Those people who surround you

Only want to see you weak enough to crawl

They’ll lie for you, decide for you

And buy up all your rights and all your wrongs

And they’ll try to stop your singing

In the middle of your song

For they do not want you free

And they will not make you strong

But only drag you down the hole they’re coming fromThey say you are foolish in wanting the sun

They say you selfish in learning to run

They tell you that the darkness

Is a blessing in disguise

For you never have to notice if you’re sighted

Or you’re blind

And they’ll do their best to keep you from the lightJanis Ian, From Me to You

Last week, at an offsite retreat, CalPERS staff and board held a full day workshop on options for CalPERS’ investment management, with most of the session devoted to private equity. However, this set of presentations differed starkly from the November 2015 private equity workshop, the last occasion when staff gave the board a strategic overview of this investment program. While the 2015 session had a clear aim of defending CalPERS’ private equity program, it also provided a great deal of information. In addition, there appeared to be a genuine effort to educate the board, even if the education had an obvious bias.

By contrast, the centerpiece of this board meeting was a star-studded panel, Larry Sosini, Sandra Horbach of Carlyle, Mark Wiseman of BlackRock and Mario Giannini of Hamilton Lane, discussing of possible private equity business models. If you listened carefully to the speakers, you could hear them more than once acknowledge that CalPERS’ proposed approach was backwards: you make your strategic choices first, then settle on the mix of business models based on those decisions, not the other way around.

But if you understood the real game, niceties like developing a bona fide strategy were beside the point. The real job of the brand-name experts was to legitimate the staff’s plan to set up an independent company to make private equity investments “run as a business.”

Thus CalPERS and its private equity industry allies saluted the idea that this new entity would operate at arm’s length without providing a justification save the assumption it would be easier to attract managerial “talent”. As we’ll discuss at greater length in our next post, there are reasons to question this view.

Nor did CalPERS staff or the experts elect to compare this approach to other options for creating private-equity-like returns without employing private equity managers, although JJ Jelincic and other board members forced some discussion of this issue.

Finally, there was no briefing to the board how as to this vehicle might work. Structural and legal issues were deferred to a future meeting. Yet the chief investment officer said explicitly that the entity would not report to the board when it is the board that acts as fiduciary for CalPERS beneficiaries, so it is board members who are most at risk under this scheme. Worse, the clear intent of staff is that by presenting the board with only one option, and refusing to consider any others in a good faith manner, the board will have no choice but to fall in line.

To their credit, several members of the normally complacent board were clearly uncomfortable with the presentations and asked some savvy and important questions. I hope they continue to push back, since they appeared to grasp the key defect of staff’s plan, which is that it will create an entity with weak oversight as an explicit design objective that has lots of CalPERS money at its disposal.

This approach is particularly dangerous in combination with another idea CalPERS pushed hard in the business models panel: that of making very long-term, Warren Buffett-like investments.

One thing that constrains private equity chicanery is the expectation that they pay back all the money that was invested in ten years or less. Even though private equity firms inflate returns around the time they raise new funds, in bad equity markets, and when they hold dogs at par value before they dump them late in the life of a fund, the amount of gaming is limited because too much overstatement of interim returns would be revealed when companies were sold and would damage a firm’s reputation. Investments not required to be sold are a prescription for valuation fraud. CalPERS would be much less exposed to that risk in other approaches.

Some of the other striking features of this workshop included:

The odd combination of CalPERS effectively admitting that it was lacking both private equity expertise and even a strategy, when owning up to weaknesses is a positive development, yet planning to rely on “independent” hired guns might find difficult to identify and select and by design would not supervise. Staff was silent on what if anything else it planned to do about its admitted shortcomings

