One of our pet peeves has been that the quality of data for oil and gas is lousy. Given that these are physical products, bought and sold through many channels, with no way of assuring consistency and accuracy of reporting, it isn’t surprising.

However, what is surprising is that many users of this information treat it as having more integrity than it does.

The latest example come via Tom Kloza on his “Speaking of Oil” blog (hat tip reader MIchael). He gives a detailed account of how EIA gasoline demand reports have been consistently, sometimes markedly, high, with many failing to take note of how their initial estimates are later revised downward.

Kloza expects the recently released January figures to be revised lower as well.

From Kloza:

EIA’s weekly numbers have consistently been riddled with overestimation of demand, whether for gasoline, diesel, or for all petroleum products….

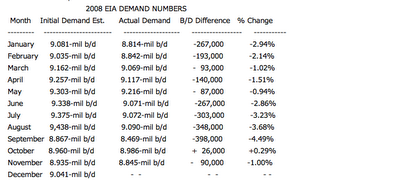

In a business where small variations in supply and demand can create huge price movements, the constant revisions are a bit unsettling. During the early part of 2008, chain marketers and fuel suppliers often complained that they thought EIA, API, and even MasterCard SpendingPulse were all guilty of overestimating demand and underestimating demand destruction. From May through July 2008, anyone looking at weekly EIA data might have erroneously concluded that four-week demand trends showed decreases of just 0.4% to 2.4% from the same period in 2007. Once monthly data was recorded, the demand destruction hit 3.23% and it eventually climaxed with a 398,000 b/d or 4.49% loss for September (click to enlarge)….

Despite the huge disconnect between weekly and monthly figures, most marketers respect the task of EIA and don’t castigate the government group for poor record-keeping. Among executives who have worked at refining and terminaling companies, there’s recognition that weekly compliance with DOE surveys is not a priority.

However, the major flaw may be the means by which EIA has to calculate an implied demand figure each week from refinery output, extensive gasoline blending operations, the occasional export, and the disappearance or accrual of inventory. Stocks of gasoline can be drained quickly from terminals if distributors are expecting a stiff price increase, and tank farms can be virtual ghost towns if marketers are aware of imminent decreases.

“All of my dealer customers are essentially ‘day traders’,” one southeastern marketer observed, adding that morning loads of fuel are routinely cancelled when it’s clear that spot prices are headed lower.

Distillate demand is even more difficult to calculate but there too, on-the-field sources suggest that EIA numbers may be inflated. Reports of diesel demand destruction of over 10% versus 2008 data persist.

That said, here are some other interesting statistical tidbits from the final January-November numbers that have been recorded:

– Total petroleum demand in November 2008 fell by 7.7% or 1.577 million b/d. That is the lowest demand level since 1998 when crude oil prices were in the $10-$12/bbl range. This aggregate number reflects a 1.6% revision from the preliminary weekly data reports.

– Exports of distillate hit their highest level ever for an autumn or winter month. U.S. companies exported 544,000 b/d of distillate in November, or some 16.3 million bbl and most of it was destined for Europe.

– The 6% decline in overall petroleum demand during the first eleven months of 2008 represents the biggest percentage slip since the Carter Administration.

– The apex of all-time U.S. gasoline demand is the 9.622 million b/d figure recorded in July 2007. A 10% increase from current levels would be needed to flirt with such a number in 2009.

Totally Cool OT and sorry to burst in here, but this is TOO cool:

More Evidence of Sharp Contraction in Money Supply (Not for the Fainthearted) http://www.nakedcapitalism.com/2…raction- in.html Note that while the Fed still published M1 (narrow money, currency plus demand deposits) and M2 (M1 plus time deposits, savings accounts, and non-institutional money market funds), it stopped reporting M3 (M2 plus large time deposits, institutional money market accounts, and short-term repos) in March 2006. However, some economists and services provide estimates, The Telegraph tells us today that those private calculations of M3, like the publicly available monetary aggregates, show a sudden contraction, a deflationary signal. From the Telegraph: Data compiled by Lombard Street Research shows that the M3 ”broad money” aggregates fell by almost $50bn (£26.8bn) in July, the biggest one-month fall since modern records began in 1959. ”Monthly data for July show that the broad money growth has almost collapsed,” said Gabriel Stein, the group’s leading monetary economist.

Monetarists insist that shifts in M3 are a lead indicator of asset prices moves, typically six months or so ahead. If so, the latest collapse points to a grim autumn for Wall Street and for the American property market. As a rule of thumb, the data gives a one-year advance signal on economic growth, and a two-year signal on future inflation. ”There are always short-term blips but over the long run M3 has repeatedly shown itself good leading indicator,” said Mr Stein…

Cool?

House Of Cards

in addition to the Jan numbers being revised lower, DJ reports that “U.S. crude oil stocks haven’t peaked in January in 55 years” and “Jan Stuart, economist at UBS Securities, said he expected refineries to slash operations to be below 70% of capacity on occasion in coming months, compared with an 83.5% rate in the Jan. 30 week. That implies a cut in crude runs of about 2 million barrels a day from current rates.”

Yves,

I’m friggn sorry to add more OT on money, but, but just thought this was inteesting:

For at least a year now, the Bank of England has been trying to avoid that mistake – by pumping liquidity into the banking system and slashing interest rates.

That policy has expanded the narrowest measure of the money supply – cash balances held by banks – and dramatically expanded the balance sheet of the Bank itself.

But, as Jamie Dannhauser at Lombard Street Research has pointed out, all these efforts have not had much effect on growth of the broader money supply.

That is the measure – known as M4 – that matters if you want to get money moving around the economy and prevent deflation.

Dannhauser says that, once you take account of some big distortions in the figures, the broader stock of money was actually shrinking in real terms in the second half of the year. And it’s moving in the wrong direction.

By the Bank’s own reckoning, M4 was growing at an annual rate of 3.7% in the third quarter of 2008. It should publish its own estimate of what happened in the last quarter of the year in next week’s Inflation Report. But based on the bank deposits and lending figures released today, Dannhauser thinks the annual growth rate for the fourth quarter will be around 1.7% – negative in real terms.

Why do these arcane figures matter? Well, for starters, they help explain why the situation for British companies has deteriorated so much faster than people expected.

Survey after survey finds firms worrying about a lack of cash and working capital, and the figures bear them out.

Money balances in the non-financial corporate sector have fallen nearly 10% in real terms over the past year – despite all the efforts of the Bank.

From: Pushing string

Thanks… just curious yah know!

Er, ok, a government agency is lying about statistics which would otherwise paint a negative picture about the economy. Mmm. Ok, and your point is?

I spent twenty years trading oil and can tell you that only rookies, morons, and manipulators traded the stats. We used to have morning meetings (in Europe) to discuss the stats’s influence on prices since management insisted, but the traders knew it was stupid for two reasons: first, we were six hours too late and we knew they were pointless in the short term.

Expat: “Ok, and your point is?”

Read the topic sentence of the post:

“One of our pet peeves has been that the quality of data for oil and gas is lousy.“

Theres more to this than just a trade. secular phenomenon of bad public information makes me, fwiw, wonder if policy is being drawn from this data. i really hope not. but based upon the way senate and house testimony goes, people cite this crap all day long.

I just wrote a blog about oil and gasoline prices in the US. Please check it out:

http://www.peterdolph.com/2009/07/are-oil-companies-screwing-us-over.html