By Steven Clifford, who served as CEO for King Broadcasting Company for five years and National Mobile Television for nine years. He has been a director of thirteen companies and has chaired the compensation committee for both public and private companies. Cross-posted from Alternet. Clifford’s complete book, The CEO Pay Machine: How It Trashes America and How to Stop It by Steven Clifford (Blue Rider Press, May 2017), from which this excerpt is drawn, is available from Amazon and IndieBound.

In the long term, the indirect effect of the Pay Machine—the increase in income inequality—is economically more injurious than the erosion of company earnings or a stock market downturn.

Income inequality in America has risen sharply since 1976. Economists and pundits point to multiple causes—globalization and competition from low-wage countries; growing educational disparities that particularly affect men and minorities; technological changes that reward the highly skilled; decline of labor unions; changes in corporate culture that place stock price and earnings above employees; free market philosophy and the rise of winner-take-all economics; households with high-income couples; lower rates of marriage and of intact families; high incarceration levels; immigration of low-skilled individuals; income tax and capital gains tax cuts and other conservative economic and tax policies; deregulation; and decreased welfare and antipoverty spending coupled with redistribution programs that disproportionately benefit the elderly.

All of the above may contribute to inequality. However, the proximate cause is quite simple. The jump in inequality is due to a small number of people, mostly business executives, who make huge amounts of money. They are the Mega Rich, the top .1 percent in income, who averaged $6.1 million in income in 2014. The Merely Rich are the rest of the 1 percent. It’s the Mega Rich, not the Merely Rich, who drive inequality. (I’m a member of the Merely Rich, so don’t blame me.)

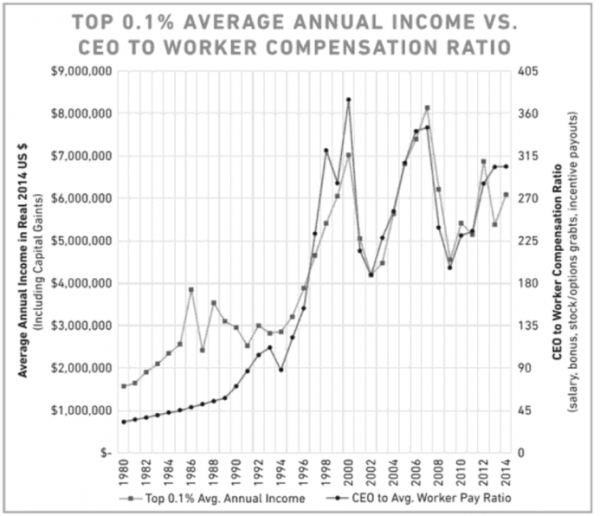

As shown in the graph [that follows]… between 1980 and 2014 the average real income of the Mega Rich has nearly quadrupled, increasing by 381 percent. Over the same period, the Merely Rich doubled their income while the bottom 90 percent lost ground, suffering a 3 percent decline.

Data from Facundo Alvaredo, Anthony B. Atkinson, Thomas Pikkety, Emmanuel Saez, and Gabriel Zucman, The World Wealth and Income Database, April 5, 2016.

The Mega Rich captured most of the national income gains during the last four decades as their share of income increased from 3.4 percent in 1980 to 10.3 percent in 2014. The share of the Merely Rich rose from 6.6 percent to 11.0 percent over the same period. Thus the Mega Rich snared over three-fifths of the income growth of the 1 percent and nearly 40 percent of all income growth. In the tepid recovery from 2010 to 2012, the 1 percent took virtually all of the income gains. The Mega Rich again got the lion’s share: their average income increased 49 percent in this three-year period.

The Mega Rich are getting mega richer. Their average household made 113 times as much as the typical American household in 2014. In 1980, this number was 47. In 2014, the 115,000 Mega Rich households had as much wealth as the bottom 90 percent. They now hold 22 percent of the nation’s wealth, nearly double their 1995 share.

Since Fortune 500 CEOs can account for only 500 of the 115,000 Mega Rich, you might be surprised to learn that the majority of the Mega Rich are business executives. CEOs and other business executives constitute the largest high-income group in America. Not the old families with their inherited wealth. Not the sports heroes with their jaw-dropping contracts. Not the movie stars at $20 million per blockbuster movie. Executives, managers, supervisors, and financial professionals constitute three-fifths of the top 0.1 percent. Moreover, they accounted for about 70 percent of the increase in income going to the top 0.1 percent from 1979 to 2005. As Nobel Prize–winning economist Paul Krugman puts it, “Basically, the top 0.1 percent is the corporate suits, with a few token sports and film stars thrown in.”

In Capital in the Twenty-First Century, Thomas Piketty, after analyzing enormous amounts of data, wrote:

The vast majority (60 to 70%, depending on what definitions one chooses) of the top 0.1% of the income hierarchy in 2000–2010 consists of top managers. By comparison, athletes, actors, and artists of all kinds make up less than 5% of this group. In this sense, the new US inequality has much more to do with the advent of “supermanagers” than with “superstars.”

Piketty asserts that increasing income inequality is caused not by investment income but by high wages driven by “the emergence of extremely high remunerations at the summit of the wage hierarchy, particularly among top managers of large firms.”

Furthermore, “CEOs use their own power not only to increase their own salaries, but also those of their subordinates,” one study determined. As a result, the majority of “supermanagers” are either CEOs or executives whose compensation is heavily influenced by their pay—private company CEOs, other senior corporate executives, and the professionals who advise them. There are more than 5,000 publicly traded companies and 5.7 million private companies with employees.

The graph… [that follows] shows that the annual income of the Mega Rich and the ratio of CEO to average worker pay are highly correlated—the two lines look almost identical. While correlation does not prove causation, I find it easier to believe that runaway CEO pay caused the income of the Mega Rich to skyrocket rather than the other way around.

