By Daniel Alpert, the founding Managing Partner of Westwood Capital. Cross posted from EconoMonitor

What Does the CCAR Really Tell Us About the Big 4 Commercial Banks?

It has been just over 36 hours since the release of the 2012 CCAR (the “stress test”) of 19 banks. Market response has been decidedly positive with respect to the three of the four top banks that passed, the bloom has somewhat come off the rose with respect to some regional banks, and Citigroup has, well, wilted.

But there is much more in the stress test than is found in the headlines and in media reports, so we thought we’d hunker down with the report yesterday and, after some overall review, focus more on the top four bank holding companies, Bank of America, Citigroup, J.P. Morgan Chase and Wells Fargo – to see what further conclusions might be drawn. After all, those four banks comprise 68% of all the activity in the CCAR.

First off, let’s start with what the stress test is, and what it is not.

The CCAR is a test of the banks’ ability to see themselves through a 25 month devastating economic and financial crisis without experiencing a fall in Tier 1 Common Capital (and other ratios, but this is the one most people care about) to below 5% of assets.

The CCAR is NOT a solvency test of the banks, or bank assets, on a marked-to-market basis. It does not purport to claim that the carrying values of the banks’ existing hold-to-maturity (HTM) assets are money good today relative to the market value thereof. Nor does it address what would happen to the operating results of the banks after the aforementioned 25 month period. It explicitly assumes a downturn followed by a period of recovery thereafter – not an unreasonable assumption – but it does not continue to “clock” (or present value) likely losses to assets that would be recognized after the projection period.

The foregoing is an important point to understand, so an example is called for. If, as the CCAR hypothesizes, housing was to fall 21% from Q3 2011 levels and stay near or close to those levels (as it has since it fell 33% from 2006 peak levels), the losses after the projection period to banks’ portfolios of residential mortgage loans could be far more extensive than those set forth in the CCAR.

The CCAR, however, does open a very useful window on the degree of expected performance of the 19 banks’ HTM portfolio loans, on a bank-by-bank basis, and permits conclusions to be drawn with regard to the levels appropriateness of current (Q3 2011) carrying values for those assets, net of existing provisions for losses assessed by each institution. This report, accordingly, includes a comparison of the foregoing information with respect to the top four banks (and the others, of course) and the results may surprise some folks who have only looked at the headlines.

In fact, the extent of the losses in the HTM portfolio, on a relative basis (bank to bank) is a reasonable test of the adequacy of loss provisions already taken by the banks (thus reducing additional provisions required during the projection period). For example, in real estate-related loans – some 45% of the top four banks’ HTM assets – we believe the CCAR demonstrates that one bank that is generally regarded as a “safe” has perhaps been less than forthright about the quality of that category of assets from the standpoint of adequately provisioning for future losses.

With that out of the way, let’s get to some specifics:

■ Total Losses During Projection Period

The CCAR projects a total of $534 billion of losses on some $7.4 trillion (Q3 2011) of risk-weighted assets during the projection period. About 36% of the losses come from trading and securities operations, but the remaining majority – $341 billion (64%) – are losses during the projection period on the so-called portfolio loans held to maturity by banks that are not subject to market valuation. These are the assets that would also likely continue to remain impaired (and experience additional losses) after the projection period.

Against these losses, the CCAR assumes that banks will earn, during the projection period, a total of $294 billion in pre-provision net revenue (PPNR) to partially offset the effects of the losses. It is, however, important to note that the PPNR has been reduced by $115 billion of operational risk event losses (lawsuits, systems failures), so that the total “damage” that results from the Fed’s disaster scenario of actually $649 billion.

Of the PPNR and the projected losses, the following is attributable to the top four banks:

|

Top Four Banks: CCAR Raw Performance |

|||||||

|

($Billions) |

|||||||

|

BAC |

C |

JPM |

WFC |

Total |

All 19 |

% |

|

|

PPNR |

40.10 |

41.20 |

59.30 |

58.30 |

198.90 |

294.00 |

67.65% |

|

Total Losses |

105.80 |

96.90 |

89.00 |

70.80 |

362.50 |

534.00 |

67.88% |

|

Risk Weighted Assets (Q3 2011) |

1,223.00 |

823.00 |

1,146.00 |

929.00 |

4,121.00 |

||

|

Losses as % of Risk Weighted Assets |

8.65% |

11.77% |

7.77% |

7.62% |

8.80% |

||

It is pretty clear why Citigroup took it on the chin in this study. But stay tuned, there is more under the hood.

