By Philip Pilkington, a journalist and writer living in Dublin, Ireland

Learn to say the same thing

What defeats people is a double confession

One time they will confess one thing

And the next they will confess something else

Talk to them, they will say:

Learn to say the same thing

Let us hold fast to saying the same thing”

– Cat Power, ‘Say’

In Ireland we used to measure our economic performance based on GDP (GNP actually, but we won’t go into that). Pretty standard fare for any advanced economy, really. Not so anymore. These days we measure our economic performance based on the government’s ability to extract tax revenue out of the general populace to pay for extortionate loans to our EU masters.

The Exchequer – that is, the Irish government body responsible for collecting taxes – released its monthly report today. Already there has been boasting in the media that we are ‘on target’ and this weekend I expect to be inundated with more self-deluded bragging from inept government officials and incompetent media commentators.

The truth – a scary word in modern-day Ireland – is that this latest news is less to be celebrated than to be feared. That the Exchequer met its targets is hazardous to the Irish economy and will prove self-defeating in the medium-to-long run.

Automatic Destabalisers

When the government extracts money out of the economy in the form of tax revenues this causes a contraction in economic activity by approximately the same amount – all else being equal. As the economy contracts and unemployment increases, tax revenues fall and transfer payments (social welfare etc.) increase. Hence, if the idea is to decrease the budget deficit (spending less tax revenues) in order to pay down usurperous debt, the process is clearly self-defeating as the deficit will probably increase in the medium-to-long term. These effects are known to economists as ‘automatic stabalisers’. In this case we might refer to them as ‘automatic destabailisers’ as even though transfer payments and decreased tax revenues will bolster GDP/GNP thus helping to maintain real living standards for Irish people, they will certainly destabalise insane government plans for deficit reduction.

Indeed, the Irish economy already seems to be headed in precisely the direction that the Irish government’s policy I geared toward. At the same time as we celebrate our extortion revenue collecting abilities, total manufacturing output slid for the third month in a row. This reflects significant weakness in domestic markets which, of course, will be further compounded by siphoning-off money in the form of taxation. And although export orders have risen, this is clearly against the general European trend and is likely to fall again in the coming months as the European markets weaken further.

Unsurprisingly, it was also recently reported that the unemployment rate had climbed from 14.3% to 14.4% month-on-month from July to August – a not insignificant increase. With less people spending their pay checks, the Irish economy is going to tip even further due to a lack of spending power. This lack of spending power will be again worsened by the announcement, made today by the Minister for Enterprise and Jobs [sic], that he will promote wage-undercutting by employers. Once again, at the risk of sounding like a broken record, all of this will be further exacerbated by collecting taxes.

We turn to the tax revenues themselves only to be further disturbed by their composition.

Vampire Squid in a Giant Novelty Leprechaun Hat

Yes, as officially announced today, the Irish government met their crazy revenue targets. And no, this is most certainly not a good thing. In fact, the figures lead one to believe that we are likely to see serious revenue shortfalls within a year or two due to these obscene government policies.

In order to understand why the taxation issue is an economic bomb waiting to go off we should look at revenue trends over the course of 2011 (if you don’t feel like wading through numbers and their implications, important as they are, I suggest skipping this section rather than clicking the ‘X’ tab on your browser – that way you can find out how Ireland can actually solve the bloody crisis).

The two most important components of Irish tax revenue are: (a) Income Taxes that take money out of working peoples’ pockets before they go and spend it and (b) VAT taxes that are taken out of consumers’ pockets when they try to spend it. What follows is a very rough and ready argument that contains some truth but more importantly allows the reader to clearly understand what is happening with Irish tax revenues – and what is likely going to happen in the coming years.

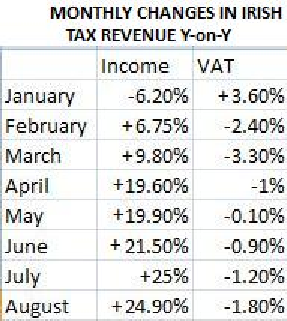

The following table – constructed by myself (hence the shoddy production values) – shows year-on-year monthly trends for both VAT and Income Tax receipts. If income taxes are a ‘+’ in January, for example, that much more have been collected in 2011 than were collected in 2010 and so on.

The trends are pretty clear. The government are raking in Income Tax but they’re falling short on VAT. It should also be noted that since last year they have raised their targets on both. So, for some reason they’re having an easy time pulling in more Income Tax and having a hard time pulling in more VAT.

The reason for this is that VAT taxes are dependent on consumer spending – and this is falling. Income Taxes on the other hand are largely dependent on, well, income. Now, here’s the kicker: when you increase Income Taxes, all else being equal, you should dampen consumer spending – because consumers spend out of income. Hence, if enough revenue is raised through Income Taxes this will negatively affect consumer spending and so will eat into VAT collection. This cannot be tracked directly in the data but it is the only logically consistent explanation – and we do, in fact, see this pattern broadly turning up in the data.

But wait, there’s more! When more taxes are sucked out of peoples’ income and they stop consuming as much, businesses don’t sell as much stuff; again, this will be reflected in the VAT receipts. And there’s something else to be brought into play here: if businesses don’t sell as much stuff the people working for those businesses will either be laid-off or they will have to take a pay-cut. If and when this occurs it will reduce consumer spending even more. Hence, less VAT – and so on and so on…

Do you see the dynamic taking shape here? When an economy is operating far below potential – as Ireland’s undoubtedly is – sucking out money by taxing people causes a negative spiral of ever-lower consumption and ever-increasing unemployment (or lower-wages).

Now, here’s where it gets really interesting. We have seen the two main taxes in Ireland come from – you got it – consumption and incomes. So, if consumption and incomes fall so will taxes.

And that is why we will probably see a decline in tax revenues in the near future. Whether this will be a year down the line or two is anyone’s guess. But while we’re waiting we can be sure that the Irish people will have plenty to think about as their economy gets ever more wretched. And if you’re Irish and you’re thinking about this wretchedness spare a thought for the idiotic Irish government. After all, it was them that sucked income out of the economy and then claimed that they’re ‘for jobs and growth’ or whatever disingenuous mush they’re trying to flog these days.

Solutions to the Crisis for the Deaf and Dumb

That this mess occurred is not so surprising, really. These pro-cyclical doomsday mechanisms were built into the Eurozone system from the outset. Eurozone nations foolishly reneged control over the right to issue their own currency and in doing so signed themselves over to a disorganised body of bureaucrats in Frankfurt.

Now there’s only two ways out of this mess for Ireland without ditching the Euro and defaulting its debt; both of which were first proposed by Warren Mosler.

The first requires that the European authorities and the ECB stop bickering like children, get their act together and make fiscal transfers to the distressed sovereigns – Ireland included. And not simply transfers that will allow for the alleviation of the current crushing debt burdens, but also transfers that will promote growth and expansion in these economies. Will this happen? Two words: ‘fat’ ‘chance’.

The other option is for the Irish government to issue ‘Mosler bonds’. This plan could easily be implemented by Ireland or any other Eurozone country and should also prove politically realistic within the current Eurozone structures.

Here’s how it works: the Irish government would issue new bonds to pay off the existing bonds as they mature. These new bonds would include a clause that states that, should the Irish sovereign default – and only in the case of said sovereign default – the bonds can be used to extinguish Irish tax liabilities. This would provide investors with an absolute guarantee as to the value of the bonds and this in turn will drive down interest rates significantly, making the Irish national debt affordable. It would also give the Irish government the breathing space necessary to stop extracting taxes from their beleaguered citizenry and start focusing on job creation through fiscal stimulus. (More detail here – the plan is laid out for Greece but would work identically for Ireland)

As stated a moment ago, this plan is perfectly viable. The Irish government can initiate it themselves without having to appeal to a foreign entity. But also, the European authorities would likely see it as an ideal solution as it would mean that the weight of the Irish debt problem was taken off their shoulders. Voters in the core countries would similarly approve as they would see it as Ireland ‘paying its own way’ rather than relying on them for backing.

