Andres Frick, Senior Researcher at KOF Swiss Economic Institute of ETH Zurich, Andrea Lassmann, PhD student and researcher at KOF Swiss Economic Institute, Heiner Mikosch, Postdoc Researcher at KOF Swiss Economic Institute, Stefan Neuwirth, PhD Student and Researcher at KOF Swiss Economic Institute, and Theo Suellow, Intern at KOF Swiss Economic Institute. Cross posted from VoxEU.

How do European economists assess the economic crisis in Europe? This column presents results of a survey of members of the Association of European Conjuncture Institutes on various issues related to the European economic crisis, such as the likelihood of Greece leaving the Eurozone, the likelihood of Europe falling back into recession, and the role of the European Central Bank.

Europe is tumbling as one crisis leads to another. Economists, policymakers, and the wider public are debating a series of questions related to the crisis.

- Should the ECB play a more active role in solving the crisis?

- How fast should fiscal consolidation be (Corsetti 2012)?

- Will the Eurozone survive in its present form?

- How can the macroeconomic imbalances prevailing in the Eurozone be reduced?

- Finally, when will Europe recover from the recession?

We asked these and other questions to the members of the Association of European Conjuncture Institutes (AIECE). The AIECE comprises 36 independent economic research institutes from 21 European countries. Here are some of the results as of 1 April.1

Greek exit

Elections in Greece on 6 May 2012 challenge the agreed reform programmes and have revived fears of a Greek exit from the Eurozone. For the first time, the ECB itself raised the possibility of an exit. Those recent events might have elevated the risk of an exit of Greece, but even beforehand the risk was present.

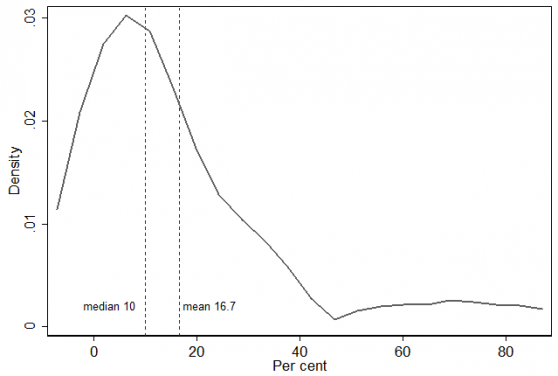

We asked the AIECE institutes in March to give their assessment on the probability of Greece leaving the Eurozone. A kernel density calculated from the answers illustrates that the institutes, on average, consider the probability of an exit to be rather low (see Figure 1), mostly due to the high costs involved for both Greece and the Eurozone. That said, the heterogeneity of estimates is high, ranging from 0% to 80%. An institute commented that an improvement in the economic conditions of Portugal, Spain, and Italy would increase the probability of a Greek exit. The reason for this is that such a scenario would moderate Eurozone contagion risks reducing the incentive for other countries to support Greece.

Figure 1. Probability of Greece leaving the Eurozone, kernel density

Note: Epanechikov kernel, bandwidth = 7.2580

Source: AIECE institutes

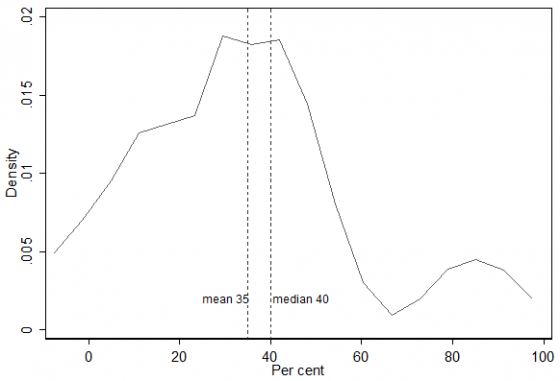

Further, the AIECE institutes were asked to give probability estimates of a haircut for the sovereign debt of Portugal. The kernel density in Figure 2 reveals that the institutes, on average, see a considerable risk of a haircut. Again, the dispersion of the estimates is high, with probabilities ranging from 0% to 90%.

