By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

Spain took a beating overnight after Moody’s downgraded the long term debt and deposit ratings of 28 Spanish banks on the back of the sovereign downgrade earlier in the month. Yields on short term debt spiked at auction:

Spain’s short-term borrowing costs nearly tripled at auction on Tuesday, underlining the country’s precarious finances as it struggles against recession and juggles with a debt crisis among its newly downgraded banks.

The yield paid on a 3-month bill was 2.362 percent, up from just 0.846 percent a month ago. For six-month paper, it leapt to 3.237 percent from 1.737 percent in May.

Longer term yields were also up with 10 years heading back towards 7%. Spain, however, was not the only bearer of dour news. Data from Italy continues to disappoint, this time it was retail sales:

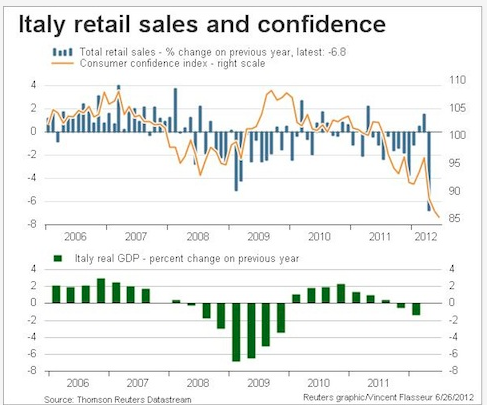

Italian retail sales plummeted in April, falling 1.6% in seasonally-adjusted terms from the month before as residents of the euro zone’s third-largest economy reduced purchases of both food and other goods and services, national statistics institute Istat said Tuesday.

The drop–the largest in at least eight years–was far larger than the average 0.2% monthly drop forecast in a poll of economists by Dow Jones Newswires.

Retail sales in Italy are now down 6.8% in unadjusted terms from April 2011, Istat said.

Not to be left out there was also Cyprus:

Cyprus, which became the fifth euro zone country on Monday to seek emergency funding from Brussels, may require a bailout amount worth up to half the size of its economy, domestic media reported on Tuesday.

The Mediterranean island, with a banking sector heavily exposed to debt-crippled Greece, said on Monday it was formally applying for aid from the European Union’s rescue funds.

Cyprus needs to plug a 1.8 billion euro – or 10 percent of its GDP – regulatory capital shortfall in its second largest lender by June 30. Potential aid could be more comprehensive to cover fiscal requirements, Finance Minister Vassos Shiarly told Reuters.

Newspapers reported that aid could be anything between 6 and 10 billion euros.

That’s somewhere around 50% of GDP by the way, however Cypriot officials later claimed that the final figure hasn’t been determined yet.

And, to the resolution…

Overnight the Europe’s fabulous 4 (European Commission President Jose Manuel Barroso, European Central Bank President Mario Draghi, Eurogroup Chairman Jean-Claude Juncker and European Council President Herman Van Rompuy) released an already shortened draft paper for the up-coming EU summit. The draft (available below) is jam packed with all of the plans I have been discussing over the last few weeks including banking unions, shared issuances and the move of fiscal sovereignty to Brussels which includes the right of veto over national budgets. As I discussed yesterday this is the grand vision for Europe but there are 4 major issues with the document.

Firstly, there really isn’t much in the seven pages that I consider new which, given the expectations of the summit, is already a problem. Secondly, the new draft is absent of any short term resolutions. Thirdly, as I hinted at yesterday, there is this line from the document:

These four building blocks offer a coherent and complete architecture that will have to be put in place over the next decade.

A decade ? Cyprus has become the 5th bailout nation, Greece is on the verge of collapse, Portugal is struggling to meet targets, Spain is crumbling and Italy is now in serious trouble. Can anyone honestly think Europe has another 10 years to build a sustainable economic architecture?

And lastly, there is this:

Chancellor Angela Merkel hardened her resistance to euro-area debt sharing to resolve the region’s financial crisis, setting Germany on a collision course with its allies at a summit of European leaders this week.

Merkel, speaking to a conference in Berlin today as Spain announced it would formally seek aid for its banks, dismissed “euro bonds, euro bills and European deposit insurance with joint liability and much more” as “economically wrong and counterproductive,” saying that they ran against the German constitution.