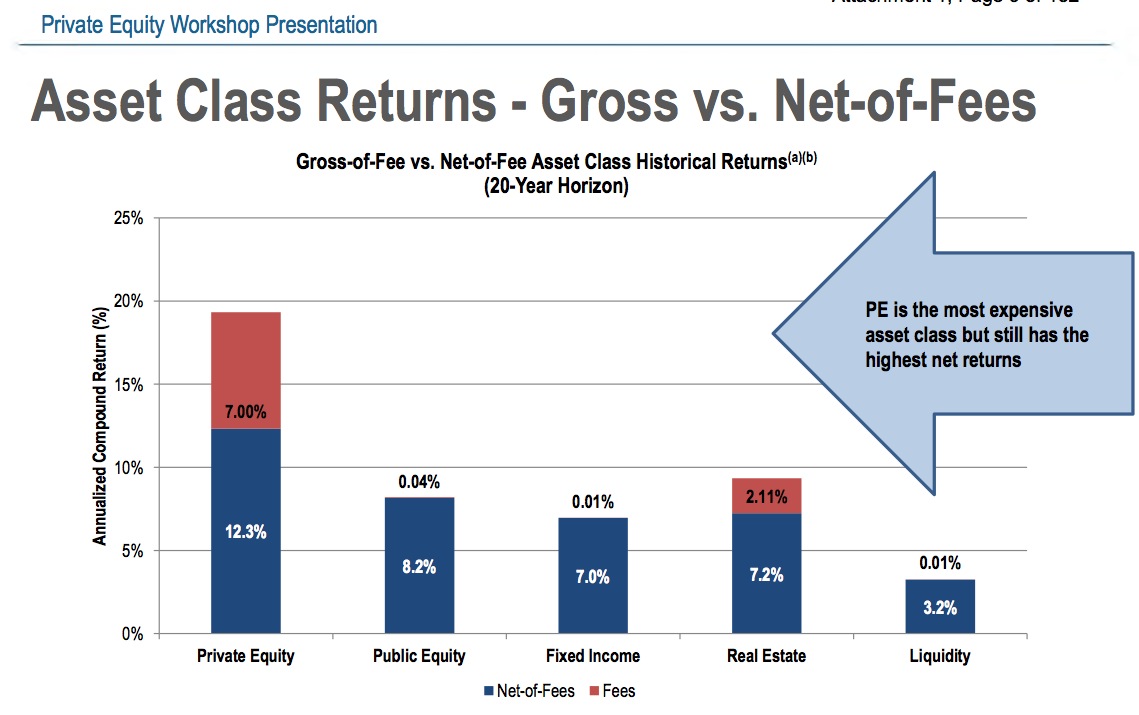

A not-well-executed version of what the management committee at Goldman would call a “honest dishonest” presentation, one that was pumping for an outcome but feigning objectivity. One big source of bias was reliance on private equity “experts” who all have far more loyalty to general partners than CalPERS. One of the most galling was the repeated insistence that private equity fees have nothing to do with returns, when in every other area of investing, where total fees are a fraction of private equity’s estimated 7% per year, it’s universally understood that every dollar paid in fees is a dollar less in returns, and that minimizing fees and costs is an important investment objective.

Some misidentification of CalPERS’ issues and requirements for CalPERS’ improving its game in private equity

We’ll discuss why the first day of the CalPERS offsite, on portfolio leverage and private equity, was not an intellectually honest exercise and why that matters. Our next post will discuss the risks of the “independent company” versus in-house approach, an option staff curiously neglected to mention.

CalPERS’ Embarrassing Pretense at a Strategic Review

CalPERS’ staff engaged in yet another snow job with the board in trying to pretend it had done a bona fide strategic review. The centerpiece was (and I am not making this up) a “listening tour” where CalPERS consulted with 50 Big Names on private equity, many of whom would have absolutely no reason to know anything relevant, such as Jeff Immelt of GE and Jamie Dimon as well as Steve Schwarzman of Blackstone and critics like Ludovic Phalippou of Oxford. They asked for their views on private equity topics as well as “What would you do if you were CalPERS?”

By contrast, the last time CalPERS thought about making a big change in its private equity strategy, it hired McKinsey.1

As anyone with a modicum of business training, or even some common sense, would recognize, this was a garbage-in, garbage-out exercise intended to provide the sheen of brand name validation. People like Immelt are too removed from the industry to have much if any insight; general partners like Schwarzman clearly have an agenda, which is to keep limited partners giving them money and paying fat fees. In addition, none of them know CalPERS well enough to provide specific advice.

It’s another sign of how little respect the staff has for the board that it didn’t deign to provide a list of its interviewees, but merely mentioned the names cited above plus Larry Fink of BlackRock and professor Ashby Monk from Stanford.