Figure 2. Probability of a haircut for Portuguese sovereign debt, kernel density

Note: Epanechikov kernel, bandwidth = 7.2580

Source: AIECE institutes

Preferred solution to Eurozone crisis

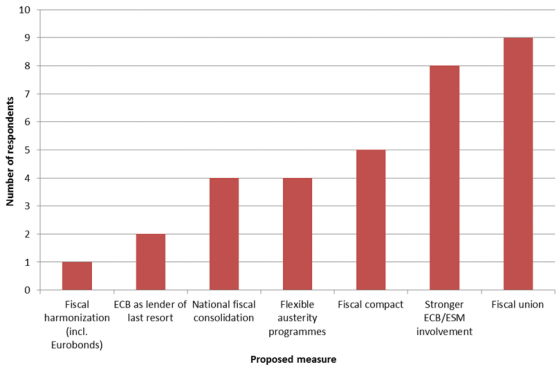

Facing these risks, we asked the AIECE institutes to provide their view on the preferred scenario to the solution of the European sovereign debt crisis. The majority of the AIECE institutes prefer a stronger involvement of the EU and the Eurozone institutions (Figure 3), including nine institutes in favour of a fiscal union. The fiscal compact, meanwhile, is preferred by only five institutes. In line with the current political discussion in Greece, France, and the UK, four institutes emphasise the need for more flexible austerity programmes. In addition, the institutes were asked to assess the ECB’s commitment to engage in solving the on-going crisis. Two institutes consider the current ECB involvement too strong, while 11 think it is just right and 10 regard it as insufficient.

Figure 3. Solutions to the European sovereign debt crisis

Source: AIECE institutes

Likely fiscal consolidation

In addition, we asked the AIECE institutes to estimate the size of fiscal consolidation measures, which the European governments implemented or will implement in 2012 and 2013. This is a delicate question, as such measures are often difficult to quantify and the institutes had to judge to what extent the planned measures will eventually be implemented. The answers show big differences within Europe. Italy seems most ambitious in consolidating its budget, although other countries are under even higher pressure from the bond markets. Finland, Germany, and Norway on the other hand have only small or even no consolidation packages. Interestingly, the Greek consolidation programme is far from being as ambitious as the Italian or Irish one; it corresponds to just about the average of the Eurozone. The institutes in the Eurozone estimate that fiscal consolidation amounts on average to 4.4% of GDP cumulated over 2012 and 2013, with a slight bias towards higher consolidation in 2013. Outside the Eurozone, the consolidation measures are with 2.7% of GDP distinctly smaller.

Effectiveness of debt brakes

Further, the institutes were asked whether they expect debt brakes (as agreed upon by the EU Summit in January 2012) to be more effective in reducing budget deficits than previous regulations (Maastricht Treaty, Dublin Stability Pact) for both in the EU as a whole and in their own country. Table 1 reports the basic results. In detail, 44% of the institutes stated that debt brakes would be more effective both in their own country and in the EU. In contrast, 19% believed that they would work neither in their own country nor in the EU aggregate. Meanwhile, 31% answered that a debt brake would work in the EU, but not in their own country; and one institute (6%) said that it would work in its home country, but not in the EU.

Table 1. Effectiveness of debt brakes

| Effectiveness in European Union | Effectiveness in own country | |

| Effective | 13 | 8 |

| Not effective | 4 | 6 |

| Total answers | 17 | 14 |

Source: AIECE institutes

Forecasted growth profile

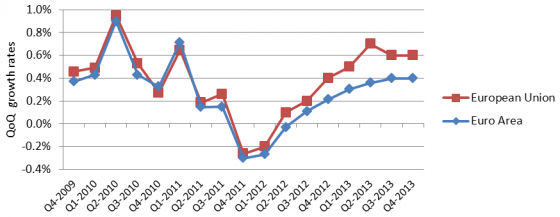

Finally, we asked the AIECE institutes to forecast the growth profile for the EU and the Eurozone. As can be seen from Figure 4, the AIECE Institutes, on average, project that the EU turns from negative to positive growth in the second quarter of 2012, while the Eurozone follows one quarter later. The institutes, on average, expect the EU to grow more strongly than the Eurozone in every single quarter of 2012 and 2013. This expected growth differential may be explained by the relatively stringent consolidation measures in the Eurozone countries, while the measures in the rest of the EU are on average smaller.