■ “Missed it by That Much” (with apologies to Maxwell Smart)

It has been well publicized that the breakpoint for failure of the CCAR is any stressed minimum capital ratio that falls below 5% during the projection period (using the banks’ proposed capital plans submitted as part of the study). While four institutions failed that test – including one of the top four, Citi – there are a number of others that exceeded the minimum threshold by only tenths of a point.

Those under 5.5%, but above 5.0%, on Tier 1 Common Capital (after their proposed capital plans) include some pretty hefty names:

J.P. Morgan Chase

Keycorp

MetLife (which failed on other counts)

Morgan Stanley

U.S. Bancorp

Of course, one needs to draw the line somewhere, but there is a certain relativity to who has a “fortress balance sheet” and who does not.

Which brings us to our final, and most important, point:

■ The Westwood Acid Test

Ultimately, the eventual stability and strength of each bank and the banking system is derived from the quality of bank assets (chiefly, the ability to actually collect amounts lent out on the HTM side of things) and the equity capital available to plug any shortfall. A rolling “going concern” analysis, such as the CCAR (which will now be a regular element of bank regulation in the U.S., under Dodd Frank), is very important. But after a period of severe dislocation, such as the credit bubble and its aftermath, it is appropriate to take a closer look at legacy assets (those originated during the credit bubble – as most HTM assets in fact were) on a class-by-class basis.

The banks that look healthier on a headline basis often do not look quite as robust relative to the losses they would likely see on individual classes of assets. Furthermore, certain asset classes – such as real estate loans – are liable to collection problems that may remain unresolved because of a more or less permanent (or at least long-term) reset in property values.

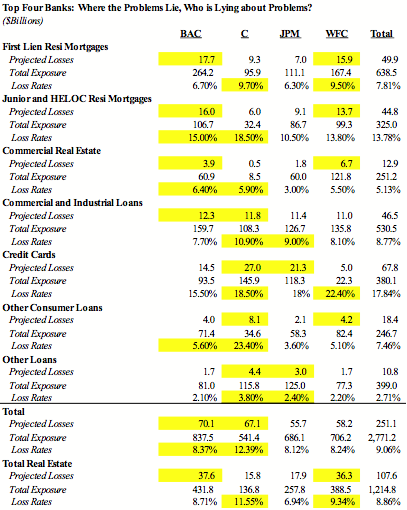

Fortunately the CCAR does give us some guidance in the foregoing respect. What we have done on the following page is to reflect the winners and losers among the top four banks in the CCAR on an asset class basis with respect to their HTM portfolios. We picked as “losers” two of the four banks that had the most losses in each class during the CCAR projection period by either dollar amount or by percentage of total assets of that class. They are highlighted in yellow. The results, as we noted above – particularly with regard to real estate loans – may come as no surprise to some and a big surprise to many. Especially when considered in light of the future collectability of those assets after the projection period – should even far less adverse circumstances prevail.

Please turn the page and draw your own conclusions (and beware the ides of March):

This “stress tests” here, just like in Europe don’t mean shit.

Does anyone think, that our completely corrupt CONgress, or any of the Agencies they head, are going to do anything?

I took one look, at just my Rep. in CONgress, and my guess is a resounding “No!” Why?

http://pfds.opensecrets.org/N00029026_2010.pdf

I the case of Bank of unAmerica, my Representative (Tsongas) would stand to lose a lot of money. Does anyone think that any CONgress Member with a porfolio like this is going to cut the legs off from their bread & butter?

Yup. opensecrets.org tells you everything you need to know about how congress votes and why. Everything else is theater.

I wish more people would accept the fact that the explanation is really that simple. Only when that’s fully accepted, and people stop wasting their time discussing other explanations, _might_ something be done.

