By Stephanie Kelton, Associate Professor of Economics at the University of Missouri-Kansas City. Cross posted from New Economic Perspectives.

I’ve grown increasingly frustrated by the near universal cry for more action from the Fed. My friend and fellow blogger Marshall Auerback has quipped that it’s as if every mainstream progressive received the same White House memo. I imagine it looked something like this:

MEMO

To: Mainstream Media (TV, Radio, Print Media)

From: Office of the White House

Date: June 10, 2012

Re: Messaging on the RecoveryThe economic recovery is faltering. The fiscal cliff is nearing. Many nations have already fallen back into recession. The net worth of a typical American family is down almost 40 percent since the start of the crisis. Unemployment is rising. People are worried about keeping their jobs, holding onto their homes and paying down the enormous debts they accumulated over the last decade or more. The bloodletting at the state and local government level continues unabated, and this is compounding our economic problems. Consumer confidence is down, and small businesses are struggling to remain profitable.

Some of you have written about the mistakes of our past, pointing out the trauma that was inflicted in 1937, when FDR decided it was time to move toward a balanced budget. Please stop that. This is an election year, and I cannot afford to be viewed as soft on the deficit. Besides, Congress will not support anything I put forward, so we’ve got to enlist the help of an independent body like the Federal Reserve if we’re going to improve things before November. So here’s what I need you to do — scapegoat the Fed. Call them out, repeatedly, for “sitting on their hands.” Demand that they do more. Tell them that “country trumps credibility.”

Message received! Krugman, Baker, Yglesias, Hayes — everyone seems to have gotten the memo. Ordinarily, they insist, the Fed could reach into its tool kit and deliver a powerful shot of economic adrenaline that would set off a frenzy of borrowing and spending. But that typically potent transmission mechanism is said to be broken because borrowing costs are already essentially zero. The curse of the so-called Zero Bound! What to do? The Fed must move into uncharted territory. It must “do more.”

And so instead of building a powerful, unrelenting case for further fiscal easing, mainstream progressives are focused on the Fed, demanding that it do just as much to promote growth and employment as it does to promote price stability. How? By following Krugman’s advice and “credibly committing to a higher inflation target,” which, it is argued, will stimulate spending by lowering the real rate of interest. It’s a policy recommendation that only an economist (or someone with enough credit hours to be dangerous) could conjure up. I almost hope the Fed tries it so that we can banish this proposal to the wasteland of failed policy recommendations (along with QE1, QE2 and Operation Twist). But millions of Americans are suffering and so I really do not want to see us pursue a losing policy just because the alternative looks like a political nonstarter.

The zero bound isn’t the problem. Brazil’s central bank has cut its policy rate by 400 basis points since August 2011. That’s 4 percentage points in under a year! Meanwhile, growth continues to slow and inflation is falling. Why? Brazil isn’t up against the zero bound (far from it, rates are at 8.5 percent). The problem is that monetary policy is a blunt instrument (at best). Committing to a higher inflation target isn’t going to pull us out of the economic doldrums.

Dean Baker has argued that the Fed could push long-term rates down another 20-30 basis points, which could allow some Americans to refinance their homes, freeing up a bit of their take-home pay for other uses. But I wonder how many people would do what I did when long-term rates fell to historic lows. I refinanced from a 30-yr fixed to a 15-year fixed mortgage and consequently spend less on everything else!

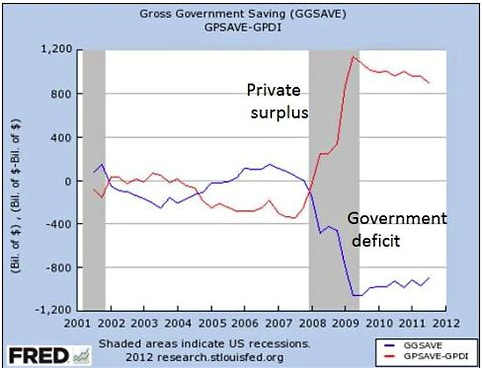

In any event, we’re in a balance sheet recession. We should be encouraging the private sector to borrow less, not taunting people with negative interest rates and encouraging them to leverage up. And we should recognize that the government’s deficit is the key to helping the private sector de-leverage.

Reducing the government’s deficit means cutting the non-government’s surplus, which frustrates their efforts to pay down debt.

We need rising incomes to support a recovery that can be sustained by private sector spending, and the Fed isn’t the agency we should be looking to for help on this front.

Wow, can’t disagree more.

