By Jerri-Lynn Scofield, who has worked as a securities lawyer and a derivatives trader. She now spends most of her time in Asia researching a book about textile artisans. She also writes regularly about legal, political economy, and regulatory topics for various consulting clients and publications, as well as writes occasional travel pieces for The National.

Here’s a heartbreaking Uncle Sam as Scrooge story, just in time for the holiday season– a real Christmas classic, with no ghosts — past, present, future– to set all right by the end.

The number of older Americans defaulting on student loans has burgeoned over the last decade, with many embarking on degree courses or skills training or agreeing to co-sign loans for friends or other family members.

No doubt the financial crisis accounts for some of this trend toward pursuing further education, with older workers often facing significant obstacles to securing employment if they’re unfortunate enough to lose a job.

“[B]orrowers age 50 and older have considerably higher rates of default on their federal student loans,” compared to younger borrowers, the Government Accountability Office said in a report released yesterday. The federal government is increasingly garnishing the Social Security benefits of these older defaulting student debtors, leaving these unfortunate beneficiaries with benefit levels that fall below federal poverty guidelines.

In 2015, the federal government seized some of the Social Security benefits of 114,000 people age 50 or older. Over half of these unfortunate people were receiving Social Security disability (as opposed to retirement benefits).

Impact of Offsets on Older Borrowers’ Social Security Benefits

From the GAO’s summary of the highlights of its report:

In fiscal year 2015, Education collected about $4.5 billion on defaulted student loan debt, of which about $171 million—less than 10 percent—was collected through Social Security offsets.

In addition to causing hardship, the problems of these defaulters continued (according to the GAO summary):

More than one-third of older borrowers remained in default 5 years after becoming subject to offset, and some saw their loan balances increase over time despite offsets. However, nearly one-third of older borrowers were able to pay off their loans or cancel their debt by obtaining relief through a process known as a total and permanent disability (TPD) discharge, which is available to borrowers with a disability that is not expected to improve.

Shockingly, however, even those who qualified for a TPD discharge could soon find themselves poleaxed by further snafus– including having this relief cancelled if they failed to comply with annual bureaucratic certification procedures.

According to the GAO summary:

GAO identified a number of effects on older borrowers resulting from the design of the offset program and associated options for relief from offset. First, older borrowers subject to offsets increasingly receive benefits below the federal poverty guideline. Specifically, many older borrowers subject to offset have their Social Security benefits reduced below the federal poverty guideline because the threshold to protect benefits—implemented by regulation in 1998—is not adjusted for costs of living…. In addition, borrowers who have a total and permanent disability may be eligible for a TPD discharge, but they must comply with annual documentation requirements that are not clearly and prominently stated. If annual documentation to verify income is not submitted, a loan initially approved for a TPD discharge can be reinstated and offsets resume.

Genesis of the GAO Report: Role of Senators McCaskill and Warren

The GAO report was prepared at the request in April 2015 of Claire McCaskill, Ranking Member of the Special Committee on Aging of the United States Senate and Senator Elizabeth Warren (who also serves on the same committee). The problem of default and subsequent Social Security or wage garnishment has accelerated throughout the last decade and is only projected to worsen as the baby boom generation retires from active employment.

If you want a depressing read, I encourage you to read the full GAO report. If you lack time to do that, the following press release, which I pulled from Senator McCaskill’s Senate website and from which I quote from at length below, summarizes the most egregious findings. (If you would prefer to grab your copy of the same press release from Senator Warren’s website, you may find it here).

The report’s troubling findings included:

- The cohort of those over 50 in student loan debt, over 7 million Americans, is growing much faster than younger cohorts. Since 2005, Americans aged 65 and up saw their total student loan debt grow by 385 percent.

- The number of Americans whose Social Security checks are being garnished by the government to recoup defaulted student loans has increased by 540 percent in the last decade to over 114,000 older borrowers.

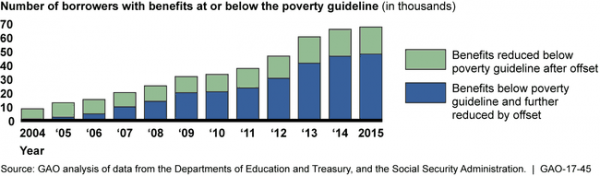

- Since 2004, the number of seniors whose Social Security benefits have been garnished below the poverty line has increased from 8,300 to 67,300.

- Thirteen percent of borrowers 50 or older at the time of their initial offset died while their loans were still outstanding.

“This report shows us that seniors clearly aren’t immune to the student loan crisis—they’re deeply impacted by this issue to the point that it’s leaving many of them in a dire financial situation,” McCaskill said. “We could have hundreds of thousands of American seniors living in poverty due to garnished Social Security benefits if this trend continues, and we shouldn’t allow that to happen.”

“The hard-earned Social Security checks that are the sole source of income for millions of seniors should not be siphoned off to pay interest and fees on student loan debt,” said Warren. “It’s no wonder many Americans don’t think Washington works for them: our government is shoving tens of thousands of seniors and people with disabilities into poverty through garnishment every year—and charging them $15 every month for the privilege—just so that the Department of Education can collect a little bit more interest and keep boosting the government’s student loan profits. This is predatory and counterproductive, and Congress should pass the bill I’ve cosponsored to put a stop to this practice.”

Some of the report’s troubling findings included that more than 70% of garnished Social Security benefits were going toward fees and interest, and not paying down seniors’ principal balances—leaving many seniors with a reduced standard of living, in a cycle of debt they could not escape.

I reiterate one of Senator Warren’s points just in case it slipped by: The Treasury Department charges the unfortunate defaulters $15 in processing fees per month to garnish their Social Security benefits, according to this article in the Washington Post.