Why won’t the Irish adopt such a sensible proposal? While anything to be said on this is indeed speculative, I think I am probably the most qualified person to do the speculating. I spent a number of weeks pitching the idea to various Irish media outlets and popular economic commentators. The response was tepid and confused. People either ignored me, didn’t understand the plan or pretended to understand the plan and then stopped corresponding with me so that I wouldn’t figure out that they didn’t understand the plan.

Moving on, I asked a friend of mine who is more ‘plugged into’ the politicos than I am to run it by them. The response was even worse. To say that they didn’t understand the proposal would be a vast understatement. They didn’t even listen. They just kept parroting what they’d read in the press about the need for deficit reduction. This wasn’t a case of talking to a brick wall; brick walls don’t parrot one-liners that they read in the newspaper. No, this was more like having an internet argument with a troll; they just repeated clichéd gobble-dee-gook ad nauseum until their unfortunate interlocutor had to surrender or risk suffering a hernia.

Ireland’s key problem is not so much its debt as the fact that its collective imagination has become stagnant and rotten. Mired in the depths of what may turn into a depression Irish politicians, together with their commentariat, have stopped thinking. They’ve come to believe their own soundbites: that raising tax revenue is progress and that deficit reduction is priority number one.

It’s not banks that will bring down the Irish economy. Nor is it the Europeans. It is the stale, crusty excuse for a ruling-class that inhabits the hallways of power. These creatures, upon entering into this brave new world post-2008, have shown that they passed their ‘sell-by date’ years ago. The Irish establishment now just rants and raves like a bunch of bipolar farm animals, shifting from elation to desperation every day or two as circumstances change and their internally contradictory strategies self-destruct. In their hopelessness they have gone mad… mad as goats.

Why haven’t the Irish people been successful in telling their government/the banks that they will not under any circumstances take on the debt incurred by the banks? That bank losses wlll either be borne by banks, shareholders and bondholders or repudiated? Why have the people been so acquiescent in their government’s betrayal, without even the protests seen in Greece and Spain?

It seems that the route taken by Iceland, and I do understand that they have much more latitude given that they have their own currency, was so much more beneficial to both the people and the country.

By the way, I am confused by the acquiescence in the US, also.

I agree with you. I also have difficulty to understand why they did not tell the EU to go to hell. It may be that it takes another election cycle to reach that result as politicans get pressured into agreements that do not serve their own people.

I am sure time works against those bankers and EU institutions who want to debt-enslave half of Europe.

I am Swiss. Just yesterday evening I had an argument with a director of Credit Suisse. Well, he insisted that all debt has to be paid back and I felt that he fully knows that time works against them.

“Why haven’t the Irish people been successful in telling their government/the banks that they will not under any circumstances take on the debt incurred by the banks?”

One reason is that they’re under significant pressure from the Germans and other Europeans. The present government was elected on the promise to ‘burn the bondholders’. I met some of the candidates toward the end of the election and I think they believed strongly in this. (It’s not hard to gauge an Irish politician’s intentions off record — they’re all very honest when you talk off-record because they know that, small country that it is, if you dared publish any of their comments your career would be over).

Anyway, when they got into power — and this is speculative, but I believe from reports it’s true — the Germans that hang around our government put major pressure on the government to float the bondholders. This is because many of the bondholders are German and if the government ‘burned’ them the German banking system would go into meltdown — something the Germans don’t want to own up to; after all, they’re the ‘responsible’ ones, the ones standing on the moral highground.

What did they threaten the new government with? I have no idea. I joked after the election when all the talk about bondholders wound down (it was VERY quickly forgotten) that Noonan, the Finance Minister, must have woken up to a horses head in the bed! Or maybe they had photos of someone buying hookers or something. Or maybe they just threatened them that they’d kick them out of the EU. I don’t know. But they said SOMETHING.

Fine Gael started backpedaling on their “burn the bondholders” before they were even elected. Moreover, whatever individual candidates thought at the time, the leadership of Fine Gael knew going into this that they were making half-ass, conditional promises (read: empty).

As we wrote way back:

“Fine Gael played to voters’ anger over the bailouts by engaging in a good deal of tough talk about unilaterally restructuring the debts of Ireland’s bailed out banks.

However, the tough talk will likely turn out to be nothing but talk. Fine Gael’s pre-election threats to bank bondholders were promised to be carried out only if they were unable to restructure the terms of the IMF “bailout.” Such restructuring would only amount to tinkering around the edges of the agreement, not rejecting it outright. The main point of contention amongst “serious” people has been the 6% interest rate Ireland was saddled with, not the obvious injustice of making the Irish people debt slaves for the benefit of Deutsche Bank and Soc. Gen.”

http://dailybail.com/home/irelands-prelude-to-revolution-imf-bankster-party-tossed-fro.html

In February, even Noonan himself was saying that the plan for bondholders was slightly more “nuanced” than was generally understood.

This was a sell-out from the very beginning.

I got a distinct impression that many candidates believed in this — but that probably never mattered if the top brass were already in talks.

Anyway, the bailouts are done. Time to move on. Mosler bonds are FAR more politically viable.

The next question is, how long until Fine Gael is kicked out like Fianna Fail was? Will backbenchers decide it’s time to defect and bring down the government? Or will this catastrophe drag on until the next scheduled election?

And the big question is, who the heck will people vote for next time? This is probably Ireland’s first crisis where nationalism can’t be used as the answer to all problems, and the people are probably a bit unclear on who to vote for given that. I’m surprised there hasn’t been rioting yet.

http://www.facebook.com/video/video.php?v=278661915493444

Here is a video where I went into Cork Ireland at the Bank of Ireland looking for the leprechaun and his pot of gold, instead I found this green Mosler MMT T-shirt under the rainbow. Let me ask you Philip, Mosler talks about a gauranteed jobs program. I went all over southern ireland the past week, and none of the places I visited had local irish employed. Instead it was checkz and lithuanians and such doing all the grunt work. Why aren’t the local Irish doing this work? Who are the capitalist masters that have decided importing cheaper labor from overseas is better than employing your own youth? I thought Ireland was a bunch of poor goat farmers with great tax subsidies taking american industry away, but when your labor force has so many checkz and lithuanians and other immigrants, I don’t see good things for the Celtic Tiger in the future. The farmers are all scared to get out of the EU, they say they will lose thier peat farms, as the EU subsidizes them heavily.

Why can’t the Irish government simply announce that they will accept the existing outstanding bonds as payment for taxes at par value?

The deficit would go massive as the bonds replaced ‘real’ revenue. Would this be a problem? With the new bonds in place maybe, maybe not. The key point is that it would be politically unviable.

The new bonds would be at a lower interest rate than the old bonds since there would be no default risk. They would be equivalent to Ireland issuing its own foreign currency interest paying “legal tender for government debts only”.

The notion that there would be no default risk is incredibly naive. The sovereign could simply disavow the terms of the bonds if it was in their interest…they clearly have that power. Why would it be in their interest to disavow these bonds? Just imagine a scenario where all the existing Irish debt is replaced by these Mosler bonds. Then jump forward to a needed Irish default. When that default occurs, Ireland’s Mosler bonds would be a noose around the neck of the government as it would choke off all revenues and recreate the problem they’re trying to solve…the obvious solution would be to disavow the terms of these bonds by simply changing the law.

“The notion that there would be no default risk is incredibly naive. The sovereign could simply disavow the terms of the bonds if it was in their interest…they clearly have that power.”

You didn’t read through Mosler’s full proposal. The terms would be set by the EU. EU law overrides national law at all levels. So there would be no escaping receipt.

“Just imagine a scenario where all the existing Irish debt is replaced by these Mosler bonds.”

This time you didn’t even read what I wrote. Mosler bonds would only be issued as debt payments fell due. Existing debt would not be replaced by Mosler bonds.

“When that default occurs, Ireland’s Mosler bonds would be a noose around the neck of the government as it would choke off all revenues and recreate the problem they’re trying to solve…”

First of all, a default wouldn’t happen because interest rates would be subdued.

