John Helmer’s site came under heavy attack as soon as he posted this story. It was not the usual DDoS attack, which can be launched by script kiddies, but a sophisticated hack aimed at the internals of his site. It succeeded in taking his site down.

This effort to quash Helmer’s story has backfired. It is being rushed into print in two different countries. The attacks had the effect of validating its importance.

As Helmer said via e-mail:

For obvious reasons, not one of the Russian agitprop sites will run it, and the Moscow Russian press cannot. Sechin is suing them for reporting the obvious.

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

As famous hoaxers go, Igor Sechin, the chief executive of Rosneft, Russia’s largest oil company, is at least as clever as Clever Hans, a German horse of the late 19th century.

Hans was apparently good at arithmetic. If his owner asked him to multiply three by four, he would tap his hoof twelve times. He could tell the square root of sixteen by tapping four times. He was also able to give answers to questions he hadn’t heard before. So he was a very famous horse in Germany. That was until a sceptical psychologist realized Hans would only get the answers right if his owner also knew the answers, and if the horse could see him when the questions were asked. If the owner or another questioner was invisible to the horse’s eye, Hans would fail. He even bit the psychologist after a string of tests produced wrong answers. The psychologist’s conclusion was that the horse was gifted, but not at arithmetic. Hans could detect the visual cues his questioner would give out when the horse was reaching the correct number of hoof taps, and he would stop. The owner wasn’t attempting a fraud, and Hans was exceptionally intelligent. But his calculations were a hoax.

In last week’s Rosneft share sale — the deal President Vladimir Putin has called the biggest privatization in Russia, and also the biggest oil sector sell-off in the world this year — clever Igor, like clever Hans, has proved his indubitable intelligence. But the arithmetic which the president has announced — €10.5 billion paid into the Russian state budget – is a hoax. That’s because a curtain has been drawn across all questions of where the money has come from.

In fact, Kremlin and Russian banking sources acknowledge, the money originated from the Central Bank of Russia, recycled through the Russian state banks to Rosneft and back, and finally concealed inside secret fiduciary agreements with a consortium of Glencore, the Swiss trading company, and the Qatar Investment Authority (QIA), an Arabian Gulf state agency. The agreements appear to make Glencore and QIA the owners of a 19.5% shareholding in Rosneft – when they are fiduciary shareholders – and that’s not the same thing as owners.

“The transaction has been financed by money creation by the Central Bank”, said a source close to the dealmakers. “The Central Bank can’t simply print money and give it to the federal budget. So this deal was engineered for Glencore and the Qataris to appear to be buying shares when the terms of the agreement reward them for acting as fiduciaries, but ensure they cannot vote the shares without instruction from the Russian state; that’s Mr Sechin. This means the privatization of the shares isn’t genuine. Also, three-quarters of the money going into the state budget is coming from the Central Bank.”

A Russian banker in London comments: “There’s a golden rule in Russian banking. If you fiddle around, never involve foreigners because in the end they will expose you. The announced terms of the Rosneft deal cannot stand the light of day. Inevitably, the truth will come out.” According to Swiss sources, the truth has already been demanded by the US Government of the Swiss Government, which will obtain the contracts from Glencore.

Until the start of this month, the Russian government held 69.5% of Rosneft through a wholly owned state enterprise called Rosneftegaz. British Petroleum (BP) owned 19.75%, and the National Settlement Depository, 10.36%. https://www.rosneft.com/Investors/Equity/Shareholder_structure/

When Putin met Sechin on December 7 to announce the privatization sale of a 19.5% shareholding in Rosneft, it was pats on the back all round. http://en.kremlin.ru/events/president/news/53431