Average Income Data from Facundo Alvaredo, Anthony B. Atkinson, Thomas Pikkety, Emmanuel Saez, and Gabriel Zucman, The World Wealth and Income Database, April 5, 2016. Compensation Ratio Data from Mishel, Lawrence, and Alyssa Davis. “Top CEOs Make 300 Times More than Typical Workers: Pay Growth Surpasses Stock Gains and Wage Growth of Top 0.1 Percent.” Economic Policy Institute. June 21, 2015. Accessed May 16, 2016.

Keep this graph in mind as we analyze how growing inequality curbs economic growth. Every time you see the phrase “increasing inequality” or “income inequality,” you could substitute “rising CEO pay.”

“There’s been class warfare going on for the last twenty years,” said Warren Buffett, “and my class has won.” Some celebrate this result in the belief that free markets have justly rewarded talent, hard work, and initiative. Others bemoan the division of America into the Mega Rich who pluck the fruits of economic growth and the 99 percent who stagnate.

I side with the bemoaners, but others have examined the moral and social reasons why income inequality is bad far better than I can. I will examine the economic damage. Americans may differ about politics, religion, and sports teams, but all applaud economic growth. They may argue how to best divide the pie, but they agree that a bigger pie beats a smaller one and that economic growth is preferable to its alternative—a recession. Whether increasing inequality helps or hurts the economy is the wrong question. The right question (and an easier one) is, “Given where America is today, will greater or lesser income inequality spur economic growth?”

From 1949 to 1979, while the ratio of CEO‑to‑average-worker pay was relatively constant, the US economy grew 2.56 percent annually. When this ratio surged from 1981 to 2014, economic growth dropped to 1.71 percent a year. The difference may sound small, but over half a century, the higher growth rate results in an economy that is 50 percent larger. That’s a big difference.

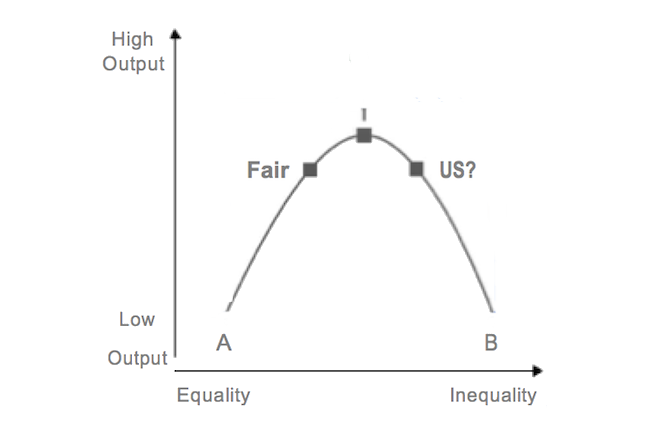

This correlation doesn’t prove that income inequality slowed economic growth, but it suggests that overpaying CEOs has not done much to help. Economist Richard Freeman draws an inequality curve in the form of an inverted U as shown [below]… The vertical axis shows the level of inequality. The horizontal axis depicts total economic output or GDP. At Point A on the left, there is perfect equality; everyone gets the same amount of money regardless of talent and effort. Therefore, no one has a financial incentive to work and economic output is zero. From this point, increases in inequality are good for the economy, for a while. At some point, more inequality begins to stifle growth. At the right end of the curve, one person gets all the money, and again, no one has an incentive to work. At the top of this curve, between total equality and total inequality, economic output is maximized at Point I.

Leading economists who argue that increasing income inequality hampers economic growth include Nobel laureates Krugman and Joseph Stiglitz, Piketty, Alan Krueger (former chairman of the White House Council of Economic Advisers), and Raghuram Rajan (former chief economist at the International Monetary Fund).

In a 2014 report, the ratings agency Standard & Poor’s says that current inequality levels are hindering US economic growth and the firm has cut its growth forecast. Its report states, “We’ve reduced our 10‑year U.S. growth forecast to a 2.5 percent rate. We expected 2.8 percent five years ago.”

It is very easy to change the situation. All power derives from the people, what they give, or allow to be given, can be taken away.

Which is why those mega wealthy have fostered a corrupt political setup that makes that taking away almost impossible. If one really wanted to change things you would have to clear out the swamp Trump talked about and we can see how they reacted to him just talking about it. Of course he, being part of it, may never have been serious.

Other countries show better hope for reform–Corbyn’s upsurge in Britain for example. So in that sense if the advent of Trump lessens our international influence it may be all to the good. But back here in the US it’s hard to see change happening short of outright collapse. Schumer and the Dems may finally be showing some populist tendencies but if they do regain power they will likely use the Repubs as their excuse for not following through.

All of which is to say that when it comes to the power of the people giving is easy, taking back is hard.

Re: Other countries show better hope for reform

“Da people” only have “the power” to change who runs the government. But, the “nice people” never EVER run the government (or any other large powerful organization). Only the smartest-n-savviest predatord can eat their way to the top of the “leadership tree”.

(Sorry).

While that is true, it is equally true that “the people” still have the power to get rid of corrupt politicians, influence legislation and even bring down governments and entire political systems. But it won’t happen until enough people are seething mad and the desire for change eclipses the desire for comfort and a predictable routine.

Wrong, wrong, wrong. Google these keywords: “Princeton Gilens Oligarchy» for an academic quality study that proves «the people” are nothing but props in a staged show….

The swamp Trump speaks of is not the swamp I talk about. My idea of The Swamp is Congress, its lobbyists, and the corporations funding both groups. The swamp Trump speaks of is, I suspect, the bureaucracy of government agencies

Am I the only one who thinks it’s well past high time to tax the rich?

Unfortunately, taxing is way too easy to avoid most of the time nowadays. You’d have to re-do the whole tax system, and include a high level of international cooperation, which US loathes (unless it suits it).

