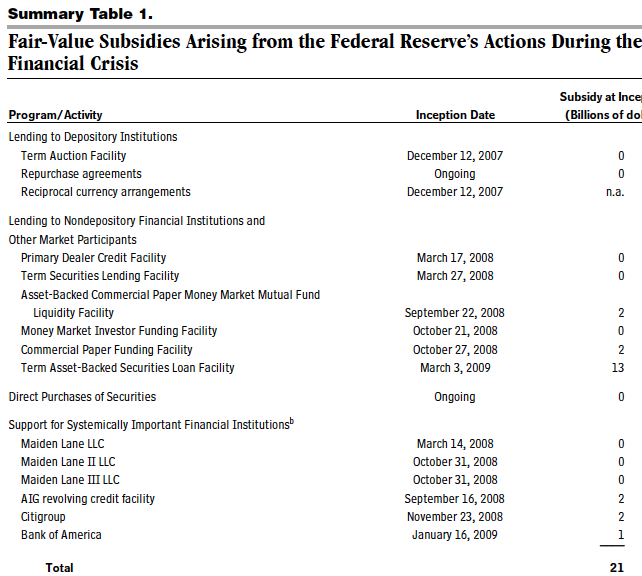

I’ve seen some eye-poppin’, credulity-stretchin’ accounts in my time. The report “The Budgetary Impact and Subsidy Costs of the Federal Reserve’s Actions During the Financial Crisis,” just released by the Congressional Budget Office, ranks with the most extreme. It claims that the budgetary cost (which corresponds roughly to expected losses) of the Fed rescue facilities launched during the financial crisis is approximately $21 billion. Moreover, its peculiar formulation (“fair value subsidies”) conveys the misleading impression that this was the extent of the central bank’s support to the financial services industry.

In a (weak) defense to the CBO, my understanding (and readers are welcome to correct me) is that the office is tasked to execute analyses as they are framed. In other words, if the CBO is asked to opine on a particular matter, it has to deal with only the questions posed to it. It is not permitted to tweak the inquiry or broaden the focus to provide more insight.

The closest thing to a statement of scope and objectives comes in the Preface and it is remarkably thin. The most important remark:

The report also presents estimates of the risk-adjusted (or fair-value) subsidies that the Federal Reserve provided to financial institutions through its emergency programs.

Yves here. The report thus purports to answer the criticism made most forcefully by former central banker Willem Buiter before he became Citigroup’s chief economist: not only were the Fed’s numerous bailout vehicles a clear violation of Constitutionally-stipulated budget processes, but they expose taxpayers to the risk of eventual costs, since if the Fed takes big enough losses, the Treasury will have to recapitalize the monetary authority (the Fed can simply “print” its way out of a certain level of losses, but if that activity were to stoke inflation, the Fed would need instead to seek funds from the Treasury).

However, note the framing of the report. It conflates the discussion of budgetary costs and financial services industry subsidies, when explicit costs to taxpayers are only the tip of the iceberg of the bennies that banks received from Fed. While the other forms of support are arguably outside the CBO’s purview, the failure to state those omissions means that defenders of the Fed and the banksters can use this report to obscure the true extent of welfare for financiers.

A partial list of the subsidies the report chose to ignore:

1. Far and away the biggest, near zero short-term interest rates. As we pointed out recently, this is the biggest source of real cash earnings at financial firms these days, since banks can earn easy, risk-free profits simply by borrowing from the Fed and parking the proceeds in longer-dated Treasuries (even though the biggest financial firms are also reporting embarrassing trading profits, those are due in part to low interest rates, both their impact on funding costs and by boosting asset values). These low interest rates are a large tax on savers. Not only do they make investing in comparatively safe and liquid investments unattractive, but they compress risk spreads by enticing investors to go into riskier assets to chase yield, which props up prices of investments generally.

2. Gross underpricing of the rescue facilities. Bagehot’s rule for a distressed financial firm is to lend freely against good collateral at a penalty rate. But the Fed instead lent against virtually any and all collateral and at attractive, often artificially low rates.

