By Chris Cook, former compliance and market supervision director of the International Petroleum Exchange

Cui Bono from High Prices?

If there is one thing that the history of commodity markets tells us it is that if producers can support and manipulate prices in their favour, then they will.

As those who have read my previous two Naked Capitalism posts (here and here) will know, my analysis of the oil market in recent years is that investment banks have enabled oil producers to create not just one but two bubbles in the oil price. The first – a private sector bubble – was from 2005 to July 2008, and then – after a collapse in price from $147/barrel to $35.00/barrel in November 2008 – a public sector bubble was inflated in the first half of 2009 which remains to this day.

I firstly outlined how passive ‘inflation hedger’ investors in Exchange Traded Funds and Index Funds essentially lent dollars to oil producers, and were able to borrow oil in return. In doing so, they not only perversely caused the very inflation they aim to avoid, but also eroded the foundations of the crude oil derivative markets as a risk management mechanism.

Secondly, I explained how much of this flow of medium and long term risk averse investment which has financialized the oil market has used the very same Prepay technique which Enron used to defraud investors and creditors. By creating what is essentially Paper Oil the investment banks who come between the funds and the producers have been able to inflate and distort the market price of physical oil, and hence the derivative contracts based upon that price.

Note here that my view of the oil market in the long term is that the price of a finite resource can only go up.

Spikes and Speculation

I have mentioned already the role in inflating these oil price bubbles of passive and risk averse investors who aim to avoid loss and thereby to ‘hedge inflation’. But these risk averse investors are diametrically opposite in motive from the active risk-taking investors who buy and sell crude oil futures contracts (not necessarily in that order) in search of transaction profit.

The US population at large; press; politicians; regulators and the majority of economists all point the finger at greedy speculators, hoarders and price gougers operating on the futures markets such as NYMEX and ICE and blaming them for the sky-high US gasoline prices which result from inflated crude oil prices.

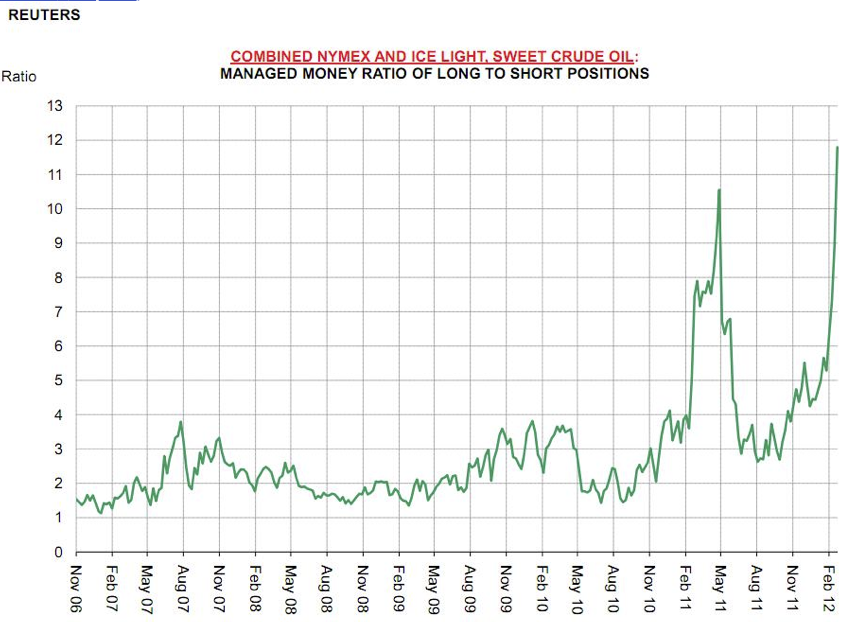

Recent market price moves, and CFTC ‘Managed Money’ market data in relation to the market participation of investors enable us to shine new light on the role of speculators and futures exchanges.

Reuters’ perceptive commodities analyst John Kemp recently suggested that the oil market might be about to repeat the dramatic correction it made in May 2011 when the current speculative ‘spike’ in prices ends.

FT Alphaville last week took up the running from Kemp and published a CFTC Commitment of Traders (COT) chart, which details current participation of ‘Managed Money’ in the US West Texas Intermediate (WTI) crude oil futures contract.

