By Philip Pilkington, a writer and journalist based in Dublin, Ireland. You can follow him on Twitter at @pilkingtonphil

We want structures that serve people, not people that serve structures!

– Graffiti in Paris, May ‘68

Recently there has been a bit of debate about MMT knocking around the blogs. To a large extent it has been rather superficial. This was not the fault of those involved – despite a few displays of pomp and bluster from some of the cruder economic bloggers (no names!). The superficiality of engagement was mainly due to the nature of the medium itself. For all their accessibility blogs don’t allow, or should I say, don’t generally encourage the scholarship that is required before considering a new theoretical approach. Indeed, the very nature of blogs is restrictive in that it demands that authors engage with a new theoretical approach only in a cursory manner. After all, there will always be something new to write about tomorrow.

Better, I thought, to engage with one of the participants more directly. So I dropped Dean Baker an email and he was more than happy to engage in a dialogue on the topic. Dean gave me a great deal of time and so I thought it might be worth publishing the results of the discussion in the hope of moving a sometimes slow moving debate forward somewhat. While Dean and I ultimately disagree on mainstream economic theory, he’s otherwise a great economist who I’ve learned a lot from and have a great deal of respect for. Anyway, enough of the niceties – on to the models.

MMT vs. The Mainstream

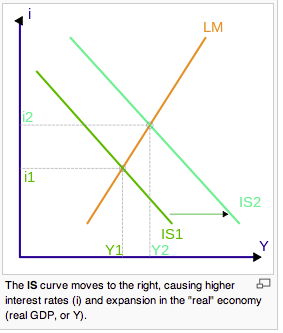

The starting point, as it so often is, is the old ISLM model. IS = “Investment-Savings”, LM = Liquidity – Money Supply”. MMTers hold that the whole model is faulty. It doesn’t take account of a labour market and there are serious problems with having a downward sloping IS-curve. Dean and I only discussed the LM-curve in any detail, however, so we will stick to that for now.

It should also be noted that many MMTers consider the ISLM, or at least the LM-curve therein, to be a fairly accurate depiction of a gold standard or fixed exchange-rate regime. In truth it probably is, but in that it is only a rough approximation; even in such regimes the money supply is far more fluid than the ISLM depicts. In what follows we will consider only a floating exchange-rate regime.

In mainstream and standard Keynesian economic analysis the LM-curve is upward-sloping. Before the reader falls asleep I’ll quickly highlight the implications of this. Basically, it means that when the demand for money rises interest rates should rise too, unless there is intervention by the central bank. Think of it this way: the economy operates with a limited supply of funds or, put differently, the money supply in the economy is fixed. If more households and firms chase after a set amount of money they will bid the ‘price’ of that money up in line with the laws of supply and demand. Thus, the interest rate will rise if more people make demands on this fixed supply of cash.

The role of the central bank is to increase or decrease the supply of money in the banking sector by engaging in open market operations. They do this either to keep inflation subdued or to expand the economy. In the mainstream analysis the central bank is assumed to have pretty much full control over the supply of money. If the economy is growing slowly, they open the spigot and supply more funds into the banking system. If the economy is overheating they extract funds from the banking system. Turning on the tap drives down interest rates as so-called ‘base money’ in the banking system increases; pulling back funds drives interest rates up as base money in the banking system decreases. The effects of these increases or decreases of base money in the banking system are then basically mirrored in the economy at large through the effect of the money multiplier.

MMTers (and other post-Keynesians) disagree with this characterisation. They claim that the central bank has little or no control over the supply of money. They claim that the supply of money is ‘endogenously determined’ – i.e. set by the amount of economic activity taking place at a given time. Because MMTers, through their close study of actual banking practices, do not adhere to the idea of a ‘money multiplier’; they do not think that the central bank determines the supply of money at all. Instead it merely sets the price of money (that is, the interest rate) and allows the demand to adjust to this price.

According to MMT in a floating exchange-rate regime there is an unlimited supply of funds, but these are given a fixed price by the central bank. This is a bit like a monopolist with enormous excess capacity that can, for all intents and purposes, produce an infinite amount of cars. The monopoly firm sets the price of the cars that they sell and allow demand to adjust in line with that price. Ditto for money in the MMT understanding of how the banking system works. The central bank is effectively a ‘money monopolist’ that allows the production of an infinite amount of money at a set price.

There is an enormous difference here in how these processes are conceptualised. The mainstream approach deals almost exclusively with ‘stocks’ of money within the banking system, while the MMT approach deals with ‘flows’ and their rate of rate of expansion and contraction. The mainstream view is that a ‘stock’ of money is injected into the banking system by the central bank and this in turn creates another ‘stock’ of money in the economy through the process of the money multiplier. The MMT view, on the other hand, is that the central bank sets a price for money and allows the demand for this money to determine the ‘flows’ into the economy that result.

The mainstream ‘money stock’ approach is actually remarkably primitive when thought through in any depth and leads to misunderstandings about money and debt creation. This harks back to the fact that mainstream theorists use crude ‘static’ modelling straight out of 19th century engineering when trying to understand the economy – but this might be a bit too complex to get into here; let’s just say that the approach is a tad dated.

But in Theory…

Frankly, if you understand how banking works in a modern monetary system you cannot really deny the MMT conception because simply describes how things actually operate. However, you can claim that it remains valid to conceptualise the money supply as being fixed theoretically.

Here’s why: It all rests on your definition of the interest rate. For the most part when economists talk about ‘the interest rate’ they are referring to the short-term or overnight interest rate that is set by the central bank. This is the interest rate that Greenspan and Bernanke talk about all the time. However, there are other interest rates in the economy. One important interest rate is the long-term interest rate on 10-year treasury bills. This interest rate is usually set by the markets. (Note that there are important exceptions to this that are not dealt with in the ISLM and call it even further into question). The markets tend to bid this interest rate up when they see a potential for inflation in the economy or when they think that the central bank might raise rates due to their own inflation expectations. So, when the economy looks like it might be growing too fast the market bids up the long-term interest rate.

The central bank keeps an eye on the inflation rate too and adjusts the short-term interest rate accordingly. If inflation gets too high, or inflationary pressures are thought to be in the pipeline, the central bank will jack up the short-term interest rate.

If you adhere to this view you could say that the standard ISLM model is theoretically valid. As the economy grows and the demand for money increases the long-term interest rate on 10-year treasury bills increases in expectation of future inflation or interest rate hikes. At the same time, the central bank is also reacting to economic expansion and the demand for money by tracking the inflation rate. These reactions on the part of both the markets and the central bank simulate a fixed stock of money because interest rates rise as the economy grows ‘too fast’. (As an aside it should be noted that these expected movements are not firmly grounded in reality because in floating exchange regimes empirical evidence indicates that interest rates can climb at the same time as the money supply increases, so there is no direct link here.)

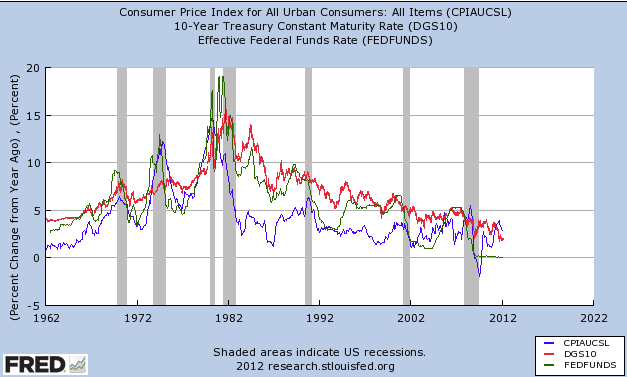

The dance that takes place between the variables is rather chaotic but there is a clear pattern. You can get a good idea of it by looking at the graph below. In red is the long-term interest rate, in blue the inflation rate and in green the short-term interest rate.