The CBO’s “fair market” value seeks to argue that the facilities were priced correctly using an NPV analysis, but that’s bogus. First, as we will see in due course, a mere eyeballing of the results strains credulity. But second, the idea of the Bagehot rule is both to provide for good incentives (you don’t want to make it attractive to use emergency facilities) and to allow for an ample margin for error. A characteristic of panics is they follow bubbles, and what looked to be a decent valuation for collateral might prove to be more than a tad exaggerated. For instance, AAA CDOs were acceptable collateral at the Fed pre-crisis, and if memory serves me correctly, the haircut was 30%. That seemed hugely generous, but the record shows that real-estate related CDOs would have needed a haircut of 80% to 100%.

Although my favorite example comes from the TARP, which is also discussed in the CBO report, it illustrates the general principle. This discussion comes from former derivatives trader Roger Ehrenberg:

The US taxpayer has been systematically looted out of hundreds of billions of dollars… Whether anyone will admit it or not, without the AIG (read: Wall Street and European bank) bail-out and the FDIC issuance guarantees, neither Goldman nor any other bulge bracket firm lacking stable base of core deposits would be alive and breathing today…

It stood with the rest of Wall Street as a firm with longer-dated, less liquid assets funded with extremely short-dated liabilities….In exchange for giving the firm life (TARP, FDIC guarantees, synthetic bail-out via AIG, etc.), the US Treasury (and the US taxpayer by extension) got some warrants on $10 billion of TARP capital injected into the firm. While JP Morgan Chase CEO Jamie Dimon prefers to poke a stick in the eye of the Treasury, seeking to negotiate down the payment to buy back the TARP warrants, Lloyd Blankfein smartly paid the full $1.1 billion requested. He looked like a hero for doing so, a true US patriot repaying the US Government in full for its lifeline, thanking the US taxpayer in the process. $1.1 billion… $1.1 billion…Hmm…something doesn’t seem right. You know why it doesn’t seem right? BECAUSE THE US TREASURY MIS-PRICED THE FREAKING OPTION.

There is not a Wall Street derivatives trader on the planet that would have done the US Government deal on an arms-length basis. Nothing remotely close. Goldman’s equity could have done a digital, dis-continuous move towards zero if it couldn’t finance its balance sheet overnight. Remember Bear Stearns? Lehman Brothers? These things happened. Goldman, though clearly a stronger institution, was facing a crisis of confidence that pervaded the market. Lenders weren’t discriminating back in November 2008. If you didn’t have term credit, you certainly weren’t getting any new lines or getting any rolls, either. So what is the cost of an option to insure a $1 trillion balance sheet and hundreds of billions in off-balance sheet liabilities teetering on the brink? Let’s just say that it is a tad north of $1.1 billion in premium. And the $10 billion TARP figure? It’s a joke. Take into account the AIG payments, the FDIC guarantees and the value of the markets knowing that the US Government won’t let you go down under any circumstances. $1.1 billion in option premium? How about 20x that, perhaps more. But no, this is not the way it went down….

Yves here. So let’s do a little comparison. Ehrenberg argues that the subsidy embodied in the underpriced TARP warrants for Goldman alone (the strongest firm of the bunch) was $21 billion, if not more. The CBO would have us believe that the subsidies provided to all financial players across ALL Fed facilities was a mere $21 billion. Tell me how credible that sounds.

3. The Fed has allowed Wall Street to skim more from its rescue operations, like its over $1 trillion purchase of mortgage backed securities. From the Financial Times in 2009:

Wall Street banks are reaping outsized profits by trading with the Federal Reserve, raising questions about whether the central bank is driving hard enough bargains in its dealings with private sector counterparties, officials and industry executives say…

However, the Fed is not a typical market player. In the interests of transparency, it often announces its intention to buy particular securities in advance. A former Fed official said this strategy enables banks to sell these securities to the Fed at an inflated price.

The resulting profits represent a relatively hidden form of support for banks, and Wall Street has geared up to take advantage. Barclays, for example, e-mails clients with news on the Fed’s balance sheet, detailing the share of the market in particular securities held by the Fed.

