If you are down under, pet a ‘roo or drink some shiraz for me!

Free Monty Python Videos on Youtube Lead to 23,000% DVD Sale Increase SlashFilm

Why the Federal Reserve should LITERALLY throw money out of helicopters John Hempton. And do read the post that prompted it: Inflation v. Deflation Cassandra

The benefits of a single European bond Wolfgang Munchau, Financial Times

Jack Welch Believes the TARP Is Working The Good News Economist, Seeking Alpha. In case you needed some comic relief.

Lynched at Merrill Financial Times. Somewhat sympathetic, with good dirt.

US may ditch twice-yearly talks with China Telegraph

Oil Cartel Keeps Cuts on Track New York Times

Bad news: we’re back to 1931. Good news: it’s not 1933 yet Ambrose Evans-Pritchard, Telegraph

American exporters in last-ditch attempt to stop Obama raising the trade barriers Times Online

Fuld Sold Florida Mansion to His Wife for $10 New York Times

Peter Schiff Was Wrong Michael Shedlock

Interview with the central banker of Zimbabwe Tyler Cowen (hat tip reader Tim)

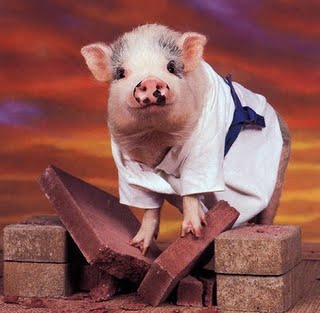

Antidote du jour:

I prefer a real “helicopter plan”, too.

http://www.unknownliberal.org/blog/?p=216

Some thoughts on a real “helicopter plan” include:

———–

The USG should print additional currency — in the order of magnitude of that being given to all the undeserving people and companies now — and hand them out to everyone. Consider the following:

(a) Will it be lot of money? Of course! But, I doubt it will be more than what’s being “guaranteed”, “lent”, and “invested” so far — and you know we haven’t seen the end of the bailouts.

(b) It helps everyone without regard to their culpability in creating the mess.

(c) It helps everyone without regard to their current wealth.

(d) It repairs the consumers’ balance sheets.

(e) It gets commerce and invention moving again. (The purpose of a business is to provide a good or service in an attempt to induce a potential consumer to part with his/her money. When businesses know consumers have money to spend, entrepreneurs form businesses and hire staff.)

(f) It helps the auto makers. Give me $50k and I’ll spend some of it to finally trade in my 20 year-old Honda for a new one (probably built in the US anyway).

(g) It helps current borrowers who can no longer afford their home payments. $50k will help many of them with payments. And, for those that want to sell anyway, I’ll spend half of my $50k on a downpayment for a home.

(h) It is — by comparison — TRIVIAL TO ADMINISTER. No alphabet soup of government programs to dole out the money. No Congressional hearings to argue over transparency. No multi-year hand-wringing in the media and around water coolers. Less social unrest.

(i) By obviating the need for so much of the government administration just mentioned, it avoids turning America into a command economy — which is what we’re quickly becoming.

———–

I’ve since learned from folks like ndk that the Fed can’t directly “print” without actually buying something. But, whatever the Fed can’t do *now* can be changed via an act of Congress. Right?

@Yves,

Thanks for the hurray, its hot and humid here, with cold drinks and BBQ, watching the cricket.

Cheers!

Cheers, Yves. I’ll have a toast for you.

VB and cricket with the kids Yves, thanks. Nearly had ‘skippy’ on the bbq. Have a nice Barossa Shiraz waiting to go.

“Why the Federal Reserve should LITERALLY throw money out of helicopters.”

*Sigh* I get that Keynesians hate savers, but do they always have to be so damned obnoxious about it?

I always console myself by buying a little more gold. It’s partly a method of silent protest against insanity like Hempton’s.