As the reader can see, the long-term interest rate is not actually a very good predictor of future trends at all. The correlation between the inflation rate and the short-term interest rate is very tight which is not surprising because the central bank is tracking the inflation rate and adjusting the short-term rate accordingly. The long-term interest rate, on the other hand, seems to follow the lead of the other two.

The Rise of the Robot Banker

Even though the long-term interest rate is clearly the dependent variable, those that adhere to the ISLM assume that the interaction between the three variables leads to a restricted ‘market for funds’ in that interest rates in general will rise as the economy and the demand for money expand. But it seems clear that the main agent of change here is not The Market at all, but instead the central bank which responds to the rate of inflation or the expectation of inflation.

In reality this is not some sort of automatic process. By assuming an upward-sloping LM-curve – that is, a fixed supply of funds – there is an implicit assumption that actions on the part of the central bank are somehow neutral. ISLM enthusiasts implicitly assume that the central bank is simply responding to some otherwise ‘equilibrating’ market conditions and adjusting its rates in line with this. The implicit bias toward self-equilibrating markets that is buried in the ISLM is what allows economists to maintain an illusion of a fixed supply of funds (upward-sloping LM-curve).

In actual fact, if we look closely at this ‘theoretical’ justification of a fixed supply of funds (upward-sloping LM-curve) we see that it is simply a self-justifying model. What the standard ISLM model does is bury within its assumptions that the central bank’s interventions are neutral. It buries the fact that the central bank is actually taking a specific stance on policy and then tries to pass off this stance as a sort of quasi-market response (i.e. as if there were a market for a fixed supply of funds). But the central bank’s policy stance is nothing of the sort. Instead it is a sort of a simulation of what a market response is thought to be. Thought to be by whom? By economists that adhere to models similar to the ISLM, of course!

This is real ‘through the looking-glass’ stuff. What the standard ISLM model does is neutralise or disappear the economist or central banker within his or her own theories.

“No need to look over here,” says the central bank economist and his followers in the profession. “We’re not taking any ‘action’ per se; we’re just humble subjects of The Market’s great laws. We’re just undertaking ‘automatic’ actions that are dictated to us by an abstract and unseen overlord.”

This is nonsense. Put simply, the moment you disagree with the abstract ‘laws’ by which the economists think the economy operates, you call into question the actions they undertake because, to give just one example, they may judge the so-called ‘natural’ rate of unemployment to be far too low and hike interest rates when there is no real threat of inflation. Then their actions start looking a lot less ‘automatic’ and a lot more ideologically driven.

Dean didn’t disagree. He told me that he points all this out to his students within the confines of the ISLM model and I have no doubt that he does. Nor do I have any doubt that his students come away better informed than others who go through the sometimes unfortunate rigmarole of training in economics. But still, I cannot help but feeling that there’s a sleight-of-hand taking place here at the level of intellectual construction.

Some might say that I’m taking a ‘normative’ view of all this. They would say that what I’m really griping about is that the central bank does not undertake the sorts of policy actions that I might favour. But I don’t think that this is the case at all, this is not a case of judging policy actions per se. In fact, I think it’s the MMTers who are being good positivists. We are describing how the system works. It is the mainstream models that plaster over the normative judgments made by central bankers by positing their ISLM model with its upward-sloping LM-curve.

By allowing for a fixed supply of funds they confuse reaction on the part of the central bank with a quasi-automatic reaction taking place within the economy itself. By claiming that the LM curve is flat and that the central bank sets a price and allows demand for money to adjust the MMTers are being far more realistic and far less convoluted in the way they represent the functioning of the central banking system.

ISLM enthusiasts will, of course, assure me that they don’t really believe central bank actions are neutral. But then why do they adhere to models that imply that it is? To those that would make this excuse I would warn them to take a look at history. Models can often take on a life of their own. I’m fairly convinced that monetarism – with its money supply targeting – arose quite organically out of the faulty ISLM model. I would also say that economists can do better than simply positing flawed models and then making excuses when they don’t work. Just drop the model altogether. The rest of us get on just fine without it.

Life in a Derelict Building

Models such as the ISLM – nearly all economic models, really – are self-justifying. One could say that they are almost tautological constructions. What they seek to do is dissolve the conceptions of the world held by the model-user into the models themselves. Buried deep within the model, most students don’t question these assumptions at all. They just assume that the world is as the ISLM says it is, while in truth the world is simply run by folks who think that the ISLM is a good representation of that world and thus a good guide to policy.

The ISLM, then, is really a model of action for neoclassical central bankers who wish to try to impose an upward-sloping supply of funds (LM curve) on the economy. It does not represent how the world works, but instead how the world should work according to such people. It is a normative model in the strongest sense of the term and frankly, all those who use it to make predictions or try to understand how the economy works are not really engaged in detached reflection on how the economy works at all. No, they are buttressing the status quo – within their own minds, no less. And even though the better of them can tear themselves away from the dictates of the model when it comes to policy recommendations, they still ultimately remain tied to its apron-strings.

Arguing against the implicit implications of this model from within the confines of the model is an uphill struggle to say the least. In order to do so all sorts of ‘ifs’ and ‘buts’ have to be dragged into the debate and the whole thing becomes terribly messy.

This is because models like the ISLM are classical or neoclassical constructions. (Remember the title of Hicks’ original paper introducing the model…). In truth these models are built on the back of a seriously flawed theoretical edifice. And that, I think, is the problem with pretty much every mainstream model: they are not intellectual constructions that promote thought; they are more akin to cages built out of the remnants of long dead assumptions that are used to entrap the minds of those they are handed to. It is only those of highly independent mind that can wrench themselves from such conceptions once taught them.

It is worth quoting Keynes in this regard, who knew well the dangers of leaving rotten buildings standing:

The difficulty lies, not in the new ideas, but in escaping from the old ones, which ramify, for those brought up as most of us have been, into every corner of our minds.

Since Keynes, most economists have stopped trying to escape the old ideas. The MMTers, on the other hand, together with their post-Keynesian colleagues, have done nothing less than construct a theoretical edifice that quite literally shakes off the old ideas completely. And that is what makes them seem so strange to their colleagues.

Loans create their own deposits. The money supply may be limited, but because of this “recycling”, the loan supply is not. Interest rates are determined by risk, not the demand for loans. HOWEVER, a demand for loans does indicated that there will be increased competition for available profit opportunities, and it is THIS, not the demand for loans, that will in turn increase interest rates.

Benedict@Large,

“THIS, not the demand for loans, that will in turn increase interest rates.”

The supply of money need not relate to loan demand at all.

The scarcity of money is artificial. If there exists production capacity in the economy only then new money should be issued (which is what banks do, the act of funding a bank loan is an act of currency issuance). New currency should be issued by the government not the banks.

more at:

http://aquinums-razor.blogspot.com/2011/11/here-is-how-bankers-game-works.html

Mansoor H. Khan

Indeed, the central banks have virtually zero control over the actual money supply. They only control the physical money supply in so far as they are the entities that operate the printing presses.

Banks do not issue currency when they loan money. If they did, they would not become insolvent when those loans failed.

What actually happens is that the banks loan money that they borrow from the Fed, and for that priviledge, they pledge some their assets as collateral. It is this borrowing against collateral that actually makes the banks fail when their loans fail.

When loans fail, banks must record the loss on their own books, despite the fact that they created the ‘money-stuff’ that was deposited for the use of the borrower.

But, so what?

The most important point missed by both the mainstream Baker and the Modernist Pilkington is that there is no scientific reason for the banks to have the power to create the national circulating medium in a modern monetary economy.

This is the tragedy of the commons today.

There is a lack of circulating medium, that , were it circulating, would provide the needed aggregate demand to restore fuller employment.

It is very unfortunate that the theoretical monetary reformers cannot see one inch past the historical failure of using interest rates to manage economic activity.