Second of all, if there were a default, which there wouldn’t be, the cancelled revenue would simply open up the same hole in balance-sheet that the Mosler bonds would be filling. The result: another EU bailout. The same size as the one we have now. We’d just be back to square one. No harm done.

All Mosler bonds do is guarantee payment. THAT’S ALL THEY DO. It’s actually very simple.

“Second of all, if there were a default, which there wouldn’t be, the cancelled revenue would simply open up the same hole in balance-sheet that the Mosler bonds would be filling.”

Let me give an example to make this clear:

Ireland issues €100,000 worth of Mosler bonds in order to cover a deficit that opens up because they’ve decided not to increase taxes (to the tune of €100,000).

Ireland defaults (it won’t, but for the sake of argument). Ireland now owes the €100,000 which it then taxes from the population.

This is how government debt works at a very fundamental level. It’s not that complicated. Although it’s VERY misunderstood.

I missed that part:

The same EU which will refuse to “stop bickering like children, get their act together and make fiscal transfers to the distressed sovereigns” (the OP correctly says “fat chance”) will turn around and guarantee and enforce the terms of the Mosler bonds.

What if Ireland exits the EU and refuses to honor the bonds?

What could the EU do to stop this – impose sanctions? Send in German troops?

Good idea btw – a stimulus in disguise.

Btw., these bonds might break EU law as-is: the ECB might not like this breaking of their money issuance monopoly.

“What if Ireland exits the EU and refuses to honor the bonds?

What could the EU do to stop this – impose sanctions? Send in German troops?”

What if the same thing happens with the bailouts? What if they drop the Euro and default?

My point: There’s a million and one ‘what ifs’ for a million and one different scenarios. I don’t see the point in getting hung up on them…

Now there’s only two ways out of this mess for Ireland without ditching the Euro and defaulting its debt

1. Ditching the Euro and defaulting on the false debt is the only way out of the mess.

2. That’s why alleged alternatives like those mentioned above are just misdirection.

It’s funny that the post rightly says “fat chance” with regard to the simpler, more direct one, and then bizarrely pretends the convoluted Rube Goldberg one is somehow plausible. I reckon if the first is politically unacceptable, the second will be as well. And sure enough, the post goes on to concede this.

Evidently, the point of the post was merely to show off the wonkery prowess of the “Mosler bond” kludge, not to actually make serious proposals. We know that wonkery cannot work. As someone said, only blunt objects are going to work in the end.

It’s not banks that will bring down the Irish economy. Nor is it the Europeans. It is the stale, crusty excuse for a ruling-class that inhabits the hallways of power.

Ah, those bad apples again. If we only we empowered Better Elites like Mosler, then we could set the banks to economically productive activity, all of globalization’s predations would end and its trickle-down promises would flow like hurricane floods, banksters would become Jimmy Stewarts, the lion would lie down with the lamb.

(The penultimate paragraph is a quote from the post. I forgot that the HTML tags are messed up.)

You forgot to say why the Mosler bond wouldn’t work.

It would bring down interest rates (which is the key problem right now). And would allow Ireland some control over spending and taxation. Why wouldn’t it work?

I don’t doubt that’s what it could do in the ivory tower fantasyland where there are parts of the government structure which aren’t kleptocratic. I said it’s unacceptable to kleptocracy, and therefore impossible as a practical matter. It won’t be done because it would tend to diminish bankster looting opportunities.

I’ll add that if we the people could rid ourselves of kleptocracy, then what we replace it with could be infinitely better than such picayune reformisms which really want nothing but to maintain most of the Ancien Regime. This proposal is lame even by MMT standards, which are lame themselves. Why aren’t you just telling the Irish to take back what you’d call money sovereignty? That wouldn’t be any more politically odious to the local kleptocrats than the Mosler idea.

Oh, I forgot – in spite of all your MMTism, you still want to keep the euro.

It sure does get confused when one rejects democracy but doesn’t have the belly to be a real gangster, doesn’t it?

No fan of the Euro. But if I can promote a plan that floats it while saving my fellow countrymen a great deal of suffering, I’m all good.

Maybe this won’t fall into line with your ‘Grand Moral Plan’ — which seems to me more about your own imagination rather than actually helping people — but if it helps people that I live with and that I daily see losing their jobs and their livelihoods, then so be it.

But you’re right. I’m the bastard…

That’s what they said in the Progressive Era, and what they said in the Thirties. And all that was during the time of oil’s ascent, when the pie was big enough and growing that it actually was sometimes the path of peast resistance for the government to let some trickle-down take place and at least pretend to be responsive and accountable. And yet look how poorly that all worked out. Imagine if we’d instead achieved democracy then. Imagine what could have been…

But the criminals, including the liberal reformists, strangled that wondrous possibility in the cradle, forever.

And now here you are at the end of the fossil fuel age, where that same pie is already contracting, where the system’s one and only goal is obviously to restore full feudalism and reduce us all to slavery, and you’re making the same promises, telling the same lies, if we all just continue to have faith in Leadership.

I’d say that by now “bastard” would be a mild term.

“if it helps people that I live with and that I daily see losing their jobs and their livelihoods”

You might have slightly more credibility if you could point to even one shred of evidence, anywhere, that there’s any possibility at all that your Elites have any intention whatsoever to do anything like that.

Unfortunately for you, 100% of the evidence points in the exact opposite direction.

(In Iceland, BTW, the government elites continue to try to find a way to restore kleptocracy and go the Ireland/Greece/Latvia route. Only the bottom-up refusal of the people has made things any different there.)

If all governments were kleptocracies, then “government” and “kleptocracy” would be synonyms. Even today, they aren’t. It follows, then, that better elites are possible. One can argue that they aren’t desireable, as I understand attempter to do, but they are possible.

I agree with Attempter. The Mosler Bonds would be a thinly disguised alternative currency for the Irish since as a practical matter the bonds would circulate because many individuals and entities would not just hold them strictly to collect interest and pay their Irish taxes. The bonds would circulate and become essentially a substitute currency. The example cited about California is instructive. IOUs issued by CA were used to transact business with the implicit knowledge that banks would accept them and the state would ultimately redeem them. The plan has merit and would probably do wonders for the Irish economy but alas the second alternative currency issue is politically a non-starter.

Just to make clear: the Mosler bonds will NEVER be accepted as tax because Ireland will never default. The whole idea is to drag down the interest rate. Low interest rate = no default.

They will never ‘circulate’ as alternative currency. They’ll just remain bonds — like T-bills. Safe investment vehicles that pay low, steady interest rates.

“They will never circulate as alternative currency”

Convince the PTB in Frankfurt and then let’s talk.

I am also a bit confused by the Mosler bond concept.

If the money raised by selling the bonds ended up funding sustainable and profitable economic activity, then clearly it would work as the bonds would have true market value and their receipt by the government as taxes would be equivalent to money paid in taxes.

If the money raised by selling the bonds did not end up funding sustainable and profitable economic activity, then the bonds would have tax value but would displace real money (to the extent there is any) in the tax payment stream.

It seems the key to success would be the form of economic activity financed by the bonds — which clearly is the wild card for any government spending. I see how this bond ooncept falls into the “let’s try it because nothing else is working” camp. But I also have some sympathy for the view that there are no sustainable economic structures in Ireland that could be animated into sustained profitability by bonds such as these. That’s a tough thing to say, but it’s a valid conjecture.

One other solution to the situation in Ireland and other periphery countries, it seems to be, would be export quotas — i.e. targeted levels of exports that the EU as a community would be committed to purchase. This would be like washing dishes to pay your bill when you find you don’t have the cash to pay for your dinner at a restaurant.

Clearly, such a scheme might and probably would intrude into the business of would-be competitors, but each solution has drawbacks.

Why not create a scheme where by the richer EU nations decide to purchase X amount in euros of a variety of Irish products. I’m not sure about the variety and depth of economic structures in Ireland to support such a scheme. But if it were doable, it would give Ireland jobs and export revenues from which they could pay debt. I know this would be hard to organize, but nothing in the situation is easy right now.

by the way, that goat pic is hellacious.

