Readers may recall that during the heat of bailout battle, the Federal Reserve got into the fancy finance business, relying on the sort of deal structuring sometimes used to try to turn toxic odd pork scraps into barely-digestible sausage, the procedure used for pigs so dead that merely putting lipstick on them just won’t do.

The items in question are Maiden Lane, the vehicle used to backstop JP Morgan’s purchase Bear Stearns, and two sons of Maiden Lane created for dodgy AIG exposures. The bank was permitted to move some particularly fragrant collateral from Bear over to the Fed for a loan of $30 billion. The arrangement got reworked on the fly, and in the end, the Fed loan was reduced to roughly $29 billion as JP Morgan agreed to assume $1.15 billion of risk. The assets were placed in a holding company to be managed by BlackRock.

Maiden Lane II and III were spawned in the course of the AIG rescue. I’ve seen much less commentary on those deals, perhaps because commentators find the whole AIG mess so complicated and upsetting it’s hard to know where best to direct one’s ire.

This was so unseemly that even Paul Volcker, who has made a point of not commenting on Fed actions, felt compelled to voice disapproval of the Bear-related subsidy to JP Morgan. Willem Buiter, who has repeatedly pointed out that the three card monte operation being run by the Fed and Treasury are anti-democratic and possibly illegal, tells us that even by Fed’s own, no doubt rosy, calculations. all three SPVs are under water.

From Buiter:

A reader of this blog drew my attention to the informative Fed publication, the Federal Reserve System Monthly Report on Credit and Liquidity Programs and the Balance Sheet. … I will focus here on the three Maiden Lane vehicles created by the Fed to park some of the wonky assets it acquired from Bear Stearns (Maiden Lane (which I shall refer to as Maiden Lane I)) and from AIG (Maiden Lane II and III)…..

By any measure, the Fed is in the hole with all three SPVs. Its own estimates are that the amount by which the fair value of the net portfolio assets of each vehicle falls short of the outstanding balance of the loans extended to each of these vehicles (including accrued interest) is US$ 3.77 billion for Maiden Lane I, US$ 1.97 billion for Maiden Lane II and US$ 2.82 billion for Maiden Lane III. This is likely to be an underestimate of the true loss, because the reported fair value of the assets in the Maiden Lane vehicles is likely to overstate the present value of their held-to-maturity net cash flows. Much of the assets is illiquid, especially those in the AIG-related SPVs, Maiden Lane II and III.

In an earlier post on this subject I wrote “The Bear Stearns-related assets are likely to be rubbish. Maiden Lane II and III I know less about.” Thanks to the Monthly Report on Credit and Liquidity Programs and the Balance Sheet I now know that I may have overstated the degree of awfulness of the Bear Stearns legacy assets. I almost surely also overestimated the quality of the AIG legacy assets.

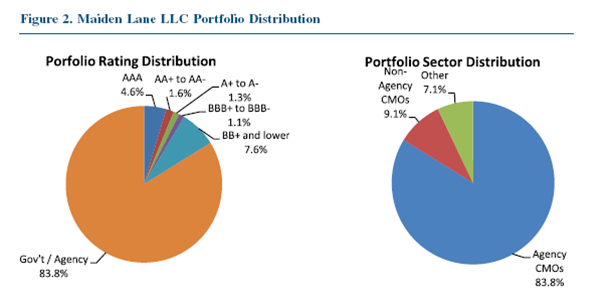

Maiden Lane I:

Maiden Lane II:

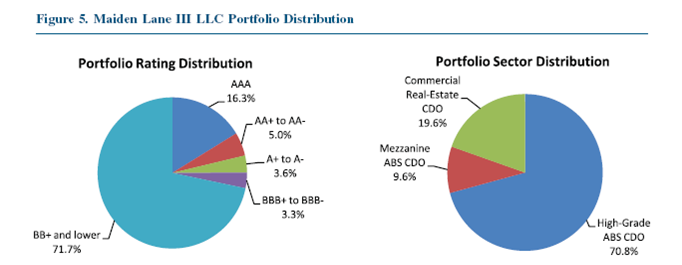

Maiden Lane III:

Most of the assets in the Maiden Lane I vehicle are securities issued or guaranteed by the federal government or federal agencies. But AIG stuck the Fed with a portfolio of RMBS 59.5 percent of which was subprime backed, with most of the remainder, 26.9 percent of the total, backed by Alt-A mortgages. I sincerely hope my retirement fund is better invested than that.