Source: Kremlin, December 7, http://en.kremlin.ru/events/president/news/53431

“[PUTIN] Mr Sechin, I would like to congratulate you on the conclusion of a privatisation deal to sell a large stake in our leading oil and gas company Rosneft: 19.5 percent. The deal was made on an upward trend in the price of oil and it therefore reflects on the value of the company itself. In this respect, the timing is very good and the overall value of the deal is significant: 10.5 billion euros…I very much hope that new investors – a consortium of the Qatar state fund and Glencore, a major international trading company – I hope that their participation in managing bodies will improve corporate procedure and the company’s transparency and will ultimately increase its capitalisation. Meanwhile, the company’s controlling stake will remain in the hands of the Russian state: over 50 percent. Overall, this is a very good result. I would like to congratulate all of you, your colleagues who have worked on it. And naturally, the question arises: when will the money come to the Russian budget?”

“[SECHIN] “This amounts to over 1 trillion rubles, which will come to the budget, including 10.5 billion euros for Rosneft’s 19.5 percent stake. The consortium that will become Rosneft’s shareholder was established by the Qatar Sovereign Wealth Fund and Glencore trading company, which is our long-standing partner. The consortium participants hold equal stakes: 50 percent each. Payment to the state budget will be made both with our own resources and with a loan organised by one of Europe’s largest banks…Overall, the privatisation of 49 percent of Rosneft in a series of transactions has earned us $30 billion, no, nearly $34 billion, which is four times more than returns from all other privatisation transactions in Russia’s oil and gas sector.”

“I am sure that the high standards of our investors and Rosneft’s transition to a new dividend payment system, which the Government has approved at 35 percent, will definitely improve the company’s capitalisation, including the state-owned stake. We estimate the state-owned stake after the transaction at approximately 80 billion rubles…Also, I would like to say that we received the necessary amount of assistance from the Government while preparing the deal.”

“[PUTIN] “The budget must receive the full sum in the ruble equivalent, in rubles.”

The London market, where Rosneft is listed, was not persuaded by the valuation of the 19.5% shareholding. By conversion of €10.5 billion into US dollars on the deal day, December 7 — $11.13 billion – the transaction figure turns out to be $300 million less than the market capitalization of Rosneft the day before at $11.43 billion. Glencore and QIA got themselves a 3% bargain.

ONE-YEAR TRAJECTORY FOR ROSNEFT SHARE PRICE

Source: https://www.bloomberg.com/quote/ROSN:LI The market capitalization of Rosneft on December 7 was $58.6 billion.

The pickup in the Rosneft share price since has followed the rise of the crude oil price. That has helped enhance the subsequent gain in the value of the foreign consortium’s side of the deal. The market value of Glencore’s and QIA’s 9.75% stakes on December 7 was $5.7 billion apiece. With the rise in Rosneft’s share price by December 13, their stakes are now worth $6.8 billion. That’s a profit of $1.1 billion to Glencore and the same to QIA. That is, if and when the terms of their agreements with Rosneft allow them to cash out on market terms.

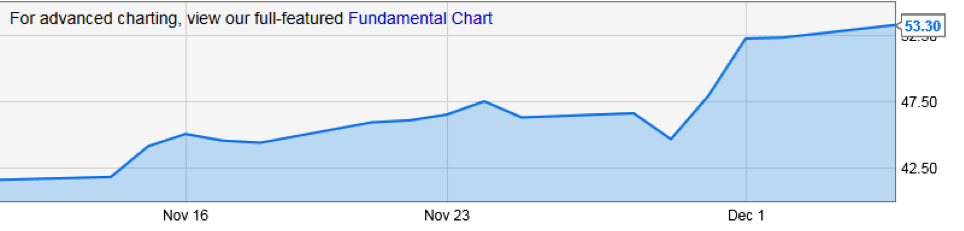

ONE-MONTH TRAJECTORY OF THE BRENT OIL PRICE

Source: https://ycharts.com/indicators/brent_crude_oil_spot_price

Rosneft’s announcement https://www.rosneft.com/press/releases/item/185049/ of the terms of the transaction express the value of the 19.5% stake sale to the state budget as Rb710.8 billion. At the Russian Central Bank rate of the day, this was equivalent to $11.12 billion; €10.4 billion.