In the absence of moral qualms amongs the CEO and the board, there are no easy solutions. THAT is the real damage that the “shareholder value” created.

Why not cut to the chase and just kill them?

I jest, of course. Mostly.

Nick Hanauer fears others getting the same idea

Change is coming. Whether that change looks more like 1776 in Philadelphia or 1789 in Paris remains to be seen.

The American Revolution resulted in thousands of Loyalists being tortured (boiling tar and feathers, riding the rails), murdered outright for their property, cruelly imprisoned, raped and generally harassed. About 100,000 were forced into exile, never mind how many died from battle, starvation and disease.

The long term effects were, and continue to be, even more catastrophic as can be seen from a comparison of Canada’s development with that of the US which still struggles with the legacy of slavery. One country became a first world social democracy, the other spread violence and mayhem around the globe.

And one of those imprisoned Loyalists was Ben Franklin’s son, William.

We have a lot of problems up here in Canada too I’m afraid. So does Australia and New Zealand.

It’s not as good as you might think, although it certainly is better than the US.

Yes, indeed, we Canadians have had our problems. When Harper ruled Canada, he got rid of scientific libraries and scientists who didn’t agree with his “science for the corporations;” he repealed many of our environmental laws, especially for rivers and oceans; he tried to destroy our trust in Federally collected statistics by changing the form; he tried to have voters carry identification for voting so that there could be no voting fraud (which didn’t exist anyway); he had a prejudiced view of Islam; he treated Omar Khadr poorly; etc., etc. We were lucky to get rid of him when we did and we just hold our breaths that the Liberals won’t deceive us. All is so precarious!

Canada as noted by others has its own problems. However It is graced in having only a tenth the population of the US and even more fortunately, a military with no pretensions of empire.

When snuggled up next to the US death star, a low military profile is preferred. That, at least partly, explains how the country stays out of much of the kind of trouble the US finds itself in.

Those who make peaceful revolution impossible will make violent revolution inevitable

JFK

Learned this from a guide at Versailles: at one point shortly before the revolution a large group of poor women from Paris walked all the way to Versailles to speak to Louis XVI about the hardships the people were enduring in the city. Louis did not listen and we all know what happened.

Seems to me Occupy Wall Street was a similar effort.

“Make America Great Again”

As far as I can tell, this slogan is harkening back to the state of the country in the 1950s and early 60s. Setting aside minor details like Jim Crow laws, gender inequality, poisoned air and water, potential for immolation in nuclear war, etc., this appears to be the era of economic progress that Donald Trump wants to recreate.

Recreation of the economic conditions of this era would probably require a major reduction of CEO-employee compensation ratios and an increase in marginal tax rates for the wealthy to match the conditions of that period of time. I assume that this is the proposed tax plan of the Trump Administration in order to “Make America Great Again” and greatly advance the middle class.

How can I help? I too jest of course, mostly.

I advocate a return to the potlach value system.

He who throws the biggest party while giving away all his worldly possessions wins!

Let’s help the process along by requiring that every year the richest 500 give away half their assets to causes or programs determined by the general populace. And equip those who refuse with a lifetime supply of orange suits and a 10 x 10 cell.

Looks like we’ll need a revolution first—.

Top marginal tax rates ought to be over 90%. Effective tax rates may very well have to be more than 70%.

The big issue is that there needs to be real enforcement. When you’ve got rich people hiring lawyers, consultants, accountants, and other specialized services to dodge taxes … there need to be real consequences for tax shelters and the like.

Tax avoidance was already a challenge in 1965 as discussed by John Brooks in Chapter 3 of “Business Adventure” https://books.google.com/books?id=HsHZBAAAQBAJ&pg=PT15&lpg=PT15&dq=john+brooks+income+tax&source=bl&ots=vhWOMmFJT_&sig=ZfUE6_0fcRU2ps8yoGe10YYzpdQ&hl=en&sa=X&ved=0ahUKEwjQ4Law76LVAhWL8YMKHUN_AjY4ChDoAQgxMAM#v=onepage&q=john%20brooks%20income%20tax&f=false

The Laffer Curve probably applies in that 70%-90% range, but it doesn’t appear to be effective in the current <40% range. The key is in controlling deductions and credits so they can't avoid the tax altogether.

Sure, let’s “tax the rich”. But, taxes are “pumped” through the government. Who do you think will take the majority of the loot? Yeah, the smart-n-savvy predators who are getting the loot now.

Perhaps the nice people need to figure-out a new fantasy economic system where the smart-n-savvy predators don’t get the first-shot at the loot.

(BTW, you can search-replace “smart-n-savvy predator(s)” with the (meaningless) word “neo-liberal(s)”.)

One of the validations of sovereign currency is the government’s power to tax. Interestingly according to MMT, taxation is not necessary for spending. One might guess then that an important use of the power to tax is redistribution of wealth.

If not the gubmint redistributin than who? Surely we shouldn’t count on the generosity of strange billionaires creating charitable foundations. Why should the likes of Koch, Musk and Gates choose the directions and goals the societal resources they’ve skimmed and grifted from the masses are to be employed?

Re: One might guess then that an important use of the power to tax is redistribution of wealth.

As long as you figure out this first: “Perhaps the nice people need to figure-out a new fantasy economic system where the smart-n-savvy predators don’t get the first-shot at the loot.” If NOT, it’s F35’s ’till the cows come home.

Re: Interestingly according to MMT, taxation is not necessary for spending.

Looks like we’ll have lots more F-35 with MMT. Wonderful fantasy ya got there…

You seem to have it figured out so I’m not sure you’ll hear anything other than points within your circular logic. However taxation is not the source of the government’s ability to spend, spending comes first, taxation legitimizes the sovereign fiat currency created by the treasury.