The Fed’s policy is a total failure. Lowering interest rates has not spurred economic growth. Even the Fed’s own research says it produced refis but resulted in no new home purchases.

At the zero bound the lost income Americans are getting hit with is not pushing them to buy stocks but to cut back consumption to make up the diffference. The Fed’s Q.E. push seems to be hoping for higher stock prices producing a wealth effect, yet each succeeding Q.E program works less and less. Then you have the problem that at zero rates we are causing huge pensions losses due to increased present value of liabilties and no ability to fund them, other than taking huge risks that probably won’t pay off. And not to berate the point, at zero rates, we’ve pretty much turned off all market discipline towards rational investments as just about everything is npv positive when the discount rate is zero.

Did you read the article? What you are saying is almost exactly what you are saying. Please re-read the article.

She said

The rest of the article was a fictional White House memo, and the response of various mainstream economists and pundits to the memo.

I should have said “What she is saying is almost exactly what you are saying.” and not “What you are saying is almost exactly what you are saying.”

We knew, buddy.

SKelton did good.

I’m pretty sure that Conscience of a Conservative meant to say “Wow, can’t Agree more.” (kind of ironic that your response to his/her typo itself contained a type :)

“typo,not type” – lol (really, it wasn’t on purpose!!)

I would refinance if I had more faith in what I was signing up for.

” I refinanced from a 30-yr fixed to a 15-year fixed mortgage and consequently spend less on everything else!”

We did this exact thing last week – will save some $45,000 in interest.

Oh, dear. Paid my house several years ago. In time to see its value halved by mortgage fraud gumming up my community with vacant, foreclosed properties being stolen at Sheriff’s sales for 20-30 percent of their previous value.

Is there ANYONE else following this blog who doesn’t live on the right or left coast????? Am I the only one?

Of course I meant, paid my house OFF….

We’re looking at a refi. We thought rates would never go low enough to be worth it, but now they have. We probably can’t swing a 15-year, but we figure if we make the same payments, we can save 8 years of payments.

And yes, I agree: all the crying about the Fed seems as if all of these guys have forgotten that Congress and the President are supposed to be doing the work here.

I don’t think most of the mainstream progressives mentioned in this post actually think that the Fed is the only solution or even the best solution to our current predicament. Rather they think it is better than nothing and way more likely to actually happen because it avoids Congress (at least directly anyways).

While it is fair to disagree with their opinion of whether the Fed can actually do anything I don’t think their writing is somehow convincing people that Fed action is superior to government stimulus. That’s not how I’ve read them anways.

Please see Lambert’s write up of Netroots Nation. Kelton is not exaggerating.

http://www.nakedcapitalism.com/2012/06/trip-report-netroots-nation-part-ii.html

“Reducing the government’s deficit means cutting the non-government’s surplus, which frustrates their efforts to pay down debt.”

A statement easily misunderstood at the end of a fine article. Many of your readers will take this to mean that “reducing the government’s deficit” is the right thing to do.

I dont think that’s the case. Most of us are pretty good readers. Many will even parse.

The ticking time bomb school of thought says that increasing debt is unsustainable when it comes to the government. The deficit is the problem, for the government. Because we have to learn to live within our means. Like Suzie Creamscheese and Nascar Nate, sitting around the kitchen table. But then, the Fed should let the kitchen table crowd do the exact opposite by enabling more debt by lowering interest rates and spurring growth. Private debt, never mentioned, is 5x the size of government debt. And spending, based on bank issued debt from HELOCS and credit cards is the more the Fed should do? The monthly carrying costs of debt exceed the wages of the employed to spend and save. The wageless can’t refi. The foreclosed can’t refi. The bankrupt Americans, who have been over 1 million per year since the late 1990’s, have no credit for a decade worth mentioning. The unemployed, underemployed, and credit damaged is an army non consumers approaching over half the population. Lower rates? For who? For what?

Capitalist – a person who owns capital, especially one who invests in a business.

I guess all homeowners (or anyone with some money) can be thought of as capitalists, in a broad sense. Some ‘rich’ capitalists even owe more than they own. Perhaps anyone with a credit card is a capitalist

Now, the other day, some one wrote that capitalists are undertakers.

Why do we even bother to save undertakers with low rates or universal bailouts?

I reject yr less than prime definition of capital. Capitalism is the union of the state and capital in the capiitalist’s pursuit to endlessly accumulate capital. Perhaps yr eyes and mind are less than prime as well, confusing the Capital One credit card in yr wallet with capital. What IS in yr wallet? It would seem, not much money.