Yesterday José Manuel Barroso gave a speech (transcript here) at the European policy centre explaining much of the document below where he also touched on a number of other topics including periphery banking Zombification. From his opening statements it would appear that he is well aware of what is at stake at this week’s summit yet also recognises that his sense of urgency is not be shared across Europe:

The last weeks have been a time of heightened tension in the European Union and in the Euro area in particular. It is now clear that the world expects Europe to commit to credible and concrete solutions to become more integrated and more united. Indeed this is now a real systemic global necessity if we are to ensure worldwide financial and economic stability.

We are now, as I have been saying for some time, in a defining moment for European integration. We must articulate the vision of where Europe must go, and a concrete path for how to get there. I am not sure whether the urgency of this is fully understood in all the capitals of the European Union.

I’m not sure what else to say, it’s bloody depressing stuff.

Although I agree with many of the long term architectural goals, the likely practical short term outcomes of this week’s summit appear to be increasingly disconnected from economic reality. The crisis is once again ahead of the policy response which means European leaders are patching up holes and fighting fires instead of delivering realisable and credible plans. The basic chicken and egg problem of debt sharing and national sovereignty appears completely unresolved and unfortunately I see very little to suggest the Eurocrats are about to leap ahead of their problems. I am therefore becoming increasingly concerned that this week’s summit will be a massive disappointment which is likely to create a huge problems for the rest of the world.

I genuinely hope I am wrong on this and I welcome any comments to convince me that I am. I need a coffee.

And on EUR tombstone it shall read “Died of procrastination”.

Died of procrastination? Why not, died because the “far-sighted statesmen” – Soros’s words not mine – conceived of a inherently flawed construct that was doomed to fail from the start?

How would Americans feel if, without any kind of democratic support, a US president decides to allow Mexico to enter into a 50/50 relationship with the USA, a relationship which would entail PERMANENT fiscal transfers from the fifty states to the 31 states down south, of 10% of GDP, PERMANENTLY?

Well, my only disagreement is with the idea that a move towards a United States of Europe would be a good thing. Only in the dreams of equation-oriented economists could such a thing work; “Europe” is not a nation. Time to cut our enormous losses and return to real national sovereignty.

For a brief delusional moment I thought the German government was smarter than it seemed and would be ready with a “German hegemon of Europe” plan once the dominoes started tumbling and everybody who mattered was truly scared enough to accept it. Now I’m back to thinking they’re in a bubble of denial.

Disorderly breakup, here we come…

It had always been a choice between orderly, or disorderly breakup. Unfortunately, years have been wasted that could have been used for exploring and planning the orderly version.

This is not about individual failure but rather of mankind’s collective intelligence not being up to par for solving today’s problems.

This whole mess is a triumph of hope (for EZ to survive on a terribly weak foundation) over experience (see Kindleberger et al.).

To those who might suggest that a stronger push for full European integration might have been possible: Desirable as it is for all European countries to get along well, and even given a lot of common history, I do not see how full European integration could ever have happened or could happen in the future, unless it would be seen as the last straw as a result of yet another big war which we hopefully won’t ever see again here in Europe. Our friends in the UK, as well as some other non-EZ countries, will likely be happy btw if European integration will not move forward at all.

I think most fellow Germans are on board with Ms Merkel when she is not giving in to demands for full mutualization of EZ debt, see also some comments form outside Germany on that, e.g. or . Some, including myself, would see this as just a bank bailout which would add to the burden of the taxpayers but wouldn’t really solve anything. Others simply would not understand why Germany and some other Northern EU countries should send money to the sunny South.

Both full European integration and debt mutualization, be it as Eurobonds, EU wide deposit guarantee schemes, or some different form, could be implemented and maintained over time only by a dictatorship. Democracy would not survive such a fundamental change, so the question is where our priority really lies: Trying to preserve current structures at the EU level, or trying to preserve democracy ?

Maybe some middle ground will evolve over the next couple of weeks or months. Martin Wolf has a very preliminary outline of something like that at .

Sorry for messing up this post, the last three paragraphs shoudl read:

I think most fellow Germans are on board with Ms Merkel when she is not giving in to demands for full mutualization of EZ debt, see also some comments from outside Germany on that, e.g. Jeremy Frankel or David McWilliams. Some, including myself, would see this as just a bank bailout which would add to the burden of the taxpayers but wouldn’t really solve anything. Others simply would not understand why Germany and some other Northern EU countries should send money to the sunny South.