Even the panelists, who should have been briefed better, regularly played the false idea that CalPERS’ board approval process leads to less than speedy responses from CalPERS. In fact, the staff has $2 billion per deal of delegated authority from the board, vastly more than it needs for private equity fund and co-investment commitments. Moreover, CalPERS staff said it felt it wasn’t getting called as early and as often as it wanted to be. There was no willingness to consider that the causes might be specific, and at least partly solved: that the recently-departed head of private equity, Real Desroches, was widely regarded as difficult.

If CalPERS had wanted candid feedback, it would have needed to interview practitioners (as in people doing the business on a day-to-day basis, and not heads of firms, a tall order given how protective most PE firms are regarding their communications, but this is one reason consultants get paid real money) and have an independent party conduct the interviews, since it’s socially awkward to talk about institutional or personal shortcomings.

Another indicator of how cursory the strategic “review” was is that CalPERS enlisted Hamilton Lane to produce a “SWOT analysis“.

We’ve written before about the slipshod work that Hamilton Lane does in its bread and butter business:

As you can see, the Hamilton Lane reports do not contain sufficient business and financial analysis for a potential investor to make a reasoned decision whether to risk a substantial equity investment. Their role is to provide due diligence theater.

I am pretty sure that Professor Phalippou would say that any of the students in his private equity course could have done a better job.