“As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills…Moreover, there will always be a market for U.S. government debt at home because the U.S. government has the only means of creating risk-free dollar-denominated assets”

St. Louis Federal Reserve

https://www.forbes.com/sites/johntharvey/2012/09/10/impossible-to-default/#6524f6631180

There’s plenty to be enraged about but it helps to be clear about the grift. Those who have the first shot at the loot after it leaves its source are the owners of Lockheed Martin, Haliburton and the MIC whose executives are in a revolving door between industry and government and employ a legion of lobbyists and fund congressional campaigns to create policy that channels public money into private coffers.

You seem aware of that but staunching taxation is no answer and it can be put to the good purpose of redistributing wealth. In this grift, the public’s only chance and it is slim, is to educate themselves and organize around controlling congress through the electoral process. The public’s access to power is through the electoral system; they have no say over private sector players like Lockheed Martin and their lobbyists except through their representatives.

That’s the only game in town unless you’ve figured something out or you’re talking about actual revolution. To the barricades, I’m right behind you.

Re: In this grift, the public’s only chance and it is slim, is to educate themselves and organize around controlling congress through the electoral process.

That’s REALLY a slim chance.

But, uneducated people still agitate for a balanced budget knowing that (in their uneducated minds) this too has a very slim hope of controlling the grift. The uneducated people think, based on their limited understanding of the past, that controlling congress will never happen. (How could it, the uneducated are no match for the educated smart-n-savvy people).

Re: good purpose of redistributing wealth

I think the uneducated people know that you can’t have any “good” from a “bad” system. (Yes, unless they educate themselves first to change things, which uneducated people have been failing at for some time now…)

Re: However taxation is not the source of the government’s ability to spend, spending comes first, taxation legitimizes the sovereign fiat currency created by the treasury.

Speaking of “goodness”. Is it “good” to have a government set-up this way? I mean, knowing how those smart-n-savvy educated people are; who eventually always capture the government and the spending?

Maybe we’ve got these economic systems backwards. Maybe it should be assumed the “bad” people will always be running things? (Like they always seem to be).

I wouldn’t disagree with much of what you say regarding who is running things and who is being run. I’m not an optimist and you’re right to be outraged.

That’s ‘paycheck’ income. What about major shareholders? US stock marker capitalization is ~25 tril. It generates dividend and appreciation. The ‘super’ managers are paid so much to align their interests with those of the major shareholders. Manager are merely fancily paid employees. You cut their salaries and stock allocations, and the ‘savings’ will go to the shareholders.

Certainly one can suggest that the CEO/senior staff additional income from the various attempts to “increase shareholder value”, AKA, pump up the stock price, might be far more damaging to the businesses themselves, and the USA economy, than the raw CEO pay.

When a company does a stock buyback while passing over options such as improved capital equipment, better facilities, more long and short term R&D, more employee training, and more employee hiring, that appears to be a failure of management imagination.

Economists might lump this under “opportunity cost” in that the foregone opportunities end up costing the corporation much more than the temporary benefit of an increased stock price, which the corporation, itself, can only harvest by selling, not buying, more stock..

You are correct, paycheck income is only one facet of the problem.

But “must increase shareholder value” has been promoted as an “everybody knows” unquestioned belief via the business press.

Isn’t “increasing shareholder value” just a gauzy disguise for distributing outsized stock options for sr. management, all signed off by complicit board compensation committees (stocked by handpicked buds of the CEO)?

Giving CEO stock options is meant to solve a real world problem of absentee ownership. CEO pay is visible owing to SEC filing and such, while the wealth of the people whose interest the CEO are supposed to protect are not.

Many CEOs come from the middle class and are nothing but mere labor at the beginning, like everybody else. Giving them massive amounts of stock is meant to turn them into owners.

Having an option may only cause one to behave as a short term focused CEO as your ownership is a derived, leveraged security, via an option.

This is a bit like an options trader should not be confused with a long term investor.

Thus the options holding CEO may not be a true owner in the sense of having a longer view and may be interested only in a short term time horizon and actions to get the price stock higher and, as a consequence their options, higher in value.

It would be best if the CEO managed the business well and let the stock price take care of itself. With options, the CEO may view themselves has having two tasks, managing the business AND managing the stock price.

In my view, these two tasks may be in conflict, at least some of the time.

A closer approach to making CEO an owner would be by requiring them to buy and hold stock in the company for a period of years. One would also need to prohibit them from transactions such as “short against the box” or writing covered call options/buying put options.

Who invests now for a long term, what is the median stock holding for Buffet? Actually not that long ‘median holding period of a year, with approximately 20% of stocks held for more than two years. At the other end of the spectrum, approximately 30% of stocks are sold within six months’

CEOs interests are aligned with Buffet…

Yes. Let me add, Buffet has been a corporate high executive himself. Do you think he “goes to the market” with the same information the rest of mortals possesses? Do you believe a few market speculators do not know when a corporation is going to order its own stock buybacks? I suggest we should not call them speculators anymore because there is a high degree of certainty on the outcome of their actions

So in effect, your are saying that the owners of stock are closer to traders, not long term owners.

Why cater to them, they’ll be replaced quickly anyway?

I don’t understand the relevance of Buffett in this discussion,

What has Warren Buffett ever built?

At least Carnegie(steel), Rockefeller(oil), Henry Ford and the railroad robber barons built something.

Look at https://www.nytimes.com/2014/04/26/opinion/nocera-buffett-punts-on-pay.html and you will find that while Buffett disagreed with a Coca-Cola pay package, he could only abstain and would not vote against it.

He has all that money but could not show his disapproval by voting against Coca-Cola management..

Buffett is good at creating a folksy image, but where is the value added to civilization/humanity by his efforts?

Buffett’s epitaph can simply read “he was a great example of buying low and selling high”.

But contributing to humanity? Maybe via his foundation after he dies.