Rosneft also claimed: “The acquisition of the Rosneft stake will be financed with investors’ own funds and will also involve debt financing. Investors’ equity in the acquiring vehicle will amount to EUR2.8 bn. The bulk of debt financing will be provided by Banca Intesa Sanpaolo that will arrange financing to the acquiring vehicle on non-recourse basis with a pledge of the acquired shares. Additionally, Glencore’s equity exposure on its investment in Rosneft shares will be reduced to EUR300 mn with full indemnity to Glencore’s balance sheet on other potential liabilities to the acquisition vehicle as through structured risk reduction instruments.”

The reference to Banca Intesa Sanpaolo has not been verified by the Italian bank, whose headquarters are in Turin. On December 2 the bank announced it was about to start a “transparency exercise” under supervision by the European Banking Authority. http://www.group.intesasanpaolo.com/scriptIsir0/si09/eng_index.jsp

On December 12 the bank said it had agreed to grant credit lines of €750 million to the Yamal liquefied natural gas project of Novatek, to enable it to build a liquefaction plant with Italian-supplied equipment. http://www.group.intesasanpaolo.com/scriptIsir0/si09/eng_index.jsp In between these releases the bank said nothing at all about lending money to Rosneft.

An international bank source said the Italian bank cannot finance Rosneft under the current US and European Union sanction rules, and it isn’t lending money to the shareholding deal as announced. “They don’t violate the sanctions,” the source said. “They don’t finance Rosneft.” A similar statement was issued by the bank a year ago. https://sputniknews.com/business/201506231023771642/

If Rosneft meant the Italian bank is arranging for other banks to lend to Glencore and QIA, that isn’t what Glencore’s account of the transaction says. Click to read the Glencore version. http://www.glencore.com/assets/media/doc/news/2016/201612102045-New-strategic-partnership-between-Glencore-and-Qatar-Investment-Authority.pdf According to Glencore, it and QIA “will commit €2.5 billion in equity to the Consortium with the balance [€7.7 billion, 76% of total] of the consideration for the acquisition of the Shares to be provided by non-recourse bank financing, principally [sic] by Intesa Sanpaolo S.pA., with Russian banks also providing financing and credit support [sic].”

The implication is that Intesa has agreed to lend Glencore and QIA more than half (“principally”) of the €7.7 billion ($8.2 billion) required by Rosneft. In its corporate and investment banking loan book which the bank reported http://www.group.intesasanpaolo.com/scriptIsir0/si09/contentData/view/20161201_Trimestrale_3Q16_uk_Def.pdf?id=CNT-05-00000004C7BDB&ct=application/pdf on September 30 at €97.6 billion, such a loan would amount to between 4% and 8% of the bank’s entire book. With shareholder equity in the bank reported at the same time to be €48.9 billion, the purported Rosneft loan may amount to 10% or more of equity. European bankers say they don’t believe it.

Instead, Russian banking sources are convinced by the evidence they have seen that Russian state banks, backed by the Central Bank, are the principal financiers of the Rosneft share sale. According to one source, “Rosneft issued bonds. Those bonds were purchased by Russian banks on credit lines from the Central Bank. Rosneft then transferred its bond sale proceeds to the same banks, and they gave this money to the so- called investment fund of Qatar and Glencore to buy shares of Rosneft. Very nice combination.”

