Yves here. Even though I pointed to this article yesterday, it is such a prototypical story of a type of success peculiar to Corporate America that I thought it warranted being featured.

By Mark Ames, the author of Going Postal: Rage, Murder and Rebellion from Reagan’s Workplaces to Clinton’s Columbine. Cross posted from eXiled.

This article was first published in The Daily Banter

Last month, shareholders finally rebelled against Citigroup, the worst of the Too Big To Fail bailout disasters, by filing a lawsuit against outgoing chairman Dick Parsons and handful of executives for stuffing their pockets while running the bank into the ground.

Anyone familiar with Dick Parsons’ past could have told you his term as Citigroup’s chairman would end like this: Shareholder lawsuits, executive pay scandals, and corporate failure on a colossal scale. It’s the Dick Parsons Management Style. In each of the three companies Parsons was appointed to lead, they all failed spectacularly, and somehow Parsons and a handful of top executives always walked away from the yellow-tape crime scenes unscathed.

This past April, for his final act as Citigroup’s chairman, Dick Parsons made sure that Citi’s top executives were handsomely rewarded for their failures. He arranged a pay package for CEO Vikram Pandit amounting to $53 million despite the fact that Citi’s stock plummeted 44% last year, and has woefully underperformed other bank stocks even by their low standards. Citigroup, as you might recall, got the largest bailout of any banking institution, larger than BofA’s– $50 billion in direct funds, and over $300 billion more in “stopgap” federal guarantees on the worthless garbage in Citi’s “assets” portfolio. Those are just the most obvious bailouts Citi received—this doesn’t take into account the flood of free cash, the murky mortgage-backed securities buyback programs, the accounting rules changes that allowed banks like Citi to decide how much their assets “should be worth” as opposed to what they’re really worth on their beloved free-market, and so on…

So just as Dick Parsons stepped down as Citigroup chairman last month, shareholders finally rebelled, suing Parsons, CEO Pandit and a handful of executives for corporate plunder.

Again, with Parsons, it’s the same story every time: Three executive jobs, three disasters, each worse than the previous one.

Before Citigroup, Parsons headed AOL Time Warner, where he helped pull off what is widely considered the single worst business deal in corporate American history: a fraud-rife merger that wiped out $200 billion in shareholder value, ruined employees, retirees and investors, sparked numerous criminal investigations and dozens of lawsuits, and yet somehow managed to enrich a tiny handful of executives—including Dick Parsons—to the tune of hundreds of millions of dollars.

Why would the government agree to name the AOL Time Warner failure Dick Parsons, Chairman of Citigroup in January 2009, just as the world’s largest banking institution was taking the biggest bailout packages, and just as its legal ownership was taken over by the American public?

It’s a basic question that goes to the heart of Dick Parsons’ rise to the top. It’s a question that should have been put to AOL Time Warner when he was thrust to the top of that firm, considering the giant S&L failure Parsons oversaw before moving over to AOL Time Warner.

From the late 1980s through the mid-1990s, Parsons served as a top executive and then chairman of Dime Savings, the Northeast’s poster child for savings & loan criminal fraud. Dime was Parsons’ first executive job—and Dime turned out to be the New England region’s closest equivalent to Charles Keating’s Lincoln Savings, a giant criminal fraud mill with victims ranging from gullible low-income home buyers to entire regional economies laid waste to fraud-pumped housing bubble.

At least in the S&L crisis of the late 80s and early 90s, some people went to jail—and Dime’s affiliates in the New England states sent scores of fraudsters to prison. Those investigations led to Dime’s New York headquarters where Dick Parsons was, but for some strange reason, even with a federal judge openly demanding criminal charges for Dime’s senior executives, in the end, Parsons and the others got away with it.

Here, for example, is a 1994 article from the New York Times about what went on at Dime Savings under Parsons’ leadership. Notice the remarkable similarities in the mortgage scam described in the article to the mortgage scams pulled off in our time:

U.S. Fraud Inquiry Into Dime’s Mortgages

Federal officials are investigating the Dime Savings Bank for possible fraud in its home-mortgage business.

The inquiry, which is being directed by the United States Attorney’s office in Concord, N.H., is apparently seeking to determine whether Dime’s executives knew during the late 1980′s that documents were falsified to allow unqualified borrowers to get loans.

The investigators also apparently want to know whether those executives knowingly allowed such mortgages to be included in packages of loans that were sold to investors.