The chart says it includes capital gains.

There are a lot of people in the 400 wealthiest individuals who are not executives (the Walton-s) or retired or are not executives in a ‘conventional’ sense, but more like heads of family and friends investment vehicles (Carl Icahn). The wealth of these people increases year by year, yet their income may be low because they simply do not sell shares to realize capital appreciation or manipulate tax filings in such a way as to reduce apparent income (are the above graph before or after tax?) or donate to their own foundations, etc.

Guess my point is that the inequality of wealth is likely to be even more dramatic…

That is true. Especially when you consider how many Americans technically have a negative wealth due to outstanding debts (student loans, home loans, auto loans, CC debt, etc.).

the inverted U inequality curve is another reason why economics is rightly called the junk science or the dismal science. it’s an assumption masquerading as theory. the real curve would likely be asymmetrical with more than one point of inflection but any such assumption is untestable.

also, one shouldn’t appeal to authority using krugman in support of an argument as it just poisons the discussion.

. . .Economist Richard Freeman draws an inequality curve in the form of an inverted U as shown [below]… The vertical axis shows the level of inequality. The horizontal axis depicts total economic output or GDP.

The inverted U inequality curve is a junk graph.

Anyhow, we should be grateful that the mega rich are using the division of labor to unequally divide the profits from that labor and keep almost 100% of any productivity gain for themselves and simultaneously slow economic groaf.

From 1949 to 1979, while the ratio of CEO‑to‑average-worker pay was relatively constant, the US economy grew 2.56 percent annually. When this ratio surged from 1981 to 2014, economic growth dropped to 1.71 percent a year. The difference may sound small, but over half a century, the higher growth rate results in an economy that is 50 percent larger. That’s a big difference.

See, greed is good! The mega rich are saving the planet.

It’s the laffer curve over different variables

Well, what should we really expect from someone who defends themselves by saying “I’m only in the 1%, not the .01%”? Still, I would think that even this guy would be able to see the obvious fallacy in following statement:

If everyone were remunerated the same for their job, no one would do anything! Funny, because I would think people would still provide themselves with housing, clothing, shelter, entertianment, etc. But apparently in this dude’s mind, the only reason people do anything at all is because of wage inequality. Says way more about the author than about anything else.

Point taken. But it’s just a graph that reflects an idealized situation–amounting to little more than dorm room bull****. But don’t let it detract from what was a most excellent main point regarding the overweening greed of the 0.01% and their various enablers (like the author himself as he freely admits) in the 1% and the 10%.

Which percentage does the greed stop? I’m in the top 15%. I spent my life writing software that allowed the banks to turn the dumb-n-clueless into debt-serfs.

If you aren’t smart enough to actually run a scam, the next best place to be is providing “services” to the smart-n-savvy predators who are eating other prey.

“smart”. Fixed it.

There’s greed, and there’s aspirational greed?

why wouldn’t the economy have shrunk like a wee-wee in a cold pool if these Masters hadn’t been in charge from 1980 and 2014?

Shrinkage! That’s what we’d have seen and it’s not a pretty sight. At least if you’re a guy. and maybe if you’re a woman too, but I wouldn’t know.

Thanks to the Masters for giving us a few extra inches of GPD. I’m not trying to advocate for Naked Capitalism but if you’re gonna get naked you might as well be ready. Thanks guys, you kept us bigger than we would have been, if you hadn’t “earned” all that money!! Especially when you were clever enough to borrow from investors and pay yourself big bonuses using the money before you did anything else with it. That’s efficiency!

It’s hard to look at numbers and see reality. Frankly, I’m not sure there’s any relation between economic numbers and economic reality — I’m serious — I think you could almost take the same reality and count it 10 different ways, say from -5 to +5 and all in between. And it would be impossible to tell which was most “objective”. Unless it’s your wee wee. Sorry . ahhahahah.

Is there any relation between economic reality and reality? Really is there reality? I’m thinking no; and yes.

Referring to the “U” curve. Really? Economic output = 0 when all make the same?

IIRC, there are these things called “co-ops” where the product of the activity is shared and everyone has an equal say in how that happens.

That sounds like economic output to me.

Junk science indeed, as Vidimi says.

Yeah that was just… odd. A family has a farm, so if you set it up so everybody would profit equally despite differing abilities* then they aren’t going to harvest the crops? Seriously?

*note that “differing abilities” doesn’t necessarily mean, heck probably rarely means, what economists like to think it means. The experienced farmer vs. his 15 year old son, how that will change given another 15 years as the son gains knowledge and physical capacity whilst Dad drops off. Isn’t it in Dad’s best interest to keep his son well fed?

– 1% Annual Wealth Tax for individuals above $10M or couples above $15M in assets

– Eisenhower-era tax brackets

– Windfall tax of 100% on income over $100M in one year for any individual (No couples discounts. You win at capitalism this year. Pay your tax.)

– Per-transaction tax on ALL high-frequency trading

– *** Significantly increased tax rates for all companies where the highest-compensated employee makes more than 10X the lowest-paid employee (stock and all non-salary incentives counts toward this total). PROHIBITIVELY higher taxes for companies where highest paid is 25X lowest paid or higher. ***

– Localize all professional sports teams to the cities they reside in (ever wonder why the “owner” scores zero points and keeps half the money?)

– Legalize online gambling nationwide and tax the everloving crap out of it

– Legalize marijauana nationwide and tax the everloving crap out of it

– Break up all TBTF banks and prosecute white collar crime (no financial penalties. PRISON.)

– Single Payer Healthcare

– Stop pouring money into the war machine

That’d be a start. Food, Housing, Healthcare, Employment, Education for all who want them is the endgame.

To whom does the last one refer: to taxpayers or their representatives in Congress?

Withholding taxes or votes seems futile. The Great Inertia Machine that is American culture is unlikely to change.