It should be obvious that an extended ZIRP monetary policy does nothing to stimulate demand.

While MMTers call for ‘fiscal activities’ to promote aggregate demand, these are in fact monetary infusion mechanisms that increase the supply of money – which is THE economic enabler, in reality.

So, yeah, modern monetarism must also be on the table.

For the Money System Common.

Is that a picture of Frederick Soddy up there by your name?

Yes.

Frederick Soddy provides the needed scientific base to understand how a monetary system MUST function in order to promote REAL economic growth (that is of wealth as opposed to virtual wealth and debt), and he began the social science understanding of how to better the well-being of the wealth-creators as opposed to wealth-accumulators – these being the ownersof “monetary” assets – which are again actually debts and virtual wealth.

At some point Soddy’s contributions will be recognizd and built upon for a permanent, non-debt-based money system that promotes true economic democracy.

Soddy, not ANY of the recognized monetary economic experts, is THE MAN.

A read of “The Role of Money” will show why.

For the Money System Common.

“Policing the Economists from Within their Own Minds.”

Holy crap! If this wasn’t written on a blog but published in a “journal” instead, the economic theorists would have gone completely mental! Guaranteed!

I don’t think this ISLM model has anything important to do with MMT, which basically endorses unlimited government spending rather than promiscuous backstopped bank lending as an engine of money creation. Those who trust politicians and distrust financiering find MMT an all purpose panacea. It is hard to imagine MMT working more disastrously than our existing world of leveraged banks and synthetic derivative bets, but then I listen to the nonsense coming out of Congress and I wonder if perhaps it might.

At the very least the people could potentially vote out the people that crashed the economy (or remove them from office in more brutal ways, but then that is also a option for private offices of control). And there would at least be some sense of oversight, unlike the insanity that is contracts between banks and other entities that are held secret for “benefits of competition”…

We do have MMT now. The Fed, the government, the big banks and media are different names for the same thing.

From the Fed to Banks to Government… to 15 Trillion of MMT and counting.

Money & media select the candidates, so who you vote for doesn’t matter at this point. With MMT, the Fed simply folds into the government and everything continues as before. It’s not at all different from the current arrangement.

The whole circlejerk has become an open secret the Fed has lost its usefulness as a patsy. It attracts undue attention and MMT is about fixing that. The mess of Congressional committees, government agencies and closed sessions can cover the tracks better at this point.

Monkeying with MMT is nothing but a diversion. Balanced trade is the most necessary change. Then Glass-Steagall, transparent Fed, cap on bank size, sane tax code, etc. This is what the politicians would do if they weren’t utterly corrupt. The US lost the New Deal and Glass-Steagal when the corruption reached critical mass. MMT is a new cover for the big, old problem – corruption.

balanced trade.

we can’t have that now can we?

what would the bullies in the sandbox do then?

They would munch sneaky grass, be complacent and avoid the issues?

That would be a devastating criticism of MMT if it were true. But it is not. There is no endorsement of unlimited government spending, nor any naive view regarding the relative goodness of politicians.

In fact, it demonstrates either the willful ignorance and/or hard-to-believe greater stupidity of our politicians through its straight forward description of how our monetary system operates.

Thanks, pebird. It’s amazing that *in every single MMT thread* on this site, this misguided view of MMT is debunked *again and again*, but still people like jake chase just trot it out like it’s never been said before and it’s never led to great embarrassment by those who said it.

Wow, I have an idea, jake chase. How about you actually investigate something before you dismiss it as something it is not?!?! Yes, that is clearly asking too much of those who scour the world looking only for those pieces of data that confirm a pre-existing world view.

I don’t know a single MMT theorist who believes that all government spending is good and that politicians should be trusted without vigilant supervision. Please, find me one! At least then we’d be talking about something real rather than this nonsense assumption you hold.

Cut the BS. MMT is in favor of universal healthcare, a government job for anyone who wants it and much more. Your attempts to describe this as some small government utopia is a joke and a lie.

I don’t endorse MMT on fundamental grounds but health care should not be mixed into it. It’s a separate subject.

Currently that subject imposes draconian criminal penalties for people who try to provide health care outside of a narrow government-sanctioned circle (quotas and all that). In effect, the government has absolute control over the supply side… it IS a government healthcare in every sense of that word, but the “right” accepts that part of it.

Here is my question: you don’t agree with universal healthcare but you do support said penalties? Am I correct? If yes, why?

It’s all about understanding how MMTers think. They say the government can’t run out of money. So they take their social agenda and fill in the holes. It’s not about whether healthcare is good or bad. It’s about MMTers being all in favor of government spending just because they know the government can’t run out of money. That’s why they’re in favor of the government hiring all the unemployed and other spending policies.

Of course, they are right that the government can’t run out of money, but the money surely can run out of value…

Again, the hiring part has little to do with MMT, the Job Guarantee is a boldfaced propaganda lie. The problems we face have nothing to do with lack of money – the banks are swimming in money, they are drowning in money…

Unemployment, inflation, housing deflation, the Greek crisis, all of that is caused by unbalanced trade, aka globalization. I hope that’s clear.

“Again, the hiring part has little to do with MMT, the Job Guarantee is a boldfaced propaganda lie.”

No, you’re wrong. It’s an inflation anchor policy to replace the current inflation anchor policy where the central bank creates unemployment so that people go on welfare and spend less. Do your homework before making such po-faced assertions.

“The problems we face have nothing to do with lack of money – the banks are swimming in money, they are drowning in money… ”

Banks holding money as reserves and you having money in your pocket are two VERY different things. Bank reserves don’t get spent into the economy (duh!) so they cannot create demand and employment. Pretty obvious, really. And not exactly controversial…

Bank reserves don’t get spent into the economy (duh!) so they cannot create demand and employment. PP

Not necessarily. If I withdraw $100 from my bank and spend it, I have spent some bank reserves. But you will say “Yes, but the moment you withdraw that $100 it is no longer bank reserves”.

OK, you are correct.

I’ve done my homework, but you haven’t.

“Bank reserves don’t get spent into the economy” – au contraire, they do… in the Asian economy.

“so they cannot create demand and employment” – au contraire, they can and they do… in Asia.

Don’t you get it? The money goes from US to Asia. No matter how much water you pump, you can’t fill a bucket with no bottom. There is no lack of money, the bottom has fallen out of the economy.

It’s a race to the bottom… down below. The amount of money has nothing to do with fixing anything. The more – the worse. Check out what a currency war is.

It goes to Asia… right. I suppose the money fairies bring it, right? Get off it and take a course in economics, please. The only way it can go to Asia is if it is taken out of the bank by a consumer and spent on Asian goods. Not happening. The reserves are just sitting there. Look:

http://t.co/Y6t2NcSd

That’s by Richard Koo, by the way. Not an MMTer.

Pilkington:”The only way it can go to Asia is if it is taken out of the bank by a consumer and spent on Asian goods. Not happening.”

Au contraire… that’s exactly what’s happening. The budget deficit comes from the Fed/banks, goes to the government workers aka consumers, they use the money for Asian products, and the money ends up in Asia. 15 Trillion and counting.

By now, it should be clear even to a first grader.

Christ, I’m not even getting into that… I can assure you that you have no idea what you’re talking about on this one. Government deficits have nothing to do with high levels of bank reserves. Whole different thing. And the demand leakage to Asia via the deficit isn’t as big as some think.

Government deficits have nothing to do with high levels of bank reserves. PP

Now I am confused. I thought that US Federal Spending was the source of US bank reserves and that US Federal Taxation was the drain for US bank reserves. If that is true then deficit spending by the US Federal Government would of course increase US bank reserves.

You’re confused because this dude has zero idea of what he’s talking about. The flood of bank reserves in the system is not due to deficits, its due to QE. Deficits create deposits for households and firms that are actually spent into the economy. QE injects reserves into banks that sit there.