Managed Money is one CFTC category of market participant, the others being Swap Dealers (such as investment banks), oil producers; and ‘other reportables’ such as certain traders.

Managed Money

What this COT chart shows in respect of the MM category is not the absolute number of WTI contracts (the MM ‘open interest’) but the relationship between MM investors holding ‘long’ positions, through buying and holding contracts open, and those who are ‘short’ of the market having sold futures contracts.

The first point that leaps out from the chart is that the ratio of Managed Money is always greater than one. This illustrates the long term presence in the market of the passive investors who are off-loading dollar risk in favour of oil risk and who are thereby structurally ‘long’ in the market.

The second point is the way that inflows of active speculative money flows in and out of the market in short-lived speculative ‘spikes’. The first in March 2011 followed the Libya supply shock and collapsed very soon after in May of the same year. Kemp’s point, and mine, is that there is a similar – but even more pronounced – spike now taking place, and that such a spike is an accident waiting to happen.

But there are is another aspect which is very relevant to the relationship between WTI futures contracts and the underlying market which has long been the subject of debate by regulators and economists.

I think of this as the Curious Incident of the Speculators in the Springtime

The Curious Incident of the Dog in the Night-time

[Inspector Gregory] “Is there any point to which you would wish to draw my attention?”

[Sherlock Holmes] “To the curious incident of the dog in the night-time.”

[Inspector Gregory] “The dog did nothing in the night-time.”

[Sherlock Holmes] “That was the curious incident.”

As will be seen, the WTI price first crashed from $146/barrel in July 2008 to just over $30/barrel in December 2008. It then more than doubled (at a time of over-supply) to over $70/barrel in July 2009.

But throughout that period the Managed Money ratio is not exactly raising the roof, or come to that, disturbing the cellar. So whatever was driving the WTI price downwards and upwards it does not appear to have been either active nor passive investment by Managed Money in buying or selling WTI futures contracts.

In other words, the speculator dog did not bark: so what does that tell us?

As I have outlined previously, there was a wave of ‘inflation hedging’ dollars which poured into commodity markets generally and the oil market in particular in the first half of 2009. My case is that this wave of dollars flowed into the markets through Enron-style Prepay contracts entered into with certain oil producers by a couple of investment banks operating in the Brent/BFOE complex of contracts which sets the global market price in crude oil.

When this financial demand for physical crude oil (paper oil) is added to normal consumer demand the result is a rapid increase in the physical market price, and the nature of Enron-style sale and repurchase use of Prepay contracts is that demand for forward contracts is also increased, thereby creating what became a ‘Super Contango’ market.

Worse, these Prepay contracts – like those of Enron – were invisible to the market at large and they created a ‘Dark Inventory’ of crude oil. This oil was no longer in the beneficial ownership of the producers who had ‘lent’ the oil to the investment banks who acted as credit intermediaries but did not take market price risk. The outcome was that a false market was created in crude oil.

So, if greedy price-gouging hoarders and speculators weren’t responsible, then who was?

I have already written of the way that BP and Goldman were joined at the head for more than 15 years and the probability that a combination of astute marketing; hype and their mutual use of Prepay contracts was instrumental in the first bubble in oil prices.

In relation to the 2008 spike which burst that bubble, some sore losers at Semgroup blamed Goldman Sachs for a market coup of which they were the principal casualty:

What transpired at Semgroup was no less than a $500 billion fraud on the people of the world,” says John Catsimatidis, the billionaire grocer turned oil refiner who is attempting to reorganize Semgroup in bankruptcy court.

The $500 billion is how much the world would have overpaid for crude had a successful scam pushed up oil prices by $50 a barrel for 100 days.

But since 2009, the principal beneficiary – and likely facilitator – of the more recent bubble in prices appears to be J P Morgan Chase, who have had a long and fruitful relationship with the Saudis. Their hire from the wreckage of Lehman Brothers of the former Goldman Sachs oil trading star Jeffrey Frase appears to have been an inspired move which has been a major contributor to their phenomenal recent profits from oil trading.

But whatever the truth behind these murky oil market dealings, I agree with Kemp’s view that market conditions today are not dissimilar to the position in May 2011 when the WTI price fell dramatically in a matter of days, and that the market is similarly exposed today to a ‘flash crash’ like that on May 5th 2011.