If the money raised by selling the bonds ended up funding sustainable and profitable economic activity, then clearly it would work as the bonds would have true market value and their receipt by the government as taxes would be equivalent to money paid in taxes. craazyman

Actually, if the Irish government just helicopter dropped that money onto the Irish people it might do the most good. Why? Because the counterfeiting and usury cartel, the banking system, has simultaneously cheated savers of honest interest rates and driven borrowers into unserviceable debt.

“If the money raised by selling the bonds did not end up funding sustainable and profitable economic activity, then the bonds would have tax value but would displace real money (to the extent there is any) in the tax payment stream.”

You missed a key point: the bonds are NOT accepted as tax payments UNLESS there is a default.

The logic here is essentially circular. If the government says that the bonds will be accepted as tax-payments in the case of default, then there is no REAL risk of default (as if the default occurs the bonds are still worth their value in tax-payments). This gives a solid floor to the bonds themselves. This in turn drags down the currently punishing interest-rates — which is the key goal of the exercise.

What Beard said is essentially right. This is a way of side-stepping the inability of the Irish government to print money. US t-bills are backed — as Greenspan made clear recently — with the US’s ability to create dollars. Hence, the low interest rates. Since Ireland cannot create Euros there is no ‘floor’ and interest rates rise. So, Ireland gives them a floor by saying that in the event of default they’re acceptable to extinguish tax liabilities.

It’s a roundabout way of restoring essential currency sovereignty without exiting the Euro.

It’s a roundabout way of restoring essential currency sovereignty without exiting the Euro. Philip Pilkington

Is there any treaty restriction preventing Ireland from skipping the bond issuance step and just issuing “tax tokens” – non-interest paying legal tender for government debts only? That way, the “tax tokens” would serve as the Irish national currency and the Euro would serve as a “private” currency.

Also, if every Euro zone country did that, it would essentially privatize the ECB since the Euro would no longer be legal tender for government debts.

I don’t know. My guess is: no.

I was talking to an Argentinian friend of mine the other day and he was telling me that this worked at a local government level during the 2001 crisis — local governments ran out of money and started issuing alternative currencies.

They also did something similar in California recently, to the best of my knowledge — albeit on a smaller scale. Funny how quote-unquote ‘monetary economists’ ignore these experiments. They have rather massive consequences.

It hasn’t come to this in Ireland… yet. Although I’m keeping it under my belt in case the local governments are squeezed to bursting point.

There is no reason why the Irish cannot issue their own currency to serve the needs of their own people.

The problem with issuance is the (current) need to borrow from a central bank which adds to the total debt burden. Better for the Irish Treasury to issue currency against some sort of reserve basis such as the mortgage value of Irish property.

If the Irish were to be imaginative, they would issue demurrage money which would eliminate the risk of inflation that accompanies Treasury currency issue.

The Mosler bonds are interesting the same way the FDIC is interesting … there is that ‘whiff of confidence’ that seeks to alter comprehension of a problem without actually addressing the problem itself.

The problem w/ Greek bonds is not their issuance but their cost. There are plenty ready to lend to Greek government @ 70% but the Greeks cannot afford to borrow! Lenders are shocked … shocked at the total corruption of Greek government. This government will not magically cease to be so with the issuance of some kind of bond or other.

Ireland can issue b/c they will endure any pain to remain within the euro. There are 2 reasons for this: to buy imported fuel (for which a hard export currency is needed, not a punt) and to remain outside the UK ambit. Better to sniff EFSF shit for a little while than to eat English shit forever …

Greece doesn’t care, they are hopeless, Mosler bonds cannot give anyone confidence: the only ones paying taxes with these bonds would be those who would never buy the bonds in the first place. Greece doesn’t care about euro ‘membership’ as it will get them by way of the Greek black market. If it cannot it will dollarize (along with China).

B/c of strong black markets in the PIGS, the euro will prove to be a durable weed, with hyperinflation as an accompaniment (leaving out the Irish).

Phil, I do appreciate that and I think the idea has merit.

A while back I made a somewhat analogous suggestion that economically depressed communities could issue their own special currency, acceptable as payment for city or county taxes to give it value. I theorized that such a currency might spark economic activity where people and resources are idle, creating commerce that might generate dollar-based revenues and profits (sort of like starting a fire with kindling). This is an obvious idea and one now being tried in various ways, from what I gather, in a few places around the US.

There are lots of moving parts in the Mosler bond scheme and I may not be grasping all of them (given my at-times short attention span and my brief scrutiny of the topic based on reading your post) — but its success would ultimately depend on the the nature of economic activity the revenue raised fomented. That, in turn, seems to depend on something hard to quantify — the social/economic structures that underly social cooperation.

A pessimistic scenario would result in the Mosler debt producing little sustainable economic activity and ultimately being substituted for cash taxes upon default, to the detriment of Irish overall budget revenue and the holders of other Irish bonds, whose interest and principal payments require payment of euro taxes to Ireland. One wonders what impact the floating of Mosler bonds would have on the prices of other Irish bonds.

An optimistic scenario would have the cash raised by the Mosler bonds fomenting sustainable economic activity that puts Ireland back on a stronger footing — raising euro tax receipts in the long run. I know that is your suggestion and I think it has theoretical merit.

In my view, much depends on the nature of the economic activity fomented by the bond proceeds, which in turn depends on a whole range of cultural forces that are hard to analyze in mathematical terms. Ireland’s history of economic success is not good, for a variety of reasons, many out of its control due to English tyranny over it. It’s a long history and not all of it is relevant any more, but at the end of the day, there has to be some form of enduring socio-economic institutions that have sustainability for a Mosler bond or any debt to work, and how to build them is, I think, something of a mystery. That’s why I always joke that ecnomics is 16 equations and 19 unknowns.

And it’s also why I think an export quota idea might have merit. This concept starts with already productive enterprises and industries — which have proven themselves to some degree — and supports them with guaranteed revenue. It doesn’t burden anyone with more debt and has an effect analagous to targeted equity investment.

yes, critics would say it’s “government interference in the private sector” but there’s no getting around that Solomon’s Baby when there are two mothers claiming the child is their’s — one who wants to feed it with debt the other who wants to starve it with discipline. If you’re the baby, it’s a bad situation. Better not to have either mother and instead have somebody pay you to cry and scream and find your way as humans will — through instinct and imagination, into something sustainable and real.

All the Mosler bonds aim to do is bring down the interest rate on government bonds. This would mean no more bailouts and no more austerity. That’s all they’re for.

Mosler makes it pretty clear that the bonds are not a silver bullet. If Greece were to adopt them, they would still need to improve tax collection capabilities and make other adjustments.

But they should lower bond interest rates by offering the additional guarantee of being able to extinguish local tax liabilities. It does provide some breathing room.

It moves some monetary power away from the ECB to the local country, which is why they are opposed.

Also note that Ireland doesn’t have any of the problems that Greece has. As you can probably tell from the above piece, we have a problem with being TOO GOOD at enforcing tax collection rather than anything else.

You live in Ireland, you get fleeced by the government. It’s well known. Plenty of it’s off the books too — ‘stealth taxes’ and the like. Mosler bonds are pretty much a silver bullet for Ireland. At least when it comes to public finances.

In my view, much depends on the nature of the economic activity fomented by the bond proceeds, which in turn depends on a whole range of cultural forces that are hard to analyze in mathematical terms. crazyman

You don’t see any economic benefit from just restitution for theft? But even amoral economists agree that excessive household debt is the problem. So any government deficit spending is bound to help unless it actually produces negative returns (as it often does).

I do, but justice is like a greased pig, with debtors and creditors.

I figure there’s 500 million people in the EU. Let’s say half are of drinking age. That’s 250 million. 10% is 25 million.

If you could get 25 million people to drink one Guiness per day, say at 1 euro revenue (not sure what Guiness costs in euroland). That’s 25 million euros per day of export revenue, times 365 = 9.1 billion euros per year. Just from Guiness.

I bet the Germans could pitch in. Better to drink the Irish to health than have them drink themselves to death. What else for the non-drinkers? Wool sweaters, pharmaceuticals, software, natural gas, sausage, (but no banking services, bowahahahahahahah!!) etc. etc.

