Submitted by Leo Kolivakis, publisher of Pension Pulse.

The FT reports that the decline of final salary pension scheme set to accelerate:

Half of UK companies whose defined benefit pension schemes are still open to existing members expect to have closed them to all employees by 2012, according to a survey by pension consultants Watson Wyatt.

If companies act on those intentions, it would leave only about 1m employees in schemes that in their heyday had at least 6m active members.

Rash Bhabra, head of corporate consulting at Watson Wyatt, said there was now “a sense of inevitability” that “the nuclear option” of closing schemes to all members was starting to become the norm.

A number of companies, including Fujitsu, IBM and Interserve, have recently announced consultations about or plans to close their UK final salary schemes to existing members.

But the survey shows that other companies “who were delaying a decision on closing their schemes to existing members until others who had stuck their heads above the parapet are now ready to act,” Mr Bhabra said.

The survey of 250 companies shows – in line with broader industry figures – that only 9 per cent of the schemes surveyed have closed to further contributions to existing members, although three-quarters are already closed to new members.

Of the latter, 48 per cent expect to close to existing members within three years. A further 28 per cent expect to keep the scheme open but make it less generous.

Only a quarter said that they did not expect to make any changes, but more than half of those have already taken steps to make the scheme less generous, for example by increasing contribution rates, raising the retirement age, or providing less pension for each year served.

Of the remaining 16 per cent of schemes open to new entrants, a mere 2 per cent expect to be so within three years, the survey shows.

Watson Wyatt estimates that more than 2m people are contributing to a private sector defined benefit scheme. More than a million of those could shortly find themselves joining the great bulk of workers in the private sector dependent on defined contribution pensions where the investment and longevity risk is switched to the individual.

Watson Wyatt said three key factors were driving the trend: the economic situation; revaluations of pension schemes that collectively had a deficit of £158bn at the end of July; and the fact that once companies start closures, the trend can become self-perpetuating.

According to Mr Bhabra, directors do not want to explain to shareholders why they are not saving money by closing their schemes, when so many other companies have done so.

“The recent surge of scheme closures could easily become an epidemic,” Mr Bhabra said.

In a related story, Bloomberg reports that Pension Corp. LLP, the British insurer of pension fund payouts started by Edmund Truell, is considering an initial public offering next year as pension plan deficits widen to their largest on record (HT to Lisa):

“The amount of capital required to solve the U.K.’s pension problem is just gargantuan, and you can only begin to get that sort of money from public markets,” Truell, 46, said in a telephone interview. The share sale “will be next year rather than this year.”

Truell started Pension Corp. in 2006, raising 900 million pounds ($1.5 billion) from investors including Swiss Reinsurance Co., J.C. Flowers & Co. and Royal Bank of Scotland Group Plc. The firm manages 5 billion pounds of assets and plans to raise the money to insure more liabilities from pension funds seeking to secure future payouts for their members.

About 87 percent of the U.K.’s 7,400 final salary pension plans are in deficit following the financial crisis, according to the Pension Protection Fund, a government-backed insurance program.

“The bulk-purchase annuity market is going to continue to be a good market because companies want to get their pension funds off their balance sheet,” said Trevor Moss, a London- based analyst at MF Global Securities Ltd. who tracks insurers. Pension liabilities add “enormous volatility to their balance sheet and profit and loss accounts, so they’re all going to find ways to take that risk away.”

Companies including Cable & Wireless Plc, RSA Insurance Group Plc and Thorn Ltd. have insured the retirement payouts of their pension fund members in the last year to reduce their exposure to volatile investment returns and the risk of former employees living longer than expected.

Pension Deficits Swell

Truell founded Pension Corp. after 18 years working for Duke Street Capital, which he helped start as part of Hambros Plc in 1988. Guernsey, Channel Islands-based Pension Corp. was the second-biggest insurer of pension plan liabilities last year behind Legal & General Group Plc, which, with Prudential Plc, has been the largest insurer in the market for almost 20 years.

Shortfalls of the U.K.’s 100 biggest publicly traded companies more than doubled to a record 96 billion pounds last month from a year earlier, according to London-based actuary Lane Clark & Peacock LLP.

