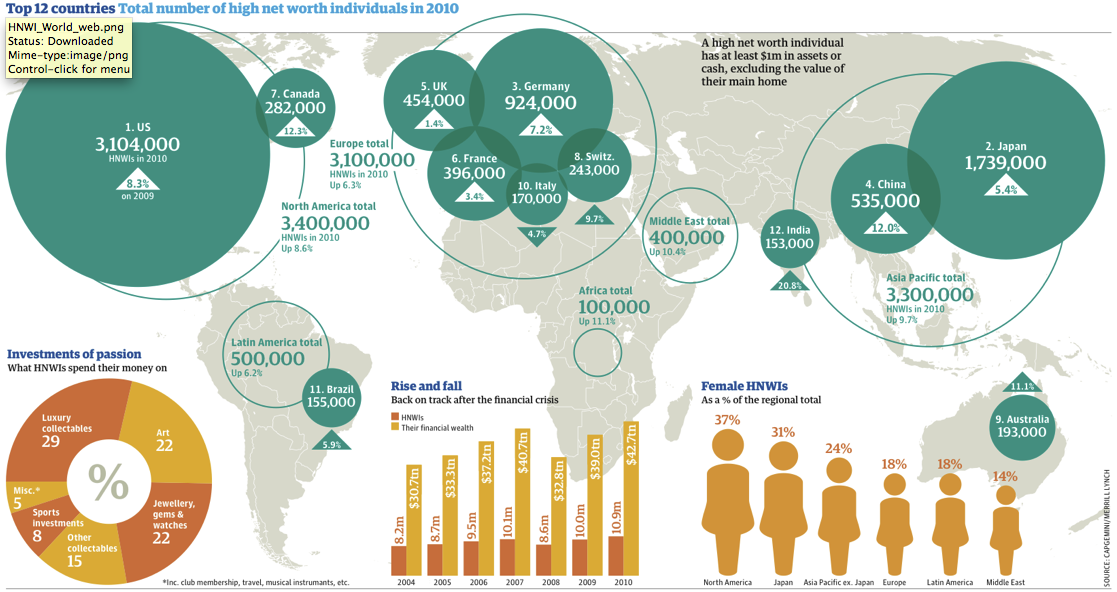

Much ink has been spilled about the increase of wealth at the top. This graphic comes from the Guardian (hat tip Merrill K, click to enlarge):

From the related article:

In the world of the well-heeled, the rich are referred to as “high net worth individuals” (HNWIs) and defined as people who have more than $1m (£620,000) of free cash.

According to the annual world wealth report by Merrill Lynch and Capgemini, the wealth of HNWIs around the world reached $42.7tn (£26.5tn) in 2010, rising nearly 10% in a year and surpassing the peak of $40.7tn reached in 2007, even as austerity budgets were implemented by many governments in the developed world.

The report also measures a category of “ultra-high net worth individuals” – those with at least $30m rattling around, looking for a home. The number of individuals in this super-rich bracket climbed 10% to a total of 103,000, and the total value of their investments jumped by 11.5% to $15tn, demonstrating that even among the rich, the richest get richer quicker. Altogether they represent less than 1% of the world’s HNWIs – but they speak for 36% of HNWI’s total wealth.

But not to fear, marketers are still plenty interested in the rest of us (hat tip reader Scott):

There was a soft coup in 2008 where the oligarchs of finance simply took over government financial authorities and dictated the terms of their own bailout. It was far, far easier than actually making any money. And the oligarchs aren’t going to give that power back, not least because the personal use of it guarantees them even greater wealth without tears. Everyone else has gone forward as if nothing has changed. The populace huddles in their homes with floursacks over their heads, eager to know nothing.

When veiled signories came to the urban communes of Italy, it never left. Little fist got eaten by bigger fish until actual kings owned everything. Democracy was only tried again came when said kings slumped into the tremors of their last senescence—but it was too inefficacious, so a detour through outright fascism was undertaken before the trappings of republican democracy were imposed by foreign conquerors. Now, I wouldn’t project that 700 year sequence ro recur in ye old US of A, but fact of the matter is we’ve got the despotism we deserve, and are doing nothing meaningful to change that. And fer sure the oligarchs aren’t going to voluntarily give up any of the absolute financial powers they’ve taken into their own hands. Not when the populace surrendered to them without even a knowing whisper.