The source is referring to the late-November bond transaction, reported by Reuters from a Rosneft briefing this way. http://uk.reuters.com/article/russia-rosneft-bonds-idUKL8N1DP24B “Nov 24. Russia’s largest oil producer Rosneft is to return to the country’s domestic bond market after a two-year absence with a programme worth 1.071 trillion roubles ($16.6 billion), the company said on Thursday. Rosneft, which is preparing to buy 19.5 percent of its own shares from the state in a share buyback deal worth around 700 billion roubles, said that the money raised from the bonds might be used for overseas projects, new upstream business and planned refinancing. A Rosneft source said the company has no plans to use bond proceeds to finance the potential share purchase from its parent company, the state energy holding Rosneftegaz. Rosneftegaz holds a 69.5 percent stake in Rosneft. ‘There is no intention, no goal to use funds any other way (than for overseas projects, new upstream business and planned refinancing),’ the source said. A Rosneft spokesman declined to comment.”

Mikhail Leontyev (lead image, left), Rosneft’s chief spokesman, doesn’t answer sensitive questions, and the company source quoted in the Reuters report was either mistaken or misleading. A Rosneft insider says the terms of the sale to Glencore and QIA have been kept secret from many senior company officials. According to Leontyev, “I have nothing to add… We have not given commitments to comment on the [transaction details] online, we’re not exhibitionists.” . https://www.bfm.ru/news/340728 Is the transaction an intermediate one, allowing Rosneft to buy the shares back again? “That’s kind of absurd,” Leontyev claimed https://izborsk-club.ru/11554 this morning. “That’s another achievement of morbid fantasies, which are generally subject already, in my opinion, to some kind of clinical diagnosis. Political or medical.”

In the outcome, however, Russian and international bankers believe the bond proceeds are the principal source of the privatization deal. A source close to the dealmakers explains: “Putin told Sechin to get more money out of Rosneft and into the budget to reduce the deficit. So the idea was to sell shares. But noone in the market wanted to buy something too small to represent even a blocking stake. The Russian oligarchs all refused because they don’t have the money. If Sechin came back to Putin with state bank financing, then the deal would obviously look fake, and simply move cash from one state pocket to another. Rosneft’s oil traders like Trafigura were asked for the cash as pre-financing for oil, but they said no. So in the end the Central Bank created the money through the bond financing, and then guaranteed the state banks’ role in the privatization. That has been camouflaged by the appearance of Glencore and QIA. Putin and Sechin wanted to prove the money came from the outside, so Glencore and QIA were persuaded with hefty rewards to act as fronts. Anything you can’t make transparent, though, is a mistake. And Sechin has compounded the mistake by making such a victory celebration of something that isn’t what it seems.”

“Such a scheme would achieve that desired purpose,” a Moscow banker comments. “It might make sense, but this is guessing. It is indeed a non-transparent deal, and what has been disclosed is not its entire financial mechanism. There may be good reasons for that. No doubt the US authorities will go after the identified deal parties one by one, and harass them. But there is the strong smell that funds of Russian origin can be involved.” The source adds the Central Bank doesn’t disclose its counter-parties in loan transactions, and will not report anything to substantiate its role last week.

A US business publication claims http://fortune.com/2016/12/08/russia-rosneft-qatar-glencore-oil/ it was told by a Russian government source “the bond issue was a safety net in case the negotiations with the outside investors fell through.”

The Qataris needed reassurance for a case of the jitters which came on after the US Government reacted with private hostility. On December 13, Putin telephoned the Emir of Qatar, Sheikh Tamim bin Hamad Al Thani, to discuss “bilateral relations. Specifically, they emphasised the importance of the recent agreement by the Qatar Investment Authority to buy a 19.5 percent stake in Rosneft together with Swiss oil trader Glencore.” http://en.kremlin.ru/events/president/news/53459

Putin with Al Thani at the Kremlin, January 18, 2016

In Washington outgoing US Government officials have been biting their tongues. Amos Hochstein, the State Department’s envoy for international energy affairs, told Bloomberg: “Clearly this is not what we were hoping for when we implemented sanctions.” https://www.bloomberg.com/news/articles/2016-12-10/glencore-qatar-commit-3-billion-in-equity-to-rosneft-stake The departing White House spokesman, Josh Earnest, said: http://uk.reuters.com/article/us-russia-rosneft-privatisation-idUKKBN13Y0FQ “ The experts at the Department of Treasury that are responsible for constructing and enforcing the sanctions regime will carefully look at a transaction like this. They’ll look at the terms of the deal and evaluate what impact sanctions would have on it.”

