This post originally appeared on Credit Writedowns

Editorial note: this article is neither a policy recommendation or a prediction. Rather, this articles looks to outline one potential outcome of the current policy choices in the European sovereign debt crisis, building upon the discussion from three recent articles “Deflationary crisis responses”, “Predicting the future of policy making”, and “Why France will be forced out of the eurozone”.

One week ago today, I was running through Italian default scenarios because the policy choices in the sovereign debt crisis have narrowed with most of the risk being on the downside. At the time, I asked “Could Italy unilaterally exit the euro zone and redenominated euro debts at par into a new Lira currency to forestall the default? Perhaps. That is something to consider at a later date. For now, here’s what will happen if Italy defaults.”

That later date is now. So let’s get cracking on what would bring about a unilateral Italian exit and how it could be accomplished.

Nationalism and “Beggar Thy Neighbour” economic policy

Let me quote something as a jumping off point which applies here that I wrote nearly three years ago about Ireland and what I correctly predicted would be a banking crisis.

Ireland must threaten to leave now if it wants to maximize any EU help it expects to receive, before the scope of other EU banking crises become apparent. Weakness in the financial sector has infected all of the Eurozone members. I have mentioned that Austria has a weak banking system (see posts here and here). But, there is even growing evidence that Germany too has a fragile banking system. To be clear: this is an ‘every nation for itself’ strategy pitting Eurozone members against each other, where those nations savvy enough to request help sooner are likely to benefit at the expense of others. The question is whether the Germans would go along with this. If they do not, tensions will rise and that will change the calculus for Portugal, Italy, Ireland, Greece, and Spain. I don’t have a view on this as yet because the situation is still evolving. However, I lean toward believing the Eurozone will remain intact even while individual nations or banking systems collapse.

As events occur in Eurozone banking, I will keep you abreast on developments.

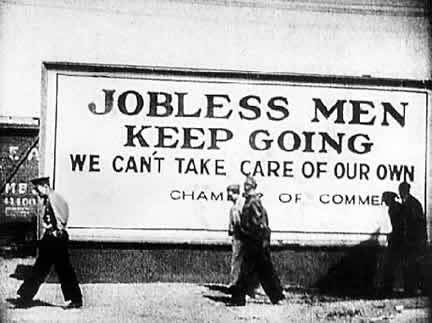

When the chips are down, an us versus them mentality starts to seep into policy choices. What happens is that significant economic downturns create economic distress that causes people to circle the wagons. One day, it’s boom time; all is well and we are full of hope for the future. We are minding our business, working hard, tending to our families and enjoying life. The next thing you know, the economy is in a deep slump; we or some of our neighbours are jobless, penniless… and angry. What caused this? Who caused this?

When times are tough, people start looking for someone to blame. And usually it is not the In-group which gets the blame; it’s usually “them”: out-groups like minorities, immigrants and foreigners. Dylan Grice calls this “in-group bias” and predicts the following:

The historic and psychological evidence clearly links economic dislocation with the scapegoating of out-groups and, of course, the eurozone edifice stands increasingly lonely and tall as a lightning rod for the latter. I believe the likelihood is that over the course of the next decade or so, the trend will be towards greater fiscal problems and greater economic problems. I believe these problems will increase the temperature of debates about whose fault it all is, and that as the conclusion to these debates becomes more polarized they will play into the hands of nationalist, anti-immigrant and increasingly, anti-euro sentiment.

If the downturn is protracted enough and deep enough, this us versus them mentality spreads into the mainstream at the political and national level. And we see economic nationalism, an ‘every nation for itself’ strategy enter mainstream politics. That’s what World War I, the Great Depression and World War II were all about. So I expect no different here with the sovereign debt crisis if policy choices point mostly to downside scenarios.

The saving grace highlighted in the Irish example above is that it really does take longer for these things to play out than one expects. I was talking about the European banking crisis in early 2009 and here it is late in 2011. So that tells me, with the right leaders and right policy choices, none of these downside scenarios is automatic. They may be likely, but there is reason to hope and exhort leaders to prevent calamity.