The loans in question are known as low-documentation loans. Unlike traditional mortgages, they were often approved on the spot, with little or no background check on an applicant’s qualifications, which were often questionable.

Sounds familiar, doesn’t it? What happened at Dime in the late 1980s—the predatory subprime loans hard-sold to the least sophisticated borrowers, loans with hidden adjustable rates which they called “low-verification” mortgage loans… the fraud in the documentation, preying on the least credit-worthy, least qualified borrowers in order to pump out as many bad subprime loans as fast as possible, dumping the losses on the government—what happened under Parsons’ watch in the late 1980s, only to be revealed in the early-mid 1990s, was repeated on a grand scale a decade later at banks like Citibank, resulting in massive payouts to a small group of executives, and devastation for everyone else.

Now that Parsons is finally stepping down as chairman, I want to briefly re-trace Dick Parsons’ career. His rise from a middle-class, frat-boy slacker, to suddenly find himself at the very pinnacle of American power and finance– offers us some insight into the culture and ideology of the ruling One Percent. To quote Starship Troopers: “To defeat The Bug, we must know The Bug.”

Why Dick Parsons? Why is failure so valuable? Why was Parsons so handsomely rewarded in perfect inverse proportion to the spectacular damage he caused to so many others? That is the big question.

Dick Parsons’ biography can be summed up in two phases of his life: before meeting Nelson Rockefeller, and after meeting Nelson Rockefeller.

Before meeting Nelson Rockefeller, Dick Parsons was a self confessed clown from a middle-class African-American family in Brooklyn. “Left to my own devices, I don’t feel any compulsion to strive,” he told to the New York Times. Race was never an issue with Parsons either: ”I don’t have any experience in my life where someone rejected me for race or any other reason.’

So Parsons dropped out of high school with a “C” average, earning a GED certificate. He enrolled in the University of Hawaii for reasons he could never really explain, joined a frat, and became their social chairman. As one of Parsons’ frat brohs recalled to journalist Nina Munk, “Here’s this guy who’s at the bar sixty-seven days in a row and, as you can imagine, he did very poorly in school.”

Parsons did worse than poorly: He flunked out of U. Hawaii. Without earning a degree.

And then slacker Dick Parsons met oligarch Nelson Rockefeller, and from here on out, Parsons lived out a Cinderella fairytale for the One Percenters. As luck would have it, Dick Parsons’ grandfather was once a favorite groundskeeper at the famous Rockefeller Compound in Pocantico Hills and lived in a hut on in the shadow of the oligarchs’ mansion. Soon, Dick Parsons and his wife would move into one of those same groundskeepers huts under Nelson Rockefeller’s patronage.

As Parsons later admitted, “The old-boy network lives…I didn’t grow up with any of the old boys. I didn’t go to school with any of the old boys. But by becoming a part of that Rockefeller entourage, that created for me a group of people who’ve looked out for me ever since.”

And so, magically, despite failing out of Hawaii without a degree, Dick Parsons was accepted into the Albany University Law School program. Nelson Rockefeller happened to be in Albany too at the time, serving as governor of the state of New York. Dick Parsons was chosen to be an intern for Rockefeller.

Whereas before, when Parsons didn’t study he failed out, now, after meeting Nelson Rockefeller, by some magical twist of fate, he was the law school’s valedictorian. Sandy Stevenson, a fellow law school classmate of Parsons’ who became a professor at Albany Law,recalled: “He didn’t study hard. He played a lot of bridge. He was so smart he didn’t have to study, and he was in the cafeteria playing bridge a lot.”

Parsons took the New York state bar exam, and scored the highest in the state, beating out all the high-achieving Ivy Leaguers that year. It may have been a complete coincidence, but Nelson Rockefeller’s right-hand man, Harry Albright, was in charge of both the law school internship program with the governor, and in charge of scoring the New York state bar exams.

By another coincidence in the 1980s, the same Harry Albright headed the Dime Savings thrift, and this same Harry Albright appointed Dick Parsons to replace him.

Parsons did something right at Dime Savings. Something wrong for everyone else, but something right for those who mattered. A handful of executives pulled off what looks remarkably like the sort of “control fraud” scheme described by Bill Black: Quickly saddle the thrift with enormous amounts of bad mortgage loans, inflate the assets, loot, cash out, and dump the problem on the public.