“There’s been too much of a victory celebration”, a New York bank source said of the Rosneft leaks to the Russian press, and of the Russian propaganda organs in English. “Another blow to Western sanctions and a vote of confidence in Russia’s economy,” claimed The Duran. “Russia has pulled off another coup.” http://theduran.com/big-boost-vladimir-putin-russia-successfully-sells-19-percent-rosneft/

Swiss sources concede that US Government officials are concerned at the appearance that “under their noses the sanctions-busting specialist Glencore pulled off an €11 billion deal”, and that unless they act, the deal will encourage others. “The point is”, according to a Geneva source, “when the Swiss give Washington the Glencore contracts, as they are certain to do, the Americans will see this is a Russian bank financing for Rosneft and the state budget, not a foreign one.”

Russian sources say they suspect Sechin of making concessions to Glencore which will end up in five years costing the Russian budget more money than Sechin told Putin he is paying in now. Russian press reporting has identified tax relief for some of Rosneft’s oilfields to be likely to cost up to $1 billion in annual budget revenues foregone. By proposing to pay out 35% of its profit as dividends, instead of 25%, Rosneft is promising Glencore and QIA a takeaway that may be more than $1 billion richer by the year than would otherwise have remained in state coffers.

Glencore’s deal announcement also reveals that Sechin has given Ivan Glasenberg, Glencore’s chief executive, a “new 5 year offtake agreement with Rosneft representing a sizeable additional 220,000 bbls/day for the Glencore Marketing business.” While Russian bank analysts of the oil trade have estimated that the trade commission has been $1 per barrel, trade sources claim Glencore will now take $3 per barrel. “An insider from Rusal, the state aluminium company, acknowledges that in return for financing

Rusal through its near-collapse into bankruptcy in 2008-2009, Glencore took a substantially higher commission than Rusal had ever wanted to concede before. The Glencore terms were also a violation of the company charter, as a successful legal challenge by Victor Vekselberg proved. For details, read this. http://johnhelmer.net/?p=14383

A calculation of the value of the new Sechin-Glasenberg oil trading concession looks like this: 220,000 bbls/day x $3 per barrel x 365 days x 5 years = $1.205 billion. Glencore does not respond to questions about its trading commissions, and the calculation may err on the low side. If the normal Rosneft trading commission had been $1 per barrel, this would earn $401.5 million over five years. The difference between $1 and $3 would be $1.05 billion minus $401.5million; that is, $648.5 million.

According to Glencore’s deal announcement, “Glencore and QIA have concluded various agreements which provide for the establishment of a 50:50 consortium.” These agreements, several European sources believe, include a fiduciary scheme which keeps ownership of the 19.5% shareholding under Sechin’s control, but allows Glencore and QIA to act as shareholders with tight restrictions. “They appear as the holders of the shares but vote as instructed by Sechin in the fiduciary agreement,” one of the sources believes. “In five years, these shares may come back to him. They may be entitled to keep the dividends over this period, or they may be required to return part or all of them.”

Sechin is currently suing in a Moscow court the RBC media group for reporting last April that he intended to impose such restrictions on Rosneft share sales, in order to prevent BP, with 19.75%, combining with a foreign shareholder to form a blocking stake. http://www.rbc.ru/business/11/04/2016/570794529a79476629976ea7

“The foreigners play a superficial role [in the deal]”, said a knowledgeable source who concedes he is speculating now, but will know for certain shortly. “Putin would not know what the structures are. He would just be told the budget is getting €10.5 billion. He would not be told what the outgoings will be.” Sources who know Sechin and other senior Rosneft executives say the Glencore oil trade concession “sounds like a provident fund. For an outlay of €300 million Glencore is going to make much more in annual dividends so long as the oil price stays stable above $50; and much more again from its trading commissions.”

