It is becoming clear that Bernanke simply does not get it. Just as he once thought subprime was contained, and has continued to misread the nature and trajectory of the credit crisis, so too he has said that there is a way out of it that involves little or no cost in terms of growth. I’ll be charitable and assume he is deluded rather than being dishonest.

As Kenneth Rogoff and Carmen Reinhart’s analysis of financial crises found, every country that experienced a housing/bank crisis of the magnitude of the one we are in has suffered a marked fall in GDP. As they noted in their paper, “Is the 2007 U.S. Sub-Prime Financial Crisis So Different? An International Historical Comparison“:

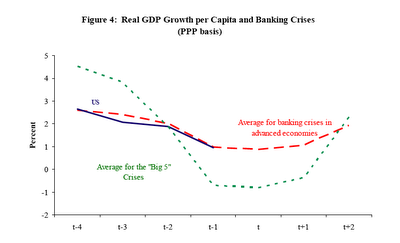

At this juncture, the book is still open on the how the current dislocations in the United States will play out. The precedent found in the aftermath of other episodes suggests that the strains can be quite severe, depending especially on the initial degree of trauma to the financial system (and to some extent, the policy response). The average drop in (real per capita) output growth is over 2 percent, and it typically takes two years to return to trend. For the five most catastrophic cases (which include episodes in Finland, Japan, Norway, Spain and Sweden), the drop in annual output growth from peak to trough is over 5 percent, and growth remained well below pre-crisis trend even after three years. These more catastrophic cases, of course, mark the boundary that policymakers particularly want to avoid.

Note that this paper was presented February 8, so it does not contain the most recent data.

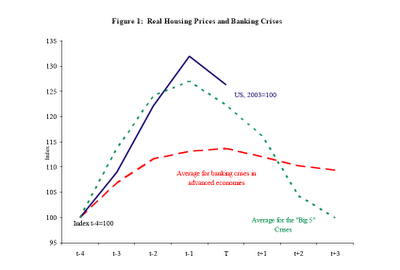

Unfortunately, their analysis also showed that the US be on an even more extreme trajectory than what they called the “Big Five”, the most serious financial crises, The housing bubble was more severe (click to enlarge):

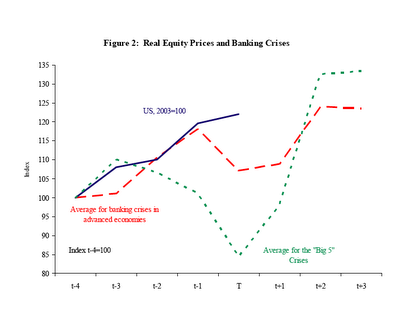

The stock market stayed at exaggerated levels longer (click to enlarge):

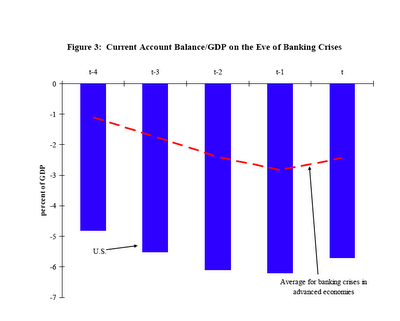

The current account deficit was (and is) vastly worse (click to enlarge):

Yet the US has not taken much a hit as far as output is concerned:

So why hasn’t the US suffered more? The big reason, as Brad Setser pointed out, is that our foreign creditors continued to lend. As Tim Duy told us:

Perhaps most importantly, however, is the massive liquidity injections from the rest of the world, or what Brad Setser calls “the quiet bailout.” In the first half of this, global central banks accumulated $283.5 billion of Treasuries and Agencies, something around $1,000 per capita. This is real money – I outlined the likely implications in January. Foreign CBs are happily financing the first US stimulus package; will they be happy to finance a second? Do they have a choice? Their accumulation of Agency debt is also keeping the US mortgage market afloat. Do not underestimate the impact of these foreign capital inflows. If the rest of the world treated the US like we treated emerging Asia in 1997-1998, the US economy would experience a slowdown commensurate with the magnitude of the financial market crisis.

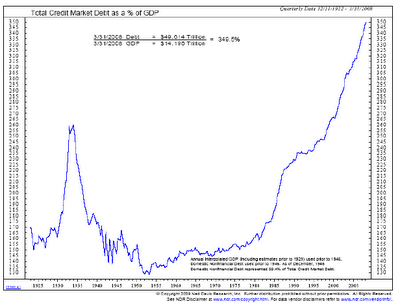

You can best see the magnitude of the forbearance from this chart, which shows debt to GDP through the end of the first quarter 2008 (click to enlarge). You can clearly see that it continued to grow on a hyperbolic curve. Despite the signs of a credit crunch, we had continued to increase rather than reduce our aggregate indebtedness.

As Setser and Duy pointed out, we got a subsidy of $1000 a person from our friendly foreign funding sources. The bailout bill $700 billion figure (which could be larger, since that is the maximum outstanding at any one time; the real limit is the increase in the debt ceiling) amounts to $2000 a person. Will our creditors play ball and lend us the money? It isn’t at all clear that they will, at least at current interest rates. They have become decidedly cool on buying agency paper. The man on the street in Asia and Europe is taken aback by the events of the last two weeks. Funding the US has become controversial in China, and may be in other major lenders. And a rise in interest rates would considerably undermine the supposed benefits of the program.