And as the Wall Street Journal reports in this article, government efforts to assist borrowers may actually be doing anything but for some older borrowers:

Daniel Pianko, a managing director of University Ventures, which invests in for-profit and nonprofit schools, says the government may be worsening the troubles of older borrowers by promoting programs that set monthly payments as a share of borrowers’ earnings. Payments under “income-driven repayment” programs frequently cover only part of the interest and not the principal, allowing balances to grow.

In that sense, the income-driven repayment programs have the same effect as payday lenders, trapping poor borrowers in a growing amount of debt.

“Every month and every year the loan balances go up, which means by definition this problem will only get worse,” Mr. Pianko said.

What Is to Be Done?

The GAO was not completely insensitive to the plight of these Social Security beneficiaries and indeed recommended (again, from the GAO summary):

GAO suggests that Congress consider adjusting Social Security offset provisions to reflect the increased cost of living. GAO is also making five recommendations to Education, including that it clarify documentation requirements for permitted relief resulting from disability. Education generally agreed with GAO’s recommendations.

Is this the best that anyone can come up with?

Senators Warren and McCaskill are both proposing legislative solutions. In 2015, Senator Warren co-sponsored the Benefits Restoration Act, a measure that would exempt Social Security Benefits from garnishment, as reported by the Washington Post here. That bill succumbed in committee, but Warren is currently calling on her website for Congress to pass that bill. The Post also reports that Senator McCaskill intends to introduce legislation that would block the garnishing of Social Security benefits is so doing would cause beneficiaries to fall below the poverty line.

Somehow, I don’t see this issue front and center on the agenda of the incoming Congress and the Trump Administration. But it should be.

`

https://vimeo.com/194002892

Is this going to happen?

It’s not just for-profit schools. $200K for a liberals arts degree at elite “nonprofit” private schools is also debt peonage.

If there is a one-off student debt “jubilee,” we can be assured that new debt will arise while the myth of a middle class life after college / career technical education continues to be told.

Student debt, like other debt, should be able to be discharged through bankruptcy. Solving the problems of high priced higher education and living wage jobs are completely separate challenges.

https://www.facebook.com/groups/ITTTechnicalInstituteLawsuitWarriors/?ref=bookmarks

ITT tech was not covered that much by naked capitalism and them, but this group is organized fighting hard.

Do not keep changing you handle. You used three in the first four comments on this post. That’s a violation of our written site Policies. You are rapidly accumulating troll points, as well as training our software to see you as a spammer. We do not go hoist comments out of spam. We get 1100-1300 spam comments a day and it is far too much work given our thin resources to dig in there to find legitimate ones.

There are two things that should be immediately changed: re-adopt the Statute of Limitations and Bankruptcy discharge provisions Joe Biden worked to eliminate.

Sam,

We should stop subsidizing failure factories that do little but ensure employment for educators and administrators. We certainly should not enact an indirect bail out like Joe Biden was planning.

Allowing students to default on their debt tightens up lending which may result in a decline in cost. If we look at historical trends, tuition greatly increased post-Biden. The Biden rule is in effect a college subsidy.

All debt should be dischargable in bankruptcy. I’m not seeing what the benefit to society is forcing people to live in perpetual penary, in the System D economy, and/or to flee the US.

The student debt crisis is a perfect example of the law of unintended consequences. Give everyone enough guaranteed infinite debt money to get a college degree and 1) college degrees become both worthless and necessary because everyone has them, and 2) the costs go through the roof unchecked by reality. Forcing these creditors to eat the losses good and hard would teach them an important moral lesson about life: just because you can buy the government to get the laws changed in your favor doesnt mean you should.

That is the proper solution. Why are things like student debt and medical costs harder, if not impossible, to discharge in bankruptcy? Businesses and billionaires walk away from billions of debt every year, often stiffing the little guys. While the government works bankruptcy laws to force the little guys to live up to their moral obligations even if it means impoverishment.

As if there was ever any question as to who our government actually serves.

When in recent memory has society been the beneficiary of primary concern?

Get the government out of the student loan debt markets. The taxpayers are now going to pay for these losses, including many who already paid back their own loans. The markets should adjust the interest rate on these loans according to normal underwriting standards, i.e. the likely hood they will be paid back. If you want to study dance you can have a loan at three X interest. If you are going to study engineering your interest is X. Demand goes down, prices go down, lenders don’t need a bail out and the tax payers are spared. It was all a plan to take from those who have and are willing to work and take risk to those who are not. This was obvious from the start.

It wouldn’t be as bad if wages and productivity were never decoupled in the 70’s and if the cost of tuition didn’t go up 1200% since the same time period.

It boggles my mind how one can read the complaining in the Wall St. journal about young students not buying homes or cars. Well you expect them to pay 2016 prices on a 1974 salary. WTF did you think would happen to the economy.

Even student debt is discharged, which it should be, that rather large elephant needs to be addressed. The min. wage of $15/hr. is a start, but it is still too low, should be more like $20. If the C-Suite has to deal with purchasing one less ivory back scratcher per year so be it.

Yes. Too bad they didn’t address this in 2009 – 2010. Oh, right. Biden was/is VP.

http://www.ibtimes.com/joe-biden-backed-bills-make-it-harder-americans-reduce-their-student-debt-2094664

Everytime I see Biden’s sh*t-eating grin, I think how he screwed vulnerable ‘folks’ who just wanted to ‘do the right thing’ and instead, were saddled with junk degrees and ballooning debt.

At the very least Obama should heed the pathetic plea of the woman in the video posted above by Toyota and pardon the victims’ loans.

