Submitted by Leo Kolivakis, publisher of Pension Pulse.

Bloomberg reports that U.S. stocks rose for a fourth week, pushing the Standard & Poor’s 500 Index above 1,000 for the first time since November, as better-than-estimated employment, manufacturing and home sales data boosted confidence that the worst slump since the Great Depression is ending:

Bank of America Corp. and Wells Fargo & Co. rallied more than 11 percent following an unexpected profit at HSBC Holdings Plc, Europe’s biggest bank, and a report from the National Association of Realtors showing contracts to buy existing homes increased for a fifth month. American International Group Inc., the insurer rescued by the U.S. government, more than doubled on its first profit in seven quarters.

“If you step back and look at fundamentals, you have to say that things are lining up in quite a positive way for the next several months,” said Linda Duessel, who helps oversee $402 billion as equity market strategist at Federated Investors Inc. in Pittsburgh.

The S&P 500 rose 2.3 percent to 1,010.48, the highest since Oct. 6. The Dow Jones Industrial Average climbed 198.46 points, or 2.2 percent, to 9,370.07. The Nasdaq Composite Index advanced 1.1 percent to 2,000.25. The Russell 2000 Index of small companies added 2.8 percent to 572.40.

The S&P 500 has jumped 49 percent from a 12-year low on March 9, the steepest surge over the same number of days since the Great Depression, as three quarters of its companies posted second-quarter earnings that beat estimates and the economy improved. Wal-Mart Stores Inc. and Macy’s Inc. are scheduled to report results next week.

The stock index must rally 55 percent to surpass its all- time high of 1,565.15 set on Oct. 9, 2007. Before November, it remained above 1,000 for five years.

So what is fueling this steep surge in stock indexes? There is no doubt that heading into year-end, big funds are experiencing serious performance anxiety. As indexes grind higher, portfolio managers who were short or neutral stocks are forced to chase returns.

But how much more steam does this rally have? On Thursday, Goldman Sachs’ Abby Cohen (yup, the Queen of Bulls!) came out to say that new bull market in U.S. stocks has begun and possibly started in March:

“We do think the new bull market has begun,” she said. “It may prove it began in March of this year.”

Cohen sees the Standard & Poor’s 500 index .SPX at between 1,050 and 1,100 toward the end of this year. She also said it appears job losses are slowing but that she sees many more months of “difficult labor situation ahead.”

It is hard to argue against the bulls. Many of the financial stocks are up huge since March and the latest U.S. manufacturing and employment reports suggest the worst is behind us.

When I wrote my outlook 2009 back in January, I was bearish on financials. My biggest mistake was not to see that the banksters on Wall Street manufactured this crisis and benefitted from government assistance and printed money on the spreads. Moreover, instead of lending money to businesses, banks are making huge profits on their trading books.

But I didn’t really care because I made good money on my solar stock positions as I knew things were getting way overdone on the downside. These are trading markets and will likely remain trading markets for a long time. Read my piece on the investment labyrinth and why in these markets, small is beautiful.

[Note: Eric Roseman is right, on a risk-adjusted basis, convertible bonds lead the way in 2009.]

My brother was telling me today how regulators are going to crack down on high frequency “flash'” trading. Great news but I would like to see them crack down on naked short selling too.

I any case, you might see more short squeezes in August and some wild moves in stocks. Just check out AIG’s move last week where it opened at $13.20 and closed the week at $27.14, more than doubling in a single week (click to enlarge):

The thing that strikes me is the volume surged in both the stock and call options before the release of earnings on Friday. There is no way that somebody did not leak out the numbers beforehand and yet nobody investigates these all too common occurences.

So how much more upside do we have after a nearly 50% move from the bottom? Technicians will tell you that you can go up to 60% or 70% from the bottom, which means we still have more room to run. But legendary investor, Paul Tudor Jones, thinks this is just another bear market rally:

Tudor Investment Corp., the $10.8 billion hedge-fund firm run by Paul Tudor Jones, said equity markets could decline later this year, creating buying opportunities.