Both full European integration and debt mutualization, be it as Eurobonds, EU wide deposit guarantee schemes, or some different form, could be implemented and maintained over time only by a dictatorship. Democracy would not survive such a fundamental change, so the question is where our priority really lies: Trying to preserve current structures at the EU level, or trying to preserve democracy ?

Maybe some middle ground will evolve over the next couple of weeks or months. Martin Wolf has a very preliminary outline of something like that at .

Damn, still haven’t got it right, maybe I also need a coffee or vodka to enhance my writing skills…

Martin Wolf can be read at Look beyond summits for euro salvation

Dictatorship. History seems to indicate that Europe responds well to that form of government. That is not a recommendation just an observation.

I do have a question for those of you who envisioned a US of Europe.

Did you also foresee one soccer team representing the US of E in World Cup competition? Olympics?

If not, why would California, for example, not be able to field a World Cup or Olympic team, competing against Texas and Mexico?

You can’t have it both ways.

Assumimg that saving the EMU is the goal, I think the main result of this summit shall be that the Spanish government will call for a referendum to transfer Spanish budgetary sovereignty to Brussels (the 2nd building block in the European Council document), and then both centrist Spanish parties should stage a quick campaing for a ‘yes’. That should be presented as a first step towards greater European political integration and debt mutualization. Anything short of that, well, could be game over for Spain and the EMU.

At that point, wouldn’t Rajoy have to resign, for Spain would immediately become a protectorate of Germany and the North?

Bloody depressing, I think I need more than a coffee, maybe some vodka will help.

My fellow Australian,

remember the euphoria associated with the invasion of Iraq? I’m going to try and distill the essence of the justification of that war in the following popular argument, “if you’r neighbour was, for example, beating his wife, would you call the police?” The overwhelming response at the time was, “Yes!”

There are two things, which I would like to suggest, _in hindsight_ about what happened back in 2003. Firstly, if the question was anything like the one above, the answer was indeed correct. Secondly, the result, after almost a decade of war is a catastrophe.

So, in this admittedly lean representation of history, there are a number of paths of argumentation, which one may follow , when musing over why the war turned out to be a catastrophe. Again, a very simple aggregate answer, might be that the war wasn’t managed very well, which doesn’t preclude that the war could have been managed significantly better. But I remind you, once again of the question! And the answer. And the result. And I suggest that the question was the wrong one*. If the premise is wrong, the conclusion will (almost) never be correct.

Further, I’m going to be so contrary as to say, that measured against the background of daily political opinion, too much consensus, is an indicator that there’s a problem.

A subtle argument, no doubt, and somewhat oblique with regards to the current problem in the EU, but instinctively, I am very suspicious about the current campaigning against Europe and in particular Germany.

—–

*Seen from the perspective of solving a real and practical problem. It sure worked in terms of campaigning!

Huh? I was in Australia (Sydney) when Iraq was invaded. I even went to the protest. 250,000 people turned out. 94% of Australians were against the war then. 94% is a number you pretty much never see in polls.

There was no euphoria over the invasion of Iraq, at least not outside the US and maybe the hard core of its “coalition of the willing,” which Oz did join thanks to John Howard.

That’s true Yves, and a very good point, indeed. Even from a population of 4million people, 250,000+ is a “good turnout” for a protest. But I remind you that Howard won the 2004 election and increased his margin in parliament by 5%.

If we are looking only from an Australian perspective, “euphoria” would be a poor description of the mood, but at the same time the issue did not translate into political action at the polls.

Listen, in the final analysis, the campaign for a war against Iraq was successful. The overwhelming support for the war in the US was enough for countries like Australia, who, perhaps against it’s better nature was part of the coalition (Although, Australia always stands by its allies, from the Boer war onwards– we are in terms of participation a war-like country.)

I’m trying to make the point that in an atmosphere of general political paralysis, the moments when there is political consensus are suspicious. For me, it’s like the desire for political consensus makes me want to believe in these moments. I’d like to believe that Eurobonds and a monetary solution to the European debt crisis could solve Europe’s financial problems. I’d like to believe that Germany only has to agree and all our problems will disappear. But I don’t have any confidence that this is true.