The sorry fact is the US has consumed at an unsustainable level. We need to reduce consumption and increase savings (and reducing debt is a form of savings). Reduced consumption means a fall in GDP. In Britain, which is going through its own credit crunch, the officialdom has said that the public will experience a fall in living standards. Why are we unwilling to accept the inevitable?

Indeed, one can argue that our current mess resulted from our refusal to tolerate recessions, our running of an unduly lax monetary policy. Not only did Greenspan lower the Fed funds rate to 1% in the wake of the dot-com bust, he kept it low for an unprecedented amount of time. Some economists have also argued that our monetary policy was too permissive even before that, due to the Fed’s failure to take account of the deflationary effect of cheap imports.

So what did Bernanke tell Congress today? From his prepared remarks:

Action by the Congress is urgently required to stabilize the situation and avert what otherwise could be very serious consequences for our financial markets and for our economy. In this regard, the Federal Reserve supports the Treasury’s proposal to buy illiquid assets from financial institutions. Purchasing impaired assets will create liquidity and promote price discovery in the markets for these assets, while reducing investor uncertainty about the current value and prospects of financial institutions. More generally, removing these assets from institutions’ balance sheets will help to restore confidence in our financial markets and enable banks and other institutions to raise capital and to expand credit to support economic growth.

This is largely rubbish. As we have reported, the plan makes no sense (in terms of assisting banks) unless the Treasury buys assets at above market prices. Indeed, a Congressional staffer told us that Paulson has said in briefings that that is precisely what they will do. This will not aid in promoting price discovery. Quite the reverse. It establishes a phony bid which will prevent finding out what assets are truly worth and will deter private buyers from bottom-fishing.

Bloomberg reports that Bernanke puts aside his formal testimony and spoke off the cuff:

“I believe if the credit markets are not functioning, that jobs will be lost, the unemployment rate will rise, more houses will be foreclosed upon, GDP will contract, that the economy will just not be able to recover,” Bernanke told the Senate Banking Committee today. “My interest is solely for the strength and recovery of the U.S. economy.”

The Fed chair seems unable to accept that there are no good outcomes from where are are now, only bad and worse ones. And his final comment, which suggests that he is not self-interested, is odd, to say the least.

Moreover, even with this magnitude of program, it isn’t clear if the amount purchased will in fact restore confidence. We still have the massive overhang of credit default swaps. Bridgewater Associates estimated that banks (as opposed to securities firms) would need over $500 bilion in new equity to recapitalize themselves and had raised only roughly $160 billion. The amount of recapitalization is the amount of overpayment for assets, not the gross amount of purchases. Thus if the Treasury overpays by, say, 25%, that is tantamount to only $175 billion of recapitalization, short of what is needed.

We have said before that this program is an inefficient, covert way to recapitalize the financial system. If I were a foreign central bank, I’d have a lot more confidence if the US imposed regulatory reform, took over dud banks, got rid of top management, and then did the good bank/bad bank split. That’s a model that has worked and could be modified and improved. But for some unknown, the powers that be are refusing to employ formulas that have worked and prefer their own home-cooked brew.

Update 4:15 PM It turns out we are in good company. Bank analyst Meredith Whitney, who has been the most accurate in her cohort in calling the credit crisis, says the bailout bill will do little to help. From Reuters (hat tip reader Dwight):

The credit crisis that began last summer has intensified so much that any U.S. government bailout plan has “little hope” of improving core fundamentals over the near and medium term, said analyst Meredith Whitney.

The Oppenheimer & Co analyst cut her outlook for U.S. banks and forecast further dividend cuts and capital raises at banks. She projected a quarterly loss for Citigroup Inc

“Since the onset of the credit crisis, over $2 trillion less liquidity has flown through the U.S. domestic capital markets than during…a year prior,” Whitney said.

“With that much less available capital, both consumers and corporations have and will spend less,” she added.

As the consumer comes under more pressure in the difficult economy, credit card debt may grow, Whitney wrote in a note to clients.

Whitney, however, noted that tighter credit standards and credit line reductions have already strained more consumers into defaulting across the spectrum of lending products.

“Credit market disruption has had underappreciated consequences on the economy… what started last summer has accelerated and intensified so much so that we believe any government bailout plan has little hope of improving core fundamentals over the near and medium term,” Whitney said.

Yves – a little Treas watching

Last year, Fed debt was flat during Sept – from 9.001T to 9.007T – seems normal as they say

This year Sept is already up $140Billion, mostly in last 6 days since Wed, 9/17

9.646 9/01

skip to Wed, 9/17

9.647 Wed – normal, up 1B

9.664 Thurs – plus 17B

9.727 Fri – plus 63B

9.785 Mon – plus 59B (rounded)

And there’s plenty more auctions to come this week (but minus the paydown of Thursday’s due bills)

link is to daily history search @ treasurydirect

Here’s an idea – why does Paulson have to worry about whether the banks will be willing to sell the assets at a price that makes sense for taxpayers? MAKE THEM DO IT, Hank! Take Ben with you and walk into C headquarters and tell Vikram Pandit that he is fired and that C is now under government supervision. THe government has decided that C will sell all its problem assets to Treasury for next to nothing. In exchange for this “rescue” of C, the government will also take 80% of the equity in C.