Everlasting shame on Biden and Obama for sins of commission and omission against the working poor.

Hey, now that Hillary has time on her hands maybe she can fight for the women and children immiserated by these predatory loans!

I think all the loans should be forgiven, because even people that went to good traditional colleges were screwed over by high tuitions and future job perspectives that really don’t exist. My two cents.

I wholeheartedly agree with you.

At the time the bankruptcy bill Biden passed, I checked Open Secrets and Biden got $140,000 from the banks. Harry Reid only a paltry $40k.

Harry remarked “people should pay their debts”, but those other people “corporations”, I guess, should not have to.

Check my math, but that looks like over $20 million/yr direct from SS to Treasury, before the garnishment takes place.

Clarifying.

Yes, it’s chicken feed in terms of the Federal budget, achieved at indefensible human cost.

Skinnier chickens, fatter pigs.

How many more examples do we need to conclude we’re living in a predatory society? The trust and legitimacy of these institutions is draining away and seemed to accelerate this year. Clearly, the US is slowly collapsing.

I suppose the upside of trump is that by collapsing faster, the masses will actually notice. This moment of optimism has been brought to you by Exxon.

Is this the same Senator Warren who refused to back Sanders?

Sounds like free college for all would have helped many of these people, especially older workers looking to transition to a new career or younger people whose families lacked financial means.

But but but Socialism!!11!!!!

I had numerous D-voter acquaintances who were enraged (only way I can describe it) at Sanders’ proposal for free college education. Enraged. Lots of angry chatter about the undeserving and not wanting to pay for “useless” degrees blah de blah blah.

Talk about a citizenry who’ve been “appropriately” brainwashed.

maybe many of them don’t have college degrees and fear the competition. I’m not saying this is morally justifiable, just it has a logic of sorts in a dog eat dog competitive society, in the same way fearing the immigrant taking one’s job does, even though immigrants are mostly good hard working people. When much of the population has degrees who will hire those without them?

But they could go get college degrees too! Oh really, that’s really a practical plan in all situations and at all ages of life? (of course there is nothing wrong with older that is “non-traditional” students, but life obligations often make it not viable- when the full obligations of adulthood are assumed – kids, elderly parents etc.). I guess this all gets back to: Job programs or a B.I.G. or you aren’t operating at many people’s reality level. Education could then be icing, but that’s the cake.

We are all old now, and most already have college degrees and decent jobs. At least in the crowd I’m talking about. So it’s not fear of competition, in this particular anecdotal case.

I see it more as the same old “welfare queen” hatred and not wanting someone else to get something “for nothing” that you didn’t get. Doesn’t matter anymore how people vote or which party they identify with, most citizens are very opposed to seeing almost anyone getting any help, especially if they feel/believe that they, themselves, never got a similar govt benefit.

Many different people – most of whom identify as mostly leftish – voiced the same complaint about students choosing to get “useless” degrees that don’t lead to jobs, so getting free college education would just “encourage” people to go to college for no good reason. As in: an education, in and of itself, is utterly valueless. And so on.

Don’t write off those complaints too quickly. I agree with you that an education, in and of itself, has real value. However, I very much object to lending people more than they can reasonably repay for said education. Doing so hurts them.

And making college free? Harder than it sounds. Should the feds simply write checks for whatever tuition colleges decide to charge? That’s carte blanche for universities to gorge on government dollars. To build facilities so ostentatious that they put the Trump Tower to shame. Should the feds establish strict spending limits instead? Safer, but it might relegate free college to community colleges only. Do a federal takeover of all colleges and universities? The blow-back would be ferocious.

And yes, the types of degrees we encourage people to get also matter. At the engineering firm where I work, we’ve been trying (without success) to hire an engineering with specialty knowledge of power electronics. It’s a good full-time job that would pay over $80k in an area where the living costs are below the national average. But most of our applications are grossly under-qualified (no, a degree in history or sociology simply will not do) or are foreign and cannot immigrate legally.

But when I look at graduate statistics, I see that everybody is moving into the liberal arts. It’s easy to do when the government will say “YES” to your loan regardless of your employment prospects. Our national economy (and people’s ability to pay their own way through life) suffers as a result.

No – the proposition is that direct funding by states (ie, “free college”) leads to meaningful oversight and limits on college administrators. What you are proposing would occur under a “free college” scenario is exactly what is occurring now – the feds write blank checks to children, which allows universities to spend with impunity, and children turn into debt serfs.

Free college via direct funding by the states? Do you mean zero federal dollars combined with a strict prohibition on the charging of any tuition or fees? If so, I don’t think that’ll work. I certainly agree that our colleges and universities need to engage in some serious cost-control efforts, but having their revenue stream cut by 60% or so (typical for a state university) would be really tough. A lot of states couldn’t afford to make up such a shortfall, and I suspect many schools would fold, and all we’d have afterward would be low-end community colleges and high-cost private schools.

Federal dollars could make up the difference, but then there’s the question of “how much”. Constant dollars per student, never growing? Growing sharply in accordance with college administrators’ dreams? Somewhere in between? The answer matters, and the right answer isn’t obvious.

But you’re right about the blank checks turning children into debt slaves. It’s one of the most terrible things the Federal Government has ever done to a whole generation of its citizens, and it needs to stop. Turning off the blank checks would be a good place to start.

Well you can have near free college in the states, they did for many years in California. So actually I think it CAN work, just most states aren’t willing. Unwilling pretty much is the reality, they might have to pay taxes for it ….