The Current Situation in Euroland

Unfortunately, these last three years have been largely wasted. Instead of bank recapitalisation, credit writedowns and rebalancing in the euro zone, we have seen self-serving and one-sided morality tales of sinful fiscal profligacy and creditor-centric policy solutions that are wholly inadequate to fix the institutional deficits of the euro zone. This morality tale is really a fairy tale. Spain is the perfect example of a country that never should have joined the euro zone. It had a fiscal surplus right through to 2007 and still has better numbers on debt than Germany. The last of the three articles upon which this discussion is built, the excerpt I posted last night by Philip Whyte and Simon Tilford, is magnificent in laying these unfortunate circumstances.

The question then is what now? How do the Europeans escape this roach motel of an economic prison they have constructed while still respecting the laws of the existing unworkable institutional structure? No one wants a free for all.

We see now that Italy will default without the central bank acting as a lender of last resort. And Italy’s default would trigger a cascade of interconnected bank runs default and Depression as did the insolvency of Creditanstalt in 1931. German policy makers are aware of this. The Irish Times has written how Merkel’s pragmatic allies offer hope of new outlook whereby the euro zone evolves toward a more integrated fiscal union with penalties for free riders and an exit clause for those that can’t make it. Germany is moving fast to implement this solution.

Alas, this is a flawed project for two reasons. First, trying to make the ‘sinners’ of the eurozone periphery more Germanic fails to understand the dynamics of intra-European capital and current account balances. Put crassly, the euro zone is one giant vendor financing scheme. You can’t have Germany and Spain both running current account surpluses with each other at the same time. The imbalances will continue.

Second, Policy makers have run out of time. They caused this problem by dithering; we wouldn’t be here if they had cut the cord early on. I still think the ECB will move eventually. But it will be too late; the debt deflation will have already set in, aided and abetted by a growth-crushing fiscal policy strait jacket that in the last month has moved from the periphery to France, Italy and Austria as contagion has spread.

The Italian Job

Even so, the ECB may not move at all. And therefore, we must run through the various worst-case policy remedies available and think about which one could be chosen.

What about a unilateral exit from the euro zone? I ran through the exit scenario a year ago and it looked bleak, one reason I saw it as unlikely at the time. But things have deteriorated and so the best alternative to a negotiated agreement for policy makers in Italy may well be exit.

So I have been thinking about this and have come up with an outline plan. The plan is based on how countries exited the gold standard during the Great Depression. I have said many times that the euro is like gold.

The euro has acted as an internal gold standard to euro zone members in that it prevents governments from printing money and devaluing to escape economic hardship and it ensures that large fiscal imbalances cannot be sustained and eventually lead to crisis.

I like to think of the Euro as gold and the Euro countries as having implicitly retained their national currencies with a fixed rate to the Euro. If you recall, that actually was the setup when the countries pegged their currencies to the ECU before Euro money was introduced.

So the euro area countries can de-peg like the gold standard countries did and unwind the euro structure by running the “euroization” process in reverse. Here’s how one could do it.

- Plan. The Italian government can plan for a redenomination into New Lira in secret that takes advantage of the Italian law jurisdiction over their sovereign debt obligations.

- Law. “Euroization” would remain in place and the euro would continue as the currency of physical payment. However, New Lira would become the national currency, pegged at 1,936.27, exactly the same rate as the Lira was fixed on 31 December 1998 and converted into euros on 1 January 2002. All debt under Italian law would be redenominated into New Lira at the 1,936.27 New Lira exchange rate peg. This would effectively bring us back to 31 December 2001 for Italy.

- Taxes. The government would announce that henceforth it will tax exclusively in New Lira. All municipal governments would be required by law to tax in New Lira.