BP Plc, Europe’s second-largest oil company, said in June it would close its final salary pension plan to new U.K. workers, and lender Barclays Plc has asked 18,000 employees forgo up similar benefits. Half of British companies with defined benefit pension plans expect to close them to all employees by 2012, Watson Wyatt Worldwide Inc. said in a survey published yesterday.

Pressure on Trustees

“More schemes closing to future accrual puts them into the back bucket from the employers’ point of view,” said Paul Belok, a London-based actuary at Aon Consulting Ltd. Once a plan is closed companies “will really want to sever the link. The only way of doing that is in the bulk annuity market.”

Pressure from pension trustees to secure members’ future payouts is likely to encourage companies to transfer as much as 20 billion pounds a year in retirement liabilities over each of the next 15 years to firms such as Pension Corp., Legal & General, and Goldman Sachs Group Inc.-owned Rothesay Life, Belok said. About 8 billion pounds of assets were moved in 2008, according to Aon.

The amount of pension liabilities transferred dropped to 1.5 billion pounds in the first half of 2009. Rising defaults on corporate bonds, which typically back annuity payments, at the beginning of this year slowed dealmaking, Belok said. Transactions may resume in the second half as the bond market stabilizes, he added.

‘Not Enough Capacity’

More insurers like Pension Corp. will have to raise capital if they wish to meet a long-term rise in demand for bulk annuities, according to Guy Coughlan, managing director of JPMorgan Chase & Co.’s pension advisory group.

“There’s not enough capacity in the global insurance and reinsurance industry to transfer the longevity risk of corporate pension plans in the U.K. alone,” he said. “It’s an overwhelming problem that you can’t solve without bringing multiples of the current capital that exist in the insurance industry.”

An overwhelming problem indeed. I have been writing about the pension pandemic for a little over a year and my worst fears are slowly but surely materializing.

IDG reports that a pension backlash is looming at IBM, trade union leaders have warned:

Unite, the UK’s largest union, said staff were increasingly angry that IBM was sticking to plans to close its final salary pension plan. IBM is also altering its early retirement scheme.

IBM should “brace itself for a backlash from thousands of employees”, the union said, after hundreds more IBM workers are understood to have joined up. Union meeting have been “packed to overflowing”, it said.

Around 5,600 staff are expected to be affected by the IBM changes, which will only see them receive what has been “accrued” so far, based on years of service and level of pay.

Unite said that typically people in their mid 50’s could lose up to £200,000 as a result of the changes. It also expects between 700 and 1000 people to opt for early retirement before April 2010 when new early retirement provisions apply.

Peter Skyte, national officer at Unite, said the pension changes represented an “unacceptable attack” on staff. He added: “These highly skilled and experienced staff were key to the company’s survival and they view the company’s proposals as a kick in the teeth.”

IBM has large offices in London, Portsmouth, Winchester, Warwick, Greenock, and the North West.

The changes there follow a similar step taken by Fujitsu in May, after that company’s scheme hit a £1 billion deficit.

People should be paying close attention to what is going on in the U.K. because the same fate awaits pension schemes on this side of the Atlantic. Mike “Mish” Shedlock posted a comment on CalPERS admitting its pension costs are unsustainable and notes the following on politically unfeasible solutions:

Dropping defined benefit plans may be “politically unfeasible”, but they are “Actuarially Mandatory”. If unions had any brains (and typically they don’t), they would hop on the 401K bandwagon for new employees, hoping to save what they have for current members.

Instead, they risk municipal bankruptcies such as happened Vallejo, California, where some bankruptcy judge ultimately decides who gets what.

Note that the system is so broken that it is highly probable that a massive reduction in pension benefits is necessary even IF the unions would agree to the 401K solution.

A massive reduction in pension benefits will likely cause massive protests by union members, which means more social unrest.

When I wrote that the pension crisis will define President Obama’s legacy, I meant it. Those pension bombs that started exploding in 2008 have exposed the vulnerability of the nation’s retirement systems.