Parsons proved himself useful in that scam. He played wingman for Harry Albright as they loaded Dime up with bad mortgage loans in warp-speed time, practically doubling the asset base from less than $7 billion in early 1987 to over $12 billion in late 1988. At the same time, as reported in the New York Times, “Checks from thousands of homeowners stopped coming.”

With the asset base pumped up and ready to collapse, Albright cashed out and moved his lawyer, Dick Parsons into the CEO’s seat to cover his tracks.

Often times I hear non-One-Percenter Americans ask, “How do these people sleep at night?” Harry Albright answered that question to the New York Times: “I am entirely unapologetic.”

Promotions and appointments followed in rapid succession for Parsons for a job well done, his career advancement largely to helping hand of Nelson Rockefeller’s brother, Laurance Rockefeller: board positions at Fannie Mae, Citibank, and most importantly, Time Warner. Thanks to Laurance Rockefeller’s introduction, Steve Ross brought Parsons onto Time Warner’s board, paving the way for Parsons to replicate his “success” at Dime over at the new AOL Time Warner, and later again, to replicate his AOL Time Warner “success” at Citigroup.

After Parsons took over AOL Time Warner, the New York Times summed up his career trajectory:

In 1988, Mr. Parsons was recruited to serve as president of the Dime Bank by Harry W. Albright Jr., another former Rockefeller aide. A few years later, the Rockefeller hand intervened again: on the recommendation of Laurance Rockefeller to Steven Ross, Mr. Parsons was invited to join Time Warner’s board in 1991. He became president of the company in 1995.

Parsons knew where his bread was buttered, as captured with painful, barely-concealed patronizing racism in this New York Times profile from the early 1990s:

”I owe them,” Mr. Parsons said of the Rockefellers one evening as the Dime’s chauffeur took him to Pocantico Hills. ”I didn’t go to the right school. I wasn’t from the right side of the tracks. But when I was fortunate enough to hook up with Nelson Rockefeller, that’s how I developed my own network.”

And the feeling was mutual, in a vague, cold, One Percenter sort of way:

“My brother liked and admired and relied on him very much,” David Rockefeller said. “I’ve always had very warm feelings about him myself.”

In fact, all the One Percenters loved their Dick Parsons:

”He’s one of the few people in this industry that I would just as soon have a shake-hand deal with as a legal contract,” said Rupert Murdoch, chairman of News Corporation, who needed the Time Warner system to carry the Fox News Channel.

Michael Eisner of Disney, which battled with Time Warner for access, also praised Mr. Parsons: ”He handled himself in such a gentlemanly and reasonable way that he got the job done.”

Everyone else would disagree of course—as revealed in the dozens of lawsuits against Dick Parsons and his fellow execs at AOL Time Warner. But they don’t count—and besides, all those settlements and legal fees were covered by AOL Time Warner, meaning Parsons and the executives were able to plunder the company to pay for their previous plunder of the company. No skin off Parsons’ back, and no skin off of the backs of those whom he “owes.”

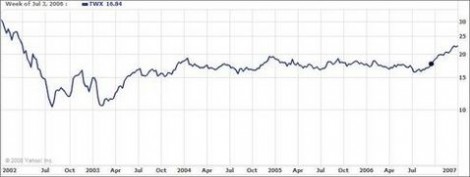

AOL TimeWarner stock during Parsons’ tenure: Oops, missed the entire bull market run!

It all reads like some half-baked hippie’s paranoid Bilderberg-obsession—and yet, Parsons’ failure up to the top, guided all the way by his “network” of oligarchs, is just the flat, unvarnished reality.

In 2007, as Citigroup director in charge of the compensation committee, it was Parsons who approved the obscene pay for outgoing CEO Chuck Prince. Parsons also played a key role in hiring current CEO Vikram Pandit, and in Citi’s awful decision to buy Pandit’s failing hedge fund, Old Lane, for $800 million in 2007—netting Pandit a cool $80 million. Shortly afterwards, Citi shut down Old Lane, collapsed, and turned to taxpayers for a $50 billion bailout and hundreds of billions more in guarantees and the like.

In November 2008, lifelong Republican Dick Parsons was brought into President-elect Obama’s transition team, thanks to then-Citigroup chairman Robert Rubin. There was talk that Parsons might be Obama’s Treasury Secretary; instead, in January 2009, he replaced Rubin as Citi’s chairman.