- Banks. Like the Argentines before them, the Italian government would convert all euro bank accounts legally into New Lira. The systems would process as if it were euros because of the fixed peg, but legally the money would be New Lira. This would make the Italian economy “euroized” but make the banking system redenominated into New Lira.

- Retail. Retailers, all sellers of Italian goods, would then be forced to return to the double accounting treatment of pre-2002 whereby they denominate all transactions in both Lira and Euros. Again, the paper money would be euros and each euro would initially be worth 1,936.27 New Lira. The electronic money would legally be New Lira, even while the systems said euro.

- Float. On day one, immediately after redominating, the Italian government would drop the 1,936.27 New Lira exchange rate peg and float the new Lira as a freely floating currency. From that day forward, foreign currency adjustments would need to be made between euro and New Lira.

- Physical currency. New Lira would be printed by the Bank of Italy and introduced to replace euros.

The hard part is about capital flight, inflation and the cost of retooling the systems for New Lira. But this is all a one time cost. Warren Mosler wrote up a plan like this for Greece that Randall Wray featured here last week. In his scenario, euro bank deposits remain as euros and existing euro denominated debt would remain in euros as well.

Repercussions

Staying in the zone. The political repercussions of a redomination would be huge. Although I have talked about this as a eurozone exit, it could be just a redomination, meaning that the New Lira would depreciate and Italy could fully re-euroize the economy without leaving the euro zone. Since we’re running through scenarios, we should consider this outcome, as countries in the Depression did eventually re-peg to gold via the Bretton Woods currency regime. But I think the impetus here is to escape the euro and the persistent current account deficits as well as to escape the anti-growth policies of the euro zone that have caused Italian sovereign debt levels to spike. Moreover, it is unlikely that the German plan of fiscal oversight, penalties and exclusion would solve Italy’s fundamental problems of low growth and eroding uncompetitiveness in a currency with an elevated value.

Inflation. This would be mitigated by the taxation policy which would give the new currency value. But we see how Iceland has battled inflation in the wake of a large currency depreciation. In some ways you could consider this a one-time standard of living adjustment. But the adjustment will be severe since markets tend to overshoot to the downside. It’s not clear how low a New Lira would sink, and so inflation would be a big problem.

Bank solvency. This was the biggest issue to begin with. The redomination solves Italian bank solvency since all their accounts would be in New Lira. But this solution heaps all of the burden of adjustment onto foreign lenders via the exchange rate adjustment. German, Dutch and French banks would be insolvent if the New Lira lost a lot of value as they would be repaid in depreciated currency. I think this point highlights what I have been saying about apportioning losses in a creditor-friendly way. The foreign lenders have used the fact that the euro is one zone to lend cross-border and increase their return on equity. They bear some of the responsibility for the credit growth in the periphery. The foreign currency losses they would take from a New Lira demonstrates this.

National Solvency. That problem would be solved. The burden of adjustment would then fall to the exchange rate.

Contagion. Clearly, an Italian exit would break apart the euro zone. All of the countries now on the hot seat would consider redominating as well. Once a euro exit takes place, it would be a mad rush to follow. In France in particular, politicians would be desperate to redenominate and depreciate the currency in order to escape the foreign currency losses. Thus would begin a currency way via competitive currency devaluation.

In conclusion, a unilateral exit would be a devastating event for Italy and the euro zone. Inflation would be high but bank and national solvency issues would recede. If the exit were done under these nationalistic pre-conditions of redomination, most of the adjustment burden would fall on foreign creditors. Italy would become export competitive again and could focus on economic growth strategies instead of ones of fiscal adjustment. The benefit of this particular plan is that it can be implemented quite quickly.

Just as during the Great Depression, those countries that left the gold standard first saw the earliest return to economic growth. I would expect the same to be true here again for the euro area countries today.

A possibly naive question: wouldn’t it be better to “freeze” the debt, i.e. stop paying interest, stop refunding expiring bonds, just promise to refund 100% of them in – say – 20 years? Given the surplus of Italian account, it seems feasible to me…

this blog is posting some crazy euro breakup scenario’s.