That’s nuts! The government can’t do that, can it?

Sure it can. Ask FNM and FRE shareholders.

Yves,

Your reasoning is correct. Perhaps the answer to the refusal of employing known formulas rests with simple politics.

A hard medicine favors democrats (by exposing the cumulative errors of the ruling party). MOAB favors the Republicans because it creates a short-span illusion of a spectacular, corrective action (emphasis on the illusionary part).

Perhaps the quality of the collateral the Fed now holds as a result of their expanded facilities has them concerned? Add some increasing counterparty risk to the equation as well? Could be Bernanke is feeling a bit picked off…..

Wonderful post as usual, Yves.

Matthew Dubuque

My view is that this 700 billion dollar package, which CLEARLY needs SUBSTANTIAL revision, is a necessary first step in the process.

Necessary, but NOT sufficient.

What will then be necessary is a substantial recapitalization of the banks, once these toxic assets are taken off their books at a price reasonably consistent with fairness to the taxpayer.

The big push seems to be for that capital to come from Asia. Several data points support that.

An additional Treasury request to Congress for bank recapitalization seems likely to be submitted before March 1, should Asian capitalization of our banks prove insufficient before that time.

Additionally, I’m getting a sense that the Bank of England may need to be recapitalized within the next two years. At this juncture, it is unlikely that the Federal Reserve would need to be recapitalized.

As for credit default swaps, they of course can easily sink us all.

Due to the opacity of these the solution will not be at all easy, for a variety of divergent reasons.

Indeed, one reason that the CDS market has not completely come apart at the scenes (other than the brilliant Fed move with respect to AIG) is that the market is so lacking in transparency that nobody still has much clue who owes what to whom when.

That uncertainty, of course, is exacerbating risk premia systemwide.

The ONLY time where we MAY POSSIBLY be able to conclude that we can see the end of this is at the end of February, and that is by no means assured.

Until then, we are in a very serious jam, more serious than most people, including Roubini, seem to understand.

Matthew Dubuque

Yves,

Fantastic work as usual. This bailout seems like a half-a$$ed measure to me too. Other than the typical political posturing that a bailout favors Republicans, I would appreciate any of your thoughts on WHY they aren’t taking the more concrete route of simply taking over the financial system. I mean, that’s where we’re heading anyway, right? That’s really the only thing that’s going to fix this mess in the long run. Maybe they just don’t want to be the one’s to have to do it.

Mike

According to Bloomberg, Bernanke wants to use 700 billion dollars to pay for various bank’s debts at well over the market price (which he calls fire sale price). Rather he wants to donate to the banks “hold-to-maturity price.” Apparently Paulson also told Congressional leaders his intention to do the same.

Why is the media not addressing this key issue more? What are the members of Congress saying about this blatant abuse of taxpayers’ money?

Someone please tell me how we can better voice our opposition to this hijacking of our democracy.

Yves,

I believe somewhere in the testimony was hidden that the assets would be bought by “holding-to-maturity” price, i.e. banking book price. I’m no expert on this, but some people who are suggested that this can easily enough be twice the “market” price. Anyone knowledgeable who could shine some light on this?

I’m dying to see who is going to be appointed to manage this thing (as far as i saw, congress didn’t ask any ?’s about this…did anyone hear otherwise??? amazing, if they didn’t)

Bernanke said in his testimony that the prices going up help everyone. This guy is seriously deluisional. Agree Yves this guy is simply deluisonal.

Please please make congress read this!

The economy is going to contract NO MATTER WHAT.

We’re broke, people!

The economy has clearly benefited from the creation of credit via leverage during the past 15 years and during the past 8 the scale of credit creation using SFR as the backbone has gone off the charts.

This credit creation with little capital reserve has been a increasingly critical part of our modern financial system and clearly it will be shrinking along with most of the financial sector.

I think the charts are suspect.

Meltdown mode only started a little more than a year ago and yet we are in the early stages leading to a depression. Until RE picks up along with consumer spending (both years away) there is no hope of funding bailouts without inflation.

Failing economy leads to less tax revenue. Without higher taxes for funding this amount of outstanding debt, it could be carried on the books for decades. At very least higher % rates are just around the corner, the markets will demand it.

[Aside: I think Germany had the worst bear market lasting 15 quarters.]

“My interest is solely for the strength and recovery of the U.S. economy.”

When a Fed Chairman says that you need to grab ahold of your wallet and hang on for dear life.

Yves, Guys,

A functioning banking system is essential and even more so, in a country with such high dependence on debt as the US.

Although even without a banking melt down the economic perspectives are poor, the result without this Paulson-Bernanke RTC-style package will be disastrous. (think GDP collapse by 10%)

It is absolutely necessary for congress to approve this for anyone to have any hope in anything.

Freeing up banks’ balance sheets will let them lend to companies and individuals, and cushion the strong deleveraging shock, which is upon the US economy in either case.

Let’s hope it gets passed soon.

FR

It probably wouldn’t look good to have hundreds financial of boards-of-directors thrown out of work this close to election time.