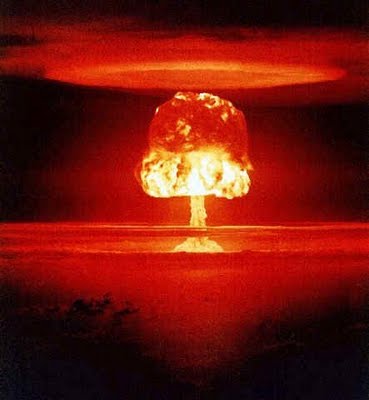

Politicians all around the world better pay close attention to global pension tension because a financial nuclear bomb was detonated in 2008 and its full effects have yet to be felt.

Leo-

You've made a good case for the impending doom regarding pensions; I always knew it was bad, but not *this* bad.

So what do you believe the response will be? Converting defined benefit plans to defined contribution plans? A pension bailout? There's only so much the PBGC can do in the US.

Good work, BTW.

jest,

The typical response is to either close defined-benefit schemes or replace them with defined-contribution schemes. The problem is that most DC plans are underperforming too and they offer no guarantees (like DB plans) concerning retirement income.

But those guarantees that DB plans offer are unsustainable as pension costs soar and pension deficits worsen. In the future, you will see mounting pressure to increase retirement age, decrease pension benefits, increase contribution rates and increase taxes to pay for these soaring costs.

In many ways, we have come full circle. We moved away from safe government bonds to invest in stocks, corporate bonds, hedge funds, private equity, real estate, commodities, and so on and sometimes I wonder if this "diversified" approach (there is a lot more correlation between these assets now) is all that it's cracked up to be.

The pension parrots (fund managers) love it because they get to game their benchmarks and walk away with big bonuses, but does it really help lower the costs of the pension plan with acceptable volatility?

The same way Canada introduced universal health care, we will introduce universal pension coverage that augments the current pension pillars. I just hope they also introduce leading governance principles to make sure the new pension plans are in the best interests of all stakeholders.

cheers,

Leo

Leo-

Given the fallout/obstinance from the healthcare debate, is reform really possible anymore? Particularly a universal government plan. One of my big fears of the potential failure of healthcare reform in the US is how it will affect the other attempts at reforms that are necessary. If we can't reform healthcare, I can't see us reforming pensions. The ramifications of the healthcare debate is going to be huge.

Bush tried getting away with something akin to a contribution plan, but that went nowhere. And you are right, the fund manager/financial services firms have a lot at stake in maintaining the status quo; their lobby is infamously entrenched in the system.

It seems like the whole system needs to crash and burn before we see any real reform in the US. Even then, the likelihood that something good is born from the ashes doesn't seem very high.

I hope I'm wrong.

Leo,

Mish nicely recapped points I've made here in the past in response to previous articles from you. He spiced this with a refreshing End of Mendacity moment from CALPERS on the current status and future of defined benefit pension plans.

This is the disconnect between planning for 8% annual ROI and real returns that are factors below this.

We moved away from safe government bonds to invest in stocks, corporate bonds, hedge funds, private equity, real estate, commodities, and so on and sometimes I wonder if this "diversified" approach (there is a lot more correlation between these assets now) is all that it's cracked up to be.

Leo, HELLO!!!! Back from the Greek Islands yet?

The 30 year long bond currently yields 4.3%. So much for "risk free". The last time 30 yr bonds were at 8% was – briefly – 1994.

Junk anyone? (sniffffff ahhh….)

On January 3, 2000 the SP500 was at 1498. Today – 9-1/2 years later – it's bouncing between 980 and 989. Figuring out the annual rate of return on this "investment" will be an instructive exercise.

The only way DB is sustainable is if *someone* serves as guarantor to fill in the deficits between unguaranteed investment returns and guaranteed benefits. This is the simple idea of California's public employee unions: tax the peons more.

we will introduce universal pension coverage

We already have such a system in the US. It's called "Social Security". I invite you to consider what David Walker, a former US Comptroller General, has to say on this subject. Although I can't conceive you aren't already aware of his findings.

So let's cut to the chase, Leo. Perhaps you'll join your colleagues at CALPERS in dropping the mendacity and speaking in simple English.

1. How are benefits going to be defined for the beneficiaries?

2. What annual rate of return do you intend to structure your universal pension plan around?

2a. How do you propose to guarantee these annual returns?