It could work, or at least help. Maybe.

I do, but justice is like a greased pig, with debtors and creditors. craazyman

The so-called “creditors” are counterfeiters. They issue “credit” in other people’s goods and services, not their own.

I live in Berlin. There used to be lots of Irish pubs in my

area (and Greek restaurants) but they started thinning out

end of the 90s and by about 2003 were all gone. You could

earn the Euros selling Guinness but you would have to control the retail space in Germany methinks, else you will just be

stuck with loads of beer competing against other beer with the retailer deciding on %ages or choosing their *local* brand to market. So you would have to bid the pub space back

off the current occupants… Or build new. Either way I don’t

think Germany would have anything against that, sounds like it’s good for the ‘economy’!

Joe, indeed it would not be easy and my example is just a metaphor for a larger concept. The German govt would have to find some way to mandate this — i.e. directing export payments to Ireland for Irish products.

Germany is in good economic shape because it’s an export powerhouse, as this web site has oft and accurately noted. And they are only because other countries have agreed to be importers. On a somewhat more abstract level, consider what that really means. It means that non-Germans have “allowed” Germans to provide goods and services to them (sure, based on competition in the “free market” ha ha), but keeping it abstract, it means that Germans have been given the opportunity to profit from serving the needs of non-Germans. To my thinking, there’s an innate social prestige in being the “doer” and every human interaction needs to balance doing and receiving. So now the Germans need to let others have the chance to be the doers.

Now the non-Germans are broke and the Germans are flush. Maybe the Germans should find a way to let the non-Germans do things for them, to balance out the reciprocity.

Germany can lend the non-Germans even more money and hope the non-Germans can pay it back, or it can give them the money as revenue in exchange for goods and services, which allows the non-Germans to pay back their current debts.

The losers would be German producers whose products and services might be displaced, but in reality the non-Germans might get their economies going and buy more German stuff over time, benefitting everybody in the end.

At any rate, targeted import quotas by the rich countries might be another way of rebalancing the eurozone. Consider that every German might have as his or her national duty to go on vacation for a week in Greece. or something like that.

It would be complicated, but with all that “financial talent” employed over there for 7 figure salaries, I’m sure a few of those boneheads could work up a plan, at least.

My, such bold statements.

I mean, really, is there a way to eliminate the bold, italicized text? It hurts my eyes! ;-) test

You don’t think it makes them look more majestic and authoritative?

No, me neither.

bold, italicized text? wunsacon

You mean like this?

Or merely this>

Well, if the Irish are going to have tax-base bonds substituting for sovereign currency bonds because there is basically no difference, why all the fuss about sovereign currency? And fictitious interest rates? What is the ECB even worried about? And another thing: I thought I read that it was Geithner that was demanding austerity for Ireland, not Germany. And also what is the solution for odious debt. Oh, we’ll just issue a tax pledge into infinity? Just like the Yanks. Because, clearly, this is what we are doing. The only temporary advantage we (USA) have is we can devalue the dollar somewhat. Would Ireland be able to devalue the face value of its tax-bonds in some instance short of national obliteration? Say, because it issued so many that none of them were worth anything? I think we should just forgive all the debt, keep the same system but with new enlightened but strict regulations, and go forward. I think Ireland’s debt should be forgiven. And everybody who takes the haircut can have a tax cut into infinity! (This won’t change anything since they already do.)

Interest rates aren’t fictitious. They’re pushing the Irish government into the austerity trap. So are the Eurocrats who demand austerity as ‘punishment’ for using the EFSF to fund the Irish government debt (and banks).

If interest rates weren’t high there would be no problem. Interest rates are VERY low in the US at the moment and so there is no problem — despite what the average Fox anchor might tell you. You should probably forget about that altogether. It’s just right-wing propaganda to justify cuts.

Just for the record Philip, I do not watch Fox News any more than you do. And I would love it if all interest rates were so close to zero you couldn’t insert a razor blade. If that is a solution that works for Ireland without everybody taking sides, maybe you have an idea that will work. I just feel like we are patching an old tire here.

Another day, another restatement of the basic problem.

Along with the day’s fantastic solution.

After – how many years? – we know the problem better than our own faces. And to date there have been how many wonderful, beautiful, fantastic, wonderful, idealistic, wonderful plans – ?

Each and every one ignored.

The problems we know.

The solutions, we got a pile of ’em. Good ones, bad ones, academic ones, hard-fought ones, unsuspecting ones, sneaky ones, easy ones, convoluted ones, on and on and on and on and on and on and on !

What we don’t got is the power to use them.

And that’s the problem.

I’d like to hear solutions to the power problem.

For starters, a general strike, to start as soon as possible and to continue until the existing government resigns (surrenders) en mass, and a new government is formed. No compromises.

The strike to then continue until that new government produces tangible results, whatever they may be. Is social media good for at least this?

I’d like to hear solutions to the power problem. Dave of Maryland

Time will take care of that. Will clueless politicians in charge things will get so bad that the need for change will become obvious.

Based on how the U.S. economy and taxes work, I’d guess there was another possible explanation – that people just aren’t spending as much. Incomes stay more or less the same, but spending is dependent on consumer confidence and on disposable income. VATs also tend to fall more on people with lower incomes. They would be the first to cut back on spending, whether they were paying more in income taxes or not.

That may not be true in Ireland, but nothing in the article suggests that to me.

There are multiple causes for VAT falls — I mentioned declining consumer spending in the piece. But income taxes eat into incomes. And since you say lower incomes lead to lower consumer spending… well…

The point of the argument was the downward drag created by all these causes.

Tax burden in Ireland is quite light compared to Scandinavian countries or to Germany. So Ireland can afford modest tax raises easily.

Irish people have only themselves to blame, too much debt everywhere and that game ends always badly everywhere, time after time.

Finland and Sweden had similar housing bubbles and debt orgies in the late 80’s and suffered quite badly in the early 90’s with Finland hitting almost 20 percent unemployment rate and Sweden about 13 percent.

Can’t compare the two. Finland and Sweden had their own currencies at the time. Also, there was no Eurozone contagion risk. ALSO, their bailout only cost 2-4% of GDP — which they could pay for themselves, having their own currency. Ireland’s is almost ten times that.

You’re not comparing like with like here at all.

As for taxes, Ireland has lot’s of ‘stealth taxes’ hence the burden is quite high it just doesn’t show in the data.

Also, it’s again irrelevant to compare the two. Ireland is facing depression, Sweden is not. Comparing them is pointless from a policy perspective. Making the comparison is just a distraction. They’re nothing alike.

As for your ‘moral’ argument about blame or whatever… take it to a church. It’s not relevant. Too many structural issues: Germany’s involvement; lack of EU regulation etc. etc.

The overall costs for Finland especially was huge, four year long depression basically, even with own currency. In 1989 Finland’s GDP was briefly bigger than Germany’s per capita but then the collapse came 1990-1991.

Without euro Irish people would have simply borrowed in other currencies, like Finnish and Swedish companies did alreary back then. Or like Icelanders did recently or just like Polish did with Swiss banks in recent years…

It is not the fault of euro, to the contrary. At least your loan valuations stay the same unlike back then when foreign loan values of Finnish and Swedish companies went 20-30 percent higher overnight.

For more, interest rates skyrocketed there to 15-20 percent and stayed up for years! That was much more effective killer of the economy, the lack of reasonably costing money.

Ireland should thank the euro for not having crashed fubar currency combined with foreign loan burden and skyhigh interest rates. That would have been the result WITHOUT euro.

For more, interest rates skyrocketed there to 15-20 percent and stayed up for years! That was much more effective killer of the economy, the lack of reasonably costing money. TimoT

Rather than borrow foreign currencies, why didn’t Finnish corporations issue their own common stock as money?

Compared to today, back then in the late 80’s it was stone age still in stock markets (except USA) and obtaining foreign loans was the easiest (and cheapest for a while) way for Nordic companies. Markets were thin and who would have bought those common stocks from near bankrupt companies…

“The overall costs for Finland especially was huge, four year long depression basically, even with own currency.”