I stand by my view that the underlying position of demand in the oil market is such that a flash crash may both wipe out the speculators and then continue, possibly to the extent of taking down the clearing houses which I believe are under-capitalised for the ‘fat tail’ risks they run.

The oil market may indeed crash … but it will be due to an economic crash started in the EU that will suck liquidity from the world’s banking sector … too much liquidity for the central banks to keep up.

What I see happening are the gyrations of the consequences of peak oil prices and the attendant woes of demand destruction. A new study out bares witness to this phenomena:

“Has the global economy become less vulnerable to oil price shocks?” … by Dr. Mingqi Li

He concludes: “Moreover, the regressions seem to have suggested that the impact of oil price on economic growth may have increased over the last one or two decades. This is in contradiction with the widely held belief that the global economy has become less vulnerable to oil price shocks.”

As far as the oil price goes here is a chart from the piece:

http://www.theoildrum.com/files/image002.png

Clearly we passed “peak oil” in about 2005 and the chart shows this. What is happening now is that even with higher prices new supply is not coming to market so the bidding skyrockets and demand destruction sets in until we have another economic crisis and another crash in the oil price.

Yes there is “gambling” in the casino because the limited supply facing a growing demand presents the opportunity to bet the spikes … but watch out for the crashes. These are the normal gyrations of the world’s most crucial market/commodity whose demand inelasticity has found an absolute limit to supply …

Link to:

“Has the global economy become less vulnerable to oil price shocks?”

by Dr. Mingqi Li

http://www.energybulletin.net/stories/2012-03-14/has-global-economy-become-less-vulnerable-oil-price-shocks

The point is that these spikes are transient and are what burst the bubbles created by financial demand loaded on top of physical demand.

Producers will always keep prices inflated if they can, and have been able to do so using ‘inflation hedging’ funds as leverage – which is a fundamentally unsustainable position.

The presence of intermediaries in the market means that the instability of current intermediated market is a feature, not a bug.

Producers seek stable high prices. Consumers seek stable low prices. A stable (and rising – since carbon fuels are finite) ‘fair’ price could in theory be attainable except that for the intermediaries who own and operate the market price stability is Death.

The approach needed to create a resilient market is to maintain prices at the upper bound where demand destruction sets in, but to ensure that the surplus over costs is shared appropriately between producers, consumers and service providers.

President Wade of Senegal was riffing on this,

http://armelopost.wordpress.com/2008/04/10/the-wade-formula-pt-29qtst/

in the context of the pillaging of African resources, but was completely ridiculed for his pains.

How naive of him, eh?

A significant levy being applied into the creation of investment pools which will make investments – energy loans (denominated in energy) – in renewable energy and energy savings (Nega Watts and Nega Barrels).

In my view the Big Trade of the 21st Century will be the exchange of intellectual value for the value of carbon energy savings.

“The presence of intermediaries in the market means that the instability of current intermediated market is a feature, not a bug.”

The instability of the “current intermediated market” is based on the relationship between inelastic demand and an absolute limit of supply. News flows have such as Libya have exaggerated the inevitable gyrations. Windfall profits are then generated because of the demand/supply relationship. IOW no one dare be left short of oil.

Hey, Dr. Mingqi Li, the ultimate –and very brilliant– doomer, good to see him get a shout out on the blog.

Couldn’t agree more with the good doctor’s conclusions. A global economic model based completely, on cheap long haul transportation, will prove much more vulnerable to oil price shocks than the old semi-regional model, since oil makes up 95% of all global transportation costs.

(Anything else is, of course, classic, neo-liberal denialist bullshit)

I plucked this section out of a PDF paper published by Dr. Li, about year ago, and saved it.

It’s fascinating, and horrifying. To substitute/replace JUST one million barrels of oil per day, or JUST 1/89 of current global supply:

• Coal-to-Liquids: 200 million tons of coal or 2.7% of

world coal production

• Natural Gas: 50 million tons of oil equivalent or 1.7% of

world natural gas production + massive infrastructure

transformation

• Biofuels: 1.6 million barrels a day or 220 million tons of

grains or 9.7% of world grain production

• Electricity (thermal equivalent): 220 terawatt-hours or

1.0% of world electricity generation + massive

infrastructure transformation

• Wind Electricity: 100 giga-watts or 50% of world total

installation of wind power + massive infrastructure

transformation

Global crude oil production flatlined in 2005. From here on out, there will be shocks in in the oil price markets, both up and down (but mostly up), due to speculation and other factors, like fundamentals, but the bottom-line on the BIG PICTURE is, the descent phase of our oil-based modern civilization has begun.

