By George Washington of Washington’s Blog.

Unemployment is disastrous on both the individual and societal level.

Individuals who look for work but can’t find it are miserable. Indeed, most people who lose their job are unprepared for their circumstances.[1]

On the national level, high unemployment is both cause and effect concerning other problems with the economy. As we’ll see below, high unemployment results from a weak economy and – in turn – weakens the economy.

Until the causes of, and solutions to, high levels of unemployment are understood, we will not be able to solve the problem.

How High is Unemployment?

Before we can even start looking at causes or solutions, we have to understand what the current level of unemployment really is, and what the trends portend for the future.

Let’s use America as an example. With the largest economy in the world, it has often been said that “when America sneezes, the rest of the world catches cold”. And much of the rest of the world has adopted the “Washington Consensus” – America’s neoliberal view of economics.[2] Moreover, the rest of the world has been infected by many types of “toxic assets” invented in America, such as credit default swap derivatives[3], as well as Wall Street style banking strategies. So I will use the United States has a case example, but will also touch on global trends.

Official figures put unemployment in the United States somewhere between 9 and 10 percent. But the official figures use a very different measure for unemployment than was used during the Great Depression and for many decades afterwards.

Specifically, the official unemployment reports of the Department of Labor’s Bureau of Labor Statistics (BLS) provide conventional “U-3” figures and various alternative measures including “U-6”. [4]

For example, as of December 2008, U-3 unemployment was 7.2 percent, while U-6 was 13.5 percent. [5]

U-6 is actually more accurate, because it includes those who would like full-time work, but can only find part-time work, or have given up looking for work altogether.

As can be seen by the December 2008 figures, U-6 unemployment rate can almost double the more commonly-cited U-3 figures.

But those in the know argue that the real rate is actually even higher than the U-6 figures.

For example, Paul Craig Roberts [6] – former Assistant Secretary of the Treasury and former editor of the Wall Street Journal – and economist John Williams both said in December 2008 that – if the unemployment rate was calculated as it was during the Great Depression – the December 2008 unemployment figure would actually have been 17.5%.

Williams says [7] that unemployment figures for July 2009 rose to 20.6% [8].

According to an article [9] summarizing the projections of former International Monetary Fund Chief Economist and Harvard University Economics Professor Kenneth Rogoff and University of Maryland Economics Professor Carmen Reinhart, U-6 unemployment could rise to 22% within the next 4 years or so.

As the New York Times pointed out in July[10] :

Include [those who have given up looking for a job and those part-time workers who want to be working full time] — as the Labor Department does when calculating its broadest measure of the job market — and the rate reached 23.5 percent in Oregon this spring, according to a New York Times analysis of state-by-state data. It was 21.5 percent in both Michigan and Rhode Island and 20.3 percent in California. In Tennessee, Nevada and several other states that have relied heavily on manufacturing or housing, the rate was just under 20 percent this spring and may have since surpassed it.

Indeed, the chief of the Atlanta Federal Reserve Bank -Dennis Lockhart – said in August 2009:

If one considers the people who would like a job but have stopped looking — so-called discouraged workers — and those who are working fewer hours than they want, the unemployment rate would move from the official 9.4 percent to 16 percent. [11]

Former Labor Secretary Robert Rubin notes:

Over the past three months annual wage growth has plummeted to just 0.7%. At the same time, furloughs — requiring workers to take unpaid vacations — are on the rise: recent surveys show 17% of companies imposing them. [12]

Temporary employment is still falling as well. [13]

And economist David Rosenberg points out:

65% of companies are still in the process of cutting their staff loads…

The Bureau of Labor Statistics also publishes a number from the Household survey that is comparable to the nonfarm survey (dubbed the population and payroll-adjusted Household number), and on this basis, employment sank — brace yourself — by over 1 million, which is unprecedented…[14]

In addition to the failure of official BLS unemployment figures to take into account discouraged and underemployed workers, many analysts argue that BLS’ “Birth-Death Model” severely understates unemployment during recessions. [15]

Many people – including economists and financial reporters – say that unemployment is much lower than it was during the Great Depression. What they mean when they say that is that current U-3 figures in America are under 10%, while unemployment hit 25% during the Great Depression.

But most people forget that the worst unemployment numbers during the Great Depression did not occur until years after the initial 1929 crash . Specifically, unemployment did not hit 25% until at least 3 years after the start of the Depression.[16]

As of this writing (2009), we are only a year into the current economic crisis. Therefore, we have at least 2 more years to go until we hit the same period that unemployment peaked during the Great Depression.

Indeed, former Secretary of Labor Robert Reich wrote in April that the unemployment figures show that we are already in a depression.[17]

And Chris Tilly – director of the Institute for Research on Labor and Employment at UCLA – points out that some populations, such as African-Americans and high school dropouts, have been hit much harder than other populations, and that these groups are already experiencing depression-level unemployment.[18]

Assuming that Williams, Roberts or Lockhart’s calculations of unemployment are correct (using the same methods of measuring unemployment as were used during the Great Depression), and depending on when we deem the current crisis to have commenced, then – as shown by the following charts – unemployment percentages may actually be worse than they were during a comparable period in the Great Depression:

[21]

We also know that, in terms of total numbers of unemployment people (as opposed to percentages), more people will be unemployed than during the Great Depression. [22]

What Are the Unemployment Trends?

If unemployment is anywhere near as bad as during a comparable period during the Great Depression, the obvious question is where the trends are heading.

It is well known among economists that unemployment is a “lagging” indicator. [23] In other words, there is a lag time. When the economy hits a rough patch, the economic weakness will not show up in the unemployment numbers until several months or years later.

For example, as Europe’s largest bank – RBS – warns:

Even if the economy starts to turn up the headwinds will be formidable,” [the company’s CEO] warned. “The green shoots are short in duration and you need to be cautious about interpreting them. Even if growth returns, unemployment will rise for some time afterwards …[24]

Because of the lag time between conditions in the economy and unemployment, we have to ask the following two questions in order to forecast future unemployment trends:

1) How bad were conditions in 2008 and early 2009?

and

2) What will economic conditions be like in the future?

How Bad Did It Get?

Unfortunately, many experts – including the following people – have said that the economic crisis which started in 2008 could be worse than the Great Depression:

- Federal Reserve chairman Ben Bernanke said on July 26, 2009:

A lot of things happened, a lot came together, [and] created probably the worst financial crisis, certainly since the Great Depression and possibly even including the Great Depression. [25]

- Economics professors Barry Eichengreen and and Kevin H. O’Rourke said that world-wide conditions are worse than during a comparable period during the Great Depression [26] (updated in June 2009 [27])

- Investment advisor, risk expert and bestselling author Nassim Nicholas Taleb said that the current crisis could be “vastly worse” than the Great Depression [28]

- Former Fed Chairman Paul Volcker believes the current crisis may be even worse than the Depression [29]

- Nobel prize winning economist Joseph Stiglitz said “this is worse than the Great Depression” [30]

- Economics scholar and former Federal Reserve Governor Frederick Mishkin said that conditions were worse than during the Depression [31]

- Well-known PhD economist PhD Economist Marc Faber believes this could be far worse than the Great Depression[32]

- Former Goldman Sachs chairman John Whitehead thinks that the current slump is worse than the Depression [33]

- Morgan Stanley’s UK equity strategist Graham Secker predicts economic collapse worse than the Great Depression [34]

- Former chief credit officer at Fannie Mae Edward J. Pinto said in January 2009 that the current housing crisis was worse than the Depression, and that current efforts to rescue the mortgage industry are less successful than those used during the 1930s. [35]

- Billionaire investor George Soros said in February 2009 that the current economic turbulence is actually more severe than during the Great Depression, comparing the current situation to the demise of the Soviet Union. [36]

What Will Economic Conditions Be Like In the Future?

