One of the arguments made by bottom-fishers is that not only are stocks “oversold” (a technical notion that reflects recent trading activity, such as trading volumes, price in relationship to various moving day averages) but are also cheap based on fundamental notions of value.

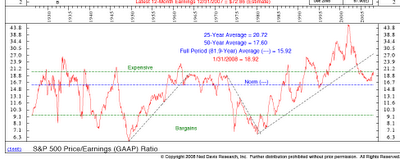

We have been somewhat leery of any long-term valuation notions given the fact that the US economy has gone through 20 years of growing leverage, with a steepening of debt levels in the mid 1990s, and a further ratchet up starting in 2004. The post 1996 period (starting the time Greenspan made, and then retreated from his famous “irrational exuberance” comment) shows a marked deviation from previous valuation norms (and that further suggests that removal or adjustment of the bubble era would have a big impact on norms as well). Click to enlarge:

Gross focuses on the role of leverage versus deleveraging, as well as government intervention, in the prospects for stocks. He concludes that those two factors mean that stocks might not be so cheap after all. Note he first looks at measures like the famed Q ratio, which suggests stocks are a bargain, and then P/E ratios, which are only a tad below their mean for the last 100 years.

Key excerpts from his monthly missive (boldface his):

We will not go back to what we have known and gotten used to. It’s like comparing Newton and Einstein: both were right but their rules governed entirely different domains. We are now morphing towards a world where the government fist is being substituted for the invisible hand, where regulation trumps Wild West capitalism, and where corporate profits are no longer a function of leverage, cheap financing and the rather mindless ability to make a deal with other people’s money. ….

Corporate profits have been positively affected for at least the past several decades by several trends that appear to be reversing. Leverage and gearing ratios – the ability of companies to make money by making paper – are coming down, not going up. In addition, the availability of cheap financing – absent government’s checkbook – will likely not return….

Gross does not mention that this last upturn saw an unprecedented portion of GDP growth going to corporate profits, as opposed to labor. Labor has had no bargaining power, and companies have been running as lean as possible in a nominally good economy. There will likely be some reversal of rules that worked against unions, but it is not clear whether this will help average workers much.

Globalization’s salutary growth rate of recent years may now be stunted…..investors should not bank on the free trade mentality of recent years to support historic growth rates….

Animal spirits, and with them the entrepreneurial dynamism of risk-taking has likely experienced a body blow….the rules will be changed and hormone levels lowered.

The benevolent fist of government is imperative and inevitable, but it will come at a cost….Profit and earnings per share growth will suffer.

My transgenerational stock market outlook is this: stocks are cheap when valued within the context of a financed-based economy once dominated by leverage, cheap financing, and even lower corporate tax rates. That world, however, is in our past not our future. More regulation, lower leverage, higher taxes, and a lack of entrepreneurial testosterone are what we must get used to – that and a government checkbook that allows for healing, but crowds the private sector into an awkward and less productive corner. Dow 5,000? We don’t have to go there if current domestic and global policies are focused on asset price support and eventual recapitalization of lending institutions. But 14,000 is a stretch as well. One only has to recognize that roughly 20% of bank capital is now owned by the U.S. government and that a near proportionate share of profits will flow in that direction as well.

We noted before that in 1980, financial shares were a mere 8% of S&P 500 earnings versus over 40% at the stock market peak. The financial services industry will shrink as the economy delevers. Some of those earnings are not coming back.

now we are valuing stocks on tobins Q. Therein lies the true tell.

Bill Gross finally gets it. That might be a time to sell, because if he gets it now and is setting up people for reality, that means everything he has touched is going to turn to garbage. Being a shill like he is, makes me question his motivation for even speaking at this point!

I’m still interested in the yield curve, which I think is way over-valued, thus stocks are a screaming bad deal and so are bonds.

This is my problem:

I think the Yield Curve is contaminated which has resulted in a broken model and a curve that represents massive fraud or misrepresentation of future value.

If, The standard deviation factor of the yield curve is not working properly, then one has to wonder about sample and date errors, and then question how long the model has been wrong or contaminated, and thus, what it will take to re-build reality back into the system; this may be a reason for systemic failure.