Yep …

Drool here, drool now…

“Global crude oil production flatlined in 2005.” –

Are you basing this on Dr. Mingqi Li paper? That’s not what he stated:

“However, a growing body of literature now suggests that world oil production may peak in the near future. It remains unclear when exactly world oil production peak will happen. What has become clear is that world oil supply has become much less responsive to world oil price increases.” –

I’m not arguing, as I don’t follow this area (but I did read it), just looking for insight as to why people say that; “Peak Oil” or “Peak cheap Oil”. To me, a laymen of everything I just read, this infers the “cheap” oil theory more. Yes? No?

Thanks in advance.

CRUDE oil production flatlined at around 74 million bpd in 2005.

http://gregor.us/wp-content/uploads/2012/01/Global-Average-Annual-Crude-Oil-Production-2001-2011.png

The world uses around 89 million bpd. The ever expanding gap between crude oil production and total oil production is made up by turning, in very expensive, unproductive, and poisonous ways, tar, shale, corn, sugar cane, coal and nat gas into oil.

Another way to look at the “vulnerability” problem: Here in the US, energy expenditures are gobbling up a growing percentage of our GDP, despite the fact that we’ve outsourced much of our manufacturing base, and with it, much of our energy use.

http://gregor.us/coal/got-btu-accounting-for-americas-energy-and-gdp/

It is clear to me that the US is more susceptible to oil price shocks now than it ever was in say, the “oil shocked” 1970’s. It may not seem that way, however, because we’ve papered over the problem nicely.

The neo-liberal denialists have simply substituted debt for cash, and consider this new payment relationship –in the face of higher price regimes– a form of strength, resilience, and prosperity.

Note: My favorite telling stat; total US household debt, 1973 –$300 billion. Total US household debt, 2012 -$13.5 trillion.

It is entirely possible that this post says something incisive and important about unique the role of credit and speculation in the oil market. I for one fail to see why credit and speculation in the oil market should have any effect much different from that which results in other markets: lenders see opportunity, money pour in, price go up, lenders get nervous, credit withdrawn, everybody try to sell, price crash. Isn’t this about it?

I think it all has to do with the inflexibility of demand thingy he and others bring up juxtaposed with a supply that finally is starting to not be able to keep up, has suddenly made the oil market unstable, a sick patient. I don’t exactly understand it, but the (very) little I do, it seems credible.

I have done extensive research on the internet about the reliability of what Mr. Cook says.

I can tell you his articles are based on:

– System Experience

– Facts

– Intellectual Honesty

Please do yourself a favor and google his background and what he has written over the last 4-5 years.

Apart from what I call “religious belief in peak oil theory” that I disagree with in its entirety, in my opinion has has been proven correct all the time.

Are you saying oil extraction amounts per year will not peak, level out, and start declining over some unknown timespan? Are you saying that oil is a renewable resource and that we can use it without using it up? To achieve a permanently sustainable rate of oil extraction forever as with the sockeye salmon fishery of the North American West Coast?

Prove it to me in a real scientific way (Richard Feynman’s way) that all you said is true?

Nice try, Kris. Did you hope that no one will notice that you avoided my question?

I will ask it again in an even simpler way. What are the various parts of “peak oil theory” that you disagree with “in its entirety”? Can you describe what you understand “peak oil” to be and can you explain why you disagree with it “in its entirety”? And since you brought up the name of Feynman, can you demonstrate to Feynman’s satisfaction why the rest of us should join you in disagreeing with ‘peak oil’ . . . ” in its entirety”?

I would love to debate with you, but blogs are not adequate for this religious topic.

Do you live around Toronto? If yes, we could sit down and discuss.

Let me put it in another way.

If you can’t come up with Peak Air Theory (which is the risk that the earth will run out of air), than you can’t come up with any theory that claims that the earth is running out of something.

The whole thing is made up by people that are interested in the theory to run.

Same as global warming is made up by United Nations employees and environmental departments at US and European universities that were about to lose funding and going into unemployment.

