Would you believe the chairman of a financial firm who told you that he was going to be able to pay off his loans to you when:

1. The company was showing a not-negative net worth ONLY because it had marked down its loans on its accounting statements by 7.5%, even when the loan agreement still calls for payment in full

2. Nearly a third of its assets are marked to model (for the technically oriented, valued as Level 3 assets) and therefore may be worth a lot less than the amount the company says they are worth

3. All the other assets he has should be benefitting from the Fed’s super low interest rates, meaning their market prices will fall if and when rates rise (which should happen when if the economy ever normalizes)

4. Other creditors will be paid before you are

5. There is every reason to expect more losses

Welcome to the wonder through the looking glass land of Maiden Lane, the bailout vehicle that holds crappy Bear Stearns assets. According to the Fed, the taxpayer will not lose a dime on it:

A number of facts mitigate the risk of losses being incurred on the FRBNY loan. First, there is a substantial pool of professionally-managed collateral at Maiden Lane that, as of March 14, 2008, was valued at $30 billion. In addition, JPMC’s subordinated loan to Maiden Lane will absorb the first $1.1 billion of any loss that ultimately occurs. Moreover, and perhaps most importantly, the collateral will be sold over time in an orderly manner that is not affected by the unnaturally strong downward market pressures that have been associated with the recent liquidity crisis. Finally, the FRBNY is entitled to any residual cash flow generated by the collateral after the FRBNY and JPMC loans are repaid. Given these protections, the Board at this time does not believe that the extension of credit to facilitate the acquisition of Bear Stearns will result in any net cost to the taxpayers resulting from the failure to repay the principal and interest of the FRBNY loan.

Yves here. Let’s parse the bullshit spin in this discussion, and then contrast it with the damning evidence in the Fed’s own documents:

“professionally-managed collateral”. Spurious. There is little a money manager can do beyond the margins to mitigate the losses (a money manager can’t prevent a Red Roof from filing for bankruptcy, cause revenue to rise at commercial buildings, or make residential mortgage borrowers pay on time).

“as of March 14, 2008, was valued at $30 billion”. This was criticized by experts at the time. The Fed took on Bear assets at their values as of the Friday before the firm failed, not the date of the collapse (March 17) when the assets were worth less. Another hidden subsidy to JP Morgan.

“collateral will be sold over time in an orderly manner that is not affected by the unnaturally strong downward market pressures that have been associated with the recent liquidity crisis”. Rough translation: we think real estate values will go up even more now that we have restored confidence by buying over a trillion dollars of mortgage securities. The Fed appears to believe its own PR. As we pointed out in an earlier post, people in the markets are of a very different view. One professional told us that the central bank-provided liquidity had goosed the values of subordinated commercial mortgage paper from its crisis levels of 30 cents on the dollar to its present value of 90 cents on the dollar. His belief of what it is worth based on its fundamentals? 5 cents on the dollar.

“the FRBNY is entitled to any residual cash flow generated by the collateral after the FRBNY and JPMC loans are repaid”. The Fed wants you to believe they might even show a profit! Do they want to buy a bridge too?

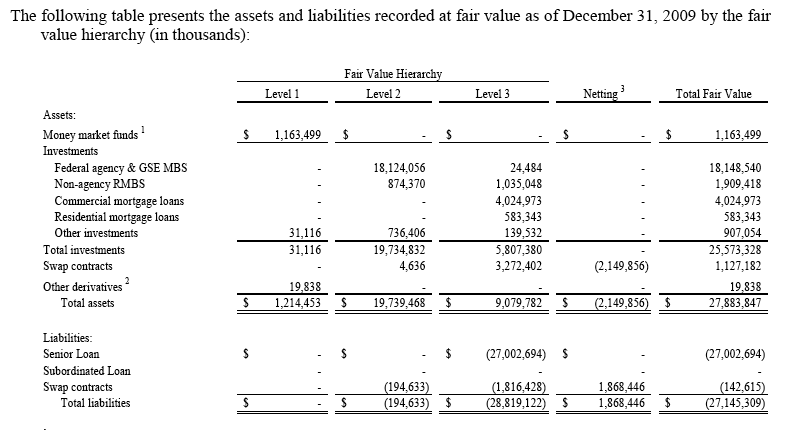

But let’s turn to its really big whopper, that the Maiden Lane loans will be repaid in full. Let’s first look at the creative accounting involved in pretending that the loans aren’t in trouble now (p. 14 of the December 31, 2009 financials, click to enlarge):