People in those postions do not vacate them lightly, and they also have many close friends, classmates and acquaintances in congress. They also employ lobbyists and are large campaign contributors.

I fully expect to see the US Taxpayer robbed blind by this administration, on behalf of this sociopathic criminal class.

And by the way: the US is becoming a nation of savers, from consumers previously, in the next years.

Anon of 4:02 PM,

Reinhart and Rogoff have made extensive study of financial crises. They’ve created an database of crises going back 800 years (obviously a lot more/better data points on more recent crises than old ones). They have studied banking/financial crises, not recessions or downturns that come from other causes.

FR,

See the updated version of this post. As various bloggers recounted over the weekend, virtually no economist or financial commentator favors the bailout proposal. Committing this much money to a flawed course of action precludes more effective measures.

Matthew Dubuque

Matthew Dubuque

Matthew Dubuque

Matthew Dubuque

You are worse than listening to the politicians today. Your manner of speaking is condescending and you add nothing at all to these exchanges.

Matthew Dubuque

Matthew Dubuque

Matthew Dubuque

Matthew Dubuque

“A functioning banking system is essential and even more so, in a country with such high dependence on debt as the US.”

So we should go into even more debt?

There is, I would humbly submit, a difference between a plan and a plan which works. What we have before us is a plan, to spend lots of money with the threat that things will get much worse if not enacted. But we don’t know that this plan will not have an equally bad outcome; in fact I suspect if implemented it would lead to an even worse outcome.

At some point you have to say, Enough.

Yves,

In my opinion this not a ‘flawed course of action’.

It will put a bid on a lot of credit assets (mostly mortgage-related), which are held by banks.

Today’s many senior tranches of mortgage debt are marked at 20%-30% in banks’ books. This is the ‘fire-sale’ price as Ben called it. These securities, if held to maturity under most economic scenarios may be worth, say, 50%-60%. They may have positive returns, but currently there isn’t enough capital in the system (and confidence…) to buy and hold them. The idea is that the government takes that role for a couple of years.

700bn is 5% of the mortgage debt stock and a significant amount. It is also not ‘expenditure’ in the budget, but rather an investment.

From what I have seen today opinions on this proposal are mixed, and certainly not all negative – at least in investment circles. Politics is a different issue.

Yves,

Great post!!!

Re: “I’ll be charitable and assume he is deluded rather than being dishonest.”

(¯`♥’¯)

Ouch, my back!!

At one point in testimony today one of the terrible twins (I believe it was Ben) made the comment that some of the $700B would be used to purchase second leins (mortgages) for ‘pennies on the dollar’. The purpose of these purchases is ‘to clear the way for action to be taken on first mortgages.’

I would like to know what second lein holders are going to settle for ‘pennies on the dollar’? Second leins are generally recourse loans and therefore, theoretically, more collectible than non-recourse first mortgages.

I believe that whoever settles the second leins will have to pay much more than ‘pennies on the dollar’ to do so.

River

Well, this is easy to fix…take the bailout and use it to reduce tax rates on working families – that is about $4500 per year tax cut, or about $90 a week in each paycheck.

Interestingly enough, that would also solve the mortgage crisis which is at the root of the problem.

But, of course, I don’t have a degree in economics, so this comment can be safely ignored.

Unfortunately this stealth recapitalization rewards the incompetent managers who gorged on poor quality debt. Correspondingly it will penalize those conservative managers through increased interest rates, and subsequently and inevitably increased tax rates to pay for this foolish bailout.

It would almost make more sense for Ben to load up his helicopter and dump dollar bills over Central Park. For $700t I wonder how long that would take? At least it keeps him out of trouble.

“but currently there isn’t enough capital in the system…to buy and hold them. The idea is that the government takes that role for a couple of years.”

Fr, if I understand you correctly, you are saying there isn’t enough capital to buy these assets. In that case, i have to disagree. There is plenty of capital waiting on the sidelines (~$10tr in mmkts alone). The problem is that there are no sellers. Nobody wants to take the losses. Plain and simple.

Now, if the TARP managers get better access than these other pools of capital and can actually value these things and actually pay an appropriate price (which makes many, me included, skeptical), it will make this an incrementally better plan.

Otherwise, for all intents and purposes, the treasury is just be another pool of capital, trying to coax sellers to sell.

“Why are we unwilling to accept the inevitable?”

Does anyone else have “In God We Trust” printed on their money?

Saying “I believe if the credit markets are not functioning, that jobs will be lost, the unemployment rate will rise, more houses will be foreclosed upon, GDP will contract…” is of course a truism. His motive here is so obvious: pass my bill or you are responsible for the calamity that ensues. So predictibly Bush — just blame everyone else for your screw-ups. Never take responsibiliity for anything. Congress should tell Bernanke to go pound sand.

Assets-in too many cases we do not know their true value.

Market Price- banker’s fiction.

Other countries need our market so it is not as charitable as some like to paint it.

We should let the market correct.

It occurs to me that Treasury is asking American taxpayers to invest in a $700 billion (+) “blind pool.”

Banks should not be extending further credit.

We want to free up their balance sheet? Give me a break. They are horrible stewards of capital. Look how lax mortgage lending standards were in the last five years. Do we want to give these bank managers another go around. At the end of the day, the U.S consumer needs to de-leverage the balance sheet, which will require credit CONTRACTION.

