countries in sync with the long overdue effects of their rapidly aging demographics. But, here again, we are not there yet.

No bet on this, just a piece of opinion:)

Where did 4 trillion go? http://wolfstreet.com/2016/10/01/why-u-s-government-deficit-numbers-are-a-big-lie-national-debt/

Interesting question. I think the Government Accounting Office(GAO) is supposed to field those questions.

How come Wolf Richter is the only one asking???

Huh? Japan couldn’t keep its house of cards going. Did you miss that it had the most spectacularly valued real estate in the world and prices fell to less than 20% of (not 20% below, 20% of) their peak?

Mentioning Japan totally undermines your case.

And I was there. I recall in 1986 hearing people who should have known better saying, “The capital flows in Japan are so enormous, the markets will never go down.” But of course they did, not just right away.

There are special considerations in China that would not arise in North America or Europe. In my experience the people are co-operative and act unitedly. Brokers and day traders call the shots. They keep their asset prices high when in our markets our prices yo-yo from the acts of contrarians.

Quite apart from that we humans are hopeless at prediction. We almost always get it wrong, sometimes quite spectacularly. So for my money, I hear what you are saying at NC and thank you for the heads up, but I’m not planning to do anything about it just yet.

Dee Woo says the GDP growth rate has been falling. True but its still growth and its growth at a level we would kill for (indeed we do). It has not been necessary for China to create more tranches of investments on top of the real economy as we ourselves have been doing for the last 8 years to simulate growth and pay pensions but let’s not talk about that.

Huh?? Have you missed how volatile the Chinese stock market is? And the Chinese love to gamble and treat the stock market as much as a gambling outlet as for investment.

Look away! No orientalism here!

Er… No, certainly not orientalism.

(Stochastically) Chinese gamble more than any other major ethnic group (when presented with the opportunity which is why the CCP works very hard to stop many forms of it, and to funnel it to their own purposes). There are cultural reasons, strong ones, for why this is so. Hence it is not a racist’s statement, but a observation well drawn, if badly worded for not carrying the pc hedged of “most”, “more than”, etc.

It may be racist when a generalization is applied to an individual (as a near certainty). i.e: Mr. Chan’s creditors are before the The Court of First Instance, he must have gambled away his fortune.

If the author of that statement had said instead; I’ll give you odds of 7 to 3 that Mr. Chan gambled himself into bankruptcy.” then he’s not being racist but rather a insensitive if clever gambler. He isn’t insisting Mr. Chan is a failed mountebank with a love of the horses, but rather laying a probability of behavior at his own risk. He may lose this time, but over enough bets he may well come out ahead.

In Seattle where I live, I hear that half of all real estate sales (King County) are from Chinese money. We have more active cranes in our downtown area than any other city in the US. Many students from China here as well.

What is interesting to note is that the market in Vancouver BC (two hours north) has contracted about 20% since last spring after being red hot for so long, and never having suffered in the downturn in the last bubble. There was a 15% tax imposed by the local authorities on foreign buyers there. Rents here have increased 9.7% in the last 12 months. It’s a bubble and I am not excited to see the meltdown. I work in construction and I suffered in the last bubble. I just got out of chapter 13 this last month. At least I know what it might look like. Cash under mattress and two years from being eligible for SS. May you live in interesting times. Right

Another worrisome point: governments in trouble at home often seek to pick a fight with another country. After an implosion of a big part of the Chinese economy, expect to see heightened tensions in the South China Sea…

I was seriously thinking about buying a condo in Seattle. Maybe it would be better to wait for the bubble to burst first, no es verdad?