To make things easy, just look at the column “Level 3”. That means the values are based on “unobservable inputs” which is accountant speak for made up with some rationale and figures to make it seem plausible. It is also known as “mark to model” or less charitably, “mark to make believe”. We see that nearly 1/3 of the assets and virtually all the liabilities (the Fed’s loan) are valued this way.

Gee, it seems rather odd that the Fed is valuing its own loan on a mark to model basis, but that does produce the happy result that Maiden Lane doesn’t show negative net worth. The December 31, 2009 balance sheet shows the Fed’s loan on a “fair market value” basis at $27.0 billion. The very same financial statements (p. 11) say that it has a principal and accrued interest balance of $29.233 billion. Oh, but the total assets are only $28.140 billion, and there are other liabilities too (for instance, $1.122 billion of swaps contracts and swaps collateral). So the financial statements show pretty clearly that the Fed’s loan is under water NOW, yet the Fed is telling us it nevertheless expects to come out whole.

This sounds an awful lot like what we heard from financial firms under duress in 2007 and 2008, and there’s even more reason to be skeptical now. The entire financial system, dodgy assets in particular, are riding high on super cheap money. For a whole host of risky assets, this is probably as good as it gets in terms of valuations. Arguing, as the Fed did in the excerpt above, that there’s more upside, is simply delusional.

Consider:

Some of the fall in asset values is not due to lack of liquidity but due to impaired credit quality. That is not going to improve not matter how much low interest rate pixie dust the Fed throws at it. The assets have over $1 billion in impaired commercial real estate (valued at 13.5% of face amount of loans) and $700 million of impaired residential real estate (valued at 27.8% of face value). And most experts think the commercial real estate market has not hit bottom.

$18 billion of of fair market value of agency securities (principal amount not disclosed) of agency securities is exposed to interest rate movements, meaning if interest rates rise, their prices fall. This is another risk the Fed seems to believe will work out just fine.

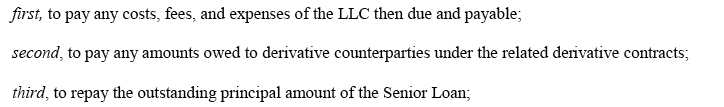

The Fed is also not the first in line for payment. Derivative counterparties come before it does, per “Distribution of Proceeds” (p. 12, click to enlarge):

Bottom line: A financial institution that reported that the fair market value of its assets was $2.2 billion less than its liabilities would be regarded as insolvent. Management’s protestations that its assets would surely be worth a lot more in the future would be treated with skepticism. But the media has chosen to give the Fed a free pass on this one.

Tom Adams contributed to this post.

Its called the Madoff model. After all, (most) everybody thought he was a really, really smart guy, ensuring returns year after year – sure, he was no “oracle” or “maestro” but the model of justing saying you had money in the fund worked well for years and made people very happy. Hmmmm…remind you of anyone?

Obviously, the problem is the truth.

I would want to know who the swap counterparties are and who is valuing those contracts. Perhaps a drop in the bucket. Waterfall is typical though my guess is the swap counterparties were not willing to renegotiate their payments to redo the waterfall – they probably figured the deal could not support them in a subordinate position?!?!! nice gig if you can get it.

” . . . though the man’s even temper and discreet bearing would seem to intimate a mind peculiarly subject to the law of reason, not the less in his heart he would seem to riot in complete exemption from that law, having apparently little to do with reason further than to employ it as an ambidexter implement for effecting the irrational. That is to say: Toward the accomplishment of an aim which in wantonness of malignity would seem to partake of the insane, he will direct a cool judgement sagacious and sound.