France to aid Airbus with €5bn in credit guarantees

http://www.ft.com/cms/s/0/20db9238-eb4b-11dd-bb6e-0000779fd2ac.html

Bye bye WTO?

Look like Estonia et. al. feeling some pain:

http://www.msnbc.msn.com/id/28850497/

That 23,000% claim looks awfully sketchy. I haven’t seen any actual numbers to support it.

Regarding Cassandra and Bronte’s discussion on inflation/deflation:

Gold has now rallied enough, and longer term treasury bonds have declined in price enough to suspect that inflation may be winning over deflation, despite what ‘logic’ may say regarding velocity and the power of debt destruction holding the economy hostage.

If it is not inflation that is influencing precious metals and long bonds, then it may be fear for the safety of paper currencies, as most central banks are competing to increase their money supplies. Either way, the rise in gold and long bond yields raise disturbing questions.

Yves,

Both sides of the inflation/deflation debate seem to miss an important point.

The deflationists are right about one thing: it could get a lot worse. In 1930-1932, we experienced a more horrific deflation than anyone expects today. Consensus seems to be using the “Japan analogy”, which would predict years of benign stagnation following a credit crisis. In the light of the historical evidence, that prediction seems optimistic.

On the other hand, the inflationists are right about one thing: inflation is easier to produce than people think. In 1933/34, during the depths of the Depression, with unemployment and price declines raging, the Fed managed to manufacture inflation (with the help of FDR’s move to abandon the gold standard). In fact, we had inflation of the price level between 1934 and 1937, when both FDR and the Fed prematurely (although that’s debatable) reversed monetary and fiscal stimulus.

How do you produce inflation during a Depression? Look no further than 1934 for the answer. What happens when that inflation starts to scare you? Look no further than the 1937/38 “mini-Depression” for the answer which calls into question the long-term effectiveness of monetary stimulus.

The experience of the 1930’s has so much more nuance, detail, “texture” than people think. Its all there, you just have to look. Its too bad most economists don’t.

That Fuld $10 mansion article is a treasure!

The Keynesian propaganda is really making me angry. I am a saver and I am getting tired of all the irresponsible idiots claiming to have a recipe for the economy. To all proponents of helicopter drops: Go Fuck Yourselves!!!

To David Pearson:

Thanks very much for your inciteful comments, both on NC and on Cassandra.

Regarding money out of helicopters: Since the concern of the Fed is that money freely-distributed to the population may be hoarded and not spent, then why doesn’t Bernanke distribute goods and services? That way, they know where, how and to which needy companies the funds have been distributed. That is the ultimate objective is it not – to put money into the hands of “deserving” corporations!

Every week, a lottery can be held whereby the names of the first 100 thousand (or million) U.S. citizens receive a good or service. First week, the keys to a new automobile. Second week, a new flat-panel TV, etc.

And maybe those U.S. corporations that are creating valuable goods and services, and that are in financial straits, could petition the government to purchase their output that particular week.

How is this approach not more beneficial in achieving the desired objective than dumping currency out of a helicopter?

To all the savers who don’t want inflation: it’s not too late. You can still invest in inflation hedges, or buy things at depressed prices. You haven’t lost anything yet! So stop getting your knickers in a twist …

(I know, you’re actually waiting to buy at even more depressed prices, but maybe this is the bottom, if the PTB inflate.)

JUST PLANE DESPICABLE CITI BUYING $50M JET

JUST PLANE DESPICABLE CITI BUYING $50M JET

Last updated: 10:06 am

January 26, 2009

Posted: 1:02 am

January 26, 2009

Beleaguered Citigroup is upgrading its mile-high club with a brand-new $50 million corporate jet – only this time, it’s the taxpayers who are getting screwed.

Even though the bank’s stock is as cheap as a gallon of gas and it’s burning through a $45 billion taxpayer-funded rescue, the airhead execs pushed through the purchase of a new Dassault Falcon 7X, according to a source familiar with the deal.