Figure 4. Forecast of quarter-over-quarter GDP growth in the EU and the Eurozone

Source: AIECE institutes. Figure 5 shows the average over the AIECE institutes’ forecast for the EU or the Eurozone, respecitively. The number of answers differs between the two forecasts.

Concluding remarks

In a policy climate marked with as much uncertainty as Europe is now experiencing, expert surveys are one way of gauging what economists think should and will happen going forward.

References

Corsetti, Giancarlo (2012), “Has austerity gone too far?”, VoxEU.org, 2 April.

1The deadline for the forecasts and statements by the AIECE Institutes was 1 April 2012. The full results are presented in the Spring 2012 AIECE General Report, which can be downloaded from the AIECE (here) or the KOF Swiss Economic Institute (here).

What do the readers of this blog think?

Does the Euro remain intact or break up?

really doubt it will break up.. more likely… the central bankers will be able to claim control over national fiscal policy…

Break up. Currency sovereignty is just too important. Fiscal union is too big of a stretch.

The euro was partly implemented to challenge the USD. Although the USD as the world’s reserve currency has had it’s advantages for the US it has been mainly to entrench a ‘corporatist’ agenda rather than true global free trade. The diminishing US purchasing power has hurt the US worker just as similar pro-export policies are hurting the average Chinese citizen.

The fight here is for the people (99 percenters) to take back control of money from the banks and corporations. Defaulting on Euro debt by returning to sovereign currencies is a step in the right direction in that fight

The US and China have their own battles to fight against these entrenched corporate interests to put their currency on a better footing with regards to better purchasing power for its workers..

Thanks for the time-saving data charts!

The question subsequent is how significant the views of a handful of econs are compared to the rest of the players.

Still, thanks for the data workup!

When the whole neighborhood has been deceptively hooked on divisive death dealing herd thinning drugs by drug dealers, the preferred solution is to jail all the drug dealers and their shills, not let the drug dealers shills frame the debate that decides how slowly or rapidly they will now administer the drugs that will kill you.

Deception is the strongest political force on the planet.

I’m sure that Greece would do everything possible to stay in the euro-zone. Actually, other wealthy countries like Germany and France also want to avoid any risk events because otherwise the Euro might collapse and the damage would be disastrous.

How much did it cost the EU to let Greece default and leave the Euro the first time aroiund? Less than 10 billion?

Now go check how much it costs today…

How much printing is needed to bailout all the piigs? France?

Anyone thinking clearly would agree that the disaster is keeping the euro.

It’s not a matter of if, but a matter of when. We are talking about sovereign nations with differing cultures and economies. Plus there is no way you can bailout the piigs without collapsing the euro.

The people rejected the euro idea, forcing a non wanted union and destroy the economy anyway and you are looking for trouble.

So Germany is willing to devalue, to bailout its banks, and the piigs have to cede control over their budget.

The piigs want cash and want to keep control over their finances.

If Germany was smart it would dump all external debt and reissue the mark. Enough is enough.

Thirty-six (36) formal “expert opinions” at the 11th hour. La-la land.

There is definitely no out-of-the-box thinking going on with these folk.

Can none stand up and say that we need to end the stupid social structure where the global inherited rich own and control everything?

“Nationalize” the FED, the World Bank and the IMF with a world government that exerts regulatory control of all business and is run by and for the masses instead of the global inherited rich and their puppets. Now there is a solution to the EU mess.

It is obvious that the EU leadership doesn’t have the balls or ovaries to stand up to the global inherited rich narrative that has enslaved us for centuries. So they will stews and sputter the masses into further enslavement. Soon to be followed by America as part of the latest Shock Doctrine event.

Wonks Gone Wild!

