Yves here. Evonomics made this comment at the end of Sally Goerner’s post:

John Fullerton’s white paper, Regenerative Capitalism, lists eight principles critical to systemic economic health. The Capital Institute’s research group, RARE[1], uses recent scientific advances – specifically, the physics of flow[2]– to create a logical and measurable explanation of how these principles work to make or break vitality in the human networks of which economies are built.

I hate to come off like a nay-sayer, because I have no doubt that the underlying methodology is useful. But this sounds an awful lot like a new improved version of system dynamics, which the economics profession successfully beat back in the 1970s. As we discussed long form in ECONNED, orthodox economics rests on the assumption that economies have a natural propensity to equilibrium, and that equilibrium is full employment. As Paul Samuelson stressed, that assumption is necessary for economics to be science, as in mathed up, and the dominance that economists have achieved is due to their scientific appearances and the fact that their mathematical exposition enables them to dismiss lay critics.

Thus any analytical method, like systems dynamics or “the physics of flow” that allow for positive feedback loops (as in self-reinforcing instability) must be aggressively rejected by economists as a threat to their standing and rice bowls.

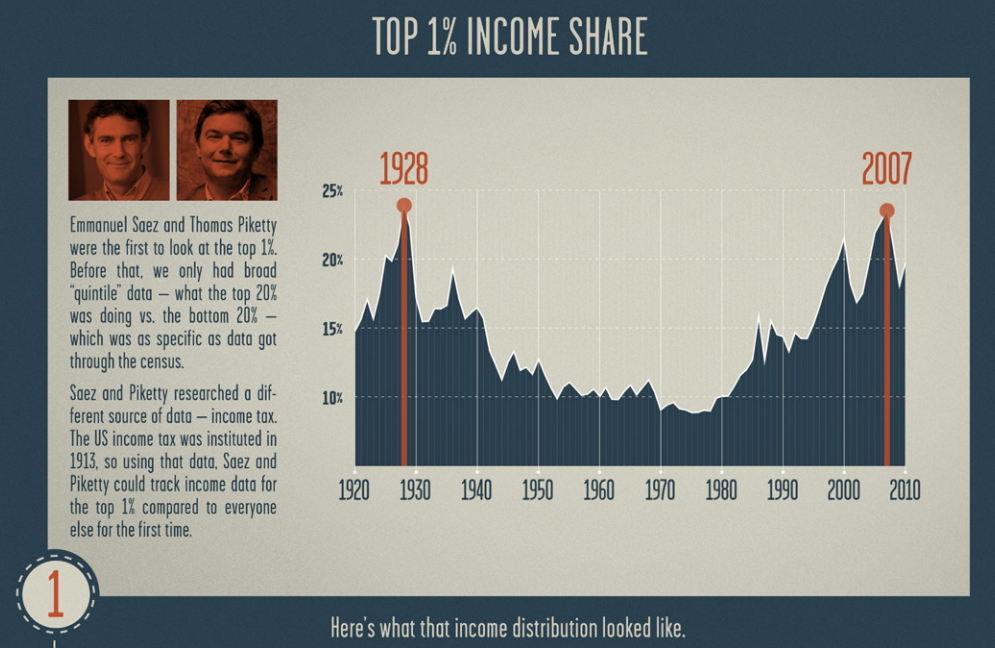

Having said that, I wish this post did not start with the Oxfam report, which suffers from serious methodological flaws. It’s not hard to make the case that wealth concentration is only getting worse, and there is solid work by people who have been tracking this trend over decades, such as Emanuel Saez and Thomas Piketty (Gabriel Zuc is a rising star on this beat; in fairness, the article does include some Piketty and Saez data further down). There’s no need to overegg the pudding.

By Dr. Sally J. Goerner, Capital Institute’s science advisor, and director of the Research Alliance for Regenerative Economics (“RARE”). She is exploring the scientific foundation for regenerative organizations, financial systems, and economies. Originally published at Capital Institute; cross posted from Evonomics

According to a recent study by Oxfam International, in 2010 the top 388 richest people owned as much wealth as the poorest half of the world’s population– a whopping 3.6 billion people. By 2014, this number was down to 85 people. Oxfam claims that, if this trend continues, by the end of 2016 the top 1% will own more wealth than everyone else in the world combined. At the same time, according to Oxfam, the extremely wealthy are also extremely efficient in dodging taxes, now hiding an estimated $7.6 trillion in offshore tax-havens.[3]

Why should we care about such gross economic inequality?[4] After all, isn’t it natural? The science of flow says: yes, some degree of inequality is natural, but extreme inequality violates two core principles of systemic health: circulation and balance.

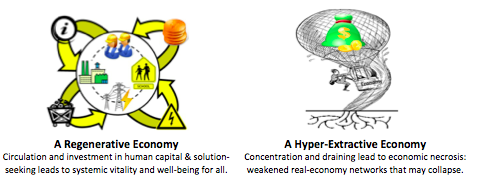

Circulation represents the lifeblood of all flow-systems, be they economies, ecosystems, or living organisms. In living organisms, poor circulation of blood causes necrosis that can kill. In the biosphere, poor circulation of carbon, oxygen, nitrogen, etc. strangles life and would cause every living system, from bacteria to the biosphere, to collapse. Similarly, poor circulation of money, goods, resources, and services leads to economic necrosis – the dying off of large swaths of economic tissue that ultimately undermines the health of the economy as a whole.

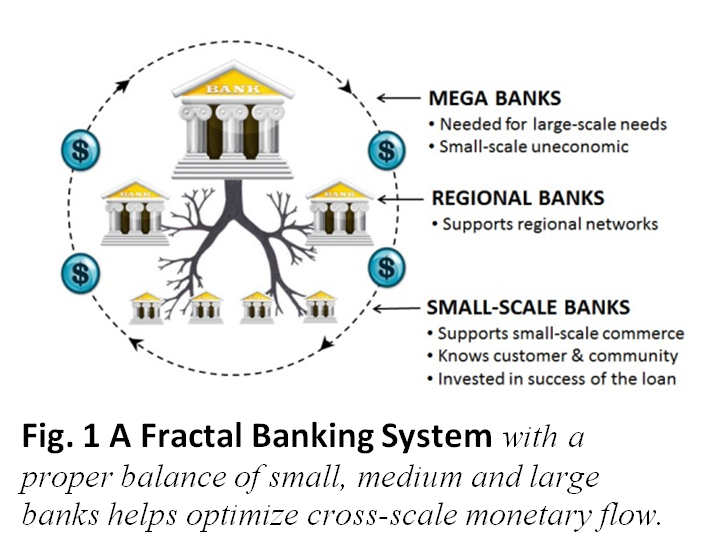

In flow systems, balance is not simply a nice way to be, but a set of complementary factors – such as big and little; efficiency and resilience; flexibility and constraint – whose optimal balance is critical to maintaining circulation across scales. For example, the familiar branching structure seen in lungs, trees, circulatory systems, river deltas, and banking systems (Fig. 1) connects a geometrically constant ratio of a few large, a few more medium-sized, and a great many small entities. This arrangement, which mathematicians call a fractal, is extremely common because it’s particular balance of small, medium, and large helps optimize circulation across different levels of the whole. Just as too many large animals and too few small ones creates an unstable ecosystem, so financial systems with too many big banks and too few small ones tend towards poor circulation, poor health, and high instability.