Just stop listening to that guy. He’s way off.

Pilkington:”Government deficits have nothing to do with high levels of bank reserves”

– I’ve never claimed that, strawman.

“And the demand leakage to Asia via the deficit isn’t as big as some think”

– says the supporter of open-ended economics which knows no numbers. Besides, the leakage is not only through the deficit… there is no bottom.

“I can assure you that you have no idea what you’re talking about on this one.”

– Hollywood would be a fitting place for you.

OK. Yeah, QE is merely the swap of one form of money, bank reserves for another form of money, the debt of a monetarily sovereign nation. As Cullen Roche explained, the net result should be deflationary since bank reserves earn less interest than sovereign debt.

Votersway, not sure if Philip gets what you are saying. Of course you’re right about “what’s happening” demand leakages due to foreign saving, unbalanced trade, “globalization” and its bad effects. When it is not offset by an equivalent budget deficit. But so what? Just practice functional finance and print the money to offset the leakage, like you would do for any other leakage. So what if the bucket has a hole in it. Who cares? In reality, the hole in the bucket is not that big. Replacing the leakage does create domestic demand & employment, and if there’s more leakage, so what? Just repeat. Take care of full employment, and everything else takes care of itself. 99% of the problems you refer to are caused by the deflationary effects of unbalanced trade, and thus 99% cured by printing enough money to offset it. The two chapters on international trade in Lerner’s Economics of Employment are imho still the clearest, most beautiful exposition, better than moderns who make everything more complicated than it really is, and shedding much light on all aspects of money.

@Calgacus

What deflationary effects of unbalanced trade? You got it backwards – the effects are inflationary – Currency Wars should I say more? It’s a race to the bottom with regard to the value of money.

It’s not abound the demand side – it’s about supply side. Unbalanced trade moves the production capacity abroad, more printing only devalues your currency until you end up with Chinese salaries, Chinese style oppressive government, Chinese work hours, American Prices and still NO INDUSTRY. Then the government implements MMT with a “Gulag Guarantee”…

It’s a race to the bottom with regards to the standard of living an political sanity, not to speak about freedoms.

You don’t get economics, actually, you get it backwards. If you are teaching it… you are destroying our children.

Well, we can agree on one thing. One of us has everything backwards. That’s what Wray says about the mainstream – it gets everything backwards. MMT is just Lerner’s Functional Finance, which Keynes eventually agreed was 100& right.

The deflationary effects of imbalanced trade are very simple & the only bad thing about it. Imbalanced trade of US vs. China is deflationary for the US, expansive/inflationary for China. The US dollar trade deficit / China surplus just means China is saving up US dollars. How could China selling the US cheap stuff NOT be disinflationary? Saving is deflationary. The Chinese trade surplus acts exactly like a US federal tax on the US economy. We get real goods & services, they get dollars which they keep in a piggy bank, rather than spending them back into the US economy.

But then there are fewer dollars running around the US economy. This is what causes the unemployment, the loss of productive capacity, the lower wages. And it can be remedied in the easiest of ways. Print the money to offset the demand leakage. Chinese widget factories undercutting US widget factories? Then keep the US factories going by having the US gubmint buy the widgets with newly printed money. Put ’em in a federal widget stockpile. Might not be the best thing to do with newly printed money, but basically, problem solved. US got more widgets, China got more dollars, and US wages & employment & productive capacity are not harmed. Printing money doesn’t directly devalue anything, doesn’t cause inflation, unless you print more than is necessary to offset the Chinese saving.

You appear to be trying to go to fast, conflating several effects, not looking at each one slowly & carefully. If you did, you would realize how simple things really are. Lerner is usually better on this than modern MMTers.

what makes us think Congress understands derivatives-they brought designated Senate banking chairman Robert Johnson before combined Congress

to explain what happened, then cut him off in first 10 minutes, when realizing,

“The American people can’t know this”…

Johnson’s testimony showed up around a year later and included the facts derivatives valued $880 billion, 2001, but $600 trillion, 2007, and were 95% owned by 6 U.S. “investment banks”…

as for “understanding” derivatives, seems to me it’s case by case-even Yves recently intoned such..

It should perhaps be pointed out that Hicks himself rejected IS-LM (which is not his initial characterization of the model) toward the end of his life, and in a letter to Paul Davidson agreed with Davidson that Davidson’s view was closer to reality than his model. See Davidson, The Keynes Solution, for a discussion of this.

Perhaps just as important historically is Samuelson’s ‘revision’ of Keynes’ theory, which Samuelson dubbed as being neoclassical Keynesianism. He admitted that one of the reasons he did this was because of the adverse reaction to Lorie Tashis’s book, which eventually was withdrawn largely because universities chose not to have their libraries buy it – in effect, the book was boycotted. No one could say that Samuelson’s political antennae weren’t working whatever one thinks of his theoretical economic stance.

And that said model has about as much to do with Keynes as christianity has to do with hinduism…

Hindis accept Christianity…christians don’t accept Hindu..

Well, what’s another god to 330,000,000 more or less?

Important point:

http://community.middlebury.edu/~colander/articles/Political%20Influence%20on%20the%20Textbook%20Keynesian%20Revolution.pdf

Tarshis was denounced as a communist. But Samuelson’s interpretation wasn’t just about politics. It was also about turning economics into a subject like engineering or computer science.

Tarshis’ book can be read at and downloaded from The Elements Of Economics

@Philip P

Thanks for link to this analysis by Colander and Landreth; if nothing more significant, this recap of the mischevious bashing/misrepresentations of Laurie Tarshis’s 1947 text, The Elements of Economics confirmed my opinion of W F Buckley as a snobbish elitist provocateur/saboteur!

‘The MMTers … have done nothing less than construct a theoretical edifice that quite literally shakes off the old ideas completely.’

I dunno. What about MMT would Marriner Eccles really not have understood? Just asking ….

http://monetaryrealism.com/marriner-eccles-explains-it-all/

http://en.wikipedia.org/wiki/Marriner_Stoddard_Eccles

http://fraser.stlouisfed.org/docs/meltzer/ecctes33.pdf#search=Eccles

In academia, the IS-LM model is essentially passe even among the mainstream. It might be presented for its nice little mathematical properties, but the real debates now focus on AS-AD and long run growth.

AD-AS model is implicitly based on the IS-LM model. See:

http://en.wikipedia.org/wiki/AD-AS_model#Aggregate_demand_curve

That’s why Krugman et al are talking about IS-LM so much right now…

AD is, but not AS. AS is derived from the Agg Production function. The AS curve is what allowed the neoclassicals to seemingly junk keynesian economics, and brought about the Expectations Augmented Phillips Curve, Ratex-AdaptiveEx debate, and NAIRU.

And Mundell-Fleming is just IS/LM with an international trade sector added… for small, open economies!

MMT is a political perspective pretending to be a macro theory. The debates the Pilkington references have made this clear. If you don’t believe in the MMT Job Guarantee then you don’t believe in MMT. This is no different than Austrian economists saying if you don’t believe in the gold standard then you don’t believe in Austrian economics. For the Austrians it’s all about making government decentralized. For the MMTers it’s all about making government central.

Personally, I am glad the cats out of the bag because something always smelled about MMT’s approach and their obviously liberal leanings.

Back to the world of comedians!

“Reality has a well-known liberal bias.” — Stephen Colbert

And a comment by Paul Krugman playing on Colbert’s line:

“Facts have a well-known liberal bias.”

Not keeping to a fact-based discussion leads to the kind of reality distortion field that we see in modern politics.

Your comment would be more interesting if you would articulate a fact-based argument about your disagreement with the basic MMT description of how our banking system works — let’s hear your version LVG.