Get the video cam in there and get it on tape! they survey 33 economists. 33 (counting from figure 3 anyway)! and construct Epanechikov kernel density functions to map the data. Not even histograms. Oh no, simple histograms won’t do. and forget basic sentences, waaaay to vague. hahahahah. this is too funny for words. only numbers.

they’re outa control, wonking it up in a math riot. somebody send in the batons and pepper spray! haha hahaha ahahaha

I am genuinely stunned at the level of self-delusion – a “V”-shaped recovery starting in Q1 2012? I have just read that “The fall in German factory orders during the month of May was the steepest since November 2011, according to data from the Economy Ministry, caused largely by a 3.6pc drop in orders from abroad.” Quelle surprise! If you are seen driving new German wheels anywhere south of the Alps or West of the Rhein you gets social noogies … And the anti-german sentiment is spreading across the Atlantic and … China too.

I’ll go with Soros on this: Set a financial structure for the EU in place within three months or watch the world unravel. Rationalists need a shrink.

It’s so obvious that single world government is needed, and soon.

Soros would like to be in charge of that single world government. The world won’t unravel if Europe can’t form a fiscal union. The financial institutions have been threatening this sort of thing for the last several years which has helped them avoid prosecutions for their crimes.

We can have a variety of governments. The TBTF fear true competition and fear people starting to understand their financial trickery and deception.

Well said,

Not sure why some hide behind the lies. Had Greece defaulted on its debt and exited the euro the first time around, it would be on a real path to recovery.

Not only can it focus on restructuring its government, but the Greeks would have gotten a dose of much needed reality.

You have 2 camps of deceivers in today’s world.

1. The world will end if you default Croydon, described by above comment and Doris. All the sacrifices and lives lost for independence were in veigb. Pieces of paper and debt are much more important. One word for these, cowards and stay away from the Americas.

2. A country can spend its way to prosperity. Japan has been trying for almost 30 years.

Its a sad state of affairs when it takes hitting a wall before people wake up.

I read the speech from Mr. Soros. I believe his analysis of the situation is correct, especially concerning the rise and collapse of what he calls the ‘EU project’. I like his framework of Reflexivity, which is a more accurate narrative of human affairs than to look for static absolute factors. However his proposed solution is typical for a Hedge Fund Manager…the financial system should be bailed out, the finance guys should be paid out via a EU wide guareentee and fiscal oversight, and the Germans will have to pay out…. Typical self-serving drivel. I like Mr. Tspras solution, nationalization of the financial system, full scale investigation into the situation, (privacy laws for the deals and financial transactions be damned), nationalization of critical infrastructure and the use of revenues From these Projects shall be put back toward stabilizing the economy and people income.

I don’t see how you have a European Union without a Euro.

And from the 30,000 foot level, we Americans tend to forget that the soil of the European continent is soaked in the blood of millions killed by wars between those same sovereign nation states. No matter the pragmatic reasons for the EU, and they are many, the EU was also formed with the idea of preventing that level of bloodletting, ever again (at least on European soil; the discussion room for colonialism is over there). And no matter the human failings of the politicans who formed the EU, and they are many, that is a noble goal, and one moreover that was achieved.

So I hope, and I believe, that the European elite will find a way to prevent the EU project from going down the sh*tter. Maybe what Churchill said about the Americans will also apply to the Europeans: [They] invariably [do] the right thing, after having exhausted every other alternative.

Of course a Euro doesn’t mean the Euro as presently constituted — treating “Euro” as a synecdoche for their monetary system. Maybe the idea of Russian aircraft carriers based at Piraeus, or the picture of Greece as the Panama of Mediterranean (the Cypriots are pikers!) — or… do poppies grow in Greece? — will concentrate the minds of the elite enough for Merkel to allow some helicopters bearing cash to be fired up (though probably black ones).

However a partial and mutual surrender of national sovereignties to a larger EU authority gets sorted, it will almost certainly have a “democratic deficit”… the next item on the agenda.

My $0.02, worth exactly what you paid for it!