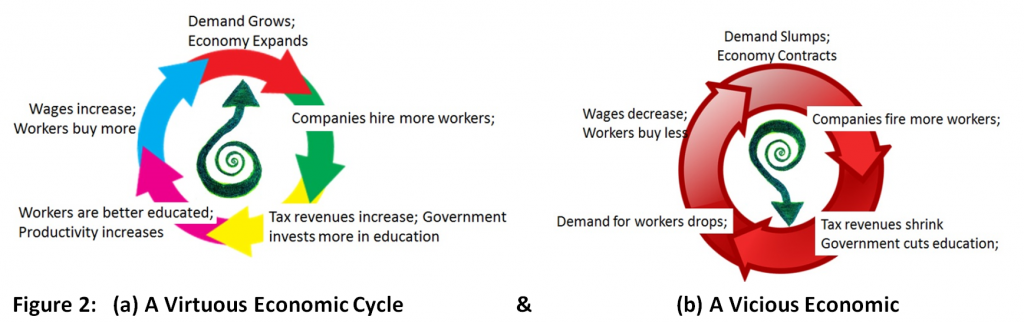

In his documentary film, Inequality for All, Robert Reich uses virtuous cycles to clarify how robust circulation of money serves systemic health. In virtuous cycles, each step of money movement makes things better. For example, when wages go up, workers have more money to buy things, which should increase demand, expand the economy, stimulate hiring, and boost tax revenues. In theory, government will then spend more money on education which will increase worker skills, productivity and hopefully wages. This stimulates even more circulation, which starts the virtuous cycle over again. In flow terms, all of this represents robust constructive flow, the kind that develops human and network capital and enhances well-being for all.

Of course, economies also sometimes exhibit vicious cycles, in which weaker circulation makes everything go downhill – i.e., falling wages, consumption, demand, hiring, tax revenues, government spending, etc. These are destructive flows, ones that erode system health.

Both vicious and virtuous cycles have occurred in various economies at various times and under various economic theories and policy pressures. But, for the last 30 years, the global economy in general and the American economy in particular has witnessed a strange combination pattern in which prosperity is booming for CEOs and Wall Street speculators, while the rest of the economy – particularly workers, the middle class, and small businesses – have undergone a particularly vicious cycle. Productivity has grown massively, but wages have stagnated. Consumption has remained reasonably high because, in an effort to maintain their standard of living, working people have: 1) added hours, becoming two-income families, often with two and even three jobs per person; and 2) increased household debt. Inequality has skyrocketed because effective tax rates on the 1% have dropped (notwithstanding a partial reversal under Obama), while their income and profits have risen steeply.

We should care about this kind of inequality because history shows that too much concentration of wealth at the top, and too much stagnation everywhere else indicate an economy nearing collapse. For example, as Reich shows (Figure 1a & b), both the crashes of 1928 and 2007 followed on the heels of peaks in which the top 1% owned 25% of the country’s total wealth.

Fig. 3a Income Share of U.S. Top 1% (Reich, 2013) & 3b Reich notes that the two peaks look like a suspension bridge, with highs followed by precipitous drops. (Original Source: Piketty & Saez, 2003)

What accounts for this strange mix of increasing concentration at the top and increasing malaise everywhere else? Putting aside the parallels to 1929 for a moment, most common explanations for today’s situation include: the rise of technology which makes many jobs obsolete; and globalization which puts incredible pressures on companies to lower wages and outsource jobs to compete against low-wage workers around the world.

But, while technology and globalization are clearly creating transformative pressures, neither of these factors completely explains our current situation. Yes, technology makes many jobs obsolete, but it also creates many new jobs. Yet, where the German, South Korean and Norwegian governments invest in educating their workforce to fill those new jobs, the American government has been cutting back on education for decades. A similar thought holds for globalization. Yes, high-volume industrialism – that is, head-to-head competition over price of mass-produced, uniform goods – leads to a race to the bottom; that’s been known for a long time. But in The Work of Nations (2010), Robert Reich also points out that the companies that are flourishing through globalization and technology are ones pursuing what he calls high-value capitalism, the high-quality customization of goods and services that can’t be duplicated by mass-produced uniformity at cheap places around the world.

So, while the impacts of globalization and technology are profound, the real explanation for inequality lies primarily with an economic belief that, intentionally or not, serves to concentrate wealth at the top by extracting it from everywhere else. This belief system is called variously neoliberalism, Reaganomics, the Chicago School, and trickle-down economics. It is easily recognized by its signature ideas: deregulation; privatization; cut taxes on the rich; roll back environmental protections; eliminate unions; and impose austerity on the public. The idea was that liberating market forces would cause a rising tide that lifted all boats, but the only boat that actually rose was that of the .01%. Meanwhile, instability has grown.

The impact this belief system has had on the American economy and its capacities can be seen in American education. Trickle-down theories are all about cutting taxes on the wealthy, which means less money for public education, more young people burdened with huge college debt, and fewer American workers who can fill the new high-tech jobs.

To be fair, this process is not just about greed. Most of the people who participate in this economic debacle do not realize its danger because they believed what they were told by the saints and sages of economics, and many are rewarded for following its principles. So, what really causes the kind of inequality that drives economies toward collapse? The basic answer from the science of flow is: economic necrosis. But, let me flesh out the story.

Institutional economists talk about two main types of economic strategies: extractive and solution-seeking. (Hopefully, these names are self-explanatory.) Most economies contain both. But, if the extractive forces become too powerful, they begin to use their power to rig the rules of the economic game to favor themselves. This creates what scientists call a positive feedback loop, one in which “the more you have, the more you get.” Seen in many kinds of systems, this loop creates a powerful pull that sucks resources to the top, and drains it away from the rest of the system causing necrosis. For example, chemical runoff into the Gulf of Mexico accelerates algae growth. This creates an escalating, “the more you have, the more you get” process, in which massive algae growth sucks up all the oxygen in the surrounding area, killing all of the nearby sea life (fish, shrimp, etc.) and creating a large “dead zone.”

Neoliberal economics set up a parallel situation by allowing the wealthy to use their money to extract ever more money from the overall economy. The uber-wealthy grow wealthier by:

- Paying for policy favors – big corporate bailouts and subsidies; lobbying; etc.

- Removing constraints on dangerous behavior – removing environmental protections; not prosecuting financial fraud offenders; ending Glass-Steagall, etc.

- Increasing the public’s vulnerability – increasing monopolistic power by diminishing antitrust regulations; limiting the public’s ability to sue big corporations; limiting Medicare’s ability to negotiate for lower pharmaceutical rates; limiting bankruptcy for student loans, etc.

- Increasing their own intake – rising CEO salaries and escalating Wall Street gambling; and limiting their own outflows – externalizing costs, cutting worker wages and lowering their own taxes.

All of these processes help the already rich concentrate more, and circulate less. In flow terms, therefore, gross inequality indicates a system that has: 1) too much concentration and too little circulation; and 2) an imbalance of wealth and power that is likely to create ever more extraction, concentration, unaccountability, and abuse. This process accelerates until the underlying human network becomes exhausted and/or the ongoing necrosis reaches a point of collapse. When this point is reached, the society will have three choices: learn, regress, or collapse.

What then shall we do? Obviously, we need to improve our “solution seeking” behavior in realms from business and finance to politics and media. Much of this is already taking place. From socially-responsible business and alternative forms of ownership, to democratic reform groups, alternative media, and the new economy movement – reforms are arising on all sides.

But, the solutions we need are also often blocked by the forces we are trying to overcome, and impeded by the massive merry-go-round momentum of “business as usual.” Today’s reforms also lack power because they are taking place piecemeal, in a million separate spots with very little cross-group unity.

How do we overcome these obstacles? The science of flow offers not so much a specific strategy, as an empowering change of perspective. In essence, it provides a more effective way to think about the processes we see every day.

The dynamics explained above are very well known; they are basic physics, just like the law of gravity. Applying them to today’s economic debates can be extremely helpful because the latter have devolved into ideological debates devoid of any scientific foundation.

We believe Regenerative Economics can provide a unifying framework capable of galvanizing a wide array of reform groups by clarifying the picture of what makes societies healthy. But, this framework will only serve if it is backed by accurate theory and effective measures and practice. This soundness is part of what Capital Institute and RARE are trying to develop.