And even if we freed up capital and the banks were WILLING to lend, maybe consumers would balk at the idea.

What’s I’m saying is the bailout means nothing if there is a liquidity trap. Yes, we can clean up bank balance sheets. Yes, the Fed can inject liquidity. Yes, the banks can use that liquidity to make longs. But NO, there is no guarantee the U.S consumer will take it.

Think liquidity trap. Kinda makes what were talking about seem inconsequential.

Correction– I meant to say the banks can use the liquidity to make loans.Yes, the banks can recapitalize and dilute existing shareholders. But no, there is no guarantee U.S consumers will take on additional debt.

Again, just pointing how a liquidity trap negates any potential economic benefits from the bailout plan.

Ok, how’s this for an idea?

Pegging any sort of asset value to the dollar is going to backfire on us. (inflation or deflation)

SO: To hell with the fed and the dollar.

1. Congress creates a new national bank with a new currency.

2. This national bank is backed by the asset value of all of the federally-owned mineral rights, domestic energy sources and public utilities (which will also (have to?) be nationalized).

3. This national bank buys up foreclosed homes, distressed CDO’s etc. *But pays for them with the new currency.*

4. This national bank also pays (creates) currency at market rate (in it’s new currency) for any fuel or energy generation- giving an incentive for domestic energy generation.

5. This sort of currency is not-quite-fiat, in that the amount of currency can expand as the amount of potential energy in the system expands. (Rather than pegged to a fixed mineral availability like gold.) It would provide economic incentive to increase the total potential energy and effiency in the system, rather than leverage the future.

Yeah? Crazy? Probably. However, remember thermodynamics:

IN = OUT!

I just don’t get it. Paulson looks, talks, gesticulates and blows snot like a moron. In every sense he’s the perfect beer drinking buddy for Bush. We all treat this cretin like he’s some sort of miracle worker. He isn’t. He’s just one more Brownie from the Bush cookie jar. He’s an incredibly lucky, stupid and ruthless jock. It’s a sad state when a guy with less on the ball than Gerald Ford can hold this country hostage.

Hank The Lord above gave man an arm of iron

So he could do his job and never shirk.

The Lord gave man an arm of iron-but

With a little bit of time, With a little bit of time,

Someone else’ll pay the blinkin’ bill! The three

With a little bit…with a little bit…

With a little bit of time you’ll never have to pay the bill!

This plan makes sense and it is not intended as a bondoggle or recapitalization.

As I understand their intentions, Bernanke and Paulson will buy assets at or near where the banks now have them on their balance sheet (typically somewhere in the range of 20 to 50 cents on the dollar).

The problem that they see is that the only buyers out there (to the extent that there are buyers at all) are at 5 or 10 or 15 cents on the dollar. No individual bank wants to sell into this type of a market as the result would be further write downs, no bonus, lower stock price, and possible job loss for CEO.

“Tough shit”, you might say. But the problem is that the banks are holding on to these assets and instead shrinking their balance sheet by cutting off loans to consumers and business i.e. the lifeblood of the economy. So “tough shit” for the banks is also, unfortunately, “tough shit” for joe sixpack.

The answer as per the Treasury’s proposal is to come in at our near the banks mark-to-market. Allowing the banks to get these bad assets off their balance sheet without significant hits to capital will help salvage the bank’s ability to fund the real economy. The credit contraction will continue but the Treasury’s effort will mitigate (but not eliminate) the impact on the real economy.

So I think the plan makes sense and is not a “bail out”, bondoggle or recap as most people see it. But Paulson and Bernanke need to do a much better job communicating exactly what it is they are trying to do, and why it is worthwhile, because people are still not clear on either issue.

Ok, this will be my last post on this forum.

I’m quite surprised. Everyone criticizes this proposal around here. And there is one general misconception. It is not a wall street bail out. If worst comes to worst (ie financial melt down, -10% GDP, +5% unemployment, deflation etc), I can assure you that the top-income bracket will be better off in relative and absolute terms than the bottom or middle income bracket.

This is not to save the CEO’s and executives – at least not in the first place. These guys are better informed, they will sell assets earlier, will have more cash and resources to live during after a melt down. The worst hit will be the working class who will loose their jobs, retirement and savings.

To the best knowledge of Bernanke and Paulson this is the best thing to do right now considering the circumstances. I absolutely believe this. It’s not the first time this is done – with a variation it’s been implemented in ’89 and worked well (RTC). In Sweden (in early 90’s) a similar solution end up making money for the government in the end. There are risks, but at this point there is no risk-free solution.

And Paulson is not Bush, not even comparable, so please…

Fr said, the executives and Ceo’s are better informed.

Are you sure about that? Compensation is paid in stock. So why make sub-prime loans that blow up and drive the company share price down?

You act like the Ceo’s of AIG, LEH etc bailed out of there positions entirely. Just the opposite is true. They some sold shares but still hold large stakes. Look no further than Hank Greenberg.

FR,

Had you bothered to check other blogs, particularly those of Serious Economists, the opposition to this plan is nearly universal. It isn’t a quirk of the people who are regular readers here.

