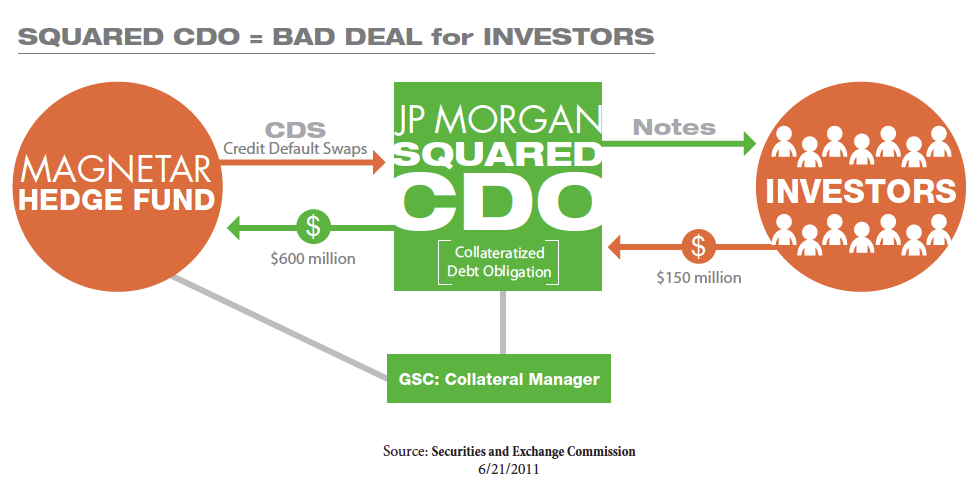

The SEC announced that JP Morgan has agreed to pay $153.6 million to settle charges related to a $1.1 billion heavily synthetic CDO called Squared which JP Morgan placed in early 2007 and was managed by GSC Partners, a now defunct CDO manager. The SEC has a cute but not all that helpful visual on the site, save it reflects the role of Magnetar as the moving force behind the deal.

Per the SEC’s complaint against JP Morgan, Magnetar provided $8.9 million in equity and shorted $600 million notional, or more than half the face amount of the CDO (this is consistent with our analysis, which had suggested that Magnetar, unlike Paulson, did not take down the full short side of its deals, since it like staying cash flow positive on its investments. The size of its short position was limited by the cash to be thrown off by the equity tranche). And needless to say, this was a CDO squared, meaning a CDO made heavily of junior tranches of other CDOs, so it was a colossally bad deal.

The complaints (one against JP Morgan and the other against GSC employee Edward Steffelin) make clear that the SEC had gotten its hands on some pretty damning e-mails. The core of the allegation against JPM was that all the marketing materials represented that the assets in the CDO were selected by GSC when they were in fact to a significant degree chosen by Magnetar.

Magnetar made clear that it regarded its equity position as “basically nothing” and really wanted to “buy some protection”, meaning get short and that Magnetar was actively involved in choosing the exposures for the deal. And JP Morgan clearly understood Magnetar’s aims and the precariousness of the subprime market: “We all know [Magnetar] wants to print as many deals as possible before everything completely falls apart. ” Per the complaint, Magnetar was involved in the selection process both by affirmatively recommending assets to be including in the portfolio and nixing others suggested by JP Morgan (one amusing e-mail from Magnetar called some securities selected by JPM as “just stupid”, by implication because they were not “decent shorts”. Needless to say, those particular instruments were not part of the final deal).