System Dynamics of Steve Keene is clearly more useful than equilibrium dogma. He predicted the 2008 crash, though I think he was only lucky .. modeling is always only good for interpolation, never for extrapolation, unless you are lucky enough to only be dealing with linear changes over time.

POSTED: Dec 13 2007 06:55 PM |

The Commerce Department said retail sales in Oct 2007 increased by 1.2% over Oct 2006, & up a huge 6.3% from Nov 2006.

10/1/2007,,,,,,,-0.47,,,,,,, -0.22 * temporary bottom

11/1/2007,,,,,,, 0.14,,,,,,, -0.18

12/1/2007,,,,,,, 0.44,,,,,,,-0.23

1/1/2008,,,,,,, 0.59,,,,,,, 0.06

2/1/2008,,,,,,, 0.45,,,,,,, 0.10

3/1/2008,,,,,,, 0.06,,,,,,, 0.04

4/1/2008,,,,,,, 0.04,,,,,,, 0.02

5/1/2008,,,,,,, 0.09,,,,,,, 0.04

6/1/2008,,,,,,, 0.20,,,,,,, 0.05

7/1/2008,,,,,,, 0.32,,,,,,, 0.10

8/1/2008,,,,,,, 0.15,,,,,,, 0.05

9/1/2008,,,,,,, 0.00,,,,,,, 0.13

10/1/2008,,,,,,, -0.20,,,,,,, 0.10 * possible recession

11/1/2008,,,,,,, -0.10,,,,,,, 0.00 * possible recession

12/1/2008,,,,,,, 0.10,,,,,,, -0.06 * possible recession

Trajectory as predicted:

BERNANKE SHOULD HAVE SEEN THIS COMING. IN DEC. 2007 I COULD.

With a simple spreadsheet projection of flows … one can see a lot, without fancy mathematics, using just simple difference equation models, even models that display cyclical behavior. For example, with any internal software development, the quantity of legacy applications increase as they are created, unless retirement of legacy applications is more rapid.

More often replacement occurs, rather than actual retirement. But retirement of legacy applications is harder than you might think, because of real dependency … one can’t retire them by fiat. The cost of maintaining legacy applications, isn’t zero. So with a fixed software development/maintenance budget, the percentage of expenditures to legacy applications approaches saturation, even without figuring in the cost of replacement (similar to the rolling over of loans vs retiring of loans). Short term maintenance using patches, can only continue for so long, eventually wholesale replacement is necessary.

Usually the only way to retire a legacy application is to produce a newer and more expensive application, that itself has higher maintenance costs. We dig the problem well deeper. Thus the exponential decay of funds available for new development, or replacement development, not only strangles new initiatives, but even strangles the ability to maintain operations long term. That is why there are still millions of lines of Cobol still working every day.

There is no free lunch, entropy reigns unless countered by new forms of initiative. Usually the end result is an extension and dilution of the problem, which then resumes decay on a larger scale. This is what happens with the attempt to allay insurance costs by ever larger pools, but there is a limit to the size of the pool, once that limit is reached, the gambit no longer works. Long term problems overwhelm short term solutions.

That’s Joseph Tainters rap if I remember it right.

An exponentially increasing real economy covers all sins. In absence of that, an exponentially increasing debt economy covers all sins, temporarily … because interest has a way of catching up with you. See Greece.

“An exponentially increasing real economy covers all sins.” Not if you’re Mother Nature–or maybe only for another 10-40 years.

An exponentially increasing real economy is a mathematical impossibility in a finite world. Unless you are an Economist who creates pseudo science in an imaginary world for the purpose of selling it for the benefit of your Overlords.

Banks turned off the money spigot to developers by the start of ’07, if I recall. Developers and policy makers knew then there was a recession, but the public was kept in the dark. After the market crash, the consumers were punished instead of the Wall Street looters.

The only people who predicted the crisis were a handful of post-Keynesians and Marxists. I’m more familiar with the work of the latter, but for them it wasn’t luck. They identified structural problems with the economy that could not be fixed by simply utilizing stabilizers (fiscal/monetary policy) and knew a massive crisis would occur once the bubbles popped and exposed the real economy’s underlying weakness. Some believed that this crisis was the result of the tendency of the rate of profit to fall and simultaneous downturns in the business cycle and the profit cycle. I think the more convincing view is that low profit rates in the manufacturing sector caused by a global crisis of overproduction/under-utilization of capacity has meant that the real economy has been weak since the 70’s and that growth since then has come from asset bubbles (Japanese real estate in the 80’s, US stock market in the 90’s, US real estate in the 00’s). These are problems that no amount of fiscal stimulus can fix in the long run.

The author briefly touched on it. It’s ALL about the circular flow of savings. And the flow’s stopped beginning in 1981, though really in 1966 (also Larry Summer’s start of secular strangulation). That’s why N-gDp decelerated and there was a 35 year bull market in bonds.

You have to retain the capacity, like Albert Einstein, to hold two thoughts in your mind simultaneously – “to be puzzled when they conflicted, and to marvel when he could smell an underlying unity”. “People like you and me never grow old”, he wrote a friend later in life. “We never cease to stand like curious children before the great mystery into which we were born”.

The smartest man to walk on earth was Leland Pritchard, Ph.D. Chicago, 1933, Economics, MS, Syracuse, statistics.

All bank-held savings originate, and are impounded and ensconced, within the commercial banking system. Say what? Yes, the CBs do not loan out existing deposits, saved or otherwise. The CBs always create new money whenever they lend/invest (loans + investments = deposits). Thus bank-held savings are un-used and un-spent. They are lost to both consumption and investment. From the standpoint of an individual bank, the institution is an intermediary (micro-economics), however, from the standpoint of the collective system of member banks (macro-economics), the institution is a deposit taking, money creating, financial institution, DFI.

The upshot is profound. The welfare of the CBs is dependent upon the welfare of the non-banks (the CB’s customers). I.e., money (savings) flowing through the NBs never leaves the CB system. Consequently the expansion of “saved” deposits, in whatever deposit classification, adds nothing to a total commercial bank’s liabilities, assets, or earning assets (nor the forms of these earning assets). And the cost of maintaining interest-bearing deposit accounts is greater, dollar for dollar, than the cost of maintaining non-interest-bearing demand deposits. Interest collectively for the commercial banking system, is its’ largest expense item (and thus its’ size isn’t necessarily synonymous with its profitability).

This is the source of the pervasive error (and our social unrest, e.g., higher murder rates), that characterizes the sui generis Keynesian economics (the Gurley-Shaw thesis), that there is no difference between money and liquid assets.

The CBs & NBs have a symbiotic relationship. And so do the have’s and have not’s. Unless the upper quintile’s savings are expeditiously activated, a corrosive degenerative economic impact is subsequently fostered.

The Golden Era in U.S. economics (Les trente glorieuses) was where democratized pooled savings were expeditiously activated (put back to work) and matched with real-investment, non-inflationary, outlets by the thrifts, MSBs, CUs, and S&Ls (principally investments in long-term residential mortgages). And in the good ol days, we had gov’t incentivized, FSLIC safety nets for non-bank conduits. Now we only have FDIC safety nets for the commercial bank clientele (which further retards savings velocity).

I.e., “risk on” is not higher FDIC insurance coverage (the FDIC formally modified the assessment base in 2011 to include all bank liabilities – which along with the LCR, contracted the E-$ market), not increased Basel bank capital adequacy provisioning (which literally destroys the money stock), not an increased FDIC assessment fee on 1/1/2007, or 4/1/2009, or 4/1/2011, or an increased churn in speculative stock purchases (the transfer of ownership in existing assets).