These men are true madmen, and of the most dangerous sort, for their lunacy is not continuous but occasional, evoked by some special object; it is probably secretive, which is as much to say it is self-contained, so that when moreover, most active, it is to the average mind not distinguishable from sanity, and for the reason above suggested that whatever its aims may be–and the aim is never declared–the method and the outward proceeding are always perfectly rational.

-“Billy Budd” by Herman Melville, Chapter 11

craazyman:

It has been a long time since I read Melville’s “Billy Budd.” Thanks for bringing it to the forefront with an apropo reference to today’s environment.

For three days and three nights Jonah languishes inside the fish’s belly. He says a prayer in which he repents for his disobedience and calls upon God for mercy. God speaks to the fish, which vomits out Jonah safely on dry land.

See: Nineveh was an important junction for commercial routes crossing the Tigris.

>> This somehow fits in, but I’m still working on the connections…and details.

Loved the Billy Budd reference to madness. One might say there is method in their madness. It is not just their egos that want the public to believe these claims. Rather, they [u]need[u/] the public to believe both because it cements their desired public perception that they are geniuses and really are doing a great job protecting the public weal and because any appearance of frailty, or error could open all forms of inquiry into other aspects of the great ruse. Such inquiry could bring disaster as the public would not support them, nor could investors be bamboozled into replacing the Fed as the maker of markets, if events proved that they have made bad decisions and they have lied. That is, their ill-thought-out actions of almost 2 years ago simply must be defended as brilliant or all manner of ills would befall the financial system.

Taking in very weak assets in exchange for cash, not just here to facilitate the marriage of Stearns to JPM, but in QE goes well outside of the limits of the Federal Reserve Act. Are they afraid of the law? The problem is – everyone knows. Everyone who wanders the blogosphere knows. The public knows. Investors know. At this point, who the hell do they think they’re kidding? Get over it guys – you made a collossal error. The country needs financial leaders it can trust. There seems to be a view that it is better to obfuscate officially in the hopes that economic activity would pick up and the losses would become smaller and their lies less obvious. But who the hell is going to jump back into the markets as a buy and hold investor when not only the big players but the house is not trustworthy? At some point, honest markets must emerge or the system will truly fail.

Yves, you do management consulting, why can’t they see this loss of trust as a very serious problem?

Thanks for asking.

Being a consultant is often like being a shrink. You are hired by the problem. Does the problem want to change? At least when a therapist is engaged, the patient does recognize he has some things to work on. Whether he wants to deal with the real issues, as opposed to what he thinks the issues are (his version is usually more superficial) remains to be seen.

Now consider senior executives. They have a lotta stuff they can blame besides themselves, generally some sort of environmental change (even thought the environment is never static and their claims to deserving status and big buckeroos are based on their ability to navigate). And even when top management is doing a good job at dealing with change, things often look worse before they get better, and their choices may not be popular (look at how much heat Steve Jobs took when he came back to Apple and refused to sell it, in pieces, to the highest bidder. Conventional wisdom circa 1997 was that Apple was toast). So the CEO who is deservedly under attack can tell himself that he is being treated unfairly. look at all those other successful CEOs who were criticized for making tough decisions. It’s classic Joseph Campbell hero’s journey stuff they identify with, no matter how ludicrous that may seem. And there is an industry of toadies, um, advisors, to toady to lofty opinion of themselves.

Then you layer in that CEOs, much more than in the past, are expected to be salesmen. Salesman (generally speaking, there is research that supports this idea) are externalizers, meaning they tend to blame others or circumstance when things don’t work out. This is useful in a salesperson, since they don’t take rejection personally and bounce back quickly. But it also means they seldom learn from their experience. This does not sound like an optimal profile for a business leader, needless to say.

I would argue that unfortunately you don’t need trust as much now as the absence of revolt. When you own the game you only need enough “trust” to keep others from taking it from you.

“trust” = fear.

Reality ultimately trumps fantasy. The problem I see is no accountability for the consequences of that event on the part of the architects and practitioners of this fantasy. If this was done in the private sector, they would be joining Bernie in the cold-iron condo. Government fantasy gets you a fat pension and a lobbyist job.

Yves, thank for another great analysis – and a highly amusing read!

You’re restoring my faith in reality.