And even now the CA public college system serves far more people in the state than all the private colleges in the state combined, which are not where most people go to college (especially if you exclude questionable degrees from for-profit colleges). But unfortunately it’s not free anymore. Yea people didn’t want to pay taxes pretty much (prop 13), that’s the whole of it. Sure some states are poorer to begin with but much is ideology.

And yet, somehow Germany muddles through. Other northern European countries are nearly free, too.

And they have limited seats available. And you only get to go to college once. If you decide later in life that you want to pursue a different career path (as many of my Gen-X friends seem to be doing these days, with lots going into nursing), you don’t get to do it. Sorry. You have to pick your track early and stick with it for the rest of your life. And the people who are “late bloomers” academically and aren’t deemed college material immediately after high school? They don’t get to go at all. Ever.

The American university system gives people a lot more flexibility, and while it’s never been free, it was certainly affordable in times past. [That combination is why our country has been such a popular destination for foreign students.] Unfortunately, tuition rates have been rising much faster than inflation (and wages) for at least 30 years straight, and now it’s horrifyingly expensive. It’s probably worth asking WHY.

As if the Social Security check by itself isn’t the barest edge above poverty, then you add the insult of garnishing it.

The fixes here are all band aids. What’s needed is a wholesale overhaul of the higher education system, but change like that seems impossible.

No kidding, but good luck with that, indeed.

I know of several seniors just barely hanging on, mainly living on Soc Sec. They’re “managing” due to having kids who can help them out, even though the kids don’t have a lot to spare.

One such friend worked full time into her early 80s, when she could no longer work due to various health issues.

Thankfully she could file for bankruptcy to discharge what debts (not that large but too big for her to pay off) she had. If she’d had student loans, I think she’d be living on the streets.

It’s just outrageous, but I’m not holding my breath to see improvements.

I think we have to address the big issues

1. Unbrainwash people of the idea they are getting enlightenment/wisdom or education with their student loans. No, they merely borrow and spend money to train themselves, in hope of being certified as worthy to serve a corporation or an overlord.

Frequently, they are left with things they can’t use for themselves, and without things they do truly enjoy. How many doctors have said they’d rather be a painter?

2. Then, we can stop more kids from falling into the same trap.

Take the Shaolin 5 Animals (crane, tiger, leopard, snake and dragon) Gongfu technique for example.

TV reporter: Who was your teacher?

Gongfu master: a crane I met.

Reporter: Was he expensive?

Master: The tuition was free. The education has benefited me for decades. I really enjoy doing this.

It seems to be one of the least generous retirement programs in the world as well. Maybe that will be the next NC essay, how U.S. retirement benefits suck compared to most everywhere else. Ok they don’t take requests but it’s an issue of important to everyone who hopes to live that long and isn’t rich.

Remember that recently arrived refugees get full SSI benefits, free housing, food stamps, free phones and job hiring preferences. Let your senior friends who are living in their cars know that about their hero, Obama.

remember when jobs retraining was supposed to be the answer to economic problems? now it’s used to impoverish people that believed that. i suspect some people will use this scam to advocate privatizing social security, along the lines of “unleashing the power of the market to help our struggling seniors”.

Very good point about the “job retraining” meme being retrained into wealth extraction. That’s horrific, now that I’ve typed it out.

“remember when jobs retraining was supposed to be the answer to economic problems? now it’s used to impoverish people that believed that.”

wow is that the sad truth. And who believes? Sometimes those who believe are less informed. Sometimes they don’t even know anyone making it financially that they could even ask advice from, when everyone around you is sinking financially you do whatever seems to offer a way out. And sometimes they know no better than to follow the dominant narrative (which is created by and for the 1%, to justify their reign with sweet sounding promises of meritocracy, but they may not realize that, and think we actually live in a society, where the advice given is actually meant to be good for people).

But if one actually was long term unemployed, no matter how much they had heard about retraining having minimal success rates, it might cause them to seek out a better program (not a for profit college for instance) but they would still retrain if it’s all they can do, people will do anything to have some active control over their fate even if the odds are low.

And it’s so much easier to believe, my profession isn’t a viable one anymore in this every changing economy, so I need to learn a new one and things will be good, than to believe: many of us are doomed to permanent poverty and I guess I just drew the short stick.

If the failure of the left is actually to be found in left narrative, which is kind of ridiculous considering the system it exists in, where the 1% own the political system, own the media, have a whole right wing noise machine, violently crush almost any dissent etc..

But if it were it might be down to how the left emphasizes collective action where often no collective action is possible. If you have a union or the chance at forming one then maybe you have an avenue. So many people work for shitty jobs at small dinky firms (including many blue collar workers) with little chance of that ever happening at that level. Meanwhile they discount individual action, but at least that has a NON-ZERO chance of paying off (retraining say) even if it does buttress up the lie of meritocracy when it does and lead to no-end of self-recrimination for the crimes of an unjust system when it doesn’t.

Senator Warren talks about the “government’s student loan profits”? There aren’t any. Credit card companies charge 15% interest on overage on $750 billion in debt, but after write-offs from a 9% default rate, they make less than $10 billion in profit. And the government can charge less than 6% on $1400 billion in student loan debt, but after write-offs from an 11% default rate, they make more than $50 billion in profit? Bullshit. I don’t believe it. We’re losing tons of money while ruining lives, and it’s all being papered over with funny accounting.

The true solution to this problem is to implement LENDING STANDARDS. Quit giving loans to people who are unlikely to repay. Does lending a person $50k to get a degree in motivational speaking from a bad Trump University knock-off truly help them? Or are we inadvertently hurting them by saddling them with debt they’ll never be able to repay? The answer seems obvious to me.