Richard,

I’m not often of contrary opinion, but for this from Bartlett and Steele, twice Pulitzer Prize winning investigative reporters, authors of “The Demise Of The Middle-Class In America”, who definitively show the TARP

bailouts were piracy-not necessary. Seems all banks were FORCED to take “bailouts”-while only few + AIG were actually in trouble=SMOKESCREEN:

http://www.globalresearch.ca/index.php?context=va&aid=15420

I’ve debunked that repeatedly, both here and in my book. The major dealer banks all would have failed without government intervention. They all fund long term exposures in the repo market and there was suddenly a ton of collateral they used to be able to fund via repo that no one would take. That means liquidity crisis. That means collapse. And it was actually a solvency crisis, they had thin enough equity and enough paper at fictive values that they had zero and negative net worths at more realistic marks. Why do you think we’ve had super low interest rates and extend and pretend? Its’ to make them look healthy when they are still very sick, even after over two years of various back-dorr subsidies.

Per former derivatives traderRoger Ehrenberg:

Goldman is a great firm with a stellar culture, and in most circumstances it’s risk management and funding practices have been second to none. Except when the crisis hit. It stood with the rest of Wall Street as a firm with longer-dated, less liquid assets funded with extremely short-dated liabilities…..

There is not a Wall Street derivatives trader on the planet that would have done the US Government deal on an arms-length basis. Nothing remotely close. Goldman’s equity could have done a digital, dis-continuous move towards zero if it couldn’t finance its balance sheet overnight. Remember Bear Stearns? Lehman Brothers? These things happened. Goldman, though clearly a stronger institution, was facing a crisis of confidence that pervaded the market. Lenders weren’t discriminating back in November 2008. If you didn’t have term credit, you certainly weren’t getting any new lines or getting any rolls, either. So what is the cost of an option to insure a $1 trillion balance sheet and hundreds of billions in off-balance sheet liabilities teetering on the brink? Let’s just say that it is a tad north of $1.1 billion in premium. And the $10 billion TARP figure? It’s a joke. Take into account the AIG payments, the FDIC guarantees and the value of the markets knowing that the US Government won’t let you go down under any circumstances. $1.1 billion in option premium? How about 20x that, perhaps more. But no, this is not the way it went down….

The site you linked to is known for running conspiracy theories. It has such a bad reputation I don’t link to it even if it has legitimate stories.

”

done a digital, dis-continuous move towards zero if it couldn’t finance its balance sheet overnight. Remember Bear Stearns? Lehman Brothers?

”

Long list of them. Started in Asia about January 008 as I remember it. Asian banks were in such jeopardy that fed governors had emergency meeting over the weekend and dropped rates. Then long list here — Country Wide F., Washington Mutual, Wachovia, etc. Iceland, England, Ireland, etc. Banks continued to fail and are still failing. Over 44 banks this year have failed and the year is not yet half over. FDIC would have had a larger shadow inventory had fed governors not come to the rescue with their spiffy new invention == extendPretend

The 4 years of the zombies

!

The idea of a coup, by financial oligarchs, is ridiculous at face value. The assumption is that one group, an identifiable one at that, was forcibly displaced by another. Good examples would be Pinochet taking over from the civilian government of Allende. Allende dead, civilians removed from power, military rules using mass arrests, murder, torture, rape. Not much subterfuge evident in naked power out of the barrel of gun. In the great American Financial Disaster, soft pedaling of the most granular descriptions offered by social science of the measurable structure of the financial social ordering of the markets coming to grinding halt and then propped up by the civilian government without resorting to violent force is turned into some academic fingering pointing exercise.

I don’t see any displaced group of people in power making way for a new set of people with different agendas. Capitalism is still working on its usual business of ceaselessly seeking more profits, accumulating more capital and doing it at a higher and higher rate of return than previously. Various tactics are used to accomplish this, especially moving industrialization to periphery and semi periphery nations, with lower wages, non existent social welfare programs and dangerous working conditions that never impede maximum production and profit taking.

The fact that 40% of the profits of American business now come from the financial sector follows from the deliberate off shoring and outsourcing of manufacturing for decades and more recently, internet based business of IT, accounting, engineering and other critical information service based businesses. It does not come from a political coup where the Big 4 Auto executives were marched out to killing fields, along with the steel, glass, rubber and machine tool industrial execs. The top management people are still here, there operations however are downsize, outsourced and out of the country. But that does not describe a coup.