Finnish was only one third the size of Ireland’s as a % of GDP.

http://static7.businessinsider.com/image/4c9268817f8b9a2821fb0700/ireland-bank-bailout-chart-916.jpg

“Without euro Irish people would have simply borrowed in other currencies, like Finnish and Swedish companies did alreary back then.”

You cannot say that for sure. That would have depended on how things were at the time. You cannot reasonably speculate on ‘what ifs’ like this.

“Or like Icelanders did recently…”

Good example. Iceland’s unemployment rate is half of what Ireland’s is. And it could be even lower if they bumped up their deficit.

Iceland’s government debt is not under the same pressure as Ireland’s — due to them having their own currency — and their recovery is largely underway:

http://www.irishtimes.com/newspaper/finance/2011/0611/1224298736664.html

Iceland and Ireland were in very similar positions a few years back. Iceland is coming out of it while Ireland sinks ever further. The reason is beyond doubt because Iceland has their own currency and has full control over their fiscal policy.

A few other random points on why you cannot compare these two:

(1) Finland et all had the option of devaluation.

(2) This would have allowed them to trade more to acquire foreign currency and pay back foreign loans.

(3) These comparisons are tedious. They’re two completely different situations. Apples and oranges. And going into ‘what if’ scenarios is just silly.

(4) Ireland’s key financial problem at the moment is extremely high bond yields. The Mosler bond would alleviate that. End of story.

“(1) Finland et all had the option of devaluation.”

Both countries were forced to devaluate hard but that did not help that much when the domestic demand just collapsed.

“(2) This would have allowed them to trade more to acquire foreign currency and pay back foreign loans.”

Except the foreign loan values IN LOCAL CURRENCY skyrocketed in Swedish Kronas or Finnish Marks within few days/weeks, forcing immediate bankruptcies.

The same thing has recently happened to Polish people taking real-estate loans from Swiss banks, nominated in Swiss Francs.

“(3) These comparisons are tedious. They’re two completely different situations. Apples and oranges. And going into ‘what if’ scenarios is just silly.”

The situation is almost exactly the same in Ireland except they are now in the eurozone. Real-estate bubble bursting combined with banks gone wild. Ireland is better off, they have not experienced currency crash combined with interest rates of ALL loans skyrocketing.

It is really stupid to say basically this: “No worries, currency devaluation will help your exports in the next few years”, when your liabilities (foreign loans) and monthly payments shoot up within weeks from the start of the crisis!

“(4) Ireland’s key financial problem at the moment is extremely high bond yields. The Mosler bond would alleviate that. End of story.”

Maybe but the situation would be even worse without euros, like it was for Finland and Sweden back then.

I’m not having this argument anymore. It’s irrelevant — not to mention a pretty tenuous comparison. We can go back and forth. Me highlighting the clear differences (different situation worldwide regarding exports is another key one, but then I could go on and on); you trying to diminish those differences. It’s pointless.

Key point: the PIIGS face potential default. Sweden et all didn’t default and didn’t face it because they issued their own currency. That’s it.

The problem RIGHT NOW is the Euro. And ‘what if’ scenarios do not diminish that one iota.

P.S.

“Except the foreign loan values IN LOCAL CURRENCY skyrocketed in Swedish Kronas or Finnish Marks within few days/weeks, forcing immediate bankruptcies.”

It doesn’t matter what the foreign loans were valued at in local currency. If they owed, say dollars, and they ramped up exports to the US through devaluation the aggregate flows of dollars from the US would have increased. In the aggregate this would have made dollars more regularly available in these countries. So, while some businesses went under, others accumulated foreign reserves that could be used to pay back foreign loans.

This occurred in Argentina after the crisis when soy exports went up in 2004 only to be met by a surge in soy prices on the world market. This led to an accumulation of foreign reserves that helped pay off some of their loans.

One more key point to clarify. Then I swear I’m done with this.

No matter how many bankruptcies occurred in these countries there was never any risk of sovereign default. This is 110% the key point. I cannot emphasise it enough.

The governments of these countries — because they issued their own currencies — could always step in as Lender of Last Resort to prevent bank failures. This is NOT the case in Ireland.

In Ireland the banks have been moved onto the government balance sheet. And this is causing a SOVEREIGN default risk and sustained spiraling interest rates. This was not the case in Sweden et all.

This is why I see the current EU architecture as hazardous. It threatens the countries themselves. Never the case in Sweden at all.

That’s it. Not coming back to this.

Nice graph of the Irish bailout versus others:

http://static7.businessinsider.com/image/4c9268817f8b9a2821fb0700/ireland-bank-bailout-chart-916.jpg

Note first that Sweden is WAY below, as is Norway. Finland, the largest of your examples, is also only about a third.

But all of these could finance these bailouts themselves because they had sovereign currencies. This is the same for the other countries on there — Uruguay, Thailand, Turkey etc. They could fund these bailouts themselves. Ireland cannot.

I recall hearing about Mosler bonds with respect to the situation in Greece.

One major problem with Mosler bonds would seem to be that they would have no value to anybody who faces little or no Irish tax liability. Only Irish citizens would seem to receive the full benefit of these kinds of bonds, and why would rich Irish citizens invest in them when they are free to park their money in other, safer investments that are higher yielding?

It seems like the only way Mosler bonds can really work is if after there has been a default.

A Mosler bond — in the case of default — can be sold to an Irish bank which can then be used to pay down taxes.

Eg. You — an American — hold a Mosler bond worth €1000. The Irish default (won’t happen if the plan is adopted, but just for the sake of argument). You sell your bond to an Irish bank for, say, €995. The bank uses it to pay one of it’s clients taxes. Simple.

“It seems like the only way Mosler bonds can really work is if after there has been a default.”

No. The default is a clause to ensure that they ALWAYS have Euro-value. Much in the same way as T-bills ALWAYS have dollar value — because the Fed creates dollars. This gives a ‘floor’ to the bond and so makes them a 100% safe investment… like T-bills. (I.e. they are always worth €€€).

Thanks for the clarification. I still don’t see how Mosler bonds can compete against other investment options. They seem like a great option for a sovereign after default, as they provide a mechanism for raising funds internally and thus remove the dependence on foreign banks. I suppose they can succeed if they have very high yields, but how does the state service the debt when there is little or no economic growth?

“Safety” in this case is really a guaranteed ROI that exceeds inflation, not capital preservation. Your example of the five euro loss does not succeed by either metric.

What kind of return would an American investor expect on a Mosler bond, and, in case of default, what’s the range of recovery?

One more question. If Ireland decides to stop using the Euro, what recourse would an American holder of Mosler bonds have? Any collateral?

I’ll be quick. Because this needs to be wound down.

How would Mosler bonds ‘compete’? There’s no shortage for 100% investments in the market EVER — let alone now. They’re called ‘hedges’. They WILL sell. Especially in times of uncertainty.

“What kind of return would an American investor expect on a Mosler bond, and, in case of default, what’s the range of recovery?”

Euribor +2% was the beginning setting, as I recall. Then let the market decide.

In case of default, again, market decides. It would be what Irish banks are willing to pay. My guess is: close to 100% as every penny saves them money in tax revenue.

But again, the idea is to AVOID default.

There’s no shortage for 100% investments in the market EVER — let alone now. Philip P

Because banks can create the money (so-called “credit”) to buy them? Are they not a perfect (risk-free) loan?

Investors always seek out safe investments to hedge themselves against risk. Simple. See: Warren Buffet’s recent comments on T-bills for example.

Investors always seek out safe investments to hedge themselves against risk. Philip P

And what more sure than this – that government can rob Jose, Leon and Billy-Bob to pay Richy Rich his interest either by taxation or by transferring purchasing power?

Where’s Michael Collins when you need him?

How do two Irish men change a light bulb?

One holds the bulb and the other starts drinking until the room spins.

And I have just the right formulas to fix Ireland’s problem:

(I – S) + (G – T) + (X – M) = 0.