It’s impossible to prove that the earth is running out of something.

” Next verse, same as the first” eh . . Kris?

If you say you consider “peak oil” to be a religious belief rather than an analysis of an ongoing development, are you surprised that someone would ask you what you base your belief on? Dropping irrelevantly baited diversionary hooks in hopes someone will bite is a clever question-avoidance tactic and sometimes works. Maybe you will get lucky some day.

And since you decide to go on the record and say: “Same as global warming is made up by United Nations employees and environmental departments at US and European universities that were about to lose funding and going into unemployment.” Are you right about that or wrong about that? Let Darwin decide.

Other readers, if any, can look at that statement and decide what relationship you have with “the reality based community.”

Our debate is equal to the one whether God exists or not.

It can’t be proven that God exists or not, by the same logic it can’t be proven that the earth could run out of anything but human use. The energy, same as for the universe, is infinite.

Well, at least you admit that your statement that . . .

“Same as global warming is made up by United Nations employees and environmental departments at US and European universities that were about to lose funding and going into unemployment.” is a mere statement of religious belief, made without regard to any relationship to facts or data.

That is a start, I suppose. It is also a handy refuge from having your statements challenged or analysed.

Thx for the debate.

I’ll try to avoid it as much as I can, since our positions will not change anyway. I’m here to learn from Ms. Smith, you and others a lot more other stuff.

With every crisis is an opportunity. What’ll be the opportunity here? EV’s? Bicycles? Ammo and canned beans?

You’d think the damn oil market would crash at the start of the heating season, not the end. Oh well…

We are heading into the driving season and 50% of the East Coast refining capacity is shutting or shut down for good.

Most heat by wood, pellets or gas now … heating oil is declining rapidly and only has a small share of the market.

I guess I succumbed to the illusion of central position on oil. I do heat with oil (like most of Maine) but do not drive (unlike everybody else). Two, two different forms of marginalization in one!

Lambert Strether,

If you own several acres of land (as I think I understood from a prior post), how much of it would you have to devote to a rotationally-harvestable close-coppice fuelwood mega-garden to keep your house sustainably heated for all perpetuity . . . if you were to convert your house to sustainably-harvested coppice-wood heat?

If this article, http://en.wikipedia.org/wiki/Coppicing, is correct, small scale coppicing is too long a cycle, and perhaps not enough product, for house heating purposes.

( Reply to CB ) . . . CB, a web-based article which first got me thinking about this was Permaculture Reflections’s “Top Ten Fuel Trees For Zone Five And Above”. By “above” I think the author means “even colder than”. The author devotes the most space to Osage Orange and then the other Top Nine trees after that. He ranks them in terms of heat yielded per dry pound of wood. He notes that Osage Orange and a couple of the other species burn at a very high temperature, meaning their burn-generated heat could flow faster down a steeper heat-gradient than the lower-temperature heat yielded through burning many other species of wood. After discussing the burn and heat-yield features of the tree types, he then discusses sustainable coppice-farming of the tree types.

http://permaculturetokyo.blogspot.com/2006/05/top-10-fuel-trees-for-zone-5-and-above.html

If I had a house and several-to-many acres of coppice-plantable land, I would first try to weatherise and then super-weatherise the house. And then “sun-temper” it (retro-design and install every feasible passive-solar sun-heat harvesting feature that I could). Maybe I could get the house’s need for fuel-supplied winter heat down to where

I could meet that need with coppicewood from my own land.

To help me get there, I would look into the updated versions of Masonry Stoves that were built for maximum-useable-heat-extraction from a set amount of firewood as designed for the very northernmost countries of Europe. They would totally-combust a set amount of wood and capture all the heat in their huge masonry mass. They would then blast all parts of the room they were in with infrared radiation from the heat stored up in their masonry mass for many hours after the relatively small initial firebox-charge of wood had been entirely burned down into ash, water

vapor, carbon dioxide, and heat almost all of which will have been captured by the masonry mass.

http://en.wikipedia.org/wiki/Masonry_heater

Between super-weatherizing, passive-solarizing, and masonry stove installing; perhaps I could get the house’s need for winter heat-from-fuelwood down to the point where I could indeed supply that need with my own coppicewood mega-garden. I would certainly give it a good hard try.