3. What will be the annual defined contribution (a/k/a/ payroll withholding tax)?

4. How will you prevent Parliaments, Congresses, Legislatures, county commissions and city councils from increasing benefits in response to pressure grousp without increasing contributions?

This isn't rocket science, Leo. Insurance company actuaries do it every day when quoting annuities for their sales agents.

Until you do so I only see distant illusions of the Big Rock Candy Mountains in all your excessively long posts.

Hey smartass,

Why don't you log on with your real name and tell us where you work? Insurance industry perhaps?

I agree with Mish that some tough choices will confront us in the following years to sustain these pension plans. The current expectations of rosy investment returns are ridiculous considering where the current 10-year bond yields are.

So what are the large pension funds and insurance companies doing? What else? Investing more in hedge funds, private equity, real estate, commodities and infrastructure. I wish them luck.

We need to rethink this pension crisis very carefully and sorry, the only people I trust less than the pension parrots are the insurance sharks.

The next time you post, have the courage to post your real name and credentials. Any wimp can post anonymously on the internet.

cheers,

Leo

I just hope they also introduce leading governance principles to make sure the new pension plans are in the best interests of all stakeholders.

Care to place a bet on that? American government and the powerbrokers do not serve the people. We're in some sort of neo-feudalism where all debates are framed around the interests of the powers and they are able to frame the debates in their favor to the general populace over TV, radio, newspaper, and, yes, the internet.

People that want defined-benefit plans to go away and instead think everything should be based on the stock market for 401k retirement plans. Overly convenient isn't it considering that those companies on the stock market would most benefit as more money gets funneled into these companies inflating their stock price.

Sorry, I'm cynical on the country. I'm young enough to not expect a dime out of Social Security or my pension or whatever.

Pithy. Thanks.

OK, when unions demand wage increases, promise them the increases but say you will pay them later (with pensions). Then when it comes time to pay, well, we've spent all the money and anyway now we will be paying the retired workers more than newly hired workers.

Really just another cramdown.

Good article.

But the mother of all pension problems is coming. Allan Sloan at Fortune had a great article on the upcoming cash flow problems at Social Security (I assume like Mr. Sloan that SS having to be "bailed out" will be a watershed momemt). Most people I know (and these are gubermint bureaucrats with 6 figure incomes) do not understand that SS is a pay as you go system. At first, the sums will be modest – but the fact is, it will only get to be greater and greater amounts. Gubermint has already taken giant size portions for its plate. When will it be able to tax more and spend less?

on a tangent, everyone knows that posting under "anonymous" has as much credit as posting under their (supposed) real name right? The name given for an author comment has no meaning other than to serve as a convenient place to put a hyperlink.

Social Security is not a pension plan. It was enacted as A TAX for the purpose of redistributing income and it remains a TAX for that purpose. It was called Old Age and Survivors Insurance.

In a global economy where the political orientation is more socialistic than in the US, US firms are less competitive because their production costs generally included the burden of employee benefits, reflect on GM.

The move away from defined benefit pensions has been driven by the fact that corporations did not adquately fund their benefit liabilities.

After several major bankruptcies we now have the Pension Benefit Guaranty Corp. Why not expand the PBGC charter to the provision of defined benefit pensions that are absolutely portable. Convert the Social Security Trust Fund to this new entity and give labor the choice of a company program; or the Government program. Corporations will drop pension plans and employees will be forced to have nothing or look to the PBGC.

Now the critical vulnerability of a defined benefit plan is that inflation can make moot any benefit. Doesn't matter who provides the benefits. Look to the public debt, as I recall, something like 40% of it is held by the Social Security and other agencies.

THIS IS THE PROBLEM!! The continuing erosion of purchasing power makes retirement unaffordable. Makes healthcare costly to the point of killing off a fair number of people every year. A currency that maintains its purchasing power can fullfill the function of serving as a store of value. A fiat currency cannot! It is the insidious and continuing erosion of purchasing power that has pushed this country to the edge of absolute bankruptcy.

FIX THE MONEY SUPPLY AND OUR FRACTIONAL RESERVE MONETARY SYSTEM AND YOU BEGIN TO SOLVE A LOT OF APPARENTLY INTRACTABLE PRBLEMS!!!!