Lambert,

I think the word “project” sums up your and the Keynesian thought of the European people. Did the European people ask for the Euro?

Try sorting this one out and I think you will get the picutre.

– how much devaluation is Germany willing to accept?

– how much is Spain willing to accept?

– Greece?

– Portugal?

– Ireland?

I hope you get the picture that what’s good for one country will break the other, and so forth. Not to mention that there is no way in hell for Europeans to just hand over their sovereignty for debt denominated in pretty pieces of papers.

Reading the few comments on this board and articles that have made their way to the MSM it is clear that the next war will not be poor against rich.

The war between the entitled and the non entitled has been declared.

I agree with you. The US/Canada/Mexico have a EU-like FTA, all without sharing a common currency. Furthermore, imagine how screwed Mexico would have been in January 1995 had it not been able to devalue.

I really don’t get those people who continue to insist on the viability of a flawed construct.

It just can’t work. Not unless the citizens of the northern states would agree to a permanent transfer of tax dollars to the south within a United States of Europe.

Posts like this one drive me a little nuts. My first thought is why should I care what 36 neoliberal institutes think about anything? My negative impressions are only reinforced when I see a couple of kernel density graphs. All I can think is you only have a sample size of 36 for chrissakes. Who are you trying to impress or fool? So then the next (third) chart, a bar graph, is clear, but A) the policy choices are presented as either/or while a stronger ECB and a fiscal (and one would hope debt) union (hopefully democratically organized but not specified as such) are not mutually exclusive. Being a little irritated at this point I bother to total the responses. I come up with 33, not the 36 mentioned at the start. This only gets worse in the next table where the columns total to 34 and 28, respectively.

So now I’m wondering what exactly is the AIECE, so I go to their site and look at their list of members.

http://sites.uclouvain.be/aiece/members/list.html

They list 35 members and 6 observers. So now I wonder is it the posters or the AIECE who can’t count to what are, let’s face it with all the billions and trillions flying around, numbers considerably less than 50. This is not a good sign.

Also I am interested in the distribution. Germany has 5 institutes, France and Italy each have 4, Belgium 3, Spain, Sweden and Hungary 2. That’s 7 countries with 22 of the 35 AIECE institutes. At the same time, countries like the UK, the Netherlands, and Switzerland only have one institute apiece.

Then there is the perennial neoliberal projection of “growth” just around the corner, even as those of us who are more reality bound see parts of Europe already in depression and large parts of the continent either in or heading into recession. To me, this is more an exercise in credentialing and validating the Conventional Wisdom with all the expected non-surprises that flow from this.

I would just repeat, again, that Europe has 6 interrelated problems:

1) Lack of a democratic fiscal and debt union

2) A weak European central bank

3) An insolvent, predatory banking sector

4) Europe internal mercantilist trading patterns

5) Corrupt political elites

6) A kleptocratic class of the rich calling the shots

We got glancing mention of the first two but as either/ors. On the rest, nothing. I think that is what the real story is here: just how disconnected and/or complicit Europe’s technocrats remain. You can’t solve a problem(s) if you don’t know or want to know what it is (they are).

Nice summary again Hugh.

I just keep beating the drum of your number 6 who I refer to as the global inherited rich. To me they represent the head of our rotten fish that has had centuries to develop into this condition.

If our struggle ultimately isn’t to laugh control out of their hands, I don’t know what it is.

Concluding remarks: economists (at least those involved in this poll) like the “status quo” even if it is damaging to the aggregate.

Guillotines for everyone.

It’s interesting how to some extent the problem has transformed from a financial crisis to an economic and political crisis. I wonder if it’s ever going to change into a cultural crisis in the sense, that real change will require a new perspective on how people see and behave in the world.

For example: All the voices that we hear and all the individuals making the decisions about the financial crisis don’t really understand the problem. And yet they have to behave like they do. Now, it seems to me, that this is really quite similar to the kind of confidence that you find in some drunk people. And it can be dangerous when there’s too large a gap between reality and the way we perceive it. And yet our current culture creates individuals which overestimate themselves, this also needs to change. There’s too much incentive to ignore one’s own (and other’s) limitations in contemporary culture– we like to hide it behind labels like pessimism and optimism. We desperately need a dose of reality– even if it’s going to be hard.