It would seem not much money, I agree with you there. And we have a lot of capitalists who owe more than they own. These people are no more capitalists than those with credit cards in their wallets. But if we call them capitalists, then many more whom we don’t normally think of as capitalists are as well.

The crony capitalists are the problem. The Oligarchs and the Plutocrats. They have monoplized the country because they are FED a steady diet of our wealth. They have the money printing machine and we have their debts. Until we realize that a nation in bankster debt is not free and they lend no money to US…they are the borrowers from US in their credit scam, nothing will change.

In economics, it’s only capital if you’re using it in production. If you’re living in it, it’s goods and services, not capital. If you’re letting it in return for rent, you’re a landlord, which is a bit like a capitalist. But if you’re an owner-occupier, then you’re neither landlord nor capitalist.

GW Bush would send out “stimulus checks”, right? And they would work, right? If they were large and sustained enough? So why isn’t the Left pushing Obama to push this?

The Right doesn’t like increases in the size of government but that’s the beauty of just handing out money – no increase in the size of government is needed!

But in reality, the checks should be called “Restitution Checks” because that is what they would be – restitution to the victims of the counterfeiting cartel that cheats both debtors and non-debtors.

Don’t understand why this idea doesn’t get traction. Seemed like the obvious solution to me since 2008.

Maybe “moral hazard” – the danger that people will discover that the banks are counterfeiters.

Yet even many of those who understand what “credit” is are enamored of it.

Do we solve all money problems this way?

Do we save all, including non- believers?

Even non-believers are entitled to justice. Even the Devil will get his due.

So, even a Mormon can be saved.

The direct government stimulus WOULD be on the lips of all progressives, were they not afraid of financing the demand through additional government debt.

MMT says the government can pay for anything it wants anytime it is needed.

True. Except for the law.

The problem lies in not separating out the monetary system operation of creating the nation’s money from the banking system, including the presently constituted Fed.

Congressman Kucinich’s proposal enables the exact distribution you are proposing.

And it does so under the public money administration function of creating new money.

What the economy needs is money creation.

Not debt creation.

I hope you’ll consider the Kucinich proposal as the vehicle for taking this first step out of our asinine enigma.

For the Money System Common.

Debt free money!! joebhed & Kucinich get it right again! we need heaps of debt-free money, not more national debt. if the govt issues it freely to spend on basic infrastructure, US will soon become again the envy of the world. No risk of inflation as long as there is work to be done and workers available to do it.

if the Fed lends more, it will quickly find its way to speculators to bid up asset prices in inflationary markets.

beat back banksterism. It’s all about political exploitation and the ambitions of MSM.

I am not an economist, but it seems to me that the Fed which simply supplies liquidity to the big banks who will not loan it, but instead play commodities (which punishes average folks with higher oil, building, appliance and food prices) or buy more Fed debt at leverage. Borrow more from the Fed, buy more treasuries. We need to see the Fed reach out and loan money to actual businesses and people. Bypass the middle man through one of their “extraordinary facilities” they discovered when their rich buds got into trouble in 2008. And most of us can’t take advantage of those lower interest rates for our homes.

Every time Krugman yells for more Fed stimulus, (and I agree, the gov needs to flood the economy THE REAL ECONOMY- real Folks as Robama and Bush would say. Otherwise we’re just looking at $150 a barrel oil, some crazy sugar corner, or god knows what hedge the banks will cook up. Which will not help, but instead will deeply harm, the average American.

The idea that the Fed as the national monetary authority ought to be making ‘liquidity’ (ha ha) available to the ‘real-economy’ is well placed.

But as presently constituted, the Fed is not capable of such participation in what is financially and economically important to real people.

The Fed is the bankers’ bank.

The problem is the lack of any viable alternative to the Fed to provide for adequate ‘circulating media’ actually performing the function of money, to provide the MEANS for exchange of goods and services in the national economy.

We have no access to our means of exchange.

I can’t say it any clearer than that.

There is such a thing as a national monetary system.

It is OUR money system.

But it is not working for US.

For the Money System Common.

Smart!

The Fed,ECB, BoJ etc…the Central Banks…are theoretically the HEGEMON in this Washington Consensus neo-liberal whatever world. They are supposed to have the Power, the Ultimate Power to make Presidents and Prime Ministers quake, tremble, and cry. And in a sense they do, and they are. Just the wrong direction.