As of this writing, the fact that unemployment will substantially increase is quite controversial. Most people still assume that the benefits of the government’s policies will soon kick in, the economy will recover, and then jobs will recover soon afterwards.

In order to accurately determine how bad general economic conditions – and thus unemployment – might be in the future, it is necessary to look at a variety of trends, including residential real estate, commercial real estate, toxic assets held by banks, loan loss rates, consumer spending, age demographics, the decline in manufacturing, and destruction of credit.

Residential Real Estate

Citigroup is projecting that unemployment in Spain will rise from its current 17.9% to 22% next year. [37]

Spain’s unemployment is largely driven by the bursting of its housing bubble. [38]

Housing bubbles are now bursting in China [39], France [40], Spain [41], Ireland [42], the United Kingdom [43], Eastern Europe [44], and many other regions. [45]

(And unemployment in Japan is apparently at the highest level since the government began collecting the data in 1953, a year after the U.S. military occupation ended.)[46]

Unfortunately, while the peak in subprime mortgages is behind us, many analysts say that Alt-A mortgage defaults have not yet occurred (as of this writing), but will not peak until 2010.[47]

Indeed, the crash in real estate and rising unemployment together form a negative feedback loop. As McClatchy notes, foreclosures rise as jobs and income drop. [48]

Former chief IMF economist Simon Johnson notes that a vicious cycle also exists between unemployment and property foreclosures:

Unemployment is always a lagging indicator, and given the record low number of average hours worked, it will turn around especially slowly this time. Until then, people will continue to lose their jobs and wages will remain flat, and any small rebound in housing prices is unlikely to help more than a few people refinance their way out of unaffordable mortgages. So unless the other part of the equation – monthly payments – changes, the number of foreclosures should just continue to rise.[49]

Indeed, the Washington Post notes:

The country’s growing unemployment is overtaking subprime mortgages as the main driver of foreclosures, according to bankers and economists, threatening to send even higher the number of borrowers who will lose their homes and making the foreclosure crisis far more complicated to unwind. [50]

Commercial Real Estate

Moreover, a crash in commercial real estate is now picking up speed. Unlike the subprime mortgage meltdown – which affected mainly the biggest banks – the commercial meltdown will apparently affect a huge number of small to medium-sized banks. [51]

On August 11, 2009, the Congressional Oversight Panel on the bailouts issued a report saying that small and medium sized banks are especially vulnerable, the report will say, in part they hold greater numbers of commercial real estate loans, “which pose a potential threat of high defaults.” [52]

That could spell real trouble for employment by small businesses since (1) smaller institutions are disproportionately responsible for providing credit to small businesses [53], (2) credit is essential for many small businesses, (3) commercial real estate is crashing even faster than residential [54], and (4) industry experts forecast that the commercial real estate market won’t bottom out for three more years.[55]

Indeed, largely because of the commercial real estate crash, the FDIC expects 500 banks to fail in the coming months. [56]

Unfortunately, the crash in commercial real estate is occurring world-wide. [57]

Toxic Assets

The Congressional Oversight Panel report also says that banks remain threatened by billions of dollars of bad loans on their balance sheets, more could fail if the economy worsens, and that – if unemployment rises sharply or the commercial real estate market collapses – the banking system could again crash:

The financial system [still remains] vulnerable to the crisis conditions that [the bailout] was meant to fix…

Financial stability remains at risk if the underlying problem of toxic assets remains unresolved.[58]

As Reuters notes:

The chairman of the congressional oversight panel, Elizabeth Warren, said no one even knows the value of the toxic assets still on banks’ books…”No one has a good handle how much is out there,” Warren said. “Here we are 10 months into this crisis…and we can’t tell you what the dollar value is.”[59]

Loan Loss Rates

Loan loss rates in could also be worse than the Great Depression, at least in the United States. Specifically, during the depths of the Great Depression, the loss rate which banks suffered on their loans climbed as high as 3.4% (it is normally well under 2.0%).[60]

Last month, banking analyst Mike Mayo predicted that loan loss rates could go as high as 5.5%, which is substantially higher than during the 1930s.[61]

But the Federal Reserve’s more adverse scenario for the stress tests – which everyone knows is too rosy concerning most of its assumptions – predicts a loan loss rate of 9.1%, nearly three times higher than during the 1930s.[62]

As US News and World Report wrote in May 2009:

For most of the past 50 years, the loss rate on all bank loans has stayed well under 2 percent. The Fed estimates that over the next two years the loss rate could reach 9.1 percent. You know all those historical comparisons that end with “the worst since the Great Depression”? Well, 9.1 percent would be EVEN WORSE than during the 1930s. Still looking forward to a soft landing or a quick recovery?[63]

Consumer Spending

Consumer spending accounts for the vast majority of the economy in the United States. The figure commonly cited is that consumer spending accounts for 70% of U.S. Gross Domestic Product. [64]. (Consumer spending has been a lower percentage of GDP in most other countries. [65])

But the economic crisis is driving consumer spending downward. Economist David Rosenberg [66] says that consumers have undergone a generational shift in spending habits, and will be frugal for a long time to come.[67]

The head of Collective Brands, Matthew Rubel, states:

Consumer spending as a percentage of GDP has moved down, will probably continue to move down through the end of year, and then normalize as we get into somewhere in early-to-mid next year, from our point of view.[68]

The chief economist of IHS Global Insight, Nariman Behravesh, says consumer spending will decline to 65 percent of GDP:

With individuals more focused on saving than spending, Behravesh said retail consumer spending as a percentage of GDP is likely to fall from 70 percent to 65 percent. “It will take a while, maybe 10 years,” he said. “Correspondingly other countries are going to have to shift in the opposite direction to rely more on their own consumers rather than the U.S. consumers.”[69]

Jason DeSena Trennert, Chief Investment Strategist for Strategas Research Partners, says:

Consumer spending as a percentage of GDP is going to go in one direction for a long time — lower.[70]

Time points out :

Economist Stephen Roach, chairman of Morgan Stanley Asia, says that “there is good reason to believe the capitulation of the American consumer has only just begun.” U.S. consumer spending as a percentage of GDP reached 72% in 2007, well above the pre-bubble norm of 67%. Using that as a gauge, Roach says that only 20% of the potential retrenchment of spending has taken place, even after the dramatic decline at the end of 2008. “The imbalance that contributed to the crisis — overconsumption and excessive savings — cannot continue,” says Ajay Chhibber, director of the Asia bureau at the United Nations Development Program in New York City. “The model where you stimulate and [then] go back to the old days is gone.”[71]

The Wall Street Journal notes:

“Economists also see an upturn in U.S. household saving as the beginning of a prolonged period of thrift…..”[72]

Demographics

Financial analysts who have studied U.S. demographics – like Harry Dent and Claus Vogt – point out that the U.S. population is aging:

United States Population Pyramid for 2010

United States Population Pyramid for 2020

United States Population Pyramid for 2050

Vogt argues that an aging population within a given nation is correlated with a decline in that country’s economy. [74]. Certainly, a population with less working-age people and more dependent elderly people will experience a drag on its economy.

Dent argues that one of the main drivers of a country’s economic growth is the number of people in the country who are in their peak spending years.

For example, Dent says that in the U.S., 45-54 year olds are the biggest spenders, because that is when – on average – they are paying for their kids’ college, paying mortgage on the biggest house they will own during their life, etc. Dent argues that the American economy will tend to grow when the number of 45-54 year olds grows, and to shrink when it shrinks.

As the charts above show, the number of 45-54 year olds in the U.S. will shrink considerably in the year ahead.