This is also the first time the SEC has sued a someone from the collateral manager, and that case is still open. The SEC complaint against Steffelin who was in charge of the team at GSC that selected the assets for Squared, alleges that he was looking to get a job with Magnetar and was thus particularly eager to do its bidding:

On January 5, 2007, the employee at Magnetar primarily responsible for the firm’s

participation in the Squared transaction (“Magnetar Employee”), sent his supervisor an electronic

mail message stating, “Steffelin wants to leave GSC and start a manager for us . . .” His

supervisor replied, “Perfect,” to which the Magnetar Employee responded, “I knew u’d like

that!!”….On February 22, 2007, the Magnetar Employee sent his supervisor an electronic

mail message with the subject line “Gsc blowing up” and the text “Ed [Steffelin] eager to get

something going. We could get whole team and all deals.” The Magnetar Employee’s

supervisor sent a reply electronic mail message asking, “Why are they blowing up?” and the

Magnetar Employee explained “They’ve been having [a] big fight over comp[ensation]. Think [the head of GSC’s structured credit department] is going to split, rest of team not that happy at

how they’ll be treat[ed] if they stay. As u know, Ed [Steffelin] was already planning to leave.”On February 26, 2007, the Magnetar Employee sent his supervisor by electronic

mail message another update, stating, “Just got off the phone w Ed [Steffelin] . . . Ed thinks

whole team can be lifted, will be able to take along 5 deals currently in warehouse, makes it cash

flow positive day 1.”

While Steffelin was in the end never hired by Magnetar (who needs a CDO manager when the CDO market is dead?) these conversations took place while the deal was being put together.

The settlement amount is proportionately lower than the $550 million Goldman paid to settle its notorious Abacus transaction, but that SEC settlement, although drawn narrowly, appeared to signal that the SEC was not going to pursue any other Abacus trades, when Abacus was a 25 transaction program. By contrast, although the Squared CDO transaction was pretty dreadful (the investors lost everything), it was the only Magnetar CDO sold by JP Morgan.

The settlement amount is roughly equal to the value of the mezzanine tranche ($150 million) which was sold to actual “cash” investors (parties who put up real money). And as we’ve suggested, they were real stuffees:

The Mezzanine Investors included a faith-based not-for-profit membership organization headquartered in Minneapolis, Minnesota (Thrivent Financial for Lutherans), a company that provides insurance and retirement products based in Topeka, Kansas (Security Benefit Corporation) and financial institutions located in East Asia (Tokyo Star Bank, Far Glory Life Insurance Company Ltd., Taiwan Life Insurance Company Ltd., and East Asia Asset Management Ltd.).

The super senior, worth $935 million, went to three JP Morgan asset backed securities conduits that issued commercial paper. It looks like one unit of JP Morgan effectively treated another as a stuffee. And recall that Len Blavatnik, the sixth richest man in the world, may have been one of the ultimate stuffees; he sued JP Morgan after losing $100 million on a $1 billion, a number that should be impossible in a money market fund that per his agreement with JPM was to be kept liquid and invested conservatively. His funds were over-invested in risky mortgage related instruments.

We’ve written repeatedly about the dubious role of CDO managers in ECONNED and on this blog. Our analysis of Magnetar deals shows that GSC managed five Magnetar deals. We hope the SEC is looking into the balance of them.

Our Tom Adams spoke about the settlement on BNN. You can view the segment here.

$153.6 million. I’ll bet they’re shaking in their boots.

And none go to jail. What a sweet deal……for them. Not so much for the rest of the world.

I guess after legalizing theft and murder the next goal is debtors prisons and the return of slavery. Wheeee.

A punk robs a Seven Eleven mart and is frogged marched into the slammer 15yrs. JP Morgan punks rob investors of hundreds of millions and they agree to a fine. Laws and prison are for the little people

rps;

That’s the business model all right. Anyone know if the privatized prisons are on the state budget chopping blocks? That would tell a lot.

They ARE shaking in the boots…from the irrepressible laughter, that is!

The shareholders pay the fine and the bankers who worked on the deal keep their bonus. Something is wrong with the shareholder system. Where is the corporate governance? Fix the issue with Boards of Directors being accountable and a lot of the other issues go away. At least that’s my two cents.

Re: Where is the corporate governance?

Ha HA HAHAHA… Funny one.

You mean employee compliance training videos right?