“uses recent scientific advances – specifically, the physics of flow[2″

Ye deities…

This post laudably critiques wealth inequality, but it suffers from the “Newtonia Delusion” that confuses economic thought in general through metaphorical malapropism.

Physcial systems possess a determinism and time-invariant structure that enables mathematical modelling. Economic systems are cultural artificacts that are not time-invariant. Money is a cultural construct, a form of social imagination and lacks any sort of deterministic attributes. Newtonian metaphors of flow and accumulation restrict analytical illlumination even though they enable quick and simple calculation.

Money is only one form of a “coordinate system” that enables the measurement of forms of social interaction and cooperation. And it’s one-dimensional. This makes it useful given its parsimonious simplicity but it badly restricts complete explanatory power. Physicists know the choice of a coordinate systems influences measurements of phenomenon, and they developed math techniques to neutralize that influence — I think use of tensors in relativity is one example. Economics relies on “money” and resultant ideas of “growth” or ‘recessionn” because that’s all it knows how to do.

First, what does “collapse” mean in the context of the post. The word is vague, undefined and subject to a multitude of interpretations — that’s not “scientific” at all. “Wealth” is also vague. Presumably it means possession of assets that can be converted into money, so in effect is uses “money” as a sole coordinate basis, and that’s reasonable as a form of dimensional reduction, but it fails to measure the implied asset value of any sort of social safety net available to those without assets. That’s no rationale for inequality — and anybody wants a job more than a safety net — but it’s a logical flaw. Third, the nature of economic structures and cultural relations isn’t easily quantifiable or translateable into money; living in a just, fair and inclusive society has an intrinsic value that defies easy measurement through the “money basis”. Measuring relies instead on application of a sense of justice and honest sensibility.

It would be bettter to start analysis with a non-monetary vision of the social rights any citizen of a community should have access to. This form of thinking in fact was the normal and dominant form over most of human history, when people lived in non-monetary tribal structures. And what their implied responsibilities are to gain that accesss. Use that as a time-invariant basis and then introduce money but only as one method of measurement of economic change, there could be other social indicators that might be used as coordinate systems too; use of these could result in very different measurements of ecoonomic phenomeenon than result with the money basiis. That would force the sort of thinking that’s required for analytical clarity and ompleteness, but that doesn’t exist in economics

(See I can bang out a comment that doesn’t mention jungle boogie butts or hot women! Calling women hot isn’t bad, as long as it’s respectful and flattering and inclusive. Women in general are hot! What do you want? to live in a world full of gay guys or what? Hahaha. Sorry I can’t help it.)

Turchin has been working on proxies, to get some measures of well-being and political instability. One measure of social rights could be the right to live, so life expectancy could be used. Dead is dead and is a hard number. Chicago police historically have a different criteria of what my rights are than I do, so the ecological measures can avoid such definitional fuzziness.

Another Turchin point relevant to the post is that in-group variance is only meaningful used as a multiplier of in-group selection, and in context of other groups. Extreme inequality does not necessarily cause economic collapse, and coherent elites consistently crush popular revolts. The “the more you have, the more you get” feedback loop can also be seen as a consolidation and success of a certain trait (“rich”), and a re-sort of within-group dynamics (national citizenry) to between-group dynamics (haves & nots).

(Also, economics does not concern itself with ompleteness, as rational actors cannot be omplete, and an agent who is omplete often withdraws from economic systems.)

I believe that biggest problem in economics is not the dogma created by money(though its a problem of Course) , but rather biggest problem is lack of a clearly defined goal. “Economic development” ,which is generally termed as goal of economics , is very ambiguous and this ambiguity is creating problems.

Thanks Craazy – that was very coherent. more please.

Very, very few physical systems involve time invariant modeling. Almost every physical system represented by a mathematical model describes how that system changes with time. Otherwise it wouldn’t be a very useful model. Few things can be said to be at steady state and even when they are it is usually a simplification, not an outgrowth of time invariance. For example a chemical reaction A + B-> C at rate k1 and C -> A + B at rate k2 is said to be at equilibrium (steady state) when k1=-k2. Even at steady state the reaction is proceeding in both directions and can be thrown out of equilibrium by a change in concentration, temperature, volume, or any host of other factors. After the shock the system will again tend towards an equilibrium but there is no requirement that the new equilibrium be the same as the last one. And all the equations that describe how we went from equilibrium 1 to 2 all involve time. Neoclassical morons obsessed with equilibrium seam to be confused by this and assume time is irrelevant and that full employment will always return.

Economists are pretty much the only people I see that try to use time invariant models. I think it is a great step forward that economists like Keen have been trying to use the full spectrum of time variant models. The fact that the models are relatable to models of other physical systems is more an outgrowth of calculous than anything else.

I actually was out today doing stuff & plan to go star gazing tonite!

What I meant is the equations that map the movement of the moon and planets or heat diffusion or chemical reactions or sound propagation worked in November 1887 the same way they’ll work in July 2020.

Of course experimental measurements change through time, depending on the phenomenon being measured. But the natural phenomenon modeled by the equations themselves are time invariant as are the equations, or science wouldn’t work. That’s why they’re called natural laws.

Ah. You mean Frame Invariant, not time invariant.

Timeframe invariant! :-)

Now wait a minute here. While I appreciate getting my terms correct and such – frame invariant, yeah, that’s what I need to know – craazyman is a gift not to be distracted or encouraged wrongly. Yes, his posting clarified the great lie of most economic theory and its teaching and modeling, but his calling is greater than that. “jungle boogie butts or hot women” are rare on this site and should not be lightly diverted. Not that I’m implying that our hostess or commentators of the female persuasion aren’t “hot women” or that jungle boogie butts aren’t finance, economics, politics, or power, but based on past personal history, if I tried a craazyman, or even a craazyboy, posting, I would be forever marked as hopeless.

Physical systems can be time-variant in that way too, it’s called a regime shift. We have observed that in several real natural systems. In some cases apparent randomness actually is very complicated but fully deterministic dynamics. Look up “bifurcation diagram”. Mathematical analysis can deal with that too.

Instead of the monetary system and flow, the analysis of human populations, including the production and exchange of the fruits of their labour, should start with the amount of cooperation as the driving variable (or coordinate as you prefer to say)?

Thanks for the thought-provoking post.

Odd that education investment is shown in the article as part of the loop between employment and consumer spending. That is a very slow regenerative path compared with the direct effect of employment, spending, and labor demand.

The article wastes time extolling circulation merely because it resembles that in natural systems such as tigers, but these do not necessarily serve human interests. It benefits most people simply because they need the inputs and outputs.

>>> But this sounds an awful lot like a new improved version of system dynamics,

One of the board members from Capital Institute (sounds like the “Human Fund”) is from Soros-backed the Institute for New Economic Thinking.

And Soros loves reflexivity, which is basically repackaged system dynamics.

not being aluminum foil-y. just interesting how Soros has his fingers in so many pots.

http://capitalinstitute.org/board/

just institute a progressive tax on bank assets above—say—$700 billion. would literally only affect a handful of banks and do much to rein in the seize of the megabanks.

oh wait, all these banks are blue state banks (JPM, C, WFC, BAC) and friends w/Schumer, Pelosi and Uncle Warren owns big chunks in WFC and AXP.

Capitalism is a balance between supply and demand but we only put in half a system.

1) Money at the top is mainly investment capital as those at the top can already meet every need, want or whim. It is supply side capital.

2) Money at bottom is mainly consumption capital and it will be spent on goods and services. It is

demand side capital.

Marx noted the class struggle between the two sides that neither can win, to do so destroys the system, either supply or demand will cease to exist.

The balance has yet to be recognised and we flick between the two sides until everything crashes into the end stops.

Before the 1930s – Supply Side, Neoclassical Economics

By the 1920s, productivity has reached a stage where supply exceeds demand and extensive advertising is required to manufacture the demand for the excess supply.