The overwhelming dominance of the political process by the wealthiest has only increased in a reactionary tidal wave of lobbying where multi billion dollar campaigns of influence and PR are conducted by over 30,000 lawyers and other lobbyists in Washington against 100 Senators and 435 Congressional Reps. The fact that Wall St reaped a huge bailout saving them from the brink of annihilation, is not much different, except in scale than what Lockheed or Chrysler in the 1980’s received. it is not much different, except in scale, what Bell Helicopter received from the military contracts for the Viet Nam war, which kept them in business. Many companies and industries have repeatedly reaped unwarranted government business that kept them alive.

What is so different about this financial bailout and the absolutely clear knowledge that the banks involved were completely out of business by any definition of solvency, profitability, or other measure you could connive, is that the government so easily, willingly gave out so much money, risked so much political exposure, offered every measure of full and complete cooperation of every institution at its disposal, including the Fed, which went into businesses that it had no business going into, AIG, European Banks etc. that it appeared that an overwhelming power had taken over the mechanisms of the nation state at every key point, much like a well planned coup would take over TV and radio stations, shut down newspapers, arrest organized political oppositions and other sources of charismatic dissent and potential leadership, outside of the new power structure.

The bail outs, the TARP, the stimulus, the QE 1&2 and the soon to come 3rd bailout/stimulus package to prevent further economic and political fall out due to NO fucking jobs whatsoever on the horizon, were carried out not by a new GROUP from completely outside of the power structure, but the same people who have been in place and have been around for years and decades and who all come from the same background of Harvard, Yale and Princeton etc. These people are all socialized through decades of living and thinking and being promoted up the ranks to the highest levels of decision making and the results are consistent with the policy wishes of continuing to operate the economy by making more and more profits for the same set of people at the very top.

Unless the usual suspects on the list of the 500 hundred wealthiest Americans loses a 100 or so people to dungeons or the Marianas Trench, that is regularly published as some sort of actual real concern for an adoring public than not only has the right to know, but really wants to know who and how rich their favorite billionaires are, so they can root for Buffet against Ellsion, or whatever…. unless that happens, there is no coup to speak of. Nothing at the top has changed. No one has taken over the government from another group.

The fact that many of the more affluent, but NOT necessarily the most affluent and powerful are shocked at what can only be described as their own personal disillusionment over how America is run, and can only cope by calling this a coup, as if America was very good for the most part for most people and all of a sudden, bad people came out of the woodwork the day Wall St fell apart, contradicts the traumatizing and brutal treatment going on for decades for much of the rest of the other America, starting from the poorest and moving up through the de-industrialized working class and through the more suburban educated middle class. And now, professors and attorneys and MBAs are disgusted by what they see as a collapse of the rule of law and clearly criminal behavior going unpunished and even rewarded and courted by politicians for campaign donations. This may look like a coup for those within spitting distance of the halls of power, but for the rest of us, these are the struggles we have had to contend with for quite some time.

If I can get away with it, check out http://www.appointmetotheboard.com. It is my protest to try to acheive a fair economy for all.

To make the point, I am looking for a CEO of our fictitious bank, and I’m hoping to be able to pay the appointee a fat cat salary. Anyone can apply, and I invite you all to check it out and take part.

The pie chart on the bottom left should be titled “Why we need to impose a 95% marginal tax rate on the rich”

The inability of ‘the huddled masses” to resist the repeated onslaughts of oligarchy …. until its malicious nature brings a desperation that provokes armed revolt and/or collapse…

has been a recurring pattern throughout history. I believe its related to the lack of meaningful feedback mechanisms (and/or the corruption of any offered) within the social body.

In a hunter/gatherer group feedback opportunities are immediate and available to all members. Hence, while such a group has some hierarchical structure (those that tend to lead and those that tend to follow)… proximity, the complex network of relationships, an awareness of mutual dependence, and the ease of ‘transaction’… will tend to make consensus a requirement.

We’ve lost that ‘proximity’… which is why localization is so important but that won’t do it alone. Also needed are feedback mechanisms allowing frequent and potent citizen impact.

Create a seed withing the belly of the beast…

Leveling The Transaction Landscape: Technology and the Campfire

http://culturalengineer.blogspot.com/2011/04/leveling-transaction-landscape.html

I wouldn’t want to be so audacious as to ever suggest that the tool as briefly described above could ever be the root of a bank or have broader utility…

So end this comment here.

I believe that historians will find this to be a unique financial crisis.

Most crises result in the wealthy that have not taken excessive risk or the right risks doing well and taking out the weaker wealthy people. In many cases, the strong wealthy would have used the crisis to take out the weaker wealthy as an act of financial warfare. However, there is usually a large net loss in wealth at the top end, especially when you go across national boundaries and find entire countries that took large hits.