“You can make big money trading with the government,” said an executive at one leading investment management firm. “The government is a huge buyer and seller and Wall Street has all the pricing power.”

A former official of the US Treasury and the Fed said the situation had reached the point that “everyone games them. Their transparency hurts them. Everyone picks their pocket.”…another official familiar with the matter said the central bank “has heard that dealers load up on securities to sell to the Fed. There is concern, but policy goals override other considerations.”

Yves here. Let me translate. “Policy goals” means the extra margin the Street nicked from the Fed was a feature, not a bug.

Now to the report itself. It is unabashedly Fed and financial services industry friendly. Start from the top: “The financial system plays a vital role in the U.S.

economy.” You can tell this is a preamble to “the Fed had to rescue the banks” which it predictably recites later:

In CBO’s judgment, if the Federal Reserve had not strategically provided credit and enhanced liquidity, the financial crisis probably would have been deeper and more protracted and the damages to the rest of the economy more severe.

Yves here. This anodyne statement is intellectually dishonest. The report discusses ONLY the Fed’s rescue programs. Thus, the CBO posits bi-modal choice (acting v. not acting) when the officialdom had a huge menu of possible actions. This “the Fed had to Do Something, ergo its programs were warranted” misses the massive moral hazard of what was put in place: the continuation of super-low interest rates and the Greenspan/Bernanke puts, the failure to remove the managements and boards of seriously troubled organizations.

Then we get to the piece de resistance (click to enlarge):

Yves here. Regular readers of this blog know we have done extensive analysis on Maiden Lane III, one of the rescue facilities for AIG’s toxic exposures (see here and here for a few of the examples). The idea that it will show no losses is utter hokum. Similarly, the Fed’s massive purchase of MBS are also likely to result in red ink. The central bank entered into them explicitly to tighten risk spreads at a time when Treasury yields were at low levels, thanks both to heightened appetite for safe assets and active efforts by the Fed to lower interest rates.

The old saw among traders is that it is easy to move markets, but hard to do so profitably. Whether the Fed seeks to sell these MBS later to mop up liquidity, or holds them to maturity, it is very likely to show losses relative to its purchase price.

So how, exactly, does the CBO come up with such a miraculous result? Go look at how they built the model. It’s sufficiently vague and technical-sounding to deter most readers:

To estimate such subsidies, the Congressional Budget Office (CBO) developed a stochastic simulation model for each major program. In general, under that approach, CBO projected probability distributions of future cash flows associated with each program and then discounted the cash flows to their present value using rates that reflected the risk associated with the particular

flows.1 The probability distribution of a program’s cash flows depended on several factors: the program’s rules and structure; the probability distributions of interest rates, default rates, and recovery rates on defaults; and how the demand for a program was affected by those variables.

Yves here. First, this is a hold-to-maturity approach. Second, there is no indication as to how they derived their default and recovery rates. We’ve seen from the famed stress tests that the officialdom has a weakness for estimates that are too optimistic. An article today from the Dow Jones Equity Analyst (hat tip reader Scott, no online source) describes hedge fund Fortress Group predicting “the great liquidation”:

If you think the opportunity for distressed debt investors has come and gone, think again, says Peter Briger Jr., principal and head of distressed debt operations at Fortress Investment Group LLC (FIG).

“In the next five years we’re going to see more financial asset liquidation out of the shadow banking system and the regulated banking system than we’ve

seen over the past 100 years,” Briger said during a keynote address at the 2010

SuperReturn U.S. conference in Boston.Briger predicted that financial institutions will offload between $5 trillion and $10 trillion in assets in the coming years. He pointed to some $1.6 trillion in asset dispositions that have already been announced by 13 financial institutions, including AIG, Fortis Bank, Royal Bank of Scotland and Lehman Brothers.

Briger said believes that it will take years for those assets to unwind, in part because of the complexity associated with financial assets in today’s market, as well as their sheer volume.

Yves here. How does this “great liquidation” impact the CBO’s valuation? All this paper hitting the market over the next few years will suppress recovery rates, big time.

