One of our regular contributors chatted with a reporter at a major financial media outlet who was frustrated that management was not willing to let him dig into open mysteries from the global financial crisis. Fortunately, the Financial Times takes a broader view, and Gillian Tett today focused on a recent IMF report that describes how rehypothecation blew up the shadow banking system to an even bigger size than experts realized.

While Tett provides a decent recap of the paper by Manmohan Singh and James Aitken, “The (sizable) Role of Rehypothecation in the Shadow Banking System,” I suggest you read it, since it’s relatively short and very informative, and a couple of key issues get short-changed in Tett’s summary.

Despite its daunting name, rehypothecating is not that hard to grasp. Imagine you operate a pawn shop. People bring things that are valuable and leave them with you as collateral for loans. In rehypothection, you as the pawn broker have gotten permission from the people who have provided their assets to you to take them to another pawn broker and get a loan from them.

You can already see this sounds dodgy. How many times might your gold watch be passed from pawnbroker to pawnbroker? And if the pawnbrokers were each willing to lend a high percentage of its market price, the loans made against this one watch could easily exceed its value.

The irony is that the US recognized the potential for abuse with rehypothecation long ago and provided for strict limits during the Depression. The Securities Exchange Act of 1934 limited the level of rehypothecation to 140% of customer loan balances. The rest of the assets must remain in a segregated account. By contrast, as Singh and Aiten remind us, there are no restrictions on rehypothecation in the UK and no customer protection laws (the US also has SIPC to provide some restitution in the event of a broker-dealer failure). The lack of restriction in the UK allowed hedge funds and dealer prop trading desks to achieve higher levels of leverage, but left many funds badly exposed when Lehman’s London operation, which had rehypothecated customer assets, collapsed. Needless to say, that mess has made participants a good bit more careful, with the result that the paper estimates that the total amount of assets that were permitted to be pledged fell from $4.5 trillion at the end of 2007 to $2.1 trillion at the end of 2009.

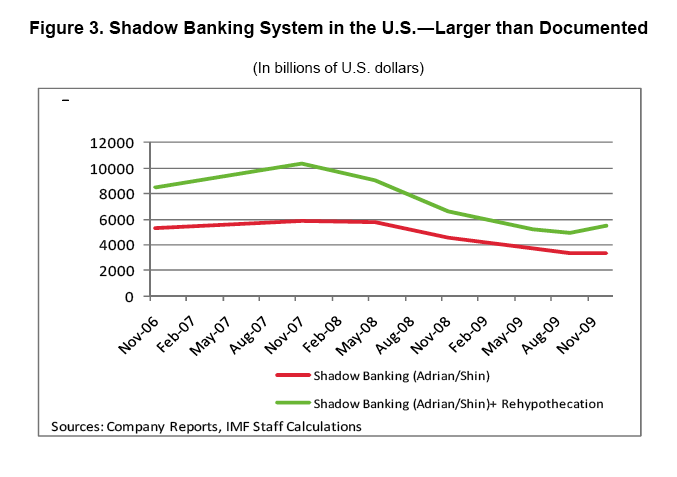

Note that rehypothecation is a source of funding to dealers (remember, if your pawnbroker can get a loan against your watch, he can use it to fund his business). The authors thus revised their previous estimates of the size of the US shadow banking system higher:

Note that $10 trillion peak figure. That’s roughly the size of the official banking system.

Any wonder why we had a crisis? We had a parallel financial system, which was not only largely unsupervised, but more important, had virtually no equity behind it. It was bound to implode when a meaningful shock hit. Get a load of this:

Discussions with collateral teams at large banks suggest that about $1 trillion of the market value of securities of the global hedge fund industry was rehypothecated, as of end-2007. Of the total pledgeable collateral of $10 trillion received by the large ten global banks that appears in their financials (via securities lending, repo and prime brokerage), about 40 percent came from hedge funds prior to the crisis; the rest of the collateral was largely posted by banks to each other to take advantage of their respective funding specialization.

Thus,40% ($10 trillion)

Churning factor of collateral =appears in their financials (via securities lending, repo and prime brokerage), about

40 percent came from hedge funds prior to the crisis; the rest of the collateral was largely

posted by banks to each other to take advantage of their respective funding specialization.

Thus,Churning factor of collateral =40% ($10 trillion)/ $ 1 trillion= 4

Eeek.

Papers like this illustrate why we need to keep shining a light on the crisis, since it serves the interest of the industry to move on and keep leverage mechanisms like this intact. The authorities in the UK, despite widespread recognition of how rehypothecation made the Lehman bankruptcy a huge problem for exposed customers, have taken no action. If the paper stirs up enough discussion, perhaps they will feel compelled to act.