I didn’t even say I disagree with the MMT description of the way the system works. But I disagree with the policy conclusions they make. Just because we can’t run out of money doesn’t mean we can necessarily afford to hire everyone who doesn’t have a job. But MMT builds their whole theory around the Job Guarantee and the idea that we can only optimize economic output if we have a huge government workforce digging ditches and filling them back up.

The way I see MMT is that it does not “..build their whole theory around the Job Guarantee…” as you put it. Rather the job guarantee program is a political policy that can logically come out of the ramifications of the MMT model. There is an incredible amount of very intelligent discussion of all sorts of details to be found in the ongoing MMT dialog. And Pilkington has turned out to be quite the guide through a lot of this for me.

Keep in mind that all this economics theorizing and discussion is a “work in progress.” It’s about a century behind modelling in engineering and physics, in my opinion. Ideas that were once “common knowledge” seem less solid. For example, even some physicists are now re-examining the concept of “time.” In their view time may be a derivative property — not a fundamental one. Our models are, after all, not reality — but merely our feeble attempts to make sense out of a fantastic universe.

We live in a wondrous (and scary) revolutionary time where all sorts of assumptions about reality (including physics and economics) are being questioned anew. Economics, however, is especially complicated because it has to incorporate our very human idiosyncrasies, along with our attempts to form intelligent, functioning, very large societies with brains that evolved for small groups of about 100 humans(See Robin Dunbar).

No offense, but you misunderstand MMT. There has been a raging debate in MMT circles in recent weeks that showed that MMT is a political agenda based on the Job Guarantee. Some former MMTers even started a new sect called Modern Monetary Realism because they disagreed with the Job Guarantee and the MMTers said they couldn’t be MMTers if they didn’t use the Job Guarantee. This MMT guy summed it up best:

“Discussing MMT without the Job Guarantee is to discuss some other economic theory, and one without any stability anchor to nominal prices.”

Don’t be confused about what MMT is. It’s primarily a policy agenda to promote full employment through government hiring.

How cute. You pulled out the quote that supported your agenda but conveniently left out the link that explains why MMTers consider the JG a fundamental part of their paradigm. So much for policy agenda blinders.

Oh please. I’ve read all the silly MMT research on how hiring millions of people will only create a “one off” inflation and how the JG will serve as a price anchor and transition job. The only problem is that there isn’t a lick of real world proof to back what are nothing more than bold assertions.

Prices couldn’t rise beyond the single rise unless the wages for the Job Guarantee were raised. Something similar would happen if you raised welfare payments sufficiently.

The whole point is that you use the JG to set a minimum wage rate. If there is persistent inflation you could lower this minimum wage rate and all wages would fall. It would be a far more effective means of controlling inflation than using monetary policy and unemployment.

I guess you’re blind to the vast amount of work that needs to be done in this country on everything from infrastructure repair and development to environmental reclamation.

The government is the only entity that can do it, and the private sector doesn’t have jobs to give these people. You’d rather pay people to sit around doing nothing than make this country a better place? Where the heck is the problem?

Actually, the private sector doesn’t have the net financial assets to do it themselves. But you guys like to give the impression that only the government can do all this work. I see right through your political agenda.

“I see right through your political agenda.”

http://www.youtube.com/watch?v=dXO88iyOyK8&feature=related

Hehehe… seriously though, we claim that if the private sector leverages too much you get serious financial instability. So, in order for adequate demand to be sustained in a modern capitalist economy large-scale government spending is required. Otherwise the private sector are largely forced to go on debt binges and wreck the party.

Pretty commonsensical if you look at the past twenty years ago. No, where did I put my red flag?

PP wrote: “… we claim that if the private sector leverages too much you get serious financial instability. So, in order for adequate demand to be sustained in a modern capitalist economy large-scale government spending is required. Otherwise the private sector are largely forced to go on debt binges and wreck the party.”

The “leverage” that ultimately causes the economic contractions/collapse/instability is almost always debt in the real estate/commodity sectors since the government allows speculators to make so much money with very little risk (“other people’s money”). When the bubble pops – which it always does – the economic fallout spills over to the “productive” economy.

Real estate is entirely different from businesses that produce goods and services. The productive businesses often suffer when the real estate and/or commodity values collapse mainly because people begin to get margin calls and deleverage in general, which contracts money spent in the “real economy,” but the Fortune 500 and even Russelll 2000 companies often have fairly conservative debt-equity ratios so they are not the source of the recurring economic contractions.

The US problems really go back to the early 1980’s when the government gave real estate speculators billions of lucrative tax write-offs for real estate deals that added nothing to the “real econoony” other than increasing everyone’s debt level and increasing the amount we all pay for housing. Until the government cleans up the real estate speculators from the housing market, the economy will never get back on track for many years.

It’s entirely possible we could see 0% interest rates for the next 10 years while the Fed waits for the real economy to catch up to the current over-valued real estate prices that act as a tremendous drag on the “real economy.”

And repeating myself from another comment, there’s nothing magic about a 40-hour work week. Thus, there’s no need for any “jobs program.” We can get to full employment by just sharing the existing work. If all large employers offered 2-4 day work weeks many people would sign-on, freeing up jobs for all of the currently under-employed and unemployed, AND reducing the government transfer payments for food stamps and unemployment benefits.

Slashing taxes on working people and raising taxes on high earners of interest, rents, capital gains and dividend income frees up additional spending that will boost the economy and create even more employment opportunities.

@mtnplover

Very good and quite practical ideas. A New Deal 2.0 of sorts. Tried and true.

@mtnplover (or PP, or anyone):

Do MMT adherents have any comments on the shortened work week as a route to full employment? I’m pushing hard for it(a little self-interest, no doubt).

@jonboinAR – Regarding shorter work time, you may find this link interesting: http://www.timesizing.com/.

We have millions of people in the US competing for jobs with millions of other people in the global village.

I am retired, but not entirely by choice. If I could work about two days a week, it would bring in enough to break even. But instead of sharing jobs, it appears that many employers enjoy the high unemployment rate, which allows them to get away with abusive practices, demanding long hours well beyond 40 per week, and ever-increasing productivity. Don’t like it? Don’t let the door hit you on the way out, and good luck finding a different job! One gets the impression that no amount of fiscal stimulus will lead to private sector job creation, but would simply be absorbed without expansion, because many people like the (un)employment situation just as it is, thank you very much.

Where I worked, less than 32 hours per week is considered part time, and the employee is ineligible for benefits, which is a problem because of our mean health insurance system. It seems to me that single-payer health care would make job sharing easier to administer for employers. As it stands, they like to use temp agencies to further avoid paying benefits.

On a related note, I like the Job Guarantee idea. It makes sense for the public sector to create jobs working for public benefit. I’ve seen figures as high as $2 Trillion worth of necessary work on public infrastructure in the USA that is not getting done due to revenue and borrowing constraints at various levels of government. My understanding of MMT is that it avoids these revenue and taxation spending constraints because the federal government can spend money into existence, for example on public works projects. And there would be no “crowding out” of private sector profit-making opportunities because the Austerity Gambit (spending constraints) isn’t providing those opportunities, which is why so much needed repair and maintenance work is not being done. The way the game is currently being played, somebody must pay for infrastructure work with money that has been legally “earned” by someone (taxation) or borrowed (bonds sold).

A monetarily sovereign government is in a unique position to be able to solve at least two problems at once by bypassing the Austerity Gambit: create money as electronic ledger entries and spend it into existence to pay currently unemployed people to work on public works projects. Because we claim to govern ourselves, we can pay ourselves to work on public works projects that benefit all of us, without borrowing, and without taxation. Millions of families could begin to pay for basic necessities again, and much needed work will be done for the common good.

If I understand MMT, new money spent into the economy would not be inflationary as long as the economy grows slowly in correlation with the slowly increasing fortunes of the new public workers. At minimum wage, it seems improbable that a family would have any discretionary income. Even at a living wage, discretionary spending seems unlikely. By the definition I learned decades ago, we would not see “too much money chasing too few goods”.

