HuffPollstrology: Candidates’ Horoscopes, Polls And More For August 30 Huffington Post. Probably can’t be any less accurate than prediction markets….

“Big Misconceptions about Small Business and Taxes” Mark Thoma

Oil Goes Limp Bespoke Investment Group

Chancellor Alistair Darling warns slump could be the worst for 60 years Times Online. Admittedly, the UK economy is more overlevered that the US’s, but why are their officials willing to be candid and ours not? Don’t try the US elections as an excuse, there’s not much more candor in the off season.

Fannie and Freddie doubts grow Financial Times

Post-Olympic slowdown and AMCs troubles paying their debt Michael Pettis

Sarah Palin’s Record Isn’t Spotless Amanda Coyne, Guardian and McCain’s maverick mistake Diane Francis, Financial Post. Two takes from women north of the lower 48.

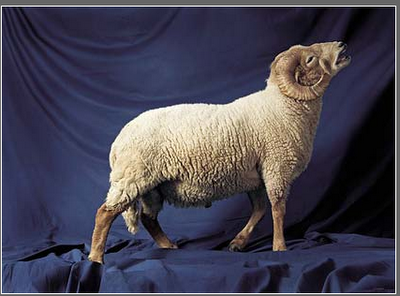

Antidote du jour:

1. If an object is moving in any reference frame, then it has momentum in that frame. It is important to note that momentum is frame dependent.

2. Relationalists deny that space should be thought of as made up of parts that exist as material bodies exist.

Worth noting that Darling’s an elected politician, not an official, and an election over here is not all that far off. His statement tends to imply that changing the government won’t make any difference – might be a smart move for the chancellor of an unpopular government (and crying up the mess left by his predecessor is good for a potential leadership candidate). I’d keeep an open mind on his candour for a bit longer.

Your point stands though with respect to the admirably blunt Merv:

http://www.independent.co.uk/news/business/news/bank-of-england-britain-is-heading-for-.htmlssion-894511.html

In general many of our our economics numbers are easier to gather, not desperately politicised and heavily scrutinised in the MSM, so it’s a bit harder to fudge.

Alas, this doesn’t apply to all our official assessments – Iraq intelligence being a case in point.

The reason that are American officials are less straight forward the the Brits has a lot to do with culture.

Since the founding of this country it has long been noted what an optimistic people Americans are. It has been my experience that is forbidden to be realistic in American no matter what the setting. You must think happy thoughts otherwise you are partially to blame for the bad things happing. It does not matter how likely those bad things were.

This religious belief in the power of positive thinking does have its benefits. I think the primary reason Americans are more likely to start their own business then the Brits has to do with the fact that Americans are not realistic about the chance of success when ever they embark on anything.

We Americans tend to pound on the Brits to make their regulations and taxes more like ours on the grounds that they would have a more entrepreneurial culture. But I think even they had the exact same regulatory regime they would be less prone to take risks. Culture does matter.

But it does have its downsides. Our politicians would be crucified for being realistic. Part of the appeal of Obama is that he can avoid being realistic with out ever setting himself up to be accountable. 10 years to get off oil? Why not make it 8?

More towards your point: The cultural bais towards positive thinking provides some cover for those who want to lie. Or at least, the line between lying and thinking positively can be very fine.

FYI: In Terry v. Ohio, the Supreme Court ruled that a person can be stopped and frisked by a police officer based on a reasonable suspicion. Such a detention does not violate the Fourth Amendment prohibition on unreasonable searches and seizure.

Ok, Ill say it, I think Paulson should be indicted by a grand jury and the records of his offices should be seized ASAP.

FYI: The United States Department of the Treasury is a Cabinet department and the treasury of the United States government. It was established by an Act of Congress in 1789 to manage government revenue.

§ 321. General authority of the Secretary

(a) The Secretary of the Treasury shall—

(1) prepare plans for improving and managing receipts of the United States Government and managing the public debt;

(5) prescribe regulations that the Secretary considers best calculated to promote the public convenience and security, and to protect the Government and individuals from fraud and loss,

(7) with a view to prosecuting persons, take steps to discover fraud and attempted fraud involving receipts and decide on ways to prevent and detect fraud;

(1) The Secretary of the Treasury may accept, hold, administer, and use gifts and bequests of property, both real and personal, for the purpose of aiding or facilitating the work of the Department of the Treasury.