Hate to sound like a broken record, but as yields fall to zero, as with the 13-week Treasury bills, something is very wrong and it isn’t just too much inventory:

http://en.wikipedia.org/wiki/Yield_curve

Fitting using parameterised curves (such as splines, the Nelson-Siegel family, the Svensson family or the Cairns restricted-exponential family of curves). Van Deventer, Imai and Mesler summarize three different techniques for curve fitting that satisfy the maximum smoothness of either forward interest rates, zero coupon bond prices, or zero coupon bond yields

Also see; http://en.wikipedia.org/wiki/Cox…soll- Ross_model

The standard deviation factor, , corrects the main drawback of Vasicek’s model, ensuring that the interest rate cannot become negative. Thus, at low values of the interest rate, the standard deviation becomes close to zero, cancelling the effect of the random shock on the interest rate. Consequently, when the interest rate gets close to zero, its evolution becomes dominated by the drift factor, which pushes the rate upwards (towards equilibrium).

«The post 1996 period (starting the time Greenspan made, and then retreated from his famous “irrational exuberance” comment) shows a marked deviation from previous valuation norms (and that further suggests that removal or adjustment of the bubble era would have a big impact on norms as well.»

I’ll repeat here my usual guess: in 1995-1996 the USA gov. essentially abolished fractional reserve, and the Japan gov. started their 0% lending policy, and this created a colossal credit bubble:

http://www.nowandfutures.com/key_stats.html

This among other things has resulted in enormous increases in stocks traded on margin:

http://bigpicture.typepad.com/2007/10/margin-debt-gro.html

I’ve been using the Flow of Funds data to follow Q, basically, line 35 from B.102 divided by line 32 (net assets.)

Net assets were $16T end of Q2. $9T of assets were categorized as “miscellaneous” financial assets, and $9T was real estate.

Commercial real estate is falling and is about to fall even more steeply. And I can’t even hazard a

guess what miscellaneous financial assets would encompass, but it seems safe to assume they aren’t terribly liquid and are taking quite a hit.

In other words, the divisor used for Q is almost certainly falling, maybe almost as fast as the dividend (total equity valuation.)

Determining Q right now would be about as easy as coming up with a valuation on Citi.

Considering the markets have historically made over-adjustments to these kinds of senarios, it is my hope that the 20% governament ownership is merely a very short-term shelter. There must be a way for capitalism to display the Wild West entrepreneurialism that has created problems in the past.

Freedom is key. We must strive for protections that allow for this freedom within the context of protectionism that we are now dealing with.

I hope that the private financial sector isn’t forever crippled. I want a chance to go West.

I'm glad to see someone of Bill Gross's visibility ('stature' would be a misnomer) getting this one mostly right in plain English. All we get from Big Media and the Guvmint is smoke and pump-it-up. PE numbers are only just touching the _heights_ of long-term norms. What we have been watching for going on six quarters is the leak-out of massive leverage from the financial system which has inflated EVERY number of any kind to nonsensical levels. The night sweats and vomitus of our economy on withdrawal from endless, 'free,' green cocaine. I haven't heard it put quite that way before, that starting in 95-96 the US Guvmint abandoned fractional reserve lending, but that is not inaccurate and a good point (any quibbles over the exact year aside).

—But even now, and normal formulation for coming up with PE is going to be wildly distorted. The economy is heading well lower than it is; many assets such as commercial re and credit card debts are going to tank far lower than is factored in to any of this; &etc., pick your falling wicket. That's to say that the E in those valuations is surely inaccurate even as a gross number, so the PE is still well high of where equities are going to go _through the mid-term_. That has been on my mind for many months, and is the takeaway I would boil out of Gross's remarks. And yes, what he has been holding is morphing into dross, so his unvarnished prose may be a 'fair warning' to his investors and tag-alongs.

doc holliday: ". . . Curve fitting that satisf[ies] the maximum smoothness . . . ." You just defined the problem with all of these models, hope you saw that flash before you eyes. Current conditions are not remotely smooth; hence attempts to fit curves and scale in standard deviations will produce false results _inherently_. The idea that one can always produce a meaningful smooth projection from a set of variables is something between The Big Lie and the Grand Delusion. Go back to wiki or elsewhere and look up 'catastrophic bifurcation,' I suggest. That is the structure of the event we experienced in Autumn 07. The financial system would stabilize at a much lower but perhaps projectable level, but the massive government interventions and shadow speculators sideways speculative pumps haven't permitted that, for better and mostly for worse. That simply guarantees that the system as a whole will 'jump' irregularly between notionally stable states as each Big Push hits the system, states which the actual profit, employment, production and etc. numbers can't sustain, so the prove transients. Trying to project on horizons of six months or less in this kind of environment is a fool's game. The best sense to make of it seems to me is to retreat to the most basic components of the system, the largest aggregates, and do a back of the envelope, order of magnitude number. Anything like _that_ says earnings are going waaaaayy lower, and hence prices are out of line. 'Smart guys' with tight models can play the daily'weekly waves and try to pinch off some dough before the whiplash pinches off their heads; good luck to 'em.