This crisis has seen a concerted world-wide effort by governments and central banks to ensure that even the wealthy with weak risk positions are permitted to maintain their wealth. There were only a few relatively small exceptions, such as Lehmann Brothers and Bear Stearns. This is locking in a fundamental structural imbalance that I believe will be ultimately very damaging in the coming decade.

This is probably the first (and last) time that virtually all major governments around the globe, who normally can’t agree on what to order for lunch, have been able to do a concerted effort with a specific goal in mind. I expect that it will start to break down over the next couple of years as governments begin to jockey for relative advantage in what they think is the end-game. I am not quite so sanguine as I think we are still only in the middle game of this huge global financial and economic chess match.

The world’s central banks have pushed all of their chips into the center of the table in this massive global poker game. If the markets and populations call their bluff, there is a good chance that they will be exposed as having nothing left as leverage. That will be disastrous, particularly given the very perilous state of politics in the world with the US unable to even have discourse, distinct us vs them politics in Europe, a very uncertain outcome of the Arab Spring, and Chinese leadership in fear of mass uprisings if any of their economic wheels fall off.

Ultimately, the governments and central banks are setting up a major showdown between the peasants and the lords. The outcome may not be pleasant for the lords, especially as there is evidence that the world’s armies now tend to be more on the side of the peasants than the lords unlike a couple of decades ago, so they may find civil unrest very difficult to control. Ultimately, this is the reason why I have been very puzzled about the relentless attack on the US safety net by the wealthy. It is what stands between a population believing that they have long-term financial support versus realizing that they may end up with nothing. Populations who believe that their future is bleak are much more likely to revolt and take the wealth back.

rd,

that’s what I visualize also…

People only accept propaganda when they have some stake or hope in the message being propagated. Watching the Nightly Business News, Washington Week, and the NewsHour are now literally surreal experiences for the kinds of folks who read this site. And as more and more people lose in some way -jobs, investments, etc- their belief in and support of the status quo will shrink.

Danb: Interesting choices as propaganda sites; all being PBS programs which IMO is the least partisan most objective source of news on TV. Surprised you didn’t mention Frontline or Charlie Rose. Then again the Right-wing hates non-profit programming so I suspect your comment was an attack masked as factoid.

Jim

Mansboro:

The first several minutes of the NewsHour is devoted to corporate sponsorship, e.g., Chevron. And, yes, I chose these examples because they are ostensibly the most “objective” news programming TV has to offer. Here’s one example: if one is aware of peak oil and its systemic consequences, one sees that the NewsHour deal with this issue almost everyday. But the knowledge from understanding peak oil -to my knowledge- has never been considered on this news program. As for left and right wing, PBS rarely has any leftist point of view; center-right (like Brookings) is as far as they go, wanting the audience to think it’s the left perspective. But really, left and right are rather besides the point of what’s unfolding, except to say each has their pet and increasingly harmful solutions of how to perpetuate economic grwoth.

Yes, that is the essence of profit maximization – keep pushing the limits until you no longer can. But it is really a creation of this economic system. Everyone cannot be wealthy, and so…..

Balance needs to be restored. It may take significant social unrest to do so, and continued significant social unrest to eke out small reversals of the status quo. Perhaps once Dancing with the Stars is cancelled. Or the Food Stamp program is gutted.

Nicely stated.

My fear however is that the US army has now been infiltrated by supporters of the inherited rich and if they don’t support the masses it could be ugly for quite a while.

I have been ready for evolution for 40+ years. Can we get started now?

Yes Psychohistorian, the evolution is well underway. One of three people alive don’t see the other side of the Promised Land though.

Not playing entirely is an option, mitigating loss is an option or fighting for a faction is an option. I’ll take the middle ground of loss mitigation.

All these options have risk, only one saves lives while the others exacerbate them. May you live in interesting times. We sure do, the trick is staying alive in the next decade while attempting to help others to do so. The Fascists will kill themselves as per norm. Unfortunately, they will take a lot of us down with them. Ahh the joys of evolution ;)

One note;

William Blum’s, “Killing Hope”, heavily documented history of CIA shows U.S. imperialism from 50’s forward, operating on same principles in OTHER countries..

no surprise it is now being turned upon Americans=privatization, end of middle-class, scapegoating of unions, education, state employees, none of whom had anything to do with economic devastation…

Ah, the 50’s

When the US motto was “changed” from E pluribus unum to In Gawd we trust.

