By Richard Alford, a former economist at the New York Fed. Since then, he has worked in the financial industry as a trading floor economist and strategist on both the sell side and the buy side.

The G-20 statement contained seven principles to guide policy during the balance of the crisis period. However, the agreed to policy principles juxtaposed with US trade data suggest that the G20 may be promoting the current recovery at the expense of contributing to a future crisis. The likely existence of this trade-off can be seen by reading the G20 statement (The executive summary is reproduced below.) and examining the behavior of the US trade deficit. The underlying politics also imply that probability of international economic and financial cooperation extending past the current stimulus packages is low to non-existent.

First, the executive summary of the G20 statement:

Executive Summary

The global economy has returned to positive growth following dramatic declines. The recovery is, however, uneven and not yet self-sustaining, notably in advanced economies. Financial conditions have continued to improve, but are still far from normal.

Exit strategies should pave the way for strong, sustained and balanced economic growth. The Principles below are intended to establish common ground for the design and implementation of policies during the exit from the extraordinary support measures taken during the crisis.

Principle 1. The timing of exits should depend on the state of the economy and the financial system, and should err on the side of further supporting demand and financial repair.

Principle 2. With some exceptions, fiscal consolidation should be a top policy priority. Monetary policy can adjust more flexibly when normalization is needed.

Principle 3. Fiscal exit strategies should be transparent, comprehensive, and communicated clearly now, with the goal of lowering public debt to prudent levels within a clearly-specified timeframe.

Principle 4. Stronger primary balances should be the key driving force of fiscal adjustment, beginning with actions to ensure that crisis-related fiscal stimulus measures remain temporary.

Principle 5. Unconventional monetary policy does not necessarily have to be unwound before conventional monetary policy is tightened.

Principle 6. Economic conditions, the stability of financial markets, and market-based mechanisms should determine when and how financial policy support is removed.

Principle 7. Making exit policies consistent will improve outcomes for all countries. Coordination does not necessarily imply synchronization, but lack of policy coordination could create adverse spillovers.

The seven principles all address domestic policies, monetary, fiscal and financial repair. The emphasis is on restoring sustainable growth. However, despite the call for balanced economic growth in the second sentence, there is no call for any country to take any steps to reduce global economic imbalances.

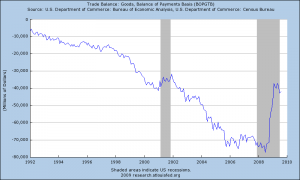

The US trade deficit since 1992:

The chart of the US trade deficit proves nothing. However, the underlying data is supportive of the argument that the US trade deficit was in large part not driven by exchange rates or excess savings in the rest of the world, but rather by income levels and the lack of savings in the US.

The juxtaposition of the G20’s seven principles, noting the absence of any effort to restore global balance, and the chart above should raise a number of questions.

Can we return to “balanced economic growth”, as per the executive summary, if the sole focus of policy is the restoration of economic growth? The behavior of the US trade deficit suggests stimulating economic growth in the US will lead to a re-widening of unsustainable international imbalances unless other steps are taken.

What does the total absence in the G20 statement of any reference to measures to reduce and prevent unsustainable global imbalances imply for the willingness and ability of policymakers to address the global imbalances?

Should not the exit strategy include steps to restore global balance if growth is to be sustainable?

Indentifying and implementing policies to prevent a return of wider trade deficits will be an economic, financial and political challenge. The effectiveness of Dollar adjustment to restore global balance is limited by the concentration of the US trade deficit and the willingness of some countries to peg the currencies to the Dollar. On the other hand, the Dollar must be part of the any adjustment process as the prices of US produced tradable goods must rise relative to the prices of US produced non tradables goods and services to incentivize resources to return the tradable goods sector. Additional adjustments will be required of the US, but adjustments by other countries will also be required to achieve an efficient and sustainable pattern of trade.

From a US geo-political perspective, there is another challenge. The US position is that other countries must make the adjustments (bear the costs) to reduce the imbalances. This turns the Washington consensus and years of precedent on their heads. In the past, when international imbalances generated problems, the costs and burden of policy and economic adjustments were borne by the deficit country(s) and not surplus countries. In this case however, the US position is exactly the opposite. The US position will not win it any friends.

Two statements this weekend, one by Geithner and the other by Chinese Premier Wen, reflect this problem. Geithner’s post-G20 statement indicates that US is still counting on cooperation from the rest of the world:

These are all global challenges. They are important to our national economic interest, but they cannot be addressed by the United States alone.