The report is silent on how it arrived at its assumptions, particularly its loss and recovery estimates. But it is hard to take an analysis that has egregious errors like this in it seriously:

At the end of 2009, the amount of reserves that banks held with the Federal Reserve was the central bank’s largest liability. Such reserves have grown from about $6 billion at the end of July 2007 to more than $1,022 billion at the end of 2009; those reserves greatly exceed the amount that banks are required to hold.3 In effect, the Federal Reserve financed its activities during the crisis primarily by creating bank reserves rather than by issuing more currency or

increasing its other liabilities.4

I was disturbed by the last sentence, and a financial analyst who has expertise in central bank operations concurred:

It’s complete nonsense. All that happened was that the Fed took the shadow banking system on its balance sheet. The Fed doesn’t “finance” any of its activities per se.

Scott Fullwiler, who has considerable knowledge of Fed operations, agreed and added:

The quote suggesting reserve balances were $6 billion in July 2007 was quite wrong, but typical. That was the size of required reserve balances. But required clearing balances were about the same size, so that brings the total to double that, then you have to add another $2 billion for excess balances. So, it was about $14-16 billion total. People who don’t understand the Fed’s operations don’t know that they have to add a few things into the Fed’s balance sheet quote of reserve balances. This can be seen in charts 2 and 3 here

This paper unwittingly suggests that any Audit the Fed initiatives that have the CBO as an important actor will be ineffective, perhaps even counterproductive. If the CBO is as easily led by the nose as this report indicates, it’s likely to be another garbage in, garbage out exercise in modeling that serves to tart up Fed propaganda. The government official who called this exercise to my attention labeled it a “disgrace”, and I agree fully with his assessment.

Excellent overview of the status of the Bailout.

In a (weak) defense to the CBO, my understanding (and readers are welcome to correct me) is that the office is tasked to execute analyses as they are framed. In other words, if the CBO is asked to opine on a particular matter, it has to deal with only the questions posed to it. It is not permitted to tweak the inquiry or broaden the focus to provide more insight.

That’s my understanding from the endless bogus “scorings” during the assembly of the health racket bailout.

The US taxpayer has been systematically looted out of hundreds of billions of dollars… Whether anyone will admit it or not, without the AIG (read: Wall Street and European bank) bail-out and the FDIC issuance guarantees, neither Goldman nor any other bulge bracket firm lacking stable base of core deposits would be alive and breathing today…

We should always remember, we the people own these banks. All of them. We paid for them (and are still paying even though we already paid in full many times over). They’re public property we can rightfully repossess anytime we choose.

While JP Morgan Chase CEO Jamie Dimon prefers to poke a stick in the eye of the Treasury, seeking to negotiate down the payment to buy back the TARP warrants, Lloyd Blankfein smartly paid the full $1.1 billion requested. He looked like a hero for doing so, a true US patriot repaying the US Government in full for its lifeline, thanking the US taxpayer in the process. $1.1 billion… $1.1 billion…Hmm…something doesn’t seem right.

As I recall the MSM, they were saying Blankfein overpaid and calling Dimon a hero for sticking to his guns.

Now to the report itself. It is unabashedly Fed and financial services industry friendly. Start from the top: “The financial system plays a vital role in the U.S.

economy.” You can tell this is a preamble to “the Fed had to rescue the banks” which it predictably recites later:

In CBO’s judgment, if the Federal Reserve had not strategically provided credit and enhanced liquidity, the financial crisis probably would have been deeper and more protracted and the damages to the rest of the economy more severe.

Flat out lies about the Bailout. It accomplished nothing and was meant to accomplish nothing but to (A) temporarily stave off the bubble’s deflation and prop up the finance zombie, (B) empower the finance sector to go into full disaster capitalist mode, using the crisis as the pretext to loot every cent of wealth left. That’s the goal.

Yves here. Regular readers of this blog know we have done extensive analysis on Maiden Lane III, one of the rescue facilities for AIG’s toxic exposures (see here and here for a few of the examples). The idea that it will show no losses is utter hokum. Similarly, the Fed’s massive purchase of MBS are also likely to result in red ink. The central bank entered into them explicitly to tighten risk spreads at a time when Treasury yields were at low levels, thanks both to heightened appetite for safe assets and active efforts by the Fed to lower interest rates.