Taxes are lowered on the wealthy and there is an excess of investment capital which pours into the US stock market. The banks get in on the act and use margin lending to fuel this boom in US stocks.

There is a shortage of consumption capital and the necessary consumption can only be maintained with debt.

1929 – Wall Street Crash

The investment capital was used to blow an asset bubble and not for productive investment, it all ends in tears. The Great Depression is the debt deflation that follows from an economy saturated with debt.

After the 1930s – Demand Side, Keynesian Economics

The New Deal starts the turnaround of the US economy and after the Second World War there is the Golden Age of the 1950s and 1960s. Redistributive capitalism looks after the demand side of the equation.

With the target of full employment, the unions start to abuse their power and by the 1970s we enter into stagflation. There is a shortage of investment capital and demand exceeds supply leading to inflation, there is not enough investment capital to redress the balance.

After the 1980s – Supply Side, Neoclassical Economics

Taxes are lowered on the wealthy and there is an excess of investment capital which pours into various different asset classes and the first round of crashes occur in the late 1980s. Leading to an early 1990s recession.

There is a shortage of consumption capital and the necessary consumption can only be maintained with debt.

After the early 1990s recession the speculative, investment capital look for another bubble to blow and finds the new dot.com companies.

Housing booms take off around the world, a speculative bubble for everyone to get involved with and the UK and Japan have already been through their first boom/bust by 1989.

Wall Street get’s into 1920s mode and leverages up the speculative bubble that is occurring there.

2008 – Wall Street Crash

The West is laid low and growth is concentrated in the East but they start to use debt to keep things running.

Even with the Central Banker’s best efforts the global economy falls into the new normal of secular stagnation, the debt repayments are a constant drag on the global economy.

2017 – World’s eight richest people have same wealth as poorest 50%

All that investment capital with almost nowhere to invest due to the lack of demand.

We just swing from the supply side, to the demand side and back again until we crash into the end stops.

We could recognise the system requires a balance between supply and demand.

An interesting idea, which adds economics itself to the dynamics of the economic system.

a balance in real time, not over decades with crashes and booms… harder to do globally than nationally which is prolly why nationalism is rising… it was China imploding c. 2008 that brought the growth of the global economy to a stop, I read somewhere….anyway the growth-forever premise of globalism was nuts. Not even the push for austerity by the neoliberals could make the required adjustments – and not for lack of trying. Yes a new balance (good shoes ;-) is what we need. One that understands the old saying ‘form follows function’ and create a functioning economy, the scaffold of a new sustainable human society. One in which banking actually follows the economy.

Bankers should be servants of the real economy and nothing more.

It’s not a math error, it’s an accounting error. It wasn’t precipitated as Alan Greenspan pontificated in his book “The Map and the Territory”, viz., FDR’s Social Security Act. It wasn’t Nixon who introduced “indexing”. It wasn’t because from 1959 to 1966 the federal gov’ts net savings was in a rare surplus. It wasn’t because between 1965 & 2012 total gross domestic savings (as a percent of gDp) declined from 22% to 13% (9 percentage points).

No, the New York Times sobriquet, the “Three-Card Maestro’s” error, like all other Keynesian economists, is the macro-economic persuasion that maintains a commercial bank is a financial intermediary (conduit between savers and borrowers matching savings with investment):

Greenspan: “Much later came the evolution of finance, an increasingly sophisticated system that enabled savers to hold liquid claims (deposits) with banks and other financial intermediaries. Those claims could be invested by banks in in financial instruments that, in turn, represented the net claims against the productivity enhancing tools of a complex economy. Financial intermediation was born”

Or Ben Bernanke in his book “The Courage to Act”: “Money is fungible. One dollar is like any other”.

“I adapted this general idea to show how, by affecting banks’ loanable funds, monetary policy could influence the supply of intermediated credit” (Bernanke and Blinder, 1988).”

For example, although banks and other intermediaries no longer depend exclusively on insured deposits for funding, nondeposit sources of funding are likely to be relatively more expensive than deposits”

The first channel worked through the banking system…By developing expertise in gathering relevant information, as well as by maintaining ongoing relationships with customers, banks and similar intermediaries develop “informational capital.”

“that the failure of financial institutions in the Great Depression increased the cost of financial intermediation and thus hurt borrowers” (Bernanke [1983b]).

A herding started by William McChesney Martin Jr, that thought “banks actually pick up savings and pass them out the window, that they are intermediaries in the true sense of the word.”

From the standpoint of an individual bank (micro-economics), a bank is an intermediary, however, from the standpoint of the entire economy, the system process (macro-economics), a bank is a deposit taking, money creating, financial institution.

The promulgation of commercial bank interest rate deregulation (banks introducing liability management, buying their liquidity, instead of following the old fashioned practice of storing their liquidity), i.e., the removal of Reg. Q ceilings (the non-banks were already deregulated until 1966), by the oligarch – the ABA, (public enemy #1), or an increasing proportion of time to transaction deposits liabilities within the DFIs, metastasized stagflation and secular strangulation. Remunerating IBDDs exacerbates this phenomenon (as subpar R-gDp illustrates).

I.e., every time a commercial bank buys securities from, or makes loans to, the non-bank public it creates new money – deposit liabilities, somewhere in the system. I.e., deposits are the result of lending, and not the other way around. Bank-held savings are un-used and un-spent. They are lost to both consumption and investment. Unless savings are expeditiously activated outside of the system (and all savings originate within the payment’s system), thru non-bank conduits, said savings exert a dampening economic impact (destroying saving’s velocity & thus AD). I.e., savings flowing thru the non-banks, never leaves the CB system.

I’ve never believed a country joining the casino economy was a sign of strength.

Debt based consumption is always unsustainable, people max. out on debt.

Greece was happy with debt based consumption until it maxed. out on debt.

Anything that relies on debt based consumption in the long term can only fail.

Neoliberalism relies on debt based consumption, it works until it doesn’t.

“With the target of full employment, the unions start to abuse their power.”

Yeah, sure.

Actually full employment is experienced by capital as an abuse of its power.

Here is Kalecki in 1943 explaining beforehand how this generates neoliberalism.

http://delong.typepad.com/kalecki43.pdf

Yes, I’d like to see what this abuse of union power looked like. Any evidence of this?

Landlords and bosses were reduced to beggars?

Craazyman says it all, but I have to say it too, just for my own mental health.

How often do social “scientists” have to make this same mistake? Biology is not physics, and human society is biology, and economics is not even close to accurately describing human society, not even the economics part of it.

Equilibria are achieved, and thermodynamic laws obeyed, on much greater and on much smaller scales than an economy, which is not even a system, per se. Life is anti-entropic, but the universe, the solar system, is not. Communities are not “social networks.” Terry Pratchett as usual brings common sense to bear on metaphors like this. Metaphor, you know, using words to convey something like the truth, but not exactly: “Oh, so it’s a lie, then.”

How economy is not a system?

You have just lost me. Of course economics is a complex system but it is a system nonetheless. Wynne Godley’s sectoral balance model is an excellent example of a systems approach to economics, and it’s precisely the systems peoperties that attract me to it. MMT is a systems approach by design and easily approached mathematically in that way if desired. I have often considered how I would do it but no doubt there is someone more able to do it than me.

The bonus of a systems approach would be the possibility of a multitude of possible equilibrium states, some could be fixed, some oscillatory if they include feedback with delay.

The author could also consider adding futile cycles to her list of cycles, long recognised by biochemists.

Craazyman says it above. A “system of pulleys” is a system. A “solar system” is a system. A galaxy, a liter of sodium bicarbonate solution under defined temperature and pressure conditions, these are systems. How is “economics” a system? What is it even a system of? Can you define the parameters of even one of the aspects of economics in some way that does not “leak energy” through every other aspect of human activity, which is not accounted for in some way by the “system” of economics? You can try, but you can’t do it. That is why economics is scientific just like astrology: it describes and explains everything, but its only prediction is more jobs for its practitioners.