While Market Watch quoted Chinese premier Wen as saying:

I hope that as the largest economy in the world and an issuing country of a major reserve currency the United States will effectively discharge its responsibilities, …Most importantly, we hope the U.S. will keep its deficit at an appropriate size so that there will be basic stability in the exchange rate and that is conducive to the stability and recovery of the world economy.

The statements suggest that international cooperation on the trade front will no better than the international cooperation on carbon emissions has been.

The ongoing financial crisis will only worsen, if economic growth is not restored. However, it would be a Pyrrhic victory if the recovery simply set the stage for another economic or financial crisis.

Most importantly, we hope the U.S. will keep its deficit at an appropriate size…

…The ongoing financial crisis will only worsen, if economic growth is not restored.

Well if you go by the data the government puts out, we have growth at the moment.

But the truth is that government spending counts as part of GDP, and so there doubtless would be no ‘growth’ without deficit spending.

And I for one do not see that changing soon.

Darn it – can’t see the graph.

What leaps out at me from the statement of principles is:

1. They don’t even try to lie and claim the point of any of this is the good of the people rather than financial elites.

2. Fiscal policy can’t even be mentioned except in the context of “exit strategies” and how “temporary” it has to be. They’re clearly disgusted by the very thought of it.

Meanwhile monetary policy can be boundless and forever. (And they don’t have to think about any bounds on unconventional looting policy before they cut back on the flow of free money to the banksters, and they don’t have to think about that until they’ve slain the evil stimulus monster.)

It’s alot like how something like health care reform mysteriously has to be “deficit neutral” while bailouts, wars, weapons spending, and tax cuts for the rich can be infinite.

Principle 1:

Every financial transaction that has nothing to do with trade or the real economy, is illegal.

Principle 2:

Governments shall pursue a policy of full employment.

Everything else is crap.

I have an enormous sproblem with:

“Principle 5. Unconventional monetary policy does not necessarily have to be unwound before conventional monetary policy is tightened.”

If they start tightening before withdrawing the alphabet soup welfare programs for Goldman Sachs and other banks, then that means:

1. The real economy, and real world considerations of human suffering (e.g., unemployment) are subordinate to the interests of the banking elite.

and

2. The financial sector cannot continue to operate, at least not with the staus quo of fat profits and bonuses, in the absence of government subsidy, so keep the subsidies coming.

A recent Guardian article quoting a whistleblower at the IEA is consistent with what has been surmised for some time now: peak oil is here or near. If so, attempts to restart growth as we’ve come to know it -as the panacea for socioeconomic problems- is over. We need to face the reality that the physical world of energy and matter can no longer sustain perpetual economic expansion.

We will in all likelihood not face this soberly and willingly -it’s just too culturally and mythologically absurd.

Alford said the following;

“The chart of the US trade deficit proves nothing. However, the underlying data is supportive of the argument that the US trade deficit was in large part not driven by exchange rates or excess savings in the rest of the world, but rather by income levels and the lack of savings in the US.”

US trade deficit was not driven by exchange rates? Poppycock. Of course it was. The US $ has weakened significantly against almost all currencies, and yet the trade deficit has accelerated. How can that be? Because our trade deficit with pegged currencies has exploded. Our trade deficit has absolutely been driven by exchange rates, just not those of the floating rate variety.

The US trade deficit was in large part not driven by excess savings in the rest of the world?

Once again poppycock. Of course it was. How has China funded it’s massive investment increases that has allowed to run up massive trade surpluses? It didn’t get this only through direct foreign investment, it has done so through net Chinese savings, and through a massive increase in bank lending. Banks cannot lend sufficiently if they do not have deposits, there is a mathematical limit. Increase the amount of deposits and the amount that can be lent increases exponentially.

Principle 1:

Every financial transaction that has nothing to do with trade or the real economy, is illegal.

Principle 2:

Governments shall pursue a policy of full employment.

Those two principles are pretty self-contradicting. If a country pursues full employment, it’s likely going to include lots of jobs that have nothing to deal with trade or the real economy.

The G-20 is a joke. There is no leadership there. There is no sense even of the problem that they now assume they can engineer exit strategies for. It is precisely because they have not fixed the current crisis that there will be another crisis.

“The ongoing financial crisis will only worsen, if economic growth is not restored.”

No. The financial system needs to be liquidated and restructured. If not, it will pull down any effort at economic recovery. The paper economy is a weight on the real economy. Both need to be resolved. The resolutions are quite different in character but the real economy can not move forward until the paper economy has been largely dismantled.

“Principle 3. Fiscal exit strategies should be transparent”

Never believe anything with the word “transparent” in it.

Dan Bednarz wrote:

“We need to face the reality that the physical world of energy and matter can no longer sustain perpetual economic expansion.”