This plan is grossly deficient, and your comparison to Sweden is inaccurate. In Sweden, they took over failed banks, kicked out management, recapitalized them, sold dud assets, and later brought them public.

Tell me what elements of that plan are in the Paulson plan? Its biggest failing, aside from the blank check, is the lack of reforms to the system or to individual members.

This blog advocated the Swedish program long before it became popular to do so. The Paulson program has just about nothing in common with it save the size of the exercise.

Paul Said:

“It would almost make more sense for Ben to load up his helicopter and dump dollar bills over Central Park. For $700t I wonder how long that would take? At least it keeps him out of trouble.”

I think this is what he is doing, only he is dumping them over Wall St.

Connect the dots (he is about to put in place a plan that will maintain a $700B deficit in China’s biggest debtor):

http://www.timeinc.net/fortune/conferences/global05/program.html

GLOBAL FORUM 2005

China and the New Asian Century

May 16-18, 2005

THE NEW ASIAN CENTURY

Speakers:

Nobuyuki Idei, Chairman and Group CEO, Sony Corp.

John B. Menzer, President and CEO, Wal-Mart International

Henry M. Paulson, Jr., Chairman and CEO, The Goldman Sachs Group, Inc.

Yang Yuanqing, Chairman, Lenovo Group Ltd.

Also, an article on the subject from June 2006, questioning Paulson’s ties:

http://article.nationalreview.com/?q=YTFmYjBmMzZkOTc0YTYwM2I4YTZlODFlYTRmZTdkYjA=#more

“As the Senate Finance Committee considers President Bush’s nomination of Henry Paulson to be the next secretary of the Treasury, the question is not whether he will be confirmed. That seems assured, as senators in both parties behave like star-struck groupies in the presence of a Wall Street “master of the universe,” whose net worth, from his time as a senior executive of Goldman Sachs, is estimated to be on the order of $600 million.

Rather, the question is: Will any of his Senate interlocutors even bother to explore the nominee’s troubling fifteen-year ties to Communist China and the potential for serious conflicts of interest they pose, with national security as well as economic implications for our country?”

And from his Wikipedia entry?

Paulson has been described as an avid nature lover.[11] He has been a member of The Nature Conservancy for decades and was the organization’s board chairman and co-chair of its Asia-Pacific Council.[7] In that capacity, Paulson worked with former President of the People’s Republic of China Jiang Zemin to preserve the Tiger Leaping Gorge in Yunnan province.

Paulson is also on the Board of Directors of the Peregrine Fund; was the founding Chairman of the Advisory Board of the School of Economics and Management of Tsinghua University in Beijing; and, previously served as chairman of the influential trade group, the Financial Services Forum.

Paulson was Staff Assistant to the Assistant Secretary of Defense at The Pentagon from 1970 to 1972.[7] He then worked for the administration of U.S. President Richard Nixon, serving as assistant to John Ehrlichman from 1972 to 1973.

He joined Goldman Sachs in 1974, working in the firm’s Chicago office. He became a partner in 1982. From 1983 until 1988, Paulson led the Investment Banking group for the Midwest Region, and became managing partner of the Chicago office in 1988. From 1990 to November 1994, he was co-head of Investment Banking, then, Chief Operating Officer from December 1994 to June 1998;[8] eventually succeeding Jon Corzine (now Governor of New Jersey) as its chief executive. His compensation package, according to reports, was US$37 million in 2005, and US$16.4 million projected for 2006.[9] His net worth has been estimated at over US$700 million.[9] Paulson has personally built close relations with China during his career. In July 2008 it was reported by The Daily Telegraph that: “Treasury Secretary Hank Paulson has intimate relations with the Chinese elite, dating from his days at Goldman Sachs when he visited the country over 70 times.”[10]

Why don’t the authorities just use the $700bn to recapitalise the banking system by buying $700bn worth of preferred shares from troubled financial institutions? Having $700bn injected into the banking system in the form of core capital must surely bolster confidence among market participants, and can provide a large cushion against potential future losses.

I’m with fr on this. But I think Bernanke and Paulson have to do a much better job of explaining alternatives and selling their plan as the best of a sorry lot, given the tremendous amount of distrust that is out there.

They should explain why their proposed use of the 700 large is better than the alternatives. Why it is better than the suggestion that they just recapitalize banks via preferred infusion, for example. I think the answer is that recapitalization is typically the response to a bank getting into trouble (i.e. it is reactive and case by case), and still raises many similar problems regarding who to support, by how much, how to value infusions, and how to manage holdings.

Or why it is better than 700 bn of tax rebates or other fiscal stimulus. I think the answer is that fiscal stimulus would still leave banks mortally wounded, so that the problem would recur once the impact of the stimulus dissipates. This was Japan’s experience. This is why the first stimulus package seemed to have no impact on the credit crunch. And this is why the Fed has placed so much emphasis on a targetted strategy via its special lending facilities.

Or why it is better than doing nothing. As Paulson emphasized, taxpayers are on the hook no matter how Congress proceeds. There is no easy way out, and what they are proposing is not a magic bullet. But it is the most efficient, least cost strategy to mitigate the impact of what is happening.