Decline in Manufacturing

As everyone knows, the manufacturing has shrunk in the United States and the service sector has grown. Even in a manufacturing center such as Detroit, manufacturing jobs have been declining for decades:

Indeed, according to professor of economics Dr. Mark J. Perry, manufacturing jobs have dropped to their lowest level since 1941, and are now below 9% of the workforce for the first time. [76]

Wayne State University’s Center for Urban Studies argues:

For each job lost in the manufacturing industry, more spinoff jobs are lost than would be in other sectors. Each manufacturing job helps support a larger number of other jobs than do most other sectors. [77]

That means that the ongoing reduction in manufacturing jobs will adversely affect unemployment for the foreseeable future.

Destruction of Credit

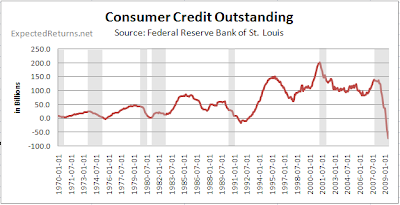

The amount of credit outstanding has been reduced by trillions of dollars in the past year.

For example, the amount of consumer credit outstanding has plummeted:

Banks have become tight-fisted about lending, and this will probably not change any time soon. As the New York Times wrote in an article from October 2008 entitled “Banks Are Likely to Hold Tight to Bailout Money”:

Banks have become tight-fisted about lending, and this will probably not change any time soon. As the New York Times wrote in an article from October 2008 entitled “Banks Are Likely to Hold Tight to Bailout Money”:

“Will lenders deploy their new-found capital quickly, as the Treasury hopes, and unlock the flow of credit through the economy? Or will they hoard the money to protect themselves?

John A. Thain, the chief executive of Merrill Lynch, said on Thursday that banks were unlikely to act swiftly. Executives at other banks privately expressed a similar view.

‘We will have the opportunity to redeploy that,’ Mr. Thain said of the new capital on a telephone call with analysts. ‘But at least for the next quarter, it’s just going to be a cushion.’

***

Lenders have been pulling back on credit lines for businesses, mortgages, home equity loans and credit card offers, and analysts said that trend was unlikely to be reversed by the government’s money.

Roger Freeman, an analyst at Barclays Capital, which acquired parts of the now-bankrupt Lehman Brothers last month [said] ‘My expectation is it’s quarters off, not months off, before you see that capital being put to work.’ ”[78]

And another New York Times article included the following quote:

“It doesn’t matter how much Hank Paulson gives us,” said an influential senior official at a big bank that received money from the government, “no one is going to lend a nickel until the economy turns.” The official added: “Who are we going to lend money to?” before repeating an old saw about banking: “Only people who don’t need it.”[79]

Reading between the lines, the bank officials are saying that they will not lend freely until the economic crisis is over.

As WLMLab Bank Loan Performance points out, outstanding loans in the United States have dropped $110 billion dollars quarter-over-quarter. [80]

McClatchy notes:

Over the course of 2008, the nation’s five largest banks reduced their consumer loans by 79 percent, real estate loans by 66 percent and commercial loans by 19 percent, according to FDIC data. A wide range of credit measures, including recent FDIC data, show that lending remains depressed.[81]

Indeed, total seasonally adjusted consumer debt fell $21.55 billion, or at a 10.4% annual rate, in July 2009 alone. credit-card debt fell $6.11 billion, or 8.5%, to $905.58 billion. This is the record 11th straight monthly drop in credit card debt. Non-revolving credit, such as auto loans, personal loans and student loans fell a record $15.44 billion or 11.7% to $1.57 trillion [82]

In addition, the securitization market has largely collapsed, which in turn has destroyed a large proportion of the world’s credit. As noted in an article in the Washington Times:

“Before last fall’s financial crisis, banks provided only $8 trillion of the roughly $25 trillion in loans outstanding in the United States, while traditional bond markets provided another $7 trillion, according to the Federal Reserve. The largest share of the borrowed funds – $10 trillion – came from securitized loan markets that barely existed two decades ago. . . .

Mr. Regalia [chief economist at the U.S. Chamber of Commerce] said … 70 percent of the system isn’t there anymore,’ he said.”[83]

The reason that seventy percent of the system “isn’t there anymore” is because the traditional bond markets and securitized loan markets (part of the “shadow banking system”) have dried up. As the Washington Times article notes:

“Congress’ demand that banks fill in for collapsed securities markets poses a dilemma for the banks, not only because most do not have the capacity to ramp up to such large-scale lending quickly. The securitized loan markets provided an essential part of the machinery that enabled banks to lend in the first place. By selling most of their portfolios of mortgages, business and consumer loans to investors, banks in the past freed up money to make new loans. . . .

“The market for pooled subprime loans, known as collateralized debt obligations (CDOs), collapsed at the end of 2007 and, by most accounts, will never come back. Because of the surging defaults on subprime and other exotic mortgages, investors have shied away from buying the loans, forcing banks and Wall Street firms to hold them on their books and take the losses.”

Senior economic adviser for UBS Investment Bank, George Magnus, confirms:

The restoration of normal credit creation should not be expected, until the economy has adjusted to the disappearance of shadow bank credit, and until banks have created the capacity to resume lending to creditworthy borrowers. This is still about capital adequacy, where better signs of organic capital creation are welcome. More importantly now though, it is about poor asset quality, especially as defaults and loan losses rise into 2010 from already elevated levels.[84]

And McClatchy writes:

The foundation of U.S. credit expansion for the past 20 years is in ruin. Since the 1980s, banks haven’t kept loans on their balance sheets; instead, they sold them into a secondary market, where they were pooled for sale to investors as securities. The process, called securitization, fueled a rapid expansion of credit to consumers and businesses. By passing their loans on to investors, banks were freed to lend more.

Today, securitization is all but dead. Investors have little appetite for risky securities. Few buyers want a security based on pools of mortgages, car loans, student loans and the like.

“The basis of revival of the system along the line of what previously existed doesn’t exist. The foundation that was supposed to be there for the revival (of the economy) . . . got washed away,” [economist James K.] Galbraith said.

Unless and until securitization rebounds, it will be hard for banks to resume robust lending because they’re stuck with loans on their books.[85]

Not only has the supply of credit been destroyed, but the demand for many types of loans – such as commercial real estate loans – is also drying up.[86]

So there is simply much less credit flowing through the economic system than there was prior to 2007.

The New Normal – Lower Economic Activity

As chief economist for the International Monetary Fund, Olivier Blanchard, said:

This recession has been so destructive that “we may not go back to the old growth path … potential output may be lower than it was before the crisis.” [87]

All of the above trends force many economists to conclude that economic activity as a whole will be lower for many, many years. In other words, they say that “The New Normal” will be a much lower level for the economy.

Pimco CEO Mohamed El-Erian says elevated unemployment and record wealth destruction will keep growth at 2 percent or less for years. [88]

As Bloomberg writes:

The New Normal theory predicts that the recession will leave unemployment, forecast to reach 10 percent for the first time since 1983 early next year, higher for years. [89]

Indeed, the “overhang” of inventory [90]- that is, the inventory of unsold goods – in everything from housing [91 and 92] to cars [93] to consumer electronics [94] means that the newly reduced consumer demand is meeting up with very high levels of supply. This is a recipe for unemployment.