Piketty also called for a wealth tax, not on income but on net worth, in order to reduce income inequality. The stupidity of the grossly and obscenely rich is that by paying taxes and investing in projects which would benefit the public at large, they would increase the rate of growth of the GDP which in turn would lift the standard of living of everyone.

The reason there is no growth is because there is no demand and there is no demand because people who need to spend money do not have it to spend while those who do have money have no place to invest it because there is no growth.

Hmmm… Freeman channeling Laffer… with all the same problems of reification, this time based on an unproven (and unmeasurable) principle of motivational psychology… oh wait, so was the original (!). It’s a shame Clifford was taken in by it, because the rest of his piece is rather interesting…

There is a scheme I advocate to rectify this situation, but it requires independent boards of governors. The plan is simple, either fire the current CEO or let them retire. Offer the job to the next in line, Vice-CEO or whatever, at half the current CEO’s salary. (They are unproven, but probably no worse than the previous occupant of the seat.) If they quibble, take the offer to the next in line. Repeat as often as is needed to reduce CEO pay to reasonable levels. If CEO candidates rebel or “commenters” whine about how such a corp will not be able to attract a high level CEO, try going without a CEO (you can have an “acting CEO” on paper) and you will see that very little is lost. The people who value the role of CEO very highly are other CEO’s. Their “leadership” is quite specious in the first place and probably unnecessary in a mature company.

This later situation has been tried at smaller scales with some success (Offer: If we do not hire a new manager, can you guys get the job done? If so, we will distribute the former managers salary amongst you. Answer: Hell, yeah!)

Remember the largest percentage of their compensation is from stock options and stock awards . This is linked to corporate stock buybacks and financial engineering. Remember, too, when you see CEO compensation data the figures are always understated for the above reason and because the equivalent dollar amount from position perks and traditional corporate expenses cheating are not included

Although I was OK with the article, it has its faults as ably observed by others already, I did get a grin out of the “Merely Rich”.

Remember the angst at the “500K max salary” proposal? I have a theory, that a “comprehensible/defendable” income to a given person, at least your standard college educated business/engineer type, can be pretty much extrapolated by their age and current income.

It’s a combination of what that person makes and their age. If you are, say, 30yrs old you can understand somebody making 6-7x as much as you. You make 80K, 500K seems like it makes some sort of sense. You have plenty of time to “move up”, so you figure you can get there “just like they did”. As you get older, your income does grow but you now see an upper bound to your income. So now you make 300k but you don’t see how anybody can possible be worth more than like 800k. You worked hard, did some good and even excellent things, and wtf did they do that was so special?

So Mr. Clifford made millions, but he can’t get his head around 100s of millions. I can’t get my head around what Mr. Clifford got paid. And so it goes.

Excessive CEO salaries means that the actual owners of the corporations, the stock holders, are being deprived of profit, one CEO gets the majority of the profit instead of 100s or 1000s of stock holders, including retirement funds, all of which are the actual owners of the corporation

The corporation is a construct of law, constructed to exist into perpetuity and to not transfer liabilities to stock holders. The law could be easily changed so that Salaries in these special constructs not exceed 25x average salary of employees, including all form of compensation. This would also incentivize increasing the salaries of all employees.

But which legislators will change these laws or any laws to benefit the general economy or the people? Most are working to rise in the legislative leadership so that they can partake of the “revolving door” and get hired into the corporations or into lobbying firms to the tune of millions or given speaker fees, “Obama.”

I’d love to see a Constitutional Amendment to the effect that corporations aren’t people and only people have constitutional rights and privileges, specifically including funding campaigns and candidates and political adds.

Economic growth toward “zero”, doesn’t mean there is “zero” activity, that’s impossible, someone would have to produce food and clothing, but “zero” growth and even “negative” growth, shirnkage, is possible. How much can the 0.1% of the population purchase versus the other 99.9%, so they’re just stockpiling cash and stocks, and of course that means slower economic growth.

I think excessive corporate CEO pay is the result of changes to both corporate and personal tax laws since 1980. Of the two, the change to corporate tax law is probably the biggest driver. See David Cay Johnson’s writings.

When ownership of a corporation is so diffuse to the point where no one individual owns much more than one or two percent, then how can you assemble a majority of shareholders to rein in executive pay? Moreover, in those instances where an individual might actually amass a large percentage of shares, he/she might gain access to the board of directors, but again, that person would be just one of many. Finally, that one person most likely would be a member of the 0.1 percent, and one thing we know about he mega rich is that they stick together (in other words, class solidarity). I guess if you are part of the merely rich, it is easier to break away.

I see the pragmatic objection to income inequality: it leads to banana-republicanism and/or violent revolution. But where is the ethical, moral objection? Does the Christian world have something to say? Or is this an instance where Christian and Capitalistic values concur? I am being sincerely curious here.

If you’re curious about a Christian perspective against substantial wealth inequality, here’s Chesterton on this subject:

His friend Hilaire Belloc summed up:

Atheist here, but I don’t believe Christian values ever concur with capitalism, or at least they shouldn’t if one really follows the New Testament teachings (which is what makes one a Xtian after all). “What you do to the least of my brethren…”, camels and eyes of needles, etc.

Jesus H Communist Xrist was pretty clear on how we should divvy up the goods.

It’s curious how reserved the opposition is in not calling out the Republicans as the White Christians Party (WCP), close—so close—as they are to the savagery of taking healthcare from millions.

Bertrand Russell in “Eastern and Western Ideals of Happiness” wrote that Confucian ethics, “unlike those of Christianity, are not too exalted for ordinary men to practise.”