What a policy that actually reverses the momentum of a $50 trillon dollar Global Economy can only be an action that terrifies. I mean terrifies. Of course they can do it. Or hell, hike interest rates to 15%. I don’t care. Just use brutal insane force.

Print and buy whatever legally, or illegally, is for sale up to $50 trillion dollars or until Bankers are facing firing squads. I want to see hyperinflation. I want to see riots. I want legislatures and politicians forced off the dime and compelled to go Keynesian. Or something else.

Nuke this old economy. It’s the only way to be sure.

I love madly Kelton, Wray, Tchernova, Hudson but they are not going to implement their plans until we are over the cliff.

Those with the Power (not supposed, but the actual, demonstrated power) to make Presidents and Prime Ministers do not CARE who you or I love, Bob McManus.

Now, how are we going to make them care? Yes, I’m talking about the Fed, the ECB, JP Morgan Chase, Deutsche Bank, Bank of America, ETC.

The only thing that will move them is fear. It doesn’t seem that it would be difficult for the 99 percent to make the 1 percent afraid.

Apparently, it is VERY DIFFICULT INDEED.

Pitchfork futures ??

Jim

It isn’t just the supposed “1%”, though it includes plenty from that stratum. It’s also the 10% (at least) that dream to one day replace them, and the next 10% who in all their professional and technical glory support them in everything they do.

So what scares this entire group? Millions in the streets who refuse to go home until some senior bankers heads roll would. But the US public has apparently become so completely disengaged and/or lazy they cannot be troubled to even TRY anymore. So not only do we need to think up some new way to scare the Overlords without violence (which automatically means they win)but we also have to make it easy for the public to participate. Tough one to figure out, but there has to be a critical weakness to be leveraged we just have not ferreted out yet.

Fiver: “Millions in the streets who refuse to go home until some senior bankers heads roll would.”

The propaganda is so effective that it’s hard for me to imagine millions in the streets, unless this is preceded by some kind of sudden, unexpected collapse. Maybe caused by a weak link that hardly anyone is thinking of now?

I don’t think the extreme inequality part of the class warfare has registered yet with the majority of Americans.

People still have their bread and circuses, so it might take food shortages or widespread hunger or 40 percent unemployment, before the mass propaganda stops working.

I hope I’m wrong but I’m still meeting people who plan to vote for Obama, yet who’ve never even heard of NDAA Version 2012, (with the indefinite detention provision), people who never question the legitimacy of drone strikes or the War on Terror, and so forth.

It’s very discouraging…

I thought part of the idea with lowering interest rates and convincing people there will be inflation was more about getting firms to stop sitting on their cash. Not so much about getting households to borrow more. If households really are tapped out, why would they leverage more, especially after they were just burned?

But yeah, who knows if lower interest rates will really convince businesses to invest. Where’s the demand? But heck, threatening inflation might be a stick to get them to support fiscal stimulus.

The “sitting on cash” is largely a myth. John Hussman (among others) started debunking it the minute it was floated by Wall Street shills and other assorted cheerleaders:

http://www.hussmanfunds.com/wmc/wmc100809.htm

Please forgive me if this suggestion is beyond prudent consideration.

I am not an economist, but I recall from Econ 101 that MV = GDP. In other words, the Supply of Money x Velocity of Money (Velocity is the annual turnover of Money in the economy) = National GDP.

Virtually all the policy attention has been focused on “M” (Think “QE”), with “V” being largely ignored and in decline since the early 1980s, while “M” (Debt-based Money) has been increased dramatically over that time period. In fact, I recall the econ prof saying that raising interest rates has the counterintuitive effect of increasing “V” and thus GDP.

I can understand the desire of the casino AKA “Wall Street” for more QE fuel through the Primary Dealers to push up their short term speculative and HFT trading gains, by the Fed for systemic liquidity, by banks to increase their net interest margins in order to recoup their underwriting losses, for low interest rates to enable highly indebted individuals and governments who form the basis of debt-based Money to repay their debts, and arguably to enable those in control of the system to channel wealth into “the right hands”.

Nonetheless, some focus on “V” would now seem to make sense in my view. If my recollection is accurate, perhaps raising interest rates going forward would be a useful policy measure to increase “V” and therefore GDP.

The velocity of money made a difference when banking and money creation was based on reserves. I don’t think it works that way anymore.

The current system seems to be based on straight counter-fitting. The only V in the system is a measure of how rapidly the 1% can move all of the money from our pockets to their pockets.

It seems velocity should still figure in there somehow.