Funny how neoliberal economic highs and a terrorist behind every bush trying to bring you down, broadcast 24/7 will do that too ya.

Skippy… yet those crazy kids on ABC wandering around with high res cameras could walk right up to high value targets, snapping pics.

IMHO the invasion of Iraq was the right thing, done for the wrong reasons and badly.

Likewise the common European currency was the right thing, done for the wrong reasons and badly.

In fact even on almost any of the rare occasions that any politician does the right thing it is invariably for the wrong reasons, and done badly.

It is never the right thing to invade a sovereign nation that has neither attacked your nation nor one of your allies. This is a very simple principle that seems to escape the Anglo-Saxon mind.

So (let’s ignore Iraq and the reasons for that, and deal with hypothetical scenario), when I see a state that happily slaughters its citizens, ritualy sacrificing children to godhood of its “Great Leader”, I’d just sit and smile at them contentedly (and at best hope they will fix their wayward ways in future?).

Never is so strong a word that you’d be really careful in using it.

America always laments its bastard kids and has to put them down one day… sigh

Nice point Vlade.

I think our military men should read Sun-Tzu… And less emphasis on the 13 th chapter ‘on deception’ . And more on the first and 2nd chapter. Sun Tzu writes that War is contrary to virtue and should be avoided until the state is clearly in peril… And even if engaged, the strategy should be to resolve the war quickly, and capture the enemy intact. I believe the followers of Clauswitz have taken the term ‘Total war’ to mean ‘Total destruction’.

As an aside… I queried (admittedly on Google) if Abraham Lincoln could have avoided civil, but still freed the slaves….some of the papers made some assertions that he could have paid off the southern landowners to free the slaves And equipped them for farming without slaves and provided the slaves with land to start their own farms and homes at far less financial cost then waging the civil war. An astonishing assessment (if analysis and assumptions are reasonably accurate).

How is a common currency shared among so disparate political entities the “right thing”? It makes more sense for the US and Mexico to share the peso than for Germany and Greece to share the Euro.

That said, where do you draw the line?

It’s as if the Euro and its proponents can’t appreciate cultural and political differences. Let alone economic.

“And on EUR tombstone it shall read “Died of procrastination”.

Nope. “Died at the hands of Neo-Liberals.”

But this crisis is a “feature,” not a “bug” in the system.

But you know this!!!

They don’t want to solve these issues, they want, instead, to use them as justification for pushing their economic ideology further toward its logical conclusions–which inherently defy the reality that to which you refer. Their goal is to keep that reality at bay as long as possible whatever the cost because the financiers’ profit-models depend on that.

from a cheap-y pseudo-news site, Atlantico, comes this on the Euro summit of this weekend:

No Delusional, I think you’ve got it right, and Krugman’s recent column and Soros’ also indicate that things are not going to turn out well. I think Soros got to the heart of the matter when he said there is no viable fiscal policy on the table. And isn’t that true for the US Federal Reserve as well, and the US Congress? In Europe, there are the structural problems of the Eurozone’s institutions, which are by now very familiar to all of us: no common debt instruments, no common banking deposit insurance…what they do have, though, are balanced budget politics, specific debt and deficit goals…which also have deep moral/political resonance in German politics.

In its broadest outline, it still comes down to re-run of the major themes of 1929-1933: banking crisis and then a vast wave of deflationary forces, especially in the periphery countries…if the neoliberal mindset will not accept higher budget deficits and debt levels to allow for a substantial public employment program…a sustained one which might take five years…I don’t see what esle puts people back to work, reduces their debts and increases the tax collections so the sovereign deficits can be overcome. Under current world economic conditions, surpluses of capital and labor everywhere, good luck with the “self-healing” processes of the neoliberals, as strong now as they were in the minds of the Austrians in the 1930’s.