As has always been clear, Putin and most of his cadres are also neo-liberals, just with some reservations against raping the country. This latest deal just shows their worldview on economical matters is astonishingly close to the ones ruling Washington DC. By demonizing Putin and his cadres, US is actually forcing Russian elites to leave the neoliberal world order, essentially shooting themselves on the foot. Putin would be forced to change the economic policy of his country to a war posture which essentially means goodbye to all the “gains” the Russian neoliberals made into integration of the rest of neo-liberal universe.

It appears Trump sees this, and will attempt to save idiots in Washington from themselves, if he is given a chance that is.

It looks like the funding for this comes in rubles and the dividends will be paid in rubles. It shows the power of a sovereign currency in that Russia’s central bank has no problem funding this or paying the dividends. The questions seem to be why would they want to do this and how strong is the ruble.

Switzerland and Qatar don’t seem to mind being paid in rubles.

Putin could probably also benefit from a consult with Stephanie Kelton and Mariana Mazzucato on how to use this sovereign currency power to diversify and help the general population rather than funding oligarchic corporations.

If the deficit reduction story really is the whole story, then this is a Feather in the Cap for Modern Monetary Theory, isn’t it. Incidentally, people were asking for an MMT tutorial; Bill Mitchell’s Weekend Quiz this week looks to be working in tutorial country.

The problem is that when I get an answer wrong, there is no explanation to help me learn the correct answer. Won’t do that again. No point.

The extended explanations come the next day.

Maybe because of time or forgetfulness I would never get that feedback. A lousy plan. Is the author afraid someone would “cheat?”

You can subscribe for free and have his daily blogging and weekly quizzes sent to your email. He is extremely detailed and I think one of the best writers on MMT. He has a particular interest in employment. He has years of useful quizzes and answers at his site.

Thanks. I’d still rather review my answers w/o clogging up my Inbox quite so much.

Bill Mitchell doesn’t know money from mud pie.

Zero value-add drive-by ad hom. Try posting commenting where such material is appreciated.

“Putin could probably also benefit from a consult with Stephanie Kelton and Mariana Mazzucato on how to use this sovereign currency power to diversify and help the general population rather than funding oligarchic corporations.”

Ha! Good one. So could our brave new President elect Trump.

So how much different is this when The Fed bought bad MBS et al.? Or when The ECB started corporate bond buying? Or The BoJ buying equities outright?

May as well throw in drug cartels are using the Discount Window to launder their money too, it’s all financial engineering to cover bad math, bad policy, and even more likely, cover criminal activity.

+1 on these questions. I’d love to see someone here make the necessary distinctions, if there are any to be made.

The Fed’s never lost any money at the discount window.

Perhaps this is, in part, as a result of the horse-trading with OPEC to boost oil prices by reducing production. Note also the comment by reader “financial matters” that the Swiss and Qataris don’t mind being paid in rubles: Part of the Russian play is the establishment of international payments in currencies other than the dollar.

Off topic, but something for you to include:https://www.thenation.com/article/why-are-the-media-taking-the-cias-hacking-claims-at-face-value/

Great piece, I’m surprised The Nation had the courage to publish it.

Who are the owners, parties of interest, of Glencore? Does Swiss secrecy protect them?

Should we infer from this statement in the article that Putin was duped? If indeed he was duped, then should we expect Putin to extract some sort of retaliation against Sechin?

Sorry, but this whole article was too dense for me. What are the key points I should take away from this article? I still don’t really understand where all this fits in.

The crux of the article is whether this is a serious attempt at privatizing Rosneft via government share sales to two other companies or is it merely government financing the purchase of its shares by Rosneft.