Many economists also point out that the length of time people are remaining unemployed is skyrocketing. As the Washington Post notes:

Another disturbing development was that the number of people out of work for 27 weeks or longer reached a record 5 million, accounting for a third of the unemployed. That suggests to some economists that those job losses were caused by structural changes in the economy and that many of those people won’t be called back to work once the economy picks up. The longer people are out of work, the harder it becomes for them to find jobs and the more likely they are to exhaust savings or lose their homes to foreclosure. [95]

The following chart from the St. Louis Federal Reserve Bank shows that people are staying unemployed much longer than they have in any previous economic downturn since 1950:

[96]

As David Rosenberg writes:

The number of people not on temporary layoff surged 220,000 in August and the level continues to reach new highs, now at 8.1 million. This accounts for 53.9% of the unemployed — again a record high — and this is a proxy for permanent job loss, in other words, these jobs are not coming back. Against that backdrop, the number of people who have been looking for a job for at least six months with no success rose a further half-percent in August, to stand at 5 million — the long-term unemployed now represent a record 33% of the total pool of joblessness. [97]

[98: for graphical updates on the state of the economy, see charts from the Cleveland Federal Reserve Bank posted at http://www.clevelandfed.org/research/data/updates/index.cfm?DCS.nav=Local]

Another Trend: Increased Productivity Means Less Jobs

All of the aforementioned economic trends point to lower levels of job creation, and thus higher unemployment.

In addition, the chief economist for MarketWatch, Distinguished Scholar of Economics at Dowling College (Irwin Kellner) points out that worker productivity is rising, and that increased worker productivity means less new people will be hired. [99]

Other Theories Regarding the Causes of Unemployment

The main cause of unemployment today is the economic crisis. For example, a report from the the National Industrial Conference Board pointed out in 1922 stated the obvious: depressions increase unemployment. [100]

The report also points out that seasonal variations, “immigration and tariff policies and international relationship” can affect unemployment figures. [101]

In fact, economists from different schools of thought ascribe different causes to unemployment. For example:

Keynesian economics emphasizes unemployment resulting from insufficient effective demand for goods and services in the economy (cyclical unemployment). Others point to structural problems, inefficiencies, inherent in labour markets (structural unemployment). Classical or neoclassical economics tends to reject these explanations, and focuses more on rigidities imposed on the labor market from the outside, such as minimum wage laws, taxes, and other regulations that may discourage the hiring of workers (classical unemployment). Yet others see unemployment as largely due to voluntary choices by the unemployed (frictional unemployment). Alternatively, some blame unemployment on disruptive technologies or Globalisation.

For example, many Americans believe that globalization has increased unemployment because “American jobs” have moved abroad. Certainly, the American government has encouraged multinational corporations based in the U.S. to move jobs overseas. But quick fixes may lead to new problems. For example, a new American protectionism could stifle trade, further weakening the American economy.

Similarly, some economists believe that inflation decreases unemployment. However, that is only true where the workers drastically underestimate the extent to which higher prices are decreasing the real value of their wages. Indeed, as the Cato Institute notes:

This reduction in unemployment cannot occur unless workers systematically underestimate the inflation rate. When workers are aware of the inflation rate and, for example, have their pay adjusted according to the cost of living, they will interpret wages properly and not be misled into thinking that a normal wage offer is a relatively high wage offer.

Rather than merely failing to decrease unemployment, inflation may actually increase the unemployment rate. Frequent concomitants of inflation, such as high interest rates and volatility and uncertainty in the financial and product markets, increase the risks inherent in business operations and thereby discourage the expansion of firms and the creation of jobs. [104]

Therefore, many “quick fixes” for unemployment may actually do more harm than good.

Isn’t the Government Helping to Reduce Unemployment?

The government has committed to give trillions to the financial industry. President Obama’s stimulus bill was $787 billion, which is less than a tenth of the money pledged to the banks and the financial system. [105]

Of the $787 billion, little more than perhaps 10% has been spent as of this writing. [106]

The Government Accountability Office says that the $787 billion stimulus package is not being used for stimulus. [107] Instead, the states are in such dire financial straights that the stimulus money is instead being used to “cushion” state budgets, prevent teacher layoffs, make more Medicaid payments and head off other fiscal problems. So even the money which is actually earmarked to help the states stimulate their economies is not being used for that purpose.

Indeed, much of the $787 billion was earmarked pork [108], not for anything which could actually stimulate the economy. [109]

Mark Zandi – chief economist for Moody’s – has calculated which stimulus programs give the most bang for the buck in terms of the economy:

But very little of the stimulus funds are actually going to high-value stimulus projects.

Indeed, as the Los Angeles Times points out:

Critics say the [stimulus money reaching California] is being used for projects that would have been built anyway, instead of on ways to change how Californians live. Case in point: Army latrines, not high-speed rail.

***

Critics say those aren’t the types of projects with lasting effects on the economy.“Whether it’s talking about building a new [military] hospital or bachelor’s quarters, there isn’t that return on investment that you’d find on something that increases efficiency like a road or transit project,” said Ellis of Taxpayers for Common Sense.

Job creation is another question. A recent survey by the Associated General Contractors of America found that slightly more than one-third of the companies awarded stimulus projects planned to hire new employees. But about one-third of the companies that weren’t awarded stimulus projects also planned to hire new employees.

“While the construction portion of the stimulus is having an impact, it is far from delivering its full promise and potential,” said Stephen E. Sandherr, chief executive of the contractors group.

It’s unclear how many jobs will be created through the Defense Department projects. Most of the construction jobs are awarded through multiple award contracts, in which the department guarantees a minimum amount of business to certain contractors, and lets only those contractors bid on projects.

That means many of the contractors working on stimulus projects already have been busy at work on government projects.even the stimulus money which is being spent [111]

David Rosenberg writes:

Our advice to the Obama team would be to create and nurture a fiscal backdrop that tackles this jobs crisis with some permanent solutions rather than recurring populist short-term fiscal goodies that are only inducing households to add to their burdensome debt loads with no long-term multiplier impacts. The problem is not that we have an insufficient number of vehicles on the road or homes on the market; the problem is that we have insufficient labour demand.[112]

Donald W. Riegle Jr. – former chair of the Senate Banking Committee from 1989 to 1994 – wrote (along with the former CEO of AT&T Broadband and the international president of the United Steelworkers union):

It’s almost as if the administration is opting for a rose-colored-glasses PR strategy rather than taking a hard-nose look at actual consumer and employment figures and their trends, and modifying its economic policies accordingly.[113]

How Much Unemployment Do We Want?

On the one end of the spectrum, Article 23 of the United Nations’ Universal Declaration of Human Rights declares:

Everyone has the right to work, to free choice of employment, to just and favourable conditions of work and to protection against unemployment.[114]

In other words, the U.N. says that there should be essentially no unemployment for those who wish to work.

On the other end of the spectrum, some people – who make a lot of money during periods where the condition lead to high levels of unemployment – are comfortable with unemployment percentages reaching those in the Great Depression.

Societies should decide for themselves what level of unemployment they consider acceptable, and then demand policies which will accomplish that goal to the greatest extent possible. As discussed above, there are many factors which affect employment levels, and so solutions are complicated.

However, without an open and visible public policy debate about the issue, unemployment levels will either remain second order affects of policy choices concerning other elements of the economy, or will be decided behind closed doors by decision-makers who may or may not have the best public interest in mind.

Public Funding

As the above facts show, unemployment is a very serious problem in the United states, and world-wide. The policy responses of the U.S. and other Western governments has not been working. As discussed above, there is no simple solution.

Senator Riegle recommends a 4-part prescription, including:

Ensure that loans and credit facilities are readily available to the nation’s small and medium size businesses and manufacturers.

Many of the top economists argue that we need to break up the giant banks which are insolvent in order to save the economy.[115] Fortune[116], BusinessWeek[117] and Federal Reserve governor Daniel K. Tarullo[118] have pointed out that breaking up the largest, insolvent banks would allow more competition from small to mid-size banks, and that such banks may actually make more loans to small businesses. More loans to small businesses would lead to more employment by those many small businesses.

In addition, the U.S. has largely been financing job creation for ten years. Specifically, as the chief economist for BusinessWeek, Michael Mandel, points out, public spending has accounted for virtually all new job creation in the past 1o years:

Private sector job growth was almost non-existent over the past ten years. Take a look at this horrifying chart:

Between May 1999 and May 2009, employment in the private sector sector only rose by 1.1%, by far the lowest 10-year increase in the post-depression period.