Why not a more straightforward scenario for the eurozone debt crisis: a eurozone wide debt jubilee.

As most of the debt is eurozone internal debt, let all eurozone governments and banks sit around the table and work out a debt restructuring. Seems less painful than the scenario’s that will wreck the eurozone economy.

Which solution do you think more likely to be adopted politically? Jubilee, or Ed’s suggestion? ;)

Anyway, Jubilee would be nice, but would have difficult-to-predict consequences, so it’s hardly risk-free (or even painless) either.

Are their examples of systemic debt forgiveness that don’t coincide with radical political regime change?

*there

Don’t worry.

Goldman Sachs has a plan to kick this whole Euro mess down the road a few more years — print endless billions of Euros over at the ECB and loan them all to the IMF so they can loan them in turn to Greece, Italy, Spain, Portugal . . . hey the Guardian reports that Hungary is holding out the begging bowl this morning, too.

Finding a way to make the ECB the lender of last resort is the only approach that will keep sovereign nations from heading for the exits, and soon.

But will Germany bend over for this kind of inflation?

Will the technocrats running Europe give the German people any say, any choice in the matter?

“”And we see economic nationalism, an ‘every nation for itself’ strategy enter mainstream politics. That’s what World War I, the Great Depression and World War II were all about.””

This is the sort of fear mongering that we have heard since the beginning of the crisis. There is no reason bailing out populations needs to lead to this scenario. Extreme austerity measures would seem a more likely precipitating event.

“”I think this point highlights what I have been saying about apportioning losses in a creditor-friendly way. The foreign lenders have used the fact that the euro is one zone to lend cross-border and increase their return on equity.”

Glossing over the fact that actually these banks made huge risky loans hoping they would be bailed out.

There is no reason to fear national monetary sovereignity. Also tariffs can be used productively to protect a nations employment force. They have positive and negative ramifications which each country could figure out according to its own needs. Nations can protect the economic well being of their populations against the global banking system without going to war.

“Nations can protect the economic well being of their populations against the global banking system without going to war.”

Precisely. Yeah, Ed went insane there for a moment. Unusual for him, he’s normally pretty steady (You ok, Ed?).

All-right, I’m going to make two, bold-ass predictions:

A return to the Lira and the Drachma will NOT lead all-out hoplite warfare between Italy and Greece.

If the French return to the Franc, they will find themselves perfectly safe behind their rebuilt Maginot Line, because the ghost of Heinz Guderian is NOT going to cut-them-in-two with an attack through the Ardennes.

Return to your currencies, nations of Europe, it will allow you to keep their individual houses in order; and then, if you want, you can keep the Euro, as a kind of Currency of Convenience — to be used, perhaps, like a travelers check (the Euro: accepted in every major bordello from Brussels to Berlin!)

Charles Hugh Smith is a certified member of the Sane Team:

http://www.oftwominds.com/blognov11/euro-dysfunction11-11.html

Have they really rebuilt the Maginot Line?

Giggle.

They can’t in the current system. Tightfisted, anti-Keynesian ECB technocrats won’t give them the cash.

But if the French government is allowed print again, look for Franco full-employment, and … concrete casements from Basel to Metz.

I know! We can all unite and build a Tower of Babel.

Oh wait, that’s been tried.

Never mind.

Max424, thanks for the link, very sane indeed. Your take is fine, too.

Teenage fantasists take note: Germany is not going to war with anyone, not even if Luxembourg were to invade and demand the Saarland.

Biggest bunch of metrosexuals ever, the Germans are. They make the French look like John Wayne movie heroes by comparison, and that takes dedication and work.

Hey if that works can we try it here? With East coast dollars, left coast dollars and flyover dollars?

Or simply revert to the former system of Union dollars and Confederate dollars. And move the fence up from Texas to the Potomac.

It’s about time that euro breakup/meltdown scenarios are seriously considered. That’s what we’re facing, folks. Great Depression 2.0 is a high possibility.