And remedies won’t be easy because the work has to be organized, funded and sustained…and has to be more than “makework.” It’s got to have some of the spirit of “the moral equivalent of war” – in peacetime. Keynes’ able biographer, Robert Skidelsky, has recognized over the past couple of years just how hard this is to do in peacetime, and the New Deal experience in the US supports that observation. And just to do full justice to the difficulty of a Keynesian revival in this ideological climate, Skidelsky has recently pointed out that underneath the lack of demand and deflationary forces lies the great increases in capitalism’s efficiency and productivity, producing a strong if not always obvious or acknowledged undercurrnet I call “automation.” Here’s his brief take on that at http://www.skidelskyr.com/site/article/labours-paradise-lost/

A public damnand creation project isn’t only heresy in Europe, though is it? It’s heresy at the Federal Reserve, its Inquisition Time in front of any Republican panel, and here’s the real tragedy for the middle and lower class: it’s also heresy in most of the Democratic Party…

Of course, the Euro summit will go nowhere. At most, some BS deal will be announced that has no substance and doesn’t address Europe’s core problems anyway. We know this because we have seen this happen every few months for the last 2+ years. I mean what are we up to on these non-deal deals? 15? 20?

Again a European solution must resolve all of the following:

1) Lack of a democratic fiscal and debt union

2) An insolvent predatory banking sector

3) An ineffective central bank

4) Mercantilist trade patterns with in the zone

5) Corrupt political classes

6) Rich kleptocrats calling the shots

The article which proximity1 cites above would only address the first of these, and that quite partially. Les Quatre Sages seem to favor an anti-democratic fiscal union and don’t take up the debt union at all.

I would write as Europe’s epitaph as “A good idea for its people, and even better idea for its looters”.

As per usual, Hugh hits the nail on the head. At this point, the only way to look at the Euro as common currency, is a nefarious plan by the big capital/banking cartel to destroy democracy and all it’s social programs. When the kleptocrats start planning for Brussel’s oversight of national sovereign budgets, the cat is out of the bag. The only question that remains is whether the people of Europe will rise up and take down the system. An appropriate german word for this coming scenario would be “gotterdammerung”.

RE:

In other words, their ideas of “mother’s milk”. To find more creature comfort, they’d have to be back in the nirvana of mother’s womb.

Masters of the Universe: “Ooops! World fell apart while we were busy trading. Okay, everybody stand back, give us room, we’ll handle this! It’s just a little disturbance in the operating program. Excuse us while we make a few minor adjustments–and, be aware, there may be some momentary (or eternal) discomfort (for you average people) while we make these adjustments. Remain calm, please.”

““And on EUR tombstone it shall read “Died of procrastination”.

Nope. “Died at the hands of Neo-Liberals.”

Both wrong. “Died from being against the nations of Europe”

I find that remarkable that decisions would be taken at the governments or the banks levels, without so much as consultation of the people, especially in these days and ages. Too much has been uncovered for people to remain passive and compliant. It is incredibly shortsighted to believe that people will agree to abdicate their sovereignty without a peep. They have already absicated too much and realize it. Now, the mood is to regain control, even if it is only at the individual level.

At best, people will ignore whatever decisions have been taken unbeknownst to them or against their will and simply go back to a simple, community-based lifestyle. We are seeing it happen all over the globe, with the resurgence of barter and moneyless trade. At worst, it will blow, the big “global” machine will be permanently compromised and… people will resume a simple, community-based lifestyle. Either way, that’s where we are headed.

It has gone too far and for too long. The beast is moribond. Europe is only one piece of the puzzle.

That’s how I see it.

The Germans have no intention of promising another Euro to Southern Europe. The market’s last bit of hope will evaporate by Monday. The periphery will become enraged, and at least one will leave the union in protest. So much pain to come.

There’s a special providence in the fall of a sparrow… Readiness is all.

Question: Would the EU be in this situation if the US banksta criminals did not “securitize” us to hell and get bailed out by money created from nothing by the Fed?

This crap was global by 2007 and AIG, et. al., created derivative manure galatic in size which numbs the brain and whose half-life appears to be close to infinity. The earthlings who bought and sold this fecal mess were/are friggin’ psychopathic criminals.

And,oh, there’s this: entropy is always increasing.

This video sums up the Euro mess.

The Indians – Too Many Chiefs Not Enough Indians – Live At Hemsby – 16th March 2012!

http://www.youtube.com/watch?v=mR8B-VV4QLY&feature=player_detailpage

Interesting related post at: http://www.golemxiv.co.uk/2012/06/save-the-euro-who-for/

Author discusses the obfuscation and propaganda surrounding for Whom the effort to “Save the Euro” is really being done, and how the crisis is primarily political; ie., about the survival of democracy, not financial. Linked article is part of broader debate at http://www.opendemocracy.net/freeform-tags/writing-on-wall-for-eurozone.