Slowing growth in China and the return of front-page stories on swine flu may be “further catalysts for global equity markets to pause in September,” the Greenwich, Connecticut-based firm said in an Aug. 3 client letter, a copy of which was obtained by Bloomberg News.

Tudor said the 47 percent gain in the Standard & Poor’s 500 Index of the largest U.S. companies since March 9, when it fell to a 12-year low, is a “bear-market rally.” The index topped 1,000 for the first time in nine months this week after companies reported better-than-expected profits.

“Impressive counter-trend rallies are a feature, not an oddity, of secular bear markets,” Tudor said. “We are not inclined to aggressively chase the market here. Many doubts remain about the sustainability of this recovery, most prominently the weakness of household income growth.”

Tudor’s biggest hedge fund, the $8.9 billion Tudor BVI, gained 10 percent this year through July after losing 4.5 percent in 2008. Hedge funds on average lost a record 19 percent last year, according to Chicago-based Hedge Fund Research Inc.

The firm said that a year-end gain in stocks may be another bear market rally with equities falling in 2010.

I agree with Mr. Jones but I also warn you that this counter-trend rally has legs so focus on high beta plays like the Nasdaq Powershares (QQQQ), the Semiconductor Holders index (SMH) and Chinese solar stocks like LDK Solar (LDK) and Yingli Green (YGE).

[Note: Some other Chinese solar stocks that have already broken out and continue to head higher are Trina Solar (TSL), Suntech Power Holdings (STP) and Canadian Solar (CSIQ).]

When the markets do pull back, keep an eye on the Ultrashort Real Estate Proshares (SRS) and the Ultrashort Financials (SKF). But I warn you these leveraged ETFs are not for retail investors and there are lawsuits filed against Proshares because they do not always behave accordingly.

Finally, I urge you all to read the Sceptical Market Observer’s Good and Bad News on the Economy and especially Hoisington Investment Management’s second quarter outlook, from which I quote the conclusion:

The combination of an extremely overleveraged economy, ineffectual monetary policy and misdirected fiscal policy initiatives suggests that the U.S. economy faces a long difficult struggle. While depleted inventories and the buildup of pent-up demand may produce intermittent spurts of growth, these brief episodes are not likely to be sustained. In several years, real GDP may be no higher than its current levels. However, since the population will continue to grow, per capita GDP will decline; thus, the standard of living will diminish as unemployment rises. These conditions will produce a deflationary environment similar to the Japanese condition.

Investments in long term Treasury securities are motivated by inflationary expectations. If fixed income investors believe inflation is headed lower, they will invest in long-dated securities, while they will invest in Treasury bills, or inflation protected securities if they believe inflation is headed higher. In the normal recessions since 1950, the low in inflation was, on average, 29 months after a complete economic recovery was underway, and bond yields moved in a similar fashion. If this recession were normal, then the low in inflation would be in late 2011, at which time investors would begin to consider shortening the maturity of their Treasury portfolios. However, because of our highly-indebted circumstances and the movement of private sector resources to the public sector, the trough in inflation will be moved out, meaning that the low in Treasury bond yields is a distant event.

The path there will be bumpy, as it was in the U.S. from 1929 to 1941 and in Japan from 1989 to 2008. Presently the 10-year yield in Japan stands at 1.3%. Ultimately, our yield level may be similar to that of the Japanese.

So while the bulls cheer on Wall Street, I tell people to focus, not to get too excited and don’t be afraid to raise some cash as asset prices keep going up. There is a lot of liquidity out there driving prices higher, but there will be more than a few hiccups along the way as inflationary headwinds eventually give way to deflationary headwinds.

People still seek Abby Cohen's opinion? If that isn't insanity I don't know what is.

She is one of many cheerleaders on Wall Street. Remember, the game is rigged so always take what a strategist or analyst says with a shaker of salt. If you ask me, they should publicly disclose their personal holdings every time they come out with a view on the markets.

Gee, I guess the 401k managers left some untapped funds for the hedge managers. Now until October should allow enough time for the sucking sound to finish.