There are “closed” and “open” systems. The behavior of the former can be modeled and understood; the latter, less so (possible only to some extent, and heavily dependent on the intellectual framework that you bring to the table).

Have you heard of Ylia Prigogine and dissipative structures?

Here is one example of an open system that has been modelled in so many intricate aspects and details: Earth’s biosphere.

My experience is opposite. Usually in systems approaches most of the detail can be ignored until it becomes important. They do not require knowing the details of the system, instead they try to simplify as far as is practical. Systems approaches attempt to infer micro from gross macro behaviour. This is fundentally opposite to orthodox economics. Godley’s model illustrates this well. You don’t need to know details about every transaction because parameters for aggregated transactions can be inferred from macro data. You don’t need to assume anything about motivations of individuals or firms, but if necessary you could try to infer them.

I clearly need to go and do reading on open systems, because understanding them makes for a richer intellectual life, like poetry, or skimming rocks. For me, the chafing starts when people try to apply a rigorous, mathematically based scientifically accepted reproducible set of theories like those of fluid dynamics (itself by no means fully elaborated) to a field where the described system cannot be even be defined by consensus.

What, for instance, exactly constitutes an “economic system,” or a “system of economics,” or an “economy”? Where is the universally accepted definition of something even as basic as money, a definition with scientific reliability, like the definition of an atom in 1930? They just aren’t there. You can tell me yours, but it will not be the same as his, or hers. If real scientists behaved that way, there could be no breakthroughs: without a definition, there is nothing even solid enough to break through.

And by scientific, I just have to fall back on Popper, however old-fashioned that may seem. The propositions of economics, like those of astrology and sociology, and also of human nutrition, and so many other fields flogged by their practitioners, remain unaccompanied by experimental methodologies that result in reliable predictions of reproducible results. They are therefore prolific with unfalsifiable claims. They are, therefore, fraudulent at worst and noisy at best, at a time where the direction of the public discourse is increasingly controlled by central authorities with agendas. A signal among the noise is harder and harder to distinguish without the further impediment of additional publish-or-perish verbiage which will be, more often than not, weaponized by an interest group, if that was not actually the reason for its creation to begin with.

Systematizers of non-scientific systems are either virtuous “pre-scientists” or frauds. What they claim as the wider social value of their work is the discriminating test. Alchemy and astrology of yore ultimately evolved into chemistry and astronomy, without actually contributing much information as such: but without the need to make magic or gold from powders, alembics, crucibles, and retorts, those tools moved into hands directed by serious, patient minds, where they produced useful and reliable information. (Not that circus entertainment, handwaving, and noise were not great disseminators and motivators of science, and remain so today!)

Until the dynamics of human society and psychology have been fully described by anthropology, there will not be a “fundamental atomic theory” for Economics to use to underpin its scientific pretensions. It still rests completely on demonstrably untrue assumptions, rules that can be proven not to apply to human behavior. Most recently, the use of the “normal curve” as generally applicable to economic “systems,” because of its near-universal employment in statistics, had catastrophic results. This was easily predicted by anyone who has worked with the normal curve; the Central Limit Theorem that underpins the normal curve assumes that the assembled variables are independent, not related functions of each other; and this is obviously not so in any human activity. So much of the use of the normal curve is nothing more than hand-waving hocus-pocus.

No serious reputable historian would claim any longer to be a scientist, and if he did, he would be no true Scotsman, either. But then, despite what I seem to be doing on these forums, neither would a professionally trained historian think to dictate public policy by appealing to the systematic rigor of his craft.

Economists today should modestly retreat from their claims to exercise any influence on public policy and direct their efforts elaborating a true science. I believe that may never happen; and I personally fear the unintended consequences that will result from the political use of the kind of knowledge about human motivations and collective activity that will be required to bring it about; maybe less, however, than I fear nuclear war or planetary desolation through aggressive environmental destruction, which may be the alternative outcomes to that kind of advance.

System means (from wikipedia), a set of interacting or interdependent component parts forming a complex or intricate whole.

Now an economy is also a complex whole consisting of various components(raw material producers are one component , capital goods producers are another component, distributors are third component, and public as a whole is another component, etc) and these components are clearly interacting and interdependent. Hence, economy is a system. And study of this system is called economics. This is simple enough to conclude by just taking a look at the definition of system.

Now, Crazyman isn’t saying that economy is not a system but he is saying that laws of physical systems can not be used to understand economic system.

Hence, once again let me ask , why economy is not a system?

Vatch, I’m going to take this on because I think you are right in a lot of things, and I think that in the popular sense or definition of a “system” there is a grain of truth to what you say. I am sorry that what follows is so redundant but I am trying to get across what I mean, and I don’t have time to make it shorter. Writing it helped me think more about how “the economy” is not a “system” in the sense of the word that is useful scientifically, however useful it is in daily discourse “where we all know what we mean, eh?”. So I am grateful, as always, for your provocative comments.

The wiki definition, which you adduce, is exactly the point. An economy is not a “system” because an economy is not a “whole.” A “whole” is something “integral,” complete, definable, with boundaries that can be set forth by common recognition, by consensus, even if they shift or change on that basis. Sometimes a whole can best be defined by saying what is not part of the “whole.” But with very rare exceptions, a “whole” that is defined in a way that is useful in further study, logic, or calculation, has a meaningful definition that we agree on before we move on to the next steps.

Here, for instance, are “systems” defined in a way that is useful for further work. An aircraft’s “propulsion system” is the set of parts that together provide the thrust to move the plane. It is clear that the wing is not part of the “propulsion system.” A “transportation system” carries things from here to there; trees and plants and birds are not part of the “transportation system.” A “neurological system” does nerve things, but does not pump blood; the “vascular system” carries blood and lymph things, but does not provide the primary force to move it through the body, nor does it do nerve things. These are all systems, although they are not “physics,” and they are vague in some respects, but they are usefully defined as “systems” so as to make further study on the basis of the definition easier; they have predictive and expository value; they are accepted by consensus among the experts of the field.

So, moving from there, let’s try to examine the “whole” that is the system of an economy. What, exactly, does an “economy” do? What exactly are its parts? What, more importantly, are not its parts; what does an economy not do? And this is where your definition does not cut the mustard making an economy a “system.” You use the general framework of a system—

“complex whole consisting of various components….and these components are clearly interacting and interdependent”

but you don’t define the whole. You only give a few examples of what we can all agree should be included:

“(raw material producers are one component , capital goods producers are another component, distributors are third component, and public as a whole is another component, etc)” .

You don’t say what is not part of the whole, or the set; and you don’t say, theoretically, what characterizes every member of the whole, or the set.

The real giveaway is when you say “the public as a whole” is part of the system that is “the economy.” Anything that includes “the public as a whole” at once loses its utility as a definition, because what is “the public,” much less “the public as a whole”? Is it everyone, or everyone productive, or all people and animals whether they leave home or not? Isn’t “the public as a whole” part of the system “politics”; aren’t all people, whether “public” or not, part of the system known as a “society”? Are those the same as, broader, or less broader than “the economy”?

Where does “the economy” stop, then? Does it include all human activity that is productive, or only human activity that is productive of goods and services? Goods, services, and knowledge? Goods, services, knowledge, pleasure, awareness, spiritual growth, love, faith, hope, charity, war? What about non-productive human activity that could have been productive, in other words, misallocation? “Creative destruction”? OK, so, now all productive or destructive activity of any kind; does it have to be measurable? OK, probably not. Are storing and saving “productive or destructive”? No, but they too are economic, of course. What about barter? What about communications about production; what about learning? Is that part of the economy? With the idea of opportunity costs, all activities that are not part of the economy are now part of “the economic system.” The environment is certainly part of the economy.