So Paulson and Bernanke must raise their communications game. But the facts support what they are trying to do with this new facility. Clearly banks are looking to deleverage. It make sense to help them get rid of the harder to value less liquid stuff to avoid having the more liquid stuff (the plain vanilla working capital loans to SMEs, for example) bear the brunt.

Again, the crisis has caused distrust and cynicism to reach incredible heights. The institutional failings seem to be everywhere (the financial community, congress, the executive, the regulators). No one is perceived as blameless. Yet these institutions are all we have. The Treasury and the Fed are all we have. Is it impossible to believe that, having failed so miserably over the past 5 years (or longer, according to some), they might nonetheless still retain the capacity to rise to the occasion in a moment of crisis??

Yves,

Ok, Sweden was taking over failed institutions, but the point here is that it’s better to strengthen the system (ie balance sheets) than wait until the banks end up like Lehman’s one by one and then take them over. The econoomy would suffer incredibly in the process ie. Great Depression when hunderds of banks failed.

Reform is another question and both B+P agree that it’s necessary but it can not be done in the same timeframe (by the end of the week?) as this bill.

Anon,

I’m glad we share a view here.

The problem with making equity injections is that you only tackle very ill institutions, which have no alternative. This means that until they get to that stage, they will stop lending and contaminate the rest of the system with forced-selling, reduced lending etc. Another point is that you’re more likely to focus on the large players, whereas small banks would be deemed less important and deciding which bank meets the criteria would be tricky and politically sensitive.

Buying credit lifts all boats, and that’s why it appears to be such an appropriate solution. It also helps the housing market by reducing interest rates.

As a side note: I like Sergei’s comment… a lot of people have taken up this idea (ironically or not) – today’s FT has a picture of Paulson throwing money on Wall St with a spade.

So FR,

Friend, I almost don’t even know where to begin with your remarks. But I’ll try here: ” . . . [T]he point here is that it’s better to strengthen the system (ie balance sheets) than wait until the banks end up like Lehman’s one by one and then take them over. ” The direct implication of the preceding statement is that every taxpayer should walk into their bank and donate $1000 to that bank ‘for the good of the system.’ You are really advocating that, that we pay the bankers for the privilege of absorbing their losses for them? The public has no obligation, zero, nada, to _give_ their money to bankers ‘in difficulty.’ If those banks don’t like the terms of private capital, that’s too damn bad: they can sell their firms for $.15 to face, and that is their problem for the costs of their past decisions. If they refuse to do so and teeter toward insolvency, they should be seized outright at no compensation to their management, shareholders, and precious little to their bondholders. If ‘the system’ involves guarantees of wealth at public expense, it’s a mafia.

Look, Congress could just as well authorize $100 billion in funds to establish ten publicly owned banks to take up the slack from whining banks which won’t lend or get out of the way. Why, then, should we just _give_ the money to failed bankers? Even supposing that the system has to be saved, that doesn’t imply that we save THEM, much as you seem at pains to conflate those two quite separate outcomes. Or you. Rising credit, does NOT lift all boats: if floats all yachts while the rest of us have to row dories to get anywhere.

The Swedish plan was the exact opposite of the Paulson plan. And it would be far better if we rapidly seized failed institutions, both to clear the market of deadweight overcapacity and as a message to other firms that Santa Claus isn’t paying for their presents so they can sell themselves to recapitalizers or be seized for nothing. As they deserve.

This doesn’t even get into the issue that housing assets are radically inflated in price and _must_ come down for the economy to return to any kind of functionality. This process would be impeded by the kind of cash push you seem to support. Of course the _banks_ wouldn’t take the eventual losses, having offloaded the rot to the public for far over its eventual clearing price if we follow Paulson’s advice. —But hey, they ‘system worked,’ right: No losses for those on the inside. While the rest of us pay for the rest of our lives on the debt shucked to us by said lucky insiders. That’s what you’re proposing. You first, FR: Be a Lloyd’s name for us, and step up to pledge YOUR personal net worth to back the banking system.

Just as a point of order, FR, this isn’t a forum and we don’t post; it’s a blog and we comment on the posts of Yves and others.

. . . But if you have more to say on the societal value of bankers in a pinch and their bondholders reaching into the pockets of everybody else for the money to make themselves whole, I suppose we’ll hear about it.

FR wrote, It also helps the housing market by reducing interest rates.

Fact is that interest rates weren’t all that high even before we bought Fannie and Freddie.

Right now rates are at 6% or less, IIRC, which is pretty cheap IMHO.

The real reason for the bubble is the absurd terms of so many mortgages: no doc loans, no money down (possibly using a second mortgage). In that environment, a 5% down, income documented loan was conservative, AFAICT.

(I had thought that decreasing rates was a major driver of the bubble until I bought a house myself and looked at monthly payment tables. The drop in rates from 2000 to the height of the bubble explains only a pretty small fraction.)

The easy credit conditions aren’t going to return, and it should be apparently that reinflating the bubble isn’t going to work.

Richard, Anon,

I thought this discussion was closely related to Yves' original post, as it discusses the arguments for and against the bail-out plan. If you think my posts are inappropriate in that respect, let me know, and I'll stop.

Now, let me take a step back and exlplain my point of view.