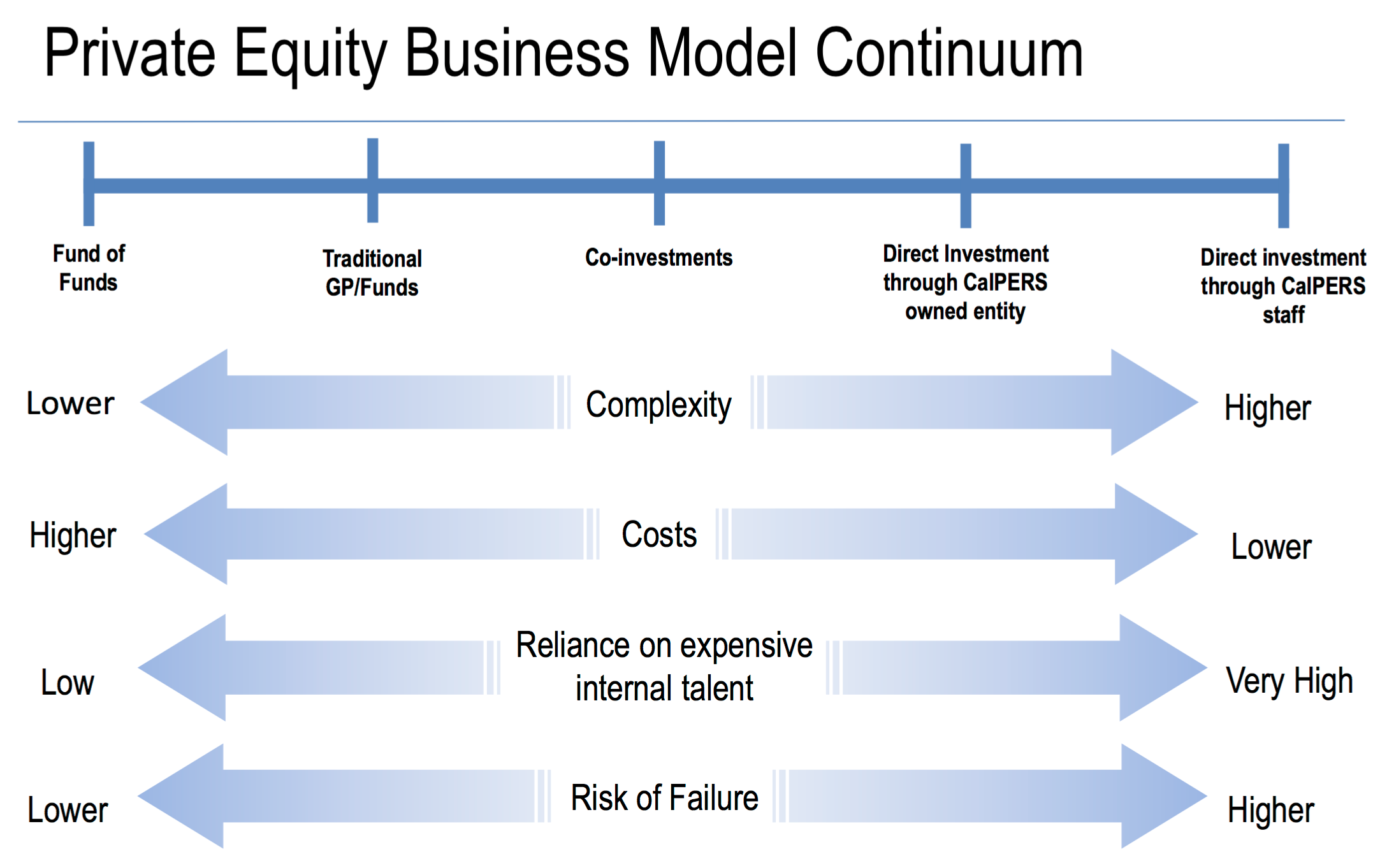

But even more important than the signs that the strategic review process was unserious was the way that staff omitted important options so as to blinker the board. Here was the slide that staff used to frame the discussion:

Remarkably, Ted Eliopoulos declared that CalPERS should use every business model. That makes no sense. You set your strategic priorities, and the use of business models derives from that. The result could be that you do wind up using a bit of all of them. But to engage in cart-before-the-horse decisions leads to the guaranteed mediocrity that pervades the financial services industry like “the financial supermarket” or “universal banking” when big banks decide to do everything without determining what they need or ought to do well.

As indicated, even with the pretense that spreading resources all over the map was both comprehensive and sound, CalPERS omitted some important options and failed to clue in the board.

First, there is no mention of replicating a private equity investing strategy in public markets. One approach we discussed in 2015 was developed by Brian Chingono and Dan Rasmussen showed how to exceed the average private equity fund’s return by a solid margin:

Looking at US data going back to the early 1960s, they found that if you’d bought a portfolio consisting of companies in the top quartile according to each of these filters, you would have made around 23 per cent per year between 1965 and 2013. You would have done slightly better with an equal-weighted portfolio and slightly worse with a value-weighted portfolio.) Compare that to the roughly 10 per cent annual returns you would have gotten over the same period if you invested in the S&P 500 index and reinvested all dividends, or the long-run net of fees returns of the Cambridge Private Equity Index of around 13 per cent per year.

Now admittedly, if CalPERS were to go this route, others would probably replicate it and reduce a good chunk of the juicy returns. But this is still effectively money sitting on the street that CalPERS is refusing to pick up. And even a mere five or so years of outsized returns from a public markets replication of private equity would buy time for CalPERS to get longer-term private equity initiatives in place. And it would take advantage of CalPERS’ genuine expertise in public equity markets.

Similarly, CalPERS staff disingenuously neglected to mention the possibility of doing private equity in house. While this may sound like a stretch, it was even more of a stretch in the early 1980s for big commercial banks like JP Morgan and Barclays to think they could get anywhere in investment banking. Yet they now give the likes of Goldman and Morgan Stanley a run for their money, while former top firms like First Boston, Salomon Brothers, and Lehman failed or were rescued and eventually lost their independence. Even the panelists all admitted that CalPERS could get there if it wanted to, but gave very attenuated time horizons. 2

If nothing else, it’s important to compare the “new entity” concept with a well-designed in-house approach. CalPERS assumes the former is preferable without having examined both in a rigorous way. Our next post will show that CalPERS has seriously underestimated the difficulty and risks of setting up a new vehicle properly.

Another curious omission, perhaps because it isn’t a business model question per se but more a “product focus” matter, is the failure to consider investing in private company debt. This is an area that private equity firms are pursuing keenly. The fact that it apparently didn’t come up in the listening tour confirms that CalPERS wasn’t speaking to people who were close to the market. Not only is this a hot area for private equity firms, but CalPERS also has a strong in-house debt investing team, so here is a sweet spot where CalPERS’ strengths match a big growth area for private equity. CalPERS could use this as a foundation for building an internal effort.

In addition, CalPERS refused to subject some private equity approaches to the sort of scrutiny you’d expect to see in a strategic review. For instance, relying on the “we’ll do a bit of every business model,” Eliopoulos swore fealty to continuing its fund of funds program.