It’s impossible to overstate how bad this is. Basically speaking, the private sector job machine has almost completely stalled over the past ten years. Take a look at this chart:

Over the past 10 years, the private sector has generated roughly 1.1 million additional jobs, or about 100K per year. The public sector created about 2.4 million jobs.

But even that gives the private sector too much credit. Remember that the private sector includes health care, social assistance, and education, all areas which receive a lot of government support.

***Most of the industries which had positive job growth over the past ten years were in the HealthEdGov sector. In fact, financial job growth was nearly nonexistent once we take out the health insurers.

Let me finish with a final chart.

Without a decade of growing government support from rising health and education spending and soaring budget deficits, the labor market would have been flat on its back. [119]

Raw Story argues that the U.S. is building a largely military economy:

The use of the military-industrial complex as a quick, if dubious, way of jump-starting the economy is nothing new, but what is amazing is the divergence between the military economy and the civilian economy, as shown by this New York Times chart.

In the past nine years, non-industrial production in the US has declined by some 19 percent. It took about four years for manufacturing to return to levels seen before the 2001 recession — and all those gains were wiped out in the current recession.

By contrast, military manufacturing is now 123 percent greater than it was in 2000 — it has more than doubled while the rest of the manufacturing sector has been shrinking…

It’s important to note the trajectory — the military economy is nearly three times as large, proportionally to the rest of the economy, as it was at the beginning of the Bush administration. And it is the only manufacturing sector showing any growth. Extrapolate that trend, and what do you get?

The change in leadership in Washington does not appear to be abating that trend…[120]

So most of the job creation has been by the public sector. But because the job creation has been financed with loans from China and private banks, trillions in unnecessary interest charges have been incurred by the U.S.

Former Washington Post editor and author of one of the leading books on the Federal Reserve, William Greider, points out that governments actually have the power to create money and credit themselves, instead of borrowing it at interest from private banks:

If Congress chooses to take charge of its constitutional duty, it could similarly use greenback currency created by the Federal Reserve as a legitimate channel for financing important public projects–like sorely needed improvements to the nation’s infrastructure. Obviously, this has to be done carefully and responsibly, limited to normal expansion of the money supply and used only for projects that truly benefit the entire nation (lest it lead to inflation)…

This approach speaks to the contradiction House Speaker Pelosi pointed out when she asked why the Fed has limitless money to spend however it sees fit. Instead of borrowing the money to pay for the new rail system, the government financing would draw on the public’s money-creation process–just as Lincoln did and Bernanke is now doing.[121]

By creating the credit itself – instead of borrowing from private banks and foreign nations – the American government could finance the creation of new jobs without incurring huge interest charges owed to the private banks and foreign countries which lent America the money. In other words, the U.S. government would itself create the new credit, just as Lincoln did to finance the civil war.

By financing new projects with credit created by the government itself, America might be able to pick itself up by its bootstraps and put its people back to work.

The same may be true for other countries as well.

This is by far the longest post I’ve ever written. Don’t worry, most of my future posts will be MUCH shorter.

Also, I usually use regular links, instead of linked footnotes.

1) On residential RE: I would dispute the idea that the Chinese housing bubble is deflating. It was, but a shot of loose lending into a hungry economy fixed that temporarily. It will eventually burst, but that time doesn’t appear to be now.

You should’ve mentioned the preposterously high prime delinquency rates(6.4%) in the U.S., as well. Any resulting increase in foreclosures could bring a lot of realized losses to a lot of generously valued securities.

2) Loan loss rate: this is a very key point. If we’re at a stage where the anticipated losses on lending are greater than the interest that can be charged(due to government efforts to lower interest rates), those loans will not be made. And, lo and behold, consumer credit is plunging at an amazing pace, as per your Destruction of Credit section. You can have the government sponge up an arbitrary amount of losses, but ask China how much fun that strategy was with their own state-owned banks.

3) Consumer spending & saving: The boost to the savings rate was mostly due to accounting methods for government transfers. More recent numbers more accurately reflect a very meager(4.2%) increase in saving. That anticipated resurgence in saving hasn’t even happened yet.

4) Decline in Manufacturing: While China is the oft-cited culprit for job losses in manufacturing, that doesn’t strike me as very ingenuous. China has seen severe losses in manufacturing employment as well, thanks to the real culprit: brilliant and amazing automation. Which makes one wonder why the physical capital is there, not here, but it’s frankly not even that important from an employment perspective. Check out a modern warehouse someday. It’ll blow your mind.

5) Destruction of Credit: The secondary markets for credit have become quite vibrant lately, and issuance is easy for those who would like to come to market. That the credit markets should pick up independently and first should come as little surprise, since that’s where monetary policy has the most traction. The short lies somewhere between the credit markets and end lending to consumers and some businesses.

I think isolation of that short is very important to understanding why things aren’t getting better on the ground, even as credit markets improve. Transmission mechanisms are a key component of macroeconomic policy, and one or more of them isn’t working right now. I suspect lack of demand and distance from direct government mediation are involved, but that’s more conjecture and cognitive bias than reasoning.

6) Another Trend: Increased Productivity Means Less Jobs: Normally you should get bashed for the lump-of-labor fallacy here. This is just demonstrably untrue in the long run of human history to date.

7) Other Theories Regarding the Causes of Unemployment: Things really aren’t consistently better internationally. I don’t think this is a transfer of jobs, so much as a generally massive adjustment.

8) Isn’t the Government Helping to Reduce Unemployment? Keynesian multipliers are well-conceived in theory but totally decoupled from empirical evidence. I consider them total voodoo(rhymes with) until proven otherwise, and this experience to date has done absolutely nothing to change my mind.

NDK’s #1: I keep harping on this, because it seems to be forgotten. The Internet is a really revolutionary technology, and it has destroyed a ton of business models. While the Internet itself may be old news at this point, the world is very far from having adapted itself to the Internet’s evolving and growing impact.

What happens to coffee shops and local stores? Malls? Music and movie industries? Publishers? Academics? Distributors? Knowledge workers of all stripes? The service industries that depended on the wages of those knowledge workers?

I’ve watched Facebook, Amazon, and Google smash far more business models, whether deliberately or by accident, than they’ve enabled. They have set expectations that businesses be able to support themselves through advertising and selling personal data alone; they’ve set expectations that everything should be free, easy, and pretty.

They’ve moved into extremely monopolistic positions. President Obama owes much of his electoral success to them, and he knows it. I expect a friendly and cooperative executive branch for awhile.

In general, though, I think you’re right. The world must come to grips with the incredible power and superstar effects engendered by the rise of the Internet. The value of an individual is changing. There are going to be a lot of has-beens. I may well be one of them soon myself.

We’re in a really protracted and difficult adjustment period for labor worldwide, and without wages increasing, corporate revenues will have trouble rising as well. Without wages and corporate revenues rising, it’ll be difficult to see sustained increases in profits and credit quality. I still sit long T-bonds.

p.s. On a personal note, I think a lot of the reason that America needs to get some psychiatric help is also the Internet. I’m a child of the digital era, having received my first computer at 2 and being on the Internet lightly at 6 and heavily at 9; I’m 27 now. Most of my socialization is digital, and I have many friends who are even more wired than me now.

While 30 years ago we might all be at some speakeasy in Manhattan together, now we see each other’s characters only in black and white, while we lead frenetic lives elsewhere. The loss of empathy, community, and compassion is probably pretty important. No offense to here, but I’d much rather be there. It’s probably healthier for all of us, in the long run.

“6) Another Trend: Increased Productivity Means Less Jobs: Normally you should get bashed for the lump-of-labor fallacy here. This is just demonstrably untrue in the long run of human history to date.”