As regards Maiden Lane III, 71.7 percent of the portfolio is rated BB+ or lower – junk in normal language. That is not surprising, as 70.8 percent of the portfolio is supposed to be in ‘high grade’ ABS CDO. A high grade ABS CDO is like a nice schoolyard bully. They may exist, but they are few and far between. We can expected further significant write-downs and ultimately write-offs on these portfolios. The US$ 8.56 shortfall reported by the Fed thus far is likely to be only the tip of the iceberg.

Ben Bernanke, the cop on the beat, says: "Move along. Nothing to see here."

Most of the assets in the Maiden Lane I vehicle are securities issued or guaranteed by the federal government or federal agencies.

Can anyone explain why it would be necessary to bundle non-toxic assets into Maiden Lane? Why not just sell them?

What happens when it starts to become apparent that Freddie and Fannie are also a big money pit?

And the next surprise, we'll be shocked just shocked to find that there is gambling going on.

dan, with such a big drop in housing prices, it is a very good question about Fannie and Freddie, and so Maiden Lane I. On the other hand, we don't have to wait to assess the Maiden Lane II and III vehicles. They are complete crap now.

So…of the $30 billion worth of assets the Fed took on–presumably representing the dreckiest garbage on Bear's balance sheet–over 80% is agencies? That, to me, is more disturbing than anything.

Every little 30 billion loss adds up. As soon as the T bond market awakens to the fact that taxpayers can not be relied upon to cover interest payments on the untold Trillions of Gov't debt/guarantees that are cavalierly added whenever there is a blip, the game will be over. The bond holders will demand that the bailout games stop and severe belt tightening will begin. This charade has continued this far only because the last decade is the absolute peak of complacency in modern history.

This is the "dead dog collateral" mentioned in earlier literature ;(

Is TARP an SPV or a SPE, or both? Ken Lay could tell you, or he will tell you, when you get to hell.

Anon 3:13 and James B are on the same track I am. When I read Yves article (haven't had time to read the full Buiter yet) I have to assume that the Bear assets were garbage, or at least that is what we have been led to believe and what makes most sense that JP Morgan would want to get off the balance sheet. Therefore there are one of two possibilities.

1) The original assumptions are wrong and the worst paper of Bear didn't go to Maiden Lane I perhaps because JP Morgan just needed less total exposure to reserve against (remember it was March of 2008 and a lot has happened since then).

2) By implication, JP Morgan was getting rid of the worst Agency paper because they knew it was garbage and didn't trust the implicit guarantee on Fannie and Freddie at the time.

I lean towards 2 being the answer and that leaves me with knowledge everyone already knew. Fannie and Freddie have a long way further down to go and we have more 100s of billions to spend to prop them up (not to mention the time bomb being jiggered at FHA as we speak). I'd be interested if anyone has a different take on how Maiden Lane I could have ended up with 80% agencies.

These are actually known as the 'Midden Lane' storage facilities, but Jamie Dimon was snickering so hard when he made the call on this the vowel got slurred into a diphthong, and by such it will be known to posterity. It looks like Bernanke at least tried _a little bit_ in the Bear mash-up to extract assets from the corpse that had better visuals. But AIG was such a Gate-of-Perdition midnight shocker that no one asked, or cared, what the 'collateral' locked like so long as the rest of the economy didn't look just like it a week on. *mmphh*

Seriously, under Paulson the Fed's balance sheet was turned into a Special Investment Vehicle. It's purpose was for interests too special to fail to be vehicled in a Cadillac from a Hell of their own design to a Hilton of all expenses paid so long as the porter was tipped for appearances sake. All those expenses will be billed to Joe from Kokomo and his like.