They are doing the stress test on 13% unemployemnt and several other crazy market predictions. If we are in a recovery, then this is no way possible. But this is only if we are in a recovery like we are being told.

http://www.dailyjobcuts.com

,

While noble, the Fed’s stress test is akin to the hackneyed, albeit apt “general fighting the last war.” An interest rate shock would seem more likely, especially given the incentive to accumulate treasuries, which along with MBS, are assigned a zero or low cap rating. This conveniently allows the government to stuff their debt with paper that is anything but risk free.

Is 13% a plausible loss rate on “Junior and HELOC” mortgages?

Under current regulatory forbearance policies, yes.

Of course it is . . . IF you base it up the “historical record” of the last five years, when the banks have only written down their HELOCs by about that amount.

This is exactly what the SCAR says it does.

IF you are talking about mark to market value or liquidation value, it doesn’t pass the “laugh test,” let alone the “smell test.”

And, of course, that would be BEFORE another 20% downward leg in housing prices.

The writedowns on 1st lien mortgages are equally laughable.

The 2012 SCAP is nothing more than a political document designed to perpetuate the myth that our banking system is fixed and banks are well-capitalized.

I’d love to see the FDIC run these banks through its failure cost model.

that was my guess…

How does the Federal Resere not provide the severities assumed per asset class

Thanks for this. I knew the stress test was nonsense, but it is always interesting to see the details. Naturally, the whole thing proceeds with nary a clue to the cumulative character of the impending deflation. Comfortingly, it assumes a bounce back for which the regulators (and everyone else) may wait a very long time. The dynamics of real estate now include collapse of the non-insured mortgage market (which eliminates the high end), and shrinking affordability (which poisons the low end). There is no reason why residential housing prices cannot fall another 50% (or more) in the next two or three years, and the idea of a 15% loss rate on junior mortgages is absolutely pollyanish. The only recovery is taking place in reported bank earnings (and banker bonuses), courtesy of ZIRP and Fed interest on free reserves. These guarantee continued shrinkage of money and real economic activity.

“The only recovery is taking place in reported bank earnings (and banker bonuses), courtesy of ZIRP and Fed interest on free reserves.”

Being less financially less literate, can somebody please explain to me the rationale behind this policy? We know the banks have not been using the money to make significant numbers of loans. Other than providing an easy source of profits for the banks, how is the Fed rationalizing this as being good for the economy? And more importantly, why can’t I have access to money at almost 0% interest and then deposit at the Fed and make free money off the spread, too? (Just kidding on the last question.)

Other than providing an easy source of profits for the banks, how is the Fed rationalizing this as being good for the economy? LucyLulu

More bank profits = more bank equity = more ability to take risks on loans.

It’s aways about saving the damn banks since they hold the economy hostage.

How about we call in a “SWAT Team” and fix the money system for good? I suggest an ethical approach this time.

Thank you! Shouldn’t somebody tell the Fed their plan isn’t working? That the banks aren’t making loans? Then perhaps they could revise their strategy to something more effective? Or are the banks investing in equities with their free money and is that what is causing stocks to be selling for more than their financials would justify and/or keep climbing oblivious to whatever news of world tragedy breaks?

“Other than providing an easy source of profits for the banks, how is the Fed rationalizing this as being good for the economy?”

LucyLulu, I hate to break it to you, but the Fed is interested in the economy only insofar as it affects the big banks. Which is to say, scarcely at all. Because those self-same banks have become in recent years largely independent of the economy, thriving on loans to the government and free money from the Fed. The big banks don’t need a robust economy; indeed it is arguable whether they need anything more than a skeleton economy to prosper in the Brave New Fed-World. This has

become so obvious that the Fed scarcely bothers anymore to rationalize its policies with respect to the economy. It is understood that they’re of the banks, by the banks, and for them. And any benefits accruing to the

general economy are purely incidental.

Here’s the Fed mandate: “Congress established the statutory objectives

for monetary policy–maximum employment, stable prices, and moderate long-term interest rates–in the Federal Reserve Act.” (from Fed website)

The big banks are doing just fine thanks to Bernanke. But that maximum

employment? Those stable prices? Not so much. They might be part of Ben’s mandate, but it’s clear they’re not his priorities.