So now we have a “system” that includes all of human activity (and inactivity), all of nature, and the world, and definitely now the solar system. What characterizes all of these things theoretically, and makes the definition useful for further analytical activity? Nothing at all. So we are back to, “Well we all know what we mean when we use the word.”

Is “poetry” part of “economics”? Is it part of the economy once it’s published? Is the “idea” of poetry part of the economy? Well it’s part of the information economy, of “know-how.” Or is a patch of ice part of the economy once the poet has failed to plant an extra potato, because he slipped on it instead of planting an extra potato? Or is it part of the economy because the slip made him forget about planting potatoes and go write a poem?

How is this a “whole”? How is it amenable to consensus definition, to analysis or prediction using any of the extremely limited measuring tools (yielding results that are not even reproducible) that economists are deploying these days, or for that matter, any tools at all?

A definition of a system that ends up including everything without limits is not useful for science (unless you are a cosmologist). That does not mean it is not personally lucrative for the scientists who expound it, in this case, economists. This is the fertile soil of their endless mission creep. Far from admitting that the lack of definitional clarity makes their task hopeless, they use it to extend their purview over areas of human activity that tower above what their education and training permits them to analyze.

Economics is a “field of study.” Economists look at, and try to describe, “an economy.” That is good, it is descriptive and taxonomic, very important steps in theoretical science. But “an economy” is not “a system.” That remains a bridge too far for the profession, and so it will always be, because to bound their own reach is just as anathema to “social scientists” professionally as it is to priests of any kind.

I was about to define “whole” in my previous comment , too , but than I realized that I am not that good at puting thoughts in words and hence refrained from doing it. But now I must try , here we go.

Humans have diverse needs (basic necessity like food, housing, etc. ) and wants ( people want to tour the world , have entertainment, etc). Now , most of resources provided by nature to humans can not be used by humans directly to satisfy its needs and wants. For example , niether rubber nor iron can be used for transportation directly, but a car which is made from steel(which itself is made from iron and other elements) and tyre (which is made from rubber and other resources) can be used for transportation. Of course making a car involves many other things beside steel and tyre, and to make this other things we once again need many other resources. Satisfying every want requires conversation of natural resources to another form in which they can be used by humans for satisfing wants and needs( iron to steel , steel to car , wheat to flour, flour to bread, etc). This process of resource conversation is commonly referrered as production of goods and services.

Now humans’ needs are just too diverse and no single person can make necessary things to satisfy all needs and wants. A person can not make car , house , smartphone , grow wheat and vegetables, make cooking equipment like microwave, etc. by himself. Making all this is possible only by combining efforts of vast number of humans. E.g. engineers and workers can afford to work on making cars only if some other groups of people undertake the jobs of growing wheat and vegetables and other food items for engineers and workers. Otherwise engineers and workers will have to convert themselves in farmers , so they can have food to survive. Similarly , farmers can afford to grow more food than they themselves need only if some other group of people is going to work to satisfy farmers’ other needs beside food. This is true for most wants and needs of humans.

Hence, to answer your question, in context of economy ,”whole” means that dimension of human world which is associated with production of goods and services which satisfy human needs and wants.

Now there can be many ways to classify different parts of the economy. Popularly , parts of economy are classified as producers, distributors and consumers etc. And when, in my previous comment, I said ” people as a whole” I was referring to consumers.

Further, if a professional poet writes and publishes poetry for others’ entertainment than he is part of this system called economy. The film making is already considered an industry.

Lastly , I don’t think that this system needs to be measurable or that this system can be measured, some of the reasons for this is described by Crazyman hence I don’t think I need to repeat.

Let me know what you think?

It is good. From this place of abstraction, or one like it, a bridge to reality needs to be built. As Yves’ posting of 2/23 demonstrates again, even the most basic economic theories require assumptions about the totality of human behavior that cannot be shown to apply to any part of the whole, much less the great totality that you describe.

“Flow Dynamics” of Money Supply are a BIG tell.

Velocity of MZM Money Supply (Money of Zero Maturity) is falling like a rock and at an ALL-TIME low.

Money velocity falls because more and more savings are impounded and ensconced within the payment’s system. This started in 1981 with the plateau in deposit financial innovation, the widespread introduction of ATS, NOW, and MMDA accounts. Thus money velocity, formally a monetary offset, started decelerating dropping N-gDp with it (and producing the 35 year bull market in bonds).

This should be evident with the remuneration of IBDDs beginning in Oct. 2008. I.e., the 1966 S&L credit crunch is the economic paradigm and precursor (lack of funds, not their cost). The “complete evaporation of liquidity” on 8/9/2007 for BNP Paribas, “runs on ABCP money funds”, “shortage of safe, liquid, assets”, “the funding crunch forced fire sales”, “efforts to replace funding that had evaporated in the panic”, i.e., non-bank dis-intermediation (an outflow of funds or negative cash flow).

“Our goal was to increase the supply of short-term funding to the shadow banking system”

Ben Bernanke, August 10, 2007:

“Our goal is to provide liquidity not to support asset prices per se in any way. My understanding of the market’s problem is that price discovery has been inhibited by the illiquidity of the subprime-related assets that are not trading, and nobody knows what they’re worth, and so there’s a general freeze-up. The market is not operating in a normal way. The idea of providing liquidity is essentially to give the market some ability to do the appropriate repricing it needs to do and to begin to operate more normally. So it’s a question of market functioning, not a question of bailing anybody out.”

I.e., Bankrupt u Bernanke doesn’t know a credit from a debit. Bad Ben was solely responsible for the world-wide GR. My “market zinger” forecast of Dec. 2012 foretold of the expiration of unlimited transaction deposit insurance (putting savings back to work), not a “taper tantrum, not budget “sequestration”.

Seems like a sales-pitch to the 1% trying to convince the 1% that sharing would be good….. I have my doubts about that strategy, the 1% respects power and care very little (if anything at all) for the common good. Use the power of the many in an democracy and force through the needed changes.

Continuing the model of a firm that requires software to function. If the executives of the firm keep taking expensive vacations at the expense of the firm, starving the software development/maintenance department of resources .. then even if there were no other systemic problems, the firm will fail (unless bailed out by a greater entity, as happened in 2008/2009). But in the end, who will be big enough, after we have extended the risk pool to the entire planet, to bail out the planet, from foolish management? I would suggest that the Roman Empire failed because it was unable to overcome either long term systemic trends, nor irresponsible management.

Inequality is directly correlated to corruption and the U.S. has an exceeding corrupt political economy, hence the extreme inequality. Germany and Japan, to take two prime examples, are part of the same global system and are subject to the same forces, technology, corporate tax arbitrage strategies, etc but neither of them have any where near the inequality of the U.S. It’s also worth noting they don’t have financial grifters like Mitt Romney and Steven Schwarzman amongst their most esteemed citizens.

So yes, it is all pretty complicated but at the end of the day the U.S. is one of the most corrupt countries on Earth, certainly the most corrupt of the Western democracies so our problems are no surprise. All this talk about globalization, tax policy, education and technology are all distractions. And that doesn’t even begin to touch on the subject of our monetary system which is at the root of the corruption.

Right on! – And the corruption is permitted, even encouraged, by the “greed is good” philosophical basis of mainstream economics, and the concentration of both media ownership and campaign finance and lobbying in the hands of the wealthy.

Yes, this does deserve some kind of award for expressing a simple idea in a pointlessly complicated way. When I was studying economics in the paleolithic era, we were taught about the “propensity to consume” – in other words the idea that the poorer you were the more of any extra income you would spend as opposed to save. So if you give everyone on the minimum wage 20% more, then they will probably put it straight back into the economy. If you give billionaires 20% more they probably won’t. The more widely wealth is spread, the more of it will be spent. This isn’t a scientific law, but it’s an observation borne out by common sense.