Different clue:

How much time do you have for these projects? And what kind of money are we talking about? Every article I’ve read about reducing non renewable energy warns against over the top “solutions.” I mean, if you can go to those lengths, more power to you, but it reminds me of the multiboot geek competitions to see who could install the most different OSs on one hard drive. (One guy, if memory serves, loaded up 68 OSs on a single hard drive. One wonders which was his working OS and whether all the OSs could access his data files–I doubt it.)

Take a look at air exchangers–you may have already–and bark shingles. If I had the money, I’d go the extra expense of bark shingles just to get the look; however, the installation requires especial expertise. If you’re building custom, some of the principles of passive solar are interesting and not difficult to execute. Tract housing, of course, you take what’s on offer, and even in expensive developments, that might be not much.

I looked into windmills. Not useful in most of NJ. Location, location, location. NJ used to have the best energy saver installation rebates in the nation, but I haven’t checked recently.

CB,

If I ever get a house with acres of land around it, I will look into the prices and costs of these things. Right now, it doesn’t apply to me and I don’t know what any of the costs are. But those who ARE multi-acre landowners ARE in a position to look into the costs of any or all or some of these things, and they may well be studying the matter even as we speak.

Seeing this is the third such story, when does it fall into the category of a broken clock is correct twice per day?

http://www.ucl.ac.uk/isrs/about/fellows/ChrisCook

You are missing the point. Click above.

Mr. Cook is NOT in the prediction and investment business. He’s just being honest and willing to show to the “willing” public about what is REALLY happening with crude oil pricing.

The possibility of a “flash crash” happening is ever-present just like in the stock market where credit and over-leverage is rife. But that is not the issue.

I was looking at data recently, and there seems to be an equilibrium as for as Demand and Supply are concerned. Growth has tailed out in Euroland (very high prices/$8/gallon) yet consumption remains only a tad less since 2009; the same in U.S. and somewhat higher consumption in both China and India (let us separate growth rates from existing levels of consumption!).

But the new monkey in the equation is post-Fukashima Japan, where consumption has gone up significantly, oh, around 1.5 mbls/day. Part of the new and additional U.S. oil is going to post-Fukushima Japan which is an issue that Chris Cook has not confronted. If the North Sea oil production has declined substantially, as Cook says, then what does it say about the supply deficit. True there is a lot of oil in the Midwest-US that is having difficulty being moved to Oklahoma and there is rife discounting of the crude/syncrude, but the oil majors are not stupid. Suncor just took about 170,000/barrels a day out of the market, saying that their heating mechanism needed to be repaired.

Cook has a point, like any one else, that there is a lot of speculation and I agree. But to cite the 2008 oil crash or the long/short ratios does not get us anywhere to a reasonable analysis. When people see an opportunity for making a killing, ie, in the futures market which allows at least 10x leverage, then they will take a chance, given that the Fed/ECB are hell-bent on stoking this credit machine and the rate of return on savings is very negative.

Oh, let us not forget the O’Bummer; he hired these swines beginning with Geithner and his pals from Goldman and the banks were not taken over and broken up and thank you Bill Clinton for letting Exxon and Mobil and Chevron-Texaco merge and BP take over Atlantic Richfield. The U.S. listed majors-producers need to broken up but Obama is afraid to go there just like with the banks.

Damn, I just filled-up yesterday…should’ve waited a couple days.

“…the market is similarly exposed today to a ‘flash crash’ like that on May 5th 2011.”

May 6, actually.

Exclusive: Iran sanctions seen spurring more Saudi oil sales to U.S.

ReutersBy Matthew Robinson and Jonathan Saul | Reuters – 17 mins ago

Related Content

A view of the Khurais oilfield, about 160 km (99 miles) from Riyadh, June 23, 2008. REUTERS/Ali JarekjiEnlarge Photo

A view of the Khurais oilfield, about 160 km (99 miles) …

NEW YORK/LONDON (Reuters) – Saudi Arabia is preparing to extend this year’s unexpected jump in oil sales to the United States, adding to speculation about the response of the world’s top oil exporter to sanctions against Iran and a rally in prices.

The kingdom’s shipments to the United States have quietly risen 25 percent to the highest level since mid-2008, according to preliminary U.S. government data, a sizeable leap that appears at least partly related to the imminent completion of a major expansion at its joint-venture Motiva refinery in Texas.