The mystery is if we have not created money for 100% of GDP (GDP = money suppy x velocity), how can we pay for it? Is that like the case of having no money created to pay for the interest on the debt money?

I have faith the Fed can do more…damage.

I think it’s funny that anyone would think the left is that organized.

I said the other night that the lefties in Chicago were “organized anarchists”. I was able to do it with a straight face.

This is why I make the big bucks.

I’m an economist in disguise. I say that we need local currencies across the U.S. that normal god fearing people can use to transact sober business among themselves.

The dollar itself has been captured by something that would look like a big lizard with triangular teeth if you could see it. that sucker nabbed us good this time.

If we were lucky, we could tell the Fed to print as many dollars as it wants to, and we could go about our business, the business of life and mind, without so much as giving it a second thought. The dollar would then become increasingly deranged and incoherent, until it could buy nothing at all. And then the big lizard would fly away and disappear in a shrinking point of space.

The rest of us would then live comfortably with our own currencies — the American Eagle for example — which would be backed by social services such as free garbage collection and doctors and water. The problem would be, we’d need to prevent a plague of insanity from taking us over and ruining our utopia. That would require vigilance and sobriety most of the time. It’s hard to keep up that level of watchfullness. It’s very tiring.

Yes, that would be tiring, as it is highly likely we w/b under constant attack. Perhaps we could appoint a rotating group of citizens known as the “Watchmen” (attribution to Alan Moore and Dave Gibbons) or “Watchpersons”.

I don’t get the impression that Krugman and Baker think that Fed stimulus is really the best solution, rather that it is pretty much the only thing available, since Congress would block pretty much anything else.

Excatly.

These guys are doing some pretty sweet work…

I hit this up every day now – def a go to site for me now…

http://onlypricesmatter.wordpress.com/

Monetary Policy?

If what we want is for the monetary system to be “the tool we use to achieve our real political and economic objectives”(Mosler), as it must be in an economic democracy, then we need to recognize the wall between any action by the Fed and any effective monetary policy.

This is sort of a monetary system 101 issue for ‘modern monetary economies’.

What is needed is growth of the M1 money supply, the part of the money supply where we all live and work. (OK, most of us). The nature of the Fed as a monetary policy “actor” is that it is incapable, systematically and institutionally, of serving anyone other than the banking sector.

The Fed involves with banks and reserves.

It does not involve with M1 and with Main Street.

It is incapable of being an effective monetary system “tool user”.

Given the “balance-sheet recession” nature of the national economy, M1 based spending power can only come from government expenditure.

That’s why the Kucinich Bill is so important.

http://kucinich.house.gov/uploadedfiles/need_act_final_112th.pdf

For the Money System Common

And yet….interest rates WILL go down further.

Good piece Stephanie.

Best as I can figure the only way the Fed can move the needle without going to Congress is with exchange rates since our $600B a year trade deficit is a hell of a demand leakage. The Fed could adopt dual exchange rate policy to reduce the CAD with de facto export bounties. Ravi Batra explains how dual exchange rates work here…

http://www.businesswire.com/news/home/20050901005833/en/Dual-Exchange-Rate-Revive-American-Manufacturing-Economist

Where’s MY discount window?

I agree with those who say that Krugman et. al. are just hitting on SOMETHING that can be done while Rome burns. Because it really appears to many of us that that is exactly what’s going on: the 1% and their handmaids in Congress are just playing in the Village while the rest of us grind along. As much as I hate what Obama has done, I hate the RW even more for what they haven’t done: considered for even one second how they might solve some of our problems instead of playing politics with people’s lives.

Inflation favors those closest to the money spigots. Revolt now against the pointy head ivy league mafia. Abolish the Fed and elite entitlement.

Abolish the Fed as presently constituted.

And replace it with what?

Thanks.

The Federal Government, as the monopoly issuer of its fiat, is the ideal institution to offer a risk-free storage and transaction service for that fiat. That service should be free up to certain limits and should extend no credit, make no loans, and pay no interest.

The above would allow deposit insurance and the Fed to be abolished. Those who chose not to use the above could still keep money in banks and credit unions but with the understanding that they were putting their money at risk.

“Americans can always be counted on to do the right thing…AFTER they have exhausted all other possibilities.” — Winston Churchill

Note to Dean Baker. Another 20-30 basis points down on long interest rates is not going to help anybody refinance their mortgage. Rates are already low enough to provide the incentive, the problem is roughly 80% of mortgage holders aren’t able to refinance because they have no or negative equity in their home.