The Catholic Church has been preaching social justice since, I don’t know, 30 AD. Listing of encyclicals here: https://educationforjustice.org/catholic-social-teaching/encyclicals-and-documents and here: http://www.frksj.org/soical_doctrine_PAPAL_ENCYCLICALS_ON_SOCIAL_JUSTICE.htm. Not to mention many comments and, more important, the conduct of Pope Francis (who chose the name of St. Francis, a follower of Lady Poverty and Matt. 19:21). And the doctrines of St. Paul, the first letter of James, and among many others Outis’s citations. Don’t forget Dorothy Day of the Catholic Workers.

The Jews had the Jubilee of debt and Mosaic teachings about respecting the poor (no usury, returning a pledged cloak so that the debtor would be warm, etc.). Tzedakah insists on taking care of the poor and needy. The prophets (notably Isaiah, but he’s by no means alone) curse the rich who take advantage of the poor.

The teachings in support of social justice go back thousands of years and are repeated over and over; I don’t know of any teaching that says the rich are entitled to get richer while the poor are deprived of what little they have. Maybe some prosperity-gospel or Calvinist doctrines, or the more extreme Opus Dei types. But I really don’t think you can square them with Judeo-Christian teachings, both in scriptures and by recognized holy people. IOW, I think they’re heretics.

To the above suggestions, I’d add this classic by Walter Rauschenbusch republished in 2007 on its 100th anniversary. It includes short essays by influential evangelicals, Catholics, and liberal Protestants (e.g., Cornel West, Stanley Hauerwas). Also an essay by Rauschenbusch’s grandson, Richard Rorty.

https://books.google.com/books/about/Christianity_and_the_Social_Crisis_in_th.html?id=TREfAVw8s94C

Blame the Fed/ZIRP. Low interest rates juices net present value (NPV) in discounted cash flow models.

Juiced NPV = higher stock prices = easier for companies to print stock grants = upper management getting a ‘free lunch’ at the expense of savers who get 0.1% savings accounts

Unfortunately, without Fed/Zirp our entire financial system would be hopelessly bankrupt. The rates must continue lower than what the market may set for this very reason. TBTF has been fixed? You gotta be kidding my, right. Also, given this reality, the bonuses that these Mega Rich are being paid are based on reported results that are just plain made up. We will ultimately be judged to have gone completely mad as a society eventually.

“The graph… [that follows] shows that the annual income of the Mega Rich and the ratio of CEO to average worker pay are highly correlated—the two lines look almost identical. While correlation does not prove causation, I find it easier to believe that runaway CEO pay caused the income of the Mega Rich to skyrocket rather than the other way around.”

The second sentence in the quote doesn’t make sense as it stands. A ratio has no causal properties as opposed to something like income. Perhaps Clifford meant the causal relationship to be between runaway CEO pay and increasingly decreasing average worker pay. If so, then this causal relationship is only plausible when seen one way. CEO pay is driving the correlation.

And tax income over 5Million at 50% and link the $5million to inflation……

They’re fighting all out to get rid of the tiny taxes they do pay. :)

Without asking how much should one person consume or possess — ask how much one person can consume or possess without grossly distorting the meanings of either word? What is this aggregation of wealth in a few hands really about and what kind of people are these who have so handsomely rewarded themselves?

I believe the gathering of great wealth is a gathering of power and control over others. And this power and control is going into the hands of people representing the very worst proclivities of human nature. They have taken control of our economy, our government, our very lives, and the lives of our children and children’s children.

How this has come about is moot but asking economists to explain things or repair things is quite pointless. That profession — like the oldest profession — best serves those who hold the wealth.

What comes next? After the last few elections I despair of finding a solution through our existing political process. And as for revolution … this time really does appear different. I fear that instead of change or revolution we may be on the edge of a massive collapse. We have an economic system made more and more fragile by those who benefit from it and many of its pillars of support sag under the growing weight.

“Personal property is the effect of society; and it is as impossible for an individual to acquire personal property without the aid of society, as it is for him to make land originally.”

“Separate an individual from society, and give him an island or a continent to possess, and he cannot acquire personal property. He cannot be rich. So inseparably are the means connected with the end, in all cases, that where the former do not exist the latter cannot be obtained. All accumulation, therefore, of personal property, beyond what a man’s own hands produce, is derived to him by living in society; and he owes on every principle of justice, of gratitude, and of civilization, a part of that accumulation back again to society from whence the whole came.”

“This is putting the matter on a general principle, and perhaps it is best to do so; for if we examine the case minutely it will be found that the accumulation of personal property is, in many instances, the effect of paying too little for the labor that produced it; the consequence of which is that the working hand perishes in old age, and the employer abounds in affluence.”

“….Despotic government supports itself by abject civilization, in which debasement of the human mind, and wretchedness in the mass of the people, are the chief criterions. Such governments consider man merely as an animal; that the exercise of intellectual faculty is not his privilege; that he has nothing to do with the laws but to obey them; and they politically depend more upon breaking the spirit of the people by poverty, than they fear enraging it by desperation.”

Thomas Paine. Agrarian Justice. 1795

Keep the masses busily distracted and addicted to with the newest bread and circuses androids and iphones checking for #likes# on social medi. Life will continue as is

What a great writer can get across in so few words. Loved this, thanks for the quote:

“All accumulation, therefore, of personal property, beyond what a man’s own hands produce, is derived to him by living in society; and he owes on every principle of justice, of gratitude, and of civilization, a part of that accumulation back again to society from whence the whole came.”

-Thomas Paine, Agrarian Justice. 1795

+1 yea it’s about power over others. Not small amounts of money, that could be about anything including liking nice things, but the pursuit of money by those who obviously don’t need money, it’s about power, and it’s as ugly as you can imagine wanting that much power over others with such callous disregard for the welfare of those they want power over is.

+1

@Jeremy: While I agree with you that money equates to power, sadly it is the nature of the human condition that people seek power under all systems. What is the alternative? That we take the money away from the wealthy and end up with a Stalin or Mao? Taxation is about control and oppression, not wealth or social equality.