Reasonable and fair lending standards would look at the student’s class rank in high school (or last round of college), ACT or SAT or GRE scores, and existing debt load as well as the planned field of study, the academic department that hosts said major, and the college itself. The Department of Education *easily* has enough data to create a decent statistical model that would describe a given student’s probability of repayment for a given major at a given school. If the chance of default exceeds 20%, the loan should be DENIED. [Side bonus: Crappy for-profit schools would wither under this model as climbing default rates eventually caused all loan applications for the school to be denied.]

The housing crisis was greatly exacerbated when banks essentially said “YES” to everybody who came through the door. Many people were financially devastated. Why do we expect better outcomes when the Department of Education is doing the same with student loans?

Most of those jiggy home loans weren’t originated by the banks, Brian. They came from mortgage companies and other non-banks.

Aye. It would be more accurate to state “when banks (and other non-banking lenders) essentially said YES to everybody who came through the door.”

They said “yes” because it was their scam. These institutions made a lot of cash while they worked the scam and then stuck the taxpayer with the bill.

Hmmm… The Department of Educations says “YES” almost universally, and the taxpayers get stuck with the bill when a substantial fraction of the loans are not repaid (whether by default or by loan forgiveness). So which institutions are making a “lot of cash” this time around? I’d argue the college and universities. Your thoughts?

The Dept. of Education, along with the educational institutions and banks, are making a lot of money by trapping student in these horrible loans. That is why they always say yes and why students and their families are never sat down and explained how bad of a deal they are. I also think there is a strong correlation that when Congress passed the law eliminating their discharge through bankruptcy, the government and the banks eagerly opened the floodgates of these toxic loans to students. It is also at that time the the tuitions also began to skyrocket. It was win/win for these culprits.

And I’ll echo what Sam Adams and jgordon said above: “All debt should be dischargable in bankruptcy.”

I’m not a big fan of bankruptcy. I believe people should repay what they owe. But sometimes things go really wrong in life and repayment becomes impossible, and people shouldn’t be hounded *to the grave* by creditors. We recognize this reality with all other types of debt, and we have bankruptcy laws accordingly.

Well, except for student loans. No bankruptcy there. It’s profoundly unjust, and it results in the carnage described by Scofield’s article.

A business that makes bad business decisions can go bankrupt. A student that makes a bad business decisision cannot.

Madness. And thanks to that loveable goof Joe Biden, the working man’s friend, for making all this possible.

A lot of businesses use bankruptcy as a business model. It is actively pursued as strategy. Think Trump and 19+ years of taxes he didn’t have to pay because of his multiple bankruptcies.

Biden’s gift is one of the three reasons we didn’t go bankrupt about a half-decade ago. (Another was we didn’t have the 1200 bucks to file. wft, why you think I’m here, mfr?!)

Janet & I cashed out the retirement, paid off all but the house & student loan last week. I just now got caught up on the GSL. Based on pensions being viewed as liabilities, we decided there was significantly less uncertainty in being out of debt before the next election. Turchin’s work factored in, too, in that he predicts greater instability in the next four years, and I see no disproving information.

My opinion, which I acted on in the most tangible way possible, is that debts are likely to get called in rather than forgiven. We went with being more independent at the expense of long-term investments. Against Lady Bracknell’s advice, we are putting our labor into raised beds and hoping land taxes don’t skyrocket.

Despite below-5-degree temperatures, my parsley and peas are still green in their Salad Table. Pleased to have fresh greens after solstice.

Yep. I believe in stuff. When your only garnish is parsley, you’re a lot safer.

I believe people should repay what they owe. Brian Lindholm

It’s not that simple when “loans create deposits” but only largely sham* liabilities wrt the general population. Let’s have an honest system first before we assume the debts owed to it are morally legitimate.

*Because bank liabilities are for a nation’s fiat. But the non-bank private sector may not even use their nation’s fiat except for unsafe, inconvenient physical fiat, aka cash. So the liabilities of the banks toward the non-bank private sector are largely a sham.

> I believe people should repay what they owe.

This from Catch 22 seems relevant. Yossarian says:

@BecauseTradition: You described “sham liabilities“.

Um, what are you talking about? When people borrow money, they are expected to repay it. That’s how debt works. That’s how debt has ALWAYS worked for as long as mankind has used money. It doesn’t matter whether it’s scrip or gold-standard money or initially-lent national fiat or re-lent bank deposits or whatever. It doesn’t matter whether the system is totally honest or occasionally unfair or totally corrupt. It doesn’t matter if the money was spent on things fair or foul. If you borrow money, you’re expected to pay it back. Period. And as Scofield’s article points out, there are consequences to not doing so. Even if life’s circumstances have rendered you truly unable.

Calling the debt a “sham” will get you precisely and exactly nowhere when you’re dealing with creditors or standing in front of a judge in bankruptcy court. If you’re waiting for the system to somehow change to make all of this excess debt to go away, don’t hold your breath. You’ll likely be waiting forever.

The real solution here is to minimize the lending in the first place. Small loans are easy to repay. Giant loans are not. Alas, every year the Department of Education’s loans become larger than ever before.

>” That’s how debt has ALWAYS worked for as long as mankind has used money.”

You may find this interesting and clarifying;

http://michael-hudson.com/2011/12/democracy-and-debt/

And chapter 5 from this;

http://deanbaker.net/images/stories/documents/cnswebbook.pdf

>” It doesn’t matter… It doesn’t matter… It doesn’t matter…”

In that ” Debts that can’t be paid, won’t be paid.”

I think you are missing a very important piece of the puzzle, Brian.

Responsible borrowing requires responsible lending and without one, you can’t have the other. That’s the job lenders get paid to do.