I find it borderline hilarious that an alpha predator such as Bill Gross is making sanguine noises regarding the massive fist of the Guvmint. Of course, he's BK if the Guvmint doesn't physically hold up his GSE paper with said fist, so he's had a change of faith on the hurry-up, what? But look, this notion of 'the constrained investor' is just waxy bogusness. We are in a _great_ environment for real investors. in the recent twenty years, any fool who could tap leverage generated cash flow and fata morgana 'profits,' and many such fools have lived very well indeed: that wasn't investing, it was speculating, and it took a stupendous fool to lose money in that environment. Now, skills will really show who can evaluate a deal and turn a real profit, because hacks and dolts will get greased, and only the smart, nimble, and lucky will earn real money. Talent WILL be rewarded, and opportunities go begging. What has changed is the _scale_ of the return, with leverage ramped down, and financial flows reduced so that rake-offs are likewise reduced. Bold investors will have ample space to move and find opportunity. Dumbass speculators have seen their skillset made redundant. Big capitalists aren't guaranteed mega returns; things like tax holidays and labor leg-breaking aren't guaranteed to go away, but hopefully will be ratcheted down also. But making money hasn't been criminalized (perhaps unfortunately, but still). It will just take skill and gumption to do so now. You got a problem with that, Bill?

Ahhh, back from a Willamette foray, knocking back Willakenzie nectar, to today's crankcase quaffing realities.

Why is so hard for people to grasp? Professor Siegles piece on Yahoo Finance (S&P earnings $95 x P/E 15 = 1425 SP500) was very frustrating to me, especially in his rebuttal rebuttal, where he missed *every* point made by Bill Gross. Why is it so hard?

The E in P/E is distorted now by extremely large writeoffs being taken by financial institutions (and other companies).

Anyway, the question is not “are stocks priced at a bargain relative to how they have been priced in the past”. The question is how stocks are priced relative to other things a long-term investor might want to do with his money. You could earn 3% on a 10 yr treasury if you want, and be exposed to substantial inflation risk and interest rate risk. You could hold cash and watch the real value of it shrivel as inflation destroys it. You could hold commodities or real estate, which have historically delivered little or no real return over time. Or you could buy a broad equity index fund and own a little slice of each of the companies that make up the US economy. The equities, if they are not bargain priced, are at least reasonably priced, and when reasonably priced they have in the past beaten the crap out of every other asset class over long periods of time. Will your real return from that be 2%/yr or 7%/yr over the next 10 or 20 yrs? I don’t know, but whatever it is will almost certainly be higher than you will get anywhere else. If you buy a value-oriented index fund you will probably do better still.

It is a common error to focus on the riskiness of equities while pretending that the other things you might do with your money have no risk of their own. Any choice you make comes with risks. It’s just that most of those risks don’t make the headlines day after day after day like the movements in the Dow do: Down 700! Up 300! Down 500! Note that the net result of all these dramatic moves over the last few weeks is basically no movement in the Dow since early October. Someone who didn’t read the paper between then and now will probably not feel as anxious about stocks as someone who has followed the headlines day after day. There is no comparable daily index to scare you about what inflation might do to your bonds.

Gross is losing assets, btw, and does have a vested interest in convincing you that fixed income is the way to go.

We have little use for the drivel espoused by the Gross twit. The call obviously coincides with his recommendation to by corporate debt and the his march to the FED screaming for a bailout like with MBS’s. The Gross one needs to dwell on that gapping hole in his Munis and leave things that are not his expertise alone.

I can sum up bill gross in two words: buy bonds.

To the previous commenters who are praising Gross’ candor. You do realize that he’s not in equities, he’s in bonds? In other words, he has every interest to warn people that stocks will continue to go down and that everyone should run to the safety of bonds.

His argument may still have merit, but there is no altruism being practiced here.