The old saw among traders is that it is easy to move markets, but hard to do so profitably. Whether the Fed seeks to sell these MBS later to mop up liquidity, or holds them to maturity, it is very likely to show losses relative to its purchase price.

As Dean Baker keeps pointing out, the GSEs are bleeding red ink because they systematically overpay for MBSs. It’s simply a hidden Bailout conveyance. Why would Fed MBS buys be any different in the end? It’s obviously the same kleptocratic intent.

This paper unwittingly suggests that any Audit the Fed initiatives that have the CBO as a central actor will be ineffective, perhaps even counterproductive. If the CBO is as easily led by the nose as this report indicates, it’s likely to be another garbage in, garbage out exercise in modeling that serves to tart up Fed propaganda.

I forgot about that. How’s the Paul/Grayson audit supposed to function? (Not that I expect anything remotely like that to be in the final bill. More like the sham Senate version. 96 senators can’t be wrong.)

The true measure of the appropriateness of the Audit The Fed bill is obvious to fathom: If it inconvenience Wall Street and the Fed to much, Obama will veto it. It goes without saying that the Senate leadership will go to extreme lengths to avoid such a scenario.

However, should they fail, Obama won’t even care about the political fallout of a veto. He thinks he know the fallout from a real audit would be far worse…for the financial elites, that is.

Of course, the quaint notion that it could be useful for the people to, at last, have a confirmation of what the Fed was up to during the bailout is not even on the radar screen in the halls of power.

It’s the usual game of mind over matter: They don’t mind, because we don’t matter!

Question:

how much do you think those bailout money is now being used to gamble european swap and shorting them? (eg. without the bailout, those hedgefunds/big funds won’t be able to sing “The PIGS are going down”.

The bailout makes the concentration of wealth worst.

It’s all Bailout money. Every cent lent and deployed among the finance sector is either handed out free by the Fed or is lent based on the Bailout’s guarantee.

And intensified concentration was their intent right from the start. That’s not just proven by their actions; when the TARP was being disbursed Treasury officials were quoted saying some of the money should be used by big banks to buy up smaller ones.

Yves: “Let me translate. “Policy goals” means the extra margin the Street nicked from the Fed was a feature, not a bug.” Of all the turpitude you describe in detail, Yves, this one happens to make my blood boil the most; personal disfavor, I suppose. The government is deliberately buying trash on the open market as a subsidy to the banking oligarchs. Of let’s put it in plain words: our government is handing billions directly into the pockets of the pigs who broke the system. If said pigs put a gun to the government’s head, that would be theft of the public. But if the government just _gives_ them our wallet which it, the government is charged with supervising, it’s all perfectly legal. Just gives them the money . . . it boggles the mind.

Do we need any clearer demonstration that the oligarchs have captured the government and secceeded from our common society than this? They don’t even need to shoot us peasants in the streets as they’ve just taken over the Treasury and the Congress for themselves, a little political theater for the vidiots notwithstanding.

The biggest jail house rape out of all of this is the pensions et al, used as a cheep cowering of the people that put their life tiol in the hands of mad men.

amends…toil

In the case of Audit the Fed, the GAO (Government Accountability Office), rather than the CBO, is the agency charged with the task – in whatever form the final legislation takes.

[By the way, is there ANY movement underway on-line to COORDINATE among blogs and bloggers to loudly push for an OPEN debate/conference session between the House and Senate on this financial reform legislation? Or are all the blogs, as in health care reform, going to independently continue to do nothing but quietly and impotently REACT to moves from the Powers That Be, right up until they yet again disappear behind closed doors to anonymously seal the (latest corrupt) deal, flipping us all off as they go.]

Aren’t these features, not bugs?

Isn’t our esteemed Fed a one trick pony? Easy credit – every time, all the time. ‘Cause credit is the lifeblood of the economy.

By analogy, food is life. But look at any gathering of Americans waddling about, and the lack of discipline and restraint with regard to eating, and you cannot have a better example that anything in excess causes problems.