It is the responsibility of the lender to assess the capacity of the borrower to repay, not the other way around. Asking for a loan when you are unqualified is not the problem. Giving a loan to someone who does not have the ability to repay, or whose ability to repay you’ve not accurately assessed, is.

In your earlier comments on this thread, you’ve contended that the student loan makers always say “yes.” What else can they do? When there is no evidence establishing future ability to repay, to whom do you say “no?”

At least where graduating high school students are concerned, there is absolutely no credit history on which to rely. In days gone by, no one with a financial stake in the outcome would have lent them a cent and expected to be repaid. But there would have been consequences for the lender as well as the borrower.

I’m sure you get my point. But here’s one more thing to think about. These days, unemployment, whatever its definition, is a sore american subject, obama’s cheerleading notwithstanding. “Students,” however they come to be called that, do not contribute to the ranks of the un-, under-employed or not-in-the-labor-force numbers.

Encumbering a generation with profitable debt while prettying up the employment/economic stats and providing a convenient victim when things go south would seem to be a win-win-win….. For somebody.

Katniss, you said, “It is the responsibility of the lender to assess the capacity of the borrower to repay, not the other way around.”

Yes!! That’s EXACTLY what I’m saying when I call for lending standards.

And yes, there is something the Department of Education can do besides always say “YES”. They can look at students’ grades. Look at their class ranks. Look at their test scores. Look at their major. Look at their academic department. Look at their college. Look at the size of the student loan. Look at their existing debt load. ALL of these are correlated with the ability to repay.

For example, would you really lend $120k to a guy who graduated in the bottom 25% of his high school class and scored 740 on the SAT to get a degree in hair-styling from a for-profit barber school with a known track record of poor student loan repayment rates? I’d hope not, but the Feds will, even though they’re almost certainly not doing him a favor.

And if a chemistry student needed $5k to finish up her master’s degree after scoring 1380 on the SAT and establishing a GPA that puts her in the top 5% of her class at a top-notch school that has an excellent record on student loan repayments, it should be a no-brainer to make the loan.

Even without credit scores, there is a lot the feds could do to be more responsible lenders. They have tons of data on student repayments, and in the hands of competent statisticians, they could build a decent statistical model that could be used to objectively make yeah or nay decisions on student loans.

But right now, they’re not. The US Department of Education issues over 90% of student loans, and they’re not doing any assessment of borrower repayment capability at all.

If the feds can’t do it right, they should stop lending entirely. They’re hurting people.

Yikes, Brian, you are making me think very hard tonight.

If the feds can’t do it right, they should stop lending entirely. They’re hurting people

I couldn’t agree more. In fact, I have a daughter who, despite my best efforts, has been caught up in this very thing and harmed, I hope not irreparably. I’d venture to say that unlimited lending hurts far more people than zero lending ever could.

I don’t think the feds can or will ever stop lending., despite the outcry. If they do, the jig is up and the con will be exposed. It’s up to the people to stop borrowing. This twisted game would come to a screeching halt so fast that some heads would never stop spinning.

Unfortunately for now, the stated goal of all this indebtedness–an “education”–is the very thing that prevents people from actually understanding the situation. Go figure.

It seems that, for now, the only thing that can be done is to keep hammering away at it until the impossibility of it all sinks in. I have no doubt that that day will come. The challenge is to limit the damage until it does.

In other words, going Galt? :-)

I firmly believe that were student loans subject to bankruptcy, we’d see a crash in tuition because no one would be willing to lend very much money to college tuition since it could so easily be wiped out.

IMO the only entities that suffer under such a scenario are the college administration and the banks (since they lose their interest rate profits). Too bad, so sad.

The US Department of Education issues over 90% of student loans, and they’re not doing any assessment of borrower repayment capability at all.

If the feds can’t do it right, they should stop lending entirely. They’re hurting people.

You make a good point. Unfortunately, there is no political will at all to tighten standards. Any attempt to do so will be met with an outcry that the “opportunity” for a college education is being taken away.

Some contributing to the chorus will be well-meaning. It’s my opinion that a primary reason the non-dischargeability rule was put in place was to protect the “fiscal solvency” of the federal student loan program. When the Republican austerity wolves gather on the hillside looking to thin the herd of federal spending, this fence constructed around the student loan program by the Democrats keeps them at bay. Oh, and it benefits some key contributors, too.

However, you are right that the rule, as well as the whole program has become counter-productive at this point. Combined with K-12 education standards that are geared, across the board, to prepare kids for four-year college, we have a tremendous amount of demand for these loans to assist kids’ pursuit of something that’s worth less and less.

Um, what are you talking about?

I’m talking about the debt (liabilities) of the banks toward depositors, including depositors whose deposit was created by bank lending. That debt is for the nation’s fiat, usually payable on demand, and can only be redeemed by the non-bank private sector via physical fiat, aka cashing a check. But physical fiat is unsafe and inconvenient so people usually, except for petty amounts of cash, leave their deposits at the bank, especially when those deposits are insured by government. Hence the debts of the banks toward the non-bank private sector are largely a sham and will be ENTIRELY a sham if physical fiat is ever abolished, i.e. try cashing a check if no cash exists!

Please note that the largely sham nature of bank liabilities toward the non-bank private sector are the result of government privileges such as:

1) Not allowing the non-bank private sector to have inherently risk-free accounts at the central bank THEMSELVES alongside those of the banks or not having a central bank at all.

2) Government insurance for deposits with banks.

I’m not a big fan of bankruptcy.

Perhaps you’d prefer that debtors who cannot pay their debts be incarcerated at Marshalsea?