(4) The Secretary of the Treasury shall, not less frequently than annually, make a public disclosure of the amount (and sources) of the gifts and bequests received under this subsection, and the purposes for which amounts in the separate fund established under this subsection are expended.

323. Investment of operating cash

(a) To manage United States cash, the Secretary of the Treasury may invest any part of the operating cash of the Treasury for not more than 90 days. Investments may be made in obligations of—

(1) depositaries maintaining Treasury tax and loan accounts secured by pledged collateral acceptable to the Secretary

§ 324. Disposing and extending the maturity of obligations

(a) The Secretary of the Treasury may—

(1) dispose of obligations—

(A) acquired by the Secretary for the United States Government; or

(B) delivered by an executive agency; and

(2) make arrangements to extend the maturity of those obligations.

(b) The Secretary may dispose or extend the maturity of obligations under subsection (a) of this section in the way, in amounts, at prices (for cash, obligations, property, or a combination of cash, obligations, or property), and on conditions the Secretary considers advisable and in the public interest.

§ 329. Limitations on outside activities

(a)

(1) The Secretary of the Treasury and the Treasurer may not—

(A) be involved in trade or commerce;

§ 331. Reports

(a) The Secretary of the Treasury shall submit to Congress each year an annual report. The report shall include—

(1) a statement of the public receipts and public expenditures for the prior fiscal year;

(2) estimates of public receipts and public expenditures for the current and next fiscal years;

(b)

(1) On the first day of each regular session of Congress, the Secretary shall submit to Congress a report for the prior fiscal year on—

(A) the total and individual amounts of contingent liabilities and unfunded liabilities of the United States Government;

(B) as far as practicable, trust fund liabilities, liabilities of Government corporations, indirect liabilities not included as a part of the public debt, and liabilities of insurance and annuity programs (including their actuarial status);

(C) collateral pledged and assets available (or to be realized) as security for the liabilities (separately noting Government obligations) and other assets specifically available to liquidate the liabilities of the Government; and

(D) the total amount in each category under clauses (A)–(C) of this paragraph for each agency.

(2) The report shall present the information required under paragraph (1) of this subsection in a concise way, with explanatory material (including an analysis of the significance of liabilities based on past experience and probable risk) the Secretary considers desirable.

(2) The Comptroller General of the United States shall audit the financial statement required by this section.

§ 3109. Employment of experts and consultants; temporary or intermittent

(b) When authorized by an appropriation or other statute, the head of an agency may procure by contract the temporary (not in excess of 1 year) or intermittent services of experts or consultants or an organization thereof, including stenographic reporting services. Services procured under this section are without regard to—

(1) the provisions of this title governing appointment in the competitive service;

>> Now then, you say, what does this image of a stuffed goat have to do with Paulson and Bear Stearns and Maiden Lane LLC ( http://www.maidenlanellc.com/ ) ?

FYI: Note: On June 26, 2008, the Federal Reserve Bank of New York (FRBNY) extended credit to Maiden Lane LLC under the authority of section 13(3) of the Federal Reserve Act. This limited liability company was formed to acquire certain assets of Bear Stearns and to manage those assets through time to maximize repayment of the credit extended and to minimize disruption to financial markets. Payments by Maiden Lane LLC from the proceeds of the net portfolio holdings will be made in the following order: operating expenses of the LLC, principal due to the FRBNY, interest due to the FRBNY, principal due to JPMorgan Chase & Co., and interest due to JPMorgan Chase & Co. Any remaining funds will be paid to the FRBNY.

Detail items affecting Federal Reserve Balance Sheet. Maiden Lane LLC has been reported as a Federal Reserve asset since July 03, 2008. Outstanding Principal is payable to the Federal REserve Bank of New York. Accrued Interest is payable to the Federal Reserve Bank of New York. Principal and Interest are payable to JP Morgan Chase & Co. Amounts are in millions of dollars.

8. Includes the liabilities of Maiden Lane LLC to entities other than the Federal Reserve Bank of New York, including liabilities that have recourse only to the portfolio holdings of Maiden Lane LLC.