The Fed obviously believes that losses taken by ANY major financial institution imperils the easy flow of credit. Even though the flow is FED – Bank – Treasury, at least by the Fed hypothesis, that is what it is all about.

Borrowing is not income, and debt is not wealth.

Borrowing becomes income should the debt be subsequently forgiven.

And my bonds – that is, what I am owed – ARE wealth, provided that my counterparties are sound.

Bonds…a parasite that now can not be remove with out losing a limb or two.

On the Maiden Lane Bear Stearns / JP Morgan LLC ( can’t remember the no ), a lengthy and interesting, to say the least, article was posted yesterday

on Zero Hedge:

http://www.zerohedge.com/article/curious-trading-federal-reserve-advisor-may-result-jpmorgan-chase-1264-billion-windfall

Yves has no intention of backing what she says with concrete alternatives. The biggest shock in ECCONED is that Yves offers no solutions. She even freely admits that, “I offer no remedies”. She should add that doesn’t have the b*lls to consider any either.

I propose that the answers have been with us all along. Thom Paine, Thomas Jefferson, Ben Franklin et. al. were not professional economists but learned from the experience with the crown, especially with the Bank of England, what not to do. They were aided in their quest to create a new political and economic system by the great minds of the Enlightenment. In that tradition, Andrew Jackson, Abe Lincoln and JFK further fought off the international bankers to their personal peril. They were not Profiles in Courage, they were courage personified.

As for me I have been destroyed by the system. Where I was once semi wealthy, I am now completely broke. But I have some of my marbles left and have used my time to study the GFC and economics. In fact economics has been a hobby of mine for 30 years. There exist a body of work that I shall call Economic Heresy. It is not socialist in nature but attempts to reform capitalism. It is not taught in academia at all. In fact if you go the the History of Economic Thought website, you will find no mention of those economic alternatives. Karl Marx is mentioned, and look at the result of his work.

I only tell you this, not for sympathy (It doesn’t pay the bills), but to let you know that I have written to Yves to ask if she would be interested in coauthoring a book which would design a new economic order which would ameliorate the flaws in our present system. I received no reply from her or anyone else from whom I have requested support. I am also talking about financial support which would allow me to finish my work. I had in mind an advance from a publisher like the one she received for ECONNED. I cannot sustain myself and spend the time necessary to do justice to this type of endeavor.

It is simple, blogging is nothing more than venting. “Put your money where your mouth is”.

If I sound a little vague, it is because I am tired of giving the fruits of my labor to others only to see them become wealthy, while I get nothing in return.

If you have any questions you can email me at avrymann@gmail.com

p.s. You are right about deception

You either did not read ECONNED, and merely flipped to the end in a bookstore, or worse, chose to misrepresent it. You quoted out of context.

Chapter 10 offered both an analysis of progress of reform as of the book’s closing date, AND a series of concrete financial reform proposals.

The comment you cited out of context was in reference to the economics profession and that section explained why: they were certain to reject anything from a non-economist.

You imply that I do not have to pay my own way and/or am independently wealthy, ideas constructed from whole cloth. In addition, I suggest you speak to authors regarding attractiveness of writing a book as a venture. You harbor fantasies in this regard as well.

Attacking someone, particularly in an intellectually dishonest manner, is guaranteed to elicit a negative reaction to a proposal.

Better an angry response than no response. I did see your recommendations, but they don’t address the underlying theme of your book, that our present economic theories are false and that they are devastating both our economy and the environment. What is needed is a new economic theory that will serve us going forward. Fixating on Wall street may solve some of the worst excesses of the financial sector, but it does not speak to the real defects in our economic system. It is the lower echelons of society who really pay the price.

By way of conciliation, I do have a great respect for you and your work. I admit that I am particularly bitter about the complete lack of interest on the part of the economic establishment in considering alternative theories.

Best wishes.

Yves has given a lot of space and thus publicity on her blog to individuals with the exact sort of alternative approaches you are suggesting. Those of us doing this sort of work are quite grateful that she has done this on a regular basis, as we couldn’t get this sort of readership on our own.