1) We are in a bubble of historic proportions and the chart from the original post illustrates that point well. The debt build up came from two sectors: financial and consumer. Within the cosumer, morgage debt is the big chunk and is today at 75% of GDP and grew from 47% of GDP in 2000. It is this increase in leverage that fuelled the housing+credit bubles. Now we will have to deal with the consequences of this. The US is probably the only country that can hope to avoid a disaster as most of its debt is in its own currency and the USD is still the reserve currency for the dollar-zone (Asia+Middle East).

2) We are where we are, and no matter what we'll do house prices will fall further, credit conditions will remain tight for a long time, consumers will become savers and the next 10 years will be nothing like the last decade. The choice we can make today is between an orderly wind down of the pile of credit or a disorderly collapse. The later option would be extremely painful and I'm sure deep inside noone wants that. The Paulson plan is aimed at providing the conditions for an ordinary wind down. I would agree that too low interest rates have caused this bubble, but I also think that now very low interest rates (at the consumer level, not on goverment securities) will be necessary to cushion the shock.

3) This is a sidepoint, but I think missed by many. Changes in leverage are the key driver of economic growth (at least in the medium term). It's not like the banks can go bankrupt, bankers on unemplyment, and the rest of us will be living happily. The fact that households have >100% of GDP means that if this source of financing disappears (ie rolling it over no longer possible) it will be disaster, not a slowdown, but disaster. Functioning credit markets are essential for any hope of economic growth going forward. It's a necessary condition, although not sufficient.

So it's in the best interest of everyone (from high-net worth to unemployed) to subsidize the banks in the short-term and reeastablish their proper functioning.

And one more point, this is _not_ giving money to bankers. This is buying assets (essentially different types of bonds), which will have a return and in many cases will generate a respectable profit for the treasury. The objective is to stabilize or prop-up their value to avoid a disorderly collapse.

Another way to think about is that the US has 350% of debt, of which ~50% is on the gov level and the rest is private sector. The private sector debt is taking a hit and it's simply a temporary transfer of ~5% of private debt to the government. I don't this is such a high price to pay considering the hopeless situation the US found itself in, much more typical of Emergin Market countries over the past 30 years.

Anyway… there is hope, I see the following news: *SEN. SCHUMER: `HIGHLY LIKELY' THAT BAILOUT PLAN WILL BE PASSED

This is buying assets (essentially different types of bonds), which will have a return and in many cases will generate a respectable profit for the treasury. The objective is to stabilize or prop-up their value to avoid a disorderly collapse.

This is extremely disingenuous. If the bonds are marketable, then investors will snap them up at market clearing prices. But the fact is the bonds are terrible investments, which is why the taxpayer must be enlisted to pay inflated prices for them.

So FR,

I wouldn’t say, offhand, that your comments are inappropriate per se. They strike me as ill-considered in depth, and reasoned against only part of the context facing the financial system.

1) We are in the deflation of a major bubble; on that we agree. Every asset class has been bloated by a third or more. Prices will come down to cash flows (and probably overshoot). Nothing can be done to prevent this, and only a little can be down to slow it, which in turn will only prolong the decline phase. We have the reserve currency now—but we won’t the second we pass this bailout. Rates will have to soar, our currency will dive, and the indirect damage we do ourselves from _that_ outcome will more than exceed the problems we have from a collapsing bubble: This is something you do not seem to anticipate, or perhaps accept. I suggest that you consider the issue more closely. [This potential has been discussed at length for many months by Yves here, and I won’t resummarize, but you might search the archives if you haven’t already.]

2) We are in agreement, as are most, that nothing can be done to stem the eventual price declines, and that consumption in the US must and will decline in tandem. You appear of the view that something in the Paulson Proposal will ‘stem a disorderly decline’ which otherwise ‘is unavoidable’ [my paraphrase, but an accurate one I believe]. It is true that the public deliverance of money to the bondholders of the US financial industry will stem the disorder in _their_ unwind_, but it will do little to save the institutions themselves. Their are many other failures coming; consider Commercial Re just as one. This massive round of funding will be the last real pop the US will have before the negative impacts on our sovereign debt and subsequent yield rises on Treasuries push us up to (and very likely beyond) the threshold of default. So using this dollop of money to repay bondholders without repairing the banks means that we bankrupt ourselves for nothing.

3) No one wants to try to live in a country without banks—but this is exactly why we can’t affort to use up public spending power bailing out bondholders. We need to think more clearly about how to save the banking system: What are their real assets? Their depositors. So we save the depositors, but leave the equity and bondholders out of it. Consider several hundred billion in private equity, a hundred billion or two in foreign equity, and matching money or more from the US: That is enough to reconstitute the equity of uncompromised firms, from scratch, or more likely saving the large share of the banking industry which is _not_ insolvent but which is hurting.

The real point here is that banks and bank like firms which are insolvent need to be taken out, so that the cease consuming equity and credit in the system: We need to cull they dying, not spend our last best shot saving their stakeholders. That is all the difference in the world. The issue is not, FR, as you would pose it, a choice between an orderly or disorderly deleveraging; it is a choice between separating sheep and goats or giving them all a fat feed pail while hoof and mouth wipes them out entire. Cull, don’t cozzen.

And another question, FR: would you care to disclose your own positions on the paper and assets you are talking up here? For the record which others know but you may not, I don’t hold a dime in or against any one.