Almost immediately, Parsons went to work fighting executive compensation limits, and obstructing banking reforms and making sure that FDIC chief Sheila Bair was unable to do her job effectively. Using taxpayer dollars, Parsons hired one of the darkest operators in DC, lobbyist Richard Hohlt, to fight against the interests of the same taxpayers who had bailed Citi out and who now effectively owned the bank. Hohlt’s impressive resume includes his role in drafting the 1982 savings & loan deregulation bill that most agree made possible the S&L collapse possible—a bill that helped make Dick Parsons and his Dime Savings pals rich. Hohlt lobbied for the scandal-ridden Fannie Mae (where Parsons served as a board director), for Washington Mutual (which took over Dime Savings), for Time Warner… Hohlt even played a central role in the Valerie Plame scandal, serving as go-between in the leak between Karl Rove and Robert Novak.

When news first hit that Parsons had hired Hohlt, former banking regulator Bill Black commented: “It is singularly obscene that any recipient of taxpayer assistance through the TARP program during the current financial crisis would hire one of the most infamous lobbyists in the world to represent them.”

Naturally, Dick Parsons hired him to protect Citigroup—and it worked. Talk of breaking up “Too Big To Fail” Citigroup is pretty much over now. The perpetrators are safe. The shareholders are angry, as are Citi’s victims of fraud in the years since Parsons joined, as are the rest of us who didn’t profit from the plunder of Citigroup, and the plunder of the treasury to keep Citi going.

Today, Parsons is gone from Citigroup, but he’s not gone from our lives: He’s just been appointed as Gov. Andrew Cuomo’s “education czar” for education reform in the state of New York. Sorry kids.

All of this begs the question: What makes whacky conspiracy theorists any worse or any more deluded than the “Meritocracy Theorists” who’ve been promoting a fairy-tale version of America since Reagan’s Revolution, a fairy-tale version in which talent, hard work and innovation are supposedly rewarded, and failure is punished? It’s time to admit it once and for all: Failure is the whole point. Failure makes looting easier and quicker. In that sense, Dick Parsons has been rewarded for a job well done.

The game is rigged, and Dick Parsons’ rancid story gives some insight into how the rigging operates, and why failure is so valuable. What looks like failure to us, like losing our jobs and our future and our democracy—is success and riches to the One Percent who profit from this dystopian setup.

Ames doesn’t understand success and class. Once you are a CEO you are a success; performance has nothing to do with it. Parsons was CEO several times. That’s success. Of course he was hired again after his company failed. He succeeded; the company failed. There is no connection between the two.

Parsons belongs to the rich. This class cannot fail. It’s axiomatic: axiom 1: rich people succeed. Ames, hit the books and try again.

that’s exacly ames’ point…

are you really that dense?

Oh. My. Goodness.

There’s just 2 rules they know & follow:

1. Anything goes, just don’t get caught.

2. If you get caught, just have a powerful network ready.

All other rules only exist for us dumb fools – not to get in their ways. Now “education czar”?? They will sure succeed and bring everything down in the end.

“The game is rigged” sounds like an euphemism.

Pretty much explains the bail-out logic.

The problem is with a misunderstanding of the end goal. Ames starts from the position that organizational success is the end goal when it doesn’t appear to be the case. Ames illustrates that Parson is in fact very good at what he does and, by showing three examples, his success is most likely not a fluke. To that point, I think it is unfair to insinuate that Parson cheated his way through law school and cheated on the Bar. These are some massive claims that should be substantiated before throwing them into an article.

George,

What kind of idiocy are you spouting? Cheating his way through law school and the bar are exactly the kind of successes that Mr. Ames details in his three other examples. If you want to critique the article for “misunderstanding of the end goal”, you have to apply that critique to the whole article, not cherry pick only the portions that bolster your argument.

If Mr. Parsons is so “very good” at cheating and bankrupting his companies, why assume that he would not rise to the bait when faced with a test? Must we endlessly indulge these pampered elites with politeness and benefit of the doubt, as you endorse? I doubt them — so sue me.

there is something almost hilarious about Mr. Parsons’ lazy and laconic ascension to the heights of corporate royalty.

It’s almost as if he’s some sort of darkly comic, masterfully subtle but ingenious performance artist — someone whose unselfconscious disavowal of any preparatory study or achievement, whose accidentally assembled collocation of lucky breaks, whose unflinching willingness to mine whatever opportunities are handed to him by cronies for whatever enrichment they are capable of, ingeniously mocks with a dripping sarcasm the very system from which and through which he profits and the very culture from which it extrudes like feces from a bunghole.