Why is there never mention given to the negative effect of near zero interest rates on the economy, which is the sharp decline in interest income for retirees who actually saved money instead of living beyond their means? Virtually every time I hear a clip of Obama talking about the economy in a sound bite on the radio he’s talking about how we need to get small businesses and consumers to borrow. Apparently the U.S. can have no economic growth without an ever expanding debt bubble.

Congress should do more but won’t. Would you want to work for a corporation or any business that wants a smaller share of the market, wants to make less money than it is now, readily admits that the company is inefficient, wasteful, and doesn’t accomplish what it was intended to do because of its poor quality control and lack of oversight? So why would senators and congress members attack the very entity that they work for? Is it because they want a weaker government, one that cannot create and enforce regulations that allow for a level playing field? Everyone is against a monopoly except the monopoly. But if you could have a monopoly because there is no law to stop you then why not? The 1% want more power and the less power the government has the more power the 1% can have. Please think about what it means to have a weak government. Some other countries with weak governments are North Korea, Russia, Iran, Pakistan, Afghanistan, and Iraq. A strong and successful country with a strong government with strong rules and regulations with enforcement of their laws is our neighbor Canada, not nearly as hard hit by the corrupt, unregulated, and collapsing bank system because they had and have strong banking laws with teeth.

“We need rising incomes”

Precisely. But the key word here is “we.” Who is this “we”? Is it the bankers? Is it the fabled “middle class”? Is it University professors? Politicians? Lawyers? Small businessmen?

I’d put it differently: “We (i.e., all of us, everyone, the bloody human race) need the incomes of workers the world over, everywhere, to rise.” Not just American workers, not just European workers, but Asiatic workers, African workers, all workers. And by “workers” I mean working class workers, once addressed as “workers of the world.” (Oh you know what I mean.)

Mole in the Ground

Haven’t the Fed done enough already? We are where we are because of the Fed.

It is abundantly clear that Fed policy to “ease” has done nothing whatever for ordinary people, and a great deal for Wall Street. At best it can be argued there is a very short term lift due to some trickle-down “wealth effect” spending. On the other side, it is evident that Fed policy wreaked havoc via commodity price spikes while hosing those on fixed income and savers in general.

Which is why I find Baker, Krugman et al’s beating the drums for this to be disgusting. ONLY banks and insiders benefit. These people purport to be on the side of the public interest – which last I checked, included people. Well, piss on that. Arguing for policy that makes your enemies stronger while doing nothing for friends is altogether reprehensible.

I just read an interesting article that States that a Professor, Dale Scott, noted in his book American War Machine: Deep Politics, The CIA Drug Connection, that a Senate Banking committee estimates that between 500 billion and a trillion dollars per year are being laundered through banks worldwide and about half of that money is being funnelled through U.S. banks. The claim is this is the only reason the banks are still operating because they are “strapped for cash”. Not buying that argument because, they print all of the money they want. They cant be cash strapped when they have control of the money printing machine. They just enjoy handing US their debt to keep US enslaved. The drug money is just more pocket money for the plutocrats and oligarchs. The TRUTH IS, the ongoing bailouts are just a farce to bankrupt US. They can print all of the fiat currency, (monopoly money) for themselves that they want and they can keep handing US all of their fraudulently induced bills to pay that they create out of thin air. They just keep US mind enslaved to keep US oppressed. By making US believe WE owe this money….when the someone who created the debt was the FED and the politicians…..This is a load of b.s. because they can print all of the money they want and pay their own damned debts. Congress has no control over their money printing. They just tell them not to print any for us and keep charging us for their debt. It is a very sick sort of bondage because it is all in our minds. Imagine if we each had our own money printing machine and we could legally counterfeit…? That is what they fear. But they never thought our feeble minds could ever comprehend their criminal racket that they have concocted like a bunch of dirty sniveling rats. They counterfeit everything. Including those mortgages and notes they utter to steal our property. They never lent US any money…..it is all a scam..

minds ts. Social engineering has done the job for these warped fascists.

This is really attention-grabbing, You’re an overly professional blogger. I’ve joined your feed and stay up for in the hunt for more of your fantastic post. Also, I have shared your site in my social networks

Heya i’m for the first time here. I found this board and I in finding It really useful & it helped me out much. I am hoping to offer one thing back and aid others such as you aided me.

If just lowering of interest rates could have helped reviving the borrowing and spending of masses then we would not have ever seen the gret depession on 2008 debt crisis or even now’s europe crisis