The French-made luxury jet seats up to 12 in a plush interior with leather seats, sofas and a customizable entertainment center, according to Dassault’s sales literature. It can cruise 5,950 miles before refueling and has a top speed of 559 mph.

>> Responsible saver said…

>> To all proponents of helicopter drops: Go Fuck Yourselves!!!

Our choices were/are:

(a) Tell Fannie/Freddie bondholders "we told you it's not our debt, so get lost!"

We did NOT do that, unfortunately. So, WHAT NEXT, PAL??? Right now, in a collapsing economy, the debt is no longer repayable. We WILL default. The question now becomes: HOW?

That brings me to 2 options:

(b) Explicit default.

(c) Technical default thru inflation, enough to devalue debts and make them servicable again.

Still with me? I believe (b) would be far worse than (c). Therefore, I prefer (c).

If we're going to do (c), why must we give the money to the banks that were a critical part of this disaster?? A real helicopter drop means money goes into YOUR pocket, along with everyone else's, per capita.

What is your problem with that?

If you hate the idea and worship gold, then buy it in advance of the policy. Trade what you believe. You'll get your share of the helicopter drop AND you'll make money from your gold trade. That PUTS YOU AHEAD OF THE RECKLESS HOME BUYERS, whose homes won't appreciate in value nearly as much as your gold. So, what's not to like? Everyone wins except the bondholders of the world — whom I was against bailing out in the first place!

Do you get it? Once the USG backed the face value of so many bonds for the benefit of bondholders, the only way to make non-bondholders "whole" is to give them money, too.

In the end, my goal is to make everyone just about as "rich" as they would've been (in real terms) had we never bailed out anyone. But, by giving money to everyone, we'll stop deflation.

A helicopter drop means people get to spend it however they want, too. Want to pay down debt? Fine. Want to buy gold? Fine. Isn't that better than having the government spend your money for you?

I ate a roo, Yves

$50 mil getaway private jet sheezz, Americans have to pay for that too.

These people better not step out side the euro zone or some nefarious types maybe inclined to give them a private walkabout in the countryside. Not unlike the Mob when they came down under to hold talks about expanding out side the States, funny they never came back, must not like feral pig hunting. Same goes for saltwater crocks in central America.

Skippy

Thanks for the wave Yves. I hope you try moving to Australia again – they may let you in this time (but don’t bet on it!)

Interesting piece over at Reality Sandwich arguing our financial woes stem from a lack of resilience (and the concurrent overabundance of efficiency) in our monetary regime:

Part I

http://www.realitysandwich.com/reinventing_money_ecosystemic_approach_part_1

Part II http://www.realitysandwich.com/reinventing_money_ecosystemic_approach_part_2

so yes, free money can assist in realizing profit but cannot create that to be realized– history has proven that higher rate of inflation are not a means to higher profit rates. until the grasp of crisis is expanded to include more than a one-sided market/demand perspective, there is no grasp.

2 wunsacon: I understand that there are ways to protect my savings and I am taking the necessary measures. However, I am against any bailouts, be it a big bank bailout or a general bailout through inflation. I am tired of people acting like idiots and then demanding inflation to “fix” the problems they have caused. I was responsible, I have not participated in the madness and it makes me angry that idiots accuse the responsible savers of destroying the economy by opposing “free” lunches for the irresponsible “me first” dickheads.

Inflation IS BAD, that’s econ 101, it distorts economic calculation, creates fake profits and fake booms and transfers wealth from productive people to the state and well connected oligarchy.

So once again to all proponents of helicopter drops: Go Fuck Yourselves!!!

and a good reading on socialist britain.

http://business.timesonline.co.uk/tol/business/economics/article5581225.ece

“it distorts economic calculation, creates fake profits and fake booms and transfers wealth from productive people to the state”

Responsible saver, this argument will fall on deaf ears because inflationists see all of these effects as *good* things.

And the fact that you were responsible and others weren’t doesn’t matter either, because “we’re all in this together.”