Being able to expand the money supply as needed is a great advantage of a fiat money system over the gold standard. The goldbugs automatically equate expanding the money supply with inflation. But in this discussion, expanding the money supply is a healthy thing, like supplying oxygen to miners trapped underground. It’s not like they have enough, and any addition will be excessive. They don’t have enough to maintain health, and if they don’t get an injection of what they need, the situation will spiral downward and end in disaster. Fiddling with interest rates by the Fed is not solving the unemployment problem. A Federal Job Guarantee would be a good, humane tool of monetary policy.

You keep on pointing out the job guartantee, as if that is a bad thing. Pretend for a second that we don’t already agree with you, that we don’t share your ideological blinders. Why is this a bad thing? If it isn’t good marco theory then you might want to actually articulate why that is the case. Just saying this doesn’t make it so. While we are talking about monetary policy here and the financial markets, this doesn’t exist in a vacuum. I haven’t seen anything that you have posted that shows you understand the larger debate and how this fits into other parts of the economy.

“Actually, the private sector doesn’t have the net financial assets to do it themselves. But you guys like to give the impression that only the government can do all this work.”

Huh? You admit that the private market can’t do this, because it can’t, then claim that people are wrong for saying that government should. If not the private market nor the government, then what? There would be no internet, computers, civilian aircraft, satellites, most biotech breakthroughs, amongst many other things, without government support. So, explain. You don’t like government apparently, yet you admit (for good reason) that private interests can’t do this. Should we just leave people to rot? Maybe you like the surplus army of labor driving down wages. Am I wrong?

“In truth these models (ISLM) are built on the back of a seriously flawed theoretical edifice.

The MMTers on the other hand, together with their post-Keynesian colleagues have done nothing less than construct a theoretical edifice that quite literally shakes off the old ideas completely.”

Philip, do you really believe that there is no normative slight-of-hand taking place at the level of the intellectual construction of MMT?

What if the MMTers theoretical edifice is ultimately as normative (just State biased rather than Market biased) as the theoretical edifice which stands behind the ISLM model?

What if all supposed pure description is disguisedly prescriptive?

And what if democracy can then be theorized as the political counterpart to the fact that none of our theoretical edifices transcend circularity?

Then all of us are equal in our ignorance (with none of us, especially economists, of whatever theoretical edifice, being able to claim superior knowledge) which leaves us with the realization that we may only have each other to rely on to fashion our structure of collective living.

We’re not talking about MMT generally (obviously job guarantee is normative). We’re talking about their description of the banking system and how credit is created. This is not normative, no.

Philip, it’s an important point that in way the JG is not “normative”. What is are the goals of full employment & price stability. Goals which just about all economists pretend to have, at least publicly. The JG is a policy aimed at achieving these goals. It can be measured objectively how it satisfies them. IMHO, theoretically & empirically it is clear that the JG is the policy solution, even more than the leading MMTers say. There just isn’t any other conceivable different policy that has a snowball’s chance in hell of the same universal applicability – at best it would be a JG in all but name, or varieties of old-fashioned Keynesianism which would have the same price stability defects.

Come on LVG get up to speed! Of course MMT is a potential political perspective. It’s pointing out that “entitlement” to well-being can come in cooperative form and not just a selfish Libertarian version as far as money creation is concerned.

Mr. pilkington, If the Fed sets the price of money where by banks keep money in reserves, by default it also sets the supply. No?

Sorry, the immediate above is related to :

“..they do not think that the central bank determines the supply of money at all. Instead it merely sets the price of money (that is, the interest rate) and allows the demand to adjust to this price.”

Sorry, I realized my first statement may not be an explicit question. Let me restate:

If the interest rate paid on reserves is higher than which a bank can loan in the market, it will park the cash at the fed in the form of reserves to get the higher rate. Will this not effect the money supply? Or more specifically, will this not effect the amount of loans made in the economy?

Yes. But interest paid on reserves sets the interest rate. So, again we’re back to the fact that the Fed sets the interest rate and lets demand adjust (i.e. the amount of loans banks can make to the public at that price).

No. If money ‘costs’, say, 3% a year and the economy is doing very well firms and households will borrow lots. If money ‘costs’ 3% a year and the economy is in the crapper few will borrow at that rate.

The demand is determined by how well the economy is doing. The supply is set at a fixed price.

Think of a car manufacturer with a monopoly and infinite capacity. He sets the price of a car at $20,000. That’s the supply price. The demand will come from the amount of spending power people have available to buy the car; their propensity to buy cars at that price etc.

Mr. Pilkington,

Thank you for the response. Much appreciated.

I think I agree with everything you said.

So it sounds like what you are saying is that GIVEN some price level chosen by the fed, demand is actually what determines the money supply. Correct? I think this is analagous to your monopoly car mfr. and the 3% loans example. Right?

BUT, if this is true, if the Fed changes the price, will this also cause a change in quatity demanded, resulting in a change in the money supply?

Sorry, I hope my questions makes sense. Please let me know if I need clarification.

Thanks

Glen

If Fed ups the interest rate we assume that demand should fall because price for money has become more expensive. But this doesn’t necessarily have to happen. If a boom is strong enough or there is significant inflation then firms and households might continue to borrow at the same pace despite the high price.

But generally, yes, if the Fed hikes rates demand for loans should in theory fall. Just as if the car manufacturer raised prices on the cars less people would buy them… unless of course they REALLY wanted cars or there was persistent inflation and the price hike simply kept pace with upward trend in wages etc.

Thank You…Much appreciated!

I appreciate all of the discussion about various monetary theories often presented on this blog, but when I hear changes to monetary policy thinking being used as some sort of rational for a jobs programs – which is often – I shudder.

The last thing we need in the US, Europe and Japan is for governments to go further into debt to create jobs. Debt has real consequences, namely the transfer of huge sums of interest and principal to the wealthiest and most powerful AND often subservience to the bondholders who can force governments into tight corners. Being a debt slave is not much different than being a regular slave, although actually it’s worse since it’s usually a previous generation that got to spend the money and later generations that have to pay off the debt and interest.

If the discussion is about jobs, let’s face facts. An increasing number of jobs that don’t involve an advanced degree can be performed by machines, better and cheaper than human labor (and fewer lawsuits!) The main policy issue of our day is that we won’t need hundreds of millions of hours or tens of millions of people to produce all the goods and services needed by society.

There isn’t a production problem in the advanced economies; it’s a distribution problem. The solution to this quandry is fairly simple without resorting to mucking around with the money system that could lead to all sorts of negative consequences. Instead,

– Reduce the work week at big employers to 3-4 days with proportional reduction of pay and benefits, which will absorb the 20% under-employed. (Poof – the unemployment problem goes away.);

– Eliminate regressive payroll taxes and income taxes on lower earners (below $50K) and eliminate regressive sales taxes, replacing the revenue with higher taxes on rents and businesss gross receipts. (This puts much more money into the pockets of working people which will spur business income and hiring.)

– Add a 30% excise tax on anyone receiving more than $150,000 a year of combined rent, interest, dividend and capital gain income, using the proceeds to pay off regressive and damaging government debt.

To a first approximation, quite sensible. Going one step further would show that the “distribution problem” is a balance of payments problems. From there on it’s nothing but politics. Ditto for working hours, retirement age etc.

Re: Philip March 8, 2010 3:30P.M.

“We’re talking about their description of the banking system and how credit is created. This is not normative. No.”

Philip what I am trying to get you to look at more closely is the specific role of conceptualization in the MMT description of the banking system.

I would argue that how MMT linguistically frames its description of the banking system is never totally determined by the banking system itself.