Looking at him, what can we say about all the human lemmings, all the grim-faced money-hungry, power-lusting sweating athletes of mammon, the MBAs, the PhDs, the careful plotters of strategy who strain their way to some mediocre and lowly perch in the corporate caste system — their fruit of a life of labor — other than that every one of you is an utter fool.

For what you have done, the through your vain ambitions and your willingness to metaphorically murder, like some soldier in a war, that part of yourself and that part of the world that comes between you and your final apotheosis, to achieve your little crown and throne over which you rule your little dukedom, your principality that the world walks by daily in ignorance and disinterest, marking your little life with its disregard.

You are a joke. And he is the joker. And his example, his effortless achievement, marks your effort as the wasted sweat of an animal. And your achievement as nothing but the punchline of a practical joke that the world has, with your complicity, perpetrated upon you, and that you have, ultimately through your failure to understand the cynicism of the world in which you live, perpetrated upon yourself.

I have to admit. It cracks me up.

Outstandingly well said, sir, and I completely concur, especially the “It cracks me up” part! You are the first I’ve seen anywhere who smacks at the crux and very heart of all the symptoms, which many mistake as ‘problems,’ that beset our species today (and in the past and what ‘future’ that may still exist). Your comment should be required reading for everyone on the planet.

Well, the answer to That ramble [which it is not, lol] is a more fitting rebuttal to policework could not be found. [lol]

If I had time, I’d check to see if The Dark Alliance has been plagiarized.

Overriding theme — ‘flipping’ the order, entitlements, coups & control frauds

that oughta keep your gears spinnin’

I agree, this is a truly beautiful view of this man and of the repressed armies of assholes that want to be like him but will never make it :D

There is also this other sneaky facet of the modus operandi of the 0.1%. They choose their water carriers well. Rich Parsons was chosen by the Rockefellers, Obama was chosen by Bob Rubin. This is a sort of fail safe method. While the looting happens to enrich their backers, these stool pigeons also serve as useful fall guys. In the case of both Obama and Parsons the 0.1% can shake their heads and say, ‘we told you affirmative action does not work’ while mentally fellating their loot in their minds eye.

Forget race. Neither Rubin nor Rocky, for all their faults, are the type to say “we told you affirmative action does not work”. Make everybody in this farce green with purple spots, and it changes nothing of importance. Corruption and crime are serious issues regardless of race. By reflexively concentrating on race you deflect attention from the real issues.

And you failed to say who chose Booshie ?? What is this ?

“Ames illustrates that Parsons is in fact very good at what he does and, by showing three examples, his success is most likely not a fluke. To that point, I think it is unfair to insinuate that Parsons cheated his way through law school and cheated on the Bar. These are some massive claims that should be substantiated before throwing them into an article.” – George

*snicker* That’s a lot of “reading into,” by George, George. As I see it, Mark Ames just laid out a string of facts. How one puts those facts together is surely one’s own problem, not Mark Ames.’

Yet, supposing for a second or twenty thousand that your extrapolation is correct and that the cheat was in for Mr. Parsons at Albany Law and the State Bar Exam that year, one would surely be able to continue that line of “success” right on through Dime Savings, AOL Time Warner and CitiGroup by adding one success on another right down the line.

He got better and bigger as time went on. From Brooklyn nobody to Hamptons somebody Dick Parsons’ rise is as true to form as those of Scarface or Nelson Rockefellar. One grasps what they are good at: cheating, sucking up, being born, criminality. The breaks one gets depend on where they start. Rockefellar started from the pinnacle John D. made for him. Scarface and Dick Parson had to fall a bit further to find the pinnacle.

When we get past our absurd sense that heroes make their own way rather than being subject to the vagaries of fate, destiny and fortune like the rest of us then we will finally rid ourselves of this insane notion of pulling one’s self up by the bootstraps. Try that with barefeet, or even with boots and see how it works for ya.

“Today, Parsons is gone from Citigroup, but he’s not gone from our lives: He’s just been appointed as Gov. Andrew Cuomo’s “education czar” for education reform in the state of New York. Sorry kids”

That’s right. He is the best qualifying man for the job (school closing).