Hallelujah!

Even Henry Ford, not exactly known for his altruism or philanthropy, knew it made sense to give his workers a significant rise so that they could afford the cars they were building for him.

I can’t read this whole post this morning — but — my one note tune: 6% labor union density in non-gov work is like 20/10 blood pressure: it starves every other healthy process — even while starving the employee herself.

Easy way back: if the 1935 Congress had intended (they didn’t) to leave any criminal enforcement of NLRA prohibited union busting to individual states — Congress would not have had to change one word of the NLRA. States in fact were left to make any form of collective bargaining (NLRA connected or not) muscling an economic felony. There is no problem of federal preemption when the area has been left blank.

Nor may the fed force local labor down an impassable road to union organizing — because rules of road unenforceable and unenforced — when a First Amendment protected right is at stake. To state that clearly: the First Amendment is violated when government insists on a mode of action that dismembers freedom of economic association before it starts.

Sometimes metaphors bring clarity to a vision and sometimes metaphors befuddle: I am befuddled.

I’ll second that. He is either a scab and Pinkerton employee or provides a confused argument in support of unions?

I think he’s saying more unions are needed, but the Federal Government left it up to the states to stop the union busting, which they have declined to do. The Feds can’t enforce union membership or collective bargaining as that would violate the first amendment right to free association.

Let’s try again — maybe it was too compressed

[cut-and-paste]

America should feel perfectly free to rebuild labor union density one state at a time — making union busting a felony. Republicans will have no place to hide.

Suppose the 1935 Congress passed the NLRA(a) intending to leave any criminal sanctions for obstructing union organizing to the states. Might have been because NLRB(b) conducted union elections take place local by local (not nationwide) and Congress could have opined states would deal more efficiently with home conditions — or whatever. What extra words might Congress have needed to add to today’s actual bill? Actually, today’s identical NLRA wording would have sufficed perfectly.

Suppose, again, that under the RLA (Railroad Labor Act — covers railroads and airlines, FedEx) — wherein elections are conducted nationally — that Congress desired to forbid states criminalizing the firing of organizers — how could Congress have worded such a preemption (assuming it was constitutionally valid)? Shouldn’t matter to us. Congress did not!

“Renewable energy” is obviously the foundation of Regenerative Economics, simply because energy itself is the foundation of all economics (as well as of all life and of the “active” part of the universe). Yet all the focus on renewable energy in recent years has done little or nothing to stop escalating economic inequality.

I think a big thing missing from RARE is a theory and program for power. What we need are institutional values and structures that will keep greed under control without much effort. This means not just getting the incentives right, but also the “political revolution” that will be needed to implement them.

So I think not just about limits-to-growth but about the need for partial universal ownership of all the major sources of wealth, combined with limited stakeholder ownership (fossil fuels, large corporations, etc).

flow is entropy

Accuracy of analytical method aside, who will implement it? Who can? Not those 8 dudes with 1/2 the world’s wealth.

And what does extreme economic equality lead to?

Give me all your income and wealth and let us find out…

Not really a salient issue for us at the moment, is it?

Equality–economic or any other kind–cannot be extreme. Equality exists, or it does not.

That depends on what kind of inequality you’re talking about. Men being paid $10/hr and women $8/hr to perform the same task is an example of “binary” inequality. Either everyone is paid the same wage (before the first performance review anyway) or they are not.

Income inequality is a bit different. If a CEO takes home 20 x more per year than the lowest paid worker in the company income equality is low (way lower than in any modern capitalist economy)…if the CEO makes 300 x as much as the lowest paid worker, it is high. Income equality – everyone being paid the same wage regardless of what they’re doing to earn it – is not the goal. Rather, it is reducing the gap between the lowest and highest paid members of society.

Only jet settesr get the advantages of civilization at its heights. My own partial solution has been an airport nation that advances flying literacy and availability.

There is an amorphous factor arising out of the defined structure and standard rights afforded travelers & businesses based on a separate airport nation. (I admit this amorphous factor which causes me some presentation problems.)

No human system will function without a common committed belief in it.

Airport movement of people & parcels is simpler to make comprehensive.

For example I have difficulty in attempting to expand passenger service in NC because the corporation Norfolk Southern was given power to inhibit it while getting the advantages of state responsibilities created with a buyout of a rail company state company where it was controlled by shareholders.

A trick was done on us with the collusion of legislators.

We can simply say the RR as analogous is a matured industry to the point of immaturity compared to an international airport accommodating both freighters & passenger airliners.

These things will not directly make an economic theory, but are about economic activity as enabled from basic port theory & the sociology of ports.

For instance I advise women in nations prone to put them at a disadvantage to put business offices on international airports which tend to be more culturally neutral.

Appreciated the author’s thought-provoking observations about the effects of extreme concentration of wealth, with its enormous feedback loops and low circulation of money that materially reduce the overall debt servicing capacity of the private sector. But I also felt that she understated the roles that private sector debt growth, central bank monetary policy, asset price speculation and manipulation, and financial fraud have historically played in causing economic collapse.

Playing Devil’s Advocate I suppose you could argue that there is something Darwinian about the way things are nowadays.

Apex predators are indeed flourishing and in a curious way they are searching further afield and adapting to new ‘food sources’ as those closer to home become less appealing, less nourishing and less worth the effort of expending the energy trying to exploit, particularly when other tastier morsels are so plentiful and readily available elsewhere.

Maybe we should just all get with the programme, know our places in the grand scheme of things and resign ourselves to our evolutionary fate?

;-)

If it’s Darwinian, it’s an example of artificial selection – nothing natural about it.

‘Life is like a box of chocolates. More and more people know what they’re gonna git’

Darwin’s artificial selection.

haha, unfortunately it’s the apex predator species that is in danger of sudden extinction as its prey declines. Of course the Darwinian analogy doesn’t hold up well because Darwinian selection works on all individuals of a species without distinction. A much better analogy is a rigged game.

We basically have an economic system where the very rich steal the productive capacity of the rest of us and add it to their own wealth.

That is the dirty not so secret truth. As the Spirit Level demonstrates, inequality is as bad for the rich at times as it can be for the rest of us.

There is also this:

https://www.theatlantic.com/magazine/archive/2011/04/secret-fears-of-the-super-rich/308419/

Our problem is that the rich really suck. They are greedy and I would not be surprised if many were psychologically diagnosed with anti social personality disorder. They are without integrity and would fight tooth and nail for their pilfered money.

But the status quo is like the Congo under Mobut Sese Seko. It is a society build on kleotocracy. Like any such society, it is inherently unstable with money going to a few.

The late 1960s had problems. The costs of the Vietnamese War, the excess deficit spending, and the dependence on Middle Eastern oil all lead to problems in the 1970s.

“As Paul Samuelson stressed, that assumption [propensity to equilibrium] is necessary for economics to be science, as in mathed up, and the dominance that economists have achieved is due to their scientific appearances and the fact that their mathematical exposition enables them to dismiss lay critics.”

Why? Non-equilibrium is accessible to maths.

In branching systems such the one imagined for monetary flow in this article, growth in the number of nodes at the terminals (and thus necrosis of excess of nodes) is controlled/limited by the number of terminals of the branching, let’s call these capillaries, that can be accommodated inside the volume of the whole versus the number of nodes than can be accommodated inside the whole. Since the total number of capillaries grow at a lower rate than the number of nodes as the volume of the whole increases, growth is limited and excess growth in times of higher volume of the whole suffers necrosis when the volume of the whole shrinks.

IHTH

‘an imbalance of wealth and power that is likely to create ever more extraction, concentration, unaccountability, and abuse

The ‘elites’ (1.0%) who created the problems, profited from them, are STILL in Charge!

Good Luck for finding solution!