Well, if I am inclined to be evil minded, which I am, I would offer that perhaps “they” are all to keenly aware of the state if play where energy scarcity is concerned, and have enacted their most recent gargantuan swindle to position themselves for maximum advantage. Because, you know, it is not enough to merely prosper, others must suffer and lose in order for the Wall Street banker types of the world to be satisfied. Do please pass the H1N1 flu vaccine when you are done with it, Lloyd.

and the cartel continues to grow ..

Replacement:

The MBA program teaches debt maximization and replacement theory. Speed to disclosure is proceeding quite well in the area of debt maximization, so here’s replacement in a nutshell:

The multi-nationals have built a global asset induction vacuum, by replicating the best business practice of cartel behavior among nation/state governments, telling their leaders how much smarter and more important they are than their “subjects”, with the proof of lucrative private sector deals following their “public” employment. With this mindset and participation, the nexus rotates internal sector capital investment, subsidized by taxpayer leverage, as well as nation/state capital investment, like an internal combustion engine, firing cylinders one after the other.

The net effect is to remain in the sector long enough to induce individual capital investment, then move on, leaving that stranded capital investment to fall in an accounting sink, controlled costs greater than controlled revenues, built for the purpose. The point of the nexus, among education, political job certification, and targeted debt expansion, is to ensure that individuals spend all their time chasing the debt manufacturing machine, and never catch up. No sooner does the system finish “educating” one group, then the next group is ready to replace them.

K-12, which teaches the value system of control, weeds out the kids that show potential for dissent. The textbooks adopted by the political body are purposefully misleading, and the associated teaching scripts reinforce the misdirection. Any student that does not follow along like a robot is stupid, obstructive, and needs medication, and the education policy out of the university complex is to prefer those college graduates with the poorest test scores for incorporation as teachers, a self-reinforcing system of ignorance propagation, where dumb is smart, and intelligence is stupid.

Anyone who has entered one the prestigious “research” schools of late, and received straight As to enter a politically protected profession, know that critical program professors tutor “special” students with special material. Those students get the highest grade, and the bell curve is applied behind them. Laziness comes with the territory, so I either figured out which textbook the teacher was getting the questions from, or observed until I caught the target professor giving the special answers to the special students, who were quite easily identified based on their behavior. The job certification process works the same way.

Vinny is obviously “old school”, where the job of the professor is to cultivate real talent. In this system, talent is not just dissuaded; it is actively punished, so Vinny, no doubt, sees a lot of conniving little monsters.

Two undergrads, 2 grads, 1 prof cert program, 7 trade unions, countless job specific cert programs, and pre-med, where I was asked to “fix” research problems with injecting the HIV virus into orangutans. The MBA was just icing on the cake.

Natural selection is about swimming against the tide; just pick a suitable tide, always readily available in the environment.

“Principle 3. Fiscal exit strategies should be transparent, comprehensive, and communicated clearly now, with the goal of lowering public debt to prudent levels within a clearly-specified timeframe”

Ha Ha Ha Ha Ha Ha Ha Ha Ha Ha Ha hahahahahahahahahahahahahahaahahah

hahahahahahahahahahahahahaha

HAHAHAHAHAHAHAHAHAHAHAHAH

HA

HA HA

ehem….

HA…

hahahahahahahahahahaha a h ahahahahahhahah ahahahahahhahahahahahahahahahah!!!!!

thats funny

A few programmers and speculators cracked the system, and the only exit is purely municipal interest law, which is already structured to trump federal law. The G-20 is specifically designed to feed the monster, and has no power to place it on a diet.

Timing the market is not difficult; measure cattle movement with calculus. They have to get the herd up and moving, fatten it up in transit, and direct it through the approptiate gate to slaughter. And the institutions specifically designed to be dumb and slow, like the pension funds, with a structured incentive to invest in speculative markets, get in when the price is high, and sell when it’s low. The smart, fast, inside institutions have brokers buying and selling retail investors similarly.

Market-makers are like bookies, seeking volume, setting price to match the maximum # of buyers and sellers, taking a cut on each transaction, and their software tracks participant behavior to improve the algorithm. Computers are trading with computers now, and the market-makers are injecting their own money back into the system, at low volume, with a short-squeeze negative limite switch, to induce continued participation.

There’s a general market understanding that an individual value investor cannot out-last irrational institutional markets. The new generations are turning that axiom on its head, simply by not participating, in a mirror algorithm.

“…the agreed to policy principles juxtaposed with US trade data suggest that the G20 may be promoting the current recovery at the expense of contributing to a future crisis.”

Is this a fancy way of saying “kick the can down the road?”

It’s no “recovery” if it is a cover up.

All gibberish.