This is further proof of the investment adage “that is better to work for an investment bank than to own shares in it”. Basically if you don’t get caught you get a huge bonus, if you do get caught the shareholders pay and you just get a large bonus. Shareholders in JP Morgan and the other banks deserve everything that is coming to them. Oops, of course nothing is coming to them as the tax payer is backing all these reckless actions. Sweet deal for all concerned outside of the tax payer and the stufees, both of whom lost hundreds of millions.

Yves, the link in the article above has a JPMorgan Public Relations advertisement couched in the guise of business analysis with one Gary Townsend. The news presenter was laying out JPMorgan’s defense very skillfully. One wonders what connection Mr. Townsend has with JPMorgan, perhaps as a minor market maker. George Orwell must be laughing his head off at the hypocrisy of the Bastion of Democracy and its Department of Justice.

Whoops, that was the link I got when I searched the site. Correcting now.

It looks like the SEC did a much better job constructing its narrative in this case than it did in the Goldman/Abacus case. I

In both cases, the essence of the crime was the CDO sponsor (JP Morgan and Goldman) representing that a registered investment advisor (a statutory fiduciary) was responsible for picking the securities in the CDO portfolio. Based on these representations, an investor should have reasonably inferred that the selection agent was trying to MAKE a return for the portfolio. In fact, and hidden to investors, the sponsor in each case (JP Morgan and Goldman) was conspiring with the selection agent (GSC and ACA) and a third party short investor (Magnetar and Paulson) to cede selection agent actual authority to that third party, whose goal was to LOSE money.

That was the crime in both cases, and the SEC lays it out pretty well in the JP Morgan one. With the Goldman situation, everyone ran around chasing their tail about whether Goldman was “short” the CDO, and almost nobody ever discussed the essence of what they did wrong. On the other hand, maybe it was Goldman’s PR handlers who so masterfully muddied the waters about what the allegation was, and by creating weak straw men, were able to convince almost all the public that the case against Goldman was weak.

Spot on, the inconsistencies between these two cases are weird. Why Steffelin, for non-disclosure, when he clearly wasn’t responsible for marketing docs, and/or why not GSC as a whole, as the only true fiduciary? Why, if the SEC recognizes the role of CDO manager in ceding asset selection control, was ACA or any individual there not named in the Abacus case? Why the smaller fine in this case for similar deal sizes, was it because JPM lost more just because they couldn’t sell their super-seniors?

Dubious congrats, Yves.

Hat tips galore. Having read Econned and consequently Tett and Partnoy I felt that only Yves made the case against Magnetar. This is a confirmation of her research.

(I confess: I read Sorkin first after reading S.JOhnson’s good review in the WaPo – forgive me, I won’t do it again but I really like JOhnson … in any case my education began with Econned.)

The SEC chart is entertainingly useless. The email quotes are genuinely helpful however. My opinion is that numerous banksters knew that if they went too far then there would be upside for them and downside for the taxpayers. They might want to argue that they only saw downside for the dumb investors, and most of them were foreigners. But aren’t banksters supposed to have more on the ball than day-traders? Assuming they won, when did they know they were going to win?

January 2007: “We all know [Magnetar] wants to print as many deals as possible before everything completely falls apart.”

I now guess the consensus formed sometime in 2006.

Now I know who I can put the blame on for getting laid off in 2009. I used to work for one of the companies in the “mezzanine tranche”.

At least up to the time they got their azz handed to them when the market went blooey.

Thanks JP Morgan. Nothing like being thrown under the bus (in the worst employment market in 60 years) to build a little character.

Yves,

Drop the link till u can fix it. It’s not Tom’s interview and this is a no shill Zone. It undermines the story, although it does mirror the ABC news breaking news flash coverage I caught when I got home.

Superficial visual note: the JPM flag flying in the clip was black amd gray, eerily threatening and ominous. Has JPM changed their brand colours. Voldemort flashed through my head, so the clip may have some creepy unintended value.

Hit the kill link button, quick.

I’m looking forward to Tom’s segment.