Yves, good summary post and thanks for all you do in keeping up with and exposing all of the hypocrisy and bullshit involved in the intentionally made complex voodoo science that threatens us all, but in the end, much of this is just another ‘eyes glaze over’ mystery for the common person who is also suffering the double whammy of concurrently being propagandized into loving and adoring the same forces that exploit and destroy her/him.

The additional work to be done is to simplify and package the message and get it to the common folks in a form that they can get interested in, understand, and relate to, so as to stimulate them to a positive corrective action. They need to better see who screwed them and how.

In the final analysis, the cause and effects of the slow death threatening spiral downward of global finance — some, like myself, would say the intentional torture and strangulation of global finance — share many similarities to the murders, here in scamerica, of JFK, MLK, and RFK.

In terms of cause and effect there are some jump off the page similarities

• Many believe in their hearts there was a conspiracy involved as a causative effect.

• And many believe in their hearts that these events were meant to effect the oppression of the common person.

It was those beliefs that stimulated the rage to at least get the Justice Department involved and create highly publicized and talked about, depending on your belief, honest or white wash reports.

Now we have the slow death spiral of global finance, with far greater significant effects to the common person, and the common person has no focus other than a nebulous overly complex system of voodoo economics to rail against. So, in order to get the public more involved and knowledgeable, I suggest to my fellow, “dear readers”, that we all bunch our undies, rely on the integrity of Yves’ great information, and get our hyperbole glands in overdrive so as to blow some life into this mess.

e.g. … attention getting sample headlines, fill in the simplified economic stories and explain who YFS is and what, in your best level down interpretations, the problems are ubder these headlines …

They Murdered JFK, They Murdered MLK, They Murdered RFK, And Now They Murder YFS!

RFK, JFK, and MLK Were Murdered! Are They Now Killing YFS?

When They Murdered RFK, JFK, and MLK We Had Justice Department Investigations! Why NO Investigations For The Death Of YFS.

And of course YFS is YOUR Financial System. A common person, mythical superman like hero who embodies the best of the myths of JFK, MLK, RFK and all of the best attributes of the fairness and democracy that they promoted. Let’s blow some life into YFS champion of the little guy.

So get cracking ‘dear readers’, if this suggestion doesn’t light your fire work on an alternative that honors the concept of getting this horrendous strangulation and torture of YFS to street level in a form that the masses can understand.

Deception is the strongest political force on the planet.

i on the ball patriot,

….the common person who is also suffering the double whammy of concurrently being propagandized into loving and adoring the same forces that exploit and destroy her/him.

People who bite the hand that feeds them usually lick the boot that kicks them.

–Eric Hoffer

http://www.phnet.fi/public/mamaa1/hoffer.htm

Wait a sec! Are you implying that our government and Wall Street conspired to steal hundreds of billions of dollars from taxpayers!

I am shocked, scandalized, and distraught…mainly because I quit the banking industry a few years ago and missed out on all this manna from heaven. Dang it!

I agree and have said similar things for about two years. $21 billion isn’t the right order of magnitude. I estimate Freddie & Fannie will need about $400 billion give or take $80 billion, but what do I know? What’s the value of interest rate suppression to say Citigroup annually? I guess at least $40 billion. Throw in B of A, Vampire Squid and the rest and you’re talking about serious money taken from America’s savers being given to insolvent banks. The CBO has discredited itself by releasing this amount.

Maybe the CBO is in bed with Spitzer-like hookers, who are being placed in a position to insert data where it doesn’t belong?

Would the world really have ended if AIG melted down?

Do we really need to bail out Goldman Sachs?

I donno, but as an employee of one of the TBTF banks, I’m really likin’ this socialism stuff.

I’m just one on many little tic sucking the blood of the taxpaying marks. Just hope he lives another 30 years.

Euro just broke 1.20. Next is 1.16. If it gets that low, I guarantee you global trading pattern will change significantly and US export (Boeing, GE, steel, car) will die.

Ben Bernanke laughs at the people running another major currency thinking they can debase it more than Ben can debase the dollar.

I think china can. If they and their economic allies can absorb high inflation, sufficiently larger than ben can crank up his money printer.