I also find it quite annoying that Gross implies that now that the heavy hand of govt is in play, people will have no choice but to become beaten down proletariat workers rather than the rugged risk-taking capitalists of yore.

Firstly, as Richard Kline points out, the outsized profits of the last few decades of “rugged capitalism” were the result of leveraged speculation, not investment. Otherwise, our economy would be far more efficient and productive if all that capitalistic vigor went toward truly investing in the economy.

Secondly, the heavy hand of govt was dragged in precisely by those rugged capitalists who got themselves in such a mess that they needed Mommy to come in and bail out their butts. Indeed, Gross was one of the people arguing vociferiously for the govt to bailout GSEs (talk about pumping up one’s book). Now he has the gall to complain that the govt comprises 20% of the country’s banking capital.

To the extent that Profit and EPS growth suffers, it’s because the rest of us have to pick up the mess left by the rugged capitalists who’ve viewed our economy as one large casino for them to play roulette with. As they walk away with the billions in speculative earnings from the past decades, and now walk way with the billions of bailout money culled from our pockets, I say good riddance to the rugged capitalists of Gross’s ilk. Perhaps that will leave more room for the rest of us boring folk to invest our hard earned money in improving our economy and earning an honest buck from the resulting profits.

The Nasdaq recently reached an all-time high — of the S&P 500.

It’s like comparing Newton and Einstein: both were right but their rules governed entirely different domains

Actually, both guys were talking about the relationship of matter, energy, and time. One is exact, the other makes one damn fine approximation.

How can anyone determine value when the underlying base is the American dollar. Having seen trillions of them leave our governments pockets in the last couple of months (to where we are not allowed to know), who can really say what the dollar is going to be worth in 6-months.

THAT is the real problem IMHO.

This link for the s&p500 graphs which is illegible.

The salient point is that S&P500 profit has already dropped from 82 to 52, which approximates the drop in financial profits (financials at the peak represented 40% of mkt cap in s&p500).

We do not know what profits will be in the future, as the recession has not really kicked into reported profits yet. It is possible that financials will have write-ups, for example.

However uncertainty is certain. And it was uncertainty that drove down PE's to their lows in the 30's, 40's, 70's and 80's.

I don't think you have to do intellectual summersaults ('reversing leverage will further depress earnings power') to see that valuations will recover to previous highs. I have set a floor of 600 to enter aggressive long positions. However if profits stagnate from here, and PE's fall to historical lows (both entirely possible) then we may see $50 x 8 = 400 – even lower than Gross comments. We live in very interesting times.

You guys may not remember that Bill Gross wrote a missive that predicted Dow 6000 (I think it was 6000) right before the last bull market started. So much about predicting stock prices based on earnings or PEs.

I would be sorry to hear that any reader of this sophisticated blog still thinks that stock prices in the short- and intermediate term are determined by fundamentals (basically profits and price to earnings ratios). At best, the three-year average of stock prices may be correlated with the ten-year average of profits, or something similar to that. My friends, you must have noticed by now that stock markets end when current profits are high and predicted to get even better. And that bear markets end when profits are really low and predicted to get worse.

Annymous of 8:30 PM:

I’m in your corner, I think. I am bullish on all stocks except financials. Why? At least they’re not dollars! To me the dollar is wildly overvalued and even more overvalued are claims to receive future dollars called bonds. With 30-year T-bonds below 4.00%, someone is about to be taken to the cleaners. Better stocks than bonds.

Gross is trying to persuade dumb money to buy his US denominated debt instruments before Bernanke destroys them with inflation.

Is it just me, or when Bill Gross is on the air pimping bonds, does anyone else see bonds tottering behind Bill, all tarted up in micro-miniskirts, 6 inch heels, and too much makeup giving us lacivious looks, while Bill is wearing a big hat with a feather, leaning against his shiny pink Coupe de Ville, as he says, “C’mon, you KNOW you want some of these babies.”?

Let me know, ‘cuz if I’m the only one seeing this, I really need to speak with my neurologist.

The real problem is we had inflation in stocks, then it shifted to housing, and then back to stocks, briefly. Now inflation is coming out of stocks and housing, creating asset deflation. And rather than allow the deflation to happen, the government steps in, where they didn’t step in to control the asset inflation.

So now we have real deflation, as a result of letting the artificial inflation of housing and stock assets to occur. It’s truly madness.

Maybe I am not seeing the point. Why wouldn’t you see the yield go to zero, and the yield curve go flat with both long and short pegged at zero.