Remind your readers there’s more to come on this out of the Merrill SEC investigation.

I’m thinking that the Merrill guys emails were a little less polished than the JPMs. K didn’t feel he had enough clear cut evidence from the email trail at JPM, but he might be hinting the Merrill guys were a little earthier, and also did more deals with your friends.

Its a good news day for the good guys I think.

Yes, I’ve fixed it, apologies. BNN changed how you find segments on their site, and I couldn’t get the link from where I viewed it (a teeny window in a main page, where I had to hunt manually for the segment). So I went to hunt, again manually in the section where they had all the segments, and the title for the one I put up was the same as for Tom’s segment, although obviously it was not the same one.

“The SEC announced that JP Morgan has “agreed” to pay $153.6 million to settle charges….”

Well, we know who’s in charge…..

SEC to JP Morgan, “Sir, may I have another bowl of porridge”

The SEC is a bunch of cowards and wimps. There is no prosecutorial steel there, only lazy time-servers.

“One hundred fifty-three million dollars? Gosh. Sure. Got change for a billion?”

I’ve got a big problem with the way this and the Goldman Sachs matters have been handled. The investment banks just look at these charges as a cost of doing business. Basically, they rip investors off for $1 billion dollars and they pay $153 million in fees for doing so.

Yes.

And that’s why I’m deciding to go long on the prospect that the issue of ‘corporate personhood’ is going to emerge as a major political issue within the next 12 – 14 months.

This kind of outrageous behavior, plus the recent SCOTUS decision (Wal-Mart) suggest that the notion of ‘corporate personhood’ is going to be coming under a whole new level of scrutiny in the coming year.

With bailout, also.

They claim they also lost $800 million on the CDO. I have trouble with that idea, since they placed the super senior in three ABS vehicles, but they may have had backup funding lines and got stuck with them anyhow when the asset backed commercial paper market started to fail.

This link worked for me-

http://watch.bnn.ca/the-close/june-2011/the-close-june-21-2011/#clip488567

Those sheeple who were stupid enough to give their money to TBTF Wall Street banks deserve to lose every cent they have and end up eating out of garbage bins and living under bridges. Maybe if enough people have thier net worth nuked it will act as a wake up call for the rest of the ignorant herd to stop doing business with the crooks on Wall Street.

But then maybe not…

Yeah, those bank customers sure are a bunch of bastards, huh? If only they weren’t such sheeple, then the bankers wouldn’t be such absolute scum.

What you say makes so much sense, now that I think about those disgusting morons and their sickening trust in their government. I mean, if no one banked, there would be no bankers!

Solved!

(Will I still be perfect tomorrow?)

The entire purpose of that graphic seems to be to inform us that the investors are “the little people” who have borne the brunt of the scam. I guess that’s so no one can accuse the SEC of failing to acknowledge that and act accordingly.

(“See? It’s made clear in the drawing, just look.”)

And the little arrow labelled 150m might explain the fine amount that puzzles. Was 150m the total amount of premiums paid by investors? If so is the penalty really just 3m?

interesting….from page 571 of levin report: Steffelin email from Feb 2007 – same time he was dealing with JPM/Magnetar…

Later, when Goldman began to market Abacus 2007-AC1 securities, Edward Steffelin, a

senior trader at GSC, sent an email to Peter Ostrem, head of Goldman’s CDO Origination Desk

saying: “I do not have to say how bad it is that you guys are pushing this thing.” When asked by

the Subcommittee what he meant, Mr. Steffelin responded that he believed that particular Abacus

CDO created “reputational risk” for GSC as the collateral manager and for the whole market.

nice catch joe

A well-deserved and long suffering congratulations to you Yves.

Obviously the SEC settlement is far short of the type of claw-back, multiple jail sentences and total annihilation of JPM you and your readers would like to see (justice), but hey, 154 million is nothing to sneeze at. Just getting the sleepy kittens at the SEC to do anything at all is quite an accomplishment.