When it has become so obvious that our politicians and economic experts really have no idea how to solve the current economic crisis, maybe it’s time for the truth? We can’t just jump off the bus whenever we want, but this “I’m just gonna keep faking it until I make it”-attitude comes at the cost of destroying trust, which is the foundation of community.

Imagine what would happen if the president said something like, ‘I have no idea what has caused, and how to solve, the financial and economic crisis…’ I mean this is impossible, right! It’s so far fetched, you can’t take it seriously– but it’s the truth, isn’t it? I mean, if you’re honest with yourself, you don’t suspect it’s the truth, you know it’s the truth.

Typical neoliberal BS from VoxEU, supporting the status quo and demanding that the working class take the hit from the financial crisis that is the fault of Big Business, the EU and the neoliberal economists advising them.

I appreciate the cross post, but really, can we please stop giving space to economists and their views on the Euro Crisis? They don’t know what to do about it, because they are simply snake-oil salesmen who have been peddling their venom as quack cures for too long.

I think one of the best ways to get long term prosperity and happiness in the Eurozone is to abolish the fake science of economics. Close down all the economic research institutes, close down all the economic departments so that we no longer have to contend with right wing economists preeching free markets and deregulation, which is what caused the eurozone crisis in the first place. It’s a joke science and as David Graeber has shown, they can’t even get the foundations of the discipline right (i.e. where did money come from?)

I say this as a recently graduated economics student who has been exposed to 3 years of right wing neoliberal propaganda on how welfare states are bad, deregulation and privatisation is good, how poverty is a life choice, etc etc. The indoctrination that goes on in Economics departments is scary, and I don’t think a lot of people realise how pervasive it is. I think this really needs wider exposure tbh. Unless Economics is exposed as the fraud it is, and unless people are told how it is a training ground for the next generation of neoliberal soldiers to serve the Corporate Interest, we’ll continue to be slaves to the subject.

Totally agree with you. The discipline of economics is in a very sorry state. It was very disturbing to read Mirowski on the lack of changes to practice in economic departments given that mainstream economists did not see the financial crisis coming and have a role in bringing the crisis about.

http://goo.gl/4HCqV

Mirowski’s spot on. I started at University in 2009, when we were right in the depth of the crisis, and thought I’d be getting at least some idea of the deeper reasons for why the crisis developed, potential solutions, etc. Instead, in the first year we were told that markets clear, and how a private ownership economy leads to stable equilibrium that are sociall optimal.

I thought, okay, maybe it’s just the first year where they are easing us into teh course, and we’ll get more realistic in the second and third years. No such luck, as the EXACT same story of perfect competition was repeated ad nauseum, and based on this story the usual policy prescriptions were suggested in all our modules. In Labour, we should liberalise the labour market, get rid of the minimum wage and abolish the welfare state. In Public Economics, we should privatise the land to prevent the so called “tragedy of the commons” problem, and should let the market allocate public goods, as the Tiebout Hypothesis shows it can work. Externalities? Don’t worry, we don’t need government, private agents should simply bargain over property rights as according to the Coase Theorem.

The module I took in Money and Banking, which you think would at least be partially more related to real world events, was an equal nonsense. We were fed the false story of how money and debt evolved, completely ignoring the Anthropological studies that refute the coventional story, and the only market failure that the course suggested may have existed in the financial markets was a bit of asymmetric information! Corruption? Lobbying governments? Collusion to rip off the public? All of that was swept under the carpet, giving us a view of the financial sector as victims.

This is why I think the subject is rotten to the core. I’ve read some of the contributions by people like Graeber and Michael Sandel to questions that I thought I would learn about in Economics, and their contributions make a 100 times more sense than the neoliberal dogma that masquerades as economic “science”. This is why I think the subject should be consigned to the dustbin of history, and the other social science and humanities subjects should take over looking at the questions that economists have until now (badly) studied.