Fundamentally it’s a stocks and flows problem. Whether or not they can kick the can down the road a little longer, as long as they pursue austerity GDP will contract. Austerity will force default and/or countries to leave the euro which likely coincides with default.

The only way this crisis ends is if the ECB agrees to monetize all debts until the recession is over. Unless that happens, default and financial meltdown is only a matter of time.

Anyone else see the bloomberg article about how BAC and co. US banksters are the main players writing CDS on Euro debt? Looks like they’re going all in…Then again, they can just move everything into FDIC protection so it’s all good…

Ed says, “Clearly, an Italian exit would break apart the euro zone. All of the countries now on the hot seat would consider redominating as well. Once a euro exit takes place, it would be a mad rush to follow.”

So what he is really talking about is not how the Italians can exit, but how any reintroduction of domestic currency by a major country (eg Italy or Spain) will cause the Eurozone to break up.

If it’s clear that all the PIIGS (plus Belgium and France) will follow Italy and/or Spain, why shouldn’t all the Eurozone members go back to native currencies all at once?

If the currencies are realistically pegged, this would solve the major problems of a currency conversion scheme: bank runs, currency flight and speculation, and inflation.

The trick is to do it when no one suspects it will happen.

Pat, you mean a kind of “gentleman’s agreement” as in days of yore? This goes back to the days when French was the language of diplomacy without question.

How about it, Max? How about it, Edward Harrison? Why not a little charade for keeping the peace? All of a sudden: a miracle! This should please the Holy Roman Reich IV.

Errrrr … who could possibly play the role of gentleman? It is a long, long dead skill, particularly where money is involved.

If there is to be an exit from the Euro it will be only be driven by nationalist parties, but these could come from the left, right or centre field.

Examples: In Ireland there is Sinn Fein which is a left leaning nationalist party. In Britain (not Euro I know) there is a centrist totalitarian nationalist party the BNP and a right wing authoritarian nationalist party the UKIP.

If any nationalist party gains traction stemming from the continued gross incompetence of the Euro leaders. Nationalism will rise and transcend the usual left/right politics. Watch out Europhiles, train wreck headed your way soon.

Forgot the SDLP in Scotland which is the Libetarian left. (Most Americans don’t even know there is a Libetarian left )

All quadrants of the political compass represented by nationalists.

Alex Salmond, the SNP leader and Scotland’s First Minister has lately been talking about an independent Scotland in Europe, and had designs on joining the Euro. Interesting spectacle: one jumps into the empty pool simultaneously as all the others jump out.

How about, rather than have every euro country issue their own currency again, that the ECB issue a second currency. This one could have different inflation targets and be geared towards peripheral countries. Each country could choose to issue debt in whichever currency was more relevant, and transactions could occur in either currency. The currencies could float relative to one another. It seems, given the two groups of countries that having two currencies would get most of the benefits of having individual currencies, but without as much friction and dislocation as reverting to national currencies would involve.

Well it would be an improvement, but you still need political cohesion within the group to make it work. It will break down sooner or later to smaller units. Might as well go the full hog.

The only attraction of the Euro I see is to save costs on currency conversion and hedging. Not a whole lot of advantage for a bag full of problems. Like destroying democracy for example.

Instead of creating the Euro. The EU would have been better advised to tightly regulate currency speculation by the financial sector and facilitate low cost currency exchange with the EU.

Thanks, Andrew, you get to the heart of the *raison d’etre*, the one that’s revealed, that is. Great insights.

Does this mean I need to prep the Italian themed cupcakes instead of the Greek ones?!! ;-)

http://goo.gl/FEKM0

Seriously though, with a former ECB VP in charge in Greece, and “Super Mario” running the show in Italy, what are the chances really?!

Nevertheless, great article.

Quite right, alas. The respective Gauleiters are in place.