For example, Scot Fullwiler, one of the architects of the theoretical edifice of MMT has argued that “the tactical logic of operations as employed by MMTers is (a)general, in the sense that the purpose is to consider a “pure”fiat system under flexible exchange rates, or a state government that is a currency user and so forth—in a general sense, not specifically referring to any particular nation or state, and (b)particularly concerned with a hierarchy of authority and thus a hierarchy of money.”

Is the conception of a “hierarchy of authority” inherent in any description of the U.S. Banking system?

Could a description of the U.S. Banking system be given without focusing on the sovereignty of the ultimate authority?

Does such a conception as “hierarchy of authority” indicate any normative bias toward the State rather than the Market?

Is there an MMT decision prior to the MMT description of the U.S. Banking system as to where to cut their conceptual focus?

“Is the conception of a “hierarchy of authority” inherent in any description of the U.S. Banking system?”

Ugh… yeah. The central bank is at the top of the chain. Member banks below. Non-member banks below that.

I think you’re reading too much into this. Way too much. It’s not a conspiracy.

Jim,

You are so close to understanding the MMT scam. This exact debate has been raging on other websites for weeks now. What MMT does is confuse the reader into thinking that the state has a monopoly on money. They make this argument by saying there is a “hierarchy of money”. They want you to believe that the state is the center of our economy. So they create this myth of the monopoly.

The MMRists explain this:

“A true monopolist controls both supply AND price. But the government controls NEITHER in the private banking system. They have only a very loose influence over both. There is no “monopoly supplier of money” in such a system. There is a monopoly supplier of bank reserves (the Federal Reserve). There is a monopoly supplier of government debt (the US Treasury). But if anyone is the monopoly supplier of credit it is the private banking system. And credit makes up the vast majority of money in the modern monetary system. Interestingly, MMT often highlights that a monopolist’s powers are about price and not just quantity. As Mosler states:

“With today’s central banking and monetary policy with its own currency, it’s always about price (interest rates) and not quantities.”

MMT obscures reality with terms like “net financial assets” and “monopoly” in order to push their political agenda of the job guarantee forward.

MMT is not a scam at least as far as this:

1) A monetarily sovereign nation has the inherent, inalienable right to spend its own money into circulation.

2) A monetarily sovereign nation has the inherent, inalienable right to require its money back for taxes and fees.

See Matthew 22:16-22 for confirmation.

The confusion results because fiat is often de facto legal tender for private debts too which is clearly unjust.

Look we can fight over government or private control of the money supply till Doomsday* UNLESS we realize the proper solution is both government AND purely private money supplies.

*Soon, unless we wise up in a hurry?

“A monetarily sovereign nation has the inherent, inalienable right to spend its own money into circulation.”

A “sovereign nation” has the inherent, inalienable right to make marmalade out of chilly peppers. It doesn’t mean that it makes sense to do so. A tautology proves nothing.

Well, sometimes it is good to remember the basics of government money creation. Too bad Greece and Ireland forgot them.

But yes, it makes perfect sense from an ethical viewpoint for a monetarily sovereign nation to just spend its own inexpensive fiat into circulation and to tax it out of circulation (only as needed to control price inflation in its money). Anything else is fascism.

We had best learn to implement money ethically. This crap is way past old.

“Too bad Greece and Ireland forgot them.”

National currency isn’t the same as a corrupt government monopoly on money.

“But yes, it makes perfect sense from an ethical viewpoint for a monetarily sovereign nation to just spend its own inexpensive fiat into circulation and to tax it out of circulation (only as needed to control price inflation in its money). Anything else is fascism.”

No it doesn’t. We do that now, the Fed is part of the Gov and the deficit is “its own inexpensive fiat spent into circulation”. There absolutely no reason why the same system, with similarly appointed regulators would preform any better. Most importantly, that kind of cute-sounding “spending” is a regressive tax. So you are proposing a system of regressive double taxation.

Historically speaking, you are describing the Continental… it couldn’t last a decade! Short memory is a source of far reaching problems.

One must not proclaim something to be ethical based on hopes and groupthink. That’s intellectually dishonest.

We do that now, the Fed is part of the Gov and the deficit is “its own inexpensive fiat spent into circulation”. votersway

You neglect [deliberately?] to mention sales of government bonds on the secondary market.

There absolutely no reason why the same system, with similarly appointed regulators would preform any better. votersway

Since your premise is wrong your conclusion does not follow.

Most importantly, that kind of cute-sounding “spending” is a regressive tax. votersway

That would depend. If the deficits were less than or equal to productivity gains in the government’s money there would be no such tax. Or if the population could use genuine private money supplies for private debts the population could dodge that “stealth inflation tax”.

So you are proposing a system of regressive double taxation. votersway

MMT is only 1/3 of the solution. We also need a universal bailout and genuine private currencies for private debts. Genuine private currencies would entail removing all explicit and implicit government privileges for the banks including borrowing by the Federal Government. And btw, the current system is double taxation: We are taxed by inflation when the Federal Government issues debt (since the debt of a monetarily sovereign nation is itself a form of money) and again when we pay interest on that debt.

You neglect [deliberately?] to mention sales of government bonds on the secondary market.

In that regard, the present system is better than MMT – at least, it keeps track of the counterfeit and discourages using it. If I’m wrong it’s only to the extent of not revealing the full scope of MMT insanity, strawman. There is no time for every little wrinkle of it.

That would depend… “stealth inflation tax”

Nobody mentioned “inflation tax”, strawman. Don’t put words in my mouth. “Spending” counterfeit is a stealth regressive tax under either inflationary or deflationary environment. What actually happens depends on the RATIO between the two extraction mechanisms. As usual, it would move between the two depending which way the public dislikes less – nothing new here. It’s a way to hide the stealing foisted by the counterfeiter – government or whoever.

MMT is only 1/3 of the solution.

You don’t have to be so shy… MMT is a big part of the problem, to the extent it’s here today.

The unaccountability and stealth are the tools that allow the real wealth of the country to be destroyed by moving it offshore. Wealth is production capacity, not money… don’t you know that?

Monkeying with money only deepens the corruption which makes the delusional short term gains of its cheerleaders even shorter term.

As for the solutions, I have already listed them elsewhere on this thread but let’s recap – balanced trade, high lending standards, Glass-Steagall, transparent Fed, limited bank size, etc. See votersway.com

“A true monopolist controls supply and price.” It’s statements like this that make me wonder if the MMR-ists have a solid grasp on conventional economics 101, let alone anything more complex. As a monopolist you can set your price, but can’t control how many sales you make at the price. Alternatively, you can set the quantity, but again you can’t guarantee that there will be the right numbers of buyers unless you let the price float. Obviously, there’s a combination of price and quantity that maximizes profit but to say that the monopolist “controls” both is simply ridiculous.

Apart from that, mixing up discussion of monopoly as it applies to the supplier of a commodity (which money isn’t) and monopoly as it applies

to a currency issuer is equally ridiculous. Currency monopoly is a legal monopoly and the government remains the monopolist, at least until the laws are rewritten to all allow banks to issue their own currency or print their own government money.

“A monopoly (from Greek monos μόνος (alone or single) + polein πωλεῖν (to sell)) exists when a specific person or enterprise is the only supplier of a particular commodity. ”

A monopoly is always about being the sole supplier. Thats called quantity. Pick up a dictionary before you go saying stupid stuff.

And still the monopolist can not set both price and quantity. If I’m the sole supplier of widget A, I can set the price at $1, $10, or $100 if I want to. Noone can undercut me. Doesn’t mean I can control how many people put down their money at 1, 10 or $100. If I set the price, the quantity has to float. This is a matter of basic economics. Consulting a dictionary really doesn’t help much.

A monopoly is always about being the sole SUPPLIER of a commodity, good or service. It’s never about being the monopolist on demand. I love it when MMTers get called out on their word games!