– C + I + G + (X – M).

exp(-y/r) = å exp(-2n/r) / 2n+1

n M (t) = (1 + u) M (t-1) u > 0 j f is increasing strictly concave on R+ and c2 is on R++; f’ (k) > 0 and f” (k) 0 f ‘ (k) = 00 and lim k > 00 f’ (k) = 0; MVt= PT, where M= stock of money, Vt = the transaction velocity of money (i.e., how quickly it circulates), P = price level, and T = total monetary value of all transactions. Here M, P, and T, are directly observable and measurable, so Vt can be solved as V = PT/M, and Fisher’s hypothesis that V is stable can be tested.p u (a+h) + (1-p) u(b+h) and something of utility q u(c+h) + (1-q) u(d+h). For now, we’ll leave it up to the Irish to show that this true if [easy] and only if [tougher] the function u is either linear [ruled out] or of the following form, up to some irrelevant rescaling: u(x) = 1 – exp( -x/r ) the quantity -u'(x)/u”(x) (notice that this definition is independent of the allowed linear rescaling of the utility function (r=kx), the utility function is then a solution of the differential equation k x u”(x) + u'(x) = 0. Solve this by letting y be u'(x), so that k x dy + y dx = 0 (or k dy/y + dx/x = 0), which means that y is proportional to x-1/k. Therefore, up to some irrelevant rescaling, the utility u is also a power of x, namely -x1-1/k. For this function to have an upper limit, the exponent should be negative. This is to say that we must have k<1. (1/2)(1) + (1/4)(2) + (1/8)(4) + (1/16)(8) + … = 1/2 + 1/2 + 1/2 + 1/2 + … (1/2)(1) + (1/4)(2) + (1/8)(4) + (1/16)(8) + … = 1/2 + 1/2 + 1/2 + 1/2 + … (1/2)(1) + (1/4)(2) + (1/8)(4) + (1/16)(8) + … = 1/2 + 1/2 + 1/2 + 1/2 + … (1/2)(1) + (1/4)(2) + (1/8)(4) + (1/16)(8) + … = 1/2 + 1/2 + 1/2 + 1/2 + … (1/2)(1) + (1/4)(2) + (1/8)(4) + (1/16)(8) + … = 1/2 + 1/2 + 1/2 + 1/2 + … square root function of money, because it's not bounded either: If a successful sequence of n+1 tosses was payed exp(k 2n), the game would still end up having an infinite "utility", even for a small value of the parameter k. With a small value like k=0.01, there's an unattractive sequence of payoffs at first, then the Irish growth becomes explosive: $1.01, $1.02, $1.04, $1.08, $1.17, $1.38, $1.90, $3.60, $12.94, $167.34, $28001.13, $784063053.14, …utility function of money is of the form 1-exp(-x/r) Let's call u(x) the utility of having x more dollars than initially. If you pay y dollars for the privilege to play, the utility of playing the Petersburg game is clearly å u(2n-y) / 2n+1 and the gamble should be accepted if and only if this is greater than u(0). In the particular case where u is exponential, this is equivalent to comparing å u(2n) / 2n+1 and u(y), namely the utility of the free gamble and the utility of a so-called certainty equivalent (CE). The CE is whatever (minimum) amount of money we would be willing to receive as a compensation for giving up the right to gamble. It may not be quite the same as the (maximum) price we're willing to pay to acquire where p = the annual rate of inflation and E(p) = the expected rate of inflation. Modern economists describe the changes in nominal interest rates that occur as expected inflation changes the Fisher effect.Once we evaluate the sum on the RHS, this is easy to solve for y (just take the natural logarithms of both sides and multiply by -r). The computation is best done numerically for midrange values of r, but we may also want to investigate what happens when r is very large or very small: For large values of r, we may observe that, when r is much larger than 2n, each term of the sum is roughly equal to 1/2n+1-1/2r. This near-constancy goes on for a number of terms roughly equal to the base-2 logarithm of r, after which the terms vanish exponentially fast. (Notice how the exponential utility function turns out to behave very much like the original "moral value" function proposed by Cramer in 1728; proportional to the k-ln(r)/(2r ln(2)) for some constant k, which turns out to be equal to 1. The natural logarithm of that, for large values of r, would therefore be -ln(r)/(r ln(4)), so that y is roughly equal to ln(r)/ln(4) for large values of r (actually, it's about 0.5549745 above that).

On the other hand, when r is very small, the sum on the RHS essentially reduces to its first term, so that y is extremely close to 1+r ln(2) . The rest of the expansion is smaller than any power of r, since the leading term equals (-r /2)exp(-1/r). In particular, a player with a risk tolerance of zero (r = 0) will only pay $1 for the gamble, since this is the amount Ireland is guaranteed to get back.

I’m impressed by what I can follow of your math. Good show!

But on the other hand, since math wizards have lead us to economic disaster, I am not so impressed.

Congratulations! Perfect example of contemporary economic theory. But you neglected to describe how it was derived.

Let me help. Harvard Economist reaches up his ass and pulls out a derivative object. Coats it in organic sugar grown by virgin surfer girls on Maui. Wraps it in paper upon which he has notated formulas calculated to the 12the decimal place by his university’s Cray Supercomputer. Tests it in the marketplace of ideas, and if it provides sufficient justification for something a vulture capitalist CEO was already doing he wins the grant, acquires a cadre of gradate student slaves to do all his work, and can spend his full time efforts lobbying for the Nobel Prize.

Is this satire? If it’s not.. then I give up.

No Phil, it’s not a satire. It’s a serious rebuttal to your post…and the person who wrote it just happened to begin with: “How do two Irish men change a lightbulb?”

Are you kidding me? [And that was a rhetorical question, Phil. Just in case you’re wondering.]

As to the laughable Mosler Bonds…

The concept only works if there is no default. But the entire justification for the eponymous absurdity is if there is a default.

[If there is no default, then Euros, as opposed to tax credits, will work just fine, thank you.]

But…what if there was a default 2 or 3 years after the implementation of this incredibly stupid idea?

If you’re an investor outside of Ireland, then you have to go to this utterly pathetic Mosler Bond Market to peddle your tax credits. They are no good to you since you have little if no Irish Tax Liability.

Only, you’re not alone. There are many other morons in the same position as you….all flooding the Mosler Bond Market, hoping to swap Irish Tax Credits for Euros or something–anything— other than Irish Tax credits.

Do you see a problem here?

Do you really think that Irish banks would “pay close to 100%” for these credits, as Pilkington claims? A novel, half-baked academic experiment that has never been tried before? Are you out of your freaking mind?

And what about Ireland? Yeah, it’s bad enough that it just defaulted…but how on earth would it go about its convalescence having to accept years of these stupid tax credits in lieu of Euros?

And how, exactly, will the Irish Government pay pensioners if it is getting these stupid bonds for tax revenue?

Imagine having to explain to retired fireman and policeman that these bonds really are as good as Euros. “No, really they are. Just redeem them in the Mosler Bond market. Yeah, any Irish bank will pay you ‘close to 100%’ for these. Seriously.”

Please.

For every Irish Taxpayer that pays taxes with these bonds, the Irish government will have to sell another bond. Supply will increase with demand on a 1 to 1 basis.

These things shouldn’t be called Mosler Bonds. They should be called Ponzi Bonds.

And after this Ponzi cycle revolves in record time, the next step–and I guarantee it–is to argue that since this stupid plan was incorporated into EU Law, that other EU states tacitly agreed to also accept these credits for payment of, say, German taxes.

Does this kind of posturing sound familiar? And how long do you think it would take to resolve these issues?

Years.

And in the end, the dumbass investors holding this worthless pile of shit will don t-shirts that read:

I invested in Mosler Bonds.

And I didn’t even get a t-shirt.

All I got, instead, were useless f*cking Irish tax credits.

I was wondering where Dan Duncan had gone. I thought he’d stopped posting after making a fool out of himself so many times before. Not so it would seem.

Dan, I didn’t read past the first line of your post — the rest looks like a quote-unquote ‘rebuttal’ of Mosler bonds. And since you’ve literally NEVER shown yourself capable of economic argument I see little point in reading further. I don’t see the point anymore. Anyway ranting like Alex Jones on the internet in order to alleviate crushing personal insecurities is a little… em… tired. One point though:

“No Phil, it’s not a satire. It’s a serious rebuttal to your post…and the person who wrote it just happened to begin with: “How do two Irish men change a lightbulb?””