I agree with the analysis of the Euro playing the same role as the gold standard during the Great Depression. The big difference is the British Empire, which set up that system and used it worldwide, including India and China, not to mention the rest of the world that was tied to a trading system under direct its direct political and military colonial control. Hopefully, US banking exposure will not transmit global shocks in the way gold did almost 90 years ago. The Eurozone and the European Union are not co-extensive yet, but that is the general political trajectory. My brief understanding is that there are no formal exit protocols for leaving the Eurozone, but there are legal exits for the European Union.

If you were to leave the Eurozone, adopt your own national currency, you would have to also leave the European Union. It seems to be an economic proposition directly coupled with the political status and all that goes with it. To drop the Euro means to drop out of the EU as well. You can’t just drop the Euro. However, like the UK, you may be in the EU, but did not have to adopt the Euro as your currency.

When it comes to territory, and the political definition of boundaries and laws within those boundaries that are only the business of the political entity that governs the social order within a territory, a nation state, it is quite clear that you deal with international law when you deal outside of your territory. Within the European Union, the Euro is not used as currency by all within the EU, but all of the states within the EU have to abide by the political agreements.

What we are watching is some short term tinkering of finance to keep the economy moving, but it is a political crisis that needs to be resolved before definitive technocratic banking and taxation issues can be proposed. The immediate human suffering may be ameliorated by some or all of your finance proposals, but the ultimate questions of by what governmental rules is the European Union as whole to operate by, knowing now that they have a dysfunctional economy. The co-evolution of capitalism and the modern nation state with a strong central government and bureaucracy to go with it, that can reach out uniformly throughout its territory, in order to collect taxes is true of only the core state of France, UK, Spain, Italy, and Germany, with the smaller countries being weak in the aspects important to debt service, taxation. See Greece.

The Euro seems to be provided by the ECB in a vendor relationship separate from the EU. The ECB needs to be under the political control of the EU for it to be a sovereign issue currency, and not a third party provided service. The US Treasury and The Federal Reserve does not operate like paypal, a software solution, as just the user of the currency, but legal and sovereign issuer and transmission mechanism of the currency. The international governing laws of the ECB seems to be the Maastricht Treaty, which means this is an inter state entity, not a sovereign entity in its own right. The EU will have to make some momentous decisions to solve this problem by making the EU more like the USA constitutionally with the Euro as the sovereign currency issued by the EU and legal in all EU countries. This is when the problem will be solved and this is when individual states will decide whether or not to stay not only with the Euro, but in the case of UK, in the EU as well. It is a very big political problem that sees its solution in the US structure but has several thousand years of history to overcome to get there. As you can see, it is not just a scenario that plays out with Italy or Greece or France dropping the Euro and leaving the EU. They may make the Euro a requirement of EU membership, forcing out the UK, which I do not believe will not give up the pound sterling.

The committee charged with designing the horse and which came up with the camel did a first-rate job compared to the committee charged with designing Europe.

Don’t worry: Italy is simply “too big to fail”…Even US banks would suffer from it.

So, isn’t Europe under the same class system as the US?

Doesn’t Europe have private banks like the US that are TBTF?

Isn’t Europe being held hostage to the same derivative gun as the US?

Why isn’t there anyone in Europe that chants my phrase: ?

Laugh the global inherited rich out of control of our society and into rooms at the Hague.

My solution seems more reasonable than some I am reading, IMO

Will we ever evolve beyond the class based social system we have now controlling Western “Democracies”?

I’m wondering – so the Euro governments have all gamed this all out already, right? And I’m guessing they see that whoever exits first gets the advantage. Which isn’t a good thing.

So it seems the only fair process for countries to exit the Euro, if it’s inevitable and a stampede, is for the exit to be coordinated. As in all at once.

All EZ countries apply Ed’s prescription: Peg their currencies, exit, and let them float where they will.

Wouldn’t this vastly improve the death-spiral dynamics? I mean, any given turd smells about the same in the shithouse, right?

I’m no economist, so maybe I’m not grasping the dynamics properly, but it seems to make sense.

Anyone care to comment?