Many of the framers of the US Declaration of Independence and Constitution were the oligarchs of their age. Good can sometimes come from oligarchs, as history shows. It is just that the oligarchs of influence today are largely corrupt internationalists with no loyalties or conscience and agendas to only enrich themselves with rent-seeking monopolies.

Higher taxation is not a solution. For example, I am strongly in favour of legislation that all corporations in the US should follow the UK’s John Lewis model, that the CEO cannot earn more than 50 times the average wage of its employees, and that there should be employee representation on the board. These types of policies, bound by law, combined with punitive import tariffs (to punish companies outside the US who do not comply with this legislation) and the elimination of taxes on the middle and lower class income brackets completely, including filing returns and paperwork, would be the best way promote income quality and return quality of life and social mobility back to our society.

This is a corporate fascist system – and not just in the USA. It cannot be fixed from within because the system itself is the problem. The only way you fix it is to eliminate the 1% and tear down the system. Keep the system and the old 1% will simply be replaced by a new 1%. Never underestimate the number of psychopaths in a society.

The catch is that such a nihlistic solution requires a generation to sacrifice itself for the future. My generation has spent a half century stealing from the future. We are the last people likely to sacrifice anything. Which means the only solution is to hope the system collapses by itself. Then cross our fingers that something better comes out of the rubble. Given people’s willful ignorance on this entire issue, I’m not optimistic. But then such ignorant people don’t deserve a society that works.

On the peaceful protest front: it should be interesting if the boycott of Sears Canada, over CEO compensation, gains any traction. The news has actually gotten MSM exposure. But do Canadians actually care enough to support even the most basic kind of protest?

Just take a look at the revolution in Syria: people there protested peacefully for a better life and got barrel-bombed by their own government for their troubles. In Canada we still have unemployment and welfare systems that make the stagnate wages and unemployment somewhat bearable. We have a long way to go before the whole system implodes and unless someone with great leadership skills comes forward and explains everything and is willing to go to extreme measures to fulfill the promises of democratic socialism, we will stay stagnating for a lot longer. I believe that the implosion will probably occur south of our border and we will be drawn in whether we want to or not.

Hopefully the skilled leadership qualities mentioned above will not be dictatorial and/or authoritarian!

I see it now: The Ban The Barrel Bomb Movement* (Sponsored by Raytheon).

I know the Bombardier Execs tried to give themselves a pay raise. The public outcry made them back off. Two reasons 1) they were bailed out by us taxpayers and 2) not filling the Toronto Light Rail order.

So, thousands of Sears Canada employees (many that worked for hours standing all day), are laid off without a severance package. Meanwhile, 43 managers who were making decisions regarding how the business is run (and probably should have lost their jobs long ago) instead get to share $7,600,000. 00. Greed certainly is good for Sears Canada managers.

In one of Branko Milanovic’s books, he says that inequality is like cholesterol. Just as there is good cholesterol (high density lipoprotein [HDL]) and bad cholesterol (some forms of low density lipoprotein [LDL]), there is inequality that rewards good behavior and inequality that rewards bad behavior or dumb luck. It really is beneficial and fair to provide higher rewards for people who work harder, who have advanced skills in useful but difficult occupations, or who work in hazardous conditions. There is no value in rewarding people for having the good fortune to inherit vast sums of money, or who are sneaky enough to manipulate the complexities of life. We certainly don’t want to reward people for committing fraud or theft, but we do.

The inequality in the United States and many other parts of the world is like bad LDL cholesterol. Any place that has billionaires or near-billionaires has LDL inequality.

I wonder what kind of sympathy Dickens might have Madame DeFarge offer Steven Clifford and other members of the Merely Rich.

One problem I find with the post is that it doesnt explain to its audience, which I suppose is the layman, is why employees below the supermanagers and CEOs should worry about the superior’s obscene pay. Is it because they are taking too much out of the company profits pool which couldve been redirected to increase employee pays instead or is it a zero sum game or something else?

We need to help people relate to inequality of income,power and wealth.

Good point. It would be easy to show with a 7 or 8 pg article or essay that the essential problem with top corp executives compensation is not that makes others jealous or that negatively affects growth -which can and does-. Once one understands the mechanisms and the mechanics that make the exorbitant top executive compensation possible, one also understands that it has made-and increasingly will make- the lives of a large mass of people miserable. Miserable in the sense of not being able to continue a humble but decent and merry lifestyle (whether wishing for more or not), which is or was human and economically productive all at once. The inescapable truth to the mechanism and mechanics- which top execs and a few others have constructed, keep constructing, trigger and employ- is that completely alters everyone else’s life: her/his maintenance, reproduction and cautios progressive and developmental changes. It is an INTRUSION “into the being of millions of human beings” exponentially more damaging than some of State interventions we are always prompt or ready to condemn.

It isn’t only the .01% or the 1% alone we have to be concerned about, but the upper ten percent (+/-) as well.

In other words, the lawyers, CPAs, media/propaganda producerss, university admins, etc. who provide necessary and highly-paid services to the uber rich are also beneficiaries and defenders of the grotesque system we currently find ourselves in. Add in militarized police forces – fattened with overtime payments – to maintain that system with an iron fist, and you’re talking about a lot of people.

If it was just the rich/uber rich we were talking about, things would be much easier.

Needless to say, include the leadership of the Democratic Party in there, since their job is primarily to provide an HR-appropriate and diverse facade for our collective imprisonment.

Good post. Great last sentence. #DownWithThirdWayClintoniteScum

By the way, here’s the Indian version of this – http://profit.ndtv.com/news/trends/article-indian-ceos-earn-up-to-1-200-times-you-read-that-right-of-average-staff-1728211?pfrom=home-business

Here’s a thought.

Norway: The country where no salaries are secret

http://www.bbc.com/news/magazine-40669239