A grand sweep of history is forming, before my eyes ?!

don’t take my word for granted,

https://www.nytimes.com/schoolbook/2012/02/28/city-pushes-ahead-on-plan-to-close-then-reopen-33-schools/

Not a bad idea to make him education czar. Normally they appoint some schmuck who went to fancy schools and tells the kids they need a good education to get ahead. Dick can level with them and say that education doesn’t mean squat as long as you have the right contacts.

The number of PhD recipients on food stamps and other forms of welfare more than tripled between 2007 and 2010 to 33,655,http://www.huffingtonpost.com/2012/05/07/food-stamps-phd-recipients-2007-. Who you know, not what you know. (Craazyman rocks:)

Thanks, hermanas. That, too, just cracked me up as I wouldn’t be a bit surprised if their quoted numbers weren’t “misunderestimates”[sic]. However, your link led to 404 but a HuffPo search garnered this one…

http://www.huffingtonpost.com/2012/05/07/food-stamps-phd-recipients-2007-2010_n_1495353.html

Ditto your sentiment on craazyman!

Amazingly good, Mark Ames.

And I chuckle, too, with craazyman re his observations.

“The scum also rises.”

“Early life

Parsons was born in Brooklyn, New York on April 4, 1948 to an electrical technician and a homemaker. [2] He grew up in the Bedford-Stuyvesant area of Brooklyn. He skipped a grade in elementary school and another in high school.[2] He later attended the University of Hawaii, where at 6’4″ tall he played varsity basketball. After four years, he was seven credits short of his diploma. However, he discovered that he could get into a law school in New York without a college degree if he scored well enough on his pre-law exams. Parson was accepted by Albany Law School, where he earned a Juris Doctor in 1971, finishing at the top of his class.[2]”

From Wikipedia — Richard Parsons (businessman)

Reference [2] is an article by Devin Leonard in BusinessWeek

I’m bothered that Mark Ames weakens his strong case against Parsons by making him out to be a dope.

Extremely interesting article–the gist of which I’m in total agreement. But I was intrigued by that Law School/Bar Exam paragraph in Ames’ article as well, so I found the same reference in Wikipedia when I tried to find additional background.

So one narrative could be that he is a genius (hey, he skipped two grades!) who under-performed in H.S. and College, got married, straightened up a bit, then kicked a$$ in law school and on the bar exam.

I couldn’t find any source that confirmed he flunked out of Hawaii. The Wiki account says he was 7 credits short, but without a trasnscript, can you really say he flunked out?

That Albany Times Union article on his law school days seems like it’s firewalled pretty well, so it’s hard to get a lot of juicier details.

“He enrolled in the University of Hawaii for reasons he could never really explain, “..

“6’4″ tall he played varsity basketball”

“He flunked out of U. Hawaii.”

“After four years, he was seven credits short of his diploma. However, he discovered that he could get into a law school in New York without a college degree if he scored well enough on his pre-law exams.”

Can we get a straight story?

Here’s more information —

“Parsons worked part-time as a janitor to pay his way through the University of Albany Law School in New York, and when he graduated in 1971, it was at the top of his class. That same year, he scored the highest marks out of the nearly four thousand lawyers who took the New York State bar examination.” (Kevin Mazur/Wire Image.com)

All this by age 23 without a HS or College diploma?! Surely the NY bar exam should be verifiable.

I worked as a janitor after grad. from S.U.N.Y.,New Paltz while building an art gallery. It’s interesting watching Dick Cavet on T.V. in the classrooms you studied in.

I’m bothered that the thing that bothers you most about this story is not the appalling theft and exploitation that Parsons enabled and profited from, but rather your “concern” over a paragraph on Parsons’ education failures. You may not be a Parsons troll, but that’s precisely the strategy a Parsons troll would take: The ol’ red herring diversion, and affected outrage directed at your red herring diversion.

Just for the record, Parsons described his high school academic record this way: “I got by, if just barely.” It’s in Nina Munk’s excellent book “Fools Rush In” on page 257. Look it up.

If Parsons was such a genius, why did he go to the U. Hawaii, which in the 60s was not exactly a magnet for the nation’s geniuses, black or otherwise? And why was he unable to finish his undergrad degree there, those last 7 credits? It’s well established that Parsons got poor grades as an undergrad, that he partied all the time and rarely showed up for class.

Sorry Charles, but you’ll have to do better than this if you want to throw up a red herring.