Are you sure? The data I looked at from the ILO suggests otherwise over the last decade or so, looking at global GDP against labour participation rate, for example. I can’t post the chart the figures yield, but I could see no clear relationship. For me, to fall back on rhetoric for a moment, the maxim “doing more with less” means, over time, less and less need for human labour. The people (including Marx and Keynes) who feared technological unemployment did not forsee the import of the service sector, but service is not immune to technological displacement of labour. Manufacturing is not the future of labour growth. Can services be? Isn’t the fact of massively increasing public sector employment simply (in part at least — the stats on the military are frightening indeed) a way of keeping purchasing power high by tax/wealth redistribution? Another sign of the effects of technological unemployment is the diminishing power of unions generally, not to mention poor wage growth. Labour is simply not as much in demand as it was. Humans can’t compete with machines and software: we are getting better and better at automating, and AI is in its infancy.

Rifkin quotes a figure of 2% global workforce employed in manufacturing by 2020. Services are under threat too: there are fully automated kitchens being introduced in MacDonald’s restaurants, and other wonders still to come. Our problem, as we stumble into the oddly frightening future, is our relationship with work and value. These magical concepts, as we tend to understand them today, are relics from religion, particularly Puritanism. Mercantalism and capitalism had a profound effect on religion, but religious thought had a profound effect on them too, poisoned them if you like. Technology (and particularly the internet as you rightly point out) will have a similarly profound effect on capitalism. It’s early days yet. History does repeat itself, but not parrot fashion. Tomorrow is effected by today, but not identical to it.

@George Washington: Thank you for a detailed and important post (if it needs to be long, let it be long!). Employment is the elephant in the room.

The data I looked at from the ILO suggests otherwise over the last decade or so, looking at global GDP against labour participation rate, for example.

I think we’re talking about different long-runs. History is full of tales of people scared of gains in productivity, dating back to the industrial revolution. We’ve always found other useful ways to employ people, even up until the end of the dot-com bubble. Employment started getting really bad only around then.

Eras of rapid productivity growth in the industrial revolution led to widespread unemployment, uproar over child labor, and sweatshop working conditions. That demonstrated an incredible surge in the productivity of a human being empowered by a little steam and a little ingenuity, and not much demand for finished goods. Sound familiar?

The world eventually recovered. There aren’t many kids working in factories in the UK anymore — nor China, for that matter. Unemployment among adults fell, and we’ve all got a much better standard of living and more interesting things to do than make nails, as a result.

I’m dubious that current productivity numbers reflect entirely productivity growth rather than lowered employment, but it is probably a genuine part of the answer.

You’re right: there’s a very long way to go. Imagine the productivity of the next Feynman who digitizes all his lectures and makes them available to the world. Imagine the lot of Dr. Smith at Podunk University once this happens, and enough students complain about high education costs. That’s just one example to counterbalance your McDonald’s kitchen. It’s an egalitarian crisis, and there’s a LOT more fat on white collar bones.

But you ask, has technological advance finally totally eclipsed mean human ability? I still don’t think so. It’s been claimed before, and though this time really is different, I maintain a trust in the incredible value, creativity, and utility of a human being. I think those qualities will shine through in 10 or 20 or 30 years. But it really is blind faith based on past experience.

Regardless of whether you’re right or I’m right, there’s many years of difficulty and adjustment ahead. I hope both find ourselves smiling once the outcome of this one is clear.

Our problem, as we stumble into the oddly frightening future, is our relationship with work and value.

Having watched bored and hopeless towns across the Midwest sink comfortably into meth and other drugs, and being a firm believer in the value of “giving a damn” writ large, even apart from religion, this part really scares me.

Unlike predictions of failure to eventually recover employment, I don’t think predictions of a generation adrift are at all premature.

Thanks for your thoughtful response.

I guess I ought to preface my posts with the statement “I am an optimist.” I’m sometimes giddily excited about what the future might bring, if we face its threats and promises wisely. Like you, I too have great faith in the ingenuity of humans (while stoking a smouldering pile of worry about our stupdity). A new relationship with work and value is possible (and necessary), because humans are, above all else, creative. Bring it on.

ndk, Toby Russel and George Washington,

Thanks for a thought-provoking discussion.

I’d like to add my two cents worth and also to take Toby to task over this remark:

“Our problem, as we stumble into the oddly frightening future, is our relationship with work and value. These magical concepts, as we tend to understand them today, are relics from religion, particularly Puritanism.”

There seems to be a great deal of misunderstanding surrounding the Puritans. Perhaps the reason they have been so demonized is because their radical ideas threatened the powers-that-be of their day. Whether this be the case or not, a portrayal of them has emerged that, as Jacques Barzun put it in From Dawn to Decadence, “omits much, takes one feature for the whole set, and yields a caricature.”

As Barzun goes on to explain: “A drive toward something close to democracy came from these Christian sects which…are not remembered as revolutionary.”

Perhaps it was the Puritans’ belief in equality that the English aristocrats found most threatening. The English lords and gentry based their legitimacy on three factors: tradition, divine right and property.

In attacking tradition, the Puritans asserted, according to Barzun,

“that human institutions were a matter of choice designed for a purpose and maintained by custom. They should be changed when the purpose was no longer served. Mere length of time–custom–is arbitrary, not in itself a reason. Consciously or not, some of the Puritans shared the scientists’ trust in experience, in results, in utility.”

The attack on divine right emerged from the Puritans’ religious beliefs. Again citing Barzun:

“When every congregation was independent and elected its minister, the whole people should be politically empowered through the vote. The religious parallel was decisive: if a purer religion, close to the one depicted in the gospel, was attainable by getting rid of superiors in church, a better social and economic life, close to the life depicted in the gospels, would follow from getting rid of social and political superiors.”

And of course there was the attack on property rights, again from Barzun:

“The sects and leaders classed as Puritans, Presbyterians, Independents, were social and political reformers…”

“Now, social reform must appeal to some accepted standard…the general welfare, or the needs of a neglected group, or the desirability of…a better standard of living. The Puritans, many of whom were called Levellers, agitated for equality of rights and conditions.”

It’s not difficult to see how, if the value and status of property were diminished, that labor, amongst other things, would become relatively more esteemed and valued. And to the landed gentry, whose property was fundamental to its entrenched privileges, this of course was an extremely radical and subversive idea.

Upon their arrival in America, however, many if not most of the Puritans themselves became landowners. But they left the older feudal culture behind—a culture where nobles owned the land and peasants provided the labor to cultivate it. The Puritan society instead conformed to John Locke’s conception of men “mixing their labor” with nature, or Jefferson’s ideal community consisting of independent freeholders, each tilling his own plot of ground and enjoying the fruits of his own labor.

And, as Reinhold Niebuhr pointed out, “the descent from Puritanism to Yankeeism in America was a fairly rapid one.” America was to develop as a bourgeoisie society and, according to Niebuhr, the Puritans’ “grateful acceptance of God’s uncovenated mercies” were “easily corrupted from gratitude to self-congratulation.” The prosperity which “had been sought in the service of God was now sought for its own sake,” and the Puritans came to believe that their legendary prosperity was a result of their own virtues, which included diligence, honesty, thrift, and of course hard work. Max Weber notes in The Protestant Ethic and the Spirit of Capitalism that “capitalism remained far less developed in some of the neighboring colonies, the later Southern States of the U.S.A., in spite of the fact that these latter were founded by large capitalists for business motives, while the New England colonies were founded by preachers…for religious reasons.”

