Reader Baruch sent us this tidbit from Reuters: Bank Hapoalim, the second largest bank in Israel, sold its entire portfolio of MBS to Pimco for 75 cents on an already-written-dollar (or in this case, shekel). Note that the previous writedowns were at least $90 million on an portfolio valued before the sale at $3.42 billion.

Now why is this significant? Per a report to the London Stock Exchange on March 8, the Bank indicated that its portfolio was almost entirely AAA:

All of the securities in the MBS portfolio of the Bank are rated AAA by the international rating agencies, except for the following: MBS amounting to 60 million US Dollars (this refers to MBS guaranteed by the insurance company FGIC) the rating of which has recently been lowered by the international rating agencies from the level of AAA to A and one MBS amounting to 5 million US Dollars rated AA which was originally purchased with that rating. In addition, MBS amounting to 302 million US Dollars rated AAA are on watch lists of the rating agencies.

Amusingly, the Bank also said that even using “severe” stress tests, the losses expected on its roughly $3.5 billion portfolio should be less than 10%:

Based on the model supplied by the company, the Bank applied an even more severe scenario in which housing prices in the USA (excluding California and Florida) fell by about 30% from their peak (by 22% when compared with the present price level) and in California and Florida by about 40% from their peak (by 28% when compared with the present price level). Given such an severe scenario and assuming that the rate of default by mortgage takers will be about 47%, the accumulated loss from the portfolio is liable to reach about 340 million US Dollars over the life span of the securities. It should be noted that this test referred to the same portion of the portfolio that was tested by the company. It should be noted that the losses calculated in all of the scenarios do not take into account the annual income (after deducting the cost of financing the portfolio) which the Bank is expected to record in the future on account of the MBS portfolio and which is estimated at about 20 million US Dollars per year. Given the average life span of the securities foreseen at the present time, of about 7 years, such income is expected to exceed 100 million US Dollars.

So we have a 25.5% writedown on a portfolio already reduced by at least 2.5%, and you get a net value of roughly 72.7% of original face value.

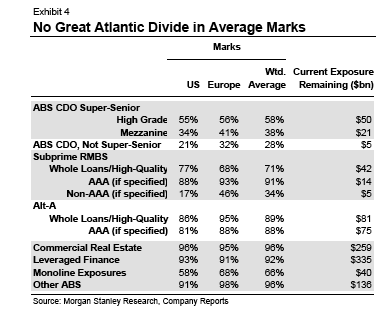

Contrast this with the marks assigned by US and European banks to AAA-rated MBS from a Morgan Stanley report dated May 13 (click to enlarge):

pimco simply had a great buy…….

FYI, this is from Hapoalim’s 2007 annual report, giving a breakdown of the portfolio:

“As at December 31, 2007, the value of the portfolio in New York is composed of the following

MBS: NIS 1,516 million (USD 394 million), prime; NIS 7,971 million (USD 2,073 million), ALT A;

NIS 1,464 million (USD 381 million), ALT B; and NIS 953 million (USD 248 million), CMBS.

In addition, the portfolio contains pass-through MBS issued by federal agencies (FNMA, FHLMC,

and GNMA).The balance of these securities as at December 31, 2007 amounts to NIS 1,605 million

(USD 417 million).

MBS issued may include a fixed interest rate, a floating rate, or a combination of both. As at

December 31, 2007, approximately 25% of the Bank’s MBS portfolio is at fixed interest rates, while

the remainder is at a floating rate or an adjustable rate (fixed rate for a predefined period, then

floating rate). About USD 1.2 billion out of the MBS portfolio are Hybrid ARMs.

There are also different options for repayment of the principal: in installments, in a variable

repayment structure, or in a single payment at the end of the period. About USD 1 billion out of

the MBS portfolio are Option ARMs.”

Anon of 9:29 AM,

If you had clicked the link, you would have seen that Hapoalim hired Deutsche Bank to shop the trade. This was a market price, not a “Pimco got lucky”.

Those Morgan Stanley figures don’t make any sense. Why would a super-senior CDOs be marked lower than the underlying raw materials? Is is that these tranches are paying such lousy interest rates that they are not even covering inflation?

At these prices, they might be good candidates for profiting from CDO liquidations. It might be a good idea to pay 50 cents on the dollar for negative real interest bearing paper if it is shortly liquidated with losses of less than 50 cents.

Not sure what you mean, Reino. The underlying in a super senior mezzanine ABS CDO are typically BBB or BB, while in a high grade they tend to be AA or A. AAAs didn’t yield enough to put in a CDO. So the super senior marks aren’t lower than the underlyings.