A gap down in the DOW gives you an island top.

When are the consumers going to start spending again?

Leo's Stock Picks again… barf. Where were you when there were true bargains to be had?

good post Leo. It is quite interesting how Goldman Sachs comes out with predictions about a month before the top on things. Wall Street would be dead if they lost the loot they were taking out of the pockets of the public. People are going to start losing their meal money in casinos and get broken of the habit.

In any case, an economy that is losing 550,000 jobs a week minus new jobs isn't in recovery. The recovery is a fiction. There is clearly a base amount of economy that has to go on regardless, so at some point it has to quit going down. Not yet. It stand to reason that we lost 800K jobs last month, as normal sideways economy is around 300,000 claims a week. In the meantime, they have managed to preserve the bubble aspect of stocks and homes despite the huge fall in prices.

@anon 8:59,

Not that Leo needs defending, I believe he does not use the Crammer brand intravenous investing injection strategy (pump it up baby).

Leo reminds me of the men, of youth, the silent generation and through their experiences with a modicum of caution invest for the long term both as an individual and for the benefit of all.

Where is your blog of good times get rich over night rock and roll hangover I married a trophy wife that took it all in the divorce so now I must bend all over to regain my ascension of the insecure social ladder, hay?

Skippy…egerly await your picks for the horse race.

Leo —

What about the belief by some analysts that there will be a bond market dislocation that will drive rates significantly higher?

ca,

The great dislocation will come when the bond market prices in long-term deflation, not inflation. The big surprise in the next decade might just be that bonds might outperform stocks on an absolute and risk-adjusted basis.

cheers,

Leo

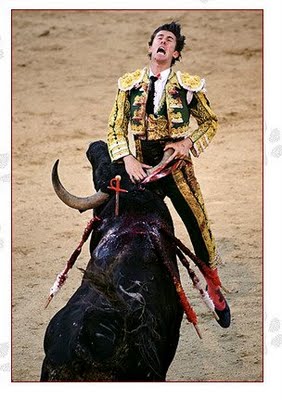

Great picture, sadly, he will probably survive and the bull will not.

So far its been a nice rally and it has the appearance of being a full blown bear market rally. I have not seen one bit of evidence that indicates that the economy is beginning to recover. What I have seen is substantial evidence that the rate of economic decline is substantially slowing.

Now the market generally looks ahead and tries to anticipate the arrival of happy days. Well hold the que-in for that little ditty because we have a long way to go.

It may come to pass that the rally will continue and morph into a new bull market. The probability of that occurrence is extremely low due to the overhang of debt which we are unable to service.

Now Abby Joseph Cohen is a nice lady from Brooklyn. She enjoyed a certain celebrity some time ago and then fell from favor. Now she's back again touting the market. It will be interesting to see how she manages to change her view point in late September or early October when a sell off is probable.

Leo,

Could you expand on your reasoning? How can governments continue to borrow trillions a year for the foreseeable future, as the sources of surplus capital (China) dry up? Isn't it possible that even with deflation, rates will rise?

All this does is show the disconnect between the market and the rest of us. Market rallies do not mean the depression is over. It just means those manipulating the market are making more money. If 70% of our economy relies on consumerism, which is now dead in the water, there is no recovery.

ca,

This is the common view, that all the budget decicits will lead to higher rates and inflation. But go back to read that quarterly comment from Hoisington Investment Management. Also, if you factor in the pension crisis, the end game will likely be a long bout of deflation. That is why monetary authorities are desperately trying to reflate the bubble again, and again.

Leo

What's this, another random conspiracy…?

Ciao,

Econolicious

Leo,

So where do you come down? Do you want to reflate the economy and revert to the profligate borrowing that we engaged in over the past 50 years; or do you want to right the ship and move toward prospertity. The supply of loanable funds may well expand, in fact it may be absolutely necessary that it expand in order to accomodate the inevitable increase in prices.

These bailouts and the monetization of debt is destroying the currency. That destruction leads to revolution. Perhaps we have spent ourselves to the point where a revolution is no longer a choice but an inevitability.