@SR819

I am heartened that you at least escaped being indoctrinated. I am just reading Keen’s Debunking Economics, and he speaks eloquently about the bad position critically thinking students are placed in. In order to get good marks you have to act as if what you are being taught are proven (mathematically) facts, when they are no such thing. I have not studied economics, but I am an academic. I find it difficult to understand neoclassical fundamentals, because as an outsider it makes no sense to me. What is the point of creating mathematically correct models, when the fundamental assumptions bear no resemblance to reality and are not in anyway predictive of aggregate behaviour? As a critical thinker, if you haven’t already read this book, I think you would enjoy it immensely as he is writing it for students like you. You must have felt very alone at times.

An excerpt from Mirowski’s article

‘Within universities, economists have rendered themselves indispensible as the new arbiters of human capital bestowal and commercial validation. They occupy key posts in business schools, law schools, and medical schools, propounding doctrines both mathematical and cultural. When the academic economist ventured beyond the ivy walls to retail her expertise and preach the virtues of the marketplace, she was simply foreshadowing for other faculty members what behavior would be required in the 21st century university. Their sometimes shadowy positions in the financial/governmental/academic complex were occasions for pride and pomp in the eyes of university trustees, and not of intellectual compromise or culpability. It would be a tremendous repudiation of everything the university had striven to become after 1980 to downsize or close an economics department as a cost-saving measure, unlike (say) the odd department of geography, or philosophy, or astronomy, or area studies.,

At my University, there have been protests against planned cuts to the Biological and Chemical Sciences department, where many lab technicians and lecturers are being laid off. Moreover, many other departments are also having to make cut backs, abolishing some courses and modules to cope with the cut in government funding. However, the economics department is actually expanding, introducing new modules, new masters degrees in banking and finance, investment and finance and Law and Economics (based on the neoliberalised treatment of law promoted by people like Posner). This is not surprising, as the Tory led government can always rely on economists to justify the policies they are pursuing, so best to keep them onside eh?

Wow – I am surprised that they are laying off staff in the sciences, usual practice is to go for humanities. I believe philosophy and anthopology are often targeted. Wouldn’t want students to learn to think critically.

(I also enjoyed reading Graebers Debt: The first 5000 years).

Keen’s words to students in the preface of his book

‘If you are a student now? Well your position is somewhat compromised: you have to pass exams, after all! I hope that, after reading this book, you will be better equipped to do that. But you are also equipped to ‘disturb the equilibrium’ of both your fellow students and your teachers, if they are themselves ignorant of the issues raised in this book. You have a voice, which has been perhaps quiescent on matters economic because you have in the past deferred to the authority of the economist. There is no reason to remain quiet.’

That looks interesting, I’ll have a look thanks. Incidentally Keen also did an interview with BBC Radio 4 yesterday.

And it does get very difficult especially revising for exams, where you’re trying to force yourself to remember and accept theories and ideas that are not simply morally abhorrent, but intellectually bogus as well. I think there are a fair number of students who felt the same way in my course, but like you say, they are forced to accept it and worry about questioning the lecturers too much, since the exams are based on these neoliberal ideas so you are compelled to focus on that.

I also noticed something that people like Robert Frank, Yoram Bauman, Ariel Rubinstein and others have pointed out about the effect of economics education on attitudes. Some of my classmates who at the start of university seemed to hold what you have consider moderately centre-left progressive views becoming more and more libertarian as the course went along.

Did you hear of a study done with undergraduate students on measures of cooperative game play? I don’t know who wrote it, but it sounded very interesting. The researchers measured the level of cooperative game play across different student groups (humanities, social sciences, science etc). They found that students in the first year were generally quite cooperative and equivalent across all academic disciplines. They then tested the students in their final year. The level of cooperative game play remained the same for all disciplines, except for economics. The economic students showed a reduction in cooperative game play and had become much more ruthless. I wish I knew who had done that study. Perphaps it is one of the researchers you mentioned above. I feel a google search coming on. Best of luck with your exams.