Mark, be assured I’m not a Parsons troll. I was “bothered that a one-sided account of Parsons’ educational abilities might be used to discredit an otherwise excellent article. BTW, on page 257, Nina Munk writes —

“In 1971, he graduated from Albany Law School at the top of his class and took top honors in the New York State Bar exam.”

Mind red herrings yourself.

I thought you raised good points, and Ames seems overly touchy about it. I’d feel better about his article if he took your concerns seriously. I don’t doubt there’s probably a lot of truth to the article, but it’s unclear if Parsons is really the complete dope Ames makes him out to be.

I thought Ames had some really good points, but I was concerned that he overdid the “Parsons is a slob that was propped up by his oligarch sponsors” stuff, so I will just back off, and not be mad at this whole thing, and say that some people think some things, and some people think the opposite, and we all have our own opinions, and, after all, they’re just opinions, and … what were we talking about?

I don’t agree with the explicit focus on ceo pay being an issue. I think the bigger point is that the board of directors is not properly representing shareholder interests here. That fact and the implied, “heads bank wins, tails tax-payer loses” mentality are what results in the eggregious CEO pay. If you pulled back on the Federal bank guarantees, by either breaking up too big to fail or bringing back Glass Stegal and fixing the board of directors issue by making them accountable to share-holders, the CEO pay issue goes away and gets solved.

Eggregious CEO pay is a symtom of the problem and not the cause.

Egregious CEO pay is a symptom of this problem:

– Power corrupts.

– Money is power.

– Feedback.

The solution is: back to 90% top tax rate. Demotivate the next generation of crooks from imagining it possible to become robber barons.

Our country is a mushroom farm. Everything that is important is underground. Didn’t they find Nelson face down in his breakfast in 1983 (or what year?). Too strange for a man so well connected. And well doctored. He was somewhat socially liberal. So beginning with Parsons’ career with Dime S&L it is almost as if the CIA (for lack of a better definition of the forces at work) swept through the US financial industry like a recessive gene. Because failure made looting quicker and easier. And there sat Parsons and hundreds of other alkies, without a clue. Question: Was Harry Albright related to Madeleine?

Ole”Rocky” was found doa indelicato making “Happy” happy with his implant as I recall. (He did give me an autograph, though.)

“Education czar” seems a very good fit for this guy. He saw that the education system was screwed up and that obediently sitting in rows speaking in unison was for suckers. It’s about schmoozing. Looks like the sheeple are going to get sheared again in NY.

Thanks, another outstanding piece of detailed work by Mr. Ames.

Hmm, let’s see, he has bank connections, was a favorite of Rubin and Obama, now Cuomo has given him a job – another step toward “Cuomo ’16”?

control fraud case study in elite criminology

Ugh. I think I just threw up in my mouth a little after reading this.

The major issue here isn’t that a guy got rich by being a mediocre businessman and great schmoozer (if that were a problem, all of America would be in trouble)….

What bugs me about this story is how he keeps getting rewarded time and time again. Boardooms are obviously waaay too small and far too cozy – is there not one person in this guy’s past who stood up and said, “no, not a good candidate.”

One of the reasons America is so deluded with regard to money is precisely because we lack a hereditary monarchy. Nobody in England wakes up one day and says “Today I’m going to work toward being a member of the Royal Family.” They KNOW it’s impossible. But here, every shoeless loser holds on to the straw of “possibility”, no matter how slim the chances. (And they look to stories like this one (and all of professional sports) to support their beliefs….nevermind facts on the ground.)

Maybe we should just let the oligarchs crown themselves. Then in 20 years, once a new generation of Americans realizes that they will NEVER be at that table, EVER, and that the oligarchs are LAUGHING AT THEM, we can kick them out and start over with fresh minds who refuse to buy the bull.

I would suggest all of you read Bonfire of Vanities by Tom Wolfe. He explains this insanity better than anyone I can recommend. The ugly truth is the 1% crowd use black people to front for them because most white americans would rather lose every penny then be called racist.

Oli Garch does a nice take on him:

Dick Parsons. Now here is a guy that really represents the absolute best in Corporate America. Dick has made a long and prosperous career out of playing corporate musical chairs. He somehow found a way to cash in as chairman of some of the largest least successful corporate behemoths ever produced in this country.

http://www.nakedcapitalism.com/2012/05/mark-ames-failing-up-with-citigroups-dick-parsons.html

Citi is so startingly corrupt, a parallel universe has already agitated against them in years of peaceful revolution. Special thanks to Robert Rubin!