When US corporations were given rights of “We the people…” so they could fight Gawdless communism.

So now we have Gawdless Christianity running around killing people and enslaving the rest for the inherited rich.

The fact that the rich are doing well won’t bother me as much if I knew that mobility were high. If the rich who are doing so well in 2010 are different people from the rich in 2000, then that’s testimony to a system that allows innovation and hard work (as well as admittedly some bribery and shenanigans) to pay off.

What’s worrisome is that today a hard working and intelligent individual is far better off (in terms of chances to reach the top) in East Asia or Russia than in the US, where the wealthy seem entrenched and entangled with the levers of political power.

With that said, the US fails to make the grade on providing a basic safety net for individuals who, whether it be from sloth, bad luck, or circumstance, fail to thrive in a capitalist system. A lack of political will to mandate universal health care coverage and inefficient distribution of aid (through Medicaid, food stamps, unemployment insurance, Social Security) are the main issues preventing the net from being adequate. That is especially considering a negative income tax (direct transfer payment to all citizens and resident alien taxpayers bumping them above poverty level) would probably be cheaper than administering aid programs (inefficiency and potential for corruption).

“The fact that the rich are doing well won’t bother me as much if I knew that mobility were high.”

That’s ok that it wouldn’t bother you, but it would still bother me quite a bit.

There’s a (quite persuasive) school of thought that the pleasantness (or unpleasantness) of existence is highly correlated to *relative* consumption, and thus, high mobility (and yes, the undeniable pleasantness of hope) does not entirely solve the problem of extreme concentrations of wealth in only a few hands.

Richard,

If I take the “international education” approach to the poly-sci of it, I see that the U.S. has NEVER attempted a fully-educated populace, and NEVER attempted a “full-employment” economy.

Having taught in Europe, and the states, secondary level, I

am amused Americans fall for scapegoating of U.S. education

as provider of “opportunity”=it was never “educational opportunity” people were after..at least not most. (I am perhaps an exception=over-education)

Note Americans and pols can all name negatives regarding educational relevancy, but noone discusses GOALS. These goals are quite different from Europe to America. Euros attempt full-employment, as this provides tax base for expensive social systems, which allow people to live life.

American businesses determine cheap labor force is our goal.

It is damning that U.S. education is demeaned by test comparison with Europe, when goals are quite different.

It is also important to note there is NO COMPARISON between

HOW Euros accomplish better than U.S. If we compare test scores, shouldn’t it follow we compare HOW such scores indicate differences in processes of education?

This charade allows businesses to scapegoat education as provider of “opportunity”. As only 20% of Americans graduate from 4 year university or vocational equivalent, as opposed to over 70% of Euros, this is false dichotomy.

At some point Americans are doomed to leave an entire generation of undereducated or uneducated behind, if only to compete, if actually competing in international marketplace…nationalized banking and resource exploitation

aside..imo.

‘little fist’

I like that.

While I love everything about your blog, Yves (except what it usually chronicles, alas), may I say that the chart at top looks like what you’d find in a petri dish, which makes it visually appropriate but hard to read. I recommend the one from MOTHER JONES which was actually linked to MSNBC yesterday.

http://lifeinc.today.com/_news/2011/06/24/6928660-good-graph-friday-youre-working-harder-theyre-making-money

OR

http://motherjones.com/politics/2011/06/speedup-americans-working-harder-charts

I raise a hand, quietly, against the contempt for the great masses. The elite spend large amounts of time and money to keep the other 95% out of power, so they have to be important.

All institutions set up to protect the vast majority against the greedy minority have the great weakness of any institution; they can be subverted. The right wing sneaks put on the judicial bench, the bullies and drones given law enforcement badges, the regulators befriended with a few coins and a cushy job, all decide their advantage is flipping from public service to private servant. While many can spout establishmentarian claptrap to justify bending the rules, a close look shows a few simple, squalid bargains.

Even when people take to the streets, surrounding the Greek parliament or occupying the Wisconsin capital, money speaks louder than duty. Elections are corrupted to a joke. The public discourse is confined to a few lurid wedge issues concerning marriage and childbirth, with the odd pussy bomb thrown in.

Bush II and other faux populists are fond of saying ‘the people’ want it. They’re talking about an artificial construct that the left, bless their snobbish little hearts, have bought without murmur. Activism short of violence is appropriate for this stage of the struggle, but it’s not out of the question in the future. People still think they have a lot to lose.

Ill-gotten gains do not profit, but righteousness delivers from death. Proverbs 10:2