Refer to table 2 and the note on consolidation accompanying table 5.

http://www.federalreserve.gov/releases/h41/Current/

Re: On June 26, 2008, the Federal Reserve Bank of New York (FRBNY) extended credit to Maiden Lane LLC under the authority of section 13(3) of the Federal Reserve Act. This limited liability company was formed to acquire certain assets of Bear Stearns and to manage those assets through time to maximize repayment of the credit extended and to minimize disruption to financial markets. Payments by Maiden Lane LLC from the proceeds of the net portfolio holdings will be made in the following order: operating expenses of the LLC, principal due to the FRBNY, interest due to the FRBNY, principal due to JPMorgan Chase & Co., and interest due to JPMorgan Chase & Co. Any remaining funds will be paid to the FRBNY.

Re: Flip through the footnotes to the Fed's latest annual report, and you'll come across an open secret. The Fed doesn't follow normal accounting rules, as promulgated by any of the major standard-setting boards. Rather, the Fed writes its own, in a document called the Financial Accounting Manual for Federal Reserve Banks.

If you ever wanted to design an accounting regime to help a bank cook its books, the Fed's would be perfect. This doesn't exactly inspire faith in the U.S. financial system, at a time when a good example might help a lot.

http://www.bloomberg.com/apps/news?pid=20601039&sid=a70JZmfcakF0

Now that the Fed is taking on the risk of Bear Stearns's assets, though, the game has changed. And the Fed's rules should, too, at least for these particular holdings. Indeed, the Fed's Board of Governors can change the rules anytime it wants.

Under its rescue plan, the Fed next week is scheduled to lend $29 billion to a Delaware limited-liability company that will hold a portfolio of illiquid Bear Stearns assets, which Bear Stearns valued at $30 billion on March 14. To put that in perspective, the Fed's total capital was $40.4 billion as of June 11. The portfolio consists mainly of mortgage-backed securities and other mortgage-related assets.

JPMorgan Chase & Co., which completed its purchase of Bear Stearns this month, will lend the Delaware entity $1 billion and absorb the first $1 billion of any losses. The Fed is on the hook for the rest. The central bank has hired an outside company, BlackRock Inc., to manage the sale of the assets over the next 10 years. The proceeds will go back to the Fed and then, if anything is left over, to JPMorgan after the Fed is paid.

OK, >>>> What does Paulson not get about: § 3109. Employment of experts and consultants; temporary or intermittent

(b) When authorized by an appropriation or other statute, the head of an agency may procure by contract the temporary (not in excess of 1 year)?????????????????

Ok, in simple terms, The Fed has usurped authority from The Treasury and that should be reason enough to bring Paulson before a grand jury, so he can account for his actions and provide legal precedents for his actions!

Furthermore: Figure It Out

http://www.bloomberg.com/apps/news?pid=20601039&sid=a70JZmfcakF0

“The Federal Reserve's accounting policies do not currently contemplate transactions like the planned credit extension related to the acquisition of Bear Stearns by JPMorgan Chase,'' Fed spokesman David Skidmore told me. “Federal Reserve staff is evaluating how to appropriately account for this transaction and will provide further information around the time the transaction closes.''

The worst thing the Fed could do now is resort to accounting trickery to avoid losses. If the Fed won't be marking all the Bear Stearns assets at fair value on its balance sheet, it at least should record writedowns whenever generally accepted accounting principles would require them.

The Fed also should eliminate the secrecy around its precious accounting manual. You won't find the manual on the Fed's Web site, even though it's cited by name in the Fed's financial statements. To get my copy, after the Fed's press office initially declined to provide one, I had to file a request under the Freedom of Information Act. The Fed sent me a lightly redacted version 18 days later.

To be fair, the Fed has said it will disclose the fair value of the Bear Stearns portfolio on a quarterly basis. That promise came April 3 from Timothy Geithner, the New York Fed bank's chief executive, during testimony before the Senate Banking Committee.

>> Now, what about games with bonds and playing with duration mismatches and manipulating the yield curve???

dems control congress — why don’t they impeach bushitler/paulson like reps did clinton? i mean, unless the cheneyburton sith lords are actually not quite guilty of colossal conspiracy…

FYI, that sheep is alive. One of the British papers (wish I had noted which one when I downloaded that photo) had a series of artistically photographed purebred sheep. I assume the photographer has a sheep fetish or a warped sense of humor.

As for impeachment, I believe one impediment is Nancy Pelosi had made clear she is not letting any article of impeachment go anywhere.