Congrats again and keep giving the crooks hell. I think this may be just enough to get your face on Jamie Dimon’s dart board.

Here is the principle as affirmed by the Supreme Court – as long as the offering prospectus was printed by some someone other than JPM, and the JPM salesman/banker did not SAY what the prospectus says – no wrong was done:

Janus Capital Group, Inc. v. First Derivative Traders

Holding: Because the petitioner, a mutual fund investment adviser, did not make the false statements included in the mutual fund prospectuses of its clients, it cannot be held liable in a private action under SEC Rule 10b–5, which prohibits “mak[ing] any untrue statement of fact” in connection with the purchase or sale of securities, for its role in preparing those prospectuses.

http://www.scotusblog.com/case-files/cases/janus-capital-group-inc-v-first-derivative-traders/

In other words, a prospectus is a “GET OUT OF JAIL FREE” card!

Anybody who relies on a prospectus to buy a financial product has to be a fool now!

Is that the hole the size of a Mack truck Magnetar is going to parade right through?

Seems to me getting another entity to rob someone on your behalf is criminal. There is no doubt Magnetar knew what they were doing and from the emails, it appears even the thieves at JPM/GS knew full well also.

XRayD if JP Morgan was the ‘book runner’ and their name is at the top of the prospectus, doesnt that mean they might as well have written it? (i dont have the prospectus with me)

With both JP Morgan Chase and Goldman Sachs having the capacity to manufacture money as banks with the help of the Federal Government assisting on reserves creation, arbitrage between Fed borrowing and bond interest rates and guaranteeing bailout solvency money just exactly who was meant to be impressed by these pointless fines? Why the great unwashed American public of course ! Works a treat ! Bankster Obama continues to get his campaign funding !

The banks were meant to be impressed. They will have job openings for some of the SEC staff after the next election, no doubt.

GS et al are now having Ben manufacture their money and borrowing it at less than the paper and printing costs!

“But here’s what I’m interested in: is SEC enforcement chief Robert Khuzami going to take on Deutsche Bank for doing the same thing? I’m wondering because Khuzami was a general counsel for Deutsche when the bank reportedly engaged in deals so exactly like the Abacus trade, they also involved the same hedge fund predator (John Paulson) and the same customer/mark (the German bank IKB).”

Matt Taibbi

http://www.rollingstone.com/politics/blogs/taibblog/jpmorgan-chase-fined-154-million-in-goldman-like-case-20110622

The banksters have always gotten away with just fines, but they handle the money and money rules.

http://lonerangersilver.wordpress.com/2011/05/09/pyramid-of-capital-system-how-true-this-is-3/

So I guess all of those crisis books that held out JP Morgan as ‘above this sort of thing’ were all blatantly wrong?

So many portray JP Morgan as the ‘wise one’, who, since it invented Credit Default Swaps, the Synthetic CDO (BISTRO), the Value-at-Risk model, etc, that it knew how to use them more wisely than the others. It is portrayed as though JP Morgan’s responsible managers watched in horror as the rest of the street went mad and drove over a CDO cliff.

Jamie Dimon, is portrayed as a wise socially conscious person in the spirit of the original JP Morgan, who managed to make a ‘soft landing’ of the credit-panic of 1907. He is also portrayed as a well-connected CEO who knows what is going on deep in his organization.

I guess this completely blows all that out of the water. JP Morgan was not that much different from Goldman, or Deutschebank, or any of the other bookrunners in the CDO game (bookrunner is not a perjorative btw, it is the name they use on their CDO prospectuses).

And poor Blythe Masters. She acted completely responsibly, and was poured upon by an unfair media, who targeted her because she was female. Now, of course, she has a highly responsible job in JP Morgan’s commodities section. (nevermind that they have actually bought warehouses just to hold certain metals. they are not speculating or manipulating the market! as Ms Masters will tell you, in an indignant voice, the price of commodites is entirely due to supply and demand)