Now a finance savvy reader might wonder why in God’s name is a player like CalPERS paying an extra layer of fees in a funds of funds program when it large enough to meet any fund investment minimum?

The reality is that for CalPERS, the “fund of funds” approach is to invest in “emerging,” meaning minority, firms. CalPERS included a discussion of that in one of its panels. However, there was no mention whatsoever of the returns. Given how deeply underfunded CalPERS is, it is hard to justify much participation in this sort of effort unless the returns are very close to or better than those of the rest of the private equity portfolio. The silence regarding results suggests that they are falling short to a meaningful degree.

Yet another proof of strategic incoherence is that the let’s put on a show, let’s created a new company scheme is inconsistent with another plan CalPERS staff wants to implement, of having private equity and public equity be combined into a “growth” unit. This would amount to a demotion of the importance of the head of private equity, since instead of reporting to the Chief Investment Officer, he would presumably have the head of “Growth” as his boss. That would send a signal to staff that they don’t regard private equity as requiring distinctive competences, let alone ones that the panelists all said in a polite way needed to be upgraded. 3

Finally, CalPERS bizarrely spent an entire morning panel discussing leveraging its entire portfolio as a way to increase returns and then proceeded to act as if that idea was not a strategic alternative to experimenting in private equity.

Although I am instinctively leery of approaches like that, since I am skeptical that CalPERS has a solid understanding of the risks in its various investment strategies, it has that problem independent of the question of adding leverage. As we’ll discuss in more detail below, CalPERS expects to earn an inadequate return for private equity risks over the next decade. And despite Eliopoulos’ oath of undying loyalty to private equity, CalPERS has been reducing its commitments to private equity, and also to public equity. That means it would not be crazy to add back some risk at the portfolio level. One advantage of that approach is that it is much more under CalPERS control, and can be adjusted far more quickly, that levered investments in very illiquid assets.

What Problem Does CalPERS Appear To Be Trying to Solve?

It is important to understand that despite the pretense that CalPERS’ staff was presenting ideas for discussion with the board, its independent company plan is yet another naked power grab, with no serious discussion of the rationale.

But we can infer what might be driving the decision process. At the outset of the business models panel, Chief Investment Officer Ted Eliopoulos swore CalPERS’ undying fealty to private equity (see at 1:14):

Chief Investment Officer Ted Eliopoulos:…because at the end of the day, we do feel very strongly that investing in the private markets in general and private equity are a necessity for us for CalPERS to be successful in meeting our investment objectives over the course of not only this next asset allocation cycle but into the next ten years, twenty years, thirty years, and in perpetuity, really.

This statement confirms that Eliopoulos is unfit to serve as chief investment officer. Private equity’s apparent attractiveness would go poof if Treasury were to tax highly leveraged transactions more heavily than ordinary corporate borrowings, as it proposed in 1987.4

More generally, the only reason to deem a particular type of financial asset or exposure as a permanent item in an investment portfolio is either that it is a distinct asset class or that it provides significant risk mitigation by performing differently than other investment strategies. Despite regular casual claims otherwise, private equity is not an asset class. It is essentially levered equity. The fact that CalPERS plans to put public and private equity in the same unit confirms that they embody largely the same risks and rewards.5

Moreover, in the very next set of presentations, on The State of Private Equity, CalPERS cannot expect private equity to earn an adequate risk-adqusted return in the next ten years. From page four of this slideshow:

According to a compilation of forecasts by Wilshire Associates, BNY Mellon, JP Morgan and Goldman Sachs, Private Equity is forecast to have a lower ten year forward return of 8.7% compared to the actual ten year return of 10.4%, as of 9/30/16. The ten year forecasted returns for Global Equities* and US Equities* are respectively, 7.5% and 6.9%.

These numbers are deadly. A bedrock principle of finance theory is that an investor must expect a higher return from an investment with higher risk to justify committing funds to it. The rule of thumb for the required risk premium for private equity over public equity is 300 basis points.6 Yet CalPERS’ experts forecast that private equity will earn only 120 to 180 basis points more than public stocks, which is too little additional return to justify investing in private equity.

CalPERS’ preliminary fiscal year 2016-2017 results confirm doubts about whether private equity is worth its higher risks. Private equity delivered 13.9% returns, which sound impressively high relative to CalPERS’ overall portfolio targets. But public equity earned 19.7%! Public equity was still 18 basis points below its benchmark, but private equity was 640 basis points short.