Complicated deal that will require some additional information to understand – perhaps in the many supporting links that Helmer provided – as well as some further thought. But other than the selection of a single company (Rosneft) to benefit from central bank largesse, and the state propaganda surrounding the transaction, it is difficult on the face of things to see how this scheme is of a material nature. The financial benefits to be derived by Glencore, the Qattaris, and the Italian bank in exchange for setting up the special purpose financing vehicle appear to be economically immaterial in a broader context.

Not to say the cui bono forensic questions that arise from the financial aspects of this particular tangled web aren’t fascinating, just as the far more material actions of other major central banks in recent years are, as Northeaster pointed out in comments above.

Just speculating here, but would it be possible that the involvment of QIA is related to some sort of compensation to back off form the Syria’s quagmire?

Going back to Pepe Escobar’s Pipelineistan theory (http://www.strategic-culture.org/news/2015/12/07/syria-ultimate-pipelineistan-war.html) Qatar is one of the sponsors of the Syrian uprising. Maybe Russia offered a slice of Rosneft to encourage Qatar to close the money tap and stop funding ISIL and all that jazz.

Good point re Qatar.

I have not found this reporter over time to have been particularly illuminating vis a vis events in Russia. That said,

What other major oil producing country has not found itself going through extreme contortions trying to keep what they view as their ‘strategic’ industries afloat, whether owned by the State or privately? Does anyone seriously believe the stronger players in the US shale oil industry were not effectively bailed out quietly to keep the industry alive when the fields ran with red ink? How do you suppose Canadian tar sands oil producers and the banks that backed them survived such a monumental hit and yet managed to keep on producing full out (apart from a major fire some human set, but for whom no search was ever mounted). How on earth did Venezuela, or Brazil, or Indonesia or the ‘stans of south-central Asia stay in business?

In other words, everyone has been playing this game. Central Banks have been the backstop of choice all over the world, West, East, North and South. To pretend Putin et al are operating on a level of non-transparency as bad or worse than anywhere else trying to cope with a major, even strategic economic war on this scale is, well, both par for the course and just plain sad. US sanctions and the US/Saudi crash of oil prices are the policies requiring reversal. Oil prices need to be much, much higher if there is a hope in hell of saving ourselves.

¿Why no mention of the mark rich/clinton relation to this entire saga?

Because Marc Rich is dead and hasn’t had anything to do with Glencore for quite a while.

Please could some one explain what this is about. Sorry to say this but I find this writer hard to follow – not being that well versed in financial dealings

You have to cut through a lot of information to get to the point.

I have the following questions

-. Is this about a privatisation that isn’t really a privatisation in real terms. (Correct me if I am wrong about this)

– Now it seems that the money came from the government banks to buy the shares is this legal

– That glencore and Qatar are just the “owners” of shares on paper and in reality are holding the shares in trust for igor sechin who gets them back after five years. Is this correct?

– They get dividends of 35% for doing this role ? Yes or no

– what was the government trying to prove ??

– Why not cut out the outsiders and borrow money and just give it to the government and then pay off the loan with dividends to the banks????

The whole thing is really odd I just don’t understand it!!!

Russia has a deficit. It doesn’t want to cut its budget. It doesn’t want to admit MMT is right and create more rubles. So it creates door number 3. Since oil is ostensibly going up and taking Rosneft’s value with it, Russia could raise funds by selling a piece of Rosneft. But it doesn’t want to do that either. So it puts smoke and mirrors behind door number 3, the appearance of a sale. First Rosneft issued bonds that the banks purchased. Rosneft deposited the bond proceeds with these purchasing banks, which then used that money to create the pot they then lent to QIA and Glencore through as yet undisclosed channels to fund the purchase of the Rosneft stock (Note that the buyers are really just a stock holding trust.). So Russia has “created” money by lending funds for the “purchase” of its Rosneft shares. Actually there is no money creation and no sale, and this is just a pocket to pocket transfer done behind a curtain, and Russia is hoping the curtain will remain intact.