I agree, Krugman has hinted at this in “Pop Internationalism.” His focus was more on the manufacturing sector, but I don’t see why that couldn’t have spread to the service sector. It seems like a common sense argument.

employment is falling because companies are replacing workers with machines, and making more efficient use of those they retain pp. 48

It was Marx therefore, and not the Puritans, who is to be credited (or blamed, depending on one’s way of looking at it) for being labor’s greatest champion and helping cement its current lofty status. “Marx is the only thinker of the nineteenth century who took its central event, the emancipation of the working class, seriously in philosophic terms,” Hannah Arendt observes in “Karl Marx and the tradition of Western political thought.” “Marx’s great influence today is still due to this one fact.”

“To put it another way,” Arendt explains; “while others were concerned with this or that right of the laboring class, Marx already foresaw the time when, not this class, but the consciousness that corresponded to it, and to its importance for society as a whole, would decree that no one would have any rights, not even the right to stay alive, who was not a laborer. The result of this process of course has not been the elimination of all other occupations, but the reinterpretation of all human activates as laboring activities.”

Cracks have appeared in this formulation, however, with the passing of time. For as Arendt writes in Crises of the Republic:

The enormous growth of productivity in the modern world was by no means due to an increase in the workers’ productivity, but exclusively the development of technology, and this depended neither on the working class nor on the bourgeoisie, but on the scientists. The “intellectuals,” much despised by Sorel and Pareto, suddenly ceased to be a marginal social group and emerged as a new elite, whose work, having changed the conditions of human life almost beyond recognition in a few decades, has remained essential for the functioning of society. There are many reasons why this new group has not, or not yet, developed into a power elite, but there is indeed every reason to believe with Daniel Bell that “not only the best talents, but eventually the entire complex of social prestige and social status, will be rooted in the intellectual and scientific communities.”

I might add that Arendt would not include the field of economics, nor any other of the social disciplines, under the rubric of science. Quite the contrary, she was quite adamant in insisting that the behavioral sciences were something very different from the natural sciences.

“Obviously, this has to be done carefully and responsibly, limited to normal expansion of the money supply and used only for projects that truly benefit the entire nation (lest it lead to inflation)…”

Is there an icicle’s chance in Hades that our hopelessly corrupt elected overlords could adhere to this limitation?

I dub thee the *Bitter Pill Post*…you may now rise. GW I have zero problem as a reader to the length of your post, is not the devil in the details and over whelming mass of them in debate.

I will spam this little Bettie around like an Hawaiian with a loaf of bread and fresh Poi (homeboy delicacy).

NDK great to see your informed thoughts back here as they always shine light into dark corners.

Skippy…only thing that keeps me sane some days is rational, adroit and some times humorist offerings found here and a few other places.

This is what Trimtabs had to say about August job losses:

” Trim Tabs…estimates that the actual job loss is 335,000. The firm estimates job losses regularly and instead of the survey used by the government, Trim Tabs looks at daily income tax deposits. The idea is that such numbers show up fast and are fairly reliable because they reflect what taxpayers are paying in taxes.”

http://newsblogs.chicagotribune.com/marksjarvis_on_money/2009/09/laboring-over-job-loss-numbers.html

And about wages: “TrimTabs also says wages dropped by 4.1 percent, year-over-year, in August. Meanwhile, the M2 measure of savings — that’s bank savings, small-denomination certificates of deposit and retail money market funds — fell by $94.6 billion over the last three months. That’s the largest three-month drop on record. Charles Biderman, CEO of TrimTabs, attributes that drop to people “yanking record amounts of money out of savings” due to the recession.”

http://www.bizjournals.com/sanfrancisco/stories/2009/08/31/daily44.html?jst=b_ln_hl

Finally, echoing ndk about Chinese house prices, Caijing reported early September that “New home prices in Shenzhen rose 18.6 percent month-on-month in August, the sixth straight monthly gain, while sales by floor area fell 29.7 percent from a month earlier, real estate consultancy DTZ said in a report on Sept. 1.”

http://english.caijing.com.cn/2009-09-02/110237354.html

It seems that American housing bubble was just a walk in the park compared to what’s going on in China.

So, what looks cheap to you?

Also, for our audience, anything look like a bargain?

Larry: Volatility

Excellent post – well thought out and detailed. An important topic demands such length and analysis. And excellent comments to boot.

Advanced socities may have to redefine what labour and leisure really is all about in the 21st century. It seems we have been putting this exercise off for decades now. We also need to understand what the so-called service sector is really comprised of in economic outcome terms. It seems to me that the service sector doesn’t necessarily create surplus value in the traditional sense but has become a proxy for a few winners takes all outcomes.

As for the internet giants and their present position, I see some real competition coming down the road once the Lisbon Treaty is adopted in the EU. Brussels has been targeting Microsoft and now Google for some time. I expect the EU technocrats to launch an all out assult on these giants. The Lisbon Treaty will be concentrating alot of power into a few hands. These new power brokers need to come up with some quick success at the earliest time possible to placate a continent of 500 million. Creating a few Euro lead internet giants, along the lines of Airbus, might keep the plebs happy and cement the new Federal European project into place.

Interesting times ahead for all the new power blocs – East and West.

I hate to go to a shoot out with a knife, but with regard to the issue that we will all sit around with nothing to do because of technology:

a. Some wag (or economist) once said that “expenditures rise to meet income.” I say that work rises to meet 40 hours. Its been over a centrury since the institution of the 40 hour week – nobody seems to be saying we should reduce it permanetly.

b. Medical field as an example. 50 years ago a blood pressure cuff, listen to your heart, and off you go. Today, blood pressure can be monitored continuously for a week. Everybody who makes and maintains such monitoring devices, and than interprets the results. Everybody who researches drugs and treatments for high blood pressure.

c. I remember 5 years ago buying a computer on-line — there was no option for talking to a real person. Now every site, you can talk to a real human representative – if you like (not me, I’m too ornery ;) – maybe not a high paying job, but a job that apparently didn’t exist too long ago.

d. granted, I’m a gubermint weenie. 10 years ago, getting a peer reviewed article from the library was time consuming and frequently not doable, and therefore not done. Now it is easy and fast – and the expectation is that there will be dozens of such articles referenced in my work. (work rises to meet time available)

e. How many people work in the entertainment field? I remember 3 networks as a kid. Now there are ????? – sure, the average TV performer is probably making less, but I imagine there are a lot more people employed in the field than there used to be.

I tend to agree that there is going to be a reduction in the material standard of living – this society does not have the income for all the Granite filled 3,500sf McMansions with 9mpg SUV’s – but it still can be productive and have a high level of employment…if we let restructuring take place, and understand that finance can’t be 17% of the economy.

From the News from 1930 website in the WSJ September 3, 1930.

“Prof. C. Persons quit job in Census Bureau because higher official decided to exclude from count of unemployed those laid off with “promise of reemployment at some indefinite future time”; Prof. Persons estimates there are 5M unemployed, contradicting census estimate.”

I would add comparing ‘numbers’ from the 1930’s and today ignores other changes and, despite the social safety net in place today, may make modern unemployment a bigger problem than even the elevated levels seen in 1933. We were a far more agrarian nation then with larger households. Hard to be truly ‘unemployed’ if your family farmed. Today we have vast numbers of discrete 1 or 2 person households without much in the way of family networks to fall back on. Lose your job in that situation and you are in real trouble. We may even start seeing ‘hobos’ again.

@fresno dan:

I read some paper on technological unemployment on the internet a while back, which said weekly hours have fallen from 80 to under forty in a century or so (can’t confirm how accurate this is). Also, the Fed’s figures show 33 hours a week and falling. I don’t know what proportion of the working population works in entertainment, but I bet it is a low percentage. Also, there was a proposal in the thirties, during the Depression, to cut the work week to 30 hours. The Senate voted it through, but Roosevelt stopped it. He claimed to regret his decision after his term. (I got this tidbit from The End of Work, by Jeremy Rifkin.) France (and maybe other EU countries) have followed a similar pattern I think, in reducing the work-week. There are stats to show it improves productivity.