Bankruptcy is not simply a way for people to escape debt rendered unpayable due to unfortunate circumstances. It also acts as a restraint upon irresponsible and usurious lending. I agree that an important element of the student loan crisis is the absence of lending standards for such loans.

Forcing student loan lenders (including the federal government) to eat bad loans they make to high risk borrowers or for the purpose of purchasing degrees of nominal or declining value would hopefully incentivize those lenders into examining their practices and adopting standards beyond the pulse check.

You misread me, Sammy. If you read above, you’ll see that I fully acknowledge the necessity for bankruptcy law. No debtors’ prisons. I think bankruptcy law should apply to student loan debt just like it applies to other debt.

And yes, you’re right that is provides additional benefit beyond protecting those whose financial lives go pear-shaped. I have no argument with you there. Bankruptcy law indeed discourages predatory lending practices and helps encourage more responsible lending. I should have stated that in my earlier comments.

Alas, the federal government is rapidly becoming the biggest predatory lender on the planet. They are irresponsibly lending ever-increasing amounts of money to students will have an ever more difficult time paying it off. And they’ve embraced onerous debt collection practices that were quite rightly outlawed in the private sector.

While I agree that forcing private lenders (who issue less than 10% of student loans) to eat bad loans would encourage better behavior, I don’t know if that’s true of the federal government (which issues over 90%). It’s claimed that student loans are profitable for the government, but with interest rates below 6%, the default rate above 11% and an additional 20% or so being written off because of participation in income-based repayment plans (with debt forgiveness at the end), I’m extremely skeptical of these claims. I think they’re papering over it with accounting methods that again would be illegal in the private sector.

The feds don’t care if they lose money. They’ll just borrow more. They like to be the “good guys” who never say NO. Apparently nobody there is evaluating the carnage that occurs afterward. It’s rather shameful behavior for a government whose primary purpose is the protection of its citizenry.

I got solid A’s and B’s in High School, went to a state school for Chemical Engineering and graduated in 2008 with $100k in debt and it took 4 years to get a job thanks to Wall Street imploding. I will never be able to afford marriage, kids, house, or retirement. I have never had a year of my life in which I have decreased the amount of debt I owe. Screw this country and ever greedy SOB that got a subsidized education and slowly rolled it back for everyone behind them.

Question for you. What do you think the life time taxes collected from an average college graduate are vs an average non college grad? Who is more likely to go to prison? Not have health insurance and go to the ER? Get on Food Stamps? Welfare?

Granted this is from 2004?, but it estimates that if the government paid for community college for someone they would be $50-$75k in the black by the end of their working life. Not to mention all the economically productive things I could be doing with my life now rather than sitting around miserable all the time. It would probably be huge bonus for GDP.

http://www.rand.org/pubs/research_briefs/RB9461/index1.html

Everyone in this country is so damn self centered. The mere concept of collective good is not only erased from people’s consciousness it is replaced with rage at anyone for wanting ‘free stuff.’ Sometimes I think this planet deserves the horrible fate it has coming to it.

“Everyone in this country is so damn self centered. The mere concept of collective good is not only erased from people’s consciousness it is replaced with rage at anyone for wanting ‘free stuff.’ Sometimes I think this planet deserves the horrible fate it has coming to it.”

Well put. It doesn’t have to be this way.

As a so-called exceptional society we could be proud for everyone to live in dignity with a decent social safety net: old, young, everyone. Bernie showed alot of people want this.

We just need to keep hammering away at this message.

Reply ↓

I empathize with your situation and you are exactly the kind of person for whom a loan should be adjusted and/or forgiven. I wish that you did not place more value in being college educated vs. no college education or having an AA degree from a community college. That’s what the people in power want us to do, fight amongst ourselves; to push people further down the ladder as we desperately cling to our rung. We are all getting a raw deal and it needs to be fixed, and that will only come about if we have each others back.

I believe that this is not known by many but student loans can be discharged under SSI or SS if you meet certain requirements. I know of two cases that were discharged. A few hoops to jump through but worth it if the loan is discharged.

https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation

http://www.disabilitysecrets.com/resources/disability/can-i-get-a-student-loan-discharge-disability

Good work. I fall through the gaps on this, but well worth looking at if it helps even one person.

Note the word ‘discharged.’ Janet pointed out that normally when a debt is discharged, you don’t have to renew the discharge every year. Forewarned.

I think this is very hard to do. They make it that way on purpose. My mother knew a woman who went completely blind. She was poor, single, and had multiple health issues. Yet, she could not get is discharged.

I’d just like to know how people who are 100% “disabled” are getting student loans for “retraining”.

Unless the whole “retraining” program is another “fleecing the sheep” scheme, underwritten by the US Government.

Keeping alive the fantasy that:

-unemployment is low, and

-currently unemployed workers just lack “skillz”

OTOH, there are plenty of examples (including one of my cousins) who are professional “students”, becoming a Dr. In “Music” while running up a half million bucks in student loans. Finally getting a teaching job in his forties, then becoming “disabled” when vested in the teachers pension plan.

I’m sure that he’ll get a free pass, somehow. Its the American Way.

Oh, yes. The income-based repayment plans are being ruthlessly exploited, both by students and by universities. Once your cousin’s debt load put him at the point where an income-based limit would kick in, was there any disincentive to limit his future borrowing? Heck no. It didn’t matter how much money he borrowed… The payments would be the same. After crossing that threshold, it essentially became FREE MONEY!!

And do you think your cousin’s university gave him any scholarships or discounts for being such a long-time repeat customer? I bet they didn’t. No even a penny. After all, if they charged him full list price, it wouldn’t hurt him any. He could just borrow the money, without suffering any real penalty. And the cash flow that such practices generated? Oh, my… The university was rolling in it.