This does not sound dodgy to me at all, once you say the magic words “you as the pawn broker have gotten permission from the people who have provided their assets to you to take them to another pawn broker”. In that case the cash borrower has consented to a bit more counterparty risk from the lender, but as long as this is allowed for properly in the amount of cash lent or a lower interest rate on the loan, I see no problem in principle. In practice of course, the collateralisation or loan price must be set so that if the ultimate borrower of the watch defaults, everyone up the chain is compensated satisfactorily (with due allowance for any delay or inconvenience involved) with what they get to keep instead, and there perhaps is the rub – in order for rehypothecation to be viable such risks had to be underpriced, and when the risk was realised, counterparties were not satisfied with their compensation.

This does not sound dodgy to me at all, once you say the magic words “you as the pawn broker have gotten permission from the people who have provided their assets to you to take them to another pawn broker”.

I disagree, because we also said the more magic words: “blew up the shadow banking system to an even bigger size than experts realized.”

not to mention the unsaid words:

“which of course led to a major credit crisis which lead to a foistering of the true costs of this onto the taxpayer”.

Maybe, but that does not necessarily mean that rehypothecation per se was the problem. It might well have been sufficient to have required more capital to be held against the exposure. In my view, since the financial crisis there have been too many prejudiced, ill-informed calls for whole areas of financial innovation to be simply swept away, such as CDOs, securitised debt etc, which often have advantages to offer but were poorly regulated because a similar lack of attention to detail before the crisis allowed the financial industry to get away with introducing them with insufficient scrutiny and safeguards.

“…it serves the interest of the industry to move on and keep leverage mechanisms like this intact…”

I don’t see why it does serve the interests of the industry. In fact, surely it would serve the interests of the industry better if all participants were barred from competing in ways that in the end will cause the industry to enter a crisis?

If its allowed, this is inevitable. So the participants individually and collectively should all be in favor of its being banned?

Sorry for ambiguous drafting. By “the industry” I meant the major dealers who get cheap leverage from rehypothecation.

I know you’ll like this, there was a saying in the markets over the last few years that there’s only really one dollar invested in the whole market and that the rest was borrowed.

Its worth pointing out that all leverage is not bad but excessive leverage can be. Witness the levered unwind from 2008, its always been about repo. Many large funds get term financing for this reason.

Here’s a leverage topic to explore – public pension debt financing – talk about leverage…

“… By contrast, as Singh and Aiten remind us, there are no restrictions on rehypothecation in the UK and no customer protection laws (the US also has SIPC to provide some restitution in the event of a broker-dealer failure). The lack of restriction in the UK allowed hedge funds and dealer prop trading desks to achieve higher levels of leverage, but left many funds badly exposed when Lehman’s London operation, which had rehypothecated customer assets, collapsed.”

It’s not a lack of restriction at work here but a completely different system of perfecting ones security interest in posted collateral. Typically, taking collateral under standard ISDA Master Agreements governed by UK law ones security interest is perfected through transfer of title of such collateral: i.e. it is delivered to the direct account of the entity requiring the collateral and not to a safe custody/customer account at such entity. With title the pledgee can use such collateral however they choose subject to return clauses. This is not rehypothecating as title has been transferred.

Similar ISDA agreements under New York law requires no such title transfer and thus the need for rehypothecation as long as the agreement specifically allows it. ISDA agreements allow parties to explicity allow or dissallow rehypotecation however for most of the banks having unusable collateral was not a successful outcome in an executed ISDA

About fifty years ago as a clearing clerk I recall going to the vault and recording and marking Treasury Notes for Hypothecation. The Treasury Notes never left the vault, we merely tendered to the bank the Hypothecation form which typically specified that we would receive 80% of the face amount of the hypothecated Treasuries as a loan which had a date certain for repayment. Note that the Hypothecation form was separate from but specifically related to the loan instrument. Also note that it was a crime to hypothecate the same Treasury Note to more than one lender.

Now, if the bank were to sell the loan, the hypothecation form, duly assigned would pass with the loan document to the loan buyer. Not infrequently the loan buyer would be the Federal Reserve.

I haven’t read the paper referenced in this thread, however, if this re-hypothecation business means that money is being lent against already hypothecated assets, that strikes as being more than passing strange.

Does re-hypothecation mean that the party who re-hypothecates is pledging to a third party what is already pledged to a second party who in the chain of claim has a prior lien? This has the ring of being the exercise of fractional reserves being applied to loan collateral. That is a very dodgy endeavour indeed!

If the foregoing is the fact, then I view the transaction of re-hypothecation as being a fraud.

hmmm….Is it the same Manmohan Singh, the current PM of India? I know he’s got some economics degree or some sort.