But some say the scale of the increase, plus other U.S. data showing Gulf Coast inventories are still subdued, suggest the potential for a political dimension as well, evoking comparisons to 2008 when the OPEC kingpin was driving up production to knock oil prices off record highs near $150 a barrel.

http://www.reuters.com/article/2012/03/16/us-saudi-exports-idUSBRE82F0W420120316

Also:

US Imports Of Saudi Oil Soar; More Seen In March, April

http://www.firstenercastfinancial.com/news/story/47668-us-imports-saudi-oil-soar-more-seen-march-april

Disregard Mr. Cook at your own risk.

This is to anybody who has any money into crude oil.

Yawn. I liked the whole “speculation is driving oil prices” meme back in 2006 when it was new (see: http://dhatz.blogspot.com/2006/06/oil-to-38657-per-barrel.html).

Extremely expensive oil is here to stay and justified by the fundamentals, let’s all just accept that and move on.

Don’t think a “flash-crash” even belongs in this discussion. And if Goldman/BP and a couple of “others” are indeed driving this, and for years, then it can ONLY be seen as an extension of US policy – there’s not a chance, none, that something this important, would, with the full knowledge of regulators, be allowed to occur absent full support from Government in achieving policy goals.

We currently have the Fed floating trial balloons about future QE that (and I think this is hilarious) would somehow NOT effect oil prices by virtue of the types of asset purchases made, or some other BS for public consumption. If oil prices “crash” it will be because there is no further support from the Fed or other CB’s Operation Infinite Liquidity, and therefore a sudden worsening of the European debt crisis with ALL asset classes hit, or a definitive “No” to any further trouble with Iran, or a combo of both that warrants the label “major surprise turn of events.” Note that ALL of these scenario outcomes are explicit results of US policy (oil price, the economy, geopolitical – ALL)

On Friday, Obama signed this Executive Order, and it can only be interpreted as in preparation for war with Iran, or even China. A disruption of oil features prominently. The powers asserted/claimed by the Executive Branch in case of a national emergency rooted in an oil disruption ought to scare the daylights out of anyone following the current fascistic leadership and policy-makers moves:

Note this article from HUFFpost, which contains the referenced Exec Order. The Huffpost contributor has his own BS agenda (i.e., fighting Islamists) but much of the info on oil is of critical interest.

http://www.whitehouse.gov/the-press-office/2012/03/16/executive-order-national-defense-resources-preparedness

http://www.huffingtonpost.com/edwin-black/obama-national-defense-resources-preparedness_b_1359715.html#comments

Mr. Cook:

Thank you for a fascinating series of articles. Of course, speculative bubbles amplify underlying fundamentals whether the market is heading up or down, and less-than-transparent markets provide opportunities for rent-seeking behavior by traders and investment banks.

What regularory changes would you suggest to improve the efficiencies of the oil market, and commodities markets in general? The low margin prices on NYMEX would seem on the surface to be a target for substantial increase. But what sort of changes would you suggest to IFRS or other international regulatory regime? What existing enforcements are there that you think are underused?

Thank you again for sharing so much!

PS As an aside to the Peak Oil thread, given the dynamic between prices, known reserves, and exploration, I expect we’ll get to the inevitable peak later than sooner. It does not help the coal industry, for instance, that there are so many years of known supply.

Mr. Cook

I’m reading on other blogs that few traders are surprised that what they think it’s the gov of USA that is bidding the price of oil up.

I would really, really hate that a Meredith Whitney fate occurred to you. She is so brilliant, but she fell for what I call “prophetic rapture”. Timing of the future is impossible regardless of the clarity of the future even in one’s eyes. I strongly recommend you DO NOT put a time on your very accurate event predictions. I’d hate, I’d really hate to see you vilified.

Can someone help me with this? I read the other day that the deficit is found by adding the private sector savings and the trade deficit. Since the government does not control these two it’s impossible to control our own deficit and impossible to set a point at which it would balance. However, it looks like if the savings would increase the deficit would increase and if the trade deficit would come down the deficit would come down. Accordingly if our money comes from the government(FED), then where is the money going to come from to grow the economy if we don’t have a defict? I’m not a economist but I’m very interested and thinking about taking economic courses in College to learn about it in more depth.