One thing that jumps out at me is that the stress test anticipate 193B in losses in the top 4 banks trading portfolios.

Hmm, if Volcker goes into effect, those projected losses disappear. No?

Strictly an academic exercise.

A smaller bank like Ally gets absorbed by a TBTF to make TBiggerTF. And life goes merrily on until it doesn’t, then the TBTF’s get bailed out.

If nothing changes, nothing changes.

Can’t we all just admit we’ve made a huge national (global?) mistake, bailout everyone and start over with an ETHICAL MONEY SYSTEM?

And no, shiny metals are not the solution.

Shiny metals are cool!

Meet Bender, a Futurama star http://fc07.deviantart.net/fs70/i/2009/364/a/6/Bite_My_Shiny_Metal_Ass_by_GaArAInO.jpg

Introducing the Metal Men. Part 1 http://blog.fpnyc.com/wp-content/uploads/2010/12/Metal_men_cover.jpg

Introducing the Metal Men, Part 2 http://4.bp.blogspot.com/-NwJ7okaw5gM/Tncxkj3FXWI/AAAAAAAAEqY/iAB8hMZ9_pM/s1600/Metal+Men+-+p1.jpg

Bender is cool but inexpensive meta-materials will greatly reduce the need for expensive materials.

And why would we wish to waste PMs as coins or store them in bank vaults?

why would we wish to waste PMs as coins or store them in bank vaults?

I agree it’s not logical… but it is TRADITION! I’ll let Tevye explain…

Tradition (Fiddler on the roof) http://www.youtube.com/watch?v=gRdfX7ut8gw

If I were a rich man (Fiddler on the roof) http://www.youtube.com/watch?v=RBHZFYpQ6nc&feature=related

Ah! That explains this.

LOL… btw, I like your new gravatar!

Maybe it’s a coincidence but skippy attacks me less too.

BTW, the new South Park season has started with a a pretty good rip on the TSA.

PM’s stored in vaults at financial institutions get stolen by pirates. If one likes shiny, pretty metals, its recommended to bury in backyard for safekeeping now.

I attacked, disproved, provided sorely need additional information, to your offerings, that is all.

Skippy… always the victim, progressives will put me in a camp, ethical money common stock (every criminal can print coupons), god only kills the bad guys, oh yeah, if your not with me its…. eternal damnation. As someone that welds one book to make all thing right or wrong, that has a history of blood and guts thousands of years long and wide, you have a lot of chutzpa to claim victim status in the first person.

PS. Go tell it to the dead and still dying around the globe…. in person… and see how you go. The ministry calls, they need your truth! Seed post card OK.

Long, shiny steel knives have appeal to some. Pirates, for example.

13% unemployment, a 21% fall in housing prices. How can these be translated into actual estimates of losses? The projected future downturn must be enough like past downturns for comparison to be possible. But the only event like this future downturn is the Crash and Great Depression, and comparisons with it can be only qualitative because of the distance in time and other differences between the economy then and now. Nor can we separate out the events beginning with the housing bust in 2007 and leading to the 2008 meltdown since this future downturn would be grounded in those events. And the 2008 meltdown played out in an environment of some $30+ trillion in bailouts at various points, which rather distort what happened.

So what you are left with are with estimates based on relationships with events that don’t correspond. What is the good of that, except as propaganda exercise?

But then we knew that.

“But then we knew that” (Hugh)

QED.

In other words, they are testing for a scenario roughly half as bad as the one we actually went through.

13% unemployment is about 50% worse than what we have now. Unemployment actually doubled during the downturn. 22% decrease in housing prices vs. the 50% or more we actually saw.

One day, unless we reform our so-called “free market capitalism” (which is actually banker fascism) it will have a crisis it cannot recover from. I doubt the replacement will be better because the baby will most likely be thrown out with the bath water.

I simply cannot reconcile those Westwood Acid Test numbers with the rally in financials. I mean Citi, which would lose over 12% of its value in such a downturn, gained 10% in market value THIS WEEK. The more I count the cards, the surer I am that the dealer is crooked.