First of all, yes, I saw the racist joke at the start. I didn’t laugh. Because it was racist, juvenile and tasteless. (Seriously, replace the Irish people in the joke with African Americans and start talking about how one of them starts eating fried chicken and see how funny it is — hmmm… oh look! it’s racist! And you, Dan Duncan, are a horrible racist with no common decency).

Secondly, the formula the commenter put forward as a solution to Ireland’s problem:

(I – S) + (G – T) + (X – M) = 0.

Has nothing to do with bond yields. So, it’s not relevant to my piece. But you didn’t understand the formula. You just enjoyed the racist joke. Because you — like most racists — are insecure and you like to laugh at what you perceive as flaws in other races to make yourself feel better about yourself. Loser.

The Mosler bonds would contain the following promise: if I, Irish state, default you may use this bond to pág your taxes.

So, this promise will only be valid if I, Irish state, breai the previous promise Not To Default on the pre- Mosler era bonds.

What kind of credibility do you think the Mosler bond promise would carry among investors? I would guess not very high… The Mosler bonds would likely sell at yields close to pre-Mosler bonds.

Because investors would likely know that in case a Black Swan event forced

The Mosler bonds would contain the following promise: if I, Irish state, default you may use this bond to pág your taxes.

So, this promise will only be valid if I, Irish state, breai the previous promise Not To Default on the pre- Mosler era bonds.

What kind of credibility do you think the Mosler bond promise would carry among investors? I would guess not very high… The Mosler bonds would likely sell at yields close to pre-Mosler bonds.

Because investors would likely know that in case a Black Swan event forced Ireland to default after say 5 years her government would simply

not be able to accept the huge amount outstanding as payment of taxes. The government would get bonds instead of euros. would not be able to pay its bills and would have to go again to the EU begging for euros.

On second thoughts – forget about the Mosler bonds. It’s a trick that won’t work. There is no salvation within the euro.

You’re clearly over-thinking the whole thing. If it was written in EU law that the Irish government would have to accept them as taxes in the case of default, they would have to accept them as taxes. That’s that. European law overrides Irish law.

that goat pic should go into the NC photo Hall of Fame!

It’s also what I feel like when I try to follow all those equations.

How do two economists change a light bulb?

One twists it ’till it breaks. Then they argue over how to get it back to equilibrium.

bowahahahahahhah!

All right. It’s not so good, but I just made it up in 15 seconds.

Isn’t Duncan an Irish name anyway? Anyway Dan, what are you doing coke and coffee at the same time? Easy dude. You make some good points but why the ultra hostility?

It’s all just letters on a screen, man, and it’s all one big mirror.

Duncan is a Scottish name. I could drum up some of the old Scotsman jokes but then I’m not a tasteless racist like Dan Duncan, so I won’t. Most Scottish people I know are very nice and don’t live up to racist stereotypes.

Philip,

I’m not overthinking anything. It’s just the Mosler bond idea – that I thought a good one, initially – that was not “overthought” enough.

A promise written into EU law is just that – a promise. The present Irish bonds also have a built-in promise of not defaulting. As you know well, such a promise is not worth much when a state is not monetarily sovereign. Ditto, for the promise to be contained in the Mosler bonds of acceptance as payment of taxes in the case of default.

In 5 or 6 years time, most of the Irish bonds outstanding would be “Mosler bonds”. Suppose Ireland is then forced to suspend payment of interest on pre-Mosler bonds – say, because of a Lehman-type crisis.

Does anyone seriously believe that the Irish government would then accept Mosler bonds as payment of taxes? That would mean maybe 50% or more of normal tax receipts would become paper bonds, instead of the needed euros the government must have to pay expenses. The deficit would explode in that year and Ireland would have to scramble for euros – go beg the ECB, the EFSF, Germany, whatever. The situation would be the worst possible.

There is simply no way investors are going to believe the promise to be contained in the Mosler bonds (acceptance as taxes in case of default) when they presently do not believe (correctly) the promise “not to default” issued on every present-day Irish bond.

In fact, paradoxically, the Mosler bond proposal is very un-MMT like, despite being authored by the founding father of MMT. Logically, MMTers should defend that Ireland get its monetary sovereignty back – and stop at that. The Mosler plan is just a clever trick – unlikely to be taken seriouly by investors, anyway – to be used inside a framework where the peripheral countries of Europe would still count for nothing, monetarily and politically speaking.

And honestly, there is no way any of the peripheral countries would ever give it a try. The EU mindset has become deeply ingrained inside said countries – both among the elites amd among the populace. They will never dare lift a finger – even a weak, Mosler plan finger – at the sacrosanct EU institutions.

Notice how even during the Greek protests no one made the obvious demand to solve the crisis: drop the euro. Whereas during the gold standard era, many protested that standard and rightly recognized it was at the source of most economic crises.

So let us be consistent. If we believe in MMT, stop the nonsense of Mosler-type plans and keep educating the people and the elites on the vital need for moetary sovereignty.

Oh, I almost forgot to add. Build alliances with the schools of thought that have the same analysis on the euro. Non-MMTers such as Krugman, Stiglitz and yes even Feldstein should be seen as allies in the struggle to get Europe back to monetary sanity.

“A promise written into EU law is just that – a promise.”

No it’s not. It’s the law. If Ireland sign up for any economic agreements with the EU they become law and this law overrides Irish law in EVERY instance.

There are plenty of cases that go to the European Court of Justice [ECJ] regarding economic every year — in fact, (shameless namedrop) one of my uncle’s is a judge in the General Court which deals with economic cases. The EU always override national law on these issues — they have since the founding of the ECSC and then the EEC.

So, no, this isn’t a promise. Any more than saying that you won’t commit War Crimes or acts of terrorism against your citizens is a promise. It’s the law.

Your ‘what if’ scenario — and I don’t like ‘what if’ scenarios anyway, they’re usually used for regressive arguments like dismantling social security — is irrelevant if we accept this.

“And honestly, there is no way any of the peripheral countries would ever give it a try. The EU mindset has become deeply ingrained inside said countries – both among the elites amd among the populace. They will never dare lift a finger – even a weak, Mosler plan finger – at the sacrosanct EU institutions.”

As argued in the piece there is every reason to believe that the EU authorities would accept such a proposal. It would be in their self-interest.

Also, a great deal of the bonds would also end up on Irish bank balance sheets. Not accepting them in the case of default — which, for the last time, wouldn’t happen (we’re still in ‘what if’ imaginary land) — would just push the banks into crisis and compound the problem.

Either way the state would need a Eurobailout.

They accept the bonds as tax. The deficit goes up. They go cap in hand for a bailout.

OR

They don’t accept them. The banks melt down. Go on the public balance sheet. Cap in hand. Bailout.

Either way we’re back to square one (which is not such a bad thing). It’s just if the latter path is followed the Irish break the law and ruin their standing as an EU citizen, incur major fines and possibly get booted out of the Union.

Phil if you go far enough back I’m at least half Scottish. Bring ’em on. I’d laugh my ass off. :)

Cheap bastards, drunks, boneheads, skirt-wearing telephone pole throwers, etc. etc. and don’t they eat something called Haggis. God knows what it is but it looks like it should be in a toilet someplace not on a plate. bowhahahahahahaha,

Upon reflection, I admit this line of discussion is irrelevant to the post and not appropriate on a web site such as this. My apologies. -C

exp(-y/r) = å exp(-2n/r) / 2n+1 said: “very much like the original “moral value” function proposed by Cramer in 1728″

What’s up with all this “moral value” bullshit?

That looks like

Hypno-GoatHypno-ToadThe Mosler Bonds are a great idea. Basically, they are a covert way for Ireland to issue its own currency. California did something quite similar a couple years ago, although it stopped short of making them transferable I think. If Ireland issued low-denomination bearer bonds in this way, they could function exactly like a currency, including having a fluctuating exchange rate with the euro.