EG. china will buy T-bill as fast as treasury can print them at maximum tolerable inflation in the US. Maintain peg. US political class is still afraid of getting voted out from bad economy. So they won’t pull brazilian/zimbabwe/weimar level of inflation. Then China will use those T-bill to buy every available hard asset in the planet. Essentially, China will drop ben’s money onto their dollar starved friends (Kazak, venezuela, africa, central asia, etc) These area are far bigger than maximum dollar printing speed can possibly overwhelmed. (for 4-5 years at least)

G-7 is no more as global economic regulator. It’s all chinese now.

Or US can declare “capital control” to stabilize its economy. But then everybody in the world will laugh when it demand “free market”

“A partial list of the subsidies the report chose to ignore … Far and away the biggest, near zero short-term interest rates.”

That’s one of my biggest complaints too, but let me play the devil’s advocate. As I understand it the Federal funds rate is targeted rather than fixed, and they try to meet the target by open market operations. I’m no fan of the Fed’s recent “cash for trash” games, but supposed that they tried to meet the Federal funds rate target by only buying good old treasuries.

This loose monetary policy is supposed to help the economy in its “recovery”. A low Federal funds rate is a consequence of the open market operations, and the low rate fills the banks pockets. But how could you have loose monetary policy without filling the banks pockets from the low Federal funds rate?

I really don’t think I understand modern economy anymore. It seems Bernanke is simply handing out free money fresh from printer with total disregard of social effect. Albeit with mumbo jumbo excuse.

Sometimes I wonder if it wouldn’t be better to set interest rate permanently at so and so percent, say slightly lower than historical 5% (4.25%), than simply ban TBTF banks (eg. limit bank to maximum size), if an entity tries to obtain larger loan than normal bank can provide, go to government. Public scrutiny decide the risk everybody wants to take.

Therefore instead of government controlling the “price” of banks can borrow from government, hence overall speed of economic growth. It simply simply controls “TBTF/extra risky/oversize” loan existence instead.

Regular banks will be relegated to peanuts loans, consumer/manufacturing/etc. No bank/hedgefunds can bet against a nation.

All large industrial investments in the ends are backed/paid for by government one way or another anyway (subsidies, tax break, public research, grant, sovereign protection, etc) Things like Boeing, GM, Ford couldn’t exist anymore without government regulatory protection. Let alone big industrial adventure like space, pure science, or medical research.

Yes, essentially, it’s turning back the clock to 1960’s, where private corporations are too small to do any serious damage, and all big undertaking are done by government.

Anybody actually believe Enron, Boeing, GM, JPM, GS are good for America? Instead of bunch of executive thinking up golden parachute?

The Fed bought 1.25T of MBS plus 300mm of Treasury coupons. Call that 1.5T. The average yield was about 5% for the MBS and 4% for the coupons. Call the whole thing 4%. Against this you have ZIRP. Money cost the Fed !/4%. Well that comes to $50+ billion of income a year.

And you wonder why the Fed is unwilling to raise interest rates? This income is coming off of the back of small savers. It is one of the biggest wealth transfers in history.

The Fed is getting rich off of ZIRP. Just what they want.

Thanks for the head up bruce.

You forgot to mention that the Fed transfers virtually all of its profits to the Treasury. So, all of this profit has simply reduced the deficit.

This is a wacky question from a non-finance professional.

Why can’t Congress pass legistlation to structure the bailout as a loan the banking industry – which they must pay back over time with interest. Set up a FED bad bank and put the loan on that balance sheet. Let the banking system own it.

ZIRP is obviously a backdoor bailout for undercapitalized banks – which wouldn’t even exist without public support.

Let them pay their own bills and get this debt off the public books.

You can’t. All those banks are legally bankrupt, adding more loan no matter how cheap won’t change a thing. They are insolvent, bankrupt, no more. They require the impossible to get back in black. (say economic growth of 20-30%)

The only way is to “bail them out” literally take off their bad investment from their book using tax payer money.

Then how would you liquidate the whole system and start over. (Oh wait a minute – that would bankrupt the banksters – we can’t have that – better to flush the whole country down the tube).

This can’t end well.