If a big chunk of your inheritance is tied up with hedge funds that won’t give it back, and your mad money money market fund broke the buck, and you think we are going to continue with the sustained deflation, and have too much money to put in a bank or under your mattress, where exactly are you going to put your money? Parking it in treasuries is will look a lot like sitting on cash to a certain type of thinking. Whether you invested long or short would probably be a factor of how long you think this will go on.

I totally agree with Doc Holiday.

Gross egged on Bernanke and the Fed to go to a ZIRP.

He’s a shill and he deserves to be taken out.

If the big kahuna’s on Wall Street got taken out and sunk, then PIMCO should also go under the wave.

Maybe Gross got a conscience…okay maybe not.

I’m hiding out in miners and some inverse funds. Have enough cash for emergencies to last six months in the event of an extended market holiday or bank holiday.

Bonds are to the point you are paying the government for the privilege of holding them.

I put a different link to the chart up. It should work better now.

The chart is only through early 2008, recall that stocks peaked in October 2007 and we have and rebounds.

doc holiday said: “The standard deviation factor, , corrects the main drawback of Vasicek’s model, ensuring that the interest rate cannot become negative.”

Why on earth does anyone think Bernanke will not go to a negative discount rate, if he thinks it’s necessary? The Fed can pay the banks 1% or 2% to borrow, and make it conditional on the bank expanding its loans.

Either I am crazy… or OK, I am. In a few short months we have devolved to the point of suggesting negative discount rates-yet it is entirely possible that techperson is right. That is how weird our situation has become.

To me it seems that all of the rushing around, throwing money, and fancy talk is an attempt to reinflate the asset bubbles so we can continue on as if nothing has happened. If we succeed, something will have happened: asset prices will be inflating wildly again AND there will be an additional 7 or 8 trillion floating around the system. Strangely enough, we could even have an overlap period where inflation is coming back with a vengeance, but gov bond and CD rates are still at rock bottom. At least during the hyperinflation of 1979-80 I was getting 16.5% interest on a CD.

While I’m heartened at the expanse of information here, I also fear the Roman parallel. The repetitiveness of actions is very disheartening. Have we really become the new Rome?

so . . . where was the government when all the asset inflation was occurring- causing multiple home contracts (with escalating clauses) so people could “win” in the bid for a home, escalating home prices that caused people to look at interest only ARM loans, no doc loans, stated income loans so they could qualify to buy a home, over-extension of credit by homeowners tapping into their inflated home equity. So- bring on the deflation I say- we need to get back to reality and to the true value of things. I will know it when I see it. That some folks are saying that now is the time to buy a home cracks me up because we are only back to 2004 home price levels- we have some more to go before homes become affordable again.

Rick Santelli commented on CNBC this morning that he would be more interested in hearing Bill Gross talking on Global Warming than talking his own book. I guess there is hope for the MSM after all.

commented

Lets not forget about the great driver of Western world productivity gains over the 30 year bull market – the digital revolution. As productivity gains slow in this domain, we will see a huge adverse effect on developed economies ability to grow efficiently – couple this with deleveraging and potential hurdles to further globalization, and the last 30 years will seem like a lost and forgotten golden era.

This was a classic sales pitch for bonds.

Gross said Dow 5000 in September 2002, too.

Of course, we are in general agreement with this tardy little punch in the gut to the fox biznews talking heads.

And I KNOW its just myopia on my part to not see things in a certain light, regardless of the apparently authoritative source.

But I saw this bit from Gross as outside my reality sphere.

“”One only has to recognize that roughly 20% of bank capital is now owned by the U.S. government…””

Now,what branch of government would that be?

The taxpayers?

Are we a branch of government?

I think not.

Given its penchant for unlimited lending to banks, BHCs and corporations, forgetting foreign governments and what have you, I am feeling that he was referring to the FED.

And, thus my problem.

The FED is not part of the federal government.

It is a private cartel of private corporations having the word federal in its title, a la FederalExpress.

If it were part of government we would have no problem finding out what kinds of things these private bankers are accepting as collateral on those loans, and from whom.

It will be a cold day in hell before Bloomberg wins anything like a partial victory in speaking for the people who might be responsible for repayment of those new TRILLIONS in debts being created solely by the FED.

Said Henry Ford, for good reason:

“”It is well enough that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.””

For good reason.