Talk about econ 101!

Who said anything about “monopolists on demand”? If I had meant to talk about monopsony I would have done so.

And surely we’re discussing economics not playing “gotcha” with dictionary definitions. Economically speaking, monopoly power is price-setting power. And the government retains power over the price of credit even if the actual loan-making is left to the private sector. If you think that’s untrue, why not make some substantive argument to that effect?

Okay fine. Let’s use your revised definition where a monopoly is all about price and not the supply of the good or service that the monopolist has the sole supply of (haha!).

The price of credit is targeted by the government. That’s why they call it the Fed Funds Target rate. It’s really easy to understand. Banks then try to make a profit based on this target rate by creating a spread with borrowers. But the size of the spread is not dependent only on the target rate or cost of government money. It is mainly based on the credit of the borrower. That’s why your mortgage, if you have good credit, is less expensive than your neighbor who has bad credit. That’s why your credit card interest rate increases when you miss payments. The spread has to do much more with the creditworthiness of the borrower than the government. So it’s easy to see that the government doesn’t control the price of credit except in a very loose way. To describe that as a monopoly is wrong.

“And still the monopolist can not set both price and quantity.”

Except that was not what was claimed. The claim was that the monopolist can set both quantity supplied and price. Nowhere was it said that the amount supplied would necessarily be sold in the market at the price set.

And please note that “money” and “currency” are not the same thing. If you want to debate about something, please refrain from talking about fish when the debate is about cucumbers.

“not necessarily sold in the market”? — We’re talking about credit issuance. Credit doesn’t even exist (except as some kind of legal

potentiality) until it is sold in the marketplace. Even for a physical commodity that’s pretty weird monopolist behavior. He’s producing a set quantity at a set price whether or not he can sell it?

“That’s not what was claimed.” – It was claimed that since the government set the price of credit but not the quantity extended by the private banking center that this alone somehow invalidated the MMT idea of government as monopoly currency supplier. Now even if we

nationalized every bank and the government issued loans directly it still

couldn’t set both the price of credit and the quantity demanded in the

market. Subcontracting loan issuance to private banks doesn’t reduce

the government’s price-setting power. It sets the price of credit (through

interest rates and the regulatory requirements imposed on the banks)

and market demand at the price sets the quantity. Just like any other monopolist.

“talking about fish and cucumbers” — I used the word “money” (in the broad sense i.e. a debt instrument, or transferable liability of any kind) once, saying that it is not a commodity. I used “currency” to refer

to a particular unit of account, issued by a particular institution (the yen, the dollar, etc.) I guess I did write “until banks can print their own government money” when I should have used currency to be perfectly consistent though the meaning seems clear to me. Nevertheless, I vow to never again say “fish” when I mean “cucumber”.

More MMT nonsense. Let’s get a few things straight. Money is credit according to MMT. Credit is issued by banks. MMT says a monopolist controls price. But the government doesn’t control the price of credit. They set a target rate. That’s why it’s called the Fed Funds TARGET rate. So do the math chief. Money = credit. Monopolist = controlling price. The price of credit isn’t controlled by the government. Therefore, no monopoly on money.

Is that clear enough for you?

Fine, the government’s sets a TARGET not a PRICE. So give some examples. Where the central bank sets a target and fails to hit it. Where the central bank announces a cut in interest rates but the private sector raises interest rates instead. (No gold standard or pegged currency regimes please). If there are no examples, TARGET = PRICE.

The Fed doesn’t fail to hit its target rate. But that doesn’t matter with regards to the monopolist argument. The price of credit is pegged off the price of government money, but it is SET at the price of government money. That’s why you can end up paying 25% for your credit card when the Fed Funds Rate is 0%.

It’s pretty easy to understand that the banks control the price of credit and the government only loosely targets the price of credit.

mistake there:

“The price of credit is pegged off the price of government money, but it is NOT SET at the price of government money.

Isn’t it clear that the REAL interest rates depend on the general health of the economy? And that health depends on such regulatory policies as the balance of payments, the lending standards, bank transparency, size and accountability.

One can print money until the cows come home and ain’t gonna do squat with regard to improving the economy if the above problems aren’t taken care of. Setting the price of money can do little good but it’s wrought with corruption problems. The Fed has been doing that for a very long time and look where it got us. Fed=Gov, so MMT is more of the same.

Stop chasing your tails and face reality.

Word on the streets is both MMR and MMT are a soft un – implied sovereign default.

Skippy… whispers of what England will do if the Euro goes boom and whom they will trade with… Canada, India, commonwealth mob, plus… ?

That’s the soft version of it. The hard one has to do with the “Job Guarantee” provided by the Gulags…

I don’t know where or how your plugged into the system, so I’ll have to leave it up to imagination as to how large a cross section you can – have observe[d. Personally I don’t see either as a doomsday scenario, can’t get much more fooked up as it is.

And as always, peoples fear will lead the way. This is as much a mental perspective issue as it is an activity[s out put problem. So for every attempt to resolve the currant predicament, half the mob will have a tanty and the other half rejoice, whats a body to do?

To top it all off, most of the world population has no idea of what has happened ( 40ish years for simplicity ), mentally kettled, manufactured desire, ideological log jams, even the big dogs are scratching their heads and eying each other off ( want to position themselves for an advantageous landing over the others ), it is a game you know ( markets are a gaming platform DYK). Completely with out an informed opinion save what was / is injected into their mental cortex via massive MSM, ideological think tanks, beliefs from antiquity, et al.

Skippy… compassion is sorely absent in all their formulas, more so than fraud, whom and for what reasons is this so prevalent?

PS. slowing down would be the simplest solution, yet its not tabled in a compassionate way ie. austerity, so much for husbandry… eh.

Gulags? We have that today, its called 3rd world manufacturing for service sector 1’st world economy’s.

Skippy… dearth is an export.

A summary of the differences between MMT and the current system:

1. Hide the budget deficit number behind the “right” of the government to print counterfeit and tax to infinity. The deficit number will no longer be kept track of.

2. Impose regressive double taxation – releasing the counterfeit in circulation is a regressive tax, collecting it back through normal taxation is another tax.

3. Hide or at least deemphasize the trade deficit number behind talk about “subjective values”, diverting attention from the incredibly destructive nature of large trade deficits and structural imbalances.

4. Replace sound science with occult shamanism and put an end to the demands for sound economics. The public will have to accept vague promises and disastrous results as matters of course. The public will also be forced to forget about numbers altogether and be led into a crusade against the new unwanted religion – the religion of truth and numbers.

5. Replace job quality and choice with government Gulags where people are engaged in nasty but useless activities in the name of “having a job”. Put an end to the various means of unemployment support to prevent people from receiving training and selecting their jobs. The hard work at the Gulags will have the additional “benefit” of combating the faith of the people in honesty, numbers, soundness, truth and other nasty religious remnants from the past.

Is this Socialism, Communism or Fascism? I don’t know, it looks like the worst of all three. Silly me, I was hoping for reservations at worst… MMT goes the extra mile… Gulags.

I was going to make a comment about how the ISLM model is only supposed to be a rough empirical predictor, and how you MMTers haven’t got a better one, but then I noticed…

Phillip, you’re just wrong. You’ve misunderstood the LM curve, which is kind of pathetic.

I know *why* you misunderstood it — because economists insist on drawing their graphs backwards!

The LM curve says that the difference in demand for money depends on the interest rate, NOT vice versa, so this statement of yours is WRONG:

“Basically, it means that when the demand for money rises interest rates should rise too,”

This is precisely backwards. This is why economists need to draw their graphs with the independent variables on the X-axis like everyone else in the world. You have gotten the independent and dependent variables in the model confused!

Please try again.

Hmm. I see that the traditional Wikipedia version of IS/LM claims that the income is the independent variable for the LM curve. So I can’t fault you for believing that…