Divide and conquer or blame the guy while avoiding the root cause. So easy!

This seems very ironic: IRS debt is dischargable in bankruptcy (some limitations apply), but student loan debt is not dischargable. So, let’s say January 15th roles around, and you have $5,000 that you can send to the IRS for your quarterly tax payment OR you can pay $5,000 of spring semester college tuition, what do you do? You can send the money to the IRS and take out a student (or parent) loan to pay tuition, or you can take a “loan” from the IRS and pay the college tuition.

What do you do?

Say you have $45k in student loan debt, and $15k in taxes due?

I’ll stop our automatic withholding and let you know next year.

since when is IRS debt dischargable in bankruptcy? news to me.

Michael Hudson, whose articles Yves posts here quite often, has written extensively on this subject. One of his best recent articles (June or July 2016 I think) is at counterpunch.org archives – “Revolts of the Debtors from Socrates to Ibn Khaldun”. Here is just the final paragraphs, but the entire article is excellent:

*****

…Today’s Treasury Secretaries, central bank heads, IMF economists and client academics serve the world’s cosmopolitan financial ideology that money and credit, debt and taxes are purely technocratic, and hence beyond the sphere of voters or the politicians they elect to “interfere” with. We are back with the Thatcherite financial Taliban (the Arab word for “students”): There Is No Alternative.

That is the protective myth that elites have wrapped around themselves and their privileges from time immemorial. To succeed, it must erase knowledge of history and live in a highly censored “present” in which the financial class takes the land, public infrastructure and government into its own hands.

It has all happened before – and so have revolts by debtors and other exploited victims of such “economism.”

*****

Social Security should not be subject to garnishment for any reason. It’s a sad commentary on how we treat seniors in our society – many living on Social Security are barely able to afford the basics of living, much less make payments on a student loan. I was with Bernie on this one – public education should be considered a benefit for “the common good” of a society. The young are also saddled with enormous debts – with no hope of getting ahead in life.

This is another issue the Dems could glom onto if they want to win future elections. Heck, there are so many, but this one would make a huge difference in people’s lives. Joe Biden – are you listening?

Joe Biden worked years to get the legislation passed that made student loans exempt from bankruptcy. So, please don’t call on him for help. That like asking an arsonist to put out the fire he started. LOL

Your other points were very good, although I have no faith in the Democratic Party. They left the middle class and the working class behind a long time ago.

We need a progressive party to replace them in my humble opinion.

s. brown: Agree totally with you – was being facetious about Joe Biden since he put through this obnoxious rule. The swamp needs to be drained of fake liberals.

Ignoring the humanitarian aspects for the moment (as our elected officials are fond of doing) I suspect there is still a sound economic argument for correcting this kind of thing: namely, that people will likely be more willing to spend money and stimulate the economy if it didn’t currently feel so much like walking a tightrope over a pit full of crocodiles. Remember Keynes and his propensity to consume? (The genuine Keynesianism, I mean, where the actors are actual consumers rather than central banks).

Do people spend more when they have basic security (roof, food) or do they spend more when their lives are precarious? I’d have to go with the studies that show people spend more when stressed.

I think you’d have more creativity, entrepreneurship with less stress as people wouldn’t be so locked down

The system can always be gamed by the unethical. Take out student loans when you are 60, take SS at 62 and don’t repay the loans if SS cannot be garnished. Take out $300,000 to get through med school and then declare bankruptcy. It might be better to do a future means test on the applicant beforehand, based upon their major. And also, jail Bill Clinton.

If the universities were on the hook for accepting students who obviously could not possibly pay back their loans, this kind of problem would evaporate faster than water in the Mohave.

It is the institutions that should be forced to have ‘skin in the game’ long before, and to a greater extent than the (usually young and financially naive) students.

Good luck with means sourcing since a heck of a lot of white collar jobs are being outsourced. Student loans were never gamed by the students. It’s myth that is right up there with the cadillac driving welfare queen.

I think if people received an education at a non-extortionist price and they could get stable, well-paying jobs, they are more than happy to pay back any loans they took out.

I do recall the stories back then, but there tweren’t no internet back in the day. If it were possible to wipe out student loan debt via bankruptcy, I am pretty certain folks, like The Donald, would game the system.

“Before the mid-1970s, debtors were able to get rid of student loans in bankruptcy court just as they could credit card debt or auto loans. But after scattered reports of new doctors and lawyers filing for bankruptcy and wiping away their student debt, resentful members of Congress changed the law in 1976.”

http://www.nytimes.com/2012/09/01/business/shedding-student-loans-in-bankruptcy-is-an-uphill-battle.html?pagewanted=all&_r=0

“I think if people received an education at a non-extortionist price and they could get stable, well-paying jobs, they are more than happy to pay back any loans they took out.”

This.

Everything is awry because our society has lost sight of this basic standard of decency.

Real leadership worthy of the name would take action to remedy this.

Garnishment of Social Security to pay off student loans to diploma mills, the never-ending War on Terror, metastasizing Casinos and the billionaires manufacturing Fentanyl and OxyContin to feed the opioid expidemic are example of how depraved western society has gotten thanks to good old fashion greed. If it makes money for the connected it is okay. Fake corporate news cannot hide how desperate the under classes have become due to oligarchs looting. This will only get worse unless there is a restoration of government by and for the people.

Well, since Social Security is going down the drain, I guess there isn’t really anything to worry about.

Jerri:

Student Loans in default make more in in default than in normal repayment. It is a hassle; but, one can slip free in 20 years if they follow the procedure set for by Direct Loans. Of course, private bank loans area horse of a different color.