It is only our idea that “work” is “labour” that holds us back on this point, as if laziness naturally and always follows having no labour to exchange. There is no evidence for this in circumstances where a resource-based economy is in operation, for example on St. Kilda for centuries. Marshall Sahlins is instructive on this with regards hunter-gathering (The Original Affluent Society).

I don’t think we need fear this process. Coming out of the closet here (hinted at above), I’ll state that for me a resource-based economy makes pragmatic sense as a direction to pursue in dealing with the challenge of automation. This is not at all an overnight process, needs to be tested and pondered deeply before any binding decisions are made, but I like knowing there are alternatives to the current system.

Speculating our loud for a moment and risking opprobrium for my sins of economic ignorance:

“Increased Productivity Means Less Jobs.” For the opposite to be true, as orthodox economics posits, wouldn’t the following also have to hold?

increasing economic activity = increasing human labour (and vise versa)

Which in turn would mean economic activity is joined at the hip with human labour, indeed IS human labour at root. Labour is where value comes from. Resources, ownership, scarcity and abundance are secondary to labour. Therefore, if machines, software and AI tend to replace over time the need for human labour, our ongoing challenge is to keep humans necessary for the task of producing goods and services they might want to consume, to find/create labour that cannot be replaced by machines/AI at a speed greater than technological development can match, AND in sufficient quantity to keep purchasing power sufficiently powerful.

This process has been fitful and observed over centuries, but the race is hotting up, becoming more pressing. Assuming we don’t destroy ourselves, what are our chances of staying ahead of our inorganic competitors in this race indefinitely? Over the next hundred years? The next fifty? If we fall behind, that is, if human labour becomes sufficiently unnecessary for producing the required/demanded goods and services, we will need a new economics. I think this needs to be discussed openly and globally.

Forgive me if I am missing something. I am but a humble seeker…

Excuse me, but what will tickle labors minds whilst the transformation occurs. Just look at the freers/brithers/Rush mob gyrations when confronted with dissolution of their traditional values.

I’m a product of that Midwest/Southwest ideology and understand their plight as they are born and bred as labors of masters, it is a birth right in their minds. Hell I spent 20 years striping that wall paper off my mind and it was not a good time for me or others around me. So what work/labors can be inserted whilst generational change occurs, they are are/going berko as ndk pointed out.

They have the potential of becoming the American equivalent of Mujahideen, tired of rapid changes of which they have little understanding or want of with regards to long held beliefs (I wanted a pickle and got the barrel).

BTW I’m good with annual hours completed for trade of goods and services, less than 29hrs a wk in any field, plus anything that can get us through till population growth pattens plateau/rescind .

Skippy….Historical parallels have ceased to be relevant its a brave new dimension.

Hi Skippy,

you point out the part of this process that is both its most dangerous and tragic consequence. It has happened repeatedly throughout history, the Luddites for example, but change is nature, as Remy says in Ratatouille. In terms of hard work, sweat-of-the-brow stuff, there is an out of wack ecosystem we can’t afford to put right at the moment. That should keep people busy during any transition. But that needs a huge amount of organisation and will only be seriously considered after a total redesign of the system is taken seriously. Until that time, for those caught in its merciless maw, this process of adjustment is not going to be pretty.

But like I already pointed out, I’m just probing around here, seeing what others think. I most certainly don’t have all the answers and could be way off base with my analysis. Time will tell.

p.s. I always enjoy your posts.

“They have the potential of becoming the American equivalent of Mujahideen, tired of rapid changes of which they have little understanding or want of with regards to long held beliefs”

That touches one of my biggest preoccupations regarding this recession. Contrary to 1930, where communities were tight knitted, families were large and living at shouting distance of one another, we have a atomized and very mobile society with few occupants per household, and a significant proportion of the population living alone.

Factor in loss of “market value” for your skill set, rapid changes that are completely out of personal control, decrease in standard of living, an acute feeling that “things are not fair” or that “the fix is in”, “the country is headed in the wrong direction” while on teevee, those who are mainly responsible for this crisis are still making like bandits aided and abetted by the pols.

To compound the problem even more, said teevee vomits a torrent of blablabla about how the economy is recovering (Really? where?), that the situation is improving (for whom) and of course, never an in-depth look at how bad things *really* are for the ordinary people. And if by happenstance they do, well, it’s just one of those things, you know. Gotta pull up you socks and get going buster!

Far out! You, the buster in question, have been frantically looking for a job for over a year now. Money is awfully tight, you’re back on your mortgage, groceries are more controlled than access to a nuclear plant, you pray no one in the family get sick; as for anything entertainment…you canceled everything cable, restaurant and movies a long time ago. Of course, if you get rear-ended, the car is gone too. Everything you ever believed in, the importnace of Church and family, hard work get rewarded, save every month, be good and loyal to your employer…all these long held beliefs are severely tested, to say the least. As for any sense of self-worth…

But…things are *improving* man!

How long can this disconnect be sustained in the face of crude and cold reality? What about the effect of time? Should I also mention the abysmal success rate of worker retraining in the US?

Feeling isolated, frazzled, discouraged, anxious and confused, you listen to this guy on the radio who provides simple and clear “explanations” to all your woes. The “others” stole you job, “the increase in criminality, it’s them!”, the government and the *libruls* (gasp!) “wants you to pull the plug on granma” and so on and so forth.

Doesn’t sound like much, but there are 4 people who, influenced by these hate mongers, already acted out and murdered innocent people. With this this economic crisis as a powerful catalyst, we’ll see more of it. To pass form these random events to the “Mujahideen” stage, the only thing needed is a catalyst like an organized group a la survivalist/militia type.

Sigh! This could be really ugly.

@fresno dan:

“a. Some wag (or economist) once said that “expenditures rise to meet income.” I say that work rises to meet 40 hours. Its been over a centrury since the institution of the 40 hour week – nobody seems to be saying we should reduce it permanetly.”

Ok, I’LL go out and say “we should be permanently reducing hours worked/the work week as a new normal”.

Hell, how many futurists of the past kept going on about how technology would “free us” such that we would work less and enjoy more leisure? THAT WAS THE POINT OF TECH INNOVATION! Yet all it has done is lead to MORE hours worked and LESS leisure. Americans in particular, are the least vacationing people in the known (developed) universe…and this is NOT a good thing.

The work week should be 4 days and vacation time should be expanded AND mandatory. The new normal needs to be less work, more time off, more leisure, exactly the way it was always supposed to be (the way it has always been sold to us).

Switch to social credit with the government creating interest-free money into existence (rather than owing some private bank the instant money is “borrowed into existence”) and leave the private banks out to fill in the cracks as MUCH smaller entitities.

May be time to look at the Work Less Party who are actively working to reduce working hours and get mandatory vacation time in the US. I know they are struggling right now. Look them up and pass the word on.

Good piece, it will take me some time to fully apprehend its content.

I do have this thought; what we are experiencing is the global equilibration of the cost of labor. The equilibration process is manifest in the exercise of the labor cost arbitrage, the exported production jobs to lower wage locales. This equilibration is imputing reduced wages in the US while they are rising in the rest of the world.

Our profligate spending that has been financed by easy credit that has created what is best described as a false level of demand. Capacity utilization rates are low and concurrently so is employment. The declines in labor utilization have been global. They are headed lower;i.e., we will see higher rates of unemployment.

The global reliance on easily inflated fiat currencies lies at the core of the false price and demand signals. To fix the employment situation we need to simultaneously fix the global currency and to rebalance the means of production. This is problem of complexity that will take years and may never be resolved.

I suppose it is a sign of the times when otherwise respectable economists are openly considering printing money.