With the history of private equity failing to meet its benchmarks for the last ten years, and almost always failing in every sub-period (five, three, and one years) with expected inadequate future returns, it’s hard to make sense of Eliopoulos’ pathological-sounding loyalty to PE.

So the best route for CalPERS to improve private equity returns would be to reduce the fat fees that private equity firms extract. This slide comes from CalPERS’ 2015 private equity workshop:

Notice that it shows a whopping 7% in private equity fees. That’s 7% per year. Mind you, CalPERS was apparently relying on the work of Oxford professor Ludovic Phalippou. CalPERS does not know the full cost of investing in private equity, which is a remarkable lapse and for the board, a breach of fiduciary duty. One of the basic requirements of being a fiduciary is evaluating the costs of an investment strategy relative to their returns.

Moreover, as Eileen Appelbaum and Rosemary Batt point out in their landmark book, Private Equity at Work, over 60% of large firm private equity fees are not at risk. The fund managers get them irrespective of how the investment performs.

The defense , that some funds deserve their juicy fees by delivering premium returns, is hollow. Investing in private equity is a crapshoot and even more so for a player as big as CalPERS, who will find it hard to do better than index-like returns. It’s a fool’s errand to try to find “top tier” funds, since outperformance stopped persisting in private equity nearly a decade ago. Indeed, the top quartile funds in one period are even less likely to be top quartile in their next fund than by chance.

In a lower-return environment, it’s reasonable to infer that investor returns will fall more than the fees paid to private equity fund managers, making the deal of “what I pay versus what I get” even worse. Thus finding more direct ways to invest means lower total costs and hopefully more net returns to CalPERS.

It was thus revealing to see the panelists repeatedly try to dismiss the elephant in the room of the egregious level of private equity fees relative to returns, when in every other area of investing, it’s a no-brainer that even an extra 50 basis points in fees represents a big drag on investment returns over time. Instead, concerns about fees were treated as if they were petty, even ignorant, when fees and net returns are obviously intertwined. It was thus embarrassing to see board member Richard Costigan put his foot in his mouth and chew by running to the defense of private equity on the matters of fees, revealing his abject ignorance of basic principles of investing and the state of CalPERS’ private equity program.

Costigan, and this appears to reflect indoctrination by Eliopoulos and other members of staff, also argued that CalPERS mustn’t compete with the oh so powerful general partners.

This is ridiculous. Wall Street firms both compete and cooperate with each other all the time. They work together on equity and debt syndications even though they fight for merger & acquisition mandates and in trading markets. The fact that the private equity industry is Goldman’s biggest client does not keep Goldman from running private equity funds. And launching a CalPERS-backed private equity investment effort, whether in some sort of inadequately supervised “independent” vehicle or in-house but sufficiently distant from other operations so as to have the needed elbow room, is competing with private equity. The fact that Costigan can’t grok that is staggering.

Another environmental issue that may be driving Eliopoulos’ scheme is that private equity firms have a large amount of so-called “dry powder,” as in uninvested funds. That suggests that even if CalPERS makes more commitments to private equity, the money may not be put to work soon. Eliopoulos may believe that more direct participation would allow for higher odds of meeting the investment allocation. But if this venture is to be “independent,” CalPERS in fact has no more assurance of that happening than with its fund investments.

Mind you, we think it is a good sign that CalPERS is finally recognizing that it needs to improve its game in private equity and ask fundamental questions about how it is managing that program. But the institution seems unwilling to do the depth of examination needed and instead is grasping at things it thinks it can do relatively easily, irrespective of their actual complexities and risks.

While I applaud CalPERS for recognizing that it needs to make significant changes in its approach to private equity, its chosen path looks like insufficiently-well-examined leading edge conventional wisdom. Even if it succeeds, CalPERS is likely to be an also-ran unless it takes concerted steps to increase its skills at the staff and board level. Naive implementation will create even more downside to the board than under its current approach.

____

1 One big problem CalPERS faces now is it would be hard to find anyone who is either knowledgeable enough about private equity but not in bed with or keen to curry favor with general partners or has the raw analytical chops to do a ground-up study. Having said that, there are boutique consulting firms manned by partners who are former big consulting firm partners, as well as experts like Oxford’s Ludovic Phalippou, who devised an unconventional private equity strategy for Norway’s sovereign wealth fund many years ago.

2 I believe CalPERS could make very substantial progress in three to five years if it made a determined effort. A major focus of my consulting career involved getting banks into investment banking, and later helping banks improve their securities markets businesses. I had a seat at the table at multiple institutions, as well as having close knowledge of initiatives at other firms. And coming out of Goldman, I was a big nay-sayer. I was wrong due to suffering from industry hubris, my lack of experience, and from thinking over too short a time horizon (not recognizing my vantage was only 2-3 years out). And one reason it took banks as long as it did was regulatory barriers, a factor absent with CalPERS. Admittedly, CalPERS might need legislative clearances for certain activities, such as restructuring its board or providing for certain types of incentive pay, but given CalPERS’ status, it would not take all that long to get narrowly-tailored waivers passed into law.

3 Notice how this restructuring also misses completely that the more important informational synergies, if any, within CalPERS, look to be between private equity and the debt investing team rather than the public equities group.

4 The October crash took place shortly after that plan was mooted.

5 The main reason private equity appears to offer modest differentiation from the simple levering of a the stocks of comparably-sized public companies is due to the false appearance of lower volatility. That in turn results from illiquidity, which is a bad thing in investing, and resulting infrequent price reporting. It is tautological that anything that is priced once a quarter is going to be less volatile than something you can buy and sell on an intra-day basis.

The other big reason that private equity appears less volatile than it is, as we’ve discussed regularly, is due to too-often rosy valuations. These have been documented to occur regularly when a fund manager is raising a new fund, during lousy equity markets, and in mature funds, where the fund manager is often holding doggy company at their purchase price, when the market price is lower. One participant in the November 2015 workshop. Bob Maynard, CIO of Idaho’s public pension fund, was so candid to admit that the phony overvaluation in bad markets was the reason they invested in private equity and not to achieve higher returns, because they liked the appearance of risk-dampening even though they fully understood it to be bogus.

6 Some practitioners, such as the former CIO of North Carolina, Andrew Silton, have argued that the risk premium should be much higher, on the order of 500 to 800 basis points. In addition, the risk premium should be relative to comparable risk public stocks, which are mid to small capitalization, and not large cap indexes like the S&P 500. In other words, if anything, using the stock indexes listed in the slideshow is flattering to private equity, since bigger cap stock indexes will have lower returns over long periods of time.

Yves, great to see your byline! Hope your eye is recovering well.

yes, same here. You must be doing better since this is a long post with a lot of work put into it. Thanks.

Right, to attract talent, reduce costs, implement investment beliefs yadda yadda they need to all of a sudden mock the Canadian model. Do you think a seasoned so-called PE expert who cant even explain a management fee offset or track expenses on a spreadsheet is the type of talent youd want to retain or attract?

No other organization has done so little with so much, and it’s the grinding, illogical, short-sighted, demoralizing bureaucracy which is sure to infect any new arms-length group that is to blame.

At the end of the day, since they are long term investors, i am sure this has nothing to do with Ted’s goals of lining his pockets as quickly as possible

So, on the one hand, if CalPERS creates an in-house levered equity investment program the right way it could be a boon to CalPERS. On the other hand, the staff proposed program is both structured the wrong way and a power grab by the staff, creating a double loss for the board and future CalPERS earnings.

What could go wrong?

Thanks for your continued reporting on CalPERS and PE.

CalPERS manages pension and health benefits for more than 1.6 million California public employees, retirees, and their families, and the word pension is mentioned once in a footnote, once. Subliminally the article does a brilliant job of highlighting the greed of “. . .it’s all about me, using other people’s money. . .”. Who cares if they lose pension money and the taxes paid by the citizens of CA have to reimburse the Fund. CalPERS is a monopolistic entity that need breaking up.

Yves has already introduced us to 2 key calpers executives: Ted Eliopoulos & Matt Jacobs. The depth of calpers problems is even more evident when you take a closer look at the calpers CEO and the other 6 calpers executives who run the place. Information from their bios published by calpers reveals a few alarming patterns. First, the calpers executive turnover rate is very high. The CEO has been there less than 1 year and 3 others have held their positions for less than 6 months. Second, their qualifications do not match their positions. The CEO has no college degree, the Chief Health Director has no health experience, and Interim Chief Financial Officer has no financial experience.

It’s all there at http://www.calpers.ca.gov/page/about/organization/executive-officers. Would calpers invest public pensions funds in a private company with an executive management staff of this caliber? It’s even more alarming to know these appointments were approved by the calpers board. A weak calpers executive management staff, protective General Counsel, and agreeable CIO is a curious combination that may not be coincidental.

I agree that the caliber of the senior staff is troubling but this can’t all be blamed on the board. The only appointments it approved are of the CEO and CIO. The former CEO Anne Stausboll chose the rest and also recommended the elevation of Ted Eliopoulos from head of RE to CIO.

“It’s a fool’s errand to try to find “top tier” funds, since outperformance stopped persisting in private equity nearly a decade ago. Indeed, the top quartile funds in one period are even less likely to be top quartile in their next fund than by chance.”

I know the conventional wisdom in the industry is that the top quartile funds achieve the best results–and as a result every fund finds a way to pitch themselves as “top quartile”, so it is interesting that the basic premise isn’t even true anymore. Can you direct me to the studies that back up that statement?

Rosemary Batt cited them in her public comments the 2015 CalPERS offsite. Due to the fact that I am recovering from an eye injury, I am having trouble reading, which also means searching, but you can find the reference to the paper via this post:

http://www.nakedcapitalism.com/2015/11/harvard-professor-josh-lerner-gives-weak-and-internally-contradictory-plug-for-private-equity-at-calpers-workshop.html

This is the key part of her remarks:

The real job of the brand-name experts was to legitimate the staff’s plan to set up an independent company to make private equity investments “run as a business.”

Yet the chief investment officer said explicitly that the entity would not report to the board when it is the board that acts as fiduciary

It appears the real objective is to pay obscene amounts without supervision of the board to the management of the new independent entity.

Looks like looting to me.

No board member should want their name and liability subject to this approach. No insurer should offer D&O coverage for it. The staff who proposed this and their patrons on the board should promptly be given the heave-ho, without a referral.

Yes, and this isn’t even covering how the Canadian PE model is rife with problems, see the link below.

http://business.financialpost.com/news/fp-street/buyer-beware-how-teachers-got-caught-up-in-the-fallout-of-brazils-biggest-scandal/wcm/642aa058-ae4e-4380-a68f-7f787b23fc8a

“Teachers’ original $206-million private-placement investment made in December 2010 is now worth less than $150 million.”

‘Reliance on expensive internal talent’? What the heck does that mean? Why would they be worried about expensive internal talent specifically, as opposed to external talent? Most businesses I’ve ever been involved with try to keep core business expertise in house when possible.

That’s the main thing that jumped out at me, but there are plenty of other things that could be said about that slide. The absence of a strategic underpinning is clear. Here’s a strategy question for starters: Should Calpers, one of the largest pension funds in the USA, be in the business of understanding what is or is not a good investment?

What does the structure mean from a FOIA perspective? Does it means that the entity would not be considered part of CalPERS and therefore would not be subject to FOIA? If so, then hold on to your hats ladies and gentlemen because the ride is about to get bumpy. I am certain that CalPERS has been advised by its PE “partners” (aka. the managers that intend to pick their pockets) that they need to conduct their business in private because of their secret sauce and blah blah blah, so secrecy is of utmost importance to ensure strong returns blah blah blah, therefore an entity that is not subject to FOIA is critical blah blah blah. PE is desperately trying to find ways to put the secrecy cat back into the bag and/or find new/creative ways to pick LP’s pockets through fees and expenses; managers can’t even help themselves since this notion of maximizing their wealth (not leaving a cent on the table) is ingrained in them at business school and in society (plus PE as an industry optimizes for individuals with a predisposition to screw others… that’s what PE managers basically do on a daily basis). CalPERS needs to understand that managers are not their friends and if they want to get serious about maximizing their returns, they needs to cut the middleman or find really out of the box options to get the returns they need. Yves proposed some good options in this post and I would curious to hear others options from readers.

Thank god you went to Monterey